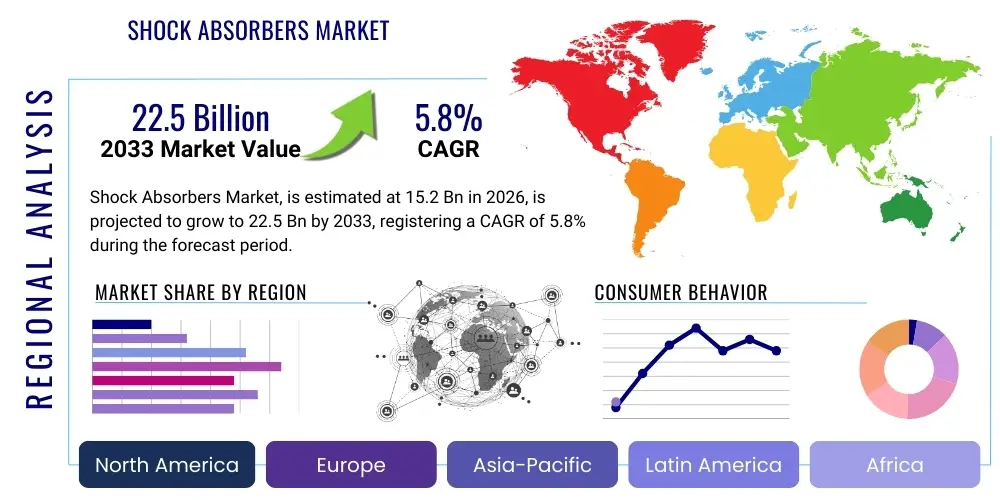

Shock Absorbers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443613 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Shock Absorbers Market Size

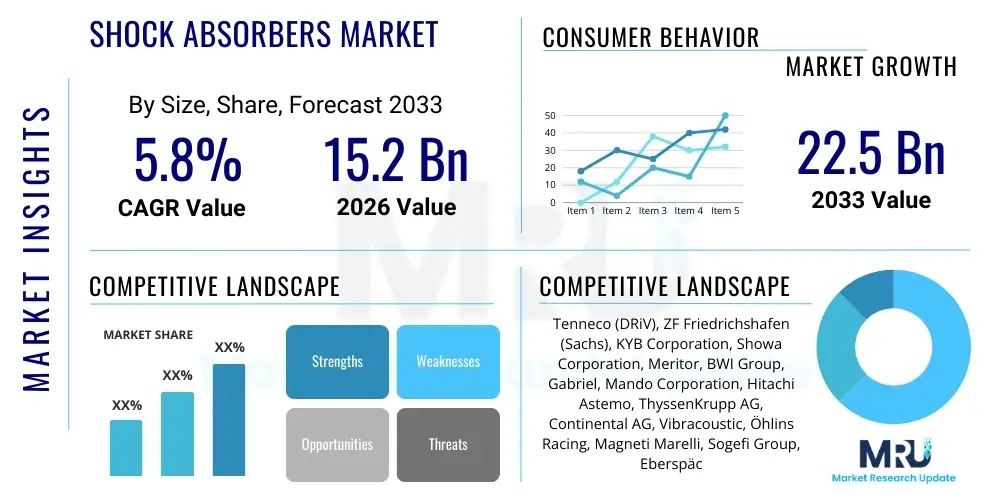

The Shock Absorbers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.2 Billion in 2026 and is projected to reach USD 22.5 Billion by the end of the forecast period in 2033.

Shock Absorbers Market introduction

Shock absorbers, critical components within automotive and industrial suspension systems, are designed primarily to dampen the oscillations and kinetic energy generated by vehicle springs and structural deflection, ensuring optimal tire contact with the road surface. These hydraulic or pneumatic devices transform kinetic energy into heat, enhancing vehicle stability, ride comfort, and overall operational safety. The product portfolio ranges from basic twin-tube designs used primarily in economic passenger vehicles to highly advanced, electronically controlled active suspension systems prevalent in luxury cars and high-performance machinery, catering to diverse requirements for load bearing, speed, and terrain variability. Major applications span across passenger cars, commercial vehicles (trucks, buses), motorcycles, rail transport, and specialized industrial equipment such as heavy machinery and aerospace landing gear, reflecting the product's fundamental role in managing dynamic loads and vibration control.

The primary benefits derived from effective shock absorption include improved vehicle handling dynamics, minimization of body roll during cornering, and significant reduction in driver and passenger fatigue by isolating the cabin from road irregularities. Furthermore, proper damping extends the service life of related suspension components, tires, and vehicle chassis by mitigating excessive stress caused by continuous oscillation. Driving factors propelling this market growth involve stringent global safety regulations requiring advanced stability features, increasing urbanization leading to greater demand for comfort and durability in vehicles, and the steady expansion of the global automotive manufacturing base, particularly across emerging economies in Asia Pacific. The transition towards electric vehicles (EVs) also necessitates redesigned shock absorption systems to handle increased battery weight and optimize energy efficiency, driving innovation in lightweight materials and adaptive technologies.

Shock Absorbers Market Executive Summary

The global shock absorbers market is currently characterized by a robust shift towards sophisticated, electronically controlled damping systems that provide real-time adaptability to driving conditions and road surface quality. Business trends indicate a heightened focus on modular design and the integration of smart sensors, enabling predictive maintenance capabilities and enhanced customization of ride profiles, positioning semi-active and active suspension technologies as the fastest-growing segments. Furthermore, supply chain optimization and material innovation, particularly the use of lightweight aluminum alloys and specialized magnetorheological fluids, are critical strategies adopted by manufacturers to meet the demands of electric and hybrid vehicle platforms that require reduced mass and high structural integrity. This transition is fueling collaborative efforts between Tier 1 suppliers and automotive OEMs early in the design phase.

Regionally, Asia Pacific (APAC) stands as the dominant market, driven by high volume automotive production in countries like China, India, and Japan, coupled with rapidly expanding infrastructure projects that increase demand for commercial and off-highway vehicle shock absorbers. Europe, while mature, is leading in the adoption of high-performance and electronically managed suspension systems due to stringent emission norms and a strong luxury vehicle manufacturing base, emphasizing advanced safety and performance characteristics. Segment trends underscore the aftermarket’s resilience, buoyed by the aging vehicle fleet worldwide and increasing consumer awareness regarding the importance of timely replacement for optimal vehicle performance. The shift towards mono-tube shock absorbers is also notable in performance-oriented applications due to their superior heat dissipation and consistent damping characteristics across varying operating temperatures.

AI Impact Analysis on Shock Absorbers Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the shock absorbers market frequently center around the optimization of damping force calibration, the transition from passive to truly adaptive suspension systems, and the implementation of predictive failure mechanisms. Key concerns and expectations revolve around how machine learning algorithms can analyze continuous real-time data—such as road profile inputs, vehicle dynamics (speed, acceleration, steering angle), and payload variation—to instantaneously adjust shock absorber settings for maximum comfort and handling. Users anticipate that AI integration will significantly reduce maintenance costs through accurate condition monitoring and extend component lifespan by preventing operation under sub-optimal parameters. There is a strong expectation that AI will standardize high-performance damping across different vehicle segments, previously reserved for high-end luxury vehicles, making superior safety and comfort accessible to the mass market.

- AI enables predictive maintenance scheduling by analyzing vibration patterns and stress data, predicting component failure before operational compromise.

- Machine learning algorithms optimize semi-active and active suspension control units (ECUs) to instantaneously adjust damping coefficients based on sensor fusion data (road conditions, speed, braking).

- AI facilitates the development of self-learning suspension systems that adapt and refine damping strategies over the vehicle’s lifetime, tailoring performance to specific driver habits and common routes.

- Manufacturing process optimization using AI for quality control ensures precise assembly tolerances and material homogeneity in high-precision fluid dynamics components.

- AI-driven simulation tools accelerate the design phase for specialized shock absorbers, reducing prototype iterations required for achieving specific performance curves.

- Enhanced integration with advanced driver-assistance systems (ADAS) to improve vehicle stability during emergency maneuvers and autonomous driving scenarios.

DRO & Impact Forces Of Shock Absorbers Market

The market dynamics are significantly influenced by a confluence of accelerating factors, structural limitations, and untapped technological potential. Primary drivers include the global expansion of the automotive industry, mandatory governmental vehicle safety standards emphasizing stability control, and a pervasive consumer demand for enhanced ride quality and comfort, particularly in premium and luxury vehicle segments. Conversely, the market faces restraints suchable as the high initial investment cost associated with advanced electronic and semi-active suspension technologies, which limits their adoption in entry-level vehicle models, alongside the increasing manufacturing complexity of integrating sophisticated electronic control units (ECUs) and sensors. The rapid transition to Electric Vehicles (EVs) introduces both opportunities and restraints; while EVs require new, heavier-load-bearing shock absorbers, the overall design shift challenges established component supply chains.

Opportunities for growth are abundant in the integration of smart technologies, offering potential for the development of fully active suspension systems that utilize external energy sources to counteract body roll and pitch completely, marking a major leap in vehicle performance. Furthermore, the burgeoning aftermarket segment across developing regions presents opportunities for standardized, high-quality replacement parts. The impact forces affecting the market are multifaceted, primarily driven by economic factors like disposable income affecting vehicle purchasing power, technological disruption from sensor integration (accelerating the shift to smart suspension), and regulatory mandates concerning vehicle safety and emissions, which often dictate design and material choices. Competitiveness remains high, pushing manufacturers towards continuous innovation in materials science (e.g., carbon fiber composites) and fluid technologies (e.g., advanced synthetic hydraulic oils) to deliver superior performance and reduced weight.

Segmentation Analysis

The Shock Absorbers Market is systematically segmented based on various technical and commercial parameters, allowing for precise market tracking and strategic planning across diverse industry verticals. Key segmentation dimensions include the fundamental product type (dictating internal mechanism and structural design), the vehicle type utilizing the component (influencing load capacity and size), the end-use application (differentiating OEM installation from aftermarket replacement), and the sales channel (defining the route to market). This structure highlights the divergence in demand characteristics, where specialized applications such as heavy-duty commercial vehicles prioritize durability and load capacity, while high-performance passenger vehicles focus intensely on responsiveness and electronic control integration. Understanding these segment dynamics is crucial for suppliers aiming to optimize product portfolios and manufacturing scale, especially given the distinct requirements imposed by the accelerating shift toward electric mobility and autonomous driving technologies.

- By Type:

- Twin-Tube

- Mono-Tube

- Strut-Type

- Reservoir/Piggyback Shock Absorbers

- By Technology:

- Passive (Conventional)

- Semi-Active (e.g., Continuously Variable Damping (CVD), Magnetorheological)

- Active Suspension Systems

- By Vehicle Type:

- Passenger Cars (PC)

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

- Two-Wheelers

- Off-Highway Vehicles

- By End-Use Market:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- By Sales Channel:

- Original Equipment Suppliers (OES)

- Independent Aftermarket (IAM)

Value Chain Analysis For Shock Absorbers Market

The value chain for the shock absorbers market begins with the upstream sourcing of critical raw materials, primarily high-grade steel, specialized aluminum alloys, rubber components for seals, and complex hydraulic fluids. Steel tubes and piston rods demand stringent quality control to ensure longevity and structural integrity under dynamic stress, typically sourced from specialized metal processors. Midstream activities involve precision manufacturing processes, including tube rolling, welding, chrome plating of piston rods, and the critical assembly and sealing stages which require high automation and zero-defect tolerance. Manufacturers invest heavily in computer-aided manufacturing (CAM) and robotics to maintain the necessary precision for internal valve systems and fluid metering, which directly dictates damping performance. Specialized component manufacturing, such as electronic control units (ECUs) and sensor arrays for semi-active systems, often relies on collaborations with electronics specialists.

The downstream flow involves a dual-channel distribution system catering to both OEM and aftermarket segments. The direct channel focuses on supplying automotive and heavy machinery Original Equipment Manufacturers (OEMs), characterized by large volume contracts, strict just-in-time delivery requirements, and high-level specification adherence determined through long-term partnership agreements. The indirect channel, primarily serving the aftermarket, utilizes a complex network of regional distributors, authorized service centers, and independent repair shops, increasingly supported by e-commerce platforms for wider reach. This channel demands robust inventory management, competitive pricing strategies, and comprehensive product education for installers. Successful navigation of the value chain requires expertise in global logistics and a strong capacity for localized service support.

Shock Absorbers Market Potential Customers

The primary end-users and buyers of shock absorbers are broadly categorized into two major groups: vehicle manufacturers and the expansive network of maintenance and repair providers. Original Equipment Manufacturers (OEMs), encompassing global passenger vehicle producers, commercial truck manufacturers, and specialized machinery builders (e.g., construction and agriculture equipment), represent the largest volume segment, requiring tailored product specifications and highly reliable components integrated into their new vehicle assembly lines. These customers demand highly specialized technical support and often engage in co-development projects to ensure the shock absorber technology aligns perfectly with the vehicle's intended performance characteristics, focusing intensely on weight reduction, fuel efficiency, and safety compliance for new models.

The secondary, yet rapidly growing, customer base resides within the aftermarket segment, comprising wholesalers, independent distributors, regional retailers, and individual consumers seeking replacement parts. This segment is less sensitive to cutting-edge technology integration but highly focused on availability, cost-effectiveness, and ease of installation. Aftermarket buyers rely on standardized replacement parts that match or exceed the original equipment specifications, typically prioritizing high durability and broad vehicle applicability. Furthermore, specialized potential customers include railway rolling stock manufacturers, aerospace maintenance facilities, and industrial automation firms requiring heavy-duty damping solutions for vibration isolation in high-precision or high-load operational environments, marking lucrative niches driven by specific engineering requirements rather than mass volume.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.2 Billion |

| Market Forecast in 2033 | USD 22.5 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenneco (DRiV), ZF Friedrichshafen (Sachs), KYB Corporation, Showa Corporation, Meritor, BWI Group, Gabriel, Mando Corporation, Hitachi Astemo, ThyssenKrupp AG, Continental AG, Vibracoustic, Öhlins Racing, Magneti Marelli, Sogefi Group, Eberspächer, Arnott Inc., Chengdu Gissle Shock Absorber Co., Ltd., WABCO Holdings Inc., Bilstein GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Shock Absorbers Market Key Technology Landscape

The technological evolution within the shock absorbers market is predominantly driven by the need for superior adaptability, reduced energy consumption, and integration with modern electronic vehicle architectures. Passive systems, while remaining dominant in low-cost segments, are increasingly being replaced or augmented by advanced solutions. Semi-Active Damping (SAD) technologies, such as Continuously Variable Damping (CVD) and Magnetorheological (MR) damping, represent the current frontier for mass-market vehicles. CVD systems use electronically controlled valves to adjust fluid flow and damping force within milliseconds based on inputs from sensors monitoring road surface and vehicle movement. MR dampers employ fluid containing microscopic magnetic particles; when a current is applied, the fluid viscosity changes instantly, providing exceptionally fast response times for precise damping control, often preferred in high-performance and luxury vehicles requiring instantaneous adjustments.

Beyond semi-active systems, the market is witnessing steady progress in fully Active Suspension Systems, though their high cost limits current adoption primarily to ultra-luxury and niche performance sectors. These systems utilize external power sources (hydraulic pumps or electric motors) to actively push or pull the suspension components, completely counteracting forces like body roll, pitch, and heave. This technology promises the highest levels of ride comfort and handling, offering the ability to isolate the cabin from external disturbances entirely. Furthermore, material science is playing a pivotal role; the adoption of lightweight materials like high-strength aluminum and composite polymers is crucial for reducing unsprung mass, thereby improving vehicle handling and supporting the energy efficiency mandates of electric vehicles. Innovations in sealing technology and low-friction bearings are also critical to enhancing durability and reducing internal heat generation, especially in high-cycle, heavy-duty applications.

Digitalization and connectivity are transforming shock absorber function through the integration of sophisticated sensors (accelerometers, linear potentiometers) and connectivity modules. These components enable remote diagnostics, over-the-air firmware updates for damping algorithms, and critical data logging for fleet management and predictive maintenance. The shift towards electrification also impacts design, necessitating specialized shock absorbers that manage the increased weight of battery packs while maintaining stability and providing structural support. Manufacturers are developing frequency-selective damping technologies that can differentiate between high-frequency vibrations (road texture) and low-frequency body movements (cornering), providing targeted damping control for an optimized balance between comfort and control, a feature highly valued by today’s discerning consumer.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by massive automotive production volumes in China, India, and Southeast Asia. The region benefits from increasing urbanization, rising disposable incomes leading to higher vehicle ownership rates, and significant investments in infrastructure, which boosts the demand for both passenger and commercial vehicle shock absorbers. Specifically, India and China are major demand centers for high-volume, cost-effective twin-tube absorbers and simultaneously emerging markets for premium, semi-active systems, driven by the expanding middle class’s preference for luxury and performance features. Government initiatives promoting vehicle safety and localization of manufacturing further propel regional market expansion.

- Europe: The European market is characterized by a high adoption rate of advanced, technologically sophisticated shock absorber systems, particularly semi-active and active suspension, reflecting the region’s strong presence in the luxury, sports, and electric vehicle segments. Stringent EU safety and performance regulations necessitate the use of premium components. Germany, France, and the UK are key markets, leading in R&D for next-generation damping fluids and lightweight materials. The mature aftermarket in Europe also demands high-quality replacement parts, often favoring established brands known for durability and performance consistency.

- North America: North America maintains a strong position, driven by robust sales of light trucks and SUVs, which require heavy-duty and performance-oriented shock absorbers. The US exhibits a highly developed aftermarket segment, where consumer preference for vehicle customization and off-road capability drives demand for specialized, high-performance, adjustable suspension kits. The accelerating transition to electric vehicles and the focus on autonomous driving technologies necessitate continuous collaboration between suppliers and OEMs to develop standardized and resilient damping solutions that meet stringent US safety standards and ride quality expectations.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth, driven by economic recovery and increased vehicle assembly operations, particularly in Brazil and Mexico. Demand is concentrated on reliable, durable shock absorbers capable of handling diverse road conditions, often favoring cost-effective solutions. The aftermarket is crucial in this region due to the prevalence of older vehicle fleets requiring regular component replacement.

- Middle East and Africa (MEA): Growth in MEA is highly dependent on oil price stability and infrastructure development. The GCC countries drive demand for luxury and large utility vehicles, thus favoring high-performance and electronically controlled suspension systems. In contrast, emerging African markets prioritize durability and robust design due to harsh operating environments, focusing primarily on commercial vehicle applications and reliable aftermarket solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Shock Absorbers Market.- Tenneco (DRiV Automotive Inc.)

- ZF Friedrichshafen AG (Sachs)

- KYB Corporation

- Showa Corporation

- Meritor, Inc.

- BWI Group

- Gabriel India Limited

- Mando Corporation

- Hitachi Astemo, Ltd.

- ThyssenKrupp AG

- Continental AG

- Vibracoustic GmbH

- Öhlins Racing AB

- Magneti Marelli S.p.A.

- Sogefi Group

- Eberspächer Group

- Arnott Inc.

- Chengdu Gissle Shock Absorber Co., Ltd.

- WABCO Holdings Inc. (now part of ZF)

- Bilstein GmbH

- Delphi Technologies (BorgWarner)

- Koni BV

Frequently Asked Questions

Analyze common user questions about the Shock Absorbers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive, semi-active, and active shock absorbers?

Passive shock absorbers offer fixed damping characteristics, while semi-active systems adjust damping force in real-time using sensors and electronic valves but require no external power to support the vehicle load. Fully active systems use external energy sources (motors or hydraulics) to proactively adjust damping, height, and support, offering maximum control and comfort.

How is the electric vehicle (EV) trend impacting the demand and design of shock absorbers?

EVs significantly increase the demand for specialized shock absorbers due to higher vehicle weight (battery packs), necessitating stronger structural components and optimized damping to maintain stability. Designs are focused on reducing unsprung mass, improving energy efficiency, and integrating with advanced regenerative braking systems.

Which regional market holds the highest growth potential for shock absorber sales through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, driven by rapid industrialization, large-scale automotive manufacturing expansion in countries like China and India, and rising consumer demand for new vehicles and high-quality replacement parts in the region's vast aftermarket segment.

What key technologies are driving innovation in modern shock absorber systems?

Key innovations include Magnetorheological (MR) fluid technology for instantaneous damping changes, Continuously Variable Damping (CVD) systems for real-time adjustments, lightweight material adoption (aluminum/composites) to reduce mass, and the integration of AI for predictive maintenance and self-learning damping algorithms.

Is the Aftermarket segment a substantial contributor to the overall Shock Absorbers Market revenue?

Yes, the Aftermarket segment is a highly substantial and resilient contributor to market revenue globally. It is driven by the necessity for periodic replacement due to wear and tear, the large installed base of aging vehicles, and increasing consumer awareness regarding the safety implications of worn-out suspension components, offering stable, long-term demand.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hydraulic Shock Absorbers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Gas Charged Shock Absorbers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hydraulic Shock Absorbers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Twin-tube, Mono-tube), By Application (Passenger, Commercial Vehicle, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager