Sporting Goods Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443062 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Sporting Goods Market Size

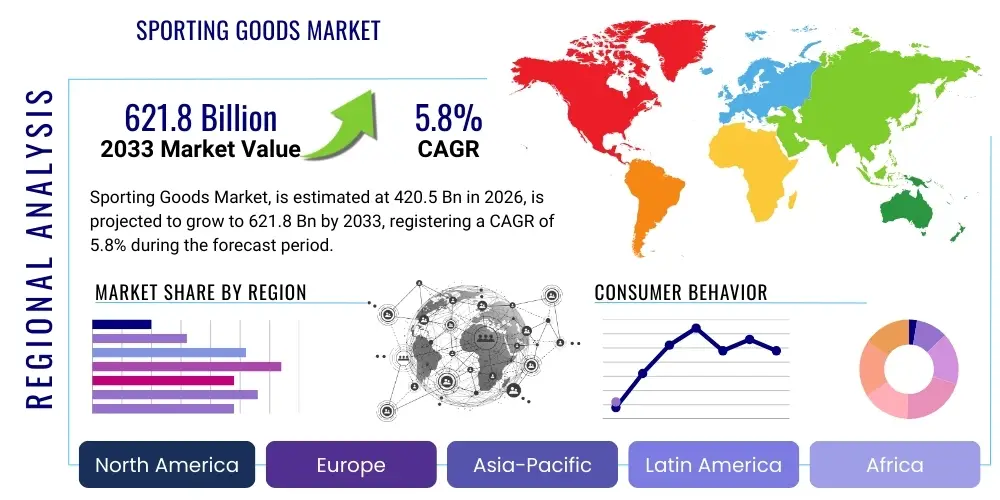

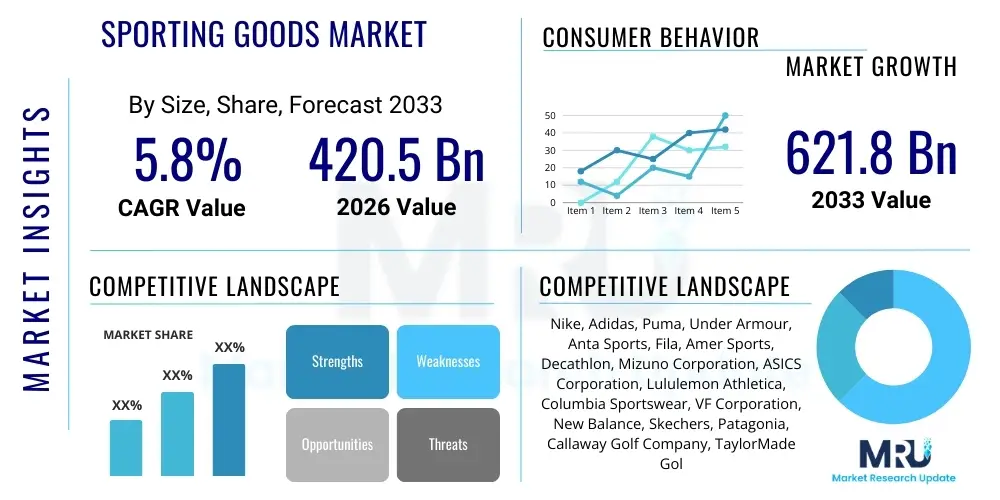

The Sporting Goods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 420.5 Billion in 2026 and is projected to reach USD 621.8 Billion by the end of the forecast period in 2033.

Sporting Goods Market introduction

The global Sporting Goods Market is defined by the manufacturing, distribution, and sales of physical items used for exercise, athletic competition, and recreational fitness. This extensive product category encompasses specialized equipment for major sports (e.g., basketball, football, golf), high-performance technical apparel and footwear designed for optimal function and recovery, and general fitness apparatus utilized in gyms and homes. The primary benefit derived from these products is the direct facilitation of physical activity, leading to improved public health outcomes, enhanced athletic performance metrics, and significant socio-economic development through sports events and industry job creation. The market is intrinsically tied to global health consciousness trends, benefiting from widespread campaigns promoting active lifestyles and preventative healthcare measures against lifestyle diseases. This emphasis on wellness has propelled consumer willingness to invest in higher-quality, durable, and technologically advanced gear, solidifying the market's long-term growth trajectory.

Major applications of sporting goods are observed across professional competitive sports, where precision and durability are paramount, amateur sports leagues and fitness programs, which prioritize accessibility and volume, and the rapidly growing niche of outdoor and adventure sports, demanding specialized, rugged equipment. The evolution of product design is increasingly focused on cross-functionality, epitomized by the athleisure trend, where technical fabrics and athletic design integrate seamlessly into daily casual wear. This diversification of application areas ensures resilience against volatility in any single sports segment, broadening the overall consumer base to include general health enthusiasts alongside dedicated athletes. The market serves as a bellwether for discretionary spending, yet its foundational link to health ensures steady baseline demand even during minor economic fluctuations.

Key driving factors accelerating market expansion include significant governmental and private investments in sports infrastructure, particularly in emerging economies, alongside technological leaps in material engineering—such as lightweight composites, moisture-wicking textiles, and ergonomic designs—that tangibly improve user performance and comfort. Furthermore, the pervasive influence of social media and sports celebrity endorsements continuously shapes consumer demand, establishing trends and driving rapid turnover in fashionable apparel and footwear lines. Digital transformation, particularly the robust growth of e-commerce platforms, has drastically improved market accessibility, enabling specialized brands to reach global audiences and offering consumers vast choices, thus driving competitive innovation across all product segments.

Sporting Goods Market Executive Summary

The Sporting Goods Market is poised for substantial expansion, fundamentally reshaped by significant digital integration and evolving consumer priorities concerning sustainability and personalization. Business trends are dominated by the shift to direct-to-consumer (DTC) models, leveraging advanced e-commerce analytics to tailor marketing and inventory management, significantly improving profit margins and brand control. Furthermore, major market players are heavily investing in circular supply chain models, utilizing recycled ocean plastics and minimizing textile waste, responding directly to growing ecological awareness among Gen Z and millennial consumers. The competitive landscape is intensifying, marked by strategic mergers, acquisitions, and technology licensing agreements aimed at consolidating market share and gaining access to specialized material science capabilities, driving innovation primarily in the performance footwear and smart equipment categories.

Regionally, the market presents a dichotomy: mature markets like North America and Western Europe, characterized by high penetration rates, focus on premium, replacement, and technology-laden products, commanding higher average selling prices. Conversely, the Asia Pacific (APAC) region, driven by demographic expansion, rising urbanization, and improving economic indicators in nations like India, China, and Southeast Asia, exhibits unparalleled growth potential. Government initiatives promoting national fitness programs and the increasing hosting of major international sports events in APAC are providing structural tailwinds, leading to extensive infrastructure development and subsequent demand for entry-level and mid-range sporting goods. Latin America and MEA continue to develop, exhibiting high demand concentrated in specific national sports, requiring localized product strategies.

Segment trends underscore the enduring power of the athleisure phenomenon, making athletic apparel and footwear the dominant segments by revenue, characterized by frequent trend cycles and high marketing expenditure. Within equipment, the highest growth is observed in home fitness and digital training gear, a residual effect of global health crises that cemented the shift toward remote wellness solutions. Specialized segments, such as outdoor recreation (hiking, camping, tactical gear), are also experiencing a robust resurgence driven by renewed interest in nature and experiential travel. The market structure, therefore, is leaning towards products that combine high technical function with aesthetic appeal and seamless digital connectivity, reflecting a holistic approach to fitness and lifestyle integration among modern consumers.

AI Impact Analysis on Sporting Goods Market

User inquiries surrounding the integration of Artificial Intelligence (AI) into the Sporting Goods Market consistently highlight three critical areas: enhanced athletic performance optimization, sophisticated supply chain responsiveness, and deeply personalized customer engagement. Consumers frequently question how AI-driven tools can offer predictive injury risk assessments, optimize training load based on individual physiological responses captured via wearables, and assist in selecting the perfect product fit—whether it be a pair of shoes or complex skiing equipment. Retail and logistics professionals express concerns and expectations regarding AI’s ability to instantaneously process global sales data to mitigate inventory excess, predict micro-trends before they peak, and ensure faster, more sustainable last-mile delivery. The convergence of these themes demonstrates a clear market expectation for AI to transition the industry from offering standardized equipment to delivering hyper-customized, data-informed solutions that significantly elevate both operational efficiency and the final consumer experience, moving beyond mere product sales into the realm of performance partnerships.

In manufacturing and product development, AI is fundamentally changing the iterative design process, enabling quicker material testing and simulating complex interactions between the human body and equipment under extreme stress conditions, drastically reducing the physical prototyping phase. For instance, AI algorithms can analyze millions of foot scans to design bespoke running shoe midsoles or predict the optimal flex pattern for a hockey stick based on a player's power profile. This capacity for rapid, data-driven customization allows major brands to achieve mass personalization, providing athletes, both professional and amateur, with gear that feels specifically engineered for their unique biological and performance requirements. This shift not only creates a significant competitive advantage but also justifies premium pricing for technology-enhanced goods.

Furthermore, AI-driven technologies are revolutionizing the consumer journey post-purchase. Smart apparel and wearables, powered by proprietary AI models, monitor everything from heart rate variability and sleep quality to muscle fatigue and form correction during exercises. This continuous feedback loop transforms the product into an ongoing service, fostering deep brand loyalty. In the retail sector, AI facilitates augmented reality (AR) try-ons, virtual fitting rooms, and personalized recommendation engines that improve conversion rates both online and in physical stores. The overall impact is the creation of an interconnected ecosystem where the product is constantly learning from the user and adapting its service offering, cementing AI as a core, non-negotiable element of future sporting goods innovation.

- Product Innovation and Design: AI algorithms accelerating material science research and enabling rapid prototyping of customized gear based on biomechanical data, optimizing structural integrity and minimizing material use.

- Personalized Training and Coaching: Integration of machine learning into wearables and apps to provide individualized workout plans, performance analysis, injury prevention recommendations, and real-time form correction through sensor data analysis.

- Retail and Demand Forecasting: Utilizing predictive analytics to optimize inventory management, personalize shopping experiences (online and in-store, often via chatbots and recommendation engines), and accurately forecast seasonal and trend-based demand across varied geographic markets.

- Manufacturing Efficiency: Implementing AI-driven robotics and automation in factories to ensure quality control, reduce textile cutting waste, optimize machinery maintenance schedules, and increase production speed for high-demand items like seasonal footwear.

- Supply Chain Optimization: Using deep learning models to predict disruptions, optimize complex global logistics routes, and manage warehousing efficiency, reducing lead times and minimizing the carbon footprint associated with transportation.

DRO & Impact Forces Of Sporting Goods Market

The Sporting Goods Market’s trajectory is heavily influenced by a confluence of accelerating drivers and persistent restraints, balanced by substantial long-term opportunities. Primary drivers include the global demographic shift toward prioritizing health and wellness, which translates into increased participation rates in organized sports and individual fitness regimes across all age groups. This trend is powerfully supported by societal factors such as the rise of digital fitness platforms and the widespread adoption of wearable technology, which motivate continuous physical activity and investment in related gear. Additionally, the recurring four-year cycles of major global sporting events (e.g., Olympics, FIFA World Cup) consistently generate massive spikes in consumer interest and purchasing, creating predictable periods of heightened demand for merchandise and specialized equipment. These internal and external forces combine to create a resilient demand base that sustains market buoyancy.

Despite robust growth potential, the market faces significant restraints. The prevalence of counterfeit and gray market goods, particularly affecting premium brands in apparel and footwear, erodes revenue and damages brand reputation, necessitating substantial investment in anti-counterfeiting technologies and legal action. Furthermore, manufacturers are highly susceptible to volatility in global commodity prices, including the costs of specialized polymers, cotton, and petroleum-derived materials crucial for high-performance textiles and plastics, which directly impacts production margins. Economic uncertainty in large consumer markets can also pose a restraint, as sporting goods, beyond essential footwear, are often classified as discretionary purchases, making them vulnerable to cuts in household budgets during inflationary periods or recessions.

Opportunities for exponential growth are concentrated primarily in digital channels and sustainability initiatives. The aggressive expansion of e-commerce, amplified by mobile commerce, allows brands to bypass traditional retail limitations, facilitating direct engagement and higher profitability via the DTC model. Parallelly, the consumer desire for sustainable and ethically produced gear presents a massive opportunity for brands innovating in circular manufacturing, utilizing recycled materials, and ensuring transparency in their supply chains. The emergence of specialized sports niches, such as e-sports merchandising, adaptive sports equipment, and extreme adventure tourism gear, also provides avenues for diversification and market entry for specialized manufacturers. Successfully capitalizing on these opportunities requires rapid technological integration and commitment to responsible business practices.

Segmentation Analysis

Market segmentation is crucial for understanding the diverse consumption patterns within the Sporting Goods sector. Segmentation by product type—encompassing equipment, apparel, and footwear—reveals distinct market dynamics; for instance, footwear and apparel are highly sensitive to fashion cycles and celebrity endorsements, whereas specialized equipment relies more heavily on technological innovation and professional requirements for replacement demand. Distribution channel segmentation highlights the ongoing power shift from traditional brick-and-mortar stores (specialty sports stores and large format mass merchandisers) to the highly efficient and scalable online retail environment, which dominates low-friction, high-volume sales. Segmentation by end-user distinguishes the highly lucrative, niche segment of professional athletes (demanding absolute performance) from the large-volume recreational user base (seeking comfort and versatility) and the institutional segment (prioritizing durability and bulk value).

The apparel segment, significantly bolstered by the athleisure trend, maintains the largest market share globally. This category’s success stems from its high replacement rate and its ability to cross over into everyday fashion, providing brands with continuous revenue streams regardless of specific sports seasons. Athletic footwear follows closely, driven by ongoing biomechanical research leading to constant iteration in running, training, and court shoes, often incorporating highly visible, proprietary cushioning and support technologies. Conversely, the equipment segment, though possessing high entry barriers due to R&D costs (e.g., carbon fiber bikes, high-end golf clubs), often commands the highest average selling price and is less susceptible to short-term fashion trends, relying instead on performance enhancement cycles.

The retail landscape is undergoing profound structural change, with online sales platforms capturing an ever-increasing share, valued for their convenience, price transparency, and extensive inventory depth. However, specialty offline retail remains vital for products requiring expert fitting, complex purchasing decisions, or immediate use, such as specialized skiing equipment, running gait analysis, or professional racket stringing services. The strategic segmentation approach adopted by leading market players involves a hybrid model: utilizing flagship physical stores as experience centers and brand builders, while relying on robust e-commerce operations for scaling and reach. This multi-channel approach ensures maximum market coverage and allows brands to control both the narrative (in-store) and the logistics (online).

- By Product Type:

- Sports Equipment (e.g., Balls, Rackets, Protective Gear, Golf Clubs, Winter Sports Equipment, Team Uniforms)

- Athletic Apparel (e.g., Jerseys, T-shirts, Shorts, Specialized Outerwear, Compression Wear, Athleisure Garments)

- Athletic Footwear (e.g., Running Shoes, Training Shoes, Cleats, Specialized Boots, Lifestyle Sneakers)

- Fitness Equipment (e.g., Treadmills, Ellipticals, Weight Training Machines, Connected Home Fitness Devices, Yoga Accessories)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand-owned Websites, Subscription Fitness Services)

- Offline Retail (Specialty Sports Stores, Department Stores, Mass Merchandisers, Hypermarkets)

- By End-User:

- Professional Athletes and Elite Teams

- Amateur and Recreational Users (General Public)

- Institutional (Schools, Universities, Corporate Fitness Centers, Government Organizations)

- By Activity:

- Team Sports (Basketball, Soccer, Baseball, Hockey)

- Individual Sports (Tennis, Golf, Swimming, Running)

- Outdoor/Adventure Sports (Hiking, Climbing, Water Sports, Skiing)

- Fitness/Gym Activities and Wellness (Yoga, Pilates, Weightlifting)

Value Chain Analysis For Sporting Goods Market

The value chain for the Sporting Goods Market is initiation begins in the upstream phase with rigorous research and development focused on material science. This phase is dominated by chemical suppliers, textile manufacturers, and composite material specialists who provide proprietary, high-performance inputs like specialized rubber, carbon fibers, technical polymers, and smart fabrics. Upstream success hinges on innovation that delivers enhanced durability, lighter weight, and improved performance characteristics, often involving complex intellectual property licensing. Efficiency in this stage dictates the quality and cost base of the final product, compelling brands to forge long-term strategic alliances with select material providers to ensure supply chain stability and exclusivity in material use.

The manufacturing process, the core of the chain, involves highly complex, often automated, production lines, particularly for high-volume items like footwear and apparel, frequently consolidated in Asian manufacturing hubs. Midstream challenges include maintaining strict quality control across various specialized products and mitigating labor costs. Following production, the downstream element is centered on sophisticated branding, marketing, and logistics. Heavy investment is allocated to athlete endorsements, digital marketing campaigns, and content creation designed to build aspirational brand identities and justify premium pricing. This marketing intensity is necessary to maintain differentiation in a highly saturated market where product lifecycles can be short, especially in fashion-driven apparel categories.

Distribution channels are critical in delivering products to the diverse end-user base. Direct channels, including brand-owned e-commerce sites and physical mono-brand stores, offer maximum control over pricing, brand experience, and customer data, often serving as the primary channel for premium and limited-edition releases. Indirect distribution involves working with wholesalers, large sporting goods retailers, and department stores, ensuring wider geographical reach, inventory clearance, and access to consumers who prefer multi-brand comparison shopping. Effective channel management requires seamless omnichannel integration, allowing customers to move fluidly between online research, in-store try-ons, and digital purchasing, supported by efficient global logistics to manage high seasonal stock fluctuations.

Sporting Goods Market Potential Customers

The core potential customer base for sporting goods is stratified into segments defined by commitment level, disposable income, and specific activity focus. Elite athletes and professional teams represent the high-value, low-volume segment, requiring cutting-edge, customized, and often expensive equipment where performance is the non-negotiable priority; their purchasing decisions are guided by specialized coaching staff and performance data. The largest volume segment comprises recreational users and fitness enthusiasts—ranging from casual runners to yoga practitioners—who seek a balance of quality, comfort, durability, and affordability, often influenced by social trends and brand aesthetics like the athleisure movement. This mass market is highly responsive to marketing campaigns focused on lifestyle integration and general wellness benefits.

A rapidly expanding segment involves technology-centric consumers who invest heavily in smart fitness equipment, wearables, and connected gym memberships. These customers prioritize data tracking, virtual reality integration, and subscription-based performance services, viewing sporting goods not just as physical items but as integral parts of a continuous digital wellness ecosystem. Marketing to this group emphasizes technological specifications, data security, and seamless integration with existing digital platforms. Furthermore, the institutional segment, including schools, universities, military organizations, and corporate wellness centers, constitutes reliable bulk buyers, focused primarily on robust durability, standardized regulatory compliance, and favorable contractual procurement terms for long-term supply.

Demographically, market targeting increasingly focuses on Gen Z and Millennials, who show higher propensity for investment in health and experiential sports (e.g., trail running, climbing, specialized niche fitness classes). These younger generations are heavily influenced by social media ambassadors and are particularly sensitive to corporate social responsibility (CSR) initiatives, driving demand for sustainable and ethically sourced products. Geographically, potential is highest in areas undergoing rapid economic development and urbanization, particularly Southeast Asia and parts of Africa, where disposable income growth is directly translating into first-time or increased purchases of organized sports gear and performance apparel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 420.5 Billion |

| Market Forecast in 2033 | USD 621.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nike, Adidas, Puma, Under Armour, Anta Sports, Fila, Amer Sports, Decathlon, Mizuno Corporation, ASICS Corporation, Lululemon Athletica, Columbia Sportswear, VF Corporation, New Balance, Skechers, Patagonia, Callaway Golf Company, TaylorMade Golf Company, Specialized Bicycle Components, Nautilus Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Sporting Goods Market Key Technology Landscape

The Sporting Goods Market is experiencing a massive technological infusion, moving far beyond traditional material science into the realm of integrated digital ecosystems. Material innovation remains foundational, with the heavy use of proprietary composites like lightweight carbon fiber in rackets and golf shafts, and specialized elastomers and foams (e.g., proprietary cushioning systems) dominating footwear production, all aimed at optimizing kinetic energy return and reducing injury risk. However, the most significant transformation is driven by the rise of smart, connected products. Internet of Things (IoT) sensors are now routinely embedded in apparel and equipment—from basketballs tracking spin rate to yoga mats analyzing posture—providing precise, actionable biometric and performance data previously available only in high-performance labs. This continuous data capture fuels personalized training recommendations and product refinement.

Additive manufacturing, specifically high-resolution 3D printing, is becoming central to the industry’s R&D and supply chain strategies. This technology allows for the rapid creation of customized, structurally complex components, such as latticed shoe midsoles or personalized helmet padding, minimizing tooling costs and enabling true mass customization on a global scale. Furthermore, the digital retail experience is being augmented by immersive technologies. Augmented Reality (AR) allows consumers to virtually try on apparel or visualize equipment in their own homes, reducing the friction associated with online returns and enhancing purchasing confidence. Virtual Reality (VR) is also expanding its presence, offering realistic sports training simulations, particularly for golf, cycling, and competitive racing, transforming training methodologies and opening new revenue streams.

Biomechanical analysis and wearable technology form the third pillar of the technological landscape. Sophisticated motion capture systems and advanced data analytics process the massive amounts of data generated by athletes, allowing coaches and designers to fine-tune performance gear based on dynamic movement patterns. This focus on bio-feedback drives the demand for specialized recovery wear, compression gear, and advanced textiles that actively regulate temperature and wick moisture. Consequently, successful technology integration requires expertise not only in textiles and engineering but also in data science and software development, blurring the lines between traditional sporting goods manufacturers and technology companies.

Regional Highlights

- North America: North America, led primarily by the robust consumer base in the United States, represents the largest and most mature market segment globally, characterized by extremely high per capita spending on performance athletic wear and specialized equipment. The region's market dynamics are heavily influenced by the prestige and commercialization of major professional sports leagues (NFL, NBA, MLB), driving colossal demand for branded merchandise and specialized training gear. Technology adoption is exceptionally high here, with consumers quick to invest in connected fitness devices and advanced apparel featuring smart technology. The focus remains on innovation in footwear, outdoor recreation gear (especially in Canada and the Pacific Northwest), and sophisticated home gym equipment, positioning the region as a primary driver of premiumization trends.

- Europe: The European market is characterized by strong traditions in sports such as football (soccer), cycling, and winter sports, maintaining steady, resilient growth. Key market trends are centered around sustainability and ethical production (AEO Focus: European Sustainable Sportswear Regulations). Consumers, particularly in Western and Northern Europe, exhibit high demand for products made from recycled or low-impact materials, favoring brands with transparent environmental policies. Germany, France, and the UK are primary revenue generators, driven by high participation rates in local community sports and a cultural emphasis on outdoor activity. The cycling segment, especially high-end road bikes and e-bikes, is notably strong, supported by significant urban infrastructure investments promoting cycling as a mode of transport and recreation.

- Asia Pacific (APAC): APAC stands out as the engine of future market growth, expected to record the highest CAGR throughout the forecast period. This rapid expansion is primarily attributable to the colossal populations of China and India, coupled with dramatic increases in disposable income and changing cultural attitudes towards physical fitness. Government initiatives promoting national health and fitness, coupled with the rising status of international sporting events hosted in the region (e.g., Beijing Olympics, major cricket tournaments), are creating structural demand. While price sensitivity remains a factor in developing APAC countries, there is simultaneous booming demand for premium international brands among the urban middle and upper classes, making the region a critical battleground for global market share. Local brands, such as Anta and Li-Ning, effectively compete by mastering distribution networks and tailoring products to regional physical needs and aesthetic preferences.

- Latin America (LATAM): Growth in Latin America is uneven but substantial, heavily concentrated in countries like Brazil and Mexico, where football (soccer) dominates the sporting landscape, driving demand for related apparel, footwear, and licensed team merchandise. Economic instability and currency fluctuations often restrict the purchase of high-end imported equipment, making price-sensitive, mid-range, and value-for-money products the staple of the region. E-commerce penetration is growing rapidly, offering a solution to complex traditional retail logistics, but infrastructure challenges still affect supply chain efficiency. Key opportunities lie in capitalizing on domestic sports enthusiasm and local manufacturing capabilities to stabilize pricing.

- Middle East and Africa (MEA): The MEA market is exhibiting emerging strength, largely driven by large-scale government investments in modernizing sports facilities and promoting physical activity, particularly in the Gulf Cooperation Council (GCC) states. These nations are actively bidding for and hosting major global sports championships, leading to a significant influx of capital into fitness infrastructure and the acquisition of advanced sporting goods, often imported from Europe and North America. The high average temperatures necessitate specialized cooling and moisture-wicking apparel. Africa presents massive long-term potential, though current market access is hindered by low per capita income and underdeveloped distribution networks, focusing consumption mainly on essential sports apparel and basic fitness gear.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Sporting Goods Market.- Nike

- Adidas

- Puma

- Under Armour

- Amer Sports

- Decathlon

- ASICS Corporation

- Mizuno Corporation

- Lululemon Athletica

- Anta Sports

- Fila

- Columbia Sportswear

- New Balance

- VF Corporation (The North Face, Vans)

- Skechers

- Patagonia

- Callaway Golf Company

- TaylorMade Golf Company

- Specialized Bicycle Components

- Nautilus Inc.

Frequently Asked Questions

Analyze common user questions about the Sporting Goods market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Sporting Goods Market?

The primary growth driver is the escalating global focus on personal health and wellness, amplified by widespread government initiatives promoting physical activity and the strong cultural acceptance of the athleisure trend blurring the lines between athletic and casual wear, fueling demand for high-performance lifestyle products.

How is technology impacting athletic equipment?

Technology is significantly impacting equipment through the integration of IoT sensors, smart textiles, and AI analysis tools, enabling real-time performance tracking, personalized feedback, the reduction of injury risk, and the development of customized, biomechanically optimized gear via 3D printing.

Which geographic region exhibits the fastest growth rate?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, increasing middle-class income levels, and substantial public and private investments in developing sports infrastructure across key economies like China, India, and Southeast Asia.

What role does sustainability play in the sporting goods industry?

Sustainability has become a critical consumer priority and a competitive differentiator, leading manufacturers to adopt circular economy models, utilize recycled and bio-based materials, minimize water use in dyeing, and optimize supply chains to reduce carbon footprints, particularly in mass-produced apparel and footwear.

What are the key challenges facing market players?

Major challenges include combating the pervasive issue of counterfeit products, managing the volatility of global supply chains and raw material costs (especially synthetic polymers), and navigating fierce competition driven by the need for continuous technological and material innovation to maintain market relevance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Retail Sporting Goods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Bowling Market Size Report By Type (Bowling Balls, Bowling Pins, Bowling Accessories), By Application (Sporting Goods Retailers, Department Stores, Online Retail), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Kinesio Tape Market Size Report By Type (Roll Form, Pre-cut Shape), By Application (Sporting Goods Store, Pharmacy & Drugstore, Online, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Outdoor Adventure Mat Market Size Report By Type (Foam Outdoor Adventure Mat, Inflatable Outdoor Adventure Mat, Other), By Application (Sporting Goods Chain Stores, Specialty Outdoor Sports Stores, Online Retailers, Other, By End-user, Men, Women, Kids, By Pricing, Low, Medium, High), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Sporting Goods Stores Market Statistics 2025 Analysis By Application (Basketball, Volleyball, Handball, Football, Rugby, Others), By Type (Independent Sporting Goods Store, Chain Sporting Goods Store), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager