Sodium Phenoxyacetate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441543 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Sodium Phenoxyacetate Market Size

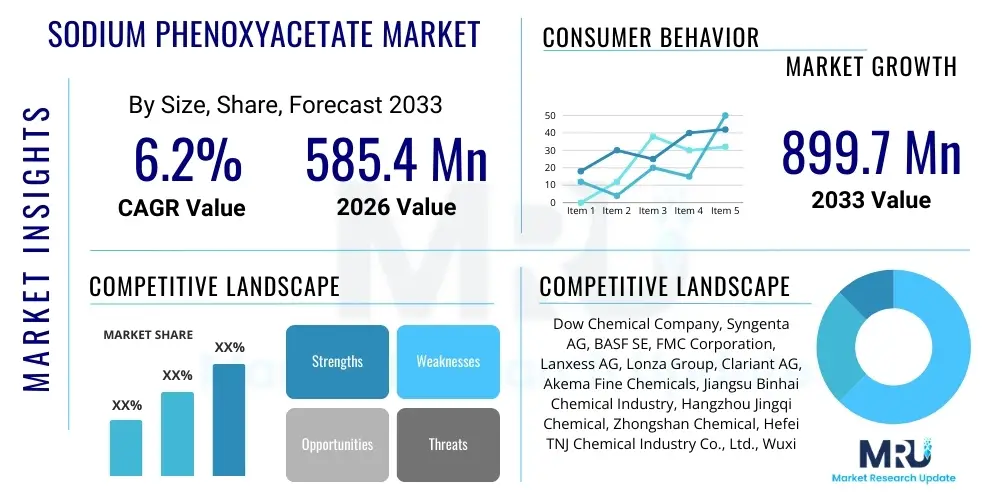

The Sodium Phenoxyacetate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.7 Million in 2026 and is projected to reach USD 669.5 Million by the end of the forecast period in 2033.

Sodium Phenoxyacetate Market introduction

Sodium Phenoxyacetate (SPA), defined chemically as the sodium salt of phenoxyacetic acid, is a pivotal chemical intermediate crucial for multiple high-value industries globally. Its molecular structure facilitates its use as a precursor in complex organic synthesis, notably acting as the foundation for the broad family of phenoxy herbicides, which are essential for selective post-emergence weed control in cereal crops, turf, and grasslands. The substantial growth trajectory of the global population necessitates increased agricultural productivity, placing sustained and elevated demand on effective crop protection solutions like those derived from SPA. This demand cycle ensures the compound's strategic importance within the agrochemical supply chain. The substance itself presents as a highly soluble, crystalline solid, which simplifies handling and reaction procedures within bulk chemical synthesis plants.

The core product description emphasizes its versatility, stemming from the functional phenoxy group, which can undergo various esterification and amidation reactions. This chemical flexibility is critical not only for generating high-efficacy systemic herbicides, such as 2,4-D and its ester forms (e.g., 2,4-D ethylhexyl ester, 2,4-D dimethylamine salt), but also for creating specialized fine chemicals. Beyond agriculture, SPA derivatives find application in the pharmaceutical sector as intermediates in the synthesis of certain non-steroidal anti-inflammatory drugs (NSAIDs) and other active pharmaceutical ingredients (APIs) requiring specific aromatic ring structures. The duality of demand—high volume in agriculture versus high purity in pharmaceuticals—creates distinct market segments that require differentiated manufacturing capabilities and regulatory compliance frameworks.

Key market driving factors are intrinsically linked to the macroeconomic trends affecting food security and global health. The economic superiority and reliable performance of 2,4-D based products over certain newer, more expensive herbicide alternatives ensure continuous demand, especially in developing agricultural economies. Furthermore, the persistent challenge of weed resistance globally compels agrochemical companies to constantly innovate formulations, often relying on established chemical backbones like phenoxyacetates in combination with newer modes of action. The inherent benefits of SPA synthesis, characterized by relatively straightforward industrial scaling and established raw material sourcing channels (primarily phenol and monochloroacetic acid), support its competitive standing. The continued refinement of synthesis methods to reduce environmental byproducts and enhance purity remains a critical driver for market longevity and regulatory acceptance in mature regions.

Sodium Phenoxyacetate Market Executive Summary

The Sodium Phenoxyacetate market is characterized by intense price competition in the bulk segment and rapid technological specialization in the high-purity niche. Current business trends show a strategic migration of high-volume manufacturing capacity towards Asia Pacific, driven by favorable economies of scale, lower labor costs, and less stringent immediate environmental capital investment requirements compared to Western economies. Leading global agrochemical companies are increasingly establishing strategic partnerships or joint ventures with dominant Asian manufacturers to secure reliable, cost-effective supplies of SPA and its immediate derivatives. This integration often includes sophisticated quality control transfer protocols to ensure the final product meets the stringent specifications required for export to highly regulated markets like Europe and North America.

Regional dynamics underscore a divergence in consumption focus. Asia Pacific utilizes SPA overwhelmingly for domestic and export agrochemical production, positioning it as the volume market leader. Conversely, North America and Europe, while consuming high volumes of the derived herbicides, exhibit a higher relative growth rate in the demand for Pharmaceutical Grade SPA. This is attributable to the concentration of advanced pharmaceutical research and development, and stringent regulatory bodies demanding c-GMP compliant intermediates. The European market, in particular, is navigating complex regulatory reviews of synthetic agrochemicals, pushing demand toward derivatives that demonstrate superior environmental degradation profiles and minimized off-target drift potential. Latin America’s explosive agricultural growth, particularly in row crops like soybeans, positions it as a key consumption region for bulk agrochemical grade SPA in the medium-term forecast.

Segmental analysis highlights the enduring dominance of the Agrochemicals application segment, which dictates overall market volume and price benchmarks. However, the Pharmaceutical Intermediates segment, although contributing a smaller revenue share, demonstrates superior market resilience and potential for margin expansion, given the premium pricing associated with certified high-purity materials. Manufacturers are strategically investing in dedicated production lines to separate pharmaceutical grade manufacturing environments from bulk commodity processes, mitigating cross-contamination risks and ensuring compliance with pharmaceutical quality management systems. Furthermore, there is a clear trend toward vertical integration across the major players, aiming to capture value throughout the synthesis of the final formulated herbicide, from basic SPA production to emulsifiable concentrate preparation, stabilizing profitability against commodity price volatility.

AI Impact Analysis on Sodium Phenoxyacetate Market

The primary inquiries from industry professionals regarding the integration of Artificial Intelligence in the Sodium Phenoxyacetate domain focus on three key areas: optimizing complex synthetic routes, predicting raw material supply chain vulnerabilities, and leveraging machine learning for accelerated compliance and safety analysis. Stakeholders frequently ask how AI can refine the alkaline condensation reaction parameters—temperature, pH, and stoichiometry—to maximize conversion yields of phenol and monochloroacetic acid into SPA, particularly when aiming for ultra-high purity (>99.5%) grades where impurity minimization is paramount. Users are concerned about AI's role in predictive maintenance for specialized reactors and distillation columns used in SPA production, aiming to reduce costly downtime and improve yield consistency. Furthermore, there is significant interest in utilizing AI to correlate dynamic factors such as seasonal weather forecasts and global planting intentions with future demand for 2,4-D, thereby allowing manufacturers to dynamically adjust their production schedules and minimize working capital tied up in excess inventory.

AI’s influence is rapidly maturing from theoretical application to practical deployment within specialized chemical manufacturing. In the realm of process chemistry, sophisticated machine learning models are now capable of analyzing vast databases of reaction conditions and material properties, suggesting non-intuitive adjustments to catalyst systems or solvent choices that can significantly increase reaction selectivity and efficiency. This not only reduces operational expenditure by consuming fewer resources but also minimizes waste streams, addressing environmental compliance concerns. For instance, reinforcement learning algorithms can continuously monitor spectroscopic data from inline process analytical technology (PAT) sensors and make micro-adjustments to flow rates, stabilizing crystallization kinetics necessary for achieving uniform particle size distribution, which is critical for formulating effective agrochemical end-products. This level of autonomous control is a significant step toward manufacturing excellence in high-volume, yet quality-sensitive, chemical production.

Furthermore, the regulatory and commercial strategy aspects of the SPA market are being profoundly reshaped by AI-powered tools. Given the complex toxicology and environmental fate data required for registering phenoxy-herbicides in multiple jurisdictions, AI models are used to rapidly screen potential derivatives for adverse environmental profiles, accelerating the R&D pipeline toward safer, more regulatory-friendly molecules. Commercially, AI analyzes global trade tariffs, logistics bottlenecks, and geopolitical events in real-time, providing predictive insights into the cost of key inputs like phenol and logistics costs associated with intercontinental shipping. This predictive capacity allows sourcing teams to secure raw materials at optimal times, ensuring margin protection against volatile commodity markets, thereby strengthening the overall resilience of the Sodium Phenoxyacetate supply chain against unforeseen macroeconomic shocks and market disruptions.

- AI-driven optimization of alkaline condensation reaction parameters enhances purity and yield consistency.

- Machine learning models accurately predict global agricultural demand for 2,4-D based on climate and planting data.

- Predictive supply chain analytics mitigates risks associated with volatile phenol and MCA raw material pricing.

- Robotics and autonomous systems, guided by AI, handle hazardous intermediate materials, improving worker safety.

- Computational chemistry accelerates the screening of novel phenoxyacetate derivatives for improved toxicity profiles.

- AI integrates real-time PAT data for dynamic quality control and process stabilization in continuous manufacturing setups.

DRO & Impact Forces Of Sodium Phenoxyacetate Market

The market trajectory for Sodium Phenoxyacetate is dictated by powerful macroeconomic drivers, stringent regulatory restraints, and compelling technological opportunities, creating a highly dynamic set of Impact Forces. A fundamental driver remains the critical role of phenoxy herbicides in global staple crop production (e.g., corn, wheat, rice), particularly given the continuous pressure on agricultural land to meet increasing global caloric needs. The ability of 2,4-D, derived from SPA, to effectively manage broadleaf weeds at a lower application cost than many alternatives ensures its sustained relevance. This economic driver is amplified by emerging global trends toward large-scale, mechanized farming, particularly in Latin America and certain parts of APAC, which rely heavily on efficient, systemic weed management solutions that depend on reliable supplies of SPA intermediates.

Conversely, significant restraints are imposed by the increasingly cautious global regulatory environment, particularly within the OECD nations. Concerns surrounding potential environmental persistence, residues in food chains, and non-target organism impact necessitate continuous, costly toxicological reassessment and formulation adjustments. The regulatory review processes, such as those undertaken by the European Chemicals Agency (ECHA) and the US Environmental Protection Agency (EPA), introduce substantial uncertainty and long lead times for product renewal, acting as a barrier to market entry and imposing high compliance costs on existing players. Furthermore, the inherent susceptibility of the production process to volatile upstream energy and petrochemical markets, given phenol's origin, restricts manufacturers' ability to maintain stable pricing and predictable margins, complicating long-term investment planning and necessitating robust risk mitigation strategies against supply disruptions.

Opportunities for market expansion are concentrated in strategic differentiation. The transition to producing ultra-high purity, certified Pharmaceutical Grade SPA opens access to lucrative health sector markets with high entry barriers but significantly higher profit margins. Moreover, technological opportunities related to 'Green Chemistry'—developing synthesis routes utilizing catalytic processes that eliminate harsh solvents or reduce energy consumption—offer a pathway to mitigate regulatory risks and enhance corporate sustainability profiles. The overarching impact forces compel chemical manufacturers to choose between two diverging strategies: either maximizing scale and cost leadership in the commodity Agrochemical Grade, primarily targeting APAC and LATAM, or investing heavily in R&D and quality systems to dominate the specialized, high-margin Pharmaceutical/Specialty Chemical segments in North America and Europe, requiring a high degree of supply chain transparency and regulatory proficiency. The competitive advantage is increasingly shifting toward manufacturers who can blend cost efficiency with impeccable regulatory track records.

- Drivers: Intensified global demand for food security necessitates effective herbicides; Cost advantage and established efficacy of 2,4-D; Expansion of large-scale commercial farming operations in emerging economies.

- Restraints: Extreme volatility in raw material costs (Phenol and MCA); High capital expenditure required for regulatory compliance and advanced waste management; Public perception and restrictive governmental regulations concerning chemical residues.

- Opportunities: Market diversification into high-purity Pharmaceutical Intermediate synthesis; Development and commercialization of advanced, low-volatility ester formulations addressing drift concerns; Utilizing biotechnology to develop sustainable, bio-based sources for feedstocks like phenol substitutes.

- Impact Forces: Regulatory harmonization efforts worldwide demand adaptable manufacturing standards; Increased focus on sustainable production practices (ESG compliance); Competitive intensity focused on pricing structure and reliable supply chain logistics, particularly during peak agricultural seasons.

Segmentation Analysis

The segmentation of the Sodium Phenoxyacetate market provides granular insights into demand characteristics and value proposition across various applications. The delineation by Product Grade remains the most economically significant segmentation, separating the high-volume commodity market from the specialized fine chemical niche. Agrochemical Grade SPA must be manufactured efficiently at scale, tolerating minor impurities provided they do not destabilize the final formulated herbicide product or violate residue limits. Conversely, Pharmaceutical Grade production operates under c-GMP guidelines, often involving dedicated, smaller, stainless-steel reactors and extensive validation protocols to ensure the absolute absence of specified heavy metals, known genotoxic impurities, and organic contaminants that could compromise the quality of Active Pharmaceutical Ingredients (APIs).

Application segmentation reveals the overwhelming market dependence on the Agrochemicals segment, which accounts for over 70% of the total volume. Within this segment, the synthesis of 2,4-D remains the largest consumer, reflecting its enduring position as a foundational herbicide. This segment's demand is inherently seasonal and geographically dependent, fluctuating based on global crop cycles and regional pest pressures. In contrast, the use of SPA in Pharmaceutical Intermediates, while volume-light, is highly stable and recession-resistant, driven by continuous production needs for various therapeutic drugs. The Specialty Chemicals segment, including dyes and high-performance polymers, demands tailored specifications but operates with relatively low, consistent volumes, serving highly specialized industrial end-users, requiring suppliers to maintain flexibility in batch size and technical specifications.

Analyzing the market by Synthesis Route illuminates the industry's strategic direction. The conventional Alkaline Hydrolysis method, utilizing sodium hydroxide, remains dominant due to its low cost and established operational reliability. However, regulatory pressures and the drive toward environmental sustainability are increasing the adoption of novel, often patented, Catalytic Synthesis routes. These newer technologies focus on minimizing energy consumption, enhancing atom economy (reducing waste), and potentially bypassing problematic intermediate steps. This technological segmentation is crucial for evaluating long-term competitive advantage, as producers mastering sustainable synthesis routes are better positioned for future regulatory landscapes and access to premium green procurement contracts from multinational corporations. Regional segmentation, as detailed in the Regional Highlights, further modifies these trends, as regulatory acceptance heavily influences which grades and applications are prioritized in specific geographical markets.

- By Grade:

- Agrochemical Grade (Standard purity, bulk sales, high price sensitivity)

- Pharmaceutical Grade (Ultra-high purity, c-GMP compliance, premium pricing)

- Technical Grade (Used in niche industrial and laboratory applications)

- By Application:

- Agrochemicals

- Herbicides (e.g., 2,4-D, MCPA)

- Plant Growth Regulators (PGRs)

- Pharmaceutical Intermediates

- Non-Steroidal Anti-inflammatory Drugs (NSAIDs)

- Veterinary APIs

- Specialty Chemicals and Dyes (Colorants and fine chemicals synthesis)

- Cosmetics and Personal Care (Preservative precursors like Phenoxyethanol)

- Agrochemicals

- By Synthesis Route:

- Conventional Alkaline Hydrolysis Route (Economically dominant, established technology)

- Advanced Catalytic Methods (Emerging, focusing on sustainability and high yield)

- By Region:

- North America (Mature, high-specification demand)

- Europe (Highly regulated, focused on sustainable chemistry)

- Asia Pacific (APAC) (Production and volume consumption hub)

- Latin America (Accelerated growth driven by large-scale farming)

- Middle East & Africa (MEA) (Emerging agricultural market)

Value Chain Analysis For Sodium Phenoxyacetate Market

The Sodium Phenoxyacetate value chain commences with the sourcing of essential upstream petrochemical and commodity chemical precursors. Phenol, a large-volume commodity chemical often derived from crude oil and natural gas through the cumene process, forms the aromatic component. Monochloroacetic acid (MCA), another key precursor, is synthesized via the chlorination of acetic acid. The strategic importance of the upstream segment lies in mitigating exposure to commodity price volatility and securing uninterrupted supply, as shortages in either phenol or MCA can halt SPA production and lead to significant delays in downstream agrochemical formulation. Major SPA manufacturers often engage in sophisticated risk management strategies, including future contracts and securing dedicated supply allocations, especially during periods of global petrochemical market instability, which requires deep understanding of global energy and chemical market dynamics.

Midstream activity focuses on the actual synthesis, purification, and packaging of SPA. The manufacturing process is capital intensive, requiring specialized corrosion-resistant reactors due to the use of strong alkalis (sodium hydroxide) and heat. Efficiency at this stage is measured by energy usage, yield rate, and waste minimization (e.g., proper handling of sodium chloride byproducts). Distribution channels exhibit a clear bifurcation: large-volume Agrochemical Grade SPA is often sold directly from the producer to Tier 1 agrochemical formulators (such as Dow, Syngenta, and BASF), facilitating just-in-time delivery and technical interchange, crucial during seasonal peaks. Conversely, smaller volumes of high-purity or Pharmaceutical Grade SPA often traverse indirect channels, utilizing specialized fine chemical distributors who manage complex regulatory documentation, relabeling, and storage conditions required by pharmaceutical CMOs and smaller research institutions, adding complexity but expanding market reach.

The downstream sector is characterized by intense formulation activity. Agrochemical companies convert purchased SPA into various salt and ester forms to optimize its efficacy, target specific weeds, and comply with regional drift regulations. This involves proprietary mixing, blending, and emulsification technologies to create the final commercial herbicide products sold to farmers and professional land managers. The pharmaceutical downstream segment utilizes SPA as an intermediate in multi-step chemical synthesis, demanding rigorous adherence to c-GMP standards throughout the handling process. Demand is largely inelastic in the pharmaceutical sector but highly elastic and sensitive to commodity crop cycles in the agrochemical sector. Successful SPA manufacturers must maintain close relationships with both global formulators and end-user regulators to ensure their product specifications remain relevant and compliant across diverse international markets, necessitating continuous feedback loops and joint technical development.

Sodium Phenoxyacetate Market Potential Customers

The core customer base for Sodium Phenoxyacetate resides within the global Agrochemicals industry, representing massive volume procurement. These companies are typically multinational corporations specializing in crop protection and seeds, such as those that formulate and market the various derivatives of 2,4-D. Their procurement strategy prioritizes reliability of supply, competitive pricing, and technical support to ensure formulation stability and registration acceptance across diverse geographical jurisdictions. The seasonal nature of agriculture means these customers place large, time-sensitive orders, often relying on global supply chain visibility and contingency planning to meet planting deadlines without interruption, thus requiring suppliers to maintain substantial inventory or agile production schedules.

Secondary, yet critically important, customers are found in the Pharmaceutical and Biopharma industries. These end-users, comprised of API manufacturers and specialized CMOs, require the highest specification of SPA, where quality assurance documentation, batch consistency, and stringent control over impurities are non-negotiable prerequisites. Purchasing decisions in this segment are based on regulatory compliance (e.g., FDA, EMA adherence), supplier auditability, and the ability to provide long-term contracts supporting clinical trial and commercial drug production timelines. While volumes are lower than in agriculture, the high margins and stable demand in this segment make these customers highly valued targets for specialized SPA producers who can guarantee lot-to-lot consistency and provide necessary regulatory file support (e.g., Drug Master Files).

Finally, a fragmented group of customers includes specialized material science firms and niche chemical producers. This category encompasses companies manufacturing specialized organic intermediates for complex polymers, electronic chemicals, or specific fragrance/flavor components where the phenoxy functional group is required. Furthermore, cosmetic and personal care manufacturers purchase high-purity derivatives (like phenoxyethanol) that utilize SPA precursors for their preservative and antimicrobial properties. These buyers often require custom synthesis capabilities, specialized packaging, and detailed technical assistance regarding product handling and safety data, positioning them as an important, albeit small, source of customized, high-margin revenue for adaptable SPA manufacturers capable of handling small-batch custom orders efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.7 Million |

| Market Forecast in 2033 | USD 669.5 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow AgroSciences, BASF SE, Syngenta AG, Bayer AG, Jiangsu Flag Chemical Industry Co. Ltd., Shandong Kangqiao Chemical Co., Ltd., Nantong Donggang Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Sino-Agri Leading Bioscience Co., Ltd., Rallis India Limited, UPL Ltd., Lianyungang Jindun Chemical Co., Ltd., Nufarm Limited, FMC Corporation, Albemarle Corporation, Lonza Group, Parchem Fine & Specialty Chemicals, Hangzhou Dayang Chemical Co., Ltd., Hebei Cangzhou Dahua Group Co., Ltd., TCI Chemicals (India) Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sodium Phenoxyacetate Market Key Technology Landscape

The technological core of Sodium Phenoxyacetate manufacturing lies in optimizing the chemical reaction system while adhering to stringent purity and environmental mandates. The conventional technology, utilizing a two-stage alkaline condensation reaction, is mature and widespread, providing excellent scalability for the Agrochemical Grade market. However, modern technological advancements are moving toward enhancing the efficiency of the post-reaction purification phases. This includes adopting sophisticated filtration and centrifugation techniques to isolate the SPA solid with minimal residual moisture and inorganic salts (primarily NaCl), which are detrimental to downstream formulations. Continuous processing technologies, replacing older batch reactors, are gaining traction, promising improved heat transfer, tighter process control, and substantially smaller operational footprints, critical for managing hazardous chemical operations safely and efficiently at high throughput rates.

A significant technological frontier involves "Green Chemistry" innovations aimed at reducing the environmental impact associated with the synthesis. Research focuses on substituting traditional corrosive alkaline media with milder catalytic systems or utilizing phase transfer catalysts that enhance reaction speed and selectivity at lower temperatures, thereby minimizing energy costs. Furthermore, advanced solvent recovery systems, often employing specialized distillation columns or supercritical fluid extraction, are integrated to maximize solvent recycling and minimize hazardous waste generation. These technological shifts are not merely cost-saving measures but are increasingly mandated by regulatory bodies and sought after by multinational buyers who adhere to strict Environmental, Social, and Governance (ESG) standards, providing a competitive edge to technologically proactive manufacturers who invest in sustainable chemical production routes and waste minimization technologies.

The adoption of advanced instrumentation and digital control systems constitutes another pivotal technological shift. Process Analytical Technology (PAT), involving spectroscopic methods (e.g., Near-Infrared or Raman) deployed inline, allows for instantaneous determination of product quality, moisture content, and residual impurities. This technological deployment supports a Quality by Design (QbD) approach, ensuring that every batch meets specifications without the reliance on time-consuming post-production lab testing. For Pharmaceutical Grade SPA, sterilization and micronization technologies, used post-synthesis, are also critical. Controlled jet milling or wet grinding techniques are utilized to achieve the precise particle size distribution required for specific API synthesis steps, ensuring optimal dissolution rates and chemical reactivity in high-value drug manufacturing processes, requiring precision engineering and validation.

Regional Highlights

Regional dynamics heavily influence the strategic direction of the Sodium Phenoxyacetate market, with distinct characteristics shaping supply, demand, and regulatory compliance across different continents. The necessity of customizing products and strategies based on regional agricultural practices and chemical regulations is paramount for global players seeking comprehensive market penetration and minimizing regulatory friction.

- Asia Pacific (APAC): APAC retains its status as the world’s production powerhouse, fueled by lower operational expenditures and large-scale manufacturing clusters, particularly in China and India. The regional market is characterized by high domestic consumption driven by intensive agriculture (rice, cotton, plantation crops) and serves as the primary global exporter of bulk Agrochemical Grade SPA and its derivatives. Government policies supporting agrarian reform and infrastructure development in countries like Vietnam and Indonesia are further stimulating regional demand. However, the region is also witnessing increasing pressure to adopt stricter waste management and environmental compliance standards, mirroring Western practices in major export-focused facilities.

- North America: This region is a major consumer, primarily driven by massive acreage devoted to high-value commodity crops (corn, soy, spring wheat) that rely heavily on 2,4-D for broadleaf weed control. Demand focuses on innovative, environmentally conscious formulations, such as choline salt versions of 2,4-D, which require high-quality SPA precursors to achieve low volatility profiles mandated by the EPA. The market is mature, stable, and highly focused on product differentiation and advanced formulation technology, valuing suppliers with transparent safety and efficacy data.

- Europe: The European market faces the most stringent regulatory hurdles, particularly concerning the registration renewal of synthetic herbicides under the Biocidal Products Regulation (BPR) and REACH. This environment compels European manufacturers and importers to prioritize high-purity SPA used in specialty chemical synthesis and certified pharmaceutical applications, often moving away from high-volume commodity agricultural use. Innovation is concentrated on bio-based alternatives and catalytic, low-environmental impact synthesis routes to ensure long-term market acceptance and compliance with strict residual limits.

- Latin America (LATAM): LATAM is experiencing explosive growth, driven by expansion of export-focused agriculture, particularly in Brazil and Argentina, necessitating extensive use of crop protection solutions. This region provides a vital growth opportunity for bulk SPA suppliers, requiring rapid logistical solutions and competitive pricing. The regulatory landscape is typically less restrictive than in Europe, favoring rapid adoption of effective, large-scale herbicide programs derived from SPA, supporting the global demand for exported agricultural commodities.

- Middle East & Africa (MEA): Growth in MEA is foundational, driven by governmental efforts to enhance domestic food security and modernize agricultural methods. Demand, currently low volume, is projected to increase steadily as agricultural mechanization increases. Challenges include complex logistics, variable climatic conditions, and the need for localized technical support for product application. The market mostly imports finished formulations, but opportunities exist for regional formulation hubs requiring bulk SPA imports for localized production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sodium Phenoxyacetate Market.- Dow AgroSciences (Part of Corteva Agriscience)

- BASF SE

- Syngenta AG (Part of ChemChina)

- Bayer AG

- Jiangsu Flag Chemical Industry Co. Ltd.

- Shandong Kangqiao Chemical Co., Ltd.

- Nantong Donggang Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Sino-Agri Leading Bioscience Co., Ltd.

- Rallis India Limited

- UPL Ltd.

- Lianyungang Jindun Chemical Co., Ltd.

- Nufarm Limited

- FMC Corporation

- Albemarle Corporation

- Lonza Group

- Parchem Fine & Specialty Chemicals

- Hangzhou Dayang Chemical Co., Ltd.

- Hebei Cangzhou Dahua Group Co., Ltd.

- TCI Chemicals (India) Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Sodium Phenoxyacetate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary commercial application of Sodium Phenoxyacetate?

Sodium Phenoxyacetate (SPA) is primarily used as a vital chemical intermediate in the production of phenoxy-herbicides, most notably 2,4-D (2,4-Dichlorophenoxyacetic acid), which is one of the world's most widely used selective systemic herbicides for weed control in agricultural crops. Its high reactivity makes it indispensable for ester and salt formation in commercial formulations.

Which geographical region dominates the global supply and consumption of Sodium Phenoxyacetate?

The Asia Pacific (APAC) region, particularly China and India, dominates both the manufacturing capacity and the bulk consumption of Sodium Phenoxyacetate, driven by massive agricultural activities, favorable economies of scale, and integrated chemical production facilities that supply both domestic and international markets.

How do raw material costs impact the profitability of SPA manufacturers?

Profitability is highly sensitive to the volatile price of key upstream raw materials, particularly phenol, which is a petroleum derivative. Price fluctuations necessitate robust hedging strategies, strategic sourcing contracts, and continuous process optimization to maintain competitive manufacturing costs and stable margins across the volatile commodity chemical sector.

What is the key difference between Agrochemical Grade and Pharmaceutical Grade SPA?

Agrochemical Grade SPA is consumed in high volumes with standard purity (98-99%) for cost-efficient herbicide synthesis. Pharmaceutical Grade requires ultra-high purity (>99.5%), stringent c-GMP compliance, and extensive impurity testing for use as an intermediate in sensitive Active Pharmaceutical Ingredients (APIs), commanding a significant price premium due to stricter quality assurance requirements.

What regulatory challenges face the Sodium Phenoxyacetate market?

The market faces significant challenges from increasing environmental scrutiny and stricter regulations, especially in Europe and North America, regarding chemical residues, safety documentation, and the demand for low-volatile, environmentally friendlier derivatives. Compliance requires ongoing investment in reformulation, process safety technology, and extensive toxicological data submission.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager