Solid Acid Catalyst Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443502 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Solid Acid Catalyst Market Size

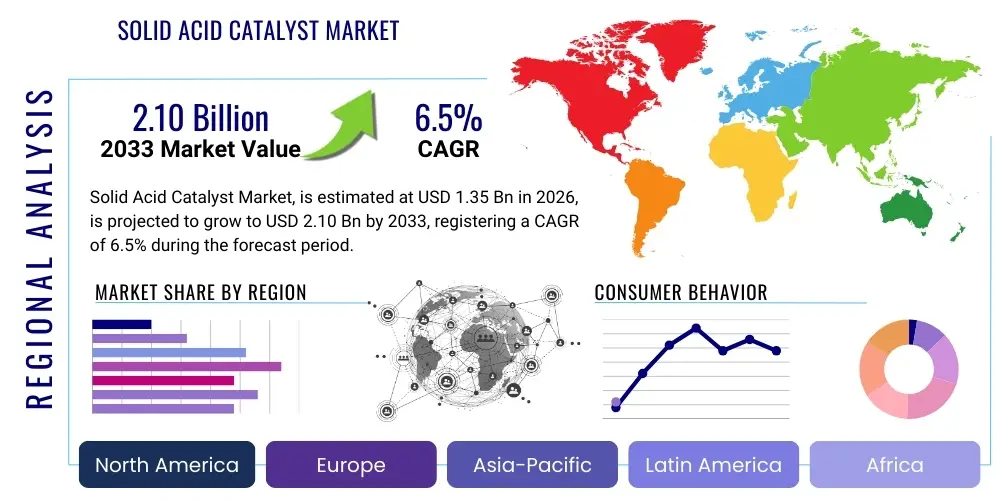

The Solid Acid Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Solid Acid Catalyst Market introduction

Solid acid catalysts represent a cornerstone technology in modern chemical processing, offering a greener, safer, and highly efficient alternative to traditional homogeneous liquid acid catalysts like sulfuric acid or hydrofluoric acid. These heterogeneous materials are crucial for driving key industrial reactions, including alkylation, isomerization, hydration, and esterification, spanning sectors from petrochemical refining to the burgeoning biofuel industry. Their solid nature facilitates easy separation from reaction mixtures, eliminating costly neutralization steps, reducing corrosive risks to equipment, and significantly minimizing the generation of hazardous waste streams, aligning perfectly with global mandates for sustainable industrial practices.

The product portfolio within the solid acid catalyst market is diverse, encompassing materials such as zeolites, functionalized mesoporous materials, sulfated metal oxides (e.g., sulfated zirconia), heteropolyacids (HPAs) supported on inert carriers, and various polymeric ion-exchange resins. Zeolites, known for their precise pore structure and high thermal stability, dominate high-temperature catalytic applications, particularly in FCC (Fluid Catalytic Cracking) units and methanol-to-gasoline (MTG) processes. Conversely, ion-exchange resins are extensively utilized in milder conditions for processes like BPA synthesis and water treatment due to their facile regeneration capabilities and high activity at lower temperatures.

Major applications driving market expansion include the production of high-octane fuels (through isomerization and alkylation), the synthesis of fine and specialty chemicals (such as bisphenol A and plasticizers), and the increasingly critical conversion of biomass and triglycerides into biodiesel and bio-based platform chemicals. The primary benefit of these catalysts lies in their enhanced selectivity, superior recyclability, and robustness under demanding industrial environments. Key driving factors include stringent environmental regulations pushing industries away from hazardous liquid acids, the increasing global demand for high-quality, cleaner transportation fuels, and significant governmental investment in sustainable chemistry research and development, particularly in the Asia Pacific region.

Solid Acid Catalyst Market Executive Summary

The solid acid catalyst market exhibits robust growth driven by a fundamental shift in industrial chemistry toward heterogeneous catalysis, a movement underpinned by enhanced operational safety and strict environmental stewardship. Current business trends highlight significant research investment focused on developing novel, highly stable solid acids, such as ordered mesoporous silicas functionalized with sulfonic acid groups, aiming to mitigate issues related to catalyst leaching and deactivation, especially in liquid-phase reactions. Strategic mergers and acquisitions among major chemical companies and catalyst manufacturers are aimed at consolidating expertise in advanced material synthesis and securing control over key patented technologies, particularly those related to hydrocracking and alkylation processes integral to modern refinery upgrades.

Regionally, the Asia Pacific (APAC) market maintains the fastest expansion trajectory, primarily fueled by the rapid growth of the petrochemical sector in China and India, coupled with rising investments in developing domestic biofuel production capabilities. North America and Europe, characterized by mature chemical industries, emphasize innovation, focusing on the deployment of existing catalysts in new, high-value applications such as green hydrogen production and plastics recycling via catalytic depolymerization. Regulatory frameworks, such as REACH in Europe, significantly influence technology adoption, favoring solid acid solutions over corrosive liquid counterparts, thereby accelerating the market shift across these Western economies.

Segmentation trends indicate that the Material Type segment, specifically zeolites and ion-exchange resins, will continue to hold the largest market shares due to their established roles in massive industrial processes. However, sulfated metal oxides and heteropolyacids are projected to demonstrate the highest CAGR, spurred by their superior performance in niche applications, including biodiesel transesterification and the catalytic conversion of natural gas. Within the Application segment, the Refining sector remains the largest consumer, but the Biofuel and Specialty Chemicals segments are experiencing rapid proportional growth, reflecting global imperatives to decarbonize transportation and source platform chemicals from renewable resources, demanding highly efficient, specialized solid acid systems.

AI Impact Analysis on Solid Acid Catalyst Market

User inquiries regarding the role of Artificial Intelligence (AI) in the solid acid catalyst domain center predominantly on accelerating material discovery, optimizing synthesis parameters, and predicting catalytic performance under varied industrial conditions. Key themes emerging from this analysis involve the expectation that AI and Machine Learning (ML) will drastically reduce the time and cost associated with screening thousands of potential catalyst compositions—a traditionally iterative and resource-intensive process. Users are particularly concerned with how AI can address the persistent challenge of catalyst deactivation, seeking predictive models that can forecast catalyst lifetime and suggest optimal regeneration schedules, thereby maximizing operational uptime and minimizing waste. Furthermore, significant interest exists in using AI to design 'designer catalysts' with tailored acidity, pore structure, and surface area specifically optimized for novel green chemistry transformations, such as CO2 conversion or highly selective biomass valorization, shifting the domain from empirical trial-and-error to rational, data-driven material design.

- Accelerated discovery and screening of novel solid acid materials by analyzing large crystallographic databases.

- Predictive modeling of catalyst stability and lifetime under diverse operating temperatures and pressures.

- Optimization of catalyst synthesis protocols, including calcination temperature and impregnation ratios, via ML algorithms.

- Real-time process control and fault detection in catalytic reactors using integrated AI-driven sensing technologies.

- Designing solid acids with enhanced selectivity and activity for complex multi-step chemical synthesis.

DRO & Impact Forces Of Solid Acid Catalyst Market

The solid acid catalyst market is primarily driven by the imperative for sustainable industrial practices and robust regulatory pressure globally, especially targeting the phase-out of highly corrosive and environmentally detrimental liquid acid catalysts. These drivers are intrinsically linked to the inherent benefits of solid catalysts, such as operational safety, reduction in capital expenditures associated with managing hazardous materials, and improved overall process economics due to efficient catalyst recycling. However, the market faces significant restraints, chiefly related to the technical challenges associated with catalyst deactivation—often caused by coking or metal fouling—which necessitate periodic, costly regeneration processes. Furthermore, the generally lower intrinsic activity of some solid acids compared to their homogeneous counterparts, requiring higher reaction temperatures or pressures, can sometimes limit their application viability.

Key opportunities are centered on the burgeoning biofuel sector, where solid acid catalysts are essential for the esterification of free fatty acids (FFAs) in low-grade feedstocks, overcoming limitations imposed by conventional alkaline catalysts. There is also substantial scope in developing tailored solid acids for emerging green chemistry applications, including biomass conversion into value-added chemicals, utilizing processes such as hydrothermal liquefaction and catalytic fast pyrolysis. Technological advancements focusing on creating highly stable, structured catalysts (like monolithic or membrane reactors) that enhance mass transfer and heat distribution are crucial impact forces shaping future market growth, addressing current limitations related to reaction efficiency.

The impact forces are profoundly favorable, pushing the industry toward non-corrosive, sustainable solutions. The rising cost and geopolitical instability associated with fossil fuels further amplify the necessity for efficient petrochemical processes utilizing solid acids for maximum yield and minimum waste. Conversely, the high initial investment required for switching from established liquid acid systems to novel solid heterogeneous reactors acts as a moderating restraint, particularly for smaller facilities. Overall, the powerful convergence of environmental compliance (driver) and technological innovation (opportunity) significantly outweighs the inertia caused by cost and deactivation challenges (restraints), guaranteeing a positive growth trajectory for the solid acid catalyst domain over the forecast period.

Segmentation Analysis

The solid acid catalyst market is comprehensively segmented based on the fundamental material composition, the specific industrial reaction type, and the ultimate end-use industry, reflecting the high degree of specialization required in heterogeneous catalysis. The performance characteristics of a solid acid catalyst—including surface area, pore size distribution, and concentration of active sites—are fundamentally determined by its material type, directly impacting its suitability for various industrial applications. Segmentation provides a clear framework for understanding technological diffusion and market maturity across different chemical processing sectors, from high-volume petroleum refining to highly specialized pharmaceutical synthesis, ensuring targeted material development aligns with specific industry needs and regulatory requirements.

- By Material Type:

- Zeolites (e.g., ZSM-5, Beta, Y-type)

- Ion-Exchange Resins (e.g., Styrene-divinylbenzene based)

- Sulfated Metal Oxides (e.g., Sulfated Zirconia, Titania)

- Heteropolyacids (HPAs) and Supported HPAs

- Functionalized Mesoporous Materials (e.g., SBA-15, MCM-41)

- Clays and others

- By Application:

- Alkylation

- Isomerization

- Cracking and Hydrocracking

- Esterification and Transesterification

- Hydration/Dehydration

- Aromatic Conversion

- By End-Use Industry:

- Petroleum Refining

- Biofuels (Biodiesel, Bio-jet fuel)

- Chemical and Petrochemical (e.g., production of BPA, MTBE)

- Specialty Chemicals and Pharmaceuticals

- Others (e.g., Environmental Catalysis)

Value Chain Analysis For Solid Acid Catalyst Market

The value chain for the solid acid catalyst market begins with the upstream sourcing of specialized raw materials, which are critical determinants of the final catalyst properties and cost. This stage involves the extraction and purification of high-purity precursors such as aluminum hydroxides, silicon sources (silica, silicates), specific metal salts (e.g., zirconium and titanium precursors), and the polymerization of high-grade polymeric resins. The quality and consistency of these input materials are paramount, as minor impurities can significantly affect the synthesis process, leading to catalysts with suboptimal acidity, reduced surface area, or compromised thermal stability, requiring rigorous quality control and specialized supply partnerships.

The core manufacturing process, midstream, involves complex, highly specialized chemical engineering steps, including hydrothermal synthesis for zeolites, functionalization techniques for mesoporous materials, and precise drying/calcination procedures. Catalyst producers invest heavily in proprietary synthesis methods to control the resulting catalyst morphology, ensuring the desired pore architecture and maximum density of active acid sites (Brønsted or Lewis). The distribution channel relies heavily on global logistics networks capable of handling high-volume, bulk chemical shipments, often requiring specialized packaging to maintain catalyst integrity and prevent moisture uptake, differentiating between high-volume standard catalysts and low-volume, high-value specialty catalysts sold directly to technical end-users.

The downstream segment involves the integration of these catalysts into complex industrial processes within refineries and chemical plants. Direct distribution involves manufacturers supplying large customized batches directly to major refineries under long-term contracts, often including technical support and regeneration services. Indirect distribution involves specialized chemical distributors who serve smaller chemical producers, offering a broader portfolio of standard catalyst types. The efficacy of the value chain is measured by the catalyst’s performance in real-world reactors, necessitating close collaboration between manufacturers and end-users to optimize reactor design, operation protocols, and spent catalyst recycling or safe disposal, ensuring maximum efficiency and minimal environmental footprint throughout the catalyst lifecycle.

Solid Acid Catalyst Market Potential Customers

The primary customers of solid acid catalysts are large-scale industrial operators whose core processes rely on acid-catalyzed reactions to convert bulk feedstocks into refined products and intermediate chemicals. Petroleum refining companies represent the largest segment, utilizing catalysts extensively for fluid catalytic cracking (FCC) to produce gasoline, and for alkylation and isomerization processes critical for boosting fuel octane ratings while meeting stringent clean air standards. These refiners demand catalysts exhibiting exceptional mechanical strength, high thermal stability, and robust resistance to poisoning agents commonly found in crude oil fractions, requiring customized, high-performance materials tailored to specific unit operations.

The rapidly expanding biofuel industry, encompassing producers of biodiesel, bioethanol, and advanced bio-jet fuels, constitutes another high-potential customer base. For biodiesel production, solid acid catalysts are essential for the simultaneous esterification of free fatty acids and transesterification of triglycerides, allowing producers to utilize cheaper, waste-derived feedstocks high in FFAs that cannot be processed using conventional alkaline methods. These customers prioritize catalysts with high tolerance to water and impurities, along with long-term reusability to maintain favorable production economics in a highly competitive renewable energy sector.

Furthermore, the specialty chemicals and petrochemical sectors, including manufacturers of polymers, resins, and fine chemicals such as bisphenol A (BPA), phthalic anhydrides, and various plasticizers, are significant customers. These manufacturers require highly selective solid acid catalysts that can facilitate complex organic transformations under mild conditions, minimizing unwanted side products and maximizing yield purity. The pharmaceutical industry also utilizes highly specific solid acid catalysts, often custom-synthesized heteropolyacids or functionalized mesoporous materials, for chiral synthesis and fine chemical production, demanding suppliers who can guarantee exceptional purity, batch consistency, and compliance with stringent quality and regulatory guidelines.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, BASF SE, W. R. Grace & Co., Clariant AG, Johnson Matthey, Haldor Topsoe (now Topsoe A/S), Honeywell UOP, PQ Corporation, Zeolyst International, Chevron Phillips Chemical Company, Axens, Arkema Group, China Petroleum & Chemical Corporation (Sinopec), Evonik Industries AG, The Dow Chemical Company, Fuji Silysia Chemical Ltd., Mitsubishi Chemical Corporation, Tosoh Corporation, Sumitomo Chemical Co., Ltd., Koch Industries (via various subsidiaries) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Acid Catalyst Market Key Technology Landscape

The technological landscape of the solid acid catalyst market is characterized by continuous innovation focused on enhancing catalyst acidity, maximizing surface area accessibility, and improving mechanical and thermal stability under rigorous industrial conditions. A major focus is the shift from micro- to mesoporous structured materials, allowing large reactant molecules (common in heavy crude oil or biomass feedstocks) to access active sites more readily, minimizing diffusion limitations that plague conventional zeolites. Technologies such as hierarchical zeolites, created using selective demetallation or templating agents, offer interconnected micro- and mesopores, significantly boosting catalytic throughput and reducing coke formation during high-temperature reactions like fluid catalytic cracking (FCC).

Another crucial area of advancement involves the precise engineering of acidic sites, moving beyond simple surface acidity to control the ratio of Brønsted acid sites (proton donors) to Lewis acid sites (electron pair acceptors). Techniques like isomorphous substitution in zeolite frameworks or the controlled loading of promoters on metal oxide supports allow manufacturers to tailor the catalyst to specific reaction mechanisms, thereby enhancing product selectivity—a critical factor in specialty chemical synthesis. Furthermore, the development of stable supported heteropolyacids (HPAs), which offer superacidity, addresses the issue of HPA leaching in polar solvents by anchoring them onto inert, high-surface-area materials like functionalized carbon or silica, thus ensuring heterogeneity and enabling easy separation.

Process engineering innovations are also transforming the utilization of solid acid catalysts. This includes the development of structured catalytic reactors, such as catalytic distillation columns and microreactors, which integrate the reaction and separation steps, drastically improving efficiency and managing the heat generated by highly exothermic processes like alkylation. The integration of advanced computational chemistry and machine learning platforms (as discussed in the AI analysis) is becoming standard practice, predicting optimal catalyst formulations and reaction pathways, substantially accelerating the design cycle for next-generation, highly specialized solid acid materials tailored for sustainable, high-value reactions like methane activation and direct CO2 hydrogenation.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing and largest regional market, driven primarily by massive investments in petrochemical complex expansions in China, India, and Southeast Asia. The region’s energy demands necessitate high-volume, continuous refining operations, favoring established solid acid systems like zeolites for FCC. Moreover, strong government mandates supporting biofuel blending, particularly in India and Indonesia, are creating surging demand for solid acid catalysts effective in converting non-edible oils and waste lipids into biodiesel.

- North America: North America holds a substantial market share, characterized by mature refining and chemical industries focused heavily on innovation and compliance. The market is propelled by the continuous modernization of refining units, emphasizing catalysts that facilitate high-quality gasoline production and the conversion of shale gas into value-added chemicals. The region is a key hub for research and development into advanced materials, including sulfated metal oxides and novel functionalized polymers, particularly targeting sustainable applications such as waste plastic pyrolysis and renewable diesel synthesis.

- Europe: Growth in Europe is intrinsically linked to stringent environmental regulations (e.g., EU Green Deal, REACH), which accelerate the replacement of traditional hazardous liquid acids. The market is concentrated on high-value applications, including fine chemical synthesis and the production of bio-based platform chemicals from lignocellulosic biomass. European manufacturers show a strong preference for durable, highly recyclable solid acids and are leading adopters of advanced reactor technologies like catalytic distillation.

- Latin America: This region presents considerable growth potential, largely influenced by the massive biofuel production capabilities, especially in Brazil (ethanol and biodiesel). Demand is strong for robust solid acid catalysts capable of handling highly variable feedstock quality. Investment in petrochemical infrastructure, though sometimes volatile, provides a sustained underlying demand for standard refining catalysts.

- Middle East and Africa (MEA): The MEA market growth is predominantly tied to the expansion and upgrading of large-scale oil refining and petrochemical capacities in the Gulf Cooperation Council (GCC) countries. The emphasis is on maximizing output efficiency and upgrading heavy crude fractions. Future growth is anticipated in African nations focusing on developing domestic energy security and introducing local chemical manufacturing capabilities, favoring proven, cost-effective solid acid catalyst technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Acid Catalyst Market.- Albemarle Corporation

- BASF SE

- W. R. Grace & Co.

- Clariant AG

- Johnson Matthey

- Topsoe A/S (formerly Haldor Topsoe)

- Honeywell UOP

- PQ Corporation

- Zeolyst International

- Chevron Phillips Chemical Company

- Axens

- Arkema Group

- China Petroleum & Chemical Corporation (Sinopec)

- Evonik Industries AG

- The Dow Chemical Company

- Fuji Silysia Chemical Ltd.

- Mitsubishi Chemical Corporation

- Tosoh Corporation

- Sumitomo Chemical Co., Ltd.

- Koch Industries (via various subsidiaries)

Frequently Asked Questions

Analyze common user questions about the Solid Acid Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary environmental advantages of using solid acid catalysts over liquid acids?

Solid acid catalysts are fundamentally heterogeneous, allowing for easy physical separation from reaction products, which eliminates costly neutralization steps and significantly reduces the generation of corrosive, hazardous wastewater. This non-corrosive nature also minimizes equipment maintenance and enhances operational safety, aligning with green chemistry principles.

Which solid acid material dominates the petroleum refining sector and why?

Zeolites, particularly Y-type and ZSM-5, dominate the petroleum refining sector, primarily due to their high thermal stability, robust mechanical strength, and tailored pore structures that enable efficient catalytic cracking and isomerization reactions critical for producing high-octane gasoline components.

What is the main technical challenge restricting the widespread adoption of solid acid catalysts?

The primary technical challenge is catalyst deactivation, typically caused by coking (carbon deposition) or leaching of active sites in liquid-phase reactions. This necessitates periodic, energy-intensive regeneration or costly replacement, which can sometimes diminish the overall economic benefit compared to highly active homogeneous systems.

How are solid acid catalysts utilized in the rapidly expanding biofuel industry?

In the biofuel industry, solid acid catalysts are essential for the simultaneous esterification of free fatty acids (FFAs) and transesterification of triglycerides. This capability allows manufacturers to efficiently process low-cost, low-quality feedstocks (e.g., waste cooking oils) that contain high FFA content, which are incompatible with conventional alkaline catalysts.

How does the concept of 'superacidity' relate to advanced solid acid catalyst development?

Superacidity refers to solid materials exhibiting an acidity stronger than 100% sulfuric acid. Advanced catalysts, such as sulfated zirconia or specific heteropolyacids, are engineered for superacidity to drive difficult chemical transformations requiring extremely strong acid sites, enhancing activity and yield in processes like skeletal isomerization and high-temperature cracking.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solid Acid Catalyst Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Solid Acid Catalyst Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Oxide, Mixed Oxide), By Application (Petrochemical Industry, Chemical Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager