Telerehabilitation Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441017 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Telerehabilitation Systems Market Size

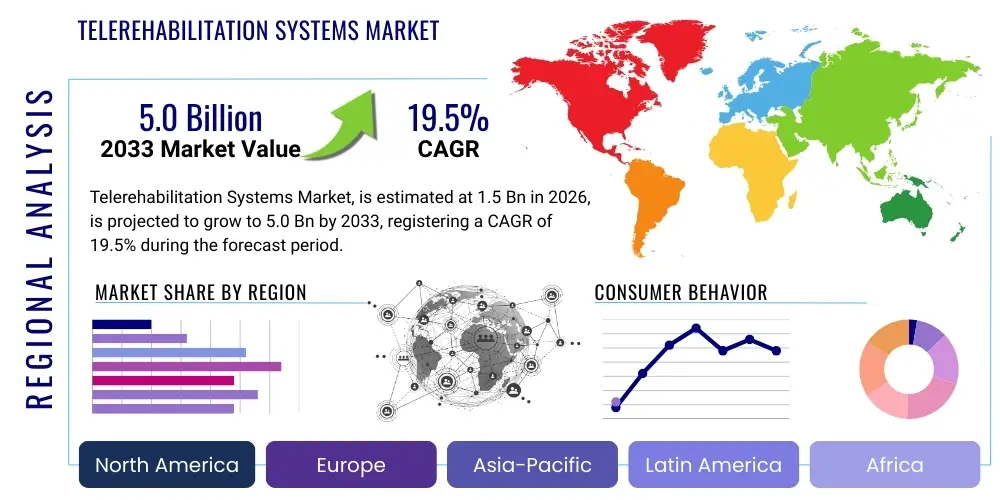

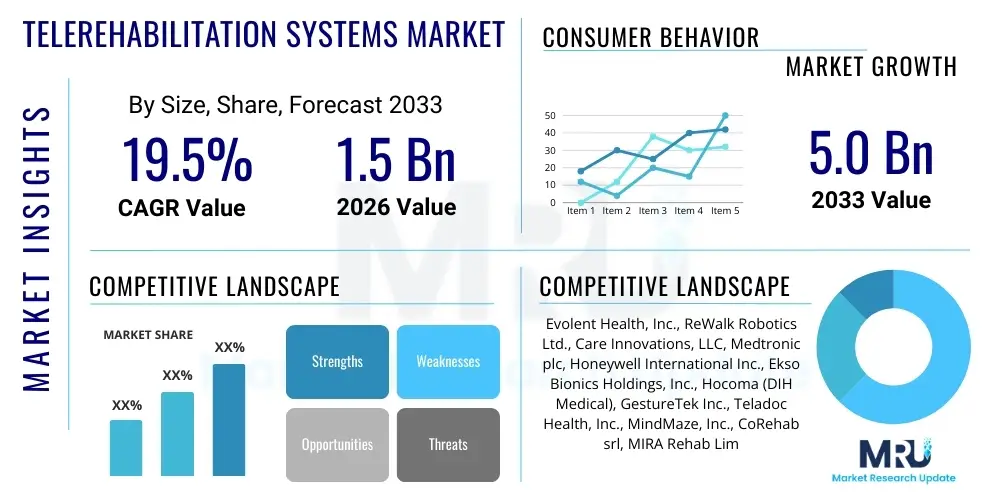

The Telerehabilitation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Telerehabilitation Systems Market introduction

The Telerehabilitation Systems Market encompasses the sophisticated ecosystem of delivering specialized rehabilitation services, including physical therapy, occupational therapy, speech-language pathology, and cognitive remediation, utilizing advanced telecommunication and digital technologies. This market segment leverages a combination of proprietary software platforms, high-definition video conferencing tools, wearable physiological sensors, and immersive interactive devices to facilitate remote diagnosis, intervention, and ongoing monitoring. The core product offering transcends basic video calls by providing integrated solutions that enable real-time, objective kinematic analysis of patient movement and deliver personalized, adaptive exercise regimens. Key factors driving sustained market expansion include the accelerating need to provide care to geographically isolated populations, the critical imperative for efficient management of rising caseloads related to chronic diseases and post-acute recovery, and the increasing acceptance of telehealth models by regulatory bodies and third-party payers globally.

Major applications of telerehabilitation systems span a broad clinical spectrum, with prominent adoption observed in orthopedic recovery following joint replacements, neurological rehabilitation for conditions such as stroke and multiple sclerosis, and cardiac and pulmonary rehabilitation programs. These systems effectively bridge the gap between in-clinic sessions, ensuring continuity of care and promoting high levels of patient adherence through engaging, customized therapeutic experiences delivered in the comfort and convenience of the patient's home environment. The foundational benefits derived from adopting these systems are extensive, including a significant reduction in patient travel time and associated costs, the enhancement of treatment access for individuals with mobility challenges, and the capability for clinicians to gather high-fidelity, ecologically valid data on patient functional performance in daily life settings. This robust data collection capability is paramount for iterative treatment refinement and demonstrating measurable clinical efficacy, which is a core requirement for favorable reimbursement.

The market trajectory is significantly bolstered by concurrent advancements in network infrastructure and computational capacity, particularly the widespread deployment of 5G technology, which guarantees the low latency and high bandwidth necessary for real-time motion capture and synchronous therapeutic interactions. Furthermore, the regulatory environment has become increasingly supportive, particularly in North America and parts of Europe, where temporary emergency measures during the recent global health crisis have evolved into permanent policy changes favoring remote therapeutic monitoring (RTM) and telehealth reimbursement. This regulatory clarity encourages massive investment in product innovation and market penetration. As healthcare systems globally grapple with resource limitations and workforce shortages, scalable telerehabilitation solutions are positioned not merely as an alternative but as an essential, high-efficiency component for the future delivery of comprehensive rehabilitative medicine, compelling hospitals, clinics, and private practices to rapidly integrate these platforms into their standard operational procedures to remain competitive and meet consumer demand for accessible care.

Telerehabilitation Systems Market Executive Summary

The Telerehabilitation Systems Market is undergoing a rapid transformation, characterized by aggressive strategic maneuvering, intense competition centered on technological differentiation, and a global movement toward decentralized healthcare delivery models. Current business trends illustrate a high frequency of mergers and acquisitions (M&A) where specialized software developers and AI analytics firms are being integrated into larger traditional medical device manufacturers to create comprehensive, interoperable ecosystem solutions. Key market players are prioritizing the development of proprietary cloud-based SaaS platforms, which allow for seamless scaling of service offerings, enhance data security, and ensure predictable recurring revenue streams based on monthly subscription models for remote patient monitoring. Additionally, securing robust regulatory certifications, such as FDA clearance for specific therapeutic claims, is increasingly critical, acting as a significant barrier to entry and a strong competitive differentiator in clinically sensitive application areas like neurological recovery.

Regional dynamics confirm North America's position as the market leader, primarily driven by established telehealth reimbursement codes, high consumer and provider technology acceptance, and a concentrated presence of leading technological innovators and venture capital funding focused on digital health startups. Within Europe, while adoption is mature, growth is strategically targeted; the Nordic countries and Germany are leading the integration of telerehabilitation into national social security systems for preventative and geriatric care, emphasizing data protection compliant with GDPR. The Asia Pacific (APAC) region is recognized as the epicenter of future growth, projected to demonstrate the highest CAGR, primarily fueled by massive infrastructure projects aimed at improving healthcare access in sprawling rural populations, particularly in rapidly digitizing economies like China, India, and Southeast Asia, where scalable solutions are essential for managing vast patient volumes efficiently.

Analysis of market segmentation reveals distinct growth patterns: the Software and Services component segment is outpacing the Hardware segment in terms of revenue growth, reflecting the intellectual property value and recurring nature of clinical consultation and platform management fees. Within therapy types, while orthopedic rehabilitation maintains the largest volume due to routine post-surgical recovery, neurological rehabilitation, encompassing stroke, spinal cord injury, and Parkinson's disease management, is experiencing the most dynamic technological innovation and fastest growth trajectory. This acceleration is driven by the suitability of complex neurological training protocols for immersive VR/AR applications and the critical need for long-term, consistent monitoring of subtle functional improvements. Furthermore, end-user trends show a pronounced shift from institutional settings (hospitals) towards home care environments, requiring providers to focus heavily on developing highly intuitive, consumer-grade user interfaces that minimize technical complexity for the patient.

AI Impact Analysis on Telerehabilitation Systems Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) within telerehabilitation systems is a central focus of user inquiry, centering on how these technologies can transition care from reactive to predictive and highly personalized. Users frequently question the clinical validity of AI-generated assessments—specifically, whether algorithms can accurately measure subtle functional improvements or deterioration, such as nuanced gait changes, which traditionally require expert human observation. Furthermore, there is considerable interest in AI's role in optimizing therapist workload by automating administrative tasks and generating predictive adherence scores, allowing clinicians to focus their limited synchronous time on patients with the highest clinical need. The overarching user expectation is that AI will democratize high-quality therapeutic expertise, making personalized care scalable, while the primary concern remains the maintenance of clinical oversight and the ethical deployment of autonomous therapeutic recommendations.

AI's application in movement analysis is fundamentally dependent on sophisticated computer vision and deep learning models, such as Convolutional Neural Networks (CNNs) for image and video processing, and Recurrent Neural Networks (RNNs) for time-series data analysis derived from IMUs and physiological sensors. These algorithms establish robust digital biomarkers of function, allowing the system to quantify metrics like joint angles, speed, acceleration, and symmetry with objective precision far exceeding human capability in a home setting. For example, AI can analyze thousands of repetitions of a specific exercise, identify micro-deviations that a patient is unconsciously performing, and instantly adjust the VR environment or provide verbal cues for correction, thereby ensuring high therapeutic fidelity and minimizing the risk of injury. This level of automated, evidence-based feedback transforms the efficacy of asynchronous care, validating remote monitoring as a robust clinical practice.

Beyond clinical intervention, AI is driving significant operational efficiencies essential for market scalability. Advanced predictive analytics are utilized to forecast patient dropout rates by analyzing engagement metrics, system usage patterns, and demographic data, enabling proactive interventions by the clinical team to maintain adherence. Moreover, AI-powered conversational agents (chatbots) are increasingly being deployed for low-level support, addressing common technical or motivational questions, freeing up highly skilled human therapists for complex clinical decision-making. The ethical framework governing data privacy, algorithmic transparency, and the potential for bias in models trained on non-representative populations remains a critical area of R&D and regulatory scrutiny, demanding continuous refinement in AI model development to ensure equitable and responsible deployment across diverse patient demographics globally.

- Precise quantification of kinematic variables (e.g., joint angles, speed, force) via computer vision and sensor fusion algorithms.

- Development of adaptive exercise difficulty in gamified environments based on real-time performance metrics evaluated by ML models.

- Automated generation of standardized clinical documentation and compliance reports through Natural Language Generation (NLG).

- Predictive identification of patients exhibiting reduced adherence or elevated risk of complications requiring synchronous intervention.

- Creation of objective functional scores and digital biomarkers for conditions like Parkinson's or stroke recovery using deep learning analysis of subtle movement patterns.

- Optimization of therapist caseload management and scheduling through AI-driven triage systems and workflow prioritization tools.

- Personalized therapeutic guidance delivered via intelligent voice assistants and interactive chatbots integrated into the telerehabilitation platform interface.

- Enhanced data security and anomaly detection using AI to monitor network traffic and protect sensitive Patient Health Information (PHI) transmitted remotely.

DRO & Impact Forces Of Telerehabilitation Systems Market

The expansion of the Telerehabilitation Systems Market is robustly driven by fundamental demographic and healthcare structural changes. A primary driver is the accelerating global aging trend, necessitating long-term, accessible care solutions for age-related chronic conditions such as osteoarthritis and neurodegenerative disorders, which require perpetual rehabilitative support that traditional clinics cannot sustainably provide. Another powerful driver is the growing technological maturity, including pervasive high-speed internet access and the consumer acceptance of smart health devices, which minimizes the technical friction of remote care adoption. These drivers collectively push demand toward high-efficiency, home-based models, which promise significant reduction in facility-based operational costs for healthcare providers and improved patient convenience, directly aligning with global initiatives to curb escalating healthcare expenditure without compromising care quality.

Conversely, critical restraints impede faster market penetration. The major barrier remains the persistent regulatory ambiguity and lack of standardization regarding cross-state or cross-country licensing for therapists, which limits the scalability of services across large geographic areas. Furthermore, the high initial capital outlay for specialized hardware, system integration, and comprehensive staff training represents a considerable hurdle, particularly for smaller private practices or healthcare systems operating on constrained budgets. Patient resistance, stemming from issues related to digital literacy, equitable access to reliable internet, and inherent discomfort with technology replacing face-to-face interaction, particularly within older or rural populations, also acts as a tangible drag on adoption rates, requiring targeted mitigation strategies from providers.

Significant opportunities exist in the development of highly engaging, clinically validated VR/AR therapeutic modules that cater to complex conditions such as chronic pain management and cognitive rehabilitation, areas where engagement is critical for long-term success. Furthermore, the market opportunity is vast in securing definitive coverage and reimbursement policies, especially in emerging markets, by providing irrefutable, data-driven evidence of superior clinical outcomes and cost-effectiveness compared to standard care. The most powerful impact force influencing strategic decisions across the market is the sustained economic pressure on healthcare systems to transition to value-based care models. Telerehabilitation systems offer a compelling mechanism to demonstrate value by providing quantifiable metrics on functional improvement, adherence, and cost avoidance, positioning them as essential tools for any provider aiming to thrive under performance-based payment structures mandated by major government and private payers worldwide.

Segmentation Analysis

Detailed segmentation of the Telerehabilitation Systems Market provides a granular view of revenue streams, growth hotspots, and targeted user groups, enabling precise commercial strategies. The market breakdown by component clearly differentiates capital expenditure (Hardware) from operational expenditure (Software/Services), highlighting the long-term profitability of software platforms underpinned by recurrent subscription fees and high-value clinical support services. Segmentation by therapy type underscores the sheer volume demanded by musculoskeletal and orthopedic conditions, but also reveals the technological innovation concentrated in neurological and speech-language pathology segments, which often require highly sophisticated, personalized, and interactive digital tools for effective remote intervention. Analyzing the market through the lens of End-User distribution illustrates the pivotal transition: while hospitals and large rehabilitation facilities remain crucial revenue generators, the highest proportional growth is forecast within the Home Care Settings and individual consumer segment, driven by convenience and patient preference.

Further analysis by application underscores the diversity of clinical needs addressed. Orthopedic applications, including pre-operative conditioning and post-surgical recovery for knee, hip, and shoulder procedures, constitute the bedrock of the market due to established protocols and high patient volumes. Neurological applications, while smaller in volume, drive the demand for advanced features like AI-powered gait analysis and haptic feedback devices, reflecting the complexity and long duration of recovery necessary for stroke or TBI patients. Segmentation therefore acts as a guide for specialized R&D investment, indicating that generalized telerehabilitation platforms must increasingly offer modular specialization to capture market share across distinct clinical specialties. This detailed structure allows market entrants to focus on specific, high-growth niches, such as cognitive rehabilitation for traumatic brain injury or specialized pediatric physical therapy, rather than attempting to compete broadly against established comprehensive platforms.

- By Component:

- Hardware (Advanced motion sensors, depth cameras, haptic feedback devices, portable biofeedback units)

- Software (Proprietary cloud-based platforms, mobile patient apps, clinician dashboards, data analytics modules)

- Services (Clinical consultation, technical support, platform maintenance, specialized therapist training)

- By Therapy Type:

- Physical Therapy (PT) (Musculoskeletal, Sports Medicine)

- Occupational Therapy (OT) (Activities of Daily Living, Fine Motor Skills)

- Speech Therapy (SLP) (Voice disorders, Dysphagia, Articulation)

- Cognitive Rehabilitation (Memory, Attention, Executive Function)

- By Application:

- Orthopedic Rehabilitation (Joint replacement, Fractures, Chronic pain management)

- Neurological Rehabilitation (Stroke recovery, Spinal cord injury, Multiple Sclerosis, Parkinson's Disease)

- Cardiovascular and Pulmonary Rehabilitation (COPD, Post-MI recovery)

- Geriatric and Pediatric Rehabilitation

- By End-User:

- Hospitals and Integrated Delivery Networks (IDNs)

- Specialized Rehabilitation Centers and Private Clinics

- Home Care Settings and Skilled Nursing Facilities (SNFs)

- Corporate Wellness Centers and Military/Veteran Health Systems

Value Chain Analysis For Telerehabilitation Systems Market

The telerehabilitation value chain commences with upstream technological innovation, focusing on the research, design, and manufacturing of specialized, medically validated components. This involves key partnerships with manufacturers of high-fidelity sensors (e.g., medical-grade IMUs), developers of secure, HIPAA-compliant cloud computing infrastructure, and creators of proprietary AI and computer vision algorithms essential for accurate movement tracking. Upstream excellence is defined by the capacity to deliver highly accurate, reliable, and cost-effective technological components that meet stringent medical device quality standards and achieve necessary regulatory clearances. Securing intellectual property rights for novel algorithms and user interface designs is paramount at this stage, establishing a fundamental competitive edge that permeates the entire value chain and dictates the efficacy of the final therapeutic offering.

The midstream segment involves the complex processes of system integration, software deployment, and rigorous clinical validation. Manufacturers must integrate diverse hardware components with scalable software platforms, ensuring seamless interoperability and user experience across multiple devices and operating systems. Critical to this stage is comprehensive clinical testing and validation studies conducted in partnership with academic institutions and leading rehabilitation clinics, providing the evidence base required for market acceptance and reimbursement eligibility. This validation demonstrates that the integrated system delivers outcomes that are non-inferior or superior to traditional, in-person therapy. Furthermore, regulatory compliance, including the management of software as a medical device (SaMD) clearances, requires specialized expertise and continuous maintenance throughout the product lifecycle, adding significant value and assurance to the final product.

Downstream activities center on market access, distribution, and service delivery, dominated by complex distribution channels. Direct distribution strategies target large IDNs and government contracts, where sales cycles are long but volume potential is high, often requiring dedicated sales engineers and integration specialists. Indirect channels involve leveraging partnerships with regional medical distributors, specialized telehealth resellers, and Electronic Health Record (EHR) vendors, which provide crucial existing infrastructure for integration and local maintenance support. The service component of the downstream value chain—including therapist training, continuous software updates, clinical implementation support, and remote technical assistance—is highly valued by customers and is often the primary factor dictating long-term customer retention and the profitability inherent in the subscription-based revenue model. Efficient service delivery ensures maximum platform uptime and therapeutic adherence, optimizing the return on investment for the purchasing healthcare institution.

Telerehabilitation Systems Market Potential Customers

The core customer base for Telerehabilitation Systems comprises institutional healthcare providers, who leverage these platforms to enhance operational efficiency, extend geographical reach, and manage increasing patient volumes related to chronic care and aging demographics. Large hospital systems, particularly those operating across multiple sites and managing extensive orthopedic or neurological patient populations, are primary buyers. Their purchasing criteria heavily emphasize seamless integration with existing IT infrastructure (e.g., Cerner, Epic EHR systems), robust enterprise-level data security protocols, and documented evidence of system scalability to handle hundreds or thousands of simultaneous patient sessions. For these customers, telerehabilitation is an essential strategy for managing resource scarcity, reducing unnecessary inpatient stays, and meeting quality metrics related to reduced readmission rates following major surgeries or acute events.

Specialized rehabilitation centers, including both inpatient and outpatient facilities, represent another vital customer segment. These clinics require highly specialized and modular systems capable of catering to niche therapeutic needs, such as advanced cognitive or vestibular rehabilitation. For private practices and smaller clinics, purchasing decisions are sensitive to initial cost and are driven by the platform's ability to demonstrate a quick ROI by expanding their serviceable patient catchment area and enabling the efficient billing of remote therapeutic monitoring (RTM) codes. These entities often favor highly configurable, user-friendly SaaS platforms with minimal dependency on local IT expertise, allowing therapists to focus primarily on clinical delivery rather than technical troubleshooting.

The direct-to-consumer (DTC) market and adjacent specialized segments, such as corporate wellness programs and military health services (e.g., Veterans Affairs), also constitute significant potential customer groups. Corporate wellness programs integrate telerehabilitation for preventative musculoskeletal health and early intervention, aiming to reduce employee sick leave and long-term disability claims. Individual consumers, particularly those with ongoing chronic needs or those seeking continuous maintenance therapy without the burden of weekly travel, represent a growing DTC revenue stream, prioritizing ease of use and affordability. Finally, government and private payers are critical indirect customers; their willingness to reimburse for specific remote services and technologies drives the financial viability and subsequent purchasing decisions of all provider customers across the healthcare ecosystem, emphasizing the necessity of robust clinical and economic justification for telerehabilitation adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Growth Rate | 19.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Evolent Health, Inc., ReWalk Robotics Ltd., Care Innovations, LLC, Medtronic plc, Honeywell International Inc., Ekso Bionics Holdings, Inc., Hocoma (DIH Medical), GestureTek Inc., Teladoc Health, Inc., MindMaze, Inc., CoRehab srl, MIRA Rehab Limited, Sword Health, Reflect Health, Evolv Rehabilitation Technologies, S.L., Remote Physiotherapy, Inc., Biobeat, Physitrack PLC, General Electric Company (GE Healthcare), Philips Healthcare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Telerehabilitation Systems Market Key Technology Landscape

The contemporary technology landscape underpinning the Telerehabilitation Systems Market is characterized by a reliance on highly sophisticated, interconnected digital infrastructure designed to accurately simulate the clinical environment remotely. Essential hardware components include medical-grade inertial measurement units (IMUs), specialized depth-sensing cameras (e.g., Microsoft Azure Kinect), and high-resolution web cameras, which collectively capture precise, three-dimensional kinematic data on patient movement. This data acquisition relies heavily on reliable, low-latency network connectivity, increasingly supported by global 5G rollouts, ensuring synchronous and near real-time interaction capabilities. Furthermore, the rising integration of haptic feedback devices and powered exoskeletons allows for precise, controlled robotic assistance and tactile feedback during remote therapy sessions, drastically expanding the scope of treatable conditions to include more severe mobility impairments.

The software architecture forms the intellectual core of these systems, typically hosted on secure, compliant cloud environments (e.g., AWS, Azure) and delivered through subscription-based Software-as-a-Service (SaaS) models. Key software technologies include proprietary computer vision algorithms utilizing deep learning (AI) for automated movement analysis and error detection, and gamified virtual reality (VR) or augmented reality (AR) interfaces designed to maximize patient motivation and compliance through engaging interactive tasks. The system must also incorporate robust biofeedback mechanisms, often connected via Bluetooth to wearable physiological sensors (measuring heart rate, skin conductance, or muscle activity), providing clinicians with a holistic view of the patient's physical and psychological response to the therapeutic activity, allowing for dynamic adjustment of exercise intensity and duration.

Interoperability and data security are paramount technological considerations that dictate market readiness and adoption rates among major healthcare providers. Telerehabilitation platforms must utilize standardized Application Programming Interfaces (APIs) and adhere to global health data standards (e.g., HL7, FHIR) to ensure seamless, secure data exchange with diverse Electronic Health Record (EHR) systems used by hospitals and clinics, facilitating comprehensive care coordination. Furthermore, the required cybersecurity framework involves end-to-end encryption for all transmitted patient health information (PHI), rigorous access controls, and continuous auditing to comply with international privacy regulations such as HIPAA and GDPR, building the essential foundation of trust necessary for the widespread adoption of remote therapeutic services in sensitive clinical contexts.

Regional Highlights

- North America (United States and Canada): Market dominance is secured by robust reimbursement for telehealth, particularly Medicare's expansion of coverage for Remote Therapeutic Monitoring (RTM) codes, driving high expenditure on advanced systems. Technological maturity, high digital literacy, and a competitive environment foster continuous innovation in AI-driven diagnostic and therapeutic tools. The US market dictates global pricing and feature sets due to its concentrated purchasing power among large IDNs.

- Europe (Germany, UK, France, Scandinavia): Characterized by stable, moderate growth, strongly influenced by centralized public health systems focused on efficiency and aging demographics. Scandinavia and Germany are pioneers in integrating telerehabilitation into long-term chronic condition management, prioritizing regulatory frameworks that emphasize data protection (GDPR compliance) and clinical validation through national health technology assessments (HTAs).

- Asia Pacific (APAC) (China, Japan, India, Australia): Fastest-growing market due to massive investments in digital infrastructure, vast, often underserved rural populations, and increasing government support for accessible healthcare solutions. The high prevalence of stroke and road traffic injuries in developing APAC nations creates an urgent need for scalable neurological and orthopedic rehabilitation, driving demand for cost-effective, mobile-based telerehabilitation platforms.

- Latin America (LATAM) (Brazil, Mexico): Emerging market segment showing accelerating growth, predominantly driven by private sector adoption in metropolitan areas and increasing internet penetration. Market expansion is dependent on the maturation of local reimbursement policies and overcoming disparities in access to high-quality internet connectivity outside of major urban centers.

- Middle East and Africa (MEA): Nascent, yet technologically sophisticated growth in the Gulf Cooperation Council (GCC) states (UAE, Saudi Arabia), where ambitious national digital transformation initiatives in healthcare are attracting international telerehabilitation vendors. The primary challenge across the broader African continent remains basic healthcare infrastructure and consistent connectivity, limiting adoption primarily to pilot programs supported by international aid or specialized private facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Telerehabilitation Systems Market.- Evolent Health, Inc.

- ReWalk Robotics Ltd.

- Care Innovations, LLC

- Medtronic plc

- Honeywell International Inc.

- Ekso Bionics Holdings, Inc.

- Hocoma (DIH Medical)

- GestureTek Inc.

- Teladoc Health, Inc.

- MindMaze, Inc.

- CoRehab srl

- MIRA Rehab Limited

- Sword Health

- Reflect Health

- Evolv Rehabilitation Technologies, S.L.

- Remote Physiotherapy, Inc.

- Biobeat

- Physitrack PLC

- General Electric Company (GE Healthcare)

- Philips Healthcare

Frequently Asked Questions

Analyze common user questions about the Telerehabilitation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Telerehabilitation Systems Market?

The Telerehabilitation Systems Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 19.5% between 2026 and 2033, driven by increasing adoption of remote patient monitoring and digital health solutions globally, reflecting a major shift towards home-based care models.

Which application segment currently holds the largest market share in telerehabilitation?

Orthopedic Rehabilitation currently holds the largest market share, attributed to the high volume of musculoskeletal injuries and post-operative recovery requirements, such as joint replacements, where structured remote physical therapy protocols are highly effective and cost-efficient.

How is AI specifically impacting the efficacy of telerehabilitation systems?

AI integration enhances efficacy by providing highly personalized, adaptive exercise regimes, enabling objective, precise quantification of movement quality via computer vision, and automating data analysis to significantly optimize therapist time and adherence monitoring.

What are the primary restraints hindering the widespread adoption of telerehabilitation?

Key restraints include the complexity of navigating diverse international regulatory and reimbursement policies, the substantial initial capital investment required for system implementation by providers, and persistent issues related to digital literacy and broadband access among specific patient populations.

Which geographical region is anticipated to experience the fastest market growth?

The Asia Pacific (APAC) region is forecasted to demonstrate the fastest market growth, fueled by rapid expansion of digital health infrastructure, immense, underserved populations, and strong governmental initiatives focused on providing scalable, accessible remote healthcare solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager