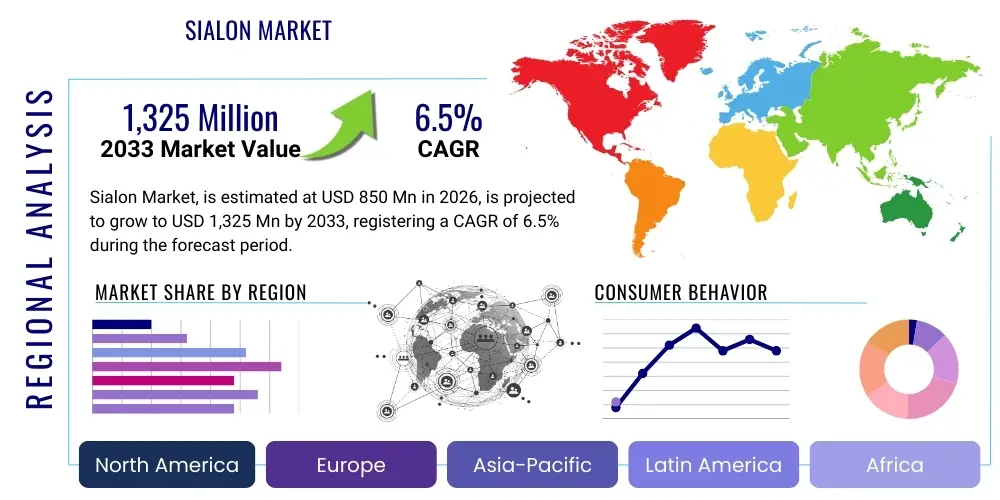

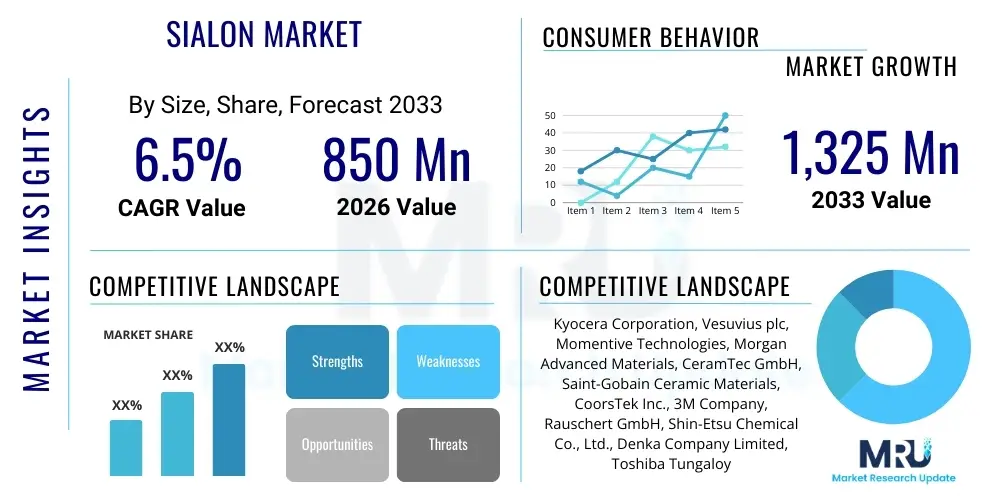

Sialon Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442871 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Sialon Market Size

The Sialon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $580.4 Million in 2026 and is projected to reach $985.1 Million by the end of the forecast period in 2033.

Sialon Market introduction

The Sialon market encompasses the production and utilization of Silicon Aluminum Oxynitride, a specialized class of high-performance technical ceramics. Sialon is derived from silicon nitride (Si₃N₄) where some silicon atoms are replaced by aluminum (Al) and nitrogen atoms are partially substituted by oxygen (O). This substitution stabilizes the crystal structure and significantly enhances the material's properties, making it superior to traditional ceramics in demanding applications. The resulting material boasts exceptional characteristics, including high hardness, superior strength retention at elevated temperatures, excellent thermal shock resistance, and robust chemical inertness against molten metals and corrosive environments. These unique attributes position Sialon as a critical material across various heavy industries, enabling efficiency and longevity in extreme operating conditions. The inherent benefits of Sialon—such as reduced wear, lower maintenance requirements, and the ability to operate effectively where metallic alloys fail—are key factors driving its adoption globally. The market growth is fundamentally propelled by the increasing demand for high-speed machining and the necessity for durable components in severe operational environments, particularly within automotive, aerospace, and metallurgical sectors. Furthermore, the push towards enhanced energy efficiency and material optimization encourages manufacturers to invest in these advanced ceramic solutions, ensuring sustained market expansion throughout the forecast period.

Sialon ceramics are predominantly categorized into two main phases: alpha (α) and beta (β), each offering distinct mechanical and thermal profiles tailored to specific industrial requirements. Alpha Sialon, known for its superior hardness and high resistance to wear, is often utilized in high-performance cutting tools and protective coatings. Beta Sialon, characterized by excellent fracture toughness and creep resistance, finds extensive application in structural components, especially those exposed to intense mechanical stress and thermal cycling, such as engine parts and heat exchangers. Major applications span the metalworking industry, where Sialon cutting inserts significantly improve machining speeds and tool life when processing hard alloys, and the non-ferrous metallurgy sector, where its resistance to molten aluminum and brass makes it ideal for casting crucibles, thermocouple protection tubes, and riser tubes. The consistent push towards miniaturization and higher operating efficiencies across manufacturing domains necessitates materials that can withstand more severe conditions than ever before. Sialon effectively meets this need, offering a crucial technological bridge for industries seeking to optimize performance and reduce operational downtime associated with component failure.

The primary driving factors sustaining the robust expansion of the Sialon market include the burgeoning demand from the automotive industry for lightweight, high-performance engine components that improve fuel efficiency and reduce emissions, alongside the rapid industrialization witnessed in emerging economies, particularly across the Asia Pacific region. Additionally, the continuous advancements in manufacturing processes, such as 3D printing of technical ceramics, are opening new avenues for complex Sialon component geometries, further broadening its application base beyond traditional machining tools and wear parts. The superior economic performance derived from Sialon’s extended lifespan and reduced replacement frequency provides a compelling value proposition to end-users. As industries worldwide continue to prioritize operational safety, material reliability, and environmental compliance, the specialized attributes of Sialon ceramics ensure their irreplaceable role in key industrial processes, cementing the market’s positive growth trajectory. Furthermore, research and development efforts are persistently focused on enhancing the fracture toughness and reliability of Sialon components, aiming to overcome existing limitations and unlock even more strenuous applications, thereby guaranteeing long-term market vitality.

Sialon Market Executive Summary

The Sialon market is characterized by robust growth, primarily driven by strong demand for advanced material solutions in sectors requiring high wear resistance and thermal stability. Current business trends indicate a significant shift towards customization and the development of specialized Sialon grades (such as reinforced composites) tailored for specific, high-stress environments like aerospace turbine components and high-speed rail brakes. Key market players are heavily investing in expanding production capacity, particularly in Beta Sialon variants due to their structural integrity and superior fracture toughness, which are vital for large industrial parts. Furthermore, technological innovation focuses intensely on optimizing powder synthesis and sintering processes to achieve denser, more consistent ceramic structures, reducing manufacturing defects, and improving overall material performance predictability. The competitive landscape remains concentrated, with leading global ceramic manufacturers dominating the market through proprietary knowledge and established supply chain networks. Strategic alliances between Sialon producers and end-use manufacturers are becoming increasingly common, ensuring co-development of materials perfectly aligned with evolving industry standards and demanding technical specifications.

Regionally, the Asia Pacific (APAC) stands out as the primary engine for Sialon market expansion, largely fueled by massive growth in its domestic metalworking, automotive manufacturing, and electronics sectors, particularly in China, Japan, and South Korea. These nations possess sophisticated manufacturing ecosystems that demand high volumes of precision components, driving the uptake of Sialon cutting tools and wear parts. North America and Europe, while being mature markets, exhibit steady growth propelled by stringent quality control regulations in aerospace and defense, necessitating the adoption of certified, high-reliability ceramic components. These regions focus heavily on R&D and advanced application development, particularly in areas like high-temperature heat exchangers and next-generation industrial pumps, utilizing Sialon’s chemical resistance. Conversely, regions like Latin America and the Middle East and Africa (MEA) are emerging markets, showing gradual adoption primarily in oil & gas equipment and general industrial maintenance, often dependent on imports from established suppliers in APAC and Europe. The regional dynamics highlight a dual trend: mass production and volume consumption in APAC versus high-value, specialized application development in Western markets.

Segmentation analysis reveals that the Cutting Tools application segment maintains the largest market share, directly benefiting from the global increase in high-speed, precision machining of hard materials such as superalloys and cast iron. However, the Metallurgical Components segment, which includes crucibles, thermocouple protection sheaths, and molten metal handling parts, is projected to register the fastest growth rate, driven by significant investments in primary metals production and casting industries aiming for enhanced efficiency and purity. In terms of type, Beta Sialon is experiencing increasing demand due to its structural applications in severe mechanical load environments, offering a better balance of toughness and temperature resistance compared to Alpha Sialon’s focus solely on extreme hardness. The End-Use Industry segmentation is dominated by the Automotive and Metalworking sectors, where Sialon plays a crucial role in optimizing engine efficiency and tooling lifetime, respectively. Future segment growth will likely be influenced by sustainability pressures, pushing Sialon adoption in sectors like energy storage and renewable energy manufacturing, where durable, inert materials are essential for prolonged system life.

AI Impact Analysis on Sialon Market

User queries regarding the impact of Artificial Intelligence (AI) on the Sialon market frequently center on themes such as predictive maintenance of Sialon components, optimization of ceramic manufacturing processes, and AI-driven materials discovery for next-generation composites. Users are concerned about how AI can improve the notoriously complex and energy-intensive sintering process, minimize batch-to-batch variability, and extend the functional lifespan of high-value Sialon parts in critical applications like jet engines or blast furnaces. The underlying expectation is that AI will introduce unprecedented levels of precision and efficiency, mitigating the risk of catastrophic failure inherent in high-stress ceramic applications. Specifically, users often inquire about the potential for AI algorithms to analyze sensor data (temperature, vibration, stress) from Sialon-equipped machinery to predict wear patterns and schedule optimal replacement times, thus maximizing operational uptime and reducing costs associated with premature component failure. This synthesis of user concerns highlights the desire for AI to transition Sialon component management from reactive replacement schedules to highly accurate, proactive maintenance strategies, fundamentally enhancing the material's reliability proposition in demanding industrial settings, while simultaneously accelerating the development cycle for new Sialon compositions with improved toughness and thermal performance.

- AI-driven predictive maintenance (PDM) extends the operational life of Sialon components in critical infrastructure (e.g., aerospace, power generation) by analyzing real-time stress and temperature data.

- Optimization of powder processing and sintering cycles through machine learning algorithms reduces manufacturing defects, minimizes energy consumption, and ensures consistency in ceramic density and microstructure.

- Accelerated materials discovery using AI to simulate and screen novel dopant combinations and alloying elements, leading to the rapid development of Sialon grades with enhanced fracture toughness and creep resistance.

- Quality control automation utilizing computer vision and deep learning for non-destructive inspection of finished Sialon parts, detecting microscopic flaws invisible to traditional inspection methods.

- Supply chain efficiency enhanced by AI forecasting of demand for specific Sialon product types, optimizing raw material procurement (e.g., silicon powder, aluminum oxide) and inventory management.

- AI modeling of thermal stress distribution during operation allows engineers to design Sialon component geometries that maximize resilience and endurance under extreme thermal cycling conditions.

- Automation of Sialon machining and finishing processes, utilizing robotic systems guided by AI for high-precision grinding and polishing, minimizing manual errors and improving surface finish quality necessary for high-performance applications.

DRO & Impact Forces Of Sialon Market

The Sialon market is significantly influenced by a powerful combination of driving forces and inherent constraints. Key drivers include the escalating demand for high-performance, durable cutting tools in the rapidly expanding metalworking industry, especially for machining difficult-to-cut superalloys used in aerospace and medical devices. The continuous optimization of internal combustion engines and the nascent integration of ceramics into electric vehicle (EV) components, aimed at thermal management and weight reduction, further bolsters demand. Simultaneously, the material’s superior resistance to corrosion and wear in molten metal environments ensures steady usage in the metallurgical sector. These drivers collectively create a robust demand profile, emphasizing the value proposition of Sialon in enhancing efficiency and longevity across industrial processes. However, the market faces significant restraints, primarily stemming from the high raw material costs (specifically high-purity silicon nitride and aluminum nitride powders), complex and energy-intensive manufacturing processes (high-temperature, pressure-assisted sintering), and the inherent brittleness and difficulty in machining the final ceramic product. These factors contribute to high component costs, which often restricts adoption in cost-sensitive, high-volume general industrial applications, forcing manufacturers to carefully balance performance benefits against economic viability.

Opportunities in the Sialon market are vast and centered around technological advancements and penetration into emerging, high-value applications. Significant opportunities exist in developing Sialon-based composite materials that incorporate reinforcements like carbon nanotubes or graphene to mitigate the intrinsic brittleness, thereby improving fracture toughness and reliability—a critical limitation in structural ceramics. Furthermore, the expansion of additive manufacturing (3D printing) technologies for ceramics presents an avenue to produce intricate, near-net-shape Sialon components, drastically reducing material waste and post-processing costs associated with traditional pressing and sintering methods. The growing global focus on sustainable energy production also opens opportunities, as Sialon ceramics are ideal for harsh environments within advanced nuclear reactors, solid oxide fuel cells (SOFCs), and specialized components for high-temperature chemical processing plants. Exploiting these technological frontiers and strategically targeting high-growth niche markets will be crucial for capitalizing on future market potential and establishing new revenue streams for Sialon producers.

The impact forces within the Sialon market are multifaceted and exert pressure on both supply and demand sides. The intense competitive rivalry among established ceramic manufacturers, primarily focused on purity standards and dimensional tolerances, drives continuous product innovation and process improvement. Substitutability poses a moderate threat, particularly from advanced tool steels, cemented carbides, and other technical ceramics like zirconia and alumina, though Sialon often holds a technological edge in extreme heat or highly corrosive scenarios. Furthermore, the regulatory environment surrounding industrial emissions and energy efficiency acts as a powerful external force, pushing end-users toward materials like Sialon that contribute to lighter components and lower overall system energy consumption. The bargaining power of suppliers is relatively high due to the limited availability of specialized, high-purity raw materials required for Sialon synthesis, necessitating strong supply chain management by manufacturers. These interacting forces dictate pricing strategies, investment priorities, and the speed of technological adoption across the market ecosystem, ensuring a dynamic and highly technical competitive environment focused on precision and performance reliability.

Segmentation Analysis

The Sialon market is comprehensively segmented based on material type, application, and end-use industry, providing a granular view of demand dynamics across various industrial landscapes. Material segmentation differentiates between Alpha Sialon, valued for its extreme hardness and wear resistance, Beta Sialon, known for superior toughness and high-temperature structural integrity, and Mixed Sialon compositions designed to leverage the benefits of both phases. This differentiation allows manufacturers to tailor products precisely to the mechanical and thermal demands of specific applications. Application segmentation captures the primary uses, spanning high-precision cutting tools, structural wear parts, and specialized components for handling molten metals, reflecting the material's critical role in optimizing industrial operational parameters. The segmentation by end-use industry categorizes consumption across major sectors like automotive, aerospace, metalworking, and general industrial machinery, demonstrating where the highest growth and specialized needs originate. The detailed analysis of these segments is crucial for strategic decision-making, allowing companies to focus R&D efforts and marketing resources on the most promising and technologically challenging segments, ensuring sustainable and profitable market penetration.

- By Type:

- Alpha Sialon

- Beta Sialon

- Mixed Sialon

- By Application:

- Cutting Tools (Turning, Milling, Drilling Inserts)

- Wear Parts (Seals, Bushings, Nozzles, Rolls)

- Metallurgical Components (Crucibles, Riser Tubes, Thermocouple Protection Tubes)

- Automotive Components (Glow Plugs, Engine Wear Parts)

- Industrial Machinery Components

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Metalworking & Machining

- General Industrial

- Chemical Processing & Energy

Value Chain Analysis For Sialon Market

The Sialon market value chain begins with the upstream segment, focusing on the procurement and preparation of high-purity raw materials, primarily silicon nitride powder (Si₃N₄), aluminum oxide (Al₂O₃), and yttria (Y₂O₃) or other sintering additives. This phase is capital-intensive and requires stringent quality control to ensure the chemical purity and particle size distribution are suitable for subsequent high-performance ceramic synthesis. Key suppliers of these high-purity powders hold significant bargaining power due to the technical barriers and high costs associated with their production. Following material procurement, the manufacturing stage involves complex processes such as mixing, compaction, and critically, high-temperature sintering (often hot pressing or pressureless sintering at temperatures exceeding 1700°C) to achieve the dense Sialon structure. This manufacturing expertise is the core value driver for Sialon producers, requiring proprietary knowledge to control microstructural development and achieve desired mechanical properties. Downstream integration involves sophisticated finishing and precision machining of the highly hard and brittle sintered blocks into final components (like cutting tool inserts or complex wear parts), which often accounts for a substantial portion of the component's final cost.

The distribution channel for Sialon products is dual-faceted, incorporating both direct sales and specialized indirect channels. For large, custom-engineered components destined for aerospace, defense, or major metallurgical facilities, direct sales models prevail, allowing for close technical collaboration between the manufacturer and the end-user. This direct engagement ensures precise adherence to strict performance specifications and facilitates technical support regarding installation and application optimization. Conversely, standardized components, such as common cutting tool inserts or wear-resistant seals, are widely distributed through specialized industrial distributors, tooling supply houses, and global ceramic trading partners. These indirect channels provide efficient market penetration, especially across diverse geographical areas and small to medium-sized enterprises (SMEs). The effectiveness of the downstream distribution strategy hinges on maintaining a robust technical sales force capable of articulating the high-value benefits of Sialon materials compared to competing solutions, and ensuring timely delivery of components critical for maintaining end-user operational continuity.

The overall efficiency of the Sialon value chain is heavily dependent on minimizing complexity and waste during the manufacturing and finishing stages. Given the high cost of raw materials and the difficulty in machining the finished ceramic, any defect or material loss significantly impacts profitability. Therefore, technological advancements aimed at near-net-shape manufacturing (like additive manufacturing or highly precise green body processing) are instrumental in optimizing the value delivered. Successful companies differentiate themselves not just through material science excellence in the upstream segment, but also through superior application engineering support in the downstream segment. The ability to design complex geometries, provide precise failure analysis, and offer specialized maintenance guidelines solidifies customer loyalty and enhances the perceived value of Sialon products. The integration of digital technologies, particularly for tracking material traceability and quality parameters throughout the chain, is becoming increasingly important to meet the demanding certification standards required by high-reliability industries like aerospace and medical device manufacturing.

Sialon Market Potential Customers

The primary potential customers and end-users of Sialon ceramics are concentrated in high-performance sectors where material failure or excessive wear is economically detrimental or structurally critical. The largest segment of buyers originates from the metalworking and machining industry, comprising manufacturers of high-performance components, precision engineering firms, and tooling suppliers that require cutting inserts capable of achieving high material removal rates and superior surface finishes when working with tough materials such as nickel-based superalloys, titanium alloys, and hardened steels. These customers value Sialon for its chemical stability at high temperatures, which prevents flank wear and cratering, significantly extending tool life compared to traditional cemented carbides. Another major customer base is the non-ferrous metallurgical industry, including aluminum smelters and brass foundries, which require components (like riser tubes and thermocouple sheaths) that can resist chemical attack and thermal shock when in continuous contact with aggressive molten metals, ensuring purity and safety during casting processes.

The automotive industry constitutes a rapidly evolving customer segment. While traditionally using Sialon for engine components like glow plugs and certain wear parts in diesel engines, the shift towards electric vehicles (EVs) is opening new avenues. EV manufacturers are exploring Sialon for specialized thermal management components, high-efficiency bearing systems, and potentially as insulating materials in battery packs due to its lightness, high strength, and electrical insulation properties. The need for lighter, more efficient components in both traditional and electric powertrain systems is a continuous driver for Sialon adoption among major Tier 1 suppliers and Original Equipment Manufacturers (OEMs). Moreover, the general industrial sector, encompassing manufacturers of pumps, compressors, seals, and textile machinery, represents a substantial volume of potential customers. These users require Sialon for high-wear parts in chemical processing, where its inertness and abrasion resistance dramatically reduce maintenance frequency and operational downtime associated with component replacement, offering a superior cost-in-use over cheaper, less durable materials.

A high-value, albeit smaller, customer segment is the aerospace and defense sector. Buyers in this domain, including aircraft engine manufacturers and defense contractors, prioritize extreme reliability and performance above cost considerations. Sialon is used in critical applications such as turbine components (though often as coatings or specialized inserts) and high-temperature wear components within landing gear or missile systems. The stringent qualification standards and extended service life requirements in this sector necessitate materials with predictable, verified performance under extreme thermal and mechanical loads, making Sialon an essential material choice. Finally, emerging customers in the energy sector, particularly in advanced power generation (e.g., concentrated solar power or next-generation nuclear reactors), are increasingly evaluating Sialon for heat exchangers and structural components due to its resistance to creep and stability at extremely high operating temperatures, signaling future demand growth potential from specialized, technically demanding energy infrastructure projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580.4 Million |

| Market Forecast in 2033 | $985.1 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kyocera Corporation, CeramTec GmbH, Saint-Gobain Ceramic Materials, Morgan Advanced Materials plc, 3M Company, Rauschert GmbH, Tata Advanced Ceramics Ltd., CoorsTek Inc., Imerys S.A., Shin-Etsu Chemical Co. Ltd., Vesuvius plc, Ortech Advanced Ceramics, Sintered Products, Unipretec Ceramics, Corning Inc., H.C. Starck GmbH, Trelleborg AB, Denka Company Limited, NGK Insulators Ltd., Mersen S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sialon Market Key Technology Landscape

The technological landscape of the Sialon market is dominated by advancements in powder synthesis, consolidation techniques, and precision post-processing methods crucial for achieving superior material performance. Initial technology focuses on achieving ultra-fine, high-purity raw powders, primarily silicon nitride, which is the foundational building block. Advanced powder processing methods, such as chemical vapor deposition (CVD) or plasma synthesis, are utilized to ensure narrow particle size distribution and high chemical homogeneity, which are essential for producing uniform microstructures and maximizing the resulting mechanical properties of the Sialon ceramic. The conversion process relies heavily on controlling the alpha-to-beta phase transformation during high-temperature sintering, often utilizing specialized additives like yttria or rare earth oxides as sintering aids to lower the required temperature and pressure, thereby improving cost-effectiveness and scalability. Key intellectual property in this area relates to proprietary additive blends and controlled atmospheric environments within the furnaces to prevent oxidation and ensure the formation of the desired Sialon phase (alpha or beta).

Consolidation techniques represent another critical technological area. While pressureless sintering is the most economical method for high volumes, Hot Isostatic Pressing (HIP) and Hot Pressing (HP) technologies are frequently employed for manufacturing high-density, complex, and high-performance Sialon components, particularly those destined for aerospace or cutting tool applications. HIP involves applying high pressure and temperature simultaneously, which eliminates residual porosity and significantly enhances the fracture toughness and strength of the final material, mitigating one of the primary weaknesses of ceramics. Continuous technological iteration focuses on developing faster, more energy-efficient furnaces and improving mold materials to handle the extreme temperatures and pressures required. Furthermore, the burgeoning field of ceramic additive manufacturing (AM), including techniques such as binder jetting or stereolithography of Sialon slurries, holds immense potential. While still nascent for large-scale, load-bearing Sialon components, AM technologies promise revolutionary capabilities in producing complex internal cooling channels and intricate geometries that are impossible to achieve via traditional pressing and machining, thereby unlocking new application spaces.

Post-processing and quality control technologies are equally pivotal, given the hardness of Sialon. Precision grinding, lapping, and polishing techniques, often utilizing diamond tooling, are essential to achieve the micron-level dimensional tolerances and surface finishes required for seals, bearing components, and cutting inserts. The focus here is on minimizing subsurface damage introduced during machining, which can significantly compromise the component's strength. Non-destructive testing (NDT) methodologies, including ultrasonic testing and X-ray computed tomography (CT), are critical technologies used to ensure material integrity and detect internal micro-cracks or density variations before components are placed into service. Advances in sensor technology and integrated digital twins are increasingly used to monitor the performance of Sialon components in real-time within operational machinery. This closed-loop system allows manufacturers to feed performance data back into the material design and production process, optimizing future batches and accelerating the validation cycle for new Sialon grades, thus maintaining a technologically superior position in the advanced ceramics market.

Regional Highlights

Regional dynamics heavily influence the Sialon market, reflecting differences in industrial development, manufacturing concentration, and technological adoption rates. Asia Pacific (APAC) dominates the global Sialon market in terms of both production volume and consumption value. The region is home to the world’s largest manufacturing bases in automotive, electronics, and general industrial machinery, driving unparalleled demand for high-performance cutting tools and wear parts. Countries like China, Japan, and South Korea are leaders in advanced machining and metallurgy, necessitating continuous supply of Sialon components to sustain high-speed production lines. Japan, in particular, houses several global leaders in technical ceramics, pioneering proprietary Sialon grades and application techniques. The rapid pace of industrial infrastructure development across Southeast Asia further contributes to the robust growth trajectory in the APAC region.

North America and Europe represent mature, high-value markets characterized by a strong emphasis on quality, precision, and adherence to stringent industry standards, especially in aerospace, defense, and high-end automotive manufacturing. While volumes may be lower than in APAC, the average selling price of Sialon components in these regions is typically higher due to custom engineering, rigorous certification requirements, and specialized, low-volume applications. European countries like Germany and the UK maintain strong metalworking and machinery sectors, providing consistent demand for Sialon wear parts and seals. North America is a key region for innovation, with heavy investment in R&D focusing on utilizing Sialon in advanced energy systems and complex composite structures to meet next-generation performance requirements.

- Asia Pacific (APAC): Market leader driven by mass manufacturing in China and sophisticated tooling industries in Japan and South Korea. Dominant consumption in metalworking and automotive sectors.

- North America: Focus on high-value applications in aerospace, defense, and high-end automotive. Strong emphasis on R&D for structural ceramics and advanced thermal management.

- Europe: Stable market with high demand from precision engineering, industrial machinery, and metallurgical processing, particularly in Germany and France. Compliance with strict environmental and safety regulations drives material selection.

- Latin America (LATAM): Emerging market primarily driven by general industrial maintenance and limited automotive manufacturing. Growth dependent on foreign investment and industrial maturity.

- Middle East and Africa (MEA): Limited but growing consumption, mainly concentrated in oil & gas exploration equipment (wear parts and seals) and localized general industrial infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sialon Market.- Kyocera Corporation

- CeramTec GmbH

- Saint-Gobain Ceramic Materials

- Morgan Advanced Materials plc

- 3M Company

- Rauschert GmbH

- Tata Advanced Ceramics Ltd.

- CoorsTek Inc.

- Imerys S.A.

- Shin-Etsu Chemical Co. Ltd.

- Vesuvius plc

- Ortech Advanced Ceramics

- Sintered Products

- Unipretec Ceramics

- Corning Inc.

- H.C. Starck GmbH

- Trelleborg AB

- Denka Company Limited

- NGK Insulators Ltd.

- Mersen S.A.

Frequently Asked Questions

Analyze common user questions about the Sialon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Sialon ceramics over traditional materials?

Sialon offers superior high-temperature strength, excellent thermal shock resistance, exceptional hardness, and high chemical inertness, making it ideal for extreme environments where metals and conventional ceramics fail, such as high-speed machining and molten metal handling.

In which industries are Alpha Sialon and Beta Sialon most commonly utilized?

Alpha Sialon is primarily used for its extreme hardness in high-performance cutting tools and wear parts. Beta Sialon, possessing superior fracture toughness and high-temperature structural reliability, is preferred for structural components, engine parts, and metallurgical applications like riser tubes.

What manufacturing challenges currently restrain the mass adoption of Sialon components?

Key restraints include the high cost and complexity of manufacturing, specifically the need for expensive, high-purity raw powders and the reliance on energy-intensive, specialized consolidation techniques like Hot Isostatic Pressing (HIP) to achieve required density and strength.

How is the Sialon market addressing the inherent brittleness of technical ceramics?

The market is focusing on developing Sialon-based ceramic matrix composites (CMCs) and incorporating advanced reinforcements (e.g., whiskers or nanotubes) to enhance fracture toughness and reliability, alongside using advanced post-processing techniques like HIP to eliminate internal flaws.

Which geographical region exhibits the fastest growth potential for the Sialon market?

The Asia Pacific (APAC) region is projected to show the fastest growth, driven by rapid expansion in its domestic automotive, metalworking, and general industrial sectors, necessitating high volumes of durable, high-performance ceramic components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Sialon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Sialon Powder Market Statistics 2025 Analysis By Application (Immersion Heater and Burner Tubes, Degassing and Injector Tubes in Nonferrous Metals, Metal Feed Tubes in Aluminum Die Casting, Welding and Brazing Fixtures and Pins), By Type ( -Sialon Powder, -Sialon Powder, O-Sialon Powder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Sialon Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Α-Sialon, Β-Sialon, Others), By Application (Military, Aerospace, Machinery, Metallurgical, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager