Thionyl Chloride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441201 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Thionyl Chloride Market Size

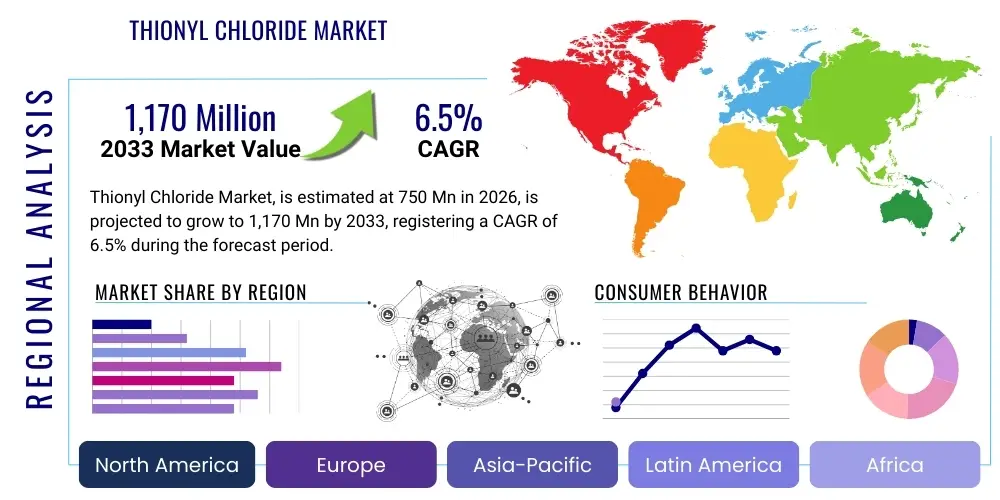

The Thionyl Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,170 Million by the end of the forecast period in 2033.

Thionyl Chloride Market introduction

Thionyl chloride (SOCl₂) is a highly specialized inorganic chemical compound primarily utilized as a chlorinating agent in organic synthesis. It is a colorless to yellowish fuming liquid with a pungent odor, critical for converting alcohols and carboxylic acids into corresponding alkyl or acyl chlorides. This high reactivity and selectivity make it indispensable in industries requiring precise chemical transformations, particularly pharmaceuticals and agrochemicals. The core function of thionyl chloride lies in its efficiency in replacing hydroxyl groups (–OH) with chlorine atoms (–Cl), often yielding high purity products with minimal byproducts, typically sulfur dioxide (SO₂) and hydrogen chloride (HCl), which are gaseous and easily removed. This characteristic clean reaction profile enhances its appeal over other chlorinating agents, driving consistent demand across mature and emerging industrial ecosystems globally.

Major applications of thionyl chloride extend significantly into complex chemical manufacturing processes. In the pharmaceutical sector, it is a crucial intermediate in the synthesis of numerous active pharmaceutical ingredients (APIs), playing a foundational role in producing antibiotics, antipyretics, and various synthetic drugs. Similarly, the agrochemical industry relies heavily on SOCl₂ for manufacturing herbicides, pesticides, and insecticides, essential for modern crop protection strategies. Beyond these primary sectors, thionyl chloride is also utilized in the production of lithium-thionyl chloride batteries, recognized for their high energy density and long shelf life, particularly valuable in military, aerospace, and specialized industrial sensor applications. Furthermore, it serves in the production of specialized dyes, pigments, and certain polymeric materials, diversifying its market footprint and insulating it against single-industry downturns.

The market benefits from several inherent driving factors. The expanding global pharmaceutical manufacturing base, particularly in Asia Pacific, coupled with increasing investments in R&D for novel drug discovery, necessitates a stable and high-quality supply of intermediate chemicals like thionyl chloride. Furthermore, the persistent need for effective crop protection solutions to feed a growing global population sustains robust demand from the agrochemical segment. While handling and environmental compliance remain significant challenges due to its corrosive and toxic nature, continuous technological advancements in safe production and utilization, particularly in closed-loop systems, are mitigating these risks. The superior performance metrics of SOCl₂ in industrial processes—namely high yield, short reaction times, and ease of byproduct removal—ensure its sustained dominance over substitute chlorinating agents, solidifying its essential role in the specialized chemical landscape.

Thionyl Chloride Market Executive Summary

The Thionyl Chloride Market is characterized by moderate growth, primarily fueled by the sustained expansion of the downstream pharmaceutical and agrochemical industries, especially within high-growth economies in Asia Pacific. Key business trends indicate a shift towards enhanced supply chain transparency and regional manufacturing hubs aiming to minimize transportation and storage risks associated with this corrosive chemical. Manufacturers are increasingly focused on process optimization, investing in advanced reaction technology to improve yield and reduce energy consumption, addressing both cost pressures and stringent environmental regulatory frameworks. Strategic alliances between upstream thionyl chloride producers and large pharmaceutical and agrochemical formulators are becoming common, securing long-term supply agreements and stabilizing pricing structures across the value chain. Furthermore, product innovation focuses on developing ultra-high purity grades tailored specifically for sensitive electronic and high-density battery applications, opening niche but highly profitable market segments.

Regionally, Asia Pacific maintains its position as the largest and fastest-growing market, driven by massive domestic consumption in China and India, which are global leaders in generic drug and agrochemical production. North America and Europe represent mature markets, where growth is steady, largely propelled by highly regulated and quality-driven pharmaceutical sectors and increasing adoption of specialized lithium-thionyl chloride batteries in defense and utility applications. These mature regions also lead in the implementation of stringent safety and handling protocols, prompting producers there to adopt advanced containment and environmental monitoring systems. Latin America and the Middle East & Africa (MEA) show nascent growth potential, primarily tied to local chemical industrialization initiatives and reliance on imported thionyl chloride for manufacturing specific agricultural inputs. The regional dynamic is heavily influenced by logistics, as the classification of thionyl chloride as a hazardous material significantly impacts cross-border trade costs and regulatory compliance burdens.

Segmentation trends highlight the dominance of the Pharmaceutical Grade segment due to the high-value nature and strict quality requirements of APIs, commanding premium pricing and demanding rigorous purification standards. Application-wise, the Agrochemicals segment accounts for the largest volume share, reflective of global food security needs and the cyclical demand inherent in agricultural production schedules. The Battery segment, while smaller in volume, exhibits rapid growth due to the rising demand for high-performance, durable power sources in remote monitoring systems and critical infrastructure. Future market expansion is anticipated to be heavily reliant on continuous advancements in synthetic chemistry techniques and the successful scaling of manufacturing capacity to meet burgeoning demand from emerging global industrial giants while simultaneously navigating complex safety and environmental regulations concerning sulfur and chlorine compounds.

AI Impact Analysis on Thionyl Chloride Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Thionyl Chloride Market frequently revolve around three core themes: safety and handling optimization, predictive maintenance in production, and accelerated R&D for derivative chemicals. Users are concerned about how AI can mitigate the inherent risks associated with manufacturing and transporting this highly corrosive and hazardous substance, seeking automated monitoring systems that can predict leakages or system failures before they occur. Furthermore, there is significant interest in utilizing AI and Machine Learning (ML) algorithms to optimize complex chemical reaction parameters, specifically in fine-tuning the synthesis of high-purity thionyl chloride and its subsequent use in API synthesis, aiming for higher yields and reduced waste. The expectation is that AI will enhance operational efficiency, reduce human exposure risks, and potentially streamline compliance reporting through automated data aggregation and anomaly detection in regulated manufacturing environments.

The integration of AI into the thionyl chloride production ecosystem offers transformative potential, moving the industry towards Industry 4.0 standards. AI-powered sensors and process control systems are now capable of analyzing real-time data streams—temperature, pressure, flow rates, and spectral analysis—to maintain optimal reaction conditions, significantly minimizing the likelihood of hazardous runaway reactions. This capability directly addresses safety restraints and improves product consistency, a paramount concern for pharmaceutical applications. Furthermore, ML models are being employed in inventory management and supply chain logistics to forecast demand volatility, especially in cyclical sectors like agrochemicals, ensuring optimal stocking levels and minimizing the high costs associated with storing hazardous materials, thereby optimizing overall capital expenditure and ensuring just-in-time delivery for critical downstream users.

Beyond process and safety improvements, AI is playing an increasingly strategic role in new product development and substitution analysis. Research institutions and chemical companies are leveraging computational chemistry platforms integrated with AI to model molecular interactions, accelerating the discovery of novel compounds utilizing thionyl chloride as a precursor, or, conversely, identifying less hazardous alternatives for specific applications. This dual impact—optimization of current production and acceleration of future chemical innovation—positions AI as a critical enabler for sustainable growth within the specialized chemicals market. Although the capital investment for advanced AI implementation remains a barrier for smaller manufacturers, the long-term benefits in safety compliance and operational excellence are compelling large industry players towards full-scale digital transformation.

- AI-driven Predictive Maintenance: Minimizing equipment failure and preventing catastrophic hazardous material leaks in SOCl₂ production facilities.

- Process Optimization: Utilizing Machine Learning (ML) to fine-tune reaction parameters (temperature, catalyst concentration) for maximum yield and purity in thionyl chloride synthesis.

- Enhanced Safety Monitoring: Real-time sensor data analysis and anomaly detection to ensure rigorous containment protocols and worker safety compliance.

- Supply Chain & Logistics Forecasting: Improving inventory management and optimizing transportation routes for hazardous materials, reducing storage duration and associated risks.

- Accelerated R&D: Computational modeling of new chemical reactions involving thionyl chloride derivatives, speeding up pharmaceutical and agrochemical innovation.

- Automated Quality Control: Employing computer vision and spectroscopic analysis linked to AI for rapid and consistent product quality verification.

DRO & Impact Forces Of Thionyl Chloride Market

The Thionyl Chloride market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. The primary drivers stem from the robust, non-substitutable demand in high-growth downstream sectors, particularly the global pharmaceutical industry's need for high-purity intermediates and the steady expansion of agrochemical production to support food supply chains. These drivers provide foundational momentum, stabilizing the market against general economic volatility. However, the market faces intense restraints, chief among them being the extreme corrosiveness and toxicity of thionyl chloride, necessitating high capital investment in specialized, regulatory-compliant handling, storage, and waste disposal infrastructure. The stringent environmental regulations concerning sulfur and chlorine emissions, especially in developed economies, impose operational limitations and elevate compliance costs. The market seeks opportunities primarily through technological advancements, focusing on the development of safer delivery mechanisms, closed-loop recycling of byproducts, and geographical market expansion into regions undergoing rapid industrialization, which offer regulatory flexibility and high untapped demand.

Drivers: The sustained growth of the pharmaceutical industry, particularly the rise in complex generic drug manufacturing in Asia, is a critical market driver. Thionyl chloride remains the preferred, highly efficient chlorinating agent for synthesizing numerous Active Pharmaceutical Ingredients (APIs) where purity and yield are non-negotiable. Furthermore, the persistent global demand for crop yield enhancement drives the agrochemical sector, which consumes vast quantities of thionyl chloride for producing key herbicides and insecticides. The tertiary driver involves the increasing global adoption of specialized, long-life lithium-thionyl chloride batteries in critical applications such as military equipment, deep-sea exploration, and remote industrial sensors, valuing their superior energy density and wide operational temperature range. These diverse, high-stakes application areas ensure continuous, necessary demand, underpinning the market's fundamental stability and growth trajectory through the forecast period.

Restraints: The most significant restraint is the inherent hazardous nature of thionyl chloride, which dictates severe regulatory hurdles globally, including strict limits on transportation, storage capacity, and exposure levels. This results in high liability risks and operational expenditures related to safety systems. Environmental concerns regarding the gaseous byproducts, SO₂ and HCl, necessitate costly scrubbers and neutralization processes to meet tightening emission standards, particularly in regions like Europe and North America. Moreover, the dependence on sulfur compounds and chlorine gas as raw materials exposes manufacturers to commodity price volatility and supply chain disruptions. The threat of substitution, while currently low due to the unique reactivity of SOCl₂, remains a potential long-term restraint if safer, equally effective, and cost-competitive chlorinating alternatives are successfully commercialized through green chemistry initiatives.

Opportunities: Significant growth opportunities are emerging from the shift towards high-purity applications, specifically in the production of specialized electronic chemicals and the electrolyte components for advanced battery systems. Developing countries, particularly those in Southeast Asia and Latin America, present opportunities for new market penetration as their domestic chemical manufacturing capabilities mature and demand for specialized inputs increases. Another major opportunity lies in process innovation, leveraging AI and catalytic chemistry to achieve more efficient use of thionyl chloride, minimize hazardous waste, and potentially develop closed-loop systems for byproduct recovery and reuse, thus improving the overall sustainability profile and reducing the total cost of ownership for end-users. Focusing on customized grades for niche markets, such as optical fiber preform production, also presents avenues for high-margin revenue generation.

- Drivers:

- Increasing global pharmaceutical and generic drug production, requiring high-purity chlorinating agents.

- Sustained expansion of the agrochemical industry (herbicides, insecticides) driven by global food demand.

- Growing utilization of high energy density lithium-thionyl chloride batteries in defense and specialized industrial applications.

- Inherent superior performance and selective reactivity of SOCl₂ over alternative chlorinating agents.

- Restraints:

- Extreme toxicity, corrosiveness, and hazardous classification leading to high storage, handling, and transportation costs.

- Stringent and evolving environmental regulations regarding sulfur dioxide (SO₂) and hydrogen chloride (HCl) emissions.

- Capital-intensive nature of establishing and maintaining compliant manufacturing facilities.

- Fluctuations in the price and supply of key raw materials (sulfur and chlorine).

- Opportunities:

- Focus on producing ultra-high purity grades for niche markets (e.g., electronics, specialized polymers).

- Geographical expansion into emerging economies with developing chemical manufacturing bases.

- Investment in process technology (catalysis, continuous flow) to improve efficiency and reduce waste generation.

- Development of safer packaging and delivery systems to mitigate handling risks for end-users.

- Impact Forces:

- Regulatory Compliance Cost: High.

- Substitution Threat: Moderate to Low (due to uniqueness).

- Downstream Demand Stability: High.

- Supply Chain Risk: Moderate to High (due to hazardous classification).

Segmentation Analysis

The Thionyl Chloride Market is comprehensively segmented primarily based on Purity Grade, Application, and End-Use Industry, reflecting the varied requirements across its extensive range of applications. Purity grade segmentation—delineating between Industrial Grade, Pure Grade, and Pharmaceutical Grade—is critical as it directly correlates with the end-product's sensitivity and the required stringency of purification processes, impacting pricing and market share distribution. The Pharmaceutical Grade segment commands the highest price point due to the rigorous quality control and ultra-low impurity levels mandatory for Active Pharmaceutical Ingredients (APIs). Conversely, Industrial Grade caters to less sensitive chemical processes like dye and pigment production where bulk volume and cost efficiency are prioritized. Understanding these purity divisions is essential for manufacturers tailoring their production capabilities and marketing strategies.

Application-based segmentation provides insights into the primary consumption hubs. The market is dominated by its use as a Chlorinating Agent, encompassing the vast majority of consumption in synthesizing organic intermediates. The second major application segment is its role as a Reagent and Catalyst, often used in laboratory settings and small-scale, high-value chemical reactions. The third distinct category is its use as a component in Lithium Battery Electrolytes, a rapidly growing but highly specialized segment characterized by demand for exceptionally high purity and moisture-free product. Analyzing these application areas reveals shifts in technological focus and identifies future growth sectors, such as the increasing global push towards high-performance power solutions that rely on specialized battery chemistry.

Segmentation by end-use industry further clarifies market dynamics and dependency on macro-economic trends. The Agrochemicals and Pharmaceuticals sectors collectively form the cornerstone of the market, absorbing the largest volumes globally. Growth within the Agrochemical sector is generally stable, tied to population growth and agricultural cycles, whereas the Pharmaceuticals segment shows consistent, strong growth driven by healthcare expenditure and drug development. Other significant end-use industries include Specialty Chemicals (dyes, polymers, additives), and the Electronics & Battery sector, where thionyl chloride’s role as an electrolyte component is expanding. Geographical distribution and regulatory environments heavily influence the relative dominance of these end-use sectors across different regions, with mature markets focusing on pharmaceutical quality and emerging markets prioritizing bulk agrochemical production. This granular segmentation facilitates accurate market forecasting and strategic resource allocation for market participants.

- By Purity Grade:

- Industrial Grade (Lower purity, high volume)

- Pure Grade (Standard chemical synthesis)

- Pharmaceutical Grade (Highest purity, low volume, high value)

- By Application:

- Chlorinating Agent (Majority share, used in organic synthesis)

- Reagent and Catalyst (Laboratory and specialized use)

- Lithium Battery Component (Electrolyte material)

- By End-Use Industry:

- Pharmaceuticals (APIs, intermediates)

- Agrochemicals (Herbicides, pesticides)

- Specialty Chemicals (Dyes, pigments, polymers)

- Electronics & Batteries (Lithium-thionyl chloride cells)

- Others (Laboratory use, military)

Value Chain Analysis For Thionyl Chloride Market

The value chain for the Thionyl Chloride Market begins with the upstream procurement of essential raw materials, primarily sulfur (S) and chlorine (Cl₂), which are typically sourced from global commodity chemical producers or brine electrolysis processes. The synthesis of thionyl chloride often involves the reaction of sulfur dioxide (SO₂) with chlorine gas, a highly controlled and energy-intensive manufacturing process requiring specialized, corrosion-resistant equipment. Upstream risks are centered around the volatile pricing and supply stability of elemental sulfur and chlorine, coupled with the high energy demand required for synthesis. Manufacturers must manage complex chemical reactions and separation processes to achieve the high purity levels demanded by downstream users, particularly the pharmaceutical sector, where impurity profiles are strictly regulated.

Midstream activities involve the core manufacturing, purification, and packaging of thionyl chloride, followed by its hazardous material transportation. Due to its corrosive nature, specialized containers and stringent safety protocols are mandatory, significantly impacting logistics costs. The distribution channel is often bifurcated: direct sales channels handle high-volume transactions, typically supplying large agrochemical manufacturers or integrated pharmaceutical companies under long-term contracts. Indirect sales, utilizing specialized chemical distributors and regional agents, cater to smaller manufacturers, research laboratories, and diverse specialty chemical producers who require smaller, more frequent deliveries and technical support. These distributors must possess specialized permits and infrastructure to handle and store Class 8 corrosive materials, adding complexity to the distribution network.

Downstream analysis focuses on the end-use applications where thionyl chloride acts as a critical intermediate. The pharmaceutical and agrochemical industries dominate this segment, leveraging SOCl₂’s ability to efficiently chlorinate functional groups, forming high-value end products. The efficiency of the supply chain is paramount, as delays can halt high-value production lines. End-users often require certification and purity testing documentation, emphasizing quality control checkpoints throughout the chain. The ultimate success of the downstream process relies on the purity and consistent quality of the thionyl chloride supplied, making the relationship between the manufacturer and the end-user highly collaborative and technically driven. Waste management and the responsible disposal of reaction byproducts (SO₂ and HCl) at the end-user site are also critical downstream considerations, increasingly factored into procurement decisions.

Thionyl Chloride Market Potential Customers

The primary customers for thionyl chloride are large-scale chemical formulators and pharmaceutical companies globally, who utilize the product as a non-substitutable reagent in the synthesis of complex organic molecules. Within the pharmaceutical sector, potential buyers include major global API manufacturers and contract manufacturing organizations (CMOs) that specialize in producing intermediates for antibiotics, cardiovascular drugs, and anti-inflammatory agents. These customers demand extremely high-purity (Pharmaceutical Grade) material, seeking consistent quality, strict batch traceability, and suppliers capable of meeting rigorous Good Manufacturing Practice (GMP) standards. Price stability and guaranteed supply reliability are key purchasing criteria for this segment due to the high regulatory risks involved in drug production.

The second major category of customers belongs to the agrochemical industry, encompassing companies that produce crop protection agents such as herbicides, fungicides, and insecticides. These end-users typically purchase Industrial to Pure Grade thionyl chloride in large volumes, often dictated by seasonal agricultural cycles. Their purchasing decisions are highly influenced by cost-effectiveness, bulk supply capacity, and the supplier's ability to navigate complex international logistics for hazardous materials. Large, integrated chemical giants with diversified portfolios across both agrochemicals and specialty chemicals represent crucial, high-volume customers requiring reliable delivery systems.

A third, specialized segment of potential customers includes advanced battery manufacturers, particularly those focusing on non-rechargeable lithium cells used in military, utility metering, and deep-sea exploration equipment. These customers require ultra-pure thionyl chloride for use as an electrolyte solvent, valuing its stability and performance characteristics under extreme conditions. Furthermore, specialty chemical manufacturers involved in the production of high-performance polymers, specialized plasticizers, and certain dyestuffs also constitute a diverse customer base, demanding flexible supply volumes and technical consultation regarding reaction optimization and safety handling protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,170 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Transpek Industry Limited, Lanxess AG, BASF SE, Merck KGaA, Avantor Inc., Jiangsu Yinhai Chemical Co., Ltd., China Wanda Group, Suzhou Jingu Chemical Co., Ltd., Hubei Xingfa Chemicals Group Co., Ltd., Triveni Interchem Private Limited, Kanto Chemical Co., Inc., PCC Group, CABB Group GmbH, Sumitomo Chemical Co., Ltd., Solvay S.A., Shandong Luba Chemical Co., Ltd., Gulbrandsen, GFS Chemicals, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thionyl Chloride Market Key Technology Landscape

The manufacturing technology for thionyl chloride primarily revolves around the reaction of sulfur dioxide (SO₂) with chlorine (Cl₂) in the presence of a catalyst, or alternatively, the reaction of sulfur trioxide (SO₃) and sulfur dichloride (SCl₂). While the fundamental chemistry is well-established, the key technological advancements in the market are centered on process intensification, achieving higher purity levels, and drastically improving operational safety and environmental performance. Process intensification involves shifting from traditional batch processes to continuous flow reactors, which allow for tighter control over reaction parameters, reduced residence time, and smaller reaction volumes, inherently enhancing safety when dealing with volatile and hazardous materials. Continuous processing is a major technological focus, particularly among major producers, offering benefits in scalability and energy efficiency, which is vital for maintaining cost competitiveness in bulk chemical production.

A critical technology area is purification and analysis, especially for producing the highly lucrative Pharmaceutical Grade thionyl chloride. Manufacturers are employing advanced fractional distillation and chromatographic techniques to remove trace impurities, notably sulfuryl chloride (SO₂Cl₂) and residual chlorine, to meet the stringent specifications required for API synthesis. The analytical technology landscape is also evolving, with integrated online sensor systems, often leveraging spectroscopic methods (e.g., Near-Infrared or Raman Spectroscopy), providing real-time quality control feedback. These systems ensure immediate identification of any deviations in purity or composition, minimizing waste and ensuring batch consistency, which is paramount for regulated industries.

Furthermore, technology related to environmental mitigation and handling safety is driving significant capital expenditure. Innovative technologies focus on closed-loop systems designed to capture and neutralize gaseous byproducts (SO₂ and HCl) before they are released, often converting them into reusable or easily disposable salts. The deployment of advanced corrosion-resistant materials, such as specialized alloys and linings in reactors and storage tanks, extends the lifespan of critical infrastructure and significantly reduces the risk of containment failure. Digital twin technology and predictive modeling, as detailed in the AI analysis, are increasingly being adopted to simulate operational scenarios and optimize maintenance schedules, representing the next frontier in minimizing operational risks associated with this corrosive chemical.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region and the primary growth engine for the thionyl chloride industry, fueled predominantly by China and India. These countries host massive pharmaceutical and agrochemical manufacturing bases, benefiting from lower operating costs and a large domestic consumer market. China, in particular, is a major global producer and exporter of thionyl chloride, though it faces increasing pressure to meet stricter domestic environmental regulations, potentially shifting production to more compliant facilities. The region's growth is driven by massive infrastructure investments in chemical parks and the government impetus for self-sufficiency in chemical inputs, necessitating high volumes of intermediate chemicals like SOCl₂. The pharmaceutical grade segment is witnessing rapid expansion here due to the surge in API production for both local consumption and global export, demanding rigorous quality upgrades across the supply chain.

- North America: This region is characterized by high demand for specialized, high-purity grades, particularly for use in advanced lithium battery production, aerospace applications, and highly regulated pharmaceutical manufacturing. The market growth here is stable and quality-driven rather than volume-driven. Strict environmental, health, and safety (EHS) regulations in the U.S. and Canada require manufacturers and distributors to adhere to the highest standards of handling and waste disposal, increasing operational costs but ensuring product safety. The region also sees significant demand from the defense sector for high-performance military-grade batteries, which rely on the robust characteristics of lithium-thionyl chloride chemistry, providing a resilient and profitable niche market.

- Europe: The European market is mature and heavily governed by the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) regulation, imposing stringent controls on the use and handling of thionyl chloride. Growth is concentrated in specialized, high-value chemical synthesis and established pharmaceutical manufacturing hubs in Germany, Switzerland, and Ireland. European manufacturers are leaders in developing sophisticated closed-loop and waste minimization technologies to comply with the region’s strict environmental mandates. The focus is increasingly on sustainable production methods and high-efficiency chemical processes, ensuring that volume growth is secondary to regulatory adherence and technological superiority.

- Latin America (LATAM): The LATAM market exhibits moderate growth, primarily tied to the robust agricultural sector, particularly in Brazil and Argentina, which drives consistent demand for agrochemical intermediates. Local production capabilities are still developing, leading to a high reliance on imports from Asia Pacific and Europe. Opportunities exist for suppliers capable of navigating complex regional logistics and establishing reliable distribution networks. Market development is intrinsically linked to government support for agricultural output and gradual industrialization efforts, suggesting future potential for local manufacturing establishment, contingent upon stable economic conditions and simplified regulatory frameworks.

- Middle East & Africa (MEA): This region is currently the smallest consumer, with demand concentrated in specific national industrial sectors, particularly in Saudi Arabia and the UAE, linked to chemical processing and oilfield services. While Africa offers long-term potential due to burgeoning pharmaceutical needs and agricultural modernization, the current market is fragmented, highly reliant on imports, and characterized by logistical challenges. Growth in MEA is expected to be slower but steady, correlating directly with national strategic investment in local chemical and pharmaceutical production capacity and infrastructure development initiatives across key economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thionyl Chloride Market.- Transpek Industry Limited

- Lanxess AG

- BASF SE

- Merck KGaA

- Avantor Inc.

- Jiangsu Yinhai Chemical Co., Ltd.

- China Wanda Group

- Suzhou Jingu Chemical Co., Ltd.

- Hubei Xingfa Chemicals Group Co., Ltd.

- Triveni Interchem Private Limited

- Kanto Chemical Co., Inc.

- PCC Group

- CABB Group GmbH

- Sumitomo Chemical Co., Ltd.

- Solvay S.A.

- Shandong Luba Chemical Co., Ltd.

- Gulbrandsen

- GFS Chemicals, Inc.

Frequently Asked Questions

Analyze common user questions about the Thionyl Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Thionyl Chloride?

The demand for Thionyl Chloride (SOCl₂) is predominantly driven by its critical role as a chlorinating agent in the production of Active Pharmaceutical Ingredients (APIs) and the synthesis of essential agrochemicals (herbicides and pesticides). Additionally, it is vital for producing specialized lithium-thionyl chloride batteries used in high-performance power solutions.

Which geographical region holds the largest market share and why?

Asia Pacific (APAC), particularly China and India, holds the largest market share. This dominance is attributed to the massive scale of the region's generic drug manufacturing capabilities, robust agrochemical production to meet regional agricultural needs, and relatively favorable regulatory environments for bulk chemical production compared to Europe and North America.

What is the most significant restraint affecting the Thionyl Chloride Market?

The most significant restraint is the inherent hazardous nature of thionyl chloride, which is highly corrosive and toxic. This classification necessitates extremely stringent regulatory compliance, leading to high capital expenditure for specialized safety equipment, storage infrastructure, handling procedures, and costly waste disposal processes.

How is the market segmented by purity grade, and which segment offers the highest value?

The market is segmented into Industrial Grade, Pure Grade, and Pharmaceutical Grade. The Pharmaceutical Grade segment commands the highest value due to the extremely rigorous purity standards and quality assurance required for its use in synthesizing highly regulated drug components (APIs), necessitating complex purification technologies.

How does the rising adoption of AI impact the manufacturing of Thionyl Chloride?

AI adoption primarily impacts SOCl₂ manufacturing by enhancing safety and efficiency. AI-driven predictive maintenance prevents hazardous system failures, while machine learning algorithms optimize complex reaction parameters for higher yield and purity, minimizing waste and ensuring tighter regulatory compliance in highly sensitive production environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Lithium Thionyl Chloride Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Primary Lithium Battery (Primary Lithium Batteries) Market Size Report By Type (Lithium/Thionyl Chloride Battery (Li/SOCL2), Lithium/Manganese Dioxide Battery (Li/MnO2), Lithium/Polycarbon Monofluoride Battery (Li/CFx), Others), By Application (Aerospace and Defense, Medical, Industrial, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Thionyl Chloride Market Statistics 2025 Analysis By Application (Pharmaceutical, Pesticide, Dye, Organic Synthesis, A Ring (or Closed Loop) Reaction), By Type (Refined Products, First-Rate Products, Second-Rate Products), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager