Structural Glazing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441744 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Structural Glazing Market Size

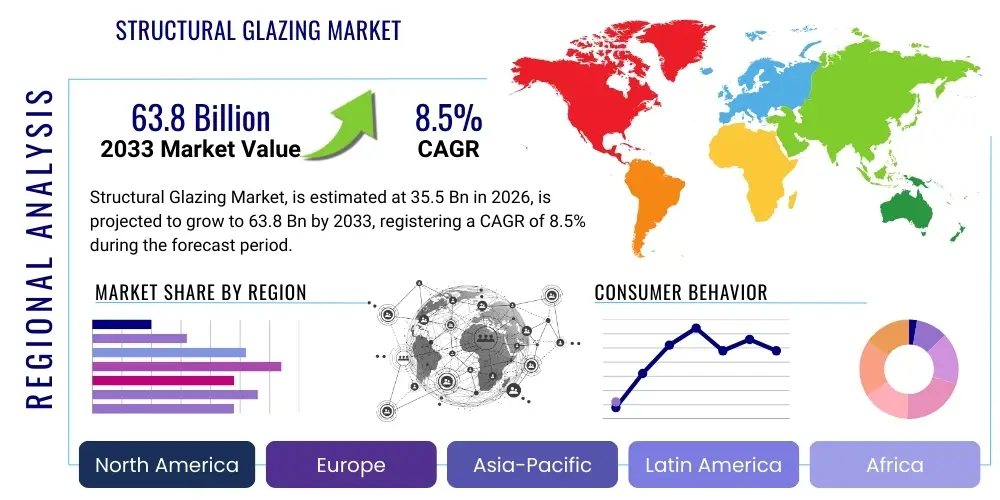

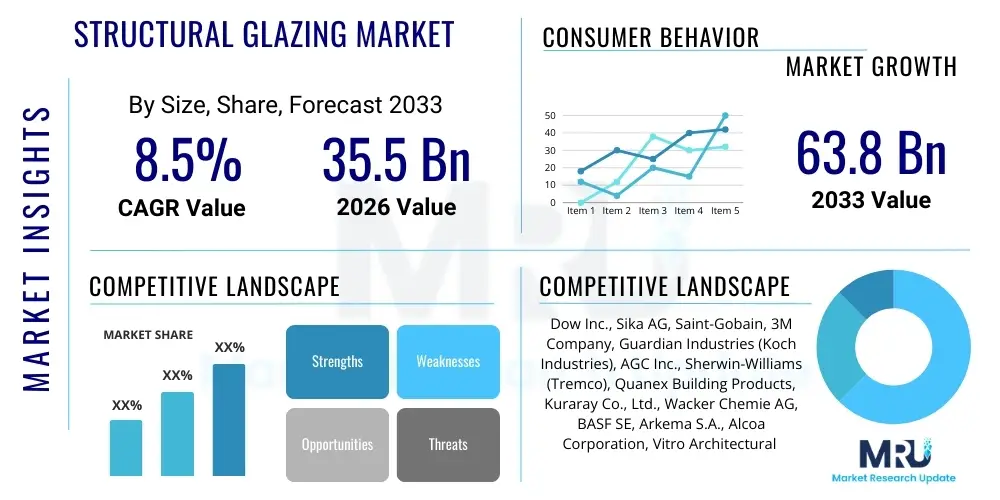

The Structural Glazing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 63.8 Billion by the end of the forecast period in 2033.

Structural Glazing Market introduction

The Structural Glazing Market encompasses advanced façade systems where glass panels are affixed to a building’s structure using high-performance silicone sealants, eliminating the need for visible exterior mechanical fasteners. This technique delivers a sleek, seamless, and aesthetically superior facade, which is highly sought after in modern commercial and high-end residential architecture. The core product offering includes the specialized glazing units, often insulated or low-emissivity (Low-E) glass, and the primary bonding agents, typically high-modulus structural silicones and weather sealants. These systems are crucial for maximizing natural light penetration, improving thermal performance, and resisting high wind loads, making them indispensable components in energy-efficient and visually striking building designs globally.

Major applications for structural glazing are predominantly found in commercial real estate, including corporate skyscrapers, large retail centers, airports, and institutional buildings where aesthetic appeal and energy management are prioritized. Beyond aesthetics, the inherent benefits of structural glazing systems—such as enhanced seismic resistance, improved sound attenuation, and reduced long-term maintenance needs compared to traditional curtain walls—are significantly driving adoption. The seamless nature of the facade minimizes air and water infiltration points, contributing directly to better indoor environmental quality and overall building longevity. Furthermore, the capacity for integrating specialized glass types, like photovoltaic or electrochromic glass, positions structural glazing as a foundational technology for smart building envelopes.

The market is currently being driven by rapid urbanization, particularly across the Asia Pacific region, coupled with stringent global regulations mandating increased energy efficiency in new construction projects. Architects and developers are increasingly utilizing these systems to comply with green building certifications such as LEED and BREEAM. Technological advancements in sealant chemistry, allowing for greater elasticity, UV stability, and adherence strength across diverse substrates, further fuel market expansion. The demand for lightweight, yet highly durable building materials that can be prefabricated and rapidly installed is accelerating the transition from conventional cladding methods to sophisticated structural glazing solutions, ensuring sustained market growth throughout the forecast period.

Structural Glazing Market Executive Summary

The global Structural Glazing Market is defined by robust growth, primarily propelled by the global commercial construction boom and a pervasive shift towards sustainable, aesthetic architecture. Current business trends indicate a strong focus on product innovation, particularly the development of high-performance silicone adhesives offering superior thermal breaks and faster curing times, alongside the increasing integration of smart glass technologies within structural glazing units. Regional dynamics show the Asia Pacific region dominating market volume due to massive infrastructure investments and rapid urbanization, while North America and Europe lead in terms of value, driven by high adoption rates of premium, energy-efficient systems necessary to comply with stringent regional building codes.

Segment trends highlight the dominance of two-sided structural glazing systems, favoured for their balance between aesthetic continuity and installation ease, although four-sided systems remain critical for high-wind-load environments and certain regulatory requirements. In terms of material, high-grade structural silicone continues to be the foundation of the market due to its unmatched durability and resistance to weathering. The commercial application segment, encompassing office buildings and retail complexes, is projected to maintain the largest market share, underscoring the vital role these systems play in modern corporate architecture that emphasizes natural light and exterior facade integrity. Manufacturers are focusing on expanding their global distribution networks and forming strategic partnerships with specialized facade engineering firms to secure large-scale project contracts.

The market faces operational challenges related to the high initial cost of materials and the complexity associated with precise, specialized installation, which necessitates certified labour. However, these challenges are being mitigated by advancements in prefabrication techniques and the standardization of unitized façade systems, reducing on-site installation time and improving quality control. Geopolitical stability and fluctuations in raw material prices (specifically specialty chemicals required for silicones) pose ongoing risks, but the long-term trend remains positive, driven by the irreversible demand for energy-efficient, visually appealing, and architecturally dynamic building envelopes globally. Strategic investment in emerging economies and continued R&D into enhanced thermal performance materials will define competitive success in the coming decade.

AI Impact Analysis on Structural Glazing Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Structural Glazing Market frequently center on predictive design optimization, efficiency improvements in manufacturing, and the future of structural integrity monitoring. Users are keenly interested in how AI can streamline the complex engineering calculations involved in load distribution and thermal modeling for bespoke glass facades, often asking: "Can AI predict the lifespan of structural silicone bonds?" or "How does machine learning improve the energy performance of a glass facade?" and "What role does AI play in error detection during the prefabrication of unitized panels?" The consensus among these inquiries revolves around leveraging AI to enhance precision, reduce material waste, accelerate design cycles, and, most critically, provide proactive, real-time diagnostics of the system's structural health over its operational life, thereby improving safety and lowering long-term maintenance costs associated with structural degradation.

The application of AI in the Structural Glazing sector fundamentally transforms the initial design and simulation phases. Generative design tools powered by AI can rapidly iterate through thousands of facade configurations, optimizing for complex variables such as solar gain, natural lighting distribution, wind resistance, and material cost simultaneously—a process that is infeasible using traditional engineering methods. This capability ensures that the final design is not only aesthetically compliant but also maximally efficient in terms of thermal performance and material usage. Furthermore, AI algorithms are being deployed to analyze vast datasets relating to environmental conditions and material performance failures, enabling the creation of predictive models that anticipate potential issues, such as adhesive fatigue or glass stress fractures, long before they manifest.

In the manufacturing and installation domains, AI integrates seamlessly with automation and robotics, leading to unprecedented levels of precision. Computer vision systems driven by machine learning algorithms inspect the quality of structural silicone application during fabrication, ensuring uniform thickness and perfect bonding contact, drastically reducing human error and improving sealant consistency. During construction logistics, AI optimizes the scheduling and sequencing of unitized panel delivery and installation, minimizing crane time and reducing project timelines. This integration of sophisticated data analytics throughout the value chain positions structural glazing contractors and material suppliers who adopt AI tools as leaders in both quality assurance and project execution efficiency, setting a new industry standard for complex facade construction.

- AI optimizes generative design for structural integrity and energy efficiency, rapidly modeling thousands of complex facade geometries.

- Machine learning algorithms predict material degradation and the lifespan of structural silicone bonds based on environmental data, enhancing long-term safety.

- Computer vision systems utilize AI for real-time quality inspection during panel fabrication, ensuring precise sealant application and adherence uniformity.

- AI-driven predictive maintenance models monitor facade sensors to detect anomalies, reducing unexpected failures and enabling proactive repairs.

- Optimization of supply chain and logistics through AI minimizes material waste and accelerates the just-in-time delivery of custom-fabricated glazing units.

DRO & Impact Forces Of Structural Glazing Market

The dynamics of the Structural Glazing Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively exert significant Impact Forces. Key drivers include the overwhelming global demand for aesthetically pleasing, modern architectural designs, where seamless glass facades are paramount, coupled with stringent environmental regulations, particularly in developed economies, emphasizing energy efficiency and thermal insulation. Restraints often revolve around the high initial capital investment required for structural glazing systems and the dependence on highly skilled, certified installers, which presents a significant barrier in emerging markets. Opportunities are vast, primarily centered on technological convergence, such as the integration of smart glazing (e.g., dynamic shading, integrated photovoltaics) and advanced sealant chemistry offering superior, long-lasting performance.

The primary driving force remains the pursuit of sophisticated building aesthetics and superior performance characteristics that structural glazing provides. Modern building codes, especially in Europe and North America, increasingly favor facade systems that maximize daylight penetration while simultaneously minimizing solar heat gain and thermal transfer (U-value reduction). This dual requirement perfectly aligns with the capabilities of advanced structural glazing incorporating insulated glass units (IGUs) and high-performance Low-E coatings, making it a compliance necessity rather than just an architectural choice. Furthermore, the shift towards unitized curtain wall systems, which leverage structural glazing principles and allow for rapid, standardized installation, significantly accelerates construction timelines, providing tangible cost-savings post-installation.

Conversely, the major restraining factor is the complexity and cost associated with quality control and long-term maintenance, especially in systems utilizing specialized, custom glass sizes or unusual load requirements. Any failure in the structural sealant can lead to catastrophic damage, necessitating rigorous inspection regimes and requiring proprietary materials, which locks clients into specific supply chains. However, the market continues to find opportunities through the development of innovative application techniques and materials. For example, the emergence of hybrid glazing systems that combine structural bonding with minimal mechanical restraints offers increased redundancy and flexibility, opening up new potential applications in retrofitting older buildings and expanding the use of structural glazing beyond its traditional reliance on new, high-rise commercial structures. The impact forces overwhelmingly push the market toward innovation in material science and engineering services.

Segmentation Analysis

The Structural Glazing Market is segmented based on critical technical characteristics including the type of bonding system, the type of material used for the sealants, and the end-use application. Understanding these segments is crucial for strategic market positioning, as each segment caters to different regulatory requirements, aesthetic demands, and environmental performance specifications. The segmentation by system type—four-sided, two-sided, and others—reflects varying levels of structural security and visual minimalism required by specific projects. Segmentation by material, primarily dominated by silicone, is critical as the quality and chemistry of the sealant directly determine the longevity, weather resistance, and thermal performance of the entire façade system, making material innovation a key competitive battleground.

The Application segment divides the market into Commercial, Residential, and Industrial sectors, with the Commercial sector consistently dominating the market due to the high volume of large-scale infrastructure projects such as corporate offices, healthcare facilities, and transportation hubs that prioritize sophisticated glass architecture. While residential adoption is growing, particularly in luxury high-rise apartments seeking maximum views and light, the structural demands and complexity generally restrict its use compared to traditional window systems. The industrial segment, while smaller, uses structural glazing for specialized needs like laboratory facilities or high-tech manufacturing plants where strict environmental control and cleanliness are essential, leveraging the superior sealing capabilities of the system.

Geographically, the market is analyzed across major regions including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa (MEA). The APAC region is poised for the fastest growth due to unprecedented construction activity, while Europe maintains its leadership in driving technological adoption and setting the highest standards for energy efficiency, which necessitates advanced structural glazing components. Strategic investments in R&D are primarily focused on developing environmentally friendly (low VOC) sealants and maximizing the thermal performance of IGUs, ensuring that the market evolution is guided by both aesthetic demand and sustainability mandates across all operational segments.

- By System Type:

- Four-Sided Structural Glazing

- Two-Sided Structural Glazing

- Slope Glazing

- Unitized Structural Glazing Systems

- By Material:

- Structural Silicone Sealants (SSS)

- Weather Sealants (WS)

- EPDM Gaskets

- Others (Tapes, Primers)

- By Application:

- Commercial (Office Buildings, Retail, Hospitality)

- Residential (High-Rise Apartments, Custom Homes)

- Industrial & Institutional (Hospitals, Educational Centers, Manufacturing)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Structural Glazing Market

The Structural Glazing Market value chain begins with the upstream suppliers, focusing on the highly specialized manufacturing of raw materials, which include primary inputs like high-purity silica, specialized polymers, and chemical catalysts necessary for producing high-grade structural silicones and glass components. Key players in this stage are chemical manufacturers and glass producers (float glass, tempered glass, laminated glass). This upstream segment is characterized by high barriers to entry due to the necessity for sophisticated chemical R&D, stringent quality control standards, and significant capital investment in production facilities. The quality of these inputs directly dictates the performance, safety, and longevity of the final facade system, emphasizing the power held by proprietary material providers.

The mid-stream encompasses the fabrication and assembly phase, where raw materials are processed into insulated glass units (IGUs) and unitized curtain wall panels. This involves highly specialized glass cutting, treatment (e.g., Low-E coating application), and the critical application of structural sealants, often performed in climate-controlled factory settings for precision (unitized systems). Direct distribution channels involve large façade engineering firms or general contractors sourcing components directly from these fabricators for bespoke, site-built projects. Indirect channels often involve specialized distributors who manage the complex logistics of delivering delicate, large-format glass and sealant materials to smaller or regional construction sites, providing technical support and quality assurance services throughout the process.

The downstream stage focuses on the installation, end-use application, and post-installation services. Specialized structural glazing contractors, who possess certified training for working with specific silicone systems, are essential for on-site execution. End-users (building owners and real estate developers) drive demand based on architectural requirements and performance mandates (e.g., energy consumption targets). The value chain culminates with maintenance and replacement services, where sealant manufacturers often provide long-term warranties, necessitating a continued relationship with certified installers for any subsequent remedial work. The efficiency and quality control throughout this entire chain are paramount, given the non-removable nature of structural glazing bonds.

Structural Glazing Market Potential Customers

Potential customers for structural glazing systems are overwhelmingly dominated by entities involved in large-scale commercial and institutional construction projects where facade aesthetics, building performance, and long-term durability are critical investment factors. The primary end-users are large-scale commercial real estate developers who are initiating projects for office skyscrapers, technology parks, and mixed-use complexes. These developers require curtain wall solutions that meet modern architectural trends, maximize tenant appeal, and comply with increasingly strict energy efficiency standards, often making the seamless, high-performance nature of structural glazing the default specification.

Another significant customer segment includes government and municipal bodies, along with institutional clients such as universities, major hospitals, and airport authorities. These entities prioritize longevity, safety, and operational efficiency. For instance, airports require robust structural integrity against high wind loads and superior acoustic insulation, making advanced structural glazing systems an ideal choice. Institutional buyers typically focus on low lifecycle costs and material robustness, favoring systems that offer long-term warranties on sealant performance and glass integrity, mitigating future repair liabilities.

Finally, high-net-worth individual clients and luxury residential developers constitute a niche but high-value customer segment. These clients use structural glazing in bespoke, high-end residential towers or custom villas where maximizing natural views, achieving complex architectural geometries, and utilizing state-of-the-art smart glass integration are key priorities. While the volume of residential installations is lower than commercial, the profitability per project is often higher, driven by custom design requirements and premium material specifications. Therefore, manufacturers must maintain distinct marketing and distribution strategies tailored to the unique procurement and quality expectations of each customer group.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 63.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., Sika AG, Saint-Gobain, 3M Company, Guardian Industries (Koch Industries), AGC Inc., Sherwin-Williams (Tremco), Quanex Building Products, Kuraray Co., Ltd., Wacker Chemie AG, BASF SE, Arkema S.A., Alcoa Corporation, Vitro Architectural Glass, Oldcastle BuildingEnvelope. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Structural Glazing Market Key Technology Landscape

The technological landscape of the Structural Glazing Market is primarily characterized by advancements in two key areas: the chemistry of the structural sealants and the enhancement of the glass unit itself, particularly concerning thermal performance and dynamic capabilities. In sealant technology, the transition from traditional one-part silicones to highly sophisticated, rapid-curing two-part silicones and specialized hybrid polymers is crucial. These next-generation sealants offer significantly improved mechanical properties, including higher tensile and tear strength, enhanced UV stability, and faster adhesion development, which greatly reduces fabrication time and increases the reliability of the facade bond. Ongoing research focuses on developing low-VOC (Volatile Organic Compound) and ultra-transparent sealants to meet environmental standards and aesthetic requirements without compromising structural integrity or bond performance over decades of exposure.

In terms of glass units, the integration of advanced technologies like Insulated Glass Units (IGUs) with triple glazing, Krypton or Argon gas fills, and switchable/dynamic glass technologies (electrochromic and thermochromic) represents the forefront of innovation. These technologies allow the structural glazing system to actively manage solar heat gain and natural light penetration, shifting the building facade from a passive barrier to an active element of the energy management system. The widespread adoption of these high-performance IGUs is directly tied to regulatory pressures favoring near-zero energy buildings, necessitating thermal performance specifications that far exceed those achievable with standard double-glazing units, thereby bolstering the demand for specialized, structurally sound glazing systems to support them.

Furthermore, technology related to the manufacturing and installation process is rapidly evolving through increased automation and precision engineering. Automated silicone application robots ensure consistent bead geometry and thickness, minimizing voids and enhancing long-term seal reliability—a critical factor for structural integrity. The shift toward factory-fabricated unitized curtain wall systems, which incorporate the structural glazing components off-site, drastically improves quality control and reduces on-site labor requirements and project risks. These unitized systems, often supported by Building Information Modeling (BIM) and digital twin technology, facilitate highly complex designs while maintaining engineering precision, thus underpinning the market's capacity to handle the increasingly ambitious architectural requirements of contemporary skyscrapers and complex enclosures.

Regional Highlights

Regional dynamics play a crucial role in shaping the Structural Glazing Market, dictated by varying building codes, architectural traditions, and economic development rates. The market is broadly categorized into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA), each presenting unique opportunities and challenges for manufacturers and specialized contractors.

- Asia Pacific (APAC): APAC is the engine of market growth, characterized by rapid urbanization and massive investment in commercial infrastructure, particularly in developing economies such as China, India, and Southeast Asia. This region leads in construction volume, translating into high demand for structural glazing systems for new office towers, retail complexes, and transportation hubs. While cost sensitivity is higher here, the sheer scale of projects and the growing adoption of Western architectural styles ensure that APAC will maintain the highest CAGR throughout the forecast period.

- North America: This region is a mature, high-value market driven by rigorous quality standards and a demand for premium, high-performance products. Key market drivers include stringent energy performance requirements in states like California and New York, necessitating the use of advanced Low-E glass and sophisticated thermal-break structural glazing systems. Innovation in smart glass integration and retrofitting of older commercial buildings using modern structural facades are strong regional trends.

- Europe: Europe stands out as the leader in sustainability and regulation. The market here is governed by strict directives aimed at achieving low-carbon and nearly zero-energy buildings (NZEB), which mandate the use of the highest performing thermal envelope components. This drives demand for triple-glazed units, passive house certification-compliant sealants, and highly specialized systems focusing on long-term durability and minimal environmental impact. Germany, the UK, and the Nordic countries are central to technological development.

- Middle East & Africa (MEA): This region is characterized by monumental construction projects, particularly in the GCC countries (UAE, Saudi Arabia, Qatar), driven by diversification efforts away from oil economies. The primary technical requirement here is addressing extreme heat and high solar radiation, leading to high demand for structural glazing systems optimized for solar control (high shading coefficient) and specialized thermal management capabilities. Large, iconic projects continue to fuel demand for aesthetically advanced glass facades.

- Latin America (LATAM): The LATAM market is growing steadily, propelled by infrastructure development and the increasing adoption of international building standards, particularly in major economies like Brazil and Mexico. Demand is segmented, with high-end projects adopting advanced European and North American systems, while cost-efficiency remains a significant factor in general commercial construction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Structural Glazing Market.- Dow Inc.

- Sika AG

- Saint-Gobain

- 3M Company

- Guardian Industries (Koch Industries)

- AGC Inc.

- Sherwin-Williams (Tremco)

- Wacker Chemie AG

- Kuraray Co., Ltd.

- BASF SE

- Arkema S.A.

- Alcoa Corporation (Kawneer)

- Vitro Architectural Glass

- Oldcastle BuildingEnvelope

- Nippon Sheet Glass Co., Ltd. (NSG Group)

- Adhesive Applications

- Dlubal Software GmbH

- Enclos Corp.

- Permasteelisa Group

- Techmer PM

Frequently Asked Questions

Analyze common user questions about the Structural Glazing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is structural glazing and how does it differ from traditional curtain walls?

Structural glazing is a specialized curtain wall system where glass panels are structurally adhered to the building frame using high-strength silicone sealants, eliminating the need for visible exterior metal frames or mechanical fasteners. Traditional curtain walls typically rely on external pressure plates or frames to secure the glass units, resulting in a less seamless, more segmented facade appearance compared to the smooth, flush aesthetic achieved with structural glazing.

What are the primary benefits of implementing structural glazing in commercial construction?

The primary benefits include superior aesthetic appeal through seamless, all-glass facades, enhanced thermal performance due to the minimized heat bridging paths, increased natural daylighting, and reduced air and water leakage. Furthermore, structural glazing offers improved resistance to seismic activity and high wind loads compared to non-structural systems, ensuring long-term structural integrity and low maintenance requirements.

Which material is most critical for the durability and performance of structural glazing systems?

Structural silicone sealant (SSS) is the most critical material, serving as the primary load-bearing adhesive that bonds the glass to the structure. High-performance SSS must possess exceptional UV stability, weather resistance, and mechanical strength to withstand continuous loading, temperature fluctuations, and environmental exposure over the projected 20-30 year lifespan of the facade system, directly impacting safety and system integrity.

How do structural glazing systems contribute to a building's energy efficiency?

Structural glazing systems contribute to energy efficiency by facilitating the use of high-performance Insulated Glass Units (IGUs), which often incorporate low-emissivity (Low-E) coatings and inert gas fills (like Argon) to drastically reduce thermal transfer. The seamless design also minimizes infiltration and air leakage, improving the overall thermal envelope and reducing the energy demands required for heating and cooling the building interior.

What are the main constraints or challenges facing the widespread adoption of structural glazing?

The main constraints include the high initial material and installation costs, which are significantly greater than traditional window systems. Additionally, the installation requires highly specialized, certified labor and precise, climate-controlled conditions for sealant application and curing, leading to complex quality control procedures and potential project delays if specialized expertise is not readily available.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Exterior Structural Glazing Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Silicone Structural Glazing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Insulating Glass Units Market Size Report By Type (Conventional Insulating Glass Units, Low-E Insulating Glass Units, Traditional Reflective Insulating Glass Units, Other Type), By Application (Structural Glazing Applications, Non-Structural Applications), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Exterior Structural Glazing Market Statistics 2025 Analysis By Application (Commercial Building, Public building, Residential), By Type (Insulating Glass, Tempered Glass, Low-e Glass), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Structural Glazing Market Statistics 2025 Analysis By Application (Commercial Building, Public building, Residential), By Type (Insulating Glass, Tempered Glass, Low-e Glass, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager