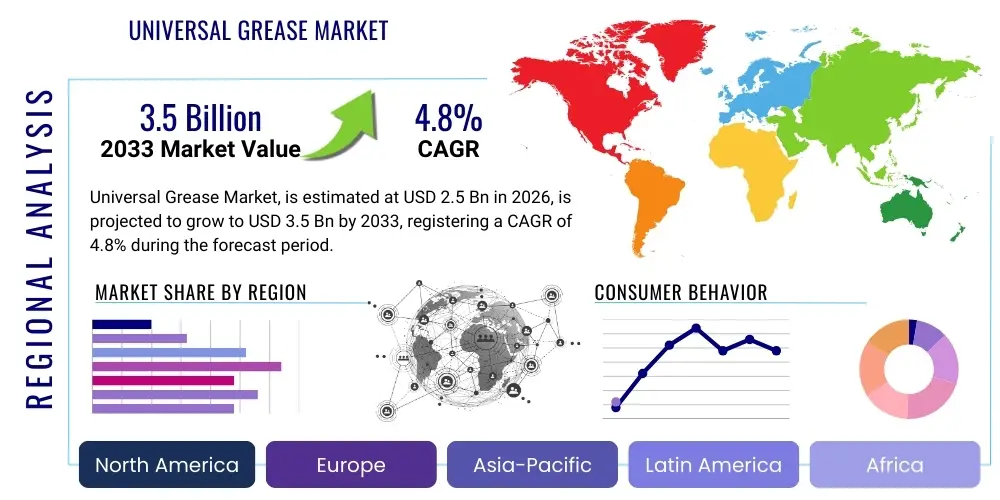

Universal Grease Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436900 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Universal Grease Market Size

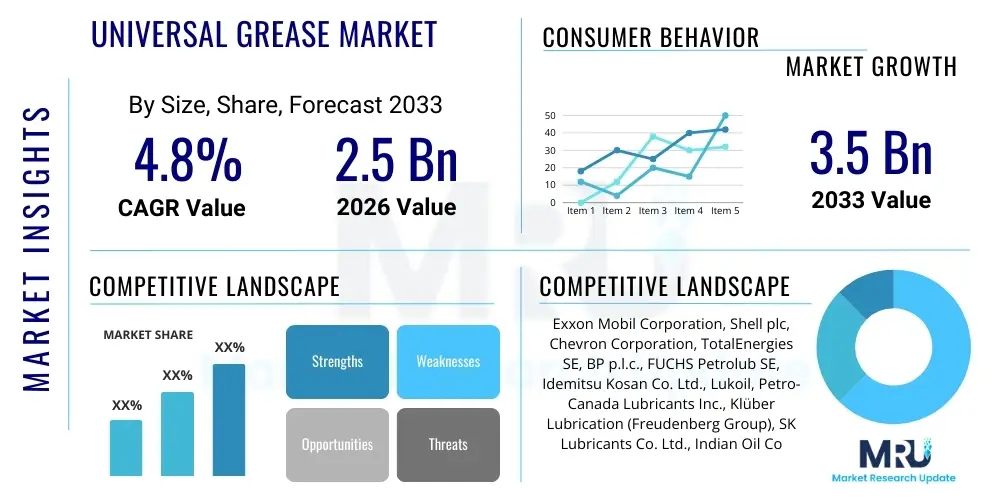

The Universal Grease Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the robust operational requirements across heavy industries, including automotive, construction, and manufacturing, where efficient machinery operation and minimized downtime are paramount. The universal nature of these greases allows for broad application, making them a cost-effective and logistically simpler solution compared to highly specialized alternatives, thereby sustaining steady demand globally.

Universal Grease Market introduction

Universal grease refers to lubricating formulations designed to perform effectively across a wide range of operating conditions, temperatures, pressures, and equipment types, thus simplifying inventory management for industrial users. These products typically consist of a base oil (mineral or synthetic), a thickener (often lithium-based), and various additives to enhance properties such as rust prevention, oxidation stability, and extreme pressure (EP) resistance. Major applications span industrial machinery, automotive components (such as chassis lubrication and bearings), agricultural equipment, and marine systems, providing crucial wear protection and extending the service life of mechanical parts operating under varying loads and speeds. The inherent benefits of universal grease include versatility, cost-effectiveness, and reliable performance in diverse environments, which collectively drive its strong adoption profile across global industrial sectors seeking maintenance efficiency.

Universal Grease Market Executive Summary

The Universal Grease Market is characterized by accelerating demand stemming from rapid industrialization in emerging economies and stringent requirements for preventative maintenance across established industrial bases. Business trends indicate a significant pivot towards high-performance synthetic and bio-based universal greases, driven by environmental regulations and the need for extended drain intervals, which directly reduces operational expenditure for end-users. Regionally, the Asia Pacific (APAC) stands as the principal growth engine, propelled by massive investments in infrastructure development, automotive manufacturing, and mining activities, necessitating large volumes of dependable lubricating solutions. Segment trends highlight the dominance of lithium complex greases due to their superior thermal and mechanical stability, while the heavy-duty machinery application segment maintains the highest consumption rate, reflecting the cyclical demands of the construction and mining industries worldwide.

AI Impact Analysis on Universal Grease Market

User queries regarding AI's impact on the Universal Grease Market predominantly revolve around predictive maintenance, optimization of lubricant formulation, and supply chain efficiency. Users are keenly interested in how Artificial Intelligence can analyze machinery sensor data (vibration, temperature) to predict component failure rates and, consequently, optimize the timing and quantity of grease application, transitioning maintenance from time-based to condition-based schedules. Furthermore, there is significant interest in how AI algorithms can accelerate the development of novel grease formulations, simulating performance under extreme conditions to meet complex industrial demands more quickly. Concerns often center on the initial investment costs associated with implementing AI-integrated smart lubrication systems and the required skill upgrade for maintenance personnel to effectively utilize these advanced diagnostic tools, ensuring that the benefits of efficiency outweigh the complexity of adoption.

The integration of AI and machine learning (ML) is fundamentally altering traditional lubrication practices by enabling real-time condition monitoring. These technologies allow maintenance teams to move beyond scheduled lubrication intervals, which often lead to either over-greasing (wasteful and potentially damaging) or under-greasing (causing premature wear). By analyzing complex datasets generated by IoT sensors embedded in machinery, AI algorithms can pinpoint the precise moment lubrication is required, optimizing the lifecycle of both the equipment and the grease itself. This shift towards hyper-precise lubrication management not only reduces overall lubricant consumption but also dramatically decreases unexpected equipment failures, offering substantial savings in downtime and repair costs, thereby enhancing the overall value proposition of high-quality universal greases.

Moreover, AI is playing a role in the raw material procurement and supply chain aspects of the grease market. ML models can forecast demand fluctuations with greater accuracy by integrating macroeconomic indicators, seasonal industrial activity, and raw material availability (like lithium or specific synthetic base stocks). This enhanced forecasting capability allows manufacturers to optimize inventory levels, reduce lead times, and mitigate the risks associated with volatile commodity prices. In the laboratory setting, AI-driven molecular modeling is streamlining the R&D process, allowing chemists to test thousands of potential additive combinations virtually, accelerating the development of next-generation universal greases that comply with evolving performance standards and stringent environmental guidelines.

- AI enables predictive lubrication scheduling, shifting from time-based to condition-based maintenance (CBM).

- Machine learning algorithms optimize grease application rates based on real-time sensor data, minimizing waste.

- AI simulation accelerates the R&D cycle for developing complex, high-performance universal grease formulations.

- Data analytics enhance supply chain resilience by providing accurate demand forecasting for raw materials (base oils, thickeners).

- Integration of smart lubrication systems facilitates proactive machinery health monitoring, reducing catastrophic failure risks.

DRO & Impact Forces Of Universal Grease Market

The market dynamics for Universal Grease are dictated by a balanced interaction between key drivers (D), significant restraints (R), and emerging opportunities (O), creating complex impact forces. Primary drivers include the continuous expansion of industrial sectors globally, particularly in construction, mining, and power generation, which require vast quantities of robust lubrication to ensure operational continuity. The increasing focus on preventative maintenance strategies across mature economies also fuels demand, as extending equipment life through optimal lubrication is highly prioritized. However, the market faces restraints such as the volatility in raw material prices, specifically base oils and lithium derivatives, which impact manufacturing costs and product pricing stability. Furthermore, the rising penetration of synthetic and high-performance specialty lubricants poses a challenge to the general-purpose universal grease segment, as specialized applications demand superior performance characteristics.

Opportunities in the Universal Grease market are significant and primarily centered around sustainability and technological innovation. The growing global emphasis on environmental compliance creates substantial opportunities for manufacturers to develop and market bio-based and readily biodegradable universal greases, particularly for applications in environmentally sensitive areas like marine or forestry operations. Moreover, the integration of advanced additives, such as nanotechnology-enhanced materials, offers pathways to create 'smarter' universal greases with enhanced wear resistance, thermal stability, and longer service life, justifying premium pricing and addressing high-load, high-temperature applications. The ability of manufacturers to successfully pivot towards these high-value, sustainable solutions will be a critical determinant of long-term market leadership.

The impact forces influencing the market are strong and multifaceted. Economically, the health of the global manufacturing index directly correlates with grease consumption, acting as a major cyclical force. Technologically, the ongoing development of electric vehicles (EVs) is a disruptive force, necessitating new grease formulations optimized for high-speed bearings and reduced electrical conductivity, potentially redefining 'universal' application within the automotive sector. Regulatory impact forces, driven by bodies like REACH in Europe, push manufacturers toward safer, less toxic formulations, compelling continuous reformulation and investment in R&D to maintain market relevance while satisfying increasingly strict health and safety standards worldwide.

Segmentation Analysis

The Universal Grease Market is meticulously segmented based on key criteria including base oil type, thickener type, application, and end-use industry, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for manufacturers to tailor product development, marketing strategies, and distribution channels effectively. The primary base oil types dictate thermal performance and environmental impact, while the thickener type largely determines the structural stability, shear resistance, and water resistance of the final product. The dominance of the industrial machinery and automotive segments underscores the market's reliance on fundamental infrastructure and transportation requirements. Segmentation also helps identify high-growth niches, such as the increasing demand for specialized greases within the renewable energy sector, particularly for wind turbine gearbox lubrication.

The segmentation by thickener type, where lithium complex greases hold a significant market share, reflects the industrial standard for balanced performance across temperature extremes and water washout resistance. However, non-soap thickeners, such as polyurea, are increasingly capturing share in specific high-temperature and extended-life applications, particularly within continuous casting and power generation plants where conventional greases fail prematurely. The distinction between mineral oil-based and synthetic oil-based universal greases is vital; while mineral oil greases remain cost-effective for general industrial uses, the synthetic variants command higher prices but offer superior performance metrics necessary for precision equipment and severe operating environments, leading to segmented customer bases based on operational criticality and budget constraints.

Furthermore, geographic segmentation reveals stark differences in consumption patterns and regulatory pressures. Mature markets in North America and Europe prioritize performance, environmental compliance, and long-life products (synthetic focus), whereas high-growth markets in Asia Pacific prioritize volume and cost-effectiveness (mineral oil focus). Analyzing consumption by end-use industry demonstrates the cyclical nature of demand; for instance, the construction segment is highly sensitive to macroeconomic shifts and government infrastructure spending, while the manufacturing segment provides a more stable, recurring demand base linked to general industrial output and maintenance schedules. This multilayered segmentation analysis is essential for strategic planning and resource allocation in the highly competitive global grease market.

- Base Oil Type:

- Mineral Oil

- Synthetic Oil (PAO, Esters, Silicones)

- Bio-based Oil (Vegetable Oils)

- Thickener Type:

- Lithium Complex

- Simple Lithium

- Calcium Sulfonate

- Polyurea

- Aluminum Complex

- Application Method:

- Manual/Grease Gun

- Automated Lubrication Systems (Centralized)

- End-Use Industry:

- Automotive (OEM & Aftermarket)

- Manufacturing & Heavy Machinery

- Construction & Mining

- Power Generation (Wind, Thermal)

- Marine & Offshore

- Agriculture

Value Chain Analysis For Universal Grease Market

The value chain for the Universal Grease Market begins with upstream activities involving the sourcing and refinement of raw materials, primarily base oils and chemical additives. Base oils, which form the bulk of the grease composition, are sourced from crude oil refining processes (mineral oils) or specialized chemical synthesis (synthetic oils). Key raw material suppliers, including major petrochemical companies and chemical manufacturers, exert significant influence over the input costs due to price volatility and supply concentration. Manufacturers must maintain robust supply chain partnerships to ensure a stable supply of high-quality lithium hydroxides, polyurea compounds, and performance-enhancing additives (e.g., anti-wear, anti-oxidants, corrosion inhibitors). Efficiency in this upstream segment is critical, as base oil costs often represent 70-90% of the final grease product cost.

Midstream activities involve the blending and manufacturing process, where base oils and thickeners are compounded under heat and shear to form the finished grease structure. This stage requires specialized mixing equipment, strict quality control procedures, and technical expertise to ensure the final product meets the specified NLGI grade (National Lubricating Grease Institute consistency classification) and performance standards (e.g., dropping point, mechanical stability). Major universal grease producers operate large-scale, automated facilities to achieve economies of scale. Direct channel distribution involves large-volume sales directly to major industrial end-users (e.g., automotive OEMs, large mining operations) through dedicated sales forces and technical support teams, ensuring specialized consulting and just-in-time delivery.

Downstream activities encompass the distribution and sales network, which is often a hybrid model utilizing both direct and indirect channels. Indirect distribution relies heavily on regional distributors, specialized lubricant resellers, and maintenance, repair, and overhaul (MRO) suppliers, particularly for the vast aftermarket segment and smaller industrial clients. These distributors provide essential local inventory management, technical support, and rapid delivery services, significantly impacting market penetration. Effective downstream management requires optimizing logistics to minimize transportation costs and ensuring product availability across diverse geographic regions, ultimately linking the manufacturers' output with the diverse and critical lubrication needs of global industries.

Universal Grease Market Potential Customers

The potential customer base for the Universal Grease Market is exceptionally broad, spanning nearly every sector that relies on rotating or sliding machinery, making it a truly universal necessity in industrial maintenance. The largest consumers are typically heavy-duty sectors that operate machinery under continuous load and challenging environmental conditions, such as mining companies utilizing earthmoving equipment, construction firms managing cranes and excavators, and agricultural operations maintaining tractors and harvesting machinery. These customers prioritize reliability, extreme pressure capabilities, and resistance to water washout, seeking products that maximize operational uptime and reduce lubrication frequency. Their purchasing decisions are often centralized and driven by maintenance schedules and regulatory compliance.

Another major segment constitutes the manufacturing and processing industries, including steel mills, cement plants, textile manufacturers, and food and beverage processing facilities. While steel and cement require greases with high thermal stability and robust anti-wear characteristics, the food and beverage sector demands specialized, NSF H1 registered universal greases to comply with stringent health and safety regulations concerning incidental food contact. These customers value the product's longevity and consistency, as unplanned equipment failure can lead to expensive production losses. Furthermore, the automotive industry, encompassing both original equipment manufacturers (OEMs) for chassis and bearing assembly and the vast automotive aftermarket, represents a constant, high-volume consumer base.

The emerging market for renewable energy infrastructure, particularly wind farms, represents a growing and high-value customer group. Wind turbines require specific universal greases for pitch, yaw, and main bearings that must withstand wide temperature variations, high loads, and operational cycles lasting years without relubrication. These customers require synthetic, high-performance universal greases with exceptional shear stability and oxidation resistance, viewing lubricant quality as a direct investment in the long-term viability and efficiency of their multi-million dollar assets. Understanding the varying operational demands and regulatory landscapes across these diverse end-user groups is fundamental to market success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Exxon Mobil Corporation, Shell plc, Chevron Corporation, TotalEnergies SE, BP p.l.c., FUCHS Petrolub SE, Idemitsu Kosan Co. Ltd., Lukoil, Petro-Canada Lubricants Inc., Klüber Lubrication (Freudenberg Group), SK Lubricants Co. Ltd., Indian Oil Corporation Ltd. (IOCL), Valvoline Inc., Phillips 66 Company, Houghton International Inc., Axel Christiernsson, Whitmore Manufacturing, Calumet Specialty Products Partners, L.P., Royal Manufacturing Co., Inc., Liqui Moly GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Universal Grease Market Key Technology Landscape

The technology landscape for the Universal Grease Market is continuously evolving, driven by the demand for enhanced longevity, superior thermal performance, and compliance with environmental mandates. A key area of innovation involves advanced thickener technology. While lithium complex greases remain dominant, significant research is focused on optimizing non-soap thickeners like calcium sulfonate and polyurea. Calcium sulfonate greases offer inherently excellent water resistance and corrosion protection without the need for additional additives, making them ideal for marine and wet environments. Polyurea thickeners are preferred in high-speed, high-temperature applications, particularly in electric motor bearings, due to their superior oxidation stability and shear resistance, addressing the demanding requirements of modern high-efficiency machinery.

The shift towards synthetic base oils, such as Polyalphaolefins (PAO) and various esters, represents a major technological advancement. Although more costly than mineral oils, synthetic bases provide superior performance over a wider temperature range, lower volatility, and extended service intervals. This technology minimizes equipment downtime and reduces overall lubricant consumption, providing a strong return on investment for critical applications. Furthermore, the development of specialized additive packages is crucial. This includes highly advanced Extreme Pressure (EP) additives that do not contain chlorine or heavy metals, anti-wear agents based on nanotechnology (e.g., carbon nanotubes, specialized ceramics), and optimized rust and oxidation inhibitors that maintain grease integrity over extended periods under adverse conditions.

The integration of digital technology is redefining the application and monitoring of universal grease. Automated and centralized lubrication systems (ALS) are becoming standard in heavy industrial settings, ensuring precise, continuous application of grease, eliminating manual errors, and preventing both over and under-lubrication. These ALS systems often incorporate IoT sensors that monitor pressure, flow rate, and machinery vibration. This data connectivity enables integration with Computerized Maintenance Management Systems (CMMS) and AI platforms, facilitating true predictive maintenance. This technology shift moves the market beyond mere product chemistry and into integrated lubrication management solutions, offering customers improved asset health and maximizing the efficiency of the universal grease itself.

Regional Highlights

The global consumption and production of Universal Grease exhibit distinct regional variations influenced by industrial maturity, regulatory frameworks, and economic growth rates. Asia Pacific (APAC) holds the largest market share and is projected to experience the highest growth rate during the forecast period. This growth is predominantly fueled by rapid infrastructure development, extensive construction activities, burgeoning automotive production (particularly in China, India, and Southeast Asian nations), and significant expansion in the manufacturing sector. The region’s demand is vast, often favoring high-volume, cost-effective mineral oil-based universal greases, though the transition to synthetic greases is accelerating in specialized sectors and high-tech manufacturing.

North America and Europe represent mature markets characterized by stringent regulatory environments and a strong emphasis on sustainability and high-performance lubrication. In these regions, consumption growth is driven not by volume but by value, with a pronounced shift towards synthetic, long-life, and biodegradable universal greases. The focus here is on maximizing equipment efficiency, reducing carbon footprint, and minimizing maintenance costs through extended drain intervals. Europe, specifically, is heavily influenced by REACH regulations, compelling manufacturers to innovate with safer and environmentally friendlier formulations. The high penetration of automated lubrication systems in these regions further elevates the average value per unit of grease consumed.

Latin America (LATAM), the Middle East, and Africa (MEA) present significant, though heterogeneous, growth potential. The MEA region, heavily reliant on oil & gas exploration, mining, and large infrastructure projects, demands robust universal greases capable of withstanding extreme heat and harsh desert conditions. LATAM's growth is tied to cyclical economic stability and investment in mining and agriculture, driving consistent demand for resilient universal greases. However, market fragmentation and dependence on imports in some sub-regions can lead to price variability and supply chain complexities. Strategic engagement in these regions often requires tailored product offerings that balance performance requirements with local cost sensitivities and logistical challenges.

- Asia Pacific (APAC): Dominates the market due to robust construction, manufacturing, and automotive growth; focus on volume and expanding synthetic penetration in high-end applications.

- North America: High demand for premium synthetic and specialized universal greases; focus on long-life lubrication, regulatory compliance, and predictive maintenance integration.

- Europe: Driven by strict environmental regulations (REACH); strong adoption of bio-based and complex lithium greases; high consumption in advanced manufacturing and wind energy sectors.

- Middle East & Africa (MEA): Demand centered around oil & gas, mining, and heavy machinery, requiring extreme temperature and dust resistance in universal formulations.

- Latin America (LATAM): Steady consumption driven by agricultural machinery and mining sectors; market sensitivity to macroeconomic fluctuations influencing infrastructure investment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Universal Grease Market.- Exxon Mobil Corporation

- Shell plc

- Chevron Corporation

- TotalEnergies SE

- BP p.l.c.

- FUCHS Petrolub SE

- Idemitsu Kosan Co. Ltd.

- Lukoil

- Petro-Canada Lubricants Inc.

- Klüber Lubrication (Freudenberg Group)

- SK Lubricants Co. Ltd.

- Indian Oil Corporation Ltd. (IOCL)

- Valvoline Inc.

- Phillips 66 Company

- Houghton International Inc.

- Axel Christiernsson

- Whitmore Manufacturing

- Calumet Specialty Products Partners, L.P.

- Royal Manufacturing Co., Inc.

- Liqui Moly GmbH

- Sinopec Limited

Frequently Asked Questions

Analyze common user questions about the Universal Grease market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using universal grease over specialized lubricants?

The primary advantages include inventory simplification, reducing the risk of misapplication, and achieving cost efficiencies by utilizing a single product across diverse equipment types and operational conditions. Universal greases provide a balanced performance profile, suitable for general industrial and automotive maintenance tasks.

How is the volatility of lithium prices impacting the universal grease market?

Since lithium soaps, particularly lithium complex, are the dominant thickeners, fluctuating lithium prices directly impact the production costs of most universal greases. Manufacturers are absorbing some costs or passing them to consumers, accelerating research into alternative thickeners like calcium sulfonate and polyurea to mitigate supply chain risk and cost uncertainty.

What is the role of NLGI grade in selecting universal grease for industrial use?

The NLGI (National Lubricating Grease Institute) grade classifies the consistency or hardness of the grease, typically ranging from 000 (fluid) to 6 (block grease). Most universal greases fall into the NLGI 2 category, which provides the optimal balance of pumpability and retention for standard industrial bearing and chassis applications.

Are synthetic universal greases required for high-temperature and high-load applications?

While mineral oil-based greases are sufficient for moderate conditions, synthetic universal greases (utilizing PAO or ester base oils) are highly recommended, and often required, for high-temperature environments (above 150°C), extreme loads, or prolonged service life, due to their superior thermal stability, oxidation resistance, and lower friction characteristics.

How do environmental regulations influence the future formulation of universal grease?

Environmental regulations, particularly in Europe and North America, are driving a strong shift toward biodegradable and less toxic universal grease formulations, often requiring the use of bio-based or synthetic ester base oils and non-toxic additives. This is essential for applications in sensitive areas like marine, forestry, and water treatment facilities to ensure compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Universal Grease Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Universal Grease Market Statistics 2025 Analysis By Application (Industrial Production Consumption, Automobile Consumption), By Type (Universal Lithium Grease, Other Soap Universal Grease), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager