Thymidine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434126 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Thymidine Market Size

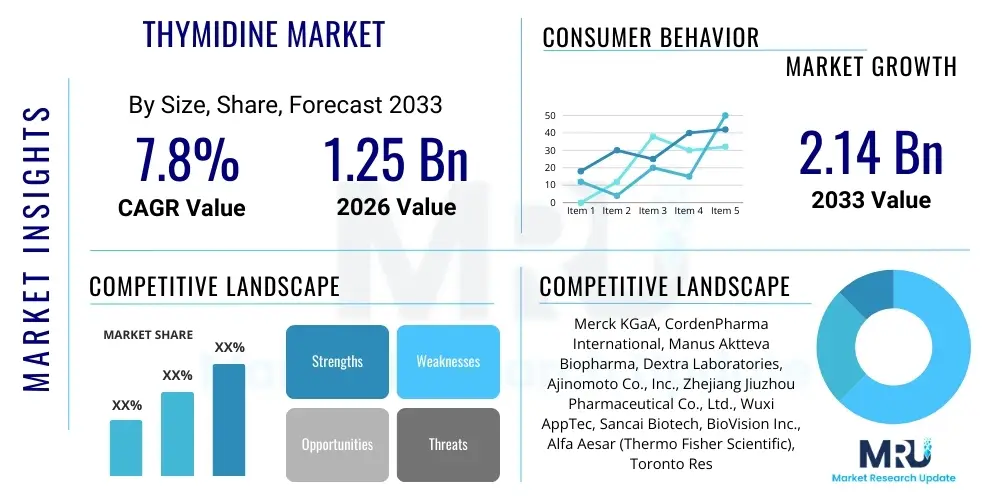

The Thymidine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $2.14 Billion by the end of the forecast period in 2033.

Thymidine Market introduction

Thymidine is a deoxyribonucleoside involved fundamentally in DNA structure and synthesis, playing a pivotal role in cellular reproduction and genetic stability. Its primary commercial form is utilized as a crucial intermediate in the synthesis of several potent antiviral drugs, particularly nucleoside analog reverse transcriptase inhibitors (NRTIs) used extensively in the treatment of Human Immunodeficiency Virus (HIV) and Hepatitis B Virus (HBV). Furthermore, labeled thymidine derivatives, such as [3H]-thymidine, are essential tools in biological research for measuring cell proliferation rates, particularly in oncology and immunology studies, providing valuable insights into the efficacy of potential therapeutic agents and understanding disease progression at a molecular level.

The core applications of thymidine span across pharmaceuticals, clinical diagnostics, and academic research. In the pharmaceutical sector, demand is predominantly driven by the continuous need for high-purity nucleoside analogs (like AZT, d4T, and stavudine) that rely on thymidine as a precursor molecule. The ongoing global incidence of chronic viral diseases, coupled with advancements in targeted cancer therapies that sometimes utilize nucleoside analogues, significantly fuels market growth. The benefits of thymidine derived compounds include high specificity in viral replication inhibition and established treatment protocols, driving sustained demand from major drug manufacturers. Market expansion is actively supported by technological improvements in synthesis and purification, particularly enzymatic methods which offer higher yield and greater stereoselectivity compared to traditional chemical synthesis routes.

Thymidine Market Executive Summary

The Thymidine Market is defined by robust demand from the pharmaceutical industry, driven primarily by the sustained global requirement for anti-retroviral and anti-hepatitis medications. Key business trends include the outsourcing of high-volume manufacturing to specialized Contract Manufacturing Organizations (CMOs) in Asia Pacific, aiming to leverage cost efficiencies and scale production. Additionally, there is a distinct shift toward advanced enzymatic synthesis technologies, which enhance purity, reduce environmental impact, and lower production costs over the long term, thereby stabilizing supply chains for critical pharmaceutical intermediates. Intellectual property surrounding synthesis methods and novel applications of thymidine derivatives in personalized medicine are also shaping the competitive landscape.

Regionally, North America and Europe maintain dominance in terms of research and development expenditure and high-value consumption, particularly within advanced diagnostics and clinical trials for oncology. However, the Asia Pacific region, led by China and India, is rapidly growing in importance, not only as a primary manufacturing and supply hub but also due to expanding patient populations and improving healthcare infrastructure demanding increased accessibility to antiviral treatments. Segment trends highlight that the therapeutic application segment, particularly for the production of antiviral Active Pharmaceutical Ingredients (APIs), remains the largest revenue contributor, though the research segment, focusing on radiolabeled thymidine for cell proliferation assays, is poised for significant growth supported by global academic and biotech funding.

AI Impact Analysis on Thymidine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Thymidine market primarily center on how AI can accelerate the discovery of novel nucleoside analogs, optimize complex chemical synthesis routes, and enhance the efficiency of clinical trials that rely on thymidine-based markers. Users are keenly interested in predictive modeling for enzyme pathway optimization, which could drastically improve the yield and purity of synthetically produced thymidine, thereby reducing manufacturing costs. Furthermore, AI is expected to revolutionize drug repurposing efforts by analyzing large genomic and pharmacological datasets to identify new therapeutic uses for existing thymidine derivatives beyond current antiviral applications, potentially expanding the market into niche oncology or neurological disorder treatments. Concerns often revolve around the data privacy implications of utilizing vast biological datasets and the initial high investment required for integrating sophisticated AI platforms into traditional chemical manufacturing processes.

- AI accelerates the identification and validation of novel thymidine-derived drug candidates, significantly shortening the preclinical development timeline.

- Machine learning algorithms optimize enzymatic synthesis processes, predicting ideal reaction conditions (temperature, pH, catalyst concentration) for maximum yield and purity.

- AI-driven analysis of patient biomarkers and genomic data enhances the precision of clinical trials utilizing thymidine analogs, improving patient stratification and treatment efficacy assessment.

- Predictive modeling assists in optimizing supply chain logistics and inventory management for critical intermediates like thymidine, reducing waste and ensuring reliable supply.

- AI facilitates high-throughput screening of compounds, enabling faster discovery of synergistic effects between thymidine derivatives and other therapeutic agents.

DRO & Impact Forces Of Thymidine Market

The Thymidine Market is profoundly influenced by a complex interplay of drivers stemming from healthcare needs and technological advancements, counterbalanced by regulatory and economic restraints, while vast opportunities arise from emerging applications and geographic expansion. The primary driver is the pervasive use of thymidine as a precursor for essential antiviral drugs, particularly for chronic diseases like HIV/AIDS and Hepatitis B. Global health initiatives aimed at disease eradication and increased access to generic antiviral medications in developing economies create a stable and high-volume demand foundation. Furthermore, advancements in oncology research, which frequently utilize nucleoside analogues for chemotherapy and diagnostics, contribute significantly to market buoyancy. The shift towards biotechnological production methods, such as fermentation and enzymatic synthesis, offering higher yields and lower environmental impact compared to older chemical methods, further drives efficiency and market penetration.

Conversely, the market faces significant restraints. The complexity and high cost associated with ensuring pharmaceutical-grade purity (API status) for thymidine derivatives, required by stringent regulatory bodies like the FDA and EMA, act as a barrier to entry for smaller manufacturers. Fluctuations in the price and availability of key raw materials, often linked to agricultural products or specialized chemical precursors, introduce supply chain volatility. Additionally, the increasing trend towards patent expiration for blockbuster nucleoside analog drugs, while benefiting generic manufacturers, can compress profit margins for the upstream thymidine suppliers focused solely on the patented APIs, demanding continuous innovation in process optimization to maintain competitiveness. Regulatory hurdles in approving new manufacturing sites and synthetic processes also prolong market introduction timelines.

Opportunities for market expansion are centered on the burgeoning field of personalized medicine and diagnostics. The application of radiolabeled thymidine analogues in Positron Emission Tomography (PET) imaging for cancer detection and monitoring cell proliferation offers a high-value niche market with substantial growth potential as diagnostic technologies improve. Geographically, expansion into rapidly developing pharmaceutical markets in Southeast Asia and Latin America provides opportunities for increased sales volume, leveraging local manufacturing partnerships. The ongoing research into next-generation antiviral and anti-cancer therapies that utilize modified nucleosides ensures a pipeline of future demand. The key impact forces driving the market trajectory include technological adoption (e.g., enzymatic synthesis), regulatory pressure for cGMP compliance, and global public health policies affecting antiviral drug procurement.

Segmentation Analysis

The Thymidine market is meticulously segmented based on product type, application, and end-user, reflecting the diverse utilization profile of this essential nucleoside. The segmentation by product type typically differentiates between Thymidine Active Pharmaceutical Ingredients (APIs) and Thymidine Intermediates. APIs represent the final, high-purity form used directly in drug formulation, commanding premium pricing and stringent regulatory oversight. Intermediates are the precursor molecules used in synthesis and purification steps, generally characterized by high volume trade and competitive pricing. The growth in the intermediates segment is highly correlated with the overall production volume of generic antiviral medications globally.

Application-wise, the market is partitioned into Therapeutics (dominant segment), Diagnostics, and Research. Therapeutics encompasses the massive demand generated by the manufacture of NRTIs (e.g., Zidovudine, Lamivudine) crucial for HIV/AIDS treatment and related antiviral protocols. The Diagnostics segment includes the use of labeled thymidine for PET imaging tracers and clinical assays measuring cellular proliferation, crucial for cancer staging and monitoring immunotherapy effectiveness. The Research segment serves academic and biotech laboratories requiring high-purity thymidine for cell culture media, genomic studies, and basic biochemical research. The sustained investment in oncology research globally ensures consistent growth in the Diagnostics and Research applications.

- By Product Type:

- Thymidine API (Active Pharmaceutical Ingredient)

- Thymidine Intermediate/Excipient Grade

- By Application:

- Therapeutics (Antiviral, Oncology)

- Diagnostics (PET Imaging, Cell Proliferation Assays)

- Research & Development (Genomic Studies, Media Components)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Contract Manufacturing Organizations (CMOs)

- Academic and Research Institutes

- Clinical Laboratories and Hospitals

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Thymidine Market

The Thymidine market value chain commences with the upstream synthesis of fundamental raw materials, primarily comprising nucleobases and specialized sugars, which are often produced through complex chemical or fermentation processes. Initial raw material sourcing requires specialized chemical suppliers who meet strict quality standards, as the purity of these starting materials directly impacts the yield and quality of the final thymidine product. Key steps in the upstream segment involve the synthesis of deoxyribose and thymine base components, which are subsequently condensed to form thymidine. Efficiency at this stage is crucial for cost control, driving many manufacturers to vertically integrate or form long-term supply agreements with specialized chemical synthesis companies to mitigate price volatility and ensure material security.

The core manufacturing stage involves the conversion of raw materials into high-purity thymidine, utilizing either traditional chemical synthesis or increasingly, advanced bioprocesses like enzymatic synthesis or microbial fermentation. This midstream segment is dominated by specialized pharmaceutical chemical manufacturers and large CMOs capable of operating under strict Current Good Manufacturing Practice (cGMP) guidelines required for API production. Stringent purification techniques, such as High-Performance Liquid Chromatography (HPLC) and multi-step crystallization, are employed to achieve the requisite pharmaceutical grade purity (typically >99%). Quality control checkpoints are rigorous and critical throughout this phase to ensure the thymidine meets pharmacopeial standards before moving downstream.

The downstream distribution channel involves the supply of the final thymidine product (API or intermediate) to various end-users. Direct distribution is common for large-volume transactions between the manufacturer and major pharmaceutical companies producing high-volume antiviral drugs. Indirect channels involve specialized distributors or brokers who handle smaller orders, cater to academic institutions, and manage the complexity of international logistics, customs, and regulatory documentation. The final consumers, which include major drug formulation companies, clinical research organizations (CROs), and university research departments, integrate thymidine into their final products or research assays. The efficiency of the distribution network, particularly the cold chain management for sensitive pharmaceutical ingredients, is essential in maintaining product integrity and ensuring timely delivery to global production sites.

Thymidine Market Potential Customers

The primary purchasers and end-users of high-purity Thymidine are pharmaceutical and biotechnology companies specializing in the development and manufacture of antiviral, anticancer, and anti-inflammatory drugs. These large enterprises, including generics manufacturers and innovator companies, require vast quantities of thymidine as the foundational intermediate for producing crucial nucleoside analog therapies (NRTIs). Their purchasing decisions are heavily influenced by supplier capacity, consistency of quality control adherence to cGMP, and competitive pricing for bulk orders, often leading to long-term contractual relationships with a limited number of specialized API suppliers.

A second significant customer base comprises Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs). CMOs utilize thymidine to fulfill large-scale manufacturing contracts on behalf of pharmaceutical clients, acting as a crucial intermediary in the value chain, particularly benefiting from the trend of pharmaceutical outsourcing. CROs, on the other hand, require small to moderate quantities of specialized or labeled thymidine derivatives for use in preclinical toxicology studies, drug efficacy testing, and cellular proliferation assays within their research projects. Their demand is driven by the volume of clinical trials and research projects they manage globally.

Finally, academic institutions, government research laboratories, and clinical diagnostic centers constitute a steady, albeit smaller volume, customer segment. These entities utilize thymidine, often in its radiolabeled form or as a component in specialized cell culture media, for fundamental biological research, genomic studies, and highly specialized clinical diagnostics like PET imaging tracer preparation. While their volume requirements are lower, their demand for extremely high purity and specialized forms of thymidine is paramount, necessitating suppliers capable of producing research-grade materials with comprehensive documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $2.14 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, CordenPharma International, Manus Aktteva Biopharma, Dextra Laboratories, Ajinomoto Co., Inc., Zhejiang Jiuzhou Pharmaceutical Co., Ltd., Wuxi AppTec, Sancai Biotech, BioVision Inc., Alfa Aesar (Thermo Fisher Scientific), Toronto Research Chemicals, TCI Chemicals, Cayman Chemical, A.M.B. S.p.A., Evonik Industries AG, Lonza Group, BASF SE, Watson Pharmaceuticals, Inc., Gland Pharma Limited, Roche Holding AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Thymidine Market Key Technology Landscape

The manufacturing of high-purity thymidine is underpinned by several critical technologies, primarily revolving around synthesis and purification optimization. Historically, traditional chemical synthesis involving multi-step organic reactions was the standard. However, this method often yields racemic mixtures or impurities that require extensive, costly purification steps. The modern landscape is increasingly dominated by advancements in biocatalysis. Enzymatic synthesis, leveraging specific enzymes like nucleoside phosphorylases, offers a highly selective and efficient route to thymidine production. This technique is preferred due to its ability to generate high stereopurity, operate under milder environmental conditions (lower temperatures and pressures), and significantly reduce the formation of unwanted byproducts, aligning with green chemistry principles and lowering overall production costs at scale.

Fermentation technology also plays a crucial role, particularly utilizing genetically engineered microorganisms (e.g., specific strains of Escherichia coli or yeasts) to biosynthesize thymidine and its precursors. Optimization of fermentation parameters, including media composition, dissolved oxygen levels, and strain selection, is critical to maximize titer and yield, making it a highly scalable option for bulk intermediate production. This approach benefits from utilizing renewable resources and can be exceptionally cost-effective in high-volume settings, particularly in Asian manufacturing hubs. Continuous innovation in metabolic engineering further promises to enhance the efficiency and sustainability of these biological routes, gradually displacing less efficient chemical processes.

The purification and analytical technologies deployed are paramount for ensuring the required pharmaceutical-grade quality. High-Performance Liquid Chromatography (HPLC) is the industry standard for both quality control and large-scale preparative purification, ensuring impurities are below regulatory thresholds. Crystallization techniques, often multi-stage and precisely controlled, are used to isolate the final product in highly pure, stable crystalline forms suitable for API manufacturing. Additionally, sophisticated analytical instrumentation, including Mass Spectrometry (MS) and Nuclear Magnetic Resonance (NMR) spectroscopy, is essential for confirming the chemical structure and confirming the absence of residual solvents or unwanted nucleoside contaminants, thereby assuring compliance with stringent international pharmacopeial guidelines and maintaining the integrity of the global pharmaceutical supply chain.

Regional Highlights

- North America: North America, led by the United States, represents the largest value market segment for thymidine, primarily due to immense R&D expenditure, particularly in oncology and infectious disease research. The presence of major pharmaceutical innovators and a robust biotech ecosystem drives high demand for specialized, high-purity thymidine derivatives and labeled compounds used in advanced diagnostics (like PET tracers) and early-stage drug discovery. Strict regulatory frameworks imposed by the FDA ensure premium pricing for APIs, while substantial government and private funding for HIV/AIDS treatment and prevention programs maintain a steady baseline demand for associated antiviral precursors. The region excels in consuming high-value, research-grade materials.

- Europe: The European market demonstrates significant consumption, supported by strong public healthcare systems and the centralized regulatory oversight of the European Medicines Agency (EMA), ensuring high-quality standards. Western Europe, notably Germany, Switzerland, and the UK, serves as a major hub for pharmaceutical manufacturing and academic research, driving demand for both bulk APIs and research reagents. The increasing prevalence of generic drug manufacturing within Eastern Europe, capitalizing on expiring patents for antiviral drugs, contributes to the demand for cost-effective thymidine intermediates. European markets are characterized by a balance between innovation (specialty pharma) and volume production (generics).

- Asia Pacific (APAC): APAC is the fastest-growing region, characterized by its dual role as a high-volume manufacturing center and a rapidly emerging consumer market. Countries like China and India dominate the production of thymidine intermediates and APIs, leveraging lower operational costs and increasing manufacturing capabilities. This region is critical for the global supply chain, serving as a key source for generic drug producers worldwide. Simultaneously, improving healthcare infrastructure and growing awareness regarding infectious diseases are rapidly expanding the domestic consumption market for antiviral drugs, particularly driven by large patient populations in countries such as India and Southeast Asian nations, positioning APAC as the engine of future volume growth.

- Latin America (LATAM): The LATAM region presents significant growth potential, driven by expanding government procurement programs focused on infectious disease management, especially HIV/AIDS treatment, reflecting successful health interventions and increased access to essential medications. While manufacturing capabilities are relatively nascent compared to APAC, reliance on imports for high-purity APIs and intermediates is strong. Brazil and Mexico are the largest consumers within the region, where improvements in healthcare budgets and economic stability directly translate into higher demand for pharmaceutical precursors like thymidine.

- Middle East & Africa (MEA): The MEA market is highly heterogeneous. The Middle East, particularly the Gulf Cooperation Council (GCC) countries, exhibits demand focused on specialized, high-end therapeutics and diagnostics, often importing finished products or high-purity APIs due to significant healthcare investment. The African continent, however, represents a large volume market for generic antiviral drugs, largely supported by international aid programs and public health initiatives (like the PEPFAR program). Demand here is driven almost entirely by the large-scale requirement for cost-effective nucleoside analogs for HIV treatment, making efficient, low-cost thymidine supply critical for regional public health efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Thymidine Market.- Merck KGaA

- CordenPharma International

- Manus Aktteva Biopharma

- Dextra Laboratories

- Ajinomoto Co., Inc.

- Zhejiang Jiuzhou Pharmaceutical Co., Ltd.

- Wuxi AppTec

- Sancai Biotech

- BioVision Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Toronto Research Chemicals

- TCI Chemicals

- Cayman Chemical

- A.M.B. S.p.A.

- Evonik Industries AG

- Lonza Group

- BASF SE

- Watson Pharmaceuticals, Inc.

- Gland Pharma Limited

- Roche Holding AG

Frequently Asked Questions

Analyze common user questions about the Thymidine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Thymidine in the global market?

The primary factor driving global demand for thymidine is its indispensable role as a fundamental precursor (intermediate) in the large-scale synthesis of nucleoside analog reverse transcriptase inhibitors (NRTIs), which are the backbone of current therapeutic regimens for chronic viral infections, particularly Human Immunodeficiency Virus (HIV) and Hepatitis B Virus (HBV). Sustained global efforts to control and treat these infectious diseases necessitate continuous, high-volume production of these antiviral APIs, ensuring consistent market traction for high-purity thymidine.

How are technological advancements in synthesis affecting the cost and quality of Thymidine production?

Technological advancements, specifically the adoption of enzymatic synthesis and improved fermentation processes, are significantly impacting thymidine production. These biotechnological methods offer enhanced stereo- and regioselectivity compared to traditional chemical synthesis, resulting in higher product purity (critical for API grade) and increased yield. This shift minimizes the need for extensive, high-cost purification steps like preparative chromatography, thereby reducing overall manufacturing costs, improving resource efficiency, and minimizing environmental waste, ultimately benefiting both generic and innovator drug manufacturers.

Which application segment holds the largest share in the Thymidine Market and why?

The Therapeutics application segment holds the largest market share. This dominance is attributable to the massive, consistent requirement for thymidine in producing essential antiviral drugs (NRTIs), which are administered to millions of patients globally in long-term treatment protocols. While diagnostic and research applications represent high-value niche areas, the sheer volume and global public health necessity associated with manufacturing HIV and HBV medications ensure the therapeutic segment remains the largest volume and revenue contributor to the overall thymidine market.

What is the competitive landscape like for Thymidine manufacturers, and where is production centralized?

The competitive landscape is moderately fragmented, featuring large, multinational chemical and life science companies alongside specialized API and intermediate manufacturers, predominantly based in the Asia Pacific (APAC) region. Production is highly centralized in countries such as China and India, which offer the necessary infrastructure, specialized chemical expertise, and cost advantages for high-volume synthesis, particularly leveraging advanced fermentation and enzymatic methods. Competition centers on production efficiency, adherence to strict cGMP standards, and secure supply chain management to serve major global pharmaceutical clients.

Beyond antivirals, what emerging opportunities exist for Thymidine derivatives?

Emerging opportunities for thymidine derivatives are concentrated in oncology and advanced diagnostics. In oncology, modified thymidine nucleosides are being investigated as potent antimetabolite chemotherapy agents and in targeted therapies. Furthermore, the use of radiolabeled thymidine analogues, such as 18F-FLT (Fluorothymidine), is a rapidly growing diagnostic area. These tracers are critical for Positron Emission Tomography (PET) imaging, providing non-invasive, quantifiable measurements of cellular proliferation in tumors, aiding in precise cancer staging, prognosis assessment, and real-time monitoring of therapeutic efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Thymidine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Thymidine Market Size Report By Type (Chemical Synthesis Method, Fermentation Method), By Application (Zidovudine, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Thymidine Market Statistics 2025 Analysis By Application (Zidovudine), By Type (Chemical Synthesis Method, Fermentation Method), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager