Smectite Clays Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443270 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Smectite Clays Market Size

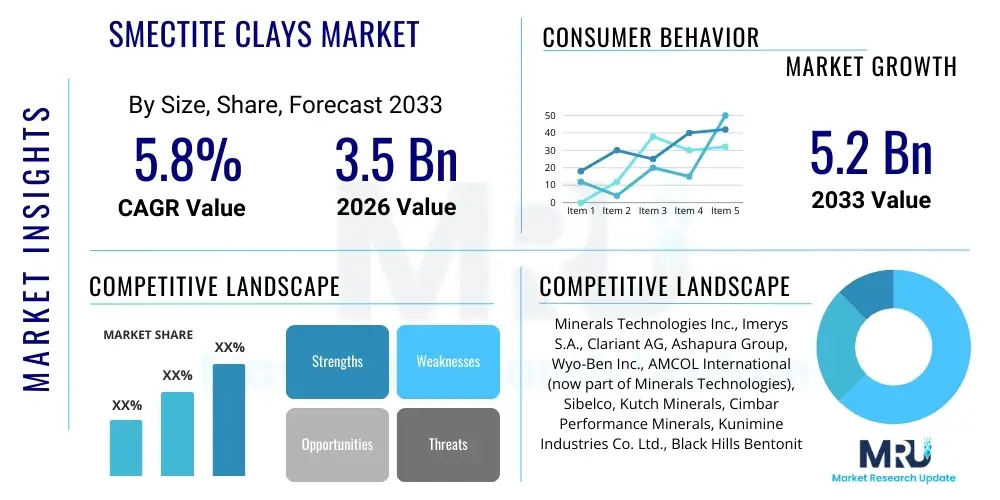

The Smectite Clays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand from the oil and gas sector, particularly for drilling muds, alongside significant expansion in civil engineering and environmental applications globally. The market valuation reflects the essential, non-substitutable properties of smectite minerals, such as high plasticity, superior adsorption capabilities, and expansive swelling capacity, making them crucial across diverse industrial matrices.

Smectite Clays Market introduction

Smectite clays constitute a vital group of phyllosilicate minerals, characterized by a layered structure and a high capacity for cation exchange, water adsorption, and significant volume expansion when hydrated. These unique physicochemical properties position smectites, primarily including bentonite (a naturally occurring clay containing mostly montmorillonite), hectorite, and saponite, as indispensable raw materials across numerous large-scale industrial applications. The geological prevalence and versatility of these clays allow for cost-effective deployment in both high-volume industrial processes and specialized high-value sectors, underpinning their stable market relevance.

The primary applications for smectite clays span industrial, construction, and specialized chemical sectors. In the oil and gas industry, they are crucial components of drilling fluids, providing viscosity, suspension, and filtration control under extreme conditions. Within civil engineering, they are utilized extensively for geotechnical barriers, slurry walls, and soil stabilization due to their sealing capabilities. Furthermore, in consumer goods, purified smectites find specialized uses in cosmetics, pharmaceuticals, and as highly efficient absorbents in the pet care industry, particularly for cat litter formulations. The diversified application portfolio shields the market from volatility in any single end-user sector.

Market growth is largely propelled by the global resurgence in infrastructural development, demanding substantial quantities of sealing and stabilizing agents, alongside sustained activity in energy exploration and production. Key driving factors include the low cost and high efficacy of bentonite in forming impervious layers, making it the material of choice for lining landfills and water containment structures. The ability of smectite clays to be chemically or thermally modified to enhance their performance—such as producing organoclays for pollution remediation—also provides a continuous avenue for market expansion and technological advancement, further cementing their role in sustainable industrial practices.

Smectite Clays Market Executive Summary

The Smectite Clays Market is defined by intense competition focused on resource quality, processing efficiency, and logistical capability. Current business trends indicate a shift towards specialty smectite grades, particularly those modified for high-performance applications such as nanofillers in polymers or pharmaceutical excipients. Major market participants are increasingly investing in sophisticated purification and activation technologies to meet stringent quality standards required by cosmetic and pharmaceutical industries, moving beyond bulk commoditization. Furthermore, consolidation among mining and processing firms is observed, aiming to secure access to high-grade bentonite reserves and optimize global supply chains, especially in regions exhibiting rapid industrial expansion.

Regionally, the Asia Pacific (APAC) market is forecast to exhibit the most rapid growth, primarily driven by massive governmental investments in infrastructure (roads, railways, smart cities) and the expansion of the manufacturing base, necessitating vast volumes of smectite for foundry, civil engineering, and environmental cleanup projects. North America retains significant market share, largely due to robust drilling activities in the U.S. shale plays, where high-yield bentonite is essential for horizontal drilling and hydraulic fracturing operations. European market maturity emphasizes high-value segments, focusing on premium cosmetics, specialized industrial thickening agents, and advanced environmental remediation solutions, where regulatory oversight drives demand for high-purity materials.

Segment trends highlight the dominance of the oil and gas application segment, although civil engineering and environmental remediation are rapidly gaining traction, propelled by global sustainability mandates and the need for effective waste management and groundwater protection. By Type, Bentonite remains the undisputed volume leader due to its wide applicability and lower cost structure. However, specialty types like Hectorite and Saponite are experiencing elevated demand, driven by their superior rheological properties required in high-end personal care products and sophisticated industrial coatings, reflecting a market trajectory moving toward both volume growth in traditional sectors and value growth in niche, specialized applications.

AI Impact Analysis on Smectite Clays Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Smectite Clays Market primarily revolve around optimizing resource management, enhancing product quality control, and streamlining logistics. Key themes surfacing include the potential for AI-driven geological modeling to locate and characterize high-purity deposits, the implementation of machine learning for real-time adjustments in processing (such as milling and activation) to ensure consistent product specifications, and the use of predictive analytics to manage complex global supply chains affected by fluctuating demand from oil, gas, and construction sectors. Users anticipate that AI integration will lead to significant cost reductions, improved operational safety, and the development of new, high-performance clay materials through advanced simulation and material design.

- AI enhances geological surveying and modeling for identifying high-grade smectite deposits, reducing exploration costs.

- Machine learning algorithms optimize the complex drying and milling processes to ensure consistent particle size and moisture content in finished products.

- Predictive maintenance schedules for heavy mining equipment are generated by AI, minimizing operational downtime and maximizing extraction output.

- AI-driven supply chain platforms improve inventory management and optimize transportation routes for bulk materials, reducing logistical bottlenecks and carbon footprint.

- Advanced data analysis facilitates the development of novel smectite composites and nanocomposites by simulating chemical interactions and performance under varying conditions.

DRO & Impact Forces Of Smectite Clays Market

The dynamics of the Smectite Clays Market are dictated by a confluence of macroeconomic factors, technological advancements, and stringent regulatory frameworks. Key drivers include the global energy demand sustaining oil and gas exploration, necessitating continuous supply of specialized drilling mud components, and the imperative for sustainable waste management, driving up demand for clay liners in landfills and wastewater treatment facilities. These forces generate substantial market momentum, but are balanced by regulatory hurdles concerning mining permits and environmental restoration requirements, which often lead to operational delays and increased compliance costs for raw material procurement.

Restraints primarily stem from the substitution threat posed by synthetic additives, particularly in high-performance drilling fluids and specialized rheology control applications, where synthetic polymers sometimes offer superior consistency and stability under extreme temperatures. Furthermore, the geographical concentration of high-quality smectite deposits introduces significant logistical challenges and geopolitical risks, impacting pricing stability and supply reliability across different regional markets. Fluctuations in energy costs, necessary for the high-energy processes of mining, drying, and grinding, also act as a constraint on profitability for market participants.

Opportunities for expansion are largely concentrated in the nanotechnology sector, where smectite-based composites (nanoclays) offer enhanced barrier properties, mechanical strength, and fire resistance for use in advanced packaging, automotive parts, and construction materials. The expanding global focus on environmental remediation presents another lucrative pathway, as smectite clays are highly effective and cost-efficient adsorbents for heavy metals and organic pollutants in contaminated soil and water. The successful leveraging of these opportunities requires significant R&D investment and collaboration between clay processors and specialized high-tech end-users.

Segmentation Analysis

The Smectite Clays Market is structurally segmented based on the fundamental mineral type, reflecting inherent compositional differences and performance characteristics, and by application, which defines the massive variability in end-user demands and required product specifications. Segmentation by Type allows producers to focus on optimizing extraction and processing technologies specific to Montmorillonite (the most common and versatile), Hectorite (known for superior viscosity), or Saponite (often used in specific catalytic or specialized pharmaceutical applications). Application segmentation is crucial for market penetration strategies, as the quality and purity requirements for drilling fluids differ drastically from those mandated for cosmetic-grade products, thereby influencing pricing and production scalability across the board.

- Type:

- Montmorillonite

- Bentonite

- Hectorite

- Saponite

- Nontronite

- Others (e.g., Beidellite)

- Application:

- Drilling Fluids (Oil and Gas)

- Foundry (Molding Sands)

- Cat Litter (Absorbents)

- Civil Engineering (Sealing and Stabilization)

- Iron Ore Pelletizing

- Cosmetics and Pharmaceuticals

- Environmental Applications (Liners, Remediation)

- Agriculture (Soil Conditioners, Binders)

- Others (e.g., Coatings, Detergents)

- Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Smectite Clays Market

The Smectite Clays value chain begins with rigorous upstream activities, primarily involving geological exploration, meticulous surveying, and the large-scale open-pit mining of raw clay deposits. Raw smectite material, such as sodium or calcium bentonite, is then transported to central processing facilities. This upstream segment is characterized by high capital expenditure for land acquisition, heavy machinery, and compliance with stringent environmental regulations governing extraction and rehabilitation, often making resource security a key competitive differentiator for large mining conglomerates that control prime, high-yield reserves globally.

The midstream processing phase involves several critical value-adding steps designed to tailor the raw clay for specific industrial requirements. This typically includes crushing, drying (to control moisture content), grinding (to achieve target particle size distribution), and, crucially, activation (chemically treating calcium bentonite to enhance its sodium-like swelling properties). Furthermore, specialized processors engage in purification techniques for high-end applications like cosmetics and pharmaceuticals, ensuring removal of impurities and heavy metals. Distribution channels vary significantly; bulk tonnage for civil engineering or drilling is typically moved via rail or maritime freight directly from mines or nearby processing hubs, minimizing handling costs.

The downstream analysis focuses on the end-user consumption and the subsequent incorporation of the clay product into final industrial formulations. Direct distribution often serves large-volume users such as major oilfield service companies or national infrastructure projects, relying on long-term contracts. Indirect channels involve specialty distributors and regional chemical wholesalers who cater to smaller users, such as local foundries, regional cat litter manufacturers, or cosmetic formulators. The efficiency of the distribution network, particularly the ability to manage the high volume and weight of the product economically, is paramount to maintaining competitive pricing across disparate global markets.

Smectite Clays Market Potential Customers

Potential customers for smectite clays represent a highly diversified industrial base, reflecting the mineral’s versatility across heavy industries and specialized consumer sectors. Primary consumers include oil and gas exploration companies and oilfield service providers who rely on high-yield bentonite for formulating drilling muds that maintain bore-hole stability and facilitate efficient cuttings removal. This segment demands reliable supply, consistent rheological performance, and compliance with API (American Petroleum Institute) specifications, making them crucial, high-volume buyers primarily focused on technical performance and supply chain reliability.

A second major customer cluster resides within the civil engineering and construction industry, encompassing geotechnical firms, construction materials manufacturers, and large infrastructure project contractors. These buyers utilize smectites for slurry walls, grouting, waterproofing membranes, and soil stabilization, valuing the material’s sealing properties, high plasticity, and cost-effectiveness as an impervious barrier. Demand from this sector is intrinsically linked to government spending on infrastructure and municipal construction activity, driving significant bulk tonnage requirements globally, particularly in developing economies.

Beyond bulk industrial consumption, specialty customers form a high-value consumer group, including pharmaceutical companies, cosmetic manufacturers, and pet care product producers. Pharmaceutical grade montmorillonite is used as an excipient, binder, or stabilizer, while refined hectorite provides unique suspension and thickening capabilities for high-end lotions and makeup. These customers prioritize ultra-high purity, certified microbiological safety, and compliance with regulatory bodies like the FDA or EMA, often necessitating customized product formulations and specialized, small-volume packaging, resulting in higher profit margins for processors capable of meeting these stringent specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Minerals Technologies Inc., Imerys S.A., Clariant AG, Ashapura Group, Wyo-Ben Inc., AMCOL International (now a part of Minerals Technologies), Laviosa Chimica Mineraria, Kunimine Industries Co. Ltd., CETCO (a subsidiary of Minerals Technologies), Elementis plc, Tolsa Group, G & W Mineral Resources, Midpoint Chemicals, P&S Group, Volclay International, C.I. Kasei Co., Ltd., Star Bentonite Group, Bentonit KFT, GSA Minerals, MTI Bentonite. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Smectite Clays Market Key Technology Landscape

The technological landscape of the Smectite Clays market is characterized by innovations aimed at enhancing the functional performance, purity, and sustainability of the processed materials. A core technological focus involves the development of advanced chemical activation techniques, such as hydrothermal or acid treatments, used primarily to convert lower-swelling calcium bentonite into high-performance sodium-type bentonite substitutes. These processes are essential for meeting the stringent specifications of API drilling mud standards and high-viscosity applications. Furthermore, advancements in fine grinding and air classification technologies ensure precise particle size distribution, which is critical for rheology control in paints, coatings, and drilling fluids, maximizing the efficiency of the clay particles.

A significant area of technological research and commercialization involves the modification of smectite surfaces to create organoclays and nanoclays. Organoclays are produced by exchanging the interlayer cations with quaternary ammonium salts, yielding hydrophobic materials essential for oil-based drilling fluids, environmental cleanup (sorbents for organic pollutants), and polymer reinforcement. Nanotechnology leverages the naturally layered structure of smectites to exfoliate the layers, resulting in materials with ultra-high aspect ratios. When incorporated into polymer matrices, these nanoclays significantly enhance mechanical strength, thermal stability, and barrier properties, driving their adoption in high-performance materials science and specialized packaging applications.

Sustainability and resource efficiency also form a key part of the technology landscape. Modern processing plants are implementing sophisticated sensor technologies and digitalization strategies to optimize energy consumption during the drying phase, a highly energy-intensive process. Concurrent efforts are focused on developing selective mining techniques and efficient resource utilization programs that minimize waste generation. Moreover, innovative encapsulation and composite formation technologies are allowing smectite clays to be combined with other materials (like zeolites or functional polymers) to create multi-functional hybrid materials specifically engineered for challenging environmental remediation tasks, thus broadening the market's technological utility and ensuring regulatory compliance regarding material safety and disposal.

Regional Highlights

- North America: This region dominates the Smectite Clays Market revenue, fundamentally driven by the extensive activity in the oil and gas sector, particularly the extraction of shale gas and unconventional resources in the United States. High-yield bentonite, meeting strict API specifications, is in constant demand for stabilizing complex horizontal drilling operations. Furthermore, the region maintains a mature market for specialty applications, including high-purity clays for pharmaceuticals and cosmetics, supported by stringent regulatory standards and robust domestic production capabilities, particularly centered around Wyoming bentonite reserves.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, propelled by unparalleled infrastructural development and rapid industrialization across emerging economies like China, India, and Southeast Asia. The demand is predominantly for bulk applications, including civil engineering (foundation stabilization, tunneling), iron ore pelletizing (a major requirement in regional steel production), and the burgeoning foundry industry. Increased urbanization is also spiking demand for cat litter and basic environmental containment measures, positioning APAC as the primary engine for volume growth.

- Europe: The European market is characterized by maturity and a strong focus on high-value, specialized segments. While bulk demand exists for construction (e.g., diaphragm walls in densely populated urban centers), the market emphasis is shifted towards highly purified smectites for advanced rheology control in industrial coatings, specialized food contact materials, and the premium cosmetic industry. Furthermore, strict environmental regulations mandate the extensive use of smectite liners in landfill construction and contaminated land remediation, ensuring sustained demand for high-quality sealing agents.

- Latin America (LATAM): Growth in LATAM is closely tied to fluctuating commodity cycles, with key demand stemming from oil exploration in Brazil and Mexico and mining operations throughout the Andean region. Civil engineering projects, though intermittently funded, contribute significantly, particularly in urban expansion. The region also exhibits rising demand for high-quality foundry products, supported by local manufacturing growth. Logistical constraints and variability in local resource quality present challenges but also opportunities for high-efficiency processors.

- Middle East and Africa (MEA): MEA remains critical primarily due to large-scale, continuous oil and gas drilling operations, particularly in the Gulf Cooperation Council (GCC) countries and North Africa. This sector demands significant volumes of drilling-grade bentonite, often imported or sourced locally if high-quality reserves are available. The region is witnessing growth in major civil infrastructure projects (e.g., ports, linear projects), increasing the requirement for geotechnical clay applications and specialized sealing barriers, particularly in arid climates where water retention is crucial.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Smectite Clays Market.- Minerals Technologies Inc.

- Imerys S.A.

- Clariant AG

- Ashapura Group

- Wyo-Ben Inc.

- AMCOL International (now a part of Minerals Technologies)

- Laviosa Chimica Mineraria

- Kunimine Industries Co. Ltd.

- CETCO (a subsidiary of Minerals Technologies)

- Elementis plc

- Tolsa Group

- G & W Mineral Resources

- Midpoint Chemicals

- P&S Group

- Volclay International

- C.I. Kasei Co., Ltd.

- Star Bentonite Group

- Bentonit KFT

- GSA Minerals

- MTI Bentonite

Frequently Asked Questions

Analyze common user questions about the Smectite Clays market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Smectite Clays Market?

The primary driver is the sustained global demand from the oil and gas industry for high-performance drilling fluids, coupled with accelerating infrastructural spending in emerging economies requiring large volumes of smectite clays for civil engineering applications, such as sealing, grouting, and soil stabilization.

How do bentonite and montmorillonite relate within the smectite group?

Montmorillonite is the key mineral component defining the smectite group, characterized by its layered structure and swelling capacity. Bentonite is an industrial term for a natural clay deposit composed predominantly (usually 50% or more) of the mineral montmorillonite. Thus, bentonite is the commercial form of smectite utilized in most industrial applications.

What role does technological innovation play in market growth?

Technological innovation is focused on developing specialty grades, particularly nanoclays and organoclays, which exhibit enhanced performance characteristics like superior mechanical strength and improved rheology control. These modifications expand smectite applications into high-value sectors such as advanced materials, specialized coatings, and pharmaceuticals, securing future value growth.

Which geographical region holds the largest market share for smectite clays?

North America currently holds the largest market share, predominantly driven by the robust and continuous requirement for high-quality bentonite in the region's expansive oil and gas exploration activities, especially unconventional drilling projects in the United States.

What are the main competitive restraints facing the smectite clays market?

The key competitive restraints include the increasing threat of substitution from specialized synthetic polymers in complex industrial fluids, and logistical challenges and high transportation costs associated with moving bulk, high-density clay products globally from geographically concentrated mining locations.

How are smectite clays used in environmental applications?

Smectite clays are critically used in environmental management as impervious barriers in landfill liners and caps to prevent leachate migration. They are also employed as efficient adsorbents in wastewater treatment and contaminated soil remediation, effectively binding heavy metals and certain organic pollutants due to their high cation exchange capacity.

What makes smectite clays suitable for the cosmetics industry?

Smectite clays, particularly refined hectorite and certain montmorillonites, are highly valued in cosmetics for their superior rheological properties. They function as effective thickeners, stabilizers, and suspending agents in lotions, creams, and makeup, improving texture and preventing separation of ingredients. They also offer detoxifying and absorbent properties for facial masks.

Is the market leaning more towards bulk or specialty smectite products?

While bulk demand (drilling, civil engineering) still accounts for the highest volume, the market is exhibiting a pronounced trend towards specialty smectite products. This shift is driven by the higher margins and increasing technological complexity demanded by the pharmaceutical, advanced materials, and high-end consumer goods sectors.

What is the typical processing method for raw smectite clay?

Raw smectite processing involves initial crushing, drying (often via rotary kilns to achieve precise moisture content), and then fine grinding or pulverization. For certain bentonites, chemical activation (soda ash treatment) is performed to enhance swelling characteristics and maximize performance for high-viscosity applications like drilling muds.

How does the quality of smectite deposits vary globally?

Smectite quality varies significantly by region; for instance, high-sodium bentonite reserves, like those found in Wyoming (USA), offer superior natural swelling capacity ideal for drilling. Conversely, deposits rich in calcium bentonite are widespread but require more extensive chemical activation to achieve comparable performance, impacting processing costs and end-product pricing.

What segment of the market utilizes the largest volume of smectite clays?

The Drilling Fluids segment, specifically for oil and gas exploration and extraction activities, currently utilizes the largest volume of smectite clays globally. Bentonite is indispensable for maintaining borehole stability, controlling fluid loss, and suspending heavy cuttings during the drilling process, driving substantial bulk demand.

Are there viable substitutes for smectite clays in foundry applications?

While some specialized synthetic binders or alternative mineral binders exist, smectite clays, primarily bentonite, remain the most cost-effective and widely used binder in green sand foundry molds due to their excellent plasticity, thermal stability, and reusable nature. Substitutes generally target niche, high-performance casting requirements but lack the broad economic appeal of bentonite.

How is AI specifically improving the efficiency of smectite mining operations?

AI is employed to analyze geological data rapidly, identifying optimal mining locations and predicting the quality variability within a deposit, thereby minimizing low-yield extraction efforts. Additionally, predictive maintenance systems, leveraging AI, reduce downtime for large-scale mining equipment, significantly enhancing overall operational efficiency and resource extraction throughput.

What is the forecast for the Smectite Clays Market CAGR between 2026 and 2033?

The Smectite Clays Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period, reflecting steady demand growth across established industrial applications and increasing penetration into high-value specialty sectors.

Do stringent regulations pose a significant barrier to market expansion?

Yes, stringent environmental regulations governing land use, mining permits, and disposal of mining waste pose operational challenges and increase compliance costs. Conversely, environmental regulations mandating efficient containment structures often drive demand for high-quality smectite liners, creating a dual impact on the market.

Which application segment is expected to show the fastest growth rate?

The Environmental Applications and Nanocomposites segments are projected to exhibit the fastest growth, driven by global mandates for waste containment, water purification, and the material science trend towards utilizing nanoclay-reinforced polymers in high-performance manufacturing.

Why is purification necessary for pharmaceutical-grade smectite?

Purification is critical to remove trace heavy metals, crystalline silica, and microbiological impurities to ensure the final product meets the extreme safety and purity standards required by global pharmacopeias. This stringent requirement mandates advanced separation and sterilization technologies.

What is the primary function of smectite clays in the iron ore pelletizing process?

Smectite clays, typically bentonite, serve as essential binders in the iron ore pelletizing process. They provide sufficient mechanical strength to the green (unfired) pellets, preventing breakage during handling and preparation for the final sintering or firing stage, crucial for blast furnace operations.

What distinguishes Hectorite from other common smectite types?

Hectorite is a rare, magnesium-rich trioctahedral smectite distinguished by its exceptionally high viscosity and unique thixotropic properties even at low concentrations, making it highly desirable for specialized applications like high-end cosmetics, paints, and specialized industrial thickening agents.

How does the global shift towards renewable energy impact smectite demand?

While reduced fossil fuel dependence may slightly moderate drilling demand long-term, smectites remain vital for renewable infrastructure, utilized in construction of energy storage facilities, geothermal drilling, and geotechnical work related to large-scale solar and wind farms, diversifying its reliance beyond traditional oil and gas.

What is the significance of the cation exchange capacity (CEC) in smectite performance?

The high Cation Exchange Capacity (CEC) of smectites dictates their ability to exchange interlayer cations, which is fundamental to their swelling behavior, adsorption capabilities (critical for environmental cleanup), and their effectiveness when modified to form organoclays for specialized applications.

What kind of distribution channels are utilized for bulk smectite products?

Bulk smectite products, intended for civil engineering and drilling, primarily utilize direct distribution channels involving large volume shipments via rail, maritime vessels, or heavy trucks, often based on long-term supply contracts to ensure logistical efficiency and cost savings.

Which region is exhibiting accelerated growth due to infrastructure investment?

The Asia Pacific region, specifically countries like China and India, is showing accelerated growth due to massive, state-sponsored infrastructure investment programs that require significant amounts of smectite clays for foundation work, tunneling, and soil stabilization projects.

How do market participants secure resource longevity in this industry?

Market participants secure resource longevity by investing heavily in geological exploration and acquiring rights to high-quality, long-life reserves. Vertical integration, from mining to processing, also ensures supply control and mitigates geopolitical risks associated with resource accessibility.

What defines a 'high-yield' bentonite product?

High-yield bentonite is characterized by its ability to generate high viscosity and gel strength when mixed with water at relatively low concentrations, crucial for maximizing efficiency and performance in demanding applications such as API-grade drilling mud formulations.

Is there a difference in market requirements between sodium and calcium bentonite?

Yes, sodium bentonite naturally exhibits superior swelling and rheological properties, commanding premium prices and dominating drilling and sealing applications. Calcium bentonite is more common but requires energy-intensive activation (sodium treatment) to upgrade its performance for most high-demand industrial uses.

What specific benefit does nanoclay provide to polymer composites?

Nanoclay, when properly exfoliated and dispersed, provides significant enhancement in the mechanical properties (stiffness and strength), thermal stability, and gas barrier properties of polymer composites, making them valuable for lightweight automotive parts and advanced packaging solutions.

How does the cat litter segment contribute to the overall market size?

The cat litter segment is a substantial volume consumer, utilizing large quantities of calcium bentonite and sometimes sodium bentonite due to its exceptional absorbent qualities, dust control properties, and clumping behavior, particularly driven by growing pet ownership globally.

What are the key concerns regarding substitutes for smectite clays?

The key concerns relate to the performance superiority of synthetic alternatives, such as specialized synthetic polymers, which can maintain stability and rheology under higher temperature and pressure conditions than natural clays, posing a risk in niche, extreme environment applications.

What challenges do processors face when supplying the cosmetics industry?

Processors must overcome challenges related to achieving extreme purity levels, including the elimination of heavy metals and crystalline silica, while maintaining consistency in particle morphology and rheological performance, demanding costly, dedicated purification facilities and rigorous quality control protocols.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager