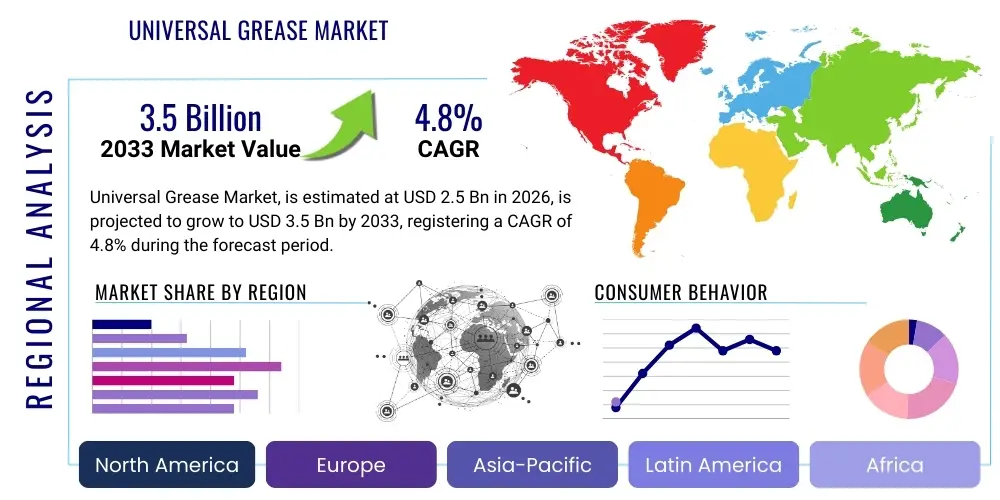

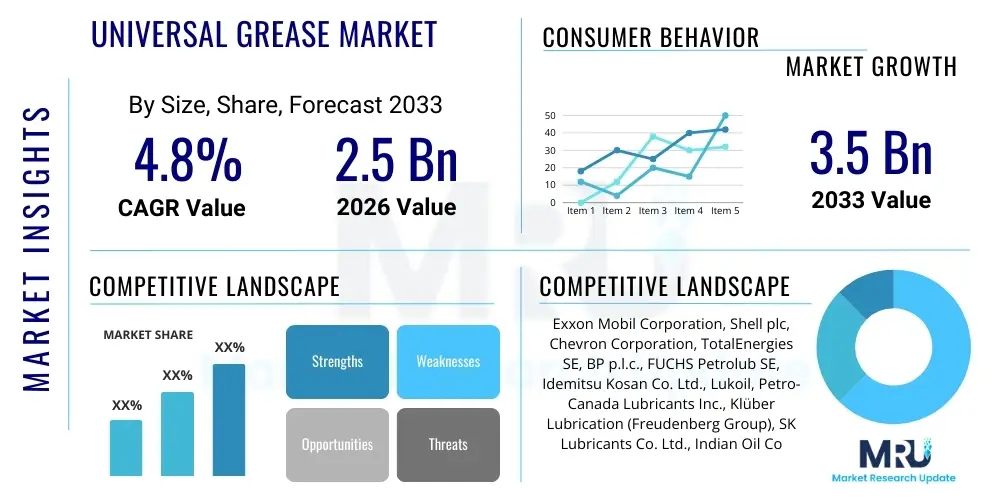

Universal Grease Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441623 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Universal Grease Market Size

The Universal Grease Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.9 Billion by the end of the forecast period in 2033.

Universal Grease Market introduction

The Universal Grease Market encompasses the production, distribution, and consumption of lubricants designed to reduce friction and wear between moving parts across various mechanical systems. These greases are typically semi-solid lubricants composed of a base oil (mineral or synthetic), a thickener (such as lithium, calcium, or polyurea), and performance-enhancing additives. Universal greases are engineered to offer balanced performance characteristics, including high temperature stability, corrosion protection, and excellent water resistance, making them suitable for a wide range of applications without the need for highly specialized products.

Major applications of universal grease span critical sectors, including automotive chassis components, industrial bearings, heavy construction equipment, and general manufacturing machinery. The primary benefit derived from the use of these greases is the extension of equipment life, reduction in maintenance downtime, and improvement in operational efficiency. Furthermore, the semi-solid nature allows the grease to adhere better to surfaces, offering continuous lubrication and sealing out contaminants, which is particularly vital in harsh or dusty operating environments.

Driving factors propelling this market include the sustained growth in global industrialization, particularly in emerging economies, leading to increased demand for efficient machinery operation and maintenance. The stringent operational requirements in industries such as mining, construction, and manufacturing necessitate robust lubricating solutions. Technological advancements focusing on developing sustainable and higher-performing synthetic and bio-based universal greases are also contributing significantly to market expansion, addressing both performance needs and evolving environmental regulations.

Universal Grease Market Executive Summary

The Universal Grease Market is characterized by steady expansion driven by robust industrial activity and increasing technological demands for higher-performance lubricants capable of operating under extreme conditions. Business trends indicate a strong shift towards synthetic and bio-based formulations, reflecting industry efforts to comply with stringent environmental standards and achieve superior service life. Key industry players are focusing on strategic mergers, acquisitions, and collaborative research initiatives to expand their product portfolios, particularly in specialized thickener chemistries like calcium sulfonate, which offers superior mechanical stability and corrosion resistance compared to traditional soap-based greases.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid infrastructural development, burgeoning manufacturing sectors in countries like China and India, and significant investments in mining and construction projects. North America and Europe maintain a mature market status, focusing heavily on premium, high-efficiency lubricants and adopting advanced maintenance practices such as predictive lubrication schedules. Regulatory trends related to occupational safety and environmental impact, particularly concerning volatile organic compounds (VOCs) and hazardous components, are shaping product innovation across all major geographic regions, pressuring manufacturers to adopt cleaner base stocks and additives.

Segment trends reveal that the industrial machinery sector remains the dominant end-user, demanding large volumes of grease for continuous operation. Within the thickener segment, lithium complex grease holds substantial market share due to its versatility and established performance record, though polyurea and calcium sulfonate are gaining traction due to their suitability in niche, high-temperature, and water-intensive applications, respectively. The ongoing adoption of advanced automation and robotics in manufacturing processes is creating new demand for specialized, high-precision lubricating greases that offer exceptional shear stability and minimal bleed characteristics.

AI Impact Analysis on Universal Grease Market

User inquiries regarding the impact of Artificial Intelligence on the Universal Grease Market primarily center on how AI enhances predictive maintenance, optimizes lubricant formulation, and improves supply chain efficiency. Users are concerned about the integration costs of smart sensors and analytical platforms, and how AI can accurately predict the remaining useful life (RUL) of grease in critical machinery components. Key themes emerging from these questions involve the transition from time-based lubrication to condition-based lubrication, the role of machine learning in analyzing vibrational data and oil particle counts to determine optimal regreasing intervals, and the potential for AI algorithms to guide R&D efforts toward tailor-made lubricant packages that meet precise operational specifications, minimizing lubricant waste and maximizing machine uptime.

- AI drives Predictive Maintenance (PdM) programs, analyzing sensor data (vibration, temperature) to optimize regreasing schedules, reducing premature equipment failure and lubricant consumption.

- Machine Learning algorithms analyze historical performance data to refine grease formulation by predicting the synergistic effects of various base oils and additive packages.

- Generative AI models assist researchers in simulating wear and friction under various operational conditions, accelerating the development cycle for new, high-performance universal greases.

- AI enhances supply chain logistics by predicting fluctuating demand across different industrial segments, optimizing inventory levels, and ensuring timely delivery of specialized grease products.

- Integration of AI-powered diagnostic tools allows for real-time monitoring of lubricant health, providing immediate actionable insights to end-users on contamination levels and degradation status.

DRO & Impact Forces Of Universal Grease Market

The Universal Grease Market is significantly influenced by a dynamic set of driving forces, inherent restraints, and emerging opportunities that collectively determine market trajectory and profitability. The primary drivers include the continuous expansion of industrial bases globally, particularly the increase in complex, high-speed machinery requiring advanced lubrication solutions. Furthermore, the imperative across all industrial sectors to minimize operational costs by extending equipment life and reducing unscheduled downtime strongly fuels the demand for high-quality, long-lasting universal greases. Government initiatives promoting infrastructural investments, such as road networks, mining operations, and large-scale manufacturing hubs, further amplify market growth by generating consistent demand from heavy machinery fleets.

However, the market faces notable restraints, chiefly environmental regulations that restrict the use of certain conventional grease components, particularly those derived from mineral oils or containing heavy metals. The volatility and fluctuating costs of raw materials, including crude oil base stocks and various chemical additives, pose significant supply chain challenges, impacting production costs and ultimately end-user pricing. Additionally, the increasing adoption of sealed-for-life components in modern machinery limits the requirement for aftermarket grease, partially dampening replacement market growth, although this trend is counterbalanced by the growing complexity and operational stress placed on the components that still require regular lubrication.

Opportunities for market players are abundant, particularly in the development and commercialization of bio-based and sustainable universal greases derived from renewable sources, appealing to environmentally conscious industries. The integration of lubrication products with Industry 4.0 technologies, specifically smart sensors and IoT platforms, represents a major avenue for innovation, enabling value-added services such as predictive maintenance packages. Moreover, specializing in high-performance greases designed for extreme temperature variations, heavy loads, or specialized applications (e.g., aerospace, wind energy) allows companies to capture premium pricing and establish strong competitive differentiation against generic, low-cost alternatives, promising higher margins and substantial market penetration.

Segmentation Analysis

The Universal Grease Market is meticulously segmented based on key parameters including the type of base oil, the chemical thickener used, and the various end-use applications, providing a granular view of market dynamics and consumer preferences. Understanding these segmentations is critical for manufacturers to tailor their product offerings to specific industry needs, optimizing performance characteristics such as viscosity, shear stability, and resistance to water wash-out. The segmentation by base oil type fundamentally divides the market into mineral, synthetic, and bio-based categories, reflecting varying price points, performance levels, and compliance with environmental mandates across different geographical regions.

Segmentation by thickener type defines the structural integrity and performance attributes of the grease, with lithium complex, calcium sulfonate, and polyurea dominating market attention due to their versatility and robustness. The dominance of lithium-based greases, particularly in general industrial and automotive applications, is gradually being challenged by high-performance thickeners like calcium sulfonate, which excels in harsh, wet, or corrosive environments, gaining prominence in marine and heavy-duty industrial settings. This shift indicates a growing preference among sophisticated end-users for application-specific solutions over purely universal products, though the latter remains the foundational volume driver.

Furthermore, the segmentation by end-use application highlights the core industries driving demand, including automotive, industrial machinery, mining, construction, and marine sectors. Each sector presents unique challenges—for instance, the mining industry demands greases with high load-carrying capacity and protection against abrasive wear, while the food and beverage industry requires non-toxic, food-grade lubricants. Strategic market development hinges on successful penetration into these high-value industrial segments, requiring specialized certifications and performance validation tailored to the operational parameters of that specific industry.

- Base Oil Type: Mineral Oil Based, Synthetic Oil Based, Bio-based (Vegetable and Animal Oils)

- Thickener Type: Lithium Soap, Lithium Complex, Calcium Sulfonate, Polyurea, Aluminum Complex, Clay/Bentonite

- End-Use Application: Automotive (Chassis, Bearings), Industrial Machinery (Gearboxes, Compressors), Mining and Construction (Heavy Equipment), Marine, Aerospace, Food & Beverage, Others (Power Generation, Agriculture)

- Consistency (NLGI Grade): NLGI 000, NLGI 00, NLGI 0, NLGI 1, NLGI 2, NLGI 3, NLGI 4

Value Chain Analysis For Universal Grease Market

The value chain for the Universal Grease Market begins with upstream activities involving the sourcing and refining of base oils and the production of chemical additives and thickeners. Base oil supply is highly dependent on the global petroleum refining industry, making this stage susceptible to volatility in crude oil prices. Key upstream suppliers include major integrated oil companies and specialized chemical manufacturers that provide complex chemical components like anti-wear agents, antioxidants, and rust inhibitors, which are crucial for defining the final performance characteristics of the universal grease product. Efficiency and scale in sourcing high-quality raw materials directly influence the manufacturer's ability to maintain competitive pricing and consistent product quality.

The central stage involves the manufacturing and formulation process, where base oils and thickeners are blended under high shear and controlled temperatures to create the stable, semi-solid structure of the grease. Manufacturers utilize sophisticated facilities and proprietary blending techniques to ensure the final product meets specific NLGI grades and performance criteria. Following manufacturing, the distribution channel takes over. Direct distribution often involves large volume sales to major industrial end-users (e.g., automotive OEMs or large mining corporations) who rely on guaranteed quality and direct technical support. Indirect distribution utilizes a network of specialized industrial distributors, retailers, and wholesalers who manage inventory and provide local access to smaller consumers and maintenance shops, providing necessary market coverage.

Downstream analysis focuses on the end-use application and post-sales support, encompassing technical service, lubrication surveys, and disposal services. The effectiveness of the universal grease ultimately determines the value captured by the end-user through extended equipment life and reduced maintenance. Key considerations downstream include ensuring proper application techniques and providing training to maintenance personnel. The cyclical nature of the grease market relies heavily on replacement demand, making effective distribution and strong relationships with industrial maintenance, repair, and overhaul (MRO) providers critical. The complexity of the product requires manufacturers to maintain a robust field support system to troubleshoot performance issues and manage product life cycle, from usage to environmentally compliant disposal.

Universal Grease Market Potential Customers

Potential customers for universal grease products span a vast spectrum of industries where mechanical components require robust friction reduction and protection against environmental degradation. The largest segment of end-users are industrial facilities involved in manufacturing, including heavy fabrication, textiles, and primary metal processing, where continuous operation of machinery like conveyors, pumps, and gear systems necessitates consistent lubrication. These customers prioritize bulk purchasing, long shelf life, and the applicability of a single grease type across numerous machines to simplify inventory management and reduce the risk of lubricant mix-up, making high-performance universal greases highly attractive for centralized maintenance programs.

Another crucial customer segment involves the mining, construction, and heavy-duty transport sectors. These environments are characterized by extreme conditions, including high shock loads, heavy contamination from dirt and dust, and significant exposure to water. Customers in this segment demand greases with exceptional load-carrying capacity, superior water wash-out resistance, and outstanding mechanical stability to protect large, expensive assets like excavators, haul trucks, and drilling rigs. The decision-making process in these sectors often involves technical evaluations and long-term performance trials, placing high value on certifications and product reliability under stress.

Furthermore, the automotive aftermarket and fleet maintenance operators constitute a substantial customer base. While modern vehicles increasingly use specialized, sealed lubricants, the maintenance and repair of older vehicles and commercial fleets (buses, trucks) require significant volumes of universal grease for components such as wheel bearings, ball joints, and universal joints. These buyers prioritize cost-effectiveness balanced with regulatory compliance and proven product pedigree. Emerging high-growth customer segments include wind energy farms, where grease is critical for pitch and yaw bearings operating under high loads and temperature fluctuations, and the burgeoning robotics and automation industry, demanding precise, synthetic universal greges with extremely low separation rates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shell, ExxonMobil, Chevron Corporation, TotalEnergies SE, BP p.l.c., Fuchs Petrolub SE, Kluber Lubrication (Freudenberg Group), SKF Group, The Lubrizol Corporation (Berkshire Hathaway), Castrol (BP), Petro-Canada Lubricants Inc. (HollyFrontier), Lukoil, Phillips 66 Company, Sinopec Corp., The Whitmore Manufacturing Company, Dow Inc., Axel Christiernsson, Idemitsu Kosan Co. Ltd., ENEOS Holdings, Inc., OKS Spezialschmierstoffe GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Universal Grease Market Key Technology Landscape

The technology landscape in the Universal Grease Market is characterized by continuous refinement in formulation chemistry and the adoption of advanced manufacturing processes to achieve superior lubricant performance. A crucial technological focus is the development of non-soap thickeners, such as polyurea and calcium sulfonate. Calcium sulfonate grease technology, in particular, offers inherent rust protection and extreme pressure characteristics without relying on traditional additives, making it highly valuable for severe operating conditions in marine and pulp/paper industries. Innovation also concentrates on enhancing the thermal and oxidative stability of the base oils, often through the use of synthetic components like PAOs (Polyalphaolefins) and esters, enabling greases to perform reliably across wider temperature ranges and extended drain intervals.

The integration of advanced additive technology represents another significant area of technological advancement. Modern universal greases utilize highly sophisticated additive packages incorporating solid lubricants like molybdenum disulfide (MoS2) and graphite, specifically formulated to provide enhanced boundary lubrication in high-load, low-speed applications where the primary fluid film might break down. Furthermore, advancements in nano-lubrication technology are being explored, involving the dispersion of nanoparticles (e.g., carbon nanotubes, metallic nanoparticles) within the grease matrix to significantly reduce friction and wear. These technological breakthroughs are crucial for meeting the demands of high-precision, high-efficiency machinery mandated by modern industrial automation.

Process technology, specifically in blending and quality control, has also seen major improvements. Modern grease manufacturing utilizes sophisticated shear mixing techniques and homogenizers to ensure uniform dispersion of the thickener fibers throughout the base oil, resulting in mechanically stable products that resist softening or hardening during use. Additionally, sensor technology and IoT integration are emerging as peripheral yet critical technologies. Smart sensors embedded in machinery or grease cartridges can monitor key parameters such as vibration and temperature, transmitting data analyzed by AI to predict the precise moment lubrication is required, moving the industry toward a condition-based maintenance model and away from obsolete time-based schedules, fundamentally changing how universal grease is consumed and managed.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, driven by massive investments in infrastructure (roads, railways), burgeoning manufacturing sectors (especially automotive and electronics), and extensive mining activities in countries like China, India, and Southeast Asian nations. The region’s rapid industrialization fuels high-volume demand for cost-effective, yet reliable, universal greases.

- North America: This region is characterized by a mature market focusing on high-performance, specialized synthetic greases and early adoption of predictive maintenance technologies. Stringent environmental regulations and a strong emphasis on operational efficiency push demand towards premium, long-life, and biodegradable formulations, particularly in the aerospace, energy, and sophisticated manufacturing sectors.

- Europe: Europe exhibits strong demand driven by the automotive industry, precision manufacturing, and renewable energy sectors (wind power). The market is heavily regulated, leading to a high penetration rate of bio-based and environmentally acceptable lubricants (EALs). Innovation centers around specialty applications and compliance with REACH regulations, favoring complex thickener chemistries that offer extended service intervals.

- Latin America (LATAM): Growth in LATAM is primarily linked to robust mining operations (Chile, Brazil) and agricultural activities. The region demands durable, high load-carrying universal greases suitable for heavy construction and agricultural equipment, often balancing performance requirements with cost considerations, making mineral oil-based universal greases a significant portion of market volume.

- Middle East and Africa (MEA): The MEA market growth is propelled by ongoing large-scale oil and gas extraction projects, infrastructure development, and growing petrochemical industries. High ambient temperatures necessitate greases with excellent thermal stability and oxidation resistance. Demand is project-based, heavily influenced by government and private investments in industrialization initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Universal Grease Market.- Shell

- ExxonMobil

- Chevron Corporation

- TotalEnergies SE

- BP p.l.c.

- Fuchs Petrolub SE

- Kluber Lubrication (Freudenberg Group)

- SKF Group

- The Lubrizol Corporation (Berkshire Hathaway)

- Castrol (BP)

- Petro-Canada Lubricants Inc. (HollyFrontier)

- Lukoil

- Phillips 66 Company

- Sinopec Corp.

- The Whitmore Manufacturing Company

- Dow Inc.

- Axel Christiernsson

- Idemitsu Kosan Co. Ltd.

- ENEOS Holdings, Inc.

- OKS Spezialschmierstoffe GmbH

Frequently Asked Questions

Analyze common user questions about the Universal Grease market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between universal grease and specialized grease?

Universal grease is formulated for versatility, offering balanced performance across a wide range of standard industrial and automotive applications. Specialized greases, conversely, are engineered with highly specific additive packages and thickeners to meet extreme performance requirements, such as ultra-high temperature resistance (e.g., polyurea grease) or specific chemical compatibility needs (e.g., food-grade grease).

How do environmental regulations affect the future development of universal grease?

Environmental regulations, particularly those in North America and Europe concerning biodegradability and toxicity (e.g., EU EALs), are driving manufacturers to shift production towards bio-based and synthetic base oils (like PAOs and esters). This focuses innovation on developing high-performance, sustainable universal greases that minimize environmental impact without compromising mechanical efficiency or service life.

Which thickener type is currently dominating the Universal Grease Market?

Lithium complex grease currently dominates the market share due to its excellent mechanical stability, high-temperature performance, and water resistance, making it suitable for automotive and general industrial applications. However, calcium sulfonate and polyurea thickeners are rapidly increasing their market presence in heavy-duty and extreme-condition niche segments.

What role does Industry 4.0 play in the consumption of industrial universal grease?

Industry 4.0 technologies, including IoT sensors and AI-driven predictive maintenance (PdM) platforms, allow companies to move from scheduled lubrication to condition-based lubrication. This precision application reduces overall grease consumption volume while ensuring optimal machinery health, extending the time between necessary re-greasing events for critical components.

What are the main growth drivers for the Universal Grease Market in the Asia Pacific region?

The primary growth drivers in the Asia Pacific (APAC) region are rapid industrialization, large-scale infrastructure projects (particularly in transportation and construction), and robust expansion of the manufacturing sector. The high volume of new machinery installations and the subsequent demand for reliable maintenance consumables fuel the market significantly.

The market analysis indicates a resilient growth trajectory, propelled by the persistent need for effective friction management across expanding global industrial infrastructure. Strategic emphasis on sustainable formulations and technological integration with industrial digitalization will define the competitive edge for leading market participants through 2033. The transition towards application-specific, high-performance universal greases, driven by advanced additive chemistries and stringent operational demands, underscores the evolution of this foundational segment within the broader lubricants industry.

The long-term sustainability of the Universal Grease Market is tied directly to managing raw material supply chain volatility and responding effectively to global environmental mandates. Companies investing in proprietary blending technologies and cultivating strong downstream partnerships, particularly with maintenance and overhaul providers, are best positioned to capitalize on emerging opportunities in high-growth geographies like APAC and specialized application areas such as renewable energy and high-precision automation. Continued research into bio-based and non-conventional thickener systems will be paramount to securing future market relevance and ensuring operational compliance worldwide.

In conclusion, while the foundational applications of universal grease remain stable, the premium segments focused on synthetic and eco-friendly products are expected to drive the highest value growth. The increasing complexity of industrial machinery necessitates a shift away from 'one-size-fits-all' solutions towards products that leverage data analytics and advanced chemistry to maximize component protection, affirming the critical nature of universal grease products within the global industrial ecosystem.

Further analysis of the competitive landscape shows that multinational oil majors leverage their integrated supply chains for cost advantages in mineral oil-based products, while independent specialty chemical companies often lead innovation in synthetic and niche thickener technologies. The evolving regulatory framework necessitates continuous portfolio management and substantial R&D expenditure to maintain product compliance and technical superiority in an increasingly demanding operational environment. The strategic segmentation of the market—based on both performance and regulatory criteria—provides a clear roadmap for targeted growth and investment decisions for stakeholders throughout the value chain.

Technological advancement is not limited to product formulation but extends to the entire delivery and application process. The development of automatic lubrication systems (ALS) and sophisticated dispensing tools is streamlining maintenance practices, ensuring the precise quantity of universal grease is applied at the optimal time, thereby maximizing its effectiveness and minimizing waste. This shift in application methodology is a direct response to end-users demanding greater efficiency and reliability from their lubrication programs, ultimately reinforcing the value proposition of high-quality universal grease products over cheaper, less effective alternatives.

The demand pattern is highly correlated with capital expenditure cycles in core industries. For instance, a surge in new construction projects drives immediate demand for construction equipment lubricants, while sustained manufacturing activity ensures a steady replacement demand. This cyclical nature requires manufacturers to maintain flexible production capabilities and robust forecasting models, often leveraging advanced analytics to predict regional consumption spikes linked to global economic indicators and sector-specific investment trends, ensuring readiness to meet fluctuating industrial requirements efficiently.

Sustainability criteria are rapidly becoming central to procurement decisions, especially among large corporate entities committed to ESG goals. This trend is fostering significant demand for certified environmentally acceptable lubricants (EALs) even in applications traditionally served by mineral oil. Universal grease manufacturers responding proactively by acquiring necessary certifications and transparently communicating the environmental benefits of their bio-based and synthetic lines are gaining a distinct advantage in accessing lucrative contracts within sectors like marine transport and wind energy, where environmental protection is a primary operational mandate.

Competition intensification is particularly evident in the Asian market, where local players are scaling up production capabilities and offering competitive pricing, pressuring international suppliers to emphasize technical service, reliability, and superior product guarantees. Consequently, major global players are increasingly focusing their R&D efforts on developing patented additive technologies that cannot be easily replicated, securing intellectual property rights as a vital defense mechanism against market erosion from lower-cost regional competitors, thereby maintaining premium positioning.

The supply chain risk profile for universal grease remains high due to dependency on petrochemical sources for base oils. Geopolitical instability and disruptions to global crude oil supplies can rapidly increase manufacturing costs. To mitigate this risk, smart procurement strategies include diversification of base oil sources, investing in backward integration (where possible), and accelerating the transition toward synthetic and bio-based alternatives which, while often more expensive upfront, offer greater price stability against volatile crude oil markets in the long term, offering critical resilience to the manufacturing process.

The emergence of electric vehicles (EVs) represents a nuanced challenge and opportunity. While EVs eliminate the need for traditional engine oil, they introduce new demands for high-efficiency, thermally stable greases specifically for electric motor bearings, specialized gearboxes, and chassis components that operate under unique electromechanical stress. Universal grease manufacturers are proactively developing specialized EV grease lines that prioritize low conductivity, compatibility with sensitive electronic components, and exceptional durability to meet the stringent requirements of next-generation mobility platforms globally.

Furthermore, educational initiatives within the industry are gaining importance. As lubrication technology becomes more complex, end-users require specialized knowledge to correctly select, apply, and monitor universal greases. Manufacturers are increasingly offering training programs and technical consultations to maintenance professionals, acting not just as suppliers but as value-added partners, ensuring that their high-performance products are used optimally, which directly translates to extended equipment life and customer satisfaction, reinforcing brand loyalty in a highly competitive market environment.

Focusing on specialized industrial applications, the aerospace sector demands greases with extreme reliability under vacuum, radiation, and temperature extremes. Universal grease manufacturers catering to this segment must adhere to rigorous certification and testing protocols (such as military and aerospace specifications), highlighting a clear differentiation in the market structure between general-purpose and highly specialized, high-margin products. The barriers to entry in these niche sectors remain high, favoring companies with established track records and deep technical expertise, further stratifying the market.

The growth in automation across food and beverage processing facilities necessitates food-grade universal greases (H1, H2 certified) that are non-toxic and compliant with FDA standards. This specialized requirement drives a specific market sub-segment where safety and certification are paramount, often overriding traditional cost considerations. Manufacturers who can provide a broad portfolio of universally applicable food-grade lubricants gain a competitive edge in serving this vital consumer packaged goods industry segment, which demands high standards of hygiene and equipment reliability.

Geographically, while APAC drives volume, North America and Europe remain the innovation hubs, particularly for synthetic and environmentally conscious products. European manufacturers are focused heavily on lightweighting and energy efficiency, developing low-friction universal greases that contribute tangibly to reducing the energy consumption of industrial machinery, aligning lubrication strategies directly with global climate change mitigation efforts and energy cost reduction goals for end-users operating in high-cost energy markets.

The market faces the challenge of lubricant consolidation and waste management. Used grease, classified as hazardous waste, requires proper collection and disposal. Manufacturers are beginning to explore circular economy principles, potentially integrating recovered or re-refined base oils into certain low-stress universal grease formulations, although this practice is still nascent. Developing cost-effective, large-scale recycling solutions for industrial grease waste represents a significant future opportunity for the market to improve its overall environmental footprint and operational efficiency.

Finally, digitalization is impacting pricing strategies. Transparent online marketplaces and sophisticated procurement platforms allow end-users to compare pricing and performance data more easily. This increased transparency drives manufacturers toward adopting more dynamic and data-driven pricing models, rewarding efficiency and high performance rather than relying solely on traditional cost-plus methodologies. The strategic use of data derived from the usage phase of the product lifecycle is increasingly being leveraged to justify premium pricing for advanced universal grease products.

The shift towards preventive and predictive maintenance methodologies is fundamentally altering the purchasing criteria for universal grease. Customers are moving away from purely price-based decisions and are increasingly evaluating the Total Cost of Ownership (TCO), factoring in the potential cost savings derived from extended equipment uptime, reduced repair expenses, and minimized lubricant consumption due to optimized application. This elevated focus on long-term performance makes the technical service and consultative selling components of the value chain more critical than ever before.

The development of standardized testing procedures for universal greases is essential for market credibility. Organizations like ASTM International and ISO play a crucial role in establishing benchmarks for characteristics such as dropping point, oxidation stability, and four-ball wear test performance. Manufacturers rigorously adhere to these standards, utilizing them as proof points of quality and consistency, which is particularly important when marketing universal products that must perform reliably across diverse mechanical applications and operational parameters.

The chemical complexity of modern universal grease formulations requires specialized expertise in handling and storage. Incorrect storage conditions, such as exposure to excessive heat or moisture, can lead to base oil separation or additive degradation, severely compromising the lubricant's performance. Manufacturers must provide detailed guidelines and often specialized packaging solutions to ensure product integrity is maintained from the point of manufacture until application, reflecting the high value placed on product quality consistency.

Furthermore, the competitive dynamic is shaped by the presence of large integrated oil companies who offer a full spectrum of lubricant products versus smaller, niche players who specialize solely in high-performance grease formulations. The integrated players leverage their brand recognition and distribution scale, whereas the specialists compete through rapid innovation, customization, and deep application-specific knowledge, creating a dual structure where both volume and specialty markets offer distinct growth avenues.

Market penetration in developing regions often involves tackling challenges related to infrastructure and technical knowledge gaps. Manufacturers must invest in localized blending facilities, robust supply chains optimized for varied local climates, and comprehensive technical training for local distributors and maintenance staff to ensure successful product uptake and sustained usage, adapting the global universal grease portfolio to meet specific regional requirements and standards effectively.

Finally, the growing trend of privatization and outsourcing of industrial maintenance services provides a significant channel for universal grease sales. Large Maintenance, Repair, and Operations (MRO) contractors often dictate the choice of lubricants used across multiple client sites. Securing partnerships with these major MRO providers ensures consistent, high-volume demand and offers a consolidated approach to market access, requiring manufacturers to meet high standards of reliability and bulk supply capabilities.

This detailed market examination confirms that while the Universal Grease Market is foundational, it is undergoing rapid evolution driven by environmental mandates, technological disruption (AI/IoT), and the global shift towards higher-efficiency industrial operations, demanding continuous adaptation and innovation from all participants.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Universal Grease Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Universal Grease Market Statistics 2025 Analysis By Application (Industrial Production Consumption, Automobile Consumption), By Type (Universal Lithium Grease, Other Soap Universal Grease), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager