Spinosad Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441124 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Spinosad Market Size

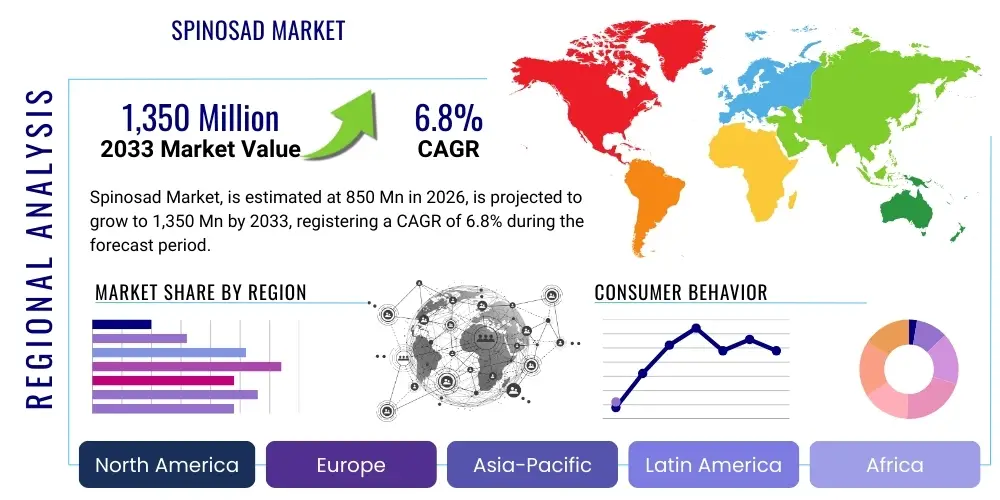

The Spinosad Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Spinosad Market introduction

The Spinosad market encompasses the production, distribution, and application of a natural insecticide derived from the fermentation of the bacterium Saccharopolyspora spinosa. Spinosad is highly valued in modern agriculture and public health due to its dual attributes: high efficacy against a broad spectrum of insect pests, particularly Lepidoptera, Diptera, and Thysanoptera, and a favorable toxicological profile, making it suitable for organic farming systems and Integrated Pest Management (IPM) programs. The product operates primarily as a mixture of two active ingredients, Spinosyn A and Spinosyn D, which affect the insect nervous system, leading to paralysis and death. Its chemical novelty and relative safety compared to traditional synthetic pesticides position it as a critical tool for sustainable pest control globally.

Major applications of Spinosad span across diverse agricultural sectors, including high-value crops such as fruits, vegetables, ornamentals, and cotton, as well as field crops like corn and soybeans. Beyond crop protection, Spinosad finds increasing utility in animal health applications, notably for controlling external parasites such as fleas and lice in companion animals and livestock. The primary benefit driving its adoption is the reduced environmental burden and lower risk to non-target organisms, including beneficial insects and pollinators, compared to broad-spectrum chemical alternatives. This environmental advantage is a key differentiator, aligning with stringent global regulatory shifts prioritizing sustainable agricultural inputs.

Key driving factors for the market include the accelerating global demand for organically produced foods, which strictly limits the use of synthetic pesticides, thus favoring certified biopesticides like Spinosad. Furthermore, the increasing prevalence of insect resistance to older chemical classes necessitates the adoption of new modes of action, where Spinosad offers a unique solution. Regulatory pressures in regions such as the European Union and North America to phase out highly toxic chemicals further enhance Spinosad's market penetration. The continuous innovation in formulation technologies, improving stability and delivery efficiency, also contributes significantly to market expansion and acceptance among commercial growers seeking reliable, residue-free crop protection solutions.

Spinosad Market Executive Summary

The Spinosad market is characterized by robust growth underpinned by strong business trends centered around sustainability and biopesticide integration within conventional farming practices. A dominant trend involves the increasing strategic collaboration between large agrochemical corporations and biotechnology firms focused on microbial fermentation to secure supply chains and enhance production scalability. The market is witnessing a shift toward specialized, lower-residue formulations designed to meet specific export market requirements, driving product differentiation. Furthermore, investment in research and development is concentrated on improving the fermentation yield of the Saccharopolyspora spinosa strain and optimizing formulation characteristics to extend shelf life and field efficacy, confirming Spinosad's status as a premium, high-performance biopesticide.

Regionally, the market exhibits differential growth patterns. North America and Europe remain the largest revenue contributors, driven by stringent residue limits, mature organic farming sectors, and high adoption rates of IPM strategies. The Asia Pacific (APAC) region, however, is projected to be the fastest-growing market, propelled by expanding agricultural intensification, government subsidies promoting biological inputs, particularly in China and India, and a rising consumer base demanding safer food products. Latin America, particularly Brazil and Argentina, demonstrates strong growth potential, fueled by the need for effective resistance management strategies against major pests in large-scale field crops like soybeans and cotton, where Spinosad is an indispensable tool.

Segmentation trends highlight the dominance of the crop protection segment, particularly within fruits, vegetables, and high-value specialty crops where quality and zero-residue requirements are paramount. Within formulation types, Suspension Concentrates (SC) are preferred due to their ease of application and stability. The application segmentation also shows burgeoning demand in animal health, driven by increasing awareness regarding the humane and effective control of ectoparasites. Key market players are expanding their portfolios to include ready-mix solutions, combining Spinosad with other biologicals to offer integrated pest management kits, thereby enhancing user convenience and synergistic efficacy against complex pest complexes, ensuring sustained segmental growth across all verticals.

AI Impact Analysis on Spinosad Market

Common user questions regarding AI's impact on the Spinosad market frequently revolve around how artificial intelligence can optimize biopesticide production efficiency, enhance application precision, and improve global supply chain responsiveness. Users seek clarity on AI's role in strain optimization, predicting pest outbreaks to ensure timely Spinosad deployment, and analyzing complex biological datasets generated during fermentation processes. The primary expectation is that AI will dramatically reduce production costs by optimizing fermentation parameters (temperature, pH, nutrient levels) in real-time, thereby increasing the yield of Spinosyn A and D. Additionally, users are concerned with how AI-driven predictive modeling can minimize waste in agriculture by ensuring Spinosad is applied only when and where required, maximizing environmental and economic returns. These analyses summarize that AI is expected to transform Spinosad from a high-cost biopesticide into a more economically competitive, precisely targeted solution, fundamentally altering its commercial landscape and operational efficiency.

- AI-driven optimization of microbial fermentation processes for Saccharopolyspora spinosa, increasing Spinosyn yield and reducing manufacturing costs.

- Predictive pest modeling using machine learning to forecast infestation severity, enabling precise and timely application of Spinosad, thus reducing overall usage volume.

- Enhanced quality control and detection of contaminants in biopesticide manufacturing using computer vision and sensor data analytics.

- Optimization of supply chain logistics, inventory management, and cold chain requirements for stable biopesticide delivery using intelligent routing algorithms.

- Development of AI-powered drone and robotic spray systems integrating Spinosad, ensuring site-specific targeting based on real-time field imaging and disease severity mapping.

- Accelerated discovery and development of improved Spinosad formulations through simulation and structural prediction of novel stabilizers and delivery agents.

- Data analysis of efficacy trials, allowing faster validation of new formulations and registration dossiers across diverse regulatory environments.

DRO & Impact Forces Of Spinosad Market

The market trajectory for Spinosad is heavily influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces steering its evolution. A primary driver is the necessity for effective resistance management in conventional agriculture, where broad-spectrum chemicals are increasingly failing. Spinosad offers a novel mode of action (Group 5), making it a crucial rotation partner. Simultaneously, the accelerating consumer demand for chemical-free and certified organic produce globally mandates the use of approved biological control agents, positioning Spinosad as an irreplaceable component of sustainable food systems. Regulatory support, particularly in developed economies that incentivize biological solutions over synthetic ones, further amplifies its market reach and acceptance among commercial growers committed to high food safety standards.

Despite strong drivers, the market faces significant restraints. The high cost of production, dictated by the complex microbial fermentation process and subsequent purification steps, makes Spinosad generally more expensive than synthetic counterparts, limiting its adoption in large-scale, low-margin row crops. Furthermore, the sensitivity of Spinosyn molecules to harsh environmental conditions, such as high UV light exposure, necessitates specialized, often costly, formulations to maintain efficacy in the field, challenging its performance consistency. Additionally, regulatory complexity surrounding the registration of biopesticides, which can vary significantly across national jurisdictions, poses a market entry barrier for smaller producers and slows down global adoption rates.

Opportunities for market expansion are substantial, primarily centered around technological advancements and untapped application areas. The development of encapsulation and micro-formulation technologies promises to overcome stability and persistence limitations, potentially broadening its applicability in tropical climates. The emergence of the animal health sector, particularly in controlling flea and tick infestations in pets and livestock, represents a high-growth, high-margin opportunity separate from agricultural cycles. The impact forces created by the confluence of increasing resistance issues (a driver) and technological solutions (an opportunity) create a positive reinforcing loop, mitigating the cost restraint over time as production scales increase and formulation efficacy improves, solidifying Spinosad's long-term commercial viability.

Segmentation Analysis

The Spinosad market is meticulously segmented across product type, application, and formulation, providing granular insights into demand dynamics and competitive landscapes. Segmentation analysis is crucial for stakeholders to tailor production, distribution, and marketing strategies effectively. The product type segmentation distinguishes between the individual active components (Spinosad A and Spinosad D) and their commercially viable blends. The application segmentation reveals the primary revenue streams, ranging from critical crop protection uses to non-agricultural applications like public health vector control. Understanding these segments allows manufacturers to prioritize investment in formulations best suited for specific end-use environments, ensuring maximum biological efficacy and meeting diverse regulatory demands across sectors.

- By Type:

- Spinosad A

- Spinosad D

- Commercial Blends (Spinosad A + D)

- By Application:

- Crop Protection

- Fruits & Vegetables

- Grains & Cereals

- Oilseeds & Pulses

- Ornamentals & Turf

- Animal Health (Veterinary Use)

- Public Health (Mosquito/Vector Control)

- By Formulation:

- Suspension Concentrate (SC)

- Wettable Powder (WP)

- Emulsifiable Concentrate (EC)

- Granules and Pellets

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Spinosad Market

The Spinosad value chain begins with complex upstream activities focused on the specialized biotechnology process of fermentation. This stage involves the selection, maintenance, and optimization of the Saccharopolyspora spinosa bacterial strain. Raw material sourcing includes specific nutrient media components required for optimal microbial growth. The manufacturing process is energy and technology-intensive, requiring strict control over fermentation parameters (temperature, pH, dissolved oxygen) in bioreactors to maximize the biosynthesis of Spinosyn A and D. Subsequent downstream processing involves rigorous extraction, purification, and concentration steps to achieve the necessary purity levels for regulatory approval and formulation stability, defining the high entry barriers and concentration of production capacity among a few specialized firms.

Following the production of the technical grade material, the mid-stream stage involves formulation and packaging. Formulators integrate the technical Spinosad with stabilizers, adjuvants, and surfactants to create commercially viable products like Suspension Concentrates (SC) or Wettable Powders (WP), enhancing shelf life, mixability, and field performance, particularly UV stability. The distribution channel is bifurcated into direct sales to large agricultural cooperatives and indirect sales through a network of specialized biopesticide distributors, regional agro-dealers, and retail veterinary outlets. Direct distribution is common for large-volume crop protection contracts, allowing for tighter quality control and customized technical support to commercial growers and farm managers.

Indirect distribution plays a crucial role in reaching diverse end-users, especially smaller farms and the veterinary segment. Agro-dealers provide critical on-the-ground technical advice concerning application rates, timing, and compatibility within local IPM programs. The effectiveness of the value chain relies heavily on robust cold chain management for certain formulations and substantial technical training provided to distributors to ensure proper handling and application by end-users. The final link involves the application by professional growers, veterinarians, or public health authorities, emphasizing residue management and compliance with local pest control regulations, thereby completing the cycle from microbial source to targeted pest control intervention.

Spinosad Market Potential Customers

The primary potential customers and end-users of Spinosad products are diverse, spanning high-value agricultural producers, livestock owners, and government health agencies. High-value crop growers, including producers of grapes, citrus, leafy greens, tomatoes, and other specialty produce, represent the largest and most critical customer segment. These producers prioritize Spinosad due to its extremely short pre-harvest interval (PHI) and its compatibility with organic certification standards, allowing them to meet stringent quality and residue demands imposed by premium retailers and export markets. These customers require sophisticated formulation support and detailed application guidance tailored to specific pest pressures in protected environments and open fields, often demanding integrated kits comprising Spinosad and other biological controls.

The second major group includes the animal health sector, specifically veterinarians and pet owners requiring effective, low-toxicity treatments for ectoparasites. Spinosad-based chewable tablets and topical solutions are widely adopted for flea control in dogs and cats due to their rapid onset of action and favorable safety profile compared to older chemistries. Additionally, agricultural organizations and government bodies engaged in public health programs for controlling vectors like mosquitoes and certain fly species constitute a vital customer base, particularly in regions where environmental safety concerns restrict the use of highly persistent chemical insecticides, driving demand for environmentally safer alternatives like Spinosad in mosquito larvae control.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow AgroSciences (Corteva), Bayer CropScience, FMC Corporation, Syngenta, Nufarm Limited, Sumitomo Chemical, Certis Biologicals, Marrone Bio Innovations (Bioceres Crop Solutions), Andermatt Group, Arysta LifeScience (UPL), Isagro S.p.A., Koppert Biological Systems, Gowan Company, BioWorks Inc., Russell IPM, CBC (Europe) S.r.l., BASF SE, ADAMA Agricultural Solutions, Novozymes, SinoHarvest |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Spinosad Market Key Technology Landscape

The core technology underpinning the Spinosad market is submerged microbial fermentation. This bio-production process utilizes large-scale, controlled bioreactors where the soil bacterium Saccharopolyspora spinosa is cultivated under highly specific conditions to produce the bioactive metabolites, Spinosyns A and D. Technological advancements in this area focus primarily on enhancing the fermentation efficiency. This includes optimizing the growth media composition, implementing sophisticated sensor technologies for real-time monitoring of bioreactor conditions (e.g., pH, oxygen tension, nutrient levels), and utilizing advanced control algorithms to maintain optimal production kinetics. The goal is to maximize the titre (concentration) of Spinosad produced per batch, thereby lowering the unit cost of the technical material and making the product more economically competitive against synthetic alternatives.

Strain improvement technology constitutes another critical area of innovation. Research and development efforts are directed toward genetic modification and mutagenesis programs aimed at enhancing the inherent productivity of the S. spinosa strain. These improvements focus on directing metabolic pathways to favor the synthesis of Spinosyns, ensuring the production strain is robust and contamination-resistant. Furthermore, downstream processing technology, which involves the efficient separation and purification of the Spinosyns from the fermentation broth, is continuously being refined. Novel solvent extraction techniques, chromatography, and membrane filtration systems are being adopted to increase purity levels while minimizing energy consumption and hazardous waste generation, crucial for maintaining the environmental integrity associated with biopesticides.

Crucially, formulation technology represents a major technological battlefield, addressing the inherent vulnerability of Spinosad to environmental degradation, particularly photodegradation from UV light. Key innovations include microencapsulation, where the active ingredients are encased in protective polymers or stabilizing matrices to ensure slow and sustained release, significantly extending the residual activity in the field. Development of advanced adjuvant systems is also paramount; these systems improve droplet spread, penetration into the target pest, and rainfastness. The shift toward low-dust, highly stable Suspension Concentrate (SC) and water-dispersible granule (WG) formulations is driven by both performance demands and applicator safety, ensuring the technological landscape supports reliable efficacy across diverse global climates and application systems, from conventional sprayers to precision agriculture equipment.

Regional Highlights

- North America: Dominates the market value due to established organic farming standards, high adoption rates of Integrated Pest Management (IPM) in specialty crops, and strong regulatory support for biopesticides. The region exhibits high demand in key states like California and Florida for residue-free produce, driving consistent market maturity and growth, especially in the fruits and vegetables segments.

- Europe: Characterized by stringent Maximum Residue Limits (MRLs) and the European Union’s Farm to Fork Strategy, which promotes ecological farming. The market growth here is regulatory-driven, fueled by the removal or restriction of many synthetic alternatives, creating significant market opportunities for Spinosad in perennial crops, viticulture, and greenhouse environments.

- Asia Pacific (APAC): Projected to show the highest growth rate, driven by agricultural intensification, rising middle-class consumer demand for safer food, and government initiatives in large markets such as India and China promoting sustainable agriculture. Challenges include price sensitivity and the need for region-specific formulations suitable for intense tropical pest pressures and varied application practices.

- Latin America: Represents a crucial growth hub, particularly in Brazil and Argentina, where Spinosad is vital for managing insecticide resistance in major field crops like cotton and soybeans. The focus is on large-scale applications requiring high-efficacy formulations and robust local technical support to integrate the product into complex crop rotation strategies.

- Middle East and Africa (MEA): Emerging market where Spinosad is increasingly adopted for controlling high-impact pests in protected agriculture (greenhouses) and date palms. Public health applications, particularly in vector control programs responding to diseases like dengue and malaria, offer specialized, stable demand segments supported by international health organizations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Spinosad Market.- Dow AgroSciences (Corteva Agriscience)

- Bayer CropScience

- FMC Corporation

- Syngenta AG (ChemChina)

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Certis Biologicals

- Marrone Bio Innovations (Bioceres Crop Solutions)

- Andermatt Group AG

- Arysta LifeScience (UPL Limited)

- Isagro S.p.A.

- Koppert Biological Systems

- Gowan Company

- BioWorks Inc.

- Russell IPM

- CBC (Europe) S.r.l.

- BASF SE

- ADAMA Agricultural Solutions

- Novozymes A/S

- SinoHarvest

Frequently Asked Questions

Analyze common user questions about the Spinosad market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mechanism of action for Spinosad and why is it effective for resistance management?

Spinosad acts primarily on the insect nervous system, targeting specific binding sites on nicotinic acetylcholine receptors and GABA-gated chloride channels. This unique dual mode of action, classified as Group 5 (nicotinic acetylcholine receptor allosteric modulators), is entirely distinct from older chemistries, making it highly effective for breaking resistance cycles developed against organophosphates, carbamates, and pyrethroids in Integrated Pest Management (IPM) programs.

Is Spinosad approved for use in organic agriculture, and what makes it a preferred biopesticide choice?

Yes, Spinosad is widely approved for use in certified organic farming systems globally, provided the non-active formulation ingredients meet organic standards. It is preferred due to its natural origin (derived from bacterial fermentation), rapid pest knockdown capability, favorable toxicological profile, and low impact on many beneficial insects, thus maintaining ecological balance in the field better than conventional pesticides.

What are the key technical challenges facing Spinosad manufacturers in optimizing production efficiency?

The key technical challenge is the inherently high cost associated with the submerged microbial fermentation process required to produce Spinosyns A and D. Manufacturers must continually invest in strain improvement technologies and optimize bioreactor conditions to increase the fermentation yield (titer) and purity of the active ingredient, aiming to reduce the overall cost of goods sold and enhance price competitiveness.

How is the market demand for Spinosad shifting between agricultural and non-agricultural applications?

While crop protection remains the largest segment, driving demand for high-value specialty crops, the non-agricultural segment, particularly animal health (flea and tick control) and public health (mosquito control), is exhibiting rapid and stable growth. This diversification is crucial for market resilience, offering new revenue streams that are less susceptible to seasonal agricultural volatility and commodity price fluctuations.

Which geographical region is expected to drive the fastest market growth for Spinosad through 2033?

The Asia Pacific (APAC) region is projected to register the fastest market growth through 2033. This acceleration is driven by expanding industrial agriculture, rising consumer awareness regarding food safety and pesticide residues, and strong governmental promotion of biopesticides to manage resistance and achieve national sustainability targets in countries like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager