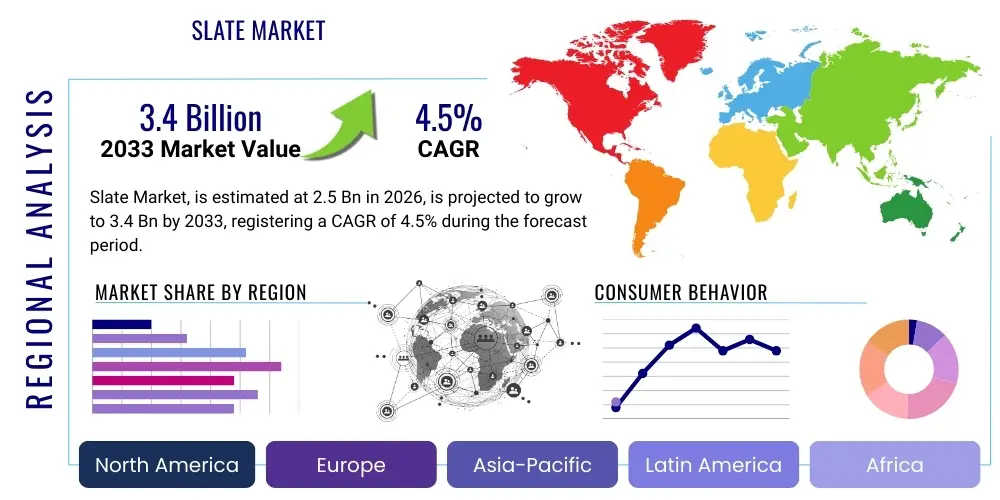

Slate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441239 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Slate Market Size

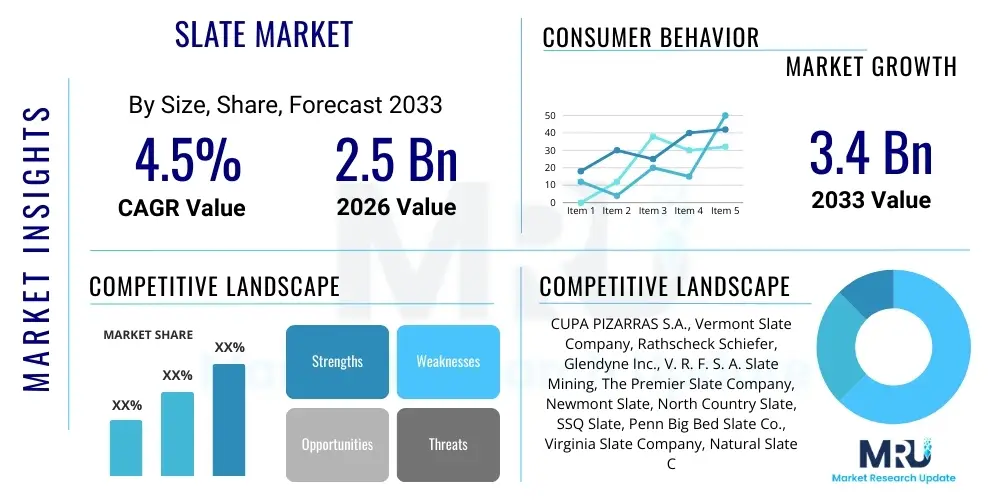

The Slate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

The valuation reflects sustained demand from the construction sector, particularly in developed economies where aesthetic appeal and durability are prioritized in high-end residential and commercial projects. Slate’s inherent properties, including low water absorption, exceptional fire resistance, and long lifespan, solidify its position as a premium building material. Market expansion is further supported by the growing renovation and remodeling activities aimed at preserving historical structures or upgrading existing residential roofing systems with durable alternatives.

Although the market experiences cyclical fluctuations tied to global construction spending and commodity prices, the long-term outlook remains positive. Investments in sustainable building practices and green architecture continue to favor natural materials like slate over synthetic counterparts. Geographically, regions with high seismic activity or extreme weather conditions drive consistent demand for slate roofing due to its superior resistance and structural integrity. Strategic regional focus on extraction efficiency and streamlined supply chains will be critical for market players aiming to capitalize on this steady growth trajectory over the forecast period.

Slate Market introduction

The Slate Market encompasses the global production, distribution, and utilization of fine-grained, metamorphic rock derived from shale. This natural stone is characterized by its perfect cleavage, allowing it to be split into thin, durable sheets, making it highly valuable for architectural applications. Slate products are widely used across diverse sectors, including roofing tiles, flooring, paving, laboratory countertops, and decorative elements. The primary defining characteristic of high-quality architectural slate is its extremely low permeability, which grants it superior resistance to freezing, water damage, and chemical erosion, leading to lifespans often exceeding 100 years.

Major applications of slate are overwhelmingly concentrated in the building and construction industry, where its aesthetic versatility—ranging from dark gray and black to subtle greens and reds—is highly sought after. Beyond construction, slate finds applications in manufacturing, particularly as electrical insulation and billiard tables, owing to its stability and heat resistance. Key benefits driving market penetration include its natural, non-toxic composition, minimal environmental footprint compared to manufactured alternatives, and its established reputation as a sustainable, premium material that significantly enhances the value of property. These inherent attributes position slate favorably amidst stringent environmental regulations and rising consumer preference for sustainable building materials.

Driving factors for the market include rapid urbanization in emerging economies, coupled with increased infrastructure spending globally, especially on heritage preservation and high-end construction projects. The escalating demand for durable roofing materials that can withstand increasingly volatile climatic events further bolsters market growth. Furthermore, technological advancements in quarrying and processing techniques are improving yield rates and reducing production costs, making high-quality slate more accessible to a broader range of construction projects, thereby maintaining a healthy supply-demand equilibrium in specialized architectural markets.

Slate Market Executive Summary

The Slate Market exhibits robust business trends dominated by consolidation among major quarry operators aimed at optimizing reserves and improving processing efficiencies. The supply chain is highly sensitive to logistics and energy costs, prompting key players to invest in localized extraction and processing centers near major consumption hubs to mitigate transportation expenses. A significant trend involves the increasing adoption of automated sawing and cutting equipment, which enhances precision and reduces material waste, thereby improving overall cost competitiveness against synthetic roofing and flooring options. Sustainability remains a central business theme, with producers highlighting the lifetime value and low lifecycle carbon footprint of slate products to gain favor in green building certifications and government projects.

Regional trends indicate that mature markets in North America and Europe remain the principal consumers, driven primarily by renovation, restoration of historical buildings, and luxury new construction. The Asia Pacific region, particularly China and India, is emerging as a critical growth engine, characterized by substantial infrastructure development and increasing middle-class disposable income, spurring demand for high-quality, durable flooring and architectural finishes. Conversely, developing regions face constraints related to the high initial cost of slate compared to locally sourced alternatives, requiring strategic pricing and distribution models tailored to regional economic realities. Policy support favoring natural stone and mandatory quality standards for premium construction materials are pivotal factors influencing regional market dynamics.

Segment trends showcase strong resilience in the roofing slate segment due to its unparalleled longevity and aesthetic appeal, often outweighing the initial installation costs. The flooring and paving segment is experiencing accelerated growth, fueled by commercial projects, municipal landscaping, and large residential builds seeking durable, low-maintenance surfaces. The market is also seeing specialized growth in value-added segments such as slate veneers and composites, which offer the aesthetic benefits of natural slate with reduced weight and easier installation. This focus on product innovation and diversification is key to unlocking new application areas beyond traditional construction use cases, catering to modern design specifications that demand material flexibility without compromising authenticity.

AI Impact Analysis on Slate Market

User inquiries regarding AI's impact on the Slate Market primarily revolve around optimizing resource extraction, improving quality control, and automating logistics within a historically labor-intensive industry. Key themes users are concerned about include how AI algorithms can predict geological stability and mineral composition in quarries, thereby minimizing operational risks and maximizing marketable yield. There is significant expectation that AI-driven image processing and computer vision systems will revolutionize the sorting and grading of finished slate tiles, ensuring consistency in color, thickness, and texture—critical factors for high-end architectural projects. Furthermore, users anticipate AI’s role in managing complex international supply chains, optimizing routing, and predicting maintenance needs for heavy quarrying machinery, ultimately leading to substantial cost reductions and enhanced operational safety.

While slate production is rooted in geological processes, the operational efficiency of large-scale quarrying and processing facilities presents fertile ground for AI implementation. Concerns often focus on the capital expenditure required to integrate these technologies and the need for specialized workforce training to manage complex predictive maintenance models and data analytics platforms. The integration of AI tools, particularly machine learning, is expected to shift the focus from brute-force extraction to precision quarrying, where waste material is minimized, and resource utilization is maximized. This technological shift is crucial for improving the industry’s environmental profile and meeting the increasing demand for high-grade material with precise specifications.

The long-term influence of AI is projected to enhance market responsiveness by providing granular insights into demand forecasting based on global construction indices and architectural trends. This capability will allow slate producers to align production schedules with anticipated market needs, reducing inventory holding costs and improving cash flow. For content strategy and sales, AI can personalize product recommendations for architects and builders based on project requirements, climate data, and aesthetic preferences, thereby accelerating the specification process and strengthening the market position of premium slate products against mass-produced alternatives.

- Quarry Optimization: AI-driven geological modeling predicts mineral deposits, optimizes blast patterns, and minimizes overburden removal, leading to higher quarry yield and reduced operational expenses.

- Quality Control Automation: Computer vision systems automatically inspect finished tiles for thickness deviations, color consistency, and surface flaws, ensuring strict adherence to premium quality standards faster than manual inspection.

- Predictive Maintenance: Machine learning models analyze sensor data from heavy machinery (drills, saws, loaders) to anticipate failures, scheduling maintenance proactively, reducing downtime, and extending equipment lifespan.

- Supply Chain Analytics: AI optimizes logistics, inventory management, and demand forecasting by analyzing global construction pipelines and transport routes, improving just-in-time delivery capabilities.

- Environmental Monitoring: Sensor networks monitored by AI track water runoff, dust levels, and acoustic pollution in and around quarry sites, ensuring compliance with increasingly strict environmental regulations.

DRO & Impact Forces Of Slate Market

The Slate Market is shaped by a confluence of critical drivers, inherent restraints, and lucrative opportunities that collectively dictate its growth trajectory and competitive landscape. Key drivers include the global emphasis on resilient and sustainable building materials, where slate’s longevity and natural composition offer distinct advantages over composite materials. High-impact forces involve the initial cost barrier associated with premium slate products, particularly in comparison to mass-market alternatives like asphalt shingles or concrete tiles, which often limit slate adoption to luxury and high-specification projects. However, the opportunity for market expansion lies in developing innovative, cost-effective installation methods and composite slate products that retain the aesthetic appeal of natural stone while offering improved affordability and ease of use.

Drivers are primarily fueled by regulatory shifts and consumer behavior. Building codes in many regions increasingly favor fire-resistant and highly durable roofing materials, naturally aligning with slate's properties. Furthermore, the strong resale value associated with slate-roofed properties acts as a significant incentive for homeowners and developers. Restraints largely center on supply-side challenges, including the finite nature of high-quality geological reserves, the complexity and high cost of extraction and processing (requiring specialized labor and machinery), and vulnerability to supply chain disruptions, especially for materials sourced from geographically distant high-grade quarries. Overcoming these restraints necessitates strategic investment in advanced quarrying technologies and labor training to enhance efficiency.

Opportunities for growth are abundant through geographic diversification and application expansion. Emerging markets present untapped potential for premium building materials as urbanization accelerates and construction quality standards rise. Furthermore, exploring non-traditional uses for slate, such as interior design features, acoustic panels, and specialized industrial components, can broaden the market base beyond traditional roofing and flooring. The major impact force balancing the market is the substitution threat posed by technologically advanced synthetic materials that mimic slate’s appearance at a lower cost; sustained market share requires slate producers to continuously emphasize the authentic, environmentally superior, and long-term economic value proposition of natural slate.

Segmentation Analysis

The Slate Market segmentation provides a detailed map of consumption patterns based on the material's structural type, its primary application, and the end-user industry driving demand. The structure of slate products—ranging from thick roofing tiles to thin flooring slabs and decorative veneers—significantly influences processing requirements and market pricing. Analyzing these segments is essential for understanding regional demand concentrations and tailoring product development strategies. The market is highly differentiated, reflecting the varying geological origins and processing methodologies required to produce slate suitable for specific functional requirements, such as skid resistance for paving or dimensional stability for architectural cladding.

By application, the market is broadly divided into segments such as roofing, flooring, cladding, and paving. Roofing slate commands the largest market share globally due to the material's unparalleled lifespan and weathering resistance, making it a benchmark for high-quality construction. However, the fastest growth is often observed in the decorative and non-traditional application segments, where architects leverage slate's natural aesthetics for unique interior and exterior finishes. End-user segmentation further clarifies demand drivers, differentiating between the consistent, project-based demand from the residential sector and the larger, more specialized volume requirements originating from commercial and institutional infrastructure projects, including government buildings and universities.

Understanding the interplay between these segments is crucial for strategic planning. For instance, residential renovation activity often drives demand for smaller volumes of standardized roofing slate, whereas high-end commercial projects require specialized cuts, specific color palettes, and large, coordinated shipments of cladding or flooring. Producers must maintain flexible manufacturing capabilities to address the diverse technical specifications across these segments, ranging from natural split surfaces for rustic appearance to honed finishes for modern interiors. This multilayered segmentation analysis highlights the specialized nature of the slate industry, demanding expertise in both geological extraction and precise architectural fabrication.

- By Product Type:

- Natural Slate Tiles

- Slate Flooring Slabs

- Slate Roofing Shingles

- Slate Paving and Flagstones

- Slate Veneers and Composites

- Dimension Stone (e.g., countertops, window sills)

- By Application:

- Roofing (Residential, Commercial, Institutional)

- Flooring (Interior and Exterior)

- Cladding and Wall Facing

- Landscaping and Paving (Walkways, Patios)

- Decorative and Architectural Accents

- Industrial and Electrical Applications (e.g., switchboards)

- By End-Use Sector:

- Residential Construction (New Builds and Renovation)

- Commercial Infrastructure (Offices, Retail, Hospitality)

- Institutional Buildings (Schools, Hospitals, Government Facilities)

- Historical Restoration and Preservation Projects

Value Chain Analysis For Slate Market

The Slate Market value chain commences with the upstream analysis, focusing on the highly specialized activities of geological exploration and quarrying. This stage is capital-intensive, requiring advanced drilling and blasting technologies to extract slate blocks efficiently while minimizing structural damage. Key upstream factors include securing long-term mineral rights, establishing compliance with environmental regulations, and investing in specialized cutting equipment essential for primary processing. The quality and purity of the raw slate extracted directly dictate the potential value downstream, highlighting the critical role of geological expertise and site selection in determining profitability. Efficiency at the quarrying stage, particularly maximizing the yield of high-grade, rift-free material, is the primary determinant of cost structure for the entire chain.

The midstream activities involve primary and secondary processing, which transform rough blocks into marketable products like tiles, shingles, and slabs. Primary processing involves splitting, sawing, and trimming, often using semi-automated machinery and highly skilled labor (splitters). Secondary processing focuses on finishing, such as honing, polishing, or calibration, to meet specific architectural standards. Distribution channels are highly varied, encompassing both direct and indirect routes. Direct distribution involves sales from the quarry operator directly to large-scale contractors or governmental infrastructure projects, ensuring tighter control over quality and logistics. Indirect channels rely heavily on specialized architectural stone distributors, building material wholesalers, and local retailers who manage inventory, provide localized cutting services, and offer expert consultation to smaller builders and homeowners.

The downstream analysis centers on the end-user application and installation, which significantly influences the final perceived value. Due to the weight and fragility of slate, transportation and installation require specialized handling and skilled installers, often leading to installation costs that exceed the material cost itself. This underscores the importance of the installation professional in the value chain, as improper fitting can compromise the durability and warranty of the slate product. Maximizing value downstream relies on strong marketing that emphasizes slate’s lifetime cost benefits, aesthetic superiority, and sustainability credentials, directly influencing the decision-making process of architects and developers who specify materials for long-term projects.

Slate Market Potential Customers

Potential customers for the Slate Market are diverse yet share a common requirement for durable, high-aesthetic, and high-performance building materials, often targeting long-term asset value. The primary end-users are concentrated within the construction and renovation sectors, particularly high-end residential homeowners and luxury property developers who prioritize longevity and architectural prestige. These buyers view slate not merely as a functional material but as an investment that enhances curb appeal and structural integrity, crucial for properties in demanding climate zones or those with historical significance. Their purchasing decisions are heavily influenced by warranty length, certified material quality, and the availability of specific color and textural grades tailored to classic or contemporary designs.

A major segment of potential customers includes institutional and commercial buyers, such as government agencies, universities, and large corporate entities, responsible for specifying materials for public infrastructure and large, long-life buildings. These customers are driven by criteria such as fire safety compliance, material sustainability (often requiring LEED or similar certifications), and minimal maintenance requirements over several decades. For example, institutional buyers frequently purchase specialized slate for laboratory countertops or high-traffic interior flooring due to its resistance to chemical spills and wear. This segment often procures slate through large volume tenders and requires stringent quality assurance protocols and predictable long-term supply agreements from vendors.

Furthermore, specialized heritage preservation organizations and restoration contractors constitute a vital customer base. These groups require historically accurate slate materials, often necessitating customized sizes, thicknesses, and sourcing from specific quarries known for producing slate that matches existing historical installations. These customers value the supplier's capacity to provide technical expertise on historical installation techniques and material matching. Lastly, landscape architects and urban planners represent a growing segment, utilizing paving slate and flagstones for premium public spaces, plazas, and parks where durability against heavy foot traffic and aesthetic integration with the natural environment are paramount design objectives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CUPA PIZARRAS S.A., Vermont Slate Company, Rathscheck Schiefer, Glendyne Inc., V. R. F. S. A. Slate Mining, The Premier Slate Company, Newmont Slate, North Country Slate, SSQ Slate, Penn Big Bed Slate Co., Virginia Slate Company, Natural Slate Company, Bangor Slate, Greenstone Slate, Camara Slate Products Inc., Grupo Samaca, Pizarras La Baña, M. L. W. Stone Group, Pizarras Los Tres Cuñados, and Australian Slate & Stone. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Slate Market Key Technology Landscape

The technology landscape in the Slate Market is primarily focused on enhancing efficiency and precision in extraction and processing, rather than developing entirely new materials. Advanced quarrying techniques represent a core technological area, moving away from conventional blasting towards controlled mechanical sawing and drilling. This shift is critical because it minimizes micro-fractures in the extracted blocks, dramatically increasing the yield of high-quality, rift-free slate suitable for premium roofing applications. Modern wire saws equipped with diamond beads allow for cleaner cuts in the quarry face, reducing waste and improving the overall safety of the extraction process. Furthermore, geophysical survey technologies, including ground-penetrating radar (GPR) and advanced mapping software, are increasingly used to precisely locate and evaluate the quality of reserves before extraction begins, optimizing resource management.

In the processing stage, technology centers around automation and precise calibration. While the critical task of splitting slate remains highly dependent on skilled manual labor due to the delicate nature of the material’s cleavage planes, subsequent processes are being automated. Computer Numerical Control (CNC) cutting and trimming machines ensure that tiles and slabs meet exacting dimensional specifications required by modern construction standards, especially crucial for calibrated flooring slate. Laser-guided systems are employed for thickness gauging and surface quality inspection, allowing manufacturers to rapidly sort and grade products, thereby improving consistency and reducing the need for costly rework. These advancements allow high-volume producers to maintain high quality control standards necessary to compete against cheaper, standardized manufactured products.

Furthermore, innovations in transportation and installation technologies are indirectly impacting the market. Lightweight slate composites and backing materials are being developed to reduce the total weight of slate systems, making installation easier and broadening the material's applicability to structures with lower load-bearing capacity. Digital modeling tools are also playing a role, enabling architects to simulate the aesthetic and performance of slate on a structure before installation, facilitating precise material ordering and minimizing site waste. Overall, the technological focus is on integrating traditional craftsmanship with modern precision engineering to ensure the longevity and inherent quality of natural slate are maintained while simultaneously addressing the cost and labor challenges associated with its use.

Regional Highlights

- Europe: Dominates the global market, driven by Spain and the UK, which are major producers and consumers, respectively. Demand is exceptionally high for heritage conservation and premium residential roofing, supported by favorable regulations concerning durable building materials. Countries like Germany and France also maintain robust demand for high-quality slate flooring and cladding in both urban renovation and new architectural projects.

- North America (NA): Characterized by high construction standards and a preference for long-lasting, high-value materials. The US market is concentrated in New England and the Mid-Atlantic regions, primarily for high-end residential roofing. Canada also shows steady demand, particularly for slate used in institutional and commercial structures requiring extreme weather resistance. Renovation activity remains a principal market driver.

- Asia Pacific (APAC): Represents the fastest-growing region, fueled by rapid urbanization, significant government investment in infrastructure, and rising disposable incomes leading to increased demand for premium home finishes. While China and India are major domestic producers, they also represent huge consumption markets, though often challenged by competition from cheaper local alternatives. Market maturity is still developing, focusing on flooring and interior applications.

- Latin America (LATAM): A key region for production, with quarries in Brazil and Argentina supplying both domestic and international markets. The consumption market is volatile, often tied directly to national economic cycles and large-scale public construction tenders. Demand is generally split between traditional roofing in temperate zones and paving/flooring in urban centers.

- Middle East and Africa (MEA): A smaller, but emerging market, primarily focused on luxury residential and commercial projects in the Gulf Cooperation Council (GCC) countries. Slate imports are driven by architectural demand for high-end, visually unique facade materials and durable flooring that can withstand intense heat and UV exposure. Growth is dependent on the continuation of large-scale, visionary real estate projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Slate Market.- CUPA PIZARRAS S.A.

- Vermont Slate Company

- Rathscheck Schiefer

- Glendyne Inc.

- V. R. F. S. A. Slate Mining

- The Premier Slate Company

- Newmont Slate

- North Country Slate

- SSQ Slate

- Penn Big Bed Slate Co.

- Virginia Slate Company

- Natural Slate Company

- Bangor Slate

- Greenstone Slate

- Camara Slate Products Inc.

- Grupo Samaca

- Pizarras La Baña

- M. L. W. Stone Group

- Pizarras Los Tres Cuñados

- Australian Slate & Stone

Frequently Asked Questions

Analyze common user questions about the Slate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the global Slate Market?

The primary factor driving demand is the increasing global emphasis on sustainable, durable, and aesthetically superior building materials, particularly for long-term investments in high-end residential and heritage restoration projects. Slate's unparalleled longevity and minimal maintenance requirements over its lifecycle provide a superior long-term economic value compared to synthetic alternatives.

How do slate quarrying technologies impact market supply and cost efficiency?

Modern slate quarrying technologies, such as diamond wire sawing and precise geological mapping, improve market supply by maximizing the yield of high-quality, rift-free material from reserves. These technologies enhance cost efficiency by reducing waste, minimizing the need for extensive secondary processing, and improving operational safety, allowing producers to meet stringent dimensional and quality standards required by architects.

Which geographical region holds the largest market share for slate consumption?

Europe currently holds the largest market share for slate consumption, primarily driven by strong demand in Spain, the United Kingdom, and Germany for both high-volume roofing applications and the critical sector of historical building preservation and restoration, where authentic slate is often mandatory for compliance.

What is the key difference between roofing slate and architectural cladding slate?

The key difference lies in material specifications and required dimensional stability. Roofing slate requires extremely low water absorption and perfect cleavage for thin splitting, ensuring weather resistance. Cladding slate, used for external walls, focuses more on aesthetic consistency, thermal performance, and specific mechanical fixings, often requiring greater uniformity in thickness and larger panel formats.

What restraints are currently limiting the broader adoption of natural slate?

The primary restraints limiting broader adoption are the high initial material and installation costs, which make slate significantly more expensive than mass-market roofing or flooring alternatives. Additionally, the labor-intensive nature of quarrying and installation, requiring highly specialized skills, contributes to the overall premium pricing of slate products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wireless Slate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Slate Tableware Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Solar Roof Mounts Market Statistics 2025 Analysis By Application (Commercial, Residential, Government, Utility, Industrial), By Type (Clay tile Roofs, Asphalt Roofs, Composite Roofs, Shake & Slate Roofs), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager