Serine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442603 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Serine Market Size

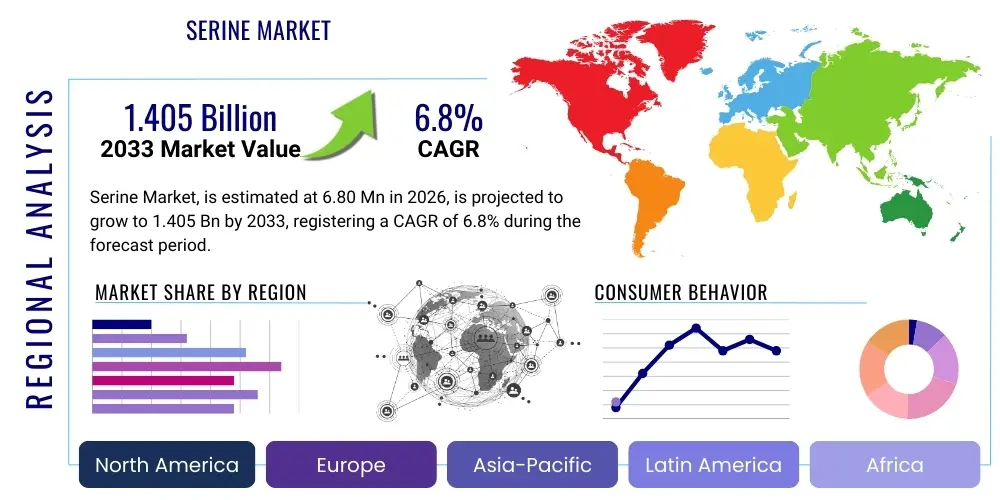

The Serine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $150 Million in 2026 and is projected to reach $235 Million by the end of the forecast period in 2033.

Serine Market introduction

The Serine market encompasses the global production, distribution, and consumption of Serine, a non-essential amino acid critical for numerous biological processes, including protein synthesis, metabolism of fats and fatty acids, and the function of the central nervous system. Serine is synthesized naturally in the human body, but exogenous sources, particularly L-Serine, are highly valued in industrial applications, notably in the pharmaceutical and nutraceutical sectors. Its importance stems from its role as a precursor to several key metabolites such as glycine, cysteine, and sphingolipids, which are essential building blocks for cell membranes and nerve tissue.

The primary applications of Serine span across high-value sectors. In pharmaceuticals, it is utilized in intravenous feeding solutions, drug formulations, and as a component in nutritional therapies aimed at addressing metabolic disorders and neurological conditions. The nutraceutical industry leverages Serine, particularly L-Serine, as a dietary supplement aimed at improving cognitive function, sleep quality, and managing stress, owing to its role in neurotransmitter pathways. Furthermore, D-Serine is gaining significant traction in research related to NMDA receptor modulation for potential psychiatric treatments.

Market growth is predominantly driven by increasing health consciousness globally, leading to higher demand for amino acid supplements. The escalating prevalence of chronic diseases and neurological disorders is fueling research and development into Serine-based therapies. Moreover, advancements in fermentation and synthetic biology techniques are improving the efficiency and purity of Serine production, lowering overall costs and expanding its accessibility across various industrial applications, including specialized cosmetic formulations where it functions as a hydrating agent.

Serine Market Executive Summary

The global Serine market is characterized by robust growth, propelled primarily by significant advancements in the biotechnology and pharmaceutical sectors, coupled with expanding consumer interest in functional foods and dietary supplements. Key business trends indicate a strong move towards sustainable and natural production methods, with fermentation-based Serine increasingly dominating over purely synthetic routes. Companies are focusing on optimizing production yields and purity levels, especially for L-Serine and D-Serine, which command premium pricing due to their specialized end-uses. Strategic alliances, mergers, and acquisitions focused on securing raw material supply chains and expanding geographical footprints, particularly in rapidly developing markets, are shaping the competitive landscape.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, driven by massive investments in pharmaceutical manufacturing capabilities in countries like China and India, coupled with the large consumer base adopting supplements. North America and Europe currently represent the largest revenue share, characterized by high regulatory standards, established healthcare infrastructure, and mature consumer markets for dietary supplements and cosmetics. Developing economies in Latin America and the Middle East & Africa are showing promising potential, fueled by improving healthcare expenditure and rising disposable incomes, encouraging market entry by global Serine manufacturers seeking diversification.

Segmentation analysis reveals that the L-Serine segment holds the largest market share due to its ubiquitous use in food, feed, and pharmaceuticals. However, the D-Serine segment is anticipated to exhibit the highest CAGR, propelled by intensive clinical research linking it to potential treatments for schizophrenia, Alzheimer’s disease, and other neurodegenerative conditions. Among applications, pharmaceuticals remain the most lucrative segment, although the nutraceutical and dietary supplements segment is experiencing the most significant volume growth, reflecting evolving consumer preferences towards preventative health and well-being solutions.

AI Impact Analysis on Serine Market

Analysis of common user questions regarding AI's influence on the Serine market reveals several key themes centered around optimization, discovery, and quality control. Users frequently inquire about how Artificial Intelligence and Machine Learning (ML) can accelerate the identification of novel therapeutic applications for Serine, particularly D-Serine in neurological disorders. Another major concern is the application of AI in optimizing fermentation processes, aiming to increase yield and reduce production costs, which is crucial for cost-sensitive industries like nutraceuticals. Furthermore, there is strong interest in using predictive analytics for supply chain management and quality assurance to ensure regulatory compliance and product purity, addressing the high-stakes environment of pharmaceutical-grade amino acids.

AI's adoption is fundamentally changing the R&D landscape in the Serine market. Machine learning algorithms are being deployed to screen large genomic and proteomic datasets to understand Serine's complex metabolic pathways and identify potential biomarkers, thereby facilitating targeted drug development. This capability significantly reduces the time and cost associated with traditional preclinical trials, moving potential Serine-based treatments faster toward commercialization. Specifically, AI-driven molecular modeling is optimizing the synthesis and formulation of Serine derivatives, enhancing efficacy and bioavailability in oral and intravenous applications.

In the manufacturing domain, AI and robotics are revolutionizing traditional fermentation and synthesis processes. Predictive maintenance models minimize downtime in bioreactors, while real-time data analysis optimizes nutrient feeds and environmental parameters, ensuring maximal Serine output purity. This integration of advanced analytics enhances operational efficiency and ensures consistent quality control, which is vital for maintaining the strict standards required by pharmaceutical and medical nutrition buyers, establishing new benchmarks for production excellence within the amino acid industry.

- AI-driven optimization of microbial strains for enhanced Serine fermentation yield.

- Predictive modeling for faster identification of novel therapeutic targets using Serine derivatives.

- Real-time quality control and purity analysis in manufacturing using machine vision and ML algorithms.

- Automated supply chain forecasting to mitigate volatility in raw material pricing and availability.

- Enhanced toxicology prediction for new Serine formulations in preclinical development.

- Optimization of large-scale bioreactor parameters using deep learning for improved production scalability.

DRO & Impact Forces Of Serine Market

The Serine market is significantly shaped by a confluence of accelerating drivers, stringent restraints, and substantial market opportunities, all interacting to create dynamic impact forces. Key drivers include the global aging population and the associated rise in neurodegenerative and metabolic diseases, necessitating advanced nutritional and pharmaceutical interventions where Serine plays a vital role. This demand is further amplified by the expanding acceptance of amino acid supplementation among mainstream consumers seeking cognitive enhancement and overall wellness. Conversely, the market faces restraints such as high manufacturing complexity, particularly for high-purity D-Serine, and the reliance on specific fermentation feedstock which can lead to price volatility and supply chain disruptions. Regulatory scrutiny, especially concerning the medical claims associated with dietary supplements, also acts as a constraint, demanding costly and extensive clinical validation.

Opportunities for market expansion are abundant, primarily through geographical penetration into emerging Asian and Latin American markets where healthcare infrastructure is rapidly improving and consumer spending power is rising. The most compelling opportunity lies in the clinical validation of D-Serine for treating severe psychiatric conditions, which, if successful in large-scale trials, would open up a multi-billion dollar segment within the specialty pharmaceuticals sector. Furthermore, technological advancements in enzymatic synthesis offer the potential to significantly reduce production costs and environmental footprint compared to traditional methods, enhancing competitiveness and enabling broader industrial adoption.

These drivers, restraints, and opportunities exert powerful impact forces on market dynamics. The synergy between increasing consumer awareness (Driver) and ongoing technological refinement (Opportunity) creates a positive feedback loop, encouraging investment and innovation. However, the counteracting force of stringent regulatory requirements (Restraint) necessitates substantial investment in R&D and quality control infrastructure, concentrating market share among established players with the capital to meet these demands. The overall impact force trajectory is strongly positive, favoring growth driven by medical necessity and consumer acceptance, provided manufacturers effectively manage the complexity and cost of producing high-grade Serine isomers.

Segmentation Analysis

The Serine market is intricately segmented based on Type (L-Serine, D-Serine, DL-Serine), Application (Pharmaceuticals, Nutraceuticals/Dietary Supplements, Cosmetics, Food & Beverages, Research), and Source (Synthetic, Natural/Fermentation). Understanding these segments is crucial for strategic market positioning, as each segment caters to unique end-user requirements regarding purity, isomer configuration, and price sensitivity. The dominance of L-Serine reflects its general utility as a common nutrient and cosmetic ingredient, whereas the high growth rate of D-Serine underscores the transformative potential of specialized clinical applications.

The application segmentation highlights the bifurcation between high-volume, lower-purity applications like Food & Beverages and high-value, stringent-purity applications such as Pharmaceuticals. Manufacturing strategies must adapt significantly based on the target application; for instance, pharmaceutical-grade Serine demands rigorous adherence to GMP standards and often involves complex purification processes to ensure enantiomeric purity. Conversely, the fast-growing nutraceutical segment focuses more on competitive pricing and innovative delivery formats, such as effervescent tablets or specialized drink mixes.

The Source segmentation reveals an ongoing industry shift towards more sustainable and cost-effective production. While traditional chemical synthesis (Synthetic) offers cost advantages in specific bulk applications, advancements in microbial fermentation (Natural) are increasingly favored, particularly for producing chiral amino acids like L-Serine, due to better specificity, environmental profile, and consumer preference for naturally sourced ingredients. This dynamic competition between synthetic and natural sources continually influences pricing power and market share distribution among key global suppliers.

- By Type:

- L-Serine

- D-Serine

- DL-Serine

- By Application:

- Pharmaceuticals (including IV solutions and specialized nutrition)

- Nutraceuticals/Dietary Supplements (Cognitive function, sleep aids)

- Cosmetics and Personal Care (Moisturizing agents)

- Food & Beverages (Functional ingredients, flavor enhancers)

- Research and Development

- By Source:

- Synthetic

- Natural (Fermentation)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Serine Market

The value chain for the Serine market initiates with raw material procurement (upstream analysis), primarily involving carbohydrate sources such as glucose or sucrose for fermentation, or petrochemical derivatives for chemical synthesis. Upstream efficiency dictates the final cost structure, with suppliers of high-quality, consistent feedstock holding significant leverage, particularly in regions where agricultural commodities are volatile. The subsequent critical stage involves manufacturing, where specialized biotechnology firms or chemical synthesis manufacturers convert raw materials into crude or high-purity Serine, utilizing specialized bioreactors and advanced separation technologies like chromatography to achieve pharmaceutical-grade purity, especially for D-Serine.

Moving downstream, the distribution channel is complex and highly specialized. Direct sales are common for large-volume, business-to-business transactions, particularly when supplying pharmaceutical companies that require strict quality documentation and audits. Conversely, indirect channels, involving specialized chemical distributors, agents, and wholesalers, facilitate market access for smaller end-users in the nutraceutical and cosmetic industries. The efficiency of the cold chain logistics (where applicable for specific formulations) and the reliability of distribution partners are crucial factors influencing market reach and customer satisfaction, especially across international borders where customs regulations and purity checks add layers of complexity.

The final stage involves application and consumption by end-users. Pharmaceutical companies incorporate Serine into complex drug formulations or clinical nutrition products, requiring highly specialized handling and inventory management. Nutraceutical manufacturers use Serine for encapsulation or blending into dietary supplements, where marketing and branding play a larger role in driving consumer adoption. The overall value chain is characterized by increasing value addition towards the downstream segment, with purification and specialized formulation contributing the most significant margin, emphasizing the strategic importance of proprietary technologies and regulatory compliance throughout the entire process.

Serine Market Potential Customers

The potential customer base for the Serine market is diverse yet concentrated in sectors requiring high-purity amino acids for either functional or nutritional purposes. The largest segment of buyers comprises pharmaceutical companies, including both major global drug manufacturers and specialized clinical nutrition providers. These customers utilize Serine primarily for intravenous feeding solutions, specialized metabolic disorder treatments, and as precursors in synthesizing complex drug molecules. Their procurement criteria are stringent, focusing intensely on GMP compliance, batch-to-batch consistency, and detailed regulatory documentation, making long-term strategic supplier relationships essential.

A rapidly expanding customer group includes nutraceutical and dietary supplement manufacturers. These buyers are driving significant volume growth, focusing on Serine's role in cognitive health, memory enhancement, and mood regulation. Unlike pharmaceutical clients, these customers are often more price-sensitive and prioritize competitive sourcing, stability, and marketing support, often preferring L-Serine in easily marketable forms like capsules, powders, or functional food additives. Their demand is highly responsive to consumer trends and marketing campaigns emphasizing wellness and preventative care.

Other vital customer segments include cosmetic formulators and food & beverage manufacturers. Cosmetic companies purchase Serine for its moisturizing and skin conditioning properties, integrating it into high-end creams, lotions, and hair care products. Food manufacturers, particularly those in the functional food sector, use Serine for nutritional fortification and, in some cases, as a flavor enhancer. Finally, academic and commercial research institutions represent a stable, albeit smaller, customer base, purchasing highly specific isomers like D-Serine for advanced preclinical studies in neurobiology and proteomics, demanding the highest levels of chemical purity and standardization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150 Million |

| Market Forecast in 2033 | $235 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ajinomoto Co. Inc., Kyowa Hakko Kirin Co. Ltd., Amino GmbH, Mitsui Chemicals Inc., Evonik Industries AG, TCI Chemicals, Sigma-Aldrich (Merck KGaA), CheilJedang (CJ) Corporation, Wacker Chemie AG, Daesang Corporation, Sichuan Tongsheng Amino Acid Co., Ltd., Sekisui Chemical Co., Ltd., Fufeng Group, Watson Inc., Spectrum Chemical Mfg. Corp., Tokyo Chemical Industry Co., Ltd., Nutrend Biotech Co., Ltd., Yoneyama Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Serine Market Key Technology Landscape

The technological landscape of the Serine market is predominantly characterized by the continuous refinement of two core production methodologies: microbial fermentation and chemical synthesis. Fermentation technology, utilizing engineered strains of bacteria (such as E. coli or Corynebacterium glutamicum), is the preferred method for producing L-Serine due to its high stereoselectivity, ensuring purity and minimizing downstream separation costs. Recent innovations in metabolic engineering and synthetic biology focus on optimizing the microbial hosts to increase yield, reduce fermentation time, and enable the utilization of cheaper, more sustainable feedstock, thereby significantly lowering the cost basis for large-scale production, particularly in APAC.

Conversely, the production of D-Serine and DL-Serine often relies on advanced chemical synthesis routes or enzymatic processes. Chemical synthesis involves complex resolution methods to separate the desired enantiomer, which can be costly and less environmentally friendly. However, the emerging field of biocatalysis, utilizing isolated enzymes (like Serine racemase or specific hydrolases), offers a highly promising alternative. Enzymatic methods provide excellent specificity and operate under mild conditions, making them ideal for high-ppurity, specialty amino acids required by the pharmaceutical sector, pushing the boundaries of cost-effective chiral resolution.

Furthermore, technology related to downstream processing, specifically chromatographic separation and crystallization techniques, remains vital. Achieving pharmaceutical-grade purity requires continuous technological investment in advanced separation columns and membrane filtration systems. The implementation of Process Analytical Technology (PAT) tools, often coupled with AI and sensors, ensures real-time monitoring of critical quality attributes during both fermentation and purification, drastically improving consistency, reducing batch rejection rates, and maintaining the high regulatory standards demanded by end-users in North America and Europe. This continuous technological optimization is paramount to sustaining profitable growth in a highly competitive global market.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by expanding pharmaceutical manufacturing hubs in China and India, coupled with increasing disposable income driving demand for dietary supplements. Favorable government initiatives supporting biotechnology and fermentation processes further solidify its leadership in production volume.

- North America: North America holds the largest revenue share, primarily due to the established presence of major pharmaceutical and nutraceutical companies and high consumer expenditure on health and wellness products. Strict regulatory oversight ensures high quality, maintaining premium pricing for Serine products used in clinical applications.

- Europe: Europe is a mature market characterized by robust academic research in neurobiology and strong regulatory support for amino acid-based medical foods. Germany, France, and the UK are key consumers, particularly in the cosmeceutical and specialty nutrition segments.

- Latin America (LATAM): This region is experiencing moderate growth, driven by improvements in healthcare infrastructure and rising awareness regarding preventative nutrition. Brazil and Mexico are emerging as significant markets for nutraceutical Serine, though local production capacity remains underdeveloped, leading to high import reliance.

- Middle East and Africa (MEA): Growth in MEA is currently lower but accelerating, predominantly concentrated in Gulf Cooperation Council (GCC) nations due to increasing investment in specialized healthcare facilities and imported functional foods. The market is highly reliant on international suppliers for high-grade Serine isomers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Serine Market.- Ajinomoto Co. Inc.

- Kyowa Hakko Kirin Co. Ltd.

- Amino GmbH

- Mitsui Chemicals Inc.

- Evonik Industries AG

- TCI Chemicals

- Sigma-Aldrich (Merck KGaA)

- CheilJedang (CJ) Corporation

- Wacker Chemie AG

- Daesang Corporation

- Sichuan Tongsheng Amino Acid Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Fufeng Group

- Watson Inc.

- Spectrum Chemical Mfg. Corp.

- Tokyo Chemical Industry Co., Ltd.

- Nutrend Biotech Co., Ltd.

- Yoneyama Chemical Industry Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Serine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between L-Serine and D-Serine, and which dominates the market?

L-Serine and D-Serine are mirror-image isomers (enantiomers) of the Serine molecule. L-Serine is the biologically standard form, crucial for protein synthesis and metabolism, and holds the dominant market share due to its widespread use in food and general pharmaceuticals. D-Serine is a specialty isomer increasingly studied for its vital role as a co-agonist of NMDA receptors in the brain, driving its high-growth trajectory in niche neurological therapeutics.

Which application segment provides the highest growth opportunity for Serine manufacturers?

The nutraceutical and dietary supplements segment is anticipated to witness the highest volume growth, driven by consumer demand for cognitive health supplements and sleep aids utilizing L-Serine. However, the pharmaceutical application segment, particularly advancements involving D-Serine in neurological disorder treatments, offers the highest potential for revenue per unit due to the premium pricing associated with high-purity medical ingredients.

How do regulatory standards impact the cost structure of Serine production globally?

Strict regulatory standards, such as those imposed by the FDA and EMA for Good Manufacturing Practices (GMP), significantly increase operational costs, particularly for pharmaceutical-grade Serine. Compliance requires sophisticated quality control, validated purification processes (like chromatography), and extensive documentation, favoring large producers capable of absorbing these substantial fixed costs, thereby acting as a barrier to market entry for smaller players.

Is the Serine market shifting towards natural fermentation or chemical synthesis?

The overall market trend indicates a shift towards natural (fermentation-based) production, particularly for L-Serine, driven by consumer preference for natural ingredients and technological advances in metabolic engineering that have made fermentation more cost-competitive. While chemical synthesis remains relevant for specific bulk or specialty DL-Serine products, fermentation offers better stereoselectivity and a more favorable environmental profile.

What are the key drivers propelling the demand for Serine in the coming years?

Key drivers include the global aging population resulting in increased neurodegenerative diseases, rising public awareness regarding the benefits of amino acid supplementation for cognitive function and stress management, and continuous expansion of clinical research validating Serine's role in specialized therapeutic nutrition and drug development, particularly in addressing conditions like schizophrenia and Alzheimer’s disease.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Phosphatidylserine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Phosphatidylserine (PS) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Phosphatidylserine Market Size Report By Type (20% Content, 50% Content, Other Content), By Application (Dietary Supplement, Functional Foods, Medical Foods, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- L-serine Market Size Report By Type (Pharm Grade, Food Grade), By Application (Pharmaceutical, Food, Cosmetics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Serine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (L-Serine, D-Serine, DL-Serine), By Application (Pharmaceutical, Food, Feed), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager