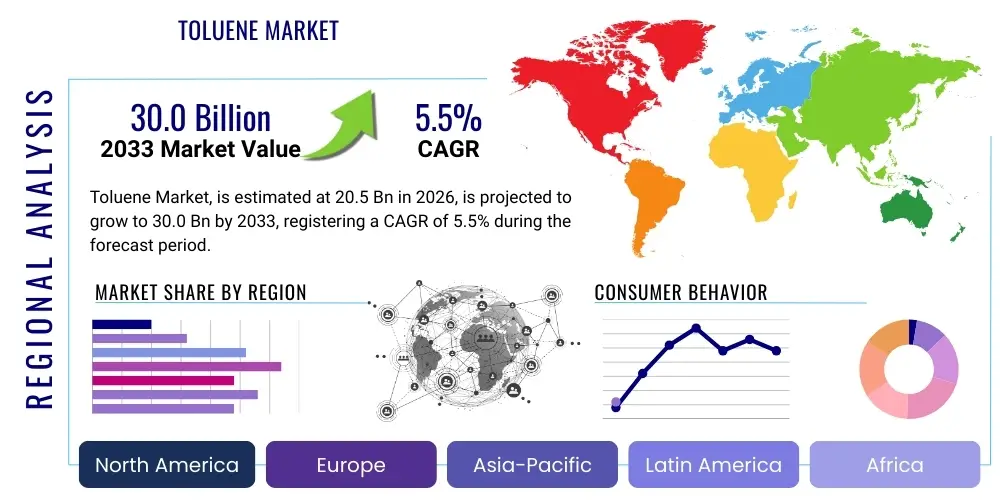

Toluene Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441615 | Date : Feb, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Toluene Market Size

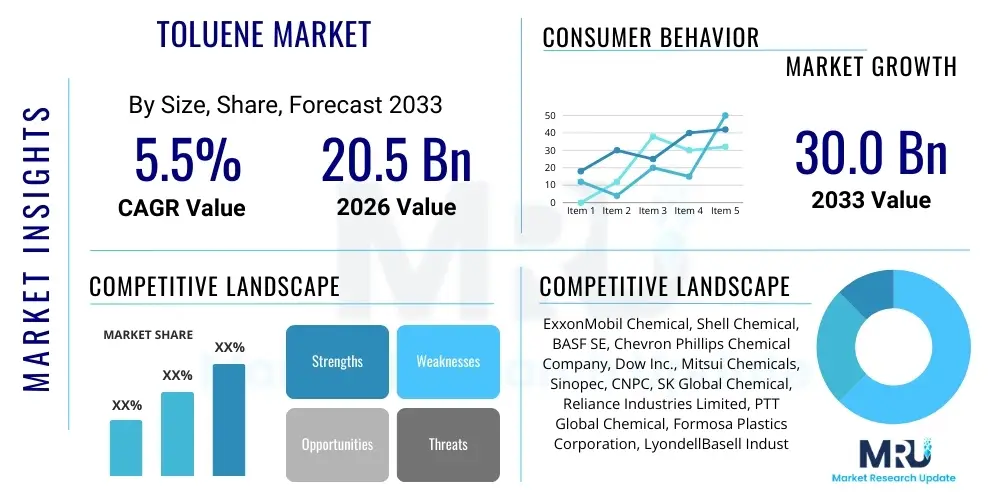

The Toluene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $20.5 Billion USD in 2026 and is projected to reach $30.0 Billion USD by the end of the forecast period in 2033.

Toluene Market introduction

Toluene, chemically known as methylbenzene (C6H5CH3), is a colorless, water-insoluble liquid with a characteristic aromatic odor. It is a critical petrochemical feedstock derived primarily from crude oil refining and, to a lesser extent, as a byproduct of coke oven operations. Its high solvency power, relatively low cost, and versatile chemical structure make it indispensable across various industrial applications. Toluene serves as a fundamental building block in the synthesis of high-value chemicals such as benzene, xylene, and toluene diisocyanate (TDI), which are vital for manufacturing plastics, polyurethane foams, and various protective coatings.

The primary benefits of Toluene lie in its efficiency as a solvent, particularly in paint thinners, adhesives, printing inks, and lacquers, providing rapid drying times and excellent solubility for resins and polymers. Moreover, its high octane rating makes it a crucial blending component in gasoline production, optimizing fuel efficiency and reducing engine knocking. Major applications encompass the production of precursors for polyurethane manufacturing (TDI being the most significant derivative), use as a powerful industrial solvent, and its role as a key intermediate in producing benzoic acid, benzaldehyde, and specialized explosives like Trinitrotoluene (TNT). The market is heavily driven by the robust expansion of the construction and automotive sectors, especially in emerging economies, which fuels demand for TDI-based foams and high-performance coatings.

Toluene Market Executive Summary

The Toluene Market demonstrates resilience driven by escalating demand for aromatic solvents and the pervasive growth of the polyurethane industry. Business trends indicate a strategic shift toward bio-based or renewable toluene production methods, although conventional sources derived from petrochemical operations still dominate market share. Geographically, the Asia Pacific region maintains the highest growth trajectory, largely attributable to massive infrastructure projects, burgeoning automotive production, and expanding manufacturing bases in countries like China and India, making it the epicenter for both consumption and production capacity expansion. North America and Europe, while mature, focus heavily on regulatory compliance regarding volatile organic compounds (VOCs) and solvent usage, prompting innovation in low-VOC formulations that still rely on specialized toluene derivatives.

Segment-wise, the application of Toluene in the production of Toluene Diisocyanate (TDI) represents the largest and fastest-growing segment, closely followed by its use as a raw material for Benzene and Xylenes (BTX production). The price volatility of crude oil remains a significant determinant of market stability, directly influencing production costs and end-product pricing for downstream industries. Additionally, stringent environmental regulations in developed nations concerning the handling and emission of aromatic hydrocarbons are encouraging manufacturers to invest in advanced catalytic processes and emission control technologies, thereby optimizing existing refining capacities and ensuring sustainable operations within the competitive landscape.

AI Impact Analysis on Toluene Market

Common user questions regarding AI's impact on the Toluene market often revolve around optimizing complex petrochemical processes, predicting fluctuating crude oil prices, and enhancing supply chain resilience. Users are keen to understand how AI-driven predictive maintenance can reduce costly plant downtime and how machine learning algorithms can refine catalyst selectivity and yield in toluene synthesis pathways. Furthermore, there is significant interest in AI's role in interpreting increasingly complex environmental monitoring data and ensuring real-time regulatory compliance across global operations, thereby minimizing risks associated with emissions and accidental releases in handling this volatile organic compound. The core theme is leveraging AI for efficiency, predictive reliability, and sophisticated risk management.

AI and machine learning are rapidly being integrated into Toluene production facilities to enhance operational efficiencies and throughput. By employing AI algorithms to analyze vast datasets relating to temperature, pressure, feed composition, and catalyst performance in reformers and crackers, producers can achieve tighter process control and significantly reduce energy consumption per unit of output. This technological integration is crucial for maximizing yield from existing assets, which is particularly vital as global competition intensifies and raw material price volatility persists. The adoption of smart sensors and IoT infrastructure, analyzed by AI models, also ensures proactive identification of equipment degradation, moving the industry from reactive maintenance schedules to highly efficient, condition-based maintenance strategies, directly impacting the Toluene production economy by increasing reliability.

- AI optimizes catalytic reforming processes, enhancing the yield of Toluene and BTX aromatics.

- Predictive maintenance using machine learning minimizes operational downtime in distillation and cracking units.

- AI algorithms forecast crude oil price trends, enabling better hedging and raw material procurement strategies.

- Supply chain AI models optimize logistics for Toluene distribution, reducing transportation costs and lead times.

- Digital twins of petrochemical plants allow for simulation of new processes or operational adjustments without physical risk, accelerating R&D.

- Advanced analytics monitors VOC emissions in real-time, ensuring stringent environmental compliance and operational safety.

DRO & Impact Forces Of Toluene Market

The Toluene market is fundamentally influenced by a complex interplay of Drivers, Restraints, and Opportunities. The primary driver remains the burgeoning demand for Toluene Diisocyanate (TDI) used in the highly expanding flexible polyurethane foam sector, critical for automotive seating, furniture, and bedding. Simultaneously, significant restraints exist, notably the increasing environmental scrutiny and stringent regulations concerning VOC emissions associated with solvent usage, pushing end-users toward alternative, less volatile chemical compounds. Opportunities are rooted in the advancement of sustainable production methods, such as bio-based Toluene derived from biomass, offering a pathway to reduce reliance on petrochemical feedstocks and meet growing sustainability mandates. These factors collectively create a dynamic competitive environment where technological innovation and regulatory compliance determine market success and sustainability.

Key impact forces shape the market trajectory. Firstly, the volatility in crude oil prices directly impacts the cost structure of Toluene, forcing manufacturers to adopt agile pricing and procurement strategies. Secondly, legislative pressure, particularly the European Union's REACH regulations and similar initiatives in North America and Asia, mandates stricter control over the use and handling of aromatic hydrocarbons, compelling investment in process safety and emission control. Thirdly, technological advancements in fractionation and separation technologies enhance purity and yield, providing a competitive edge to producers with modern facilities. Finally, the macroeconomic factors, specifically the health of the global construction and automotive sectors, exert a massive influence on end-user demand for coatings, adhesives, and TDI products, amplifying or dampening market growth depending on regional economic stability.

The market also faces inherent challenges related to the toxicity and flammability of Toluene, which necessitate high capital expenditure for safety infrastructure and specialized transportation logistics. However, this is partially offset by the continuous exploration of new applications, particularly in emerging markets where rapid urbanization demands high-performance construction materials and cost-effective solvent solutions. Strategic investments in capacity expansion in Asia Pacific, coupled with R&D focused on converting low-value refinery streams into high-purity Toluene, are crucial drivers for future growth and mitigating dependency on single-source methodologies.

- Drivers:

- High demand for Toluene Diisocyanate (TDI) from the expanding polyurethane and foam industries (automotive and construction).

- Toluene's efficacy as an octane booster in gasoline blending, driven by global fuel quality standards.

- Rapid industrialization and infrastructural development in Asia Pacific economies fueling demand for coatings and adhesives.

- Restraints:

- Volatile raw material prices linked directly to fluctuating crude oil and naphtha markets.

- Stringent governmental regulations concerning VOC emissions and occupational exposure limits for Toluene.

- Availability and competitive substitution by alternative solvents (e.g., bio-solvents, exempt compounds) in certain applications.

- Opportunities:

- Development and commercialization of bio-based Toluene derived from sustainable feedstocks.

- Growing market penetration in niche applications like specialized pharmaceuticals and agrochemical synthesis.

- Increasing integration of Toluene production with larger petrochemical complexes for enhanced synergy and cost reduction.

- Impact Forces:

- Crude Oil Price Volatility (High Impact)

- Environmental Regulatory Shifts (High Impact)

- Automotive and Construction Industry Output (Medium to High Impact)

- Technological Advancements in Catalyst Efficiency (Medium Impact)

Segmentation Analysis

The Toluene Market segmentation provides a granular view of demand dynamics across different types, applications, and end-user industries, reflecting the multifaceted role Toluene plays in the chemical ecosystem. Segmentation by source distinguishes between Toluene derived conventionally from petroleum refining (e.g., catalytic reforming and pyrolisis gasoline fractionation), which dominates supply, and less common sources such as coke oven gas and the emerging segment of bio-Toluene. This distinction is vital for understanding supply chain risks and environmental footprint variations across the market.

The application segmentation is critical for market assessment, as it highlights Toluene's primary consumption streams. The production of Toluene Diisocyanate (TDI), Benzene and Xylenes (BTX), and its usage as a Solvent are the three pillars of demand. TDI production dictates high-purity requirements and links the Toluene market directly to the buoyancy of the polyurethane sector, while BTX conversion connects it to the wider aromatics value chain, feeding into plastics and fibers. Understanding the shifting proportion across these applications is key to forecasting future capacity requirements.

Furthermore, segmentation by end-user industry reveals the ultimate drivers of consumption. The Chemical & Petrochemical sector holds the largest share, reflecting its use as an intermediate. However, the fastest growth is often recorded in the Construction, Automotive, and Paints & Coatings sectors, where demand for high-performance materials and specialized solvents is intrinsically tied to global economic cycles and infrastructural spending. Analyzing these segments provides strategic insights into targeting efforts and anticipating areas of robust expansion or regulatory constraint.

- By Source:

- Toluene from Petroleum

- Toluene from Coke Oven Gas

- Bio-Toluene

- By Application:

- Toluene Diisocyanate (TDI) Production

- Benzene and Xylenes Production (BTX)

- Solvents (Paints, Coatings, Inks, Adhesives)

- Gasoline Additives (Octane Enhancement)

- Other Derivatives (Benzoic Acid, Benzyl Chloride, TNT)

- By End-User Industry:

- Chemical & Petrochemical

- Automotive

- Construction

- Paints & Coatings

- Pharmaceuticals

- Agriculture

Value Chain Analysis For Toluene Market

The Toluene value chain begins with the upstream segment, primarily involving the extraction and processing of crude oil, which yields naphtha, the main feedstock for aromatic production. Key upstream activities include crude distillation and subsequent catalytic reforming or steam cracking processes that produce reformate or pyrolysis gasoline, both rich in aromatics including Toluene. Reliability in the upstream segment is heavily dependent on global oil supply stability and refinery operational efficiency, as feedstock cost represents the largest component of Toluene production expenditure. Suppliers must manage complex logistics associated with transporting vast quantities of volatile hydrocarbon raw materials to integrated petrochemical hubs.

The midstream process focuses on the separation and purification of Toluene from mixed aromatics using techniques like solvent extraction, extractive distillation, or crystallization to achieve the required purity grades, particularly for chemical synthesis applications such as TDI production. This stage is capital-intensive, requiring advanced technology and energy inputs. Distribution channels then move the product downstream, encompassing bulk shipping via pipelines, railcars, tanker trucks, and specialized marine vessels, managed by large chemical distributors and traders. Direct sales often characterize large-volume transactions between integrated producers and major industrial customers (like polyurethane manufacturers), while indirect channels cater to smaller users via regional chemical distributors.

The downstream analysis focuses on the transformation of purified Toluene into end-use products. Major customers include manufacturers converting Toluene into TDI, which is subsequently used for rigid and flexible polyurethane foams; companies utilizing Toluene as a solvent in formulating paints, coatings, and adhesives; and petrochemical firms using it for disproportionation or transalkylation processes to produce Benzene and Xylenes. The resilience of the value chain is increasingly being tested by regulatory pressures demanding greater transparency and safety throughout handling and usage, particularly concerning indirect distribution to small and medium enterprises (SMEs) that utilize Toluene as a solvent.

Toluene Market Potential Customers

The primary consumers of Toluene are large-scale chemical manufacturers engaged in the production of derivatives, constituting the bulk of global demand. These potential customers require high-purity grades of Toluene as a fundamental feedstock for complex chemical reactions. Manufacturers of Toluene Diisocyanate (TDI), notably major producers of polyurethanes, are critical end-users, as TDI is essential for manufacturing flexible foams used extensively in mattresses, automotive interiors, and insulation. These customers prioritize long-term supply agreements and consistency in quality to maintain continuous production cycles and ensure product integrity for their demanding applications.

Another significant customer base resides within the Solvents and Coatings industries. Paint and ink formulators, especially those serving industrial markets like marine coatings, automotive refinishing, and construction materials, rely on Toluene for its excellent solvency and fast-drying properties. While regulatory pressures have diminished its use in consumer-facing products in some regions, its technical advantages in industrial-grade applications remain irreplaceable for many high-performance formulations. These buyers often seek customized blends and reliable, regional distribution networks to manage their inventory and regulatory exposure effectively.

Additionally, the petroleum industry remains a substantial end-user, utilizing Toluene as a critical high-octane component in gasoline blending. Refineries purchase Toluene to meet strict governmental fuel quality standards, particularly in markets mandating higher octane ratings and cleaner-burning fuels. Furthermore, specialized chemical companies involved in the synthesis of agrochemicals, pharmaceuticals, and specialized explosives (like TNT) represent important niche buyers, often requiring bespoke batch sizes and specific quality certifications for their highly regulated production processes. The diversity of end-users ensures market stability against localized downturns in any single industrial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion USD |

| Market Forecast in 2033 | $30.0 Billion USD |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil Chemical, Shell Chemical, BASF SE, Chevron Phillips Chemical Company, Dow Inc., Mitsui Chemicals, Sinopec, CNPC, SK Global Chemical, Reliance Industries Limited, PTT Global Chemical, Formosa Plastics Corporation, LyondellBasell Industries, Huntsman Corporation, China Petrochemical Development Corporation (CPDC), TotalEnergies, Flint Hills Resources, Repsol, SABIC, GS Caltex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Toluene Market Key Technology Landscape

The primary technologies utilized in the Toluene market are centered around extraction, purification, and conversion processes within integrated petrochemical complexes. Catalytic reforming is the dominant technology for producing aromatics, including Toluene, where naphtha feedstock is reacted over platinum-containing catalysts at high temperatures and pressures. Advancements in reforming catalysts, focusing on increased thermal stability and improved selectivity towards Toluene and other desired aromatics, are crucial for modern refinery profitability. Furthermore, the use of specialized solvent extraction methods, such as the Sulfolane process or UDEX (Universal Oil Products EXtraction) process, is critical for efficiently separating high-purity Toluene from the mixed aromatic stream, ensuring it meets the stringent purity requirements for downstream chemical synthesis, particularly TDI production.

Another significant technological focus lies in Toluene conversion processes, designed to optimize the balance of aromatics production. Technologies such as Toluene Disproportionation (TDP) and Toluene Transalkylation (TTA) are employed to convert Toluene into more economically valuable chemicals like Benzene and Xylenes. Recent innovations in these areas focus on developing zeolite-based catalysts with modified pore structures to enhance shape selectivity, thus maximizing the yield of paraxylene, a high-demand chemical used in polyester production, thereby managing the market supply balance of Toluene derivatives. The efficiency of these conversion technologies is key for integrated producers looking to adapt their output based on fluctuating downstream demand for BTX products.

Looking ahead, emerging technologies include the commercialization of bio-Toluene production pathways, primarily utilizing biomass-derived feedstocks or fermentative processes. While nascent, this technology offers a sustainable, non-petroleum alternative, potentially mitigating future regulatory risks and dependence on fossil fuels. Furthermore, in the realm of operational technology, the deployment of advanced process control (APC) and optimization software, often integrated with AI, is becoming standard. These systems enable real-time adjustments to reactor conditions, minimizing energy consumption, reducing operational variance, and ensuring consistent product quality, thus forming a critical layer of modern Toluene production technology.

Regional Highlights

Regional dynamics play a paramount role in shaping the global Toluene market, with disparities evident in demand growth rates, regulatory stringency, and production capacity. The Asia Pacific (APAC) region stands out as the undisputed leader in both production capacity and consumption, largely propelled by massive economic growth, rapid urbanization, and extensive infrastructural development in countries like China, India, and Southeast Asian nations. The region hosts the world’s largest polyurethane manufacturing base, driving unparalleled demand for TDI, which directly translates into high Toluene consumption. Furthermore, lower operating costs and governmental support for integrated petrochemical projects continue to attract significant investment, cementing APAC's dominance and making it the key market for future capacity additions.

North America and Europe represent mature, yet highly regulated, markets. While consumption growth is modest compared to APAC, the demand is stable, primarily driven by the automotive sector (for high-performance coatings and foams) and the gasoline blending segment. The primary challenge in these regions is the increasingly strict environmental regulatory framework, particularly regarding VOC emissions and worker safety standards. This regulatory environment encourages technological innovation focused on high-efficiency production processes and the exploration of non-petroleum-based Toluene alternatives. Producers in these areas focus heavily on value-added derivatives and specialty chemical applications rather than sheer volume expansion, aiming for premium pricing based on quality and compliance.

The Middle East and Africa (MEA) and Latin America regions are experiencing steady growth, largely due to expanding refinery and petrochemical capacities, particularly in the GCC countries (Saudi Arabia, UAE), which benefit from vast, low-cost hydrocarbon reserves. These regions are increasingly becoming major export hubs for Toluene and its derivatives, capitalizing on geographical advantages to supply Europe and South Asia. Latin America, driven by Brazil and Mexico, shows consistent demand linked to local manufacturing, especially for automotive and construction applications, although economic volatility can occasionally dampen investment and demand stability. Strategic partnerships and foreign direct investment are crucial for developing the integrated petrochemical infrastructure necessary to satisfy rising internal and external demand in these developing regions.

- Asia Pacific (APAC): Highest volume market; driven by TDI production, automotive manufacturing, and infrastructural growth in China and India. Focus on capacity expansion and competitive manufacturing costs.

- North America: Mature market; stable demand from gasoline blending and specialized solvent applications. Strong emphasis on regulatory compliance (VOC reduction) and high-quality product supply.

- Europe: Highly regulated market; steady consumption in advanced coatings and automotive sectors. Driven by technological innovation in low-emission derivative production and compliance with REACH standards.

- Middle East and Africa (MEA): Emerging production hub; significant growth due to low feedstock costs and state-backed investment in petrochemical diversification, targeting export markets.

- Latin America: Growing market dependent on regional economic health; consumption linked mainly to construction, local solvents, and paint industries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Toluene Market.- ExxonMobil Chemical

- Shell Chemical

- BASF SE

- Chevron Phillips Chemical Company

- Dow Inc.

- Mitsui Chemicals

- Sinopec

- China National Petroleum Corporation (CNPC)

- SK Global Chemical

- Reliance Industries Limited

- PTT Global Chemical

- Formosa Plastics Corporation

- LyondellBasell Industries

- Huntsman Corporation

- China Petrochemical Development Corporation (CPDC)

- TotalEnergies

- Flint Hills Resources

- Repsol

- SABIC

- GS Caltex

Frequently Asked Questions

Analyze common user questions about the Toluene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Toluene globally?

The primary driver is the rapid growth in the production of Toluene Diisocyanate (TDI), a precursor for polyurethane foams widely used in the automotive, construction, and furniture industries. Additionally, its continued application as a key octane enhancer in gasoline blending sustains significant demand.

How do regulatory changes impact the profitability and usage of Toluene?

Strict environmental regulations, particularly those limiting Volatile Organic Compound (VOC) emissions in North America and Europe, increase production costs related to compliance and safety. This pushes manufacturers toward investment in advanced control technologies and potentially favors alternative solvents in non-industrial applications.

Which geographical region holds the largest market share and why?

The Asia Pacific (APAC) region, specifically led by China and India, holds the largest market share due to its massive, rapidly expanding manufacturing base, substantial infrastructural development projects, and extensive capacity for petrochemical processing and derivative production, especially TDI.

What is the role of crude oil prices in determining the market price of Toluene?

Toluene is predominantly derived from petroleum feedstocks like naphtha through catalytic reforming. Therefore, fluctuations in global crude oil prices directly influence the production cost of Toluene, making raw material price volatility a central determinant of market pricing.

Are there sustainable or bio-based alternatives challenging conventional Toluene supply?

Yes, while still small in market share, the development of bio-Toluene derived from biomass or renewable sources presents a growing opportunity. This bio-based segment aims to provide an environmentally friendly alternative, addressing regulatory pressures and corporate sustainability mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Trinitrotoluene (TNT) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Chlorotoluene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nitric Acid Market Size Report By Type (Strong Nitric Acid, Fuming Nitric Acid), By Application (Fertilizers, Ammonium Nitrate, Calcium Ammonium Nitrate, Others, Nitrobenzene, Adipic Acid, Toluene Di-isocyanate (TDI), Nitrochlorobenzene), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Toluene Solvents Market Statistics 2025 Analysis By Application (Pharmaceuticals, Oilfield Chemicals, Automotive, Paint & Coatings), By Type (Experimental Grade, Industrial Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aromatic Sulfonic Acid Market Statistics 2025 Analysis By Application (Paints & Coating Industry, Industrial Cleaners, Personal Care, Pharmaceuticals), By Type (Toluene Sulfonic Acid, Xylene Sulfonic Acid, Cumene Sulfonic Acid), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager