Solid Acid Catalyst Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437385 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Solid Acid Catalyst Market Size

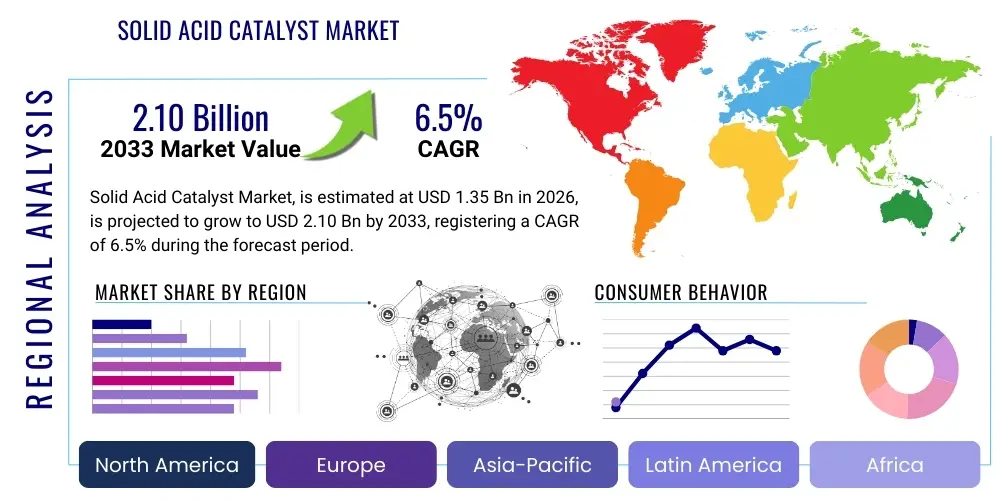

The Solid Acid Catalyst Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.10 Billion by the end of the forecast period in 2033.

Solid Acid Catalyst Market introduction

Solid acid catalysts are heterogeneous materials that possess high intrinsic acidity and are employed extensively across various industrial chemical processes, offering significant environmental and operational advantages over traditional liquid mineral acids like sulfuric or hydrofluoric acid. These catalysts function by providing active sites for proton donation or Lewis acid activation, driving reactions such as alkylation, isomerization, esterification, cracking, and transesterification. Their solid nature facilitates easier separation from reaction mixtures, minimizing corrosion issues, reducing waste generation, and enabling continuous flow processes, which are critical for sustainable industrial chemistry. The intrinsic stability and reusability of these materials, combined with the ability to tailor their porosity, surface area, and acid strength, make them indispensable components in modern chemical manufacturing, particularly in high-volume processes like petroleum refining and bulk chemical production.

The primary applications commanding market attention include the refining industry, where solid acid catalysts are pivotal in fluid catalytic cracking (FCC) processes and the production of high-octane gasoline components through alkylation. Furthermore, the burgeoning demand for sustainable energy sources has accelerated their adoption in the biofuel sector, notably for the esterification of free fatty acids (FFAs) in low-grade feedstocks and the conversion of biomass-derived sugars into valuable chemical intermediates like furans and levulinic acid. The shift toward greener chemistry practices, driven by stringent environmental regulations concerning hazardous waste and emissions, is fundamentally underpinning the growth trajectory of these catalysts. Their capacity to operate selectively under milder conditions contributes directly to improved energy efficiency and enhanced product purity across diverse chemical synthesis routes.

Key driving factors propelling the expansion of the Solid Acid Catalyst Market encompass rapid industrialization, particularly in the Asia-Pacific region, coupled with the increasing global focus on maximizing yields and efficiencies in crude oil processing. The development of advanced catalyst formulations, such as hierarchical zeolites and functionalized metal oxides, allows for improved performance characteristics, addressing challenges related to catalyst deactivation and hydrothermal stability. Furthermore, significant investment in research and development aimed at discovering novel materials with customizable acid sites and enhanced thermal resilience is widening their applicability beyond conventional petrochemical routes into specialized areas like fine chemical synthesis and pharmaceutical intermediates production, securing the long-term viability and growth potential of the market segment.

Solid Acid Catalyst Market Executive Summary

The global Solid Acid Catalyst market exhibits robust business trends characterized by intense competitive dynamics focused on product innovation, particularly the development of highly selective, regenerable catalysts capable of handling complex feedstocks. Major industry players are heavily investing in expanding production capacities, especially for advanced zeolite structures and novel heteropoly acids, to meet the escalating demand from the petroleum refining and petrochemical industries. A critical trend involves the integration of catalytic solutions into bio-refining platforms, aligning business strategy with global sustainability goals. Strategic mergers, acquisitions, and long-term supply partnerships are becoming common tactics employed by key manufacturers to secure raw material access, expand geographical reach, and consolidate technological expertise, thereby sustaining high market entry barriers for new participants and driving overall market maturation toward high-performance solutions.

Regionally, the market is profoundly influenced by the differential pacing of industrial output and environmental regulatory stringency across major geographies. Asia Pacific (APAC) stands out as the predominant growth engine, primarily due to the vast expansion of refining and petrochemical complexes in China and India, coupled with increasing governmental mandates supporting biofuel production. North America and Europe, while representing mature markets, exhibit strong demand driven by continuous optimization projects within existing facilities, coupled with a stringent focus on cleaner fuels and specialty chemical synthesis, fostering a premium market for high-activity, low-deactivation catalysts. The Middle East and Africa (MEA) region is emerging as a critical future growth area, fueled by ambitious capacity expansions in integrated refinery and petrochemical projects aimed at maximizing the value chain derived from abundant hydrocarbon resources, necessitating substantial procurement of advanced solid acid catalyst systems.

Segment trends reveal that the Zeolites category maintains market dominance owing to their unparalleled versatility, high thermal stability, and tunable pore structure, making them essential in FCC and alkylation. However, the Sulfated Zirconia segment is experiencing accelerated growth, particularly in applications requiring superacidity, such as isomerization and polymerization. In terms of application, the Biofuels segment is projected to register the fastest CAGR, stimulated by global mandates for renewable fuel blending and the increasing economic feasibility of utilizing non-food biomass feedstocks, which often necessitate robust solid acid catalysts for effective conversion. Conversely, while the Refining segment remains the largest revenue contributor, its growth is steadier, driven mainly by replacement demand and catalyst upgrades rather than entirely new facility construction in established economies, highlighting a shift in investment toward process intensification and optimization across the application landscape.

AI Impact Analysis on Solid Acid Catalyst Market

Common user inquiries regarding AI's influence on the Solid Acid Catalyst market frequently revolve around how artificial intelligence and machine learning (ML) can accelerate catalyst discovery, optimize operational parameters in industrial reactors, and predict catalyst longevity or deactivation rates. Users seek validation on the feasibility of using high-throughput computational screening powered by AI to identify novel solid acid materials with superior properties—specifically focusing on acidity strength, surface area, and selectivity—much faster than traditional empirical methods. Furthermore, significant user interest exists concerning the integration of AI-driven predictive maintenance systems into refining units to monitor catalyst beds in real-time, allowing for optimized regeneration cycles and minimizing unplanned shutdowns. The key underlying themes users express are centered on leveraging AI to reduce R&D costs, shorten the time-to-market for new catalysts, and substantially enhance the efficiency and economic performance of existing catalytic processes in large-scale operations.

The impact of AI is transforming the entire lifecycle of solid acid catalysts, moving processes away from iterative trial-and-error toward predictive, data-driven optimization. In the research phase, machine learning algorithms analyze vast databases of material structures, synthetic routes, and experimental results to pinpoint optimal compositional ranges and synthesis conditions that yield catalysts with desired acidic and textural properties. This capability dramatically accelerates the identification of novel materials, such as non-zeolitic solid acids or tailored metal-organic frameworks (MOFs) with high stability. Operationally, AI-driven process modeling integrates data from thousands of sensor points within catalytic reactors (temperature, pressure, flow rates, effluent composition) to create digital twins. These models then recommend precise adjustments to reaction conditions in real-time to maintain peak activity, maximize conversion, and mitigate the onset of coke formation, thereby significantly extending catalyst runtime before regeneration is required. This analytical power is essential for managing the complex, non-linear kinetics typical of heterogeneous catalysis, enhancing both sustainability and profitability across the petrochemical and biofuel industries.

- AI accelerates the discovery of novel solid acid formulations (e.g., highly selective zeolites) through high-throughput computational screening and predictive modeling of structure-function relationships.

- Machine learning algorithms optimize the synthesis parameters (temperature, pH, aging time) of existing catalysts, ensuring batch-to-batch consistency and maximizing active site density.

- Real-time monitoring and predictive analytics, powered by AI, forecast catalyst deactivation (coking, poisoning), allowing for proactive scheduling of regeneration or replacement, minimizing downtime in refining operations.

- AI-driven autonomous control systems enhance reactor performance by dynamically adjusting operating conditions (flow rate, temperature profiles) to maximize product yield and selectivity based on immediate feedback loops.

- Data integration platforms utilize AI to correlate feedstock variability with catalyst performance, enabling processors to select the most appropriate solid acid system for specific, non-standard crude oil batches or biomass inputs.

DRO & Impact Forces Of Solid Acid Catalyst Market

The dynamics of the Solid Acid Catalyst Market are primarily shaped by a powerful confluence of drivers, restraints, and opportunities (DRO), which collectively constitute the principal impact forces determining market growth and evolution. Key drivers include the stringent global regulatory push toward utilizing cleaner fuels and reducing industrial effluent, compelling industries to transition from highly corrosive and environmentally damaging liquid acids (like HF or H₂SO₄) to safer, recyclable solid alternatives. This shift is coupled with the overwhelming need for increased process efficiency and higher product selectivity in major consumption sectors, especially petroleum refining and the rapidly expanding biomass conversion industry. However, market growth faces inherent restraints, most notably the high initial capital investment required for adopting new catalytic systems and the challenges associated with the relatively lower hydrothermal and mechanical stability of certain solid acid structures compared to their liquid counterparts, which limits their application in high-severity environments.

Significant opportunities are emerging from the ongoing advancements in material science, particularly the development of superacidic materials and catalysts with engineered porosity, such as mesoporous or hierarchical structures, which effectively mitigate mass transfer limitations and enhance accessibility to active sites. The accelerating commercial viability of third-generation biofuel production, utilizing solid acid catalysts for complex pathways like lignin depolymerization and saccharification, represents a substantial long-term growth avenue. Furthermore, the rising demand for specialty and fine chemicals synthesized through acid-catalyzed reactions (e.g., biodiesel production, cumene synthesis, and pharmaceutical intermediates) opens niche, high-value markets for customized solid acid materials. These emerging applications allow manufacturers to diversify their product portfolio beyond bulk petrochemicals, offering tailored solutions that address specific industrial catalytic challenges, thereby broadening the market's total addressable space and sustaining technological relevance.

The impact forces driving the market are magnified by geopolitical trends affecting crude oil supply and pricing volatility, which mandate refiners to adopt catalysts that maximize the upgrading of cheaper, heavier crude fractions into high-value products. Technological maturity, specifically the widespread adoption of established solid acids like ZSM-5 and Beta Zeolites in existing infrastructure, provides a stable foundation but also necessitates continuous innovation to overcome performance plateaus. The primary restraining force remains catalyst deactivation mechanisms—coking, leaching, and thermal degradation—which directly influence operational costs and necessitate intensive R&D efforts focused on designing robust, poison-resistant materials. The cumulative effect of these drivers and restraints dictates that market participants must prioritize the development of economically viable, highly stable, and easily regenerable solid acid catalysts to secure competitive advantage and meet the escalating industrial demands for sustainable and efficient chemical processing.

Segmentation Analysis

The Solid Acid Catalyst market is comprehensively segmented based on material type, application, and geographical region, reflecting the diverse industrial requirements and technological specifications driving demand. The segmentation by material type is crucial as it dictates the inherent catalytic properties, including acid strength, site accessibility, and thermal stability, thereby determining suitability for specific reaction environments. Application segmentation highlights the largest revenue streams and fastest-growing end-use sectors, ranging from large-scale bulk chemical production to specialized synthesis in fine chemical industries. The geographical breakdown provides insight into regional consumption patterns, regulatory impacts, and underlying industrial capacity expansions, particularly emphasizing the rapid growth observed across Asian markets contrasted with the mature optimization focus in North American and European economies.

- By Type:

- Zeolites (e.g., ZSM-5, Zeolite Beta, Faujasite)

- Heteropoly Acids (HPAs)

- Metal Oxides (e.g., Alumina, Silica-Alumina)

- Sulfated Metal Oxides (e.g., Sulfated Zirconia, Tungstated Zirconia)

- Ion Exchange Resins

- By Application:

- Petroleum Refining (Alkylation, Isomerization, Cracking)

- Petrochemicals (Cumene, Bisphenol A, Ethylbenzene Production)

- Biofuels (Biodiesel Production, Bio-oil Upgrading, Hydrolysis)

- Fine Chemicals and Pharmaceuticals

- Others (e.g., Polymerization, Esterification)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Solid Acid Catalyst Market

The value chain for the Solid Acid Catalyst market commences with the upstream segment involving the sourcing and refinement of specialized raw materials. Key raw materials include silica, alumina, zirconia, rare earth metals, and specific inorganic acids (like tungstic acid, sulfuric acid, and phosphoric acid) used in the synthesis of catalyst precursors. The quality and purity of these raw materials are paramount, as they directly influence the structural integrity, acidity, and longevity of the final catalyst product. Suppliers in this phase typically operate within the bulk industrial chemical or specialty minerals sectors. Effective upstream management focuses heavily on securing reliable, high-purity inputs and maintaining strict quality control over precursor formulations, which is especially critical for complex catalysts like zeolites, where crystal structure formation depends heavily on synthesis environment control and the precise ratios of elemental components, ensuring the final material meets the rigorous performance specifications demanded by refiners and chemical manufacturers.

The midstream stage constitutes the core manufacturing process, where catalyst producers engage in complex synthesis, shaping, calcination, and activation processes. This phase is highly capital and technology-intensive, requiring specialized facilities for hydrothermal synthesis (for zeolites), impregnation, drying, and pelletizing or extrusion to create catalysts with optimal mechanical strength and pore structure for industrial reactors. Direct and indirect distribution channels play a vital role in connecting manufacturers to end-users. Direct sales are common for large-volume, customized contracts with major integrated oil and gas companies and global petrochemical giants, allowing manufacturers to provide technical support, custom formulations, and tailored services. Indirect channels involve regional distributors and specialized chemical supply houses, which are instrumental in reaching smaller refineries, specialty chemical manufacturers, and emerging biofuel producers, ensuring broad market access and efficient logistics for standard product lines across diverse geographical markets.

The downstream segment is dominated by end-users, primarily the petroleum refining, petrochemical, and emerging biofuel industries, which utilize the solid acid catalysts in continuous process reactors. Catalyst usage involves critical technical support, including initial charging, monitoring during operation (often utilizing AI and advanced sensors), and eventual regeneration or disposal. The effectiveness of the solid acid catalyst directly impacts the end-users' profitability, yield, and compliance with environmental standards, making technical service and post-sale support a critical component of the value proposition. Optimization of the distribution channel often relies on minimizing transit times and managing hazardous material classifications, ensuring that high-performance, often sensitive, catalytic materials are delivered efficiently and safely to remote or complex operational sites globally, thereby maintaining the stability of continuous industrial chemical production processes worldwide.

Solid Acid Catalyst Market Potential Customers

Potential customers for Solid Acid Catalysts primarily reside within the heavy process industries that rely extensively on acid-catalyzed reactions for bulk chemical production and energy conversion. The largest segment of buyers consists of petroleum refining companies, ranging from integrated multinational oil and gas corporations to independent refiners. These entities procure massive volumes of catalysts, particularly zeolites and specialized metal oxides, for core operations such as Fluid Catalytic Cracking (FCC), hydrocracking, naphtha isomerization, and alkylation, all essential for producing transportation fuels, including high-octane gasoline and diesel, and ensuring compliance with tightening environmental regulations concerning sulfur content and aromatic levels. Refiners are long-term, high-volume purchasers who prioritize catalyst longevity, activity, and high regenerability to minimize costly unit shutdowns and maximize crude oil conversion efficiency.

Another rapidly expanding segment of critical customers includes manufacturers in the petrochemical and specialty chemical industries. Petrochemical producers utilize solid acid catalysts for synthesizing key intermediates such as cumene (a precursor to phenol and acetone), Bisphenol A (used in polycarbonates), and various alkyl aromatics. Furthermore, the emerging biofuel industry represents a significant growth area, encompassing bio-refineries focused on converting biomass and agricultural waste into sustainable fuels (biodiesel, bio-jet fuel) and bio-based chemicals. These biofuel producers require catalysts specifically optimized for handling high free fatty acid content in feedstocks and demanding esterification and transesterification reactions, often preferring robust, water-tolerant solid acids like sulfated zirconia or specific ion-exchange resins tailored for these aggressive operating conditions. Consequently, catalyst manufacturers must tailor their product offerings and support services to meet the varied technical demands and scale of operation inherent in these distinct customer segments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.10 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Albemarle Corporation, Johnson Matthey Plc, Haldor Topsoe A/S, W. R. Grace & Co., Honeywell UOP, PQ Corporation, Zeolyst International, Sinopec, China Petrochemical Corporation, Axens, Arkema S.A., Chevron Phillips Chemical Company, Sud-Chemie (Clariant Group), Dow Chemical Company, Evonik Industries AG, KNT Group, JGC Catalysts and Chemicals, TOSOH Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Solid Acid Catalyst Market Key Technology Landscape

The technological landscape of the Solid Acid Catalyst market is dominated by advancements in materials science focused on synthesizing heterogeneous structures with precise control over acidity, porosity, and thermal stability. Current technologies extensively rely on crystalline aluminosilicates, or zeolites, specifically ZSM-5 and Zeolite Beta, which are foundational in large-scale refining operations due to their strong Bronsted acidity and shape-selective characteristics. Ongoing innovation involves creating hierarchical zeolites that combine the high acidity of micropores with the enhanced mass transport capabilities of deliberately introduced mesopores, significantly mitigating diffusion limitations and improving the conversion rates of bulky molecules encountered in heavy crude oil processing or biomass liquefaction. Furthermore, advanced synthesis techniques, such as seed-assisted crystallization and dry gel conversion, are crucial for lowering production costs and achieving tailor-made crystal sizes and morphologies, ensuring optimal performance under demanding industrial conditions characterized by high temperatures and pressures.

A parallel technological stream focuses on developing highly active non-zeolitic solid acid materials, particularly sulfated metal oxides (e.g., sulfated zirconia and titania) and supported heteropoly acids (HPAs). Sulfated zirconia is highly valued for its superacidity, making it an excellent catalyst for difficult reactions like butane isomerization, which requires extremely strong acid sites. The stability challenge inherent in HPAs, which tend to leach under aqueous or high-temperature conditions, is being addressed through novel anchoring techniques, such as encapsulation within porous silica matrices or dispersion onto high surface area supports like carbon nanotubes or graphene oxide. These stabilization technologies enhance the thermal and hydrolytic stability of HPAs, allowing them to be utilized effectively in bio-refining processes, such as the hydrolysis of cellulose and the esterification of fatty acids, where the presence of water often compromises catalyst integrity and lifetime.

The future trajectory of the technology landscape is being shaped by digitalization and sustainable chemistry principles. High-throughput experimentation and robotics are accelerating the screening of thousands of new catalyst candidates, while computational chemistry and Density Functional Theory (DFT) simulations are indispensable tools for predicting reaction pathways and optimizing active site design at the molecular level. Emerging technologies also include the synthesis of solid acid catalysts derived entirely from biomass or waste streams, offering a fully circular approach to catalyst manufacturing. Moreover, the integration of solid acids with photothermal or electrochemical activation methods is gaining traction. These hybrid systems aim to achieve significantly higher catalytic activity at lower ambient temperatures by utilizing renewable energy sources, thereby dramatically reducing the energy footprint of industrial chemical manufacturing and pushing the boundaries toward highly efficient, energy-saving catalytic conversion technologies.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, driven primarily by the colossal expansion of the petrochemical and refining sectors, particularly in China and India. Rapid industrial growth, coupled with increasing domestic demand for refined petroleum products and the mandated transition to cleaner transportation fuels, necessitates continuous investment in new catalytic capacity. Furthermore, significant governmental support for indigenous biofuel production programs in countries like Malaysia, Indonesia, and China is accelerating the adoption of specialized solid acid catalysts for transesterification and biomass conversion, positioning the region as the global epicenter for both production and consumption growth. The emphasis on new capacity build-out, rather than just optimization, defines this market.

- North America: This region is characterized by high technological maturity and a focus on maximizing efficiency within established refining infrastructure. Demand is largely stable, driven by catalyst replacement cycles and the continuous upgrading of existing units to process heavier, non-conventional crude feedstocks from sources like shale oil and oil sands, which require robust and specific solid acid formulations (e.g., enhanced zeolites for FCC units). The strong presence of major catalyst manufacturers and heavy R&D expenditure focused on advanced alkylation technologies and specialty chemical production maintains the region's position as a premium market for high-performance, low-deactivation catalysts.

- Europe: The European market is highly regulated and strongly emphasizes sustainability, driving demand for solid acid catalysts that specifically enable green chemistry. Growth is concentrated in the Biofuels and Fine Chemicals segments, stimulated by strict mandates for renewable energy integration and the phase-out of traditional hazardous liquid acid processes. European catalyst consumption leans heavily towards specialized applications, such as the production of bio-based monomers, sustainable polymers, and high-value pharmaceutical intermediates, prioritizing high selectivity and recyclability over sheer volume, reflecting a mature market focused on environmental performance and high-specification products.

- Middle East & Africa (MEA): This region is experiencing significant market acceleration due to massive ongoing investments in integrated refining and petrochemical complexes. Gulf nations are aggressively expanding their downstream capacity to maximize the value addition of their vast hydrocarbon reserves, transitioning from crude exporters to sophisticated producers of refined products and bulk chemicals. This strategic push is creating substantial procurement opportunities for solid acid catalysts used in isomerization, alkylation, and petrochemical synthesis (e.g., ethylene and propylene production), requiring high volumes of reliable, performance-oriented catalysts to support these large-scale greenfield projects.

- Latin America: The market growth in Latin America is uneven but promising, primarily tied to the petroleum industries of Brazil and Mexico. The region's market dynamics are influenced by national oil company investment cycles and fluctuating commodity prices. Brazil, with its extensive sugarcane-based ethanol industry, is a strong consumer of catalysts for bio-refining processes. Future growth is expected to stabilize as economic conditions improve and new investments focus on increasing local refining capacity and integrating solid acid technology into existing chemical and biofuel production facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Solid Acid Catalyst Market.- BASF SE

- Clariant AG

- Albemarle Corporation

- Johnson Matthey Plc

- Haldor Topsoe A/S

- W. R. Grace & Co.

- Honeywell UOP

- PQ Corporation

- Zeolyst International

- Sinopec

- China Petrochemical Corporation

- Axens

- Arkema S.A.

- Chevron Phillips Chemical Company

- Sud-Chemie (Clariant Group)

- Dow Chemical Company

- Evonik Industries AG

- KNT Group

- JGC Catalysts and Chemicals

- TOSOH Corporation

Frequently Asked Questions

Analyze common user questions about the Solid Acid Catalyst market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using solid acid catalysts over traditional liquid acid catalysts in industrial processes?

Solid acid catalysts, being heterogeneous, offer crucial advantages including easier separation from the reaction mixture, enabling continuous flow processes, minimizing equipment corrosion, and significantly reducing environmental waste associated with hazardous liquid acids like hydrofluoric or sulfuric acid. Their reusability and operational safety enhance overall process sustainability and economics.

How is the growth in the global biofuel industry specifically impacting the demand for solid acid catalysts?

The biofuel industry is a major growth driver. Solid acid catalysts are indispensable for converting low-grade, high free fatty acid (FFA) feedstocks into biodiesel through esterification and transesterification, and for the selective hydrolysis and conversion of lignocellulosic biomass. Their water tolerance and robust activity under bio-refining conditions make them the preferred catalytic solution for sustainable fuel production.

Which material type segment currently holds the largest market share, and why is this dominance maintained?

The Zeolites segment holds the largest market share due to their exceptional thermal stability, tunable surface acidity (Bronsted and Lewis sites), and high shape selectivity. Zeolites, particularly ZSM-5 and Zeolite Beta, are foundational to high-volume applications in petroleum refining, specifically Fluid Catalytic Cracking (FCC) and alkylation, securing their sustained market dominance.

What major technological challenges restrict the wider adoption of solid acid catalysts in certain chemical processes?

The primary restriction is the challenge of catalyst deactivation, often caused by coking (carbon deposition) or leaching of active components under high-severity or aqueous reaction conditions. Addressing these issues requires continuous technological innovation focused on developing robust, regeneration-friendly materials with improved hydrothermal and mechanical stability for long-term industrial reliability.

Which geographic region is expected to demonstrate the highest Compound Annual Growth Rate (CAGR) in the Solid Acid Catalyst Market through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest CAGR. This rapid growth is fueled by massive capital investment in new refining and petrochemical complex construction, coupled with strong government initiatives supporting the expansion of the regional biofuel manufacturing industry across key economies such as China, India, and Southeast Asia.

................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................................

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Solid Acid Catalyst Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Solid Acid Catalyst Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Oxide, Mixed Oxide), By Application (Petrochemical Industry, Chemical Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager