Thymidine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442822 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Thymidine Market Size

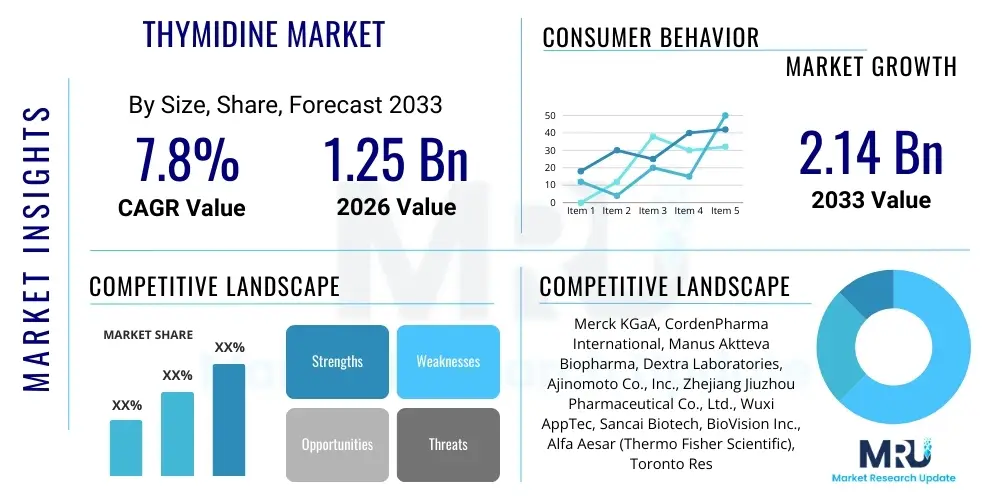

The Thymidine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $775 Million by the end of the forecast period in 2033.

Thymidine Market introduction

The Thymidine Market involves the production and distribution of thymidine, a fundamental nucleoside integral to biological processes, specifically DNA synthesis and repair. Thymidine serves as a critical precursor in the pharmaceutical industry, primarily for synthesizing nucleoside analog reverse transcriptase inhibitors (NRTIs), such as Azidothymidine (AZT) and Stavudine (D4T), essential components in anti-retroviral therapies for HIV/AIDS treatment. Beyond pharmaceuticals, it is extensively used in molecular biology and biochemical research as a radiolabeled marker for cell proliferation studies and in diagnostics to detect specific biological pathways. The market is propelled by the growing prevalence of chronic viral diseases, particularly in emerging economies, coupled with increased global investment in oncology and infectious disease research. Furthermore, advancements in biotechnology and the development of new gene therapies that rely on precise manipulation of nucleoside building blocks are consistently driving the demand for high-purity thymidine compounds, making it a critical segment within the broader chemical and life science industry landscape.

Thymidine Market Executive Summary

The Thymidine market is currently characterized by moderate yet steady growth, driven predominantly by sustained demand from the anti-retroviral drug manufacturing sector and increasing activities in genomic research and personalized medicine. Business trends indicate a strategic focus on vertical integration among key manufacturers to secure raw material supply chains and maintain stringent quality standards necessary for pharmaceutical-grade production. Companies are heavily investing in improving chemical synthesis routes to achieve higher yields and purity levels, addressing the regulatory requirements of major markets like the FDA and EMA. Segment trends highlight the dominance of the antiviral application segment due to the established usage of thymidine derivatives in HIV treatment, although the research and diagnostics segments are expected to exhibit higher growth trajectories fueled by novel molecular probes and tracer development. Regionally, Asia Pacific is emerging as the fastest-growing market, primarily due to expanding pharmaceutical manufacturing bases, favorable government initiatives supporting biotech innovation, and increasing access to advanced medical treatments in densely populated countries such as China and India, shifting the manufacturing focal point eastward while North America and Europe remain pivotal centers for R&D expenditure and high-value consumption.

AI Impact Analysis on Thymidine Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Thymidine market frequently revolve around how AI can accelerate drug discovery processes utilizing thymidine derivatives, optimize complex chemical synthesis pathways, and improve predictive modeling for demand forecasting in niche pharmaceutical markets. Users are keen to understand if AI-driven simulations can replace traditional laboratory screening methods for new NRTI compounds, thereby reducing the lengthy R&D cycle and associated costs. Key concerns center on the reliability of AI models in predicting specific biological interactions of thymidine analogs and the intellectual property implications of AI-generated synthetic routes. Expectations are high regarding AI’s ability to refine supply chain logistics, predicting fluctuations in raw material availability (such as uracil) and optimizing inventory levels for manufacturers dealing with short shelf-life or high-purity requirements, ensuring regulatory compliance is maintained across sophisticated production lines.

- AI accelerates the identification and optimization of novel nucleoside analogs derived from thymidine, reducing the time spent in preclinical screening phases through molecular docking and quantitative structure-activity relationship (QSAR) modeling.

- Predictive maintenance algorithms deployed in manufacturing facilities use sensor data to optimize fermentation or chemical synthesis reactors, enhancing yield and purity of pharmaceutical- grade thymidine production.

- Supply chain optimization through machine learning ensures precise forecasting of global demand for anti-retroviral drugs, mitigating risks associated with inventory shortages or excess capacity in thymidine supply.

- AI-enabled automated synthesis platforms (chemputers) are utilized to explore and validate novel, sustainable, and cost-effective chemical routes for thymidine synthesis, minimizing waste and energy consumption.

- Deep learning models assist in genomic research and diagnostic applications that utilize thymidine tracers, providing faster, more accurate interpretation of cellular proliferation rates and mutation patterns in oncology studies.

DRO & Impact Forces Of Thymidine Market

The dynamics of the Thymidine market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively manifesting as significant Impact Forces influencing strategic decision-making and market evolution. Key drivers include the persistent global burden of HIV/AIDS, which mandates a stable supply of high-quality anti-retroviral drugs dependent on thymidine derivatives like AZT, and the escalating research activities in oncology and personalized medicine, where thymidine tracers are crucial. Restraints largely involve the high cost and technical complexity associated with manufacturing pharmaceutical-grade, ultra-pure thymidine, coupled with stringent regulatory scrutiny imposed by global health authorities regarding nucleoside sourcing and quality control. Opportunities arise from expanding applications in radiopharmaceuticals, advancements in CRISPR technology requiring specialized nucleosides, and untapped market potential in developing nations seeking localized drug production capabilities. These forces collectively propel the market towards greater emphasis on process innovation, supply chain resilience, and achieving cost efficiencies while maintaining the highest standard of product purity, essential for therapeutic efficacy and patient safety.

Segmentation Analysis

The Thymidine Market is comprehensively segmented based on its application, required purity level, and the end-use industry utilizing the compound, providing a granular view of demand patterns and strategic areas for investment. The application segmentation clearly demarcates the established pharmaceutical use in antiviral drugs from the high-growth potential segments of diagnostics and fundamental life science research. Purity levels, which are paramount in this market, distinguish standard research-grade material from highly regulated pharmaceutical intermediates, impacting pricing and market access. Finally, the end-use analysis helps identify the primary consumers—pharmaceutical giants, specialized biotechnology firms, and academic institutions—each with unique volume and specification requirements. This structured segmentation allows manufacturers to tailor their product offerings, quality assurance protocols, and distribution strategies to effectively penetrate specific high-value sub-markets, maximizing efficiency across the complex value chain.

- By Application:

- Antiviral Drugs (e.g., Azidothymidine (AZT), Stavudine (D4T))

- Diagnostics

- Research & Development (R&D)

- Other Therapeutic Uses

- By Purity:

- 99.0% Purity

- 99.5% Purity

- Above 99.5% Purity (Pharmaceutical Grade)

- By End-Use:

- Pharmaceutical Industry

- Biotechnology Companies

- Academic & Research Institutes

Value Chain Analysis For Thymidine Market

The Thymidine market value chain commences with upstream activities centered on the procurement and initial chemical conversion of foundational raw materials. The primary precursor for synthetic thymidine production is often uracil, a pyrimidine base, which is chemically or biologically converted into deoxyribose derivatives. Upstream providers are specialized chemical and biochemical manufacturers who must maintain rigorous quality control over basic compounds, as impurities at this initial stage severely impact the feasibility and final purity of the thymidine product. Key challenges in the upstream segment include ensuring a stable, cost-effective supply of high-grade uracil and managing the complex, multi-step chemical synthesis processes (such as enzymatic synthesis or total chemical synthesis) required to create the specific nucleoside structure. Companies often integrate backwards or establish long-term contracts with specialized raw material suppliers to mitigate volatility and ensure consistency in input quality, which is vital for meeting pharmaceutical regulatory standards.

The midstream stage involves the core manufacturing process where the crude thymidine is synthesized, followed by crucial purification and crystallization steps. Achieving pharmaceutical-grade purity (often exceeding 99.5%) demands advanced chromatographic techniques and specialized equipment, making this stage highly capital-intensive and technically demanding. Manufacturers in this segment, primarily large chemical and pharmaceutical intermediate companies, invest heavily in process optimization to enhance yield and reduce batch-to-batch variability. Distribution channels for thymidine are highly specialized, utilizing both direct and indirect routes. Direct distribution is common for large-volume pharmaceutical clients who require guaranteed traceability and specific regulatory documentation (e.g., Certificates of Analysis, DMF filings). Indirect channels, involving global chemical distributors and regional specialty chemical suppliers, serve the fragmented market of academic research labs, smaller diagnostic companies, and niche biotech firms, requiring efficient inventory management and cold chain logistics for sensitive compounds.

Downstream activities involve the final end-use of thymidine, predominantly its incorporation as a precursor in the synthesis of finished antiviral drug products like AZT (Zidovudine) or D4T (Stavudine) by major pharmaceutical companies. The utilization by biotechnology and research institutes includes its incorporation into labeled probes, diagnostic kits, and specialized nucleic acid synthesis for gene editing research. The complexity of the downstream pharmaceutical synthesis process—which involves converting thymidine into its active triphosphate form or a specific analog—demands stringent quality control from the end-user. Direct channels dominate the high-volume pharmaceutical supply, ensuring minimal risk of contamination or counterfeit materials. Indirect channels facilitate broader access to smaller, specialized orders, leveraging distributor networks to penetrate diverse geographic markets, particularly in regions with growing academic and early-stage biotechnology sectors that are crucial for future therapeutic innovation.

Thymidine Market Potential Customers

The primary cohort of potential customers for high-purity thymidine originates within the global pharmaceutical industry, particularly major drug developers and generic manufacturers focused on anti-retroviral therapies (ARTs). These companies rely on bulk quantities of pharmaceutical-grade thymidine as a key chemical precursor for manufacturing essential medicines used in treating HIV/AIDS, such as zidovudine and stavudine. Given the chronic nature of HIV infection, the demand from this segment is consistent and inelastic, highly correlated with global treatment initiatives supported by organizations like the World Health Organization and national health agencies. Procurement decisions in this sector are driven less by marginal cost reductions and more significantly by stringent regulatory compliance, documented quality control (e.g., Drug Master File status), and guaranteed supply chain stability, prioritizing long-term relationships with reputable, certified thymidine manufacturers.

A rapidly expanding customer base is represented by specialized biotechnology companies and contract development and manufacturing organizations (CDMOs) involved in cutting-edge molecular diagnostics and advanced therapeutics. These entities utilize highly purified or modified thymidine derivatives (such as radiolabeled thymidine, 3H-thymidine, or thymidine derivatives for oligonucleotide synthesis) for applications including cell proliferation assays, oncology research markers, and the synthesis of custom nucleic acids required for gene therapy, mRNA therapeutics, and CRISPR-based applications. While the volume requirements from this segment are typically lower than those of bulk pharmaceutical manufacturing, the demand for ultra-high purity, custom specifications, and expedited delivery of specialized nucleosides commands a premium pricing structure, indicating a high-value customer profile focused on precision and innovation in molecular medicine.

Furthermore, academic and government research institutes worldwide constitute a substantial segment of potential customers, primarily consuming research-grade and diagnostic-grade thymidine. These institutions utilize the compound extensively in basic life science research, molecular biology studies, toxicology testing, and the development of novel diagnostic probes and experimental therapies. Their purchasing is often driven by grant cycles and institutional budget constraints, making cost-effectiveness an important factor, though purity and ready availability through established chemical suppliers (catalogue sales) are also critical. This segment acts as an incubator for future applications of thymidine, where early-stage research discoveries eventually transition into commercial therapeutic or diagnostic pipelines, underlining their crucial role in the overall innovation pipeline of the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $775 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sigma-Aldrich (Merck KGaA), TCI Chemicals, Alfa Aesar (Thermo Fisher Scientific), Cayman Chemical, Spectrum Chemical, Santa Cruz Biotechnology, MP Biomedicals, Apollo Scientific, LGC Standards, VWR International (Avantor), Alichem, Carbosynth, Clearsynth, Atom Scientific, AK Scientific, BOC Sciences, ChemScene, Combi-Blocks, Angene International, Key Organics. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thymidine Market Key Technology Landscape

The technological landscape of the Thymidine market is primarily defined by advancements in synthesis and purification methods crucial for achieving the extremely high purity required for pharmaceutical and molecular biological applications. Traditionally, chemical synthesis involving multiple complex steps and hazardous reagents dominated production. However, significant technological shifts are now favoring enzymatic or biocatalytic synthesis routes. Biocatalysis utilizes specific enzymes (e.g., thymidine phosphorylase) derived from microorganisms to catalyze the conversion of precursors (like thymine and deoxyribose-1-phosphate) into thymidine under milder conditions. This bio-based approach offers substantial advantages, including improved environmental sustainability, higher regioselectivity leading to fewer by-products, and potentially higher yields, which directly translate into reduced purification costs and enhanced process scalability, making it a critical area of R&D investment for leading manufacturers seeking cost-competitive advantages.

Following the synthesis, the core technological hurdle remains the large-scale purification of thymidine to pharmaceutical standards, particularly removing trace nucleoside contaminants which can interfere with downstream therapeutic efficacy or research integrity. High-Performance Liquid Chromatography (HPLC) remains the gold standard, but newer, more efficient separation techniques are gaining traction. Technologies such as Simulated Moving Bed (SMB) chromatography and specialized crystallization techniques are being optimized for continuous operation, reducing solvent consumption, and significantly improving the efficiency of separating the final high-purity product from reaction mixtures. Furthermore, analytical technologies, including advanced Nuclear Magnetic Resonance (NMR) spectroscopy and high-resolution Mass Spectrometry (HRMS), are indispensable for rigorous quality assurance (QA) and quality control (QC), ensuring every batch meets the predefined criteria stipulated by pharmacopeial standards such as USP and EP.

The integration of advanced process control systems and digitalization is another defining feature of the current technology landscape. Manufacturers are increasingly implementing Process Analytical Technology (PAT) tools, which allow for real-time monitoring of critical process parameters (CPPs) during synthesis and purification. PAT deployment, enabled by sensor technology and sophisticated data analytics, ensures immediate detection and correction of process deviations, guaranteeing consistent product quality and reducing the need for extensive end-product testing. This focus on intelligent manufacturing and automation not only minimizes human error but also aligns the thymidine production process with Industry 4.0 principles, thereby ensuring maximal operational efficiency and robust compliance with Good Manufacturing Practices (GMP), securing the market position for technologically advanced producers.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Thymidine market, reflecting differences in R&D investment, pharmaceutical manufacturing capacity, and regulatory environments. North America and Europe currently represent the largest revenue-generating regions, primarily due to the established presence of global pharmaceutical and biotechnology giants, coupled with substantial government and private funding directed toward advanced genomics, oncology, and infectious disease research. These regions are characterized by a high demand for ultra-pure, research-grade thymidine and a robust regulatory framework that favors manufacturers with certified quality systems, leading to higher average selling prices. The consumption pattern here is highly sophisticated, driven by innovation in personalized medicine and ongoing clinical trials utilizing nucleoside analogs.

Conversely, the Asia Pacific (APAC) region is projected to register the fastest growth rate throughout the forecast period. This rapid expansion is fueled by several factors, including the migration of pharmaceutical and active pharmaceutical ingredient (API) manufacturing bases to countries like China and India, attracted by lower operational costs, supportive governmental policies encouraging domestic production, and a rapidly expanding pool of skilled chemical synthesis professionals. Furthermore, increasing access to ARTs and rising healthcare expenditure in populous nations are boosting the internal demand for thymidine derivatives. Latin America, the Middle East, and Africa (MEA) represent emerging markets where demand is largely correlated with efforts to combat chronic infectious diseases, particularly HIV/AIDS, with market growth heavily influenced by international aid programs and regional government procurement policies.

- North America (U.S. and Canada): Dominant in high-value R&D segments, strong regulatory framework, primary consumer of research-grade and proprietary pharmaceutical precursors. High adoption of advanced diagnostic kits based on nucleoside tracers.

- Europe (Germany, UK, France): Major center for established pharmaceutical manufacturing and academic biological research; focus on stringent purity standards and implementation of advanced enzymatic synthesis technologies for sustainability.

- Asia Pacific (China, India, Japan): Fastest-growing market due to rapid expansion of API manufacturing capacity, favorable cost structures, and increasing domestic demand for anti-retroviral drugs and associated diagnostic tools.

- Latin America (Brazil, Mexico): Market growth driven by public health initiatives aimed at expanding access to essential medicines and increasing regional drug production capabilities, often relying on imported high-purity raw materials.

- Middle East and Africa (MEA): Demand heavily sustained by international organizations funding HIV treatment programs; focus on securing stable supply chains for essential nucleoside derivatives critical for local health stability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thymidine Market.- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals

- Alfa Aesar (Thermo Fisher Scientific)

- Cayman Chemical

- Spectrum Chemical

- Santa Cruz Biotechnology

- MP Biomedicals

- Apollo Scientific

- LGC Standards

- VWR International (Avantor)

- Alichem

- Carbosynth

- Clearsynth

- Atom Scientific

- AK Scientific

- BOC Sciences

- ChemScene

- Combi-Blocks

- Angene International

- Key Organics

Frequently Asked Questions

Analyze common user questions about the Thymidine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of thymidine in the pharmaceutical industry?

Thymidine is primarily utilized as a crucial chemical intermediate for synthesizing nucleoside analog reverse transcriptase inhibitors (NRTIs), such as Azidothymidine (AZT) and Stavudine (D4T), which form the backbone of modern anti-retroviral therapies (ART) for treating HIV/AIDS.

Which manufacturing technology is gaining prominence for producing high-purity thymidine?

Enzymatic synthesis, or biocatalysis, is increasingly favored over traditional chemical synthesis methods due to its ability to produce high-ppurity thymidine with greater selectivity, lower environmental impact, and often higher yields, aligning with stringent pharmaceutical quality requirements.

How do purity standards affect the pricing and end-use of thymidine?

Purity is a critical determinant; pharmaceutical-grade thymidine (typically above 99.5%) commands premium pricing due to the rigorous purification and regulatory compliance (GMP) required for drug manufacturing, while lower-purity grades are typically used for routine academic research.

Which geographical region exhibits the highest growth potential for the thymidine market?

The Asia Pacific (APAC) region is expected to register the fastest market growth, driven by substantial investment in API manufacturing, favorable governmental support for biotechnology, and expanding access to anti-retroviral treatments in countries like China and India.

What is the role of thymidine in molecular biology research beyond drug synthesis?

In research, thymidine, often in radiolabeled form (3H-thymidine), is essential as a tracer or marker to measure cellular proliferation rates, aiding in studies related to cancer biology, cell cycle regulation, and DNA damage and repair mechanisms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thymidine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Thymidine Market Size Report By Type (Chemical Synthesis Method, Fermentation Method), By Application (Zidovudine, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Thymidine Market Statistics 2025 Analysis By Application (Zidovudine), By Type (Chemical Synthesis Method, Fermentation Method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager