Ursodeoxycholic Acid Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442759 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Ursodeoxycholic Acid Market Size

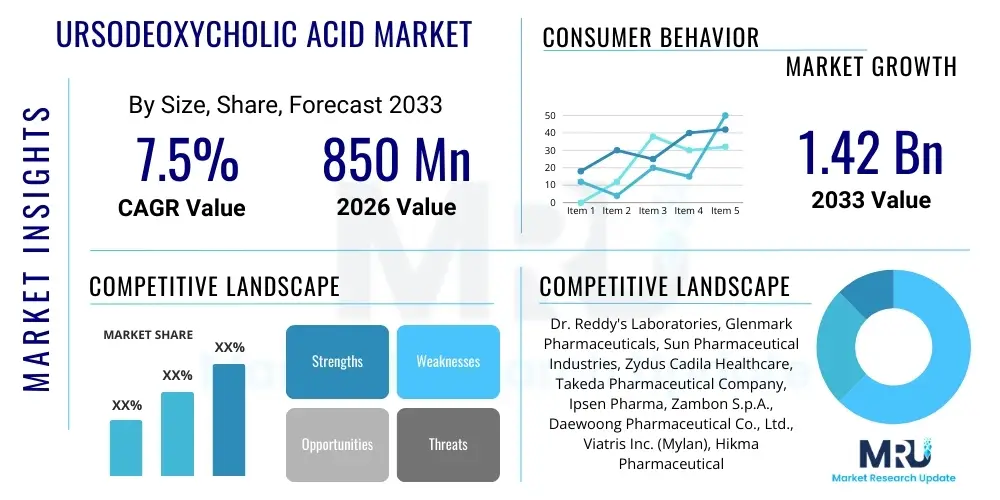

The Ursodeoxycholic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1040 Million by the end of the forecast period in 2033.

Ursodeoxycholic Acid Market introduction

The Ursodeoxycholic Acid (UDCA) market encompasses pharmaceuticals utilized primarily for the treatment of cholestatic liver diseases, notably Primary Biliary Cholangitis (PBC) and, historically, for the dissolution of cholesterol gallstones. UDCA, a naturally occurring bile acid found in small amounts in human bile, is synthetically produced for therapeutic applications owing to its cytoprotective, anti-apoptotic, and immunomodulatory properties. Its mechanism of action involves altering the bile acid pool composition, protecting cholangiocytes from toxic bile acids, and improving liver function tests. The fundamental applications of UDCA extend across gastroenterology and hepatology, offering essential management strategies for patients suffering from chronic liver pathologies that impair bile flow and lead to progressive liver damage.

The product description involves both bulk active pharmaceutical ingredient (API) production and finished dosage forms, including capsules, tablets, and suspensions. The global pharmaceutical sector relies heavily on stringent quality control for UDCA synthesis, differentiating between pharmaceutical grade material derived from animal sources (extraction from bear bile, though heavily restricted) and synthetic chemical pathways, with the latter increasingly dominating production due to ethical concerns and scalability. Major applications are anchored in chronic liver disease management, specifically slowing the progression of PBC and reducing the need for liver transplantation. Furthermore, it is occasionally used off-label in neonatal cholestasis and various forms of liver injury where bile flow impairment is a central pathology, cementing its status as a foundational therapeutic agent in hepatobiliary disorders.

Key driving factors propelling the market expansion include the escalating global prevalence of chronic liver diseases, particularly non-alcoholic fatty liver disease (NAFLD) and Primary Sclerosing Cholangitis (PSC), where UDCA is often explored as an adjunctive therapy despite variable efficacy in PSC. The demographic shift towards an aging population globally inherently increases the incidence of chronic conditions requiring long-term UDCA treatment. Furthermore, improvements in diagnostic capabilities for early-stage cholestatic diseases enable quicker initiation of UDCA therapy, broadening the eligible patient pool. Regulatory approvals for generics and enhanced manufacturing efficiencies also contribute to market penetration, especially in emerging economies where affordability drives adoption.

Ursodeoxycholic Acid Market Executive Summary

The Ursodeoxycholic Acid market is poised for robust growth, driven primarily by favorable epidemiological trends related to chronic liver diseases and sustained clinical utilization in Primary Biliary Cholangitis (PBC). Business trends highlight a strong focus on enhancing synthetic production methods to mitigate reliance on natural sources, leading to reduced cost volatility and improved supply chain resilience. Key market players are increasingly investing in developing specialized formulations, such as extended-release tablets, designed to improve patient compliance and therapeutic efficacy. Mergers and acquisitions focusing on API manufacturing expertise and regional distribution networks are observed, aimed at consolidating market share and achieving economies of scale in this competitive genericized segment. Furthermore, the market is seeing increased pressure for demonstrating cost-effectiveness in highly regulated healthcare systems, prompting manufacturers to optimize production processes and secure preferred formulary status.

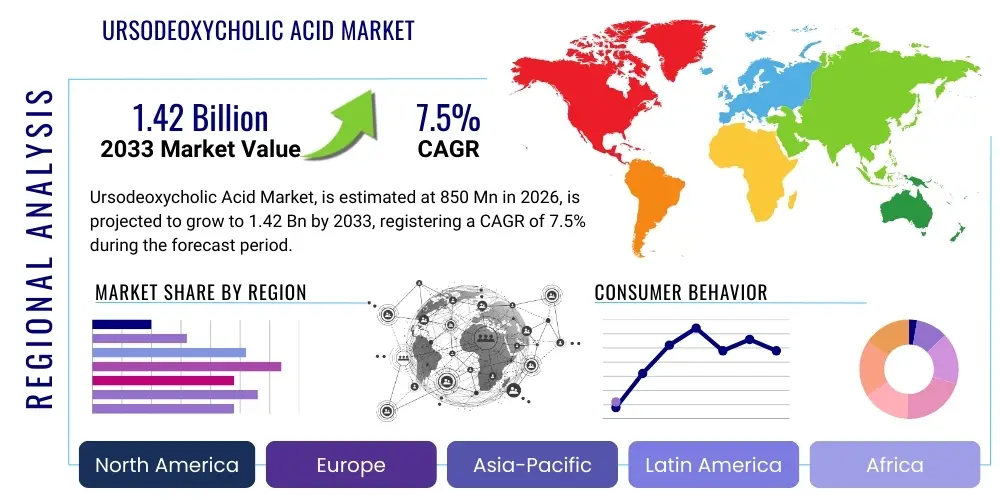

Regional trends indicate that the Asia Pacific (APAC) region is expected to exhibit the fastest growth rate, fueled by a large patient base, improving healthcare access, and significant domestic manufacturing capabilities, particularly in China and India, which are major producers of UDCA API. North America and Europe remain mature markets, characterized by high treatment adherence and well-established clinical guidelines, where growth is steady but driven by price competition and formulation innovation. Regulatory harmonization efforts, particularly concerning generic drug approvals, across major jurisdictions are influencing market entry strategies, allowing quicker dissemination of UDCA formulations globally. The increasing awareness and diagnosis rates of liver diseases in Latin America and the Middle East and Africa (MEA) are also contributing incrementally to global demand.

Segment trends reveal that the Primary Biliary Cholangitis (PBC) application segment maintains the dominant market share due to UDCA’s established status as the first-line therapy. The synthetic source type segment is rapidly outpacing natural sources, driven by scalability, ethical manufacturing mandates, and consistent product purity. Geographically, the consumption is heavily concentrated in regions with stringent quality standards, necessitating higher-purity APIs, thus favoring sophisticated synthetic manufacturers. The dosage form segment shows preference towards traditional immediate-release tablets, but sustained-release and specialized pediatric formulations are gaining traction, catering to specific patient needs and enhancing long-term management protocols.

AI Impact Analysis on Ursodeoxycholic Acid Market

User queries regarding AI's influence on the UDCA market often revolve around three central themes: optimizing the drug development process, enhancing diagnostic precision for cholestatic diseases, and improving personalized treatment regimens. Users are particularly interested in how Artificial Intelligence and Machine Learning (ML) can accelerate the identification of novel therapeutic targets or complementary compounds to UDCA for patients who are non-responsive, known as incomplete responders. Concerns frequently surface about the integration of complex diagnostic data (imaging, genomics, metabolomics) into clinical decision support systems to predict patient response to UDCA therapy, thereby reducing unnecessary treatment cycles or delayed intervention. Expectations are high that AI-driven clinical trials will significantly reduce the cost and duration of studying UDCA's efficacy in less common liver conditions, such as Primary Sclerosing Cholangitis (PSC) or NAFLD-related cholestasis, ensuring that UDCA is utilized more effectively within precise patient cohorts and potentially repositioning the drug for broader applications based on detailed outcome prediction.

- Accelerated discovery of UDCA analogues or combination therapies through generative chemistry models.

- Optimization of complex API synthesis processes using ML algorithms to enhance yield and purity, reducing manufacturing costs.

- AI-driven analysis of patient electronic health records (EHR) and genomic data to predict non-response rates in PBC patients, enabling personalized dosage adjustments.

- Enhancement of diagnostic imaging (MRI, ultrasound) through deep learning for earlier and more accurate detection of gallstones and biliary pathologies requiring UDCA intervention.

- Virtual clinical trial simulation platforms utilizing AI to model UDCA efficacy across diverse patient populations, streamlining Phase III trials.

- Improved pharmacovigilance by analyzing vast datasets of reported adverse events and drug interactions associated with long-term UDCA use.

- Development of smart patient monitoring tools using wearable technology, integrated with AI, to track adherence and physiological responses to UDCA therapy in real time.

- Supply chain risk management and demand forecasting optimization for the UDCA API based on predictive epidemiological models.

DRO & Impact Forces Of Ursodeoxycholic Acid Market

The UDCA market dynamics are primarily driven by the established clinical efficacy of the compound in managing Primary Biliary Cholangitis (PBC) and its inclusion in global consensus treatment guidelines, ensuring sustained demand despite the generic nature of the drug. However, the market faces significant restraints, chiefly the presence of numerous generic manufacturers leading to intense price erosion, and the emergence of potential alternative treatments, such as Ocaliva (Obeticholic Acid), which targets patients who do not adequately respond to UDCA. Opportunities for growth lie in exploring new formulations, particularly sustained-release variants that improve patient compliance, and leveraging the drug’s potential in combination therapies for complex liver diseases like non-alcoholic steatohepatitis (NASH) where UDCA may offer protective benefits against associated cholestasis. The inherent conflict between established generic drug status and the continuous need for innovative delivery systems shapes the market trajectory, necessitating manufacturers to focus heavily on cost optimization while ensuring premium quality and regulatory compliance.

The dominant driving force remains the rising global incidence of cholestatic and chronic liver disorders, intrinsically linked to lifestyle factors and demographic aging. Furthermore, increasing clinical research validating UDCA’s role beyond its primary indication, including its utility in conditions related to liver transplantation and certain drug-induced liver injuries, supports broader adoption. A significant restraint is the regulatory scrutiny over API sourcing, particularly the restrictions on animal-derived UDCA, pushing manufacturing costs for synthetic alternatives, and the challenge of maintaining high purity standards across diverse global production sites. The opportunity landscape is further broadened by patent expiry of proprietary delivery systems of competitors, allowing generic manufacturers to introduce bioequivalent alternatives with enhanced marketability, focusing on adherence and reduced pill burden for chronic treatment.

Impact forces on the market include strong buyer power from large pharmaceutical distributors and hospital procurement groups, demanding low prices due to the generic availability. Supplier power is moderate, influenced by the specialized chemical synthesis required for the API, although the rise of Chinese and Indian manufacturers has somewhat diluted this power. The threat of substitutes is moderate; while OCA exists, it is expensive and reserved for specific patient subsets, yet continuous R&D in novel FXR and TGR5 agonists poses a long-term threat. Regulatory pressure remains high, particularly concerning API origin and quality management, driving investment in vertically integrated manufacturing processes to secure the supply chain. Overall, the market exhibits characteristics typical of a mature generic segment, where efficiency, scale, and reliable quality are paramount to maintaining profitability.

Segmentation Analysis

The Ursodeoxycholic Acid market is extensively segmented based on Source Type, Application, and Dosage Form, allowing for granular analysis of demand and supply dynamics across the pharmaceutical value chain. The Source Type dichotomy—Synthetic versus Natural—is crucial, reflecting the ethical, regulatory, and cost differences inherent in production methods. Application segmentation focuses heavily on established clinical indications, with Primary Biliary Cholangitis dominating demand, alongside smaller, yet significant, segments like gallstone dissolution and specific forms of hepatic disorders. Dosage Form stratification, encompassing capsules, tablets, and suspensions, highlights preferences based on patient age, adherence requirements, and regional clinical practices, influencing manufacturing strategies and product presentation.

- By Source Type:

- Synthetic UDCA

- Natural/Animal-Derived UDCA

- By Application:

- Primary Biliary Cholangitis (PBC)

- Gallstone Dissolution

- Intrahepatic Cholestasis of Pregnancy (ICP)

- Liver Transplantation-associated Cholestasis

- Other Liver Disorders (e.g., Cystic Fibrosis-related liver disease)

- By Dosage Form:

- Tablets (Immediate Release and Sustained Release)

- Capsules

- Suspensions/Syrups

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Ursodeoxycholic Acid Market

The Ursodeoxycholic Acid value chain begins with complex upstream activities, primarily involving the sourcing and synthesis of the raw materials necessary for the Active Pharmaceutical Ingredient (API). For synthetic UDCA, this involves the procurement of precursor chemicals, usually derived from petrochemicals or specific steroids, followed by multi-step chemical reactions (esterification, oxidation, hydrolysis) to produce the high-purity bile acid structure. Due to the precision required for chiral synthesis and polymorphism control, API manufacturing is highly specialized and capital-intensive, leading to significant concentration of production in specialized facilities in Asia. Stringent regulatory compliance for Good Manufacturing Practices (GMP) and impurity profiling adds layers of complexity and cost to the upstream segment, making reliable, high-quality sourcing a critical differentiator in this competitive market.

Midstream activities involve the formulation and packaging of the API into finished dosage forms, such as tablets, capsules, and oral suspensions. This stage includes drug product manufacturing, quality assurance testing, and securing regulatory approvals (ANDA, NDA) for specific markets. Formulation specialization, particularly for sustained-release or pediatric liquid dosage forms, represents a key value-addition point, allowing manufacturers to potentially capture premium pricing or achieve better market segmentation. The distribution channel, which constitutes the downstream segment, is critical for market access. UDCA products move primarily through a tripartite system: direct sales to large hospital groups and government purchasing bodies for specialized use, wholesale distribution to retail pharmacies for chronic outpatient care, and increasingly, direct-to-consumer online pharmacy sales, particularly for maintaining prescriptions over the long term.

Distribution channels for UDCA are heavily influenced by its prescription status and long-term use profile. Direct channels often involve large pharmaceutical companies selling bulk finished products to national health systems (e.g., NHS in the UK, centralized purchasing in certain European nations), streamlining the supply chain but intensifying pricing negotiations. Indirect distribution utilizes wholesalers and third-party logistics (3PL) providers to reach thousands of scattered retail pharmacies and smaller clinical centers. Given UDCA's critical role in chronic disease management, supply chain resilience, temperature control (for suspensions), and traceability are non-negotiable requirements across both direct and indirect channels. The final stage involves dispensing to the end-user—the patient—requiring collaboration between pharmaceutical marketers, prescribing physicians, and pharmacists to ensure adherence and proper usage instructions.

Ursodeoxycholic Acid Market Potential Customers

The primary consumers and end-users of Ursodeoxycholic Acid are patients suffering from chronic cholestatic liver diseases, particularly those diagnosed with Primary Biliary Cholangitis (PBC), which mandates lifelong pharmacological intervention. Consequently, the immediate institutional buyers are Hospitals, specifically their gastroenterology and hepatology departments, which initiate UDCA therapy following diagnosis and manage acute phases of liver disease. Specialty clinics focused on liver disorders, transplant centers, and private practice gastroenterologists are also crucial prescription generators, driving demand through retail and specialty pharmacies. Since UDCA is generally a first-line therapy, its consumption is consistent and predictable, making long-term supply agreements with these institutions highly valuable for pharmaceutical manufacturers.

A second major category of potential customers includes large institutional purchasing bodies, such as Government Health Agencies, managed care organizations (MCOs) in North America, and large national pharmacy benefit managers (PBMs). These entities act as bulk buyers, negotiating formulary placement and pricing for generic UDCA formulations to ensure widespread, cost-effective access for insured or publicly covered populations. Their purchasing decisions are highly sensitive to price, quality certification (e.g., US FDA, EMA approval), and guaranteed supply volumes. Pharmaceutical manufacturers targeting high market penetration must successfully navigate the complex tender and negotiation processes dictated by these large volume purchasers, often leading to competitive bidding wars that significantly impact gross margins.

The third tier encompasses pharmaceutical wholesalers, distributors, and retail pharmacy chains (e.g., CVS, Walgreens, Boots). These entities procure UDCA from manufacturers or bulk suppliers to maintain inventory for over-the-counter or prescription dispensing to individual patients. While not the final end-user, their stocking decisions and inventory management practices directly affect product availability and geographic reach. Furthermore, compounding pharmacies represent a niche but important customer base, often required to prepare specialized liquid formulations or customized dosages for pediatric patients or individuals with specific swallowing difficulties, thereby maintaining demand for bulk API materials of the highest purity standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1040 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axcan Pharma Inc. (now Salix/Bausch Health), Dr. Reddy’s Laboratories Ltd., Zambon S.p.A., EP Manufacturing Bhd, Ipca Laboratories Ltd., Centaur Pharmaceuticals Pvt. Ltd., ICE S.p.A., Mitsubishi Tanabe Pharma Corporation, Sun Pharmaceutical Industries Ltd., Mylan N.V. (now Viatris), Teva Pharmaceutical Industries Ltd., Glenmark Pharmaceuticals Ltd., Taj Pharmaceuticals Limited, Panacea Biotec Ltd., Daewoong Pharmaceutical Co. Ltd., PharmaScience Inc., FDC Limited, Samjin Pharmaceutical Co., Ltd., Hanmi Pharmaceutical Co., Ltd., Takeda Pharmaceutical Company Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ursodeoxycholic Acid Market Key Technology Landscape

The technological landscape surrounding the Ursodeoxycholic Acid market is primarily focused on optimizing the Active Pharmaceutical Ingredient (API) synthesis process and enhancing drug delivery systems to improve therapeutic performance and patient compliance. In API production, advanced synthetic chemistry techniques are paramount. This includes implementing highly efficient, multi-step synthesis routes that minimize environmental impact and maximize yield from precursor steroids, moving away from environmentally sensitive or ethically challenging natural extraction methods. Crucially, manufacturers are utilizing techniques like High-Performance Liquid Chromatography (HPLC) for exhaustive impurity profiling, ensuring UDCA purity levels consistently exceed 99.5%, which is critical given the long-term, chronic administration of the drug. Controlling polymorphism—the ability of UDCA to exist in multiple crystalline forms—is also a key technological challenge addressed through controlled crystallization and drying technologies to ensure batch-to-batch consistency in dissolution rate and bioavailability.

Innovations in drug delivery systems constitute the second major technological focus. Although UDCA has traditionally been administered in immediate-release (IR) tablet or capsule form, R&D is heavily concentrated on developing sustained-release (SR) or extended-release formulations. These advanced systems aim to maintain more stable therapeutic plasma concentrations over 24 hours, potentially reducing the required daily dosing frequency and thereby improving patient adherence, a significant challenge in chronic care. Techniques used include matrix technology, osmotic release systems, and micronization to enhance dissolution characteristics. Furthermore, specialized pediatric formulations, such as flavored oral suspensions with improved stability and accurate dosing mechanisms, utilize advanced excipient technology to mask the naturally bitter taste of the bile acid, making long-term treatment feasible for younger patients.

In the realm of formulation and manufacturing, continuous manufacturing processes are gradually replacing traditional batch manufacturing to achieve greater consistency, reduce waste, and lower operational costs. Process Analytical Technology (PAT) tools are increasingly integrated into the production lines, providing real-time monitoring and control over critical quality attributes, such as tablet hardness, disintegration time, and API content uniformity. The utilization of computational chemistry and machine learning models also plays an emerging role in predicting optimal solvent systems and crystallization conditions, further refining the synthetic route and formulation stability. These technological investments are crucial for manufacturers seeking to differentiate their generic UDCA products in a highly competitive pricing environment, ensuring premium quality and clinical parity with originator products.

Regional Highlights

The global UDCA market exhibits significant regional variation in consumption patterns, regulatory pathways, and manufacturing dominance, driven by disease prevalence and healthcare infrastructure maturity.

- North America (U.S. and Canada): Characterized by high per-capita healthcare expenditure and strong adherence to clinical guidelines. The market is mature and highly regulated by the FDA, favoring high-quality synthetic UDCA. Growth is stable, primarily driven by pricing strategies and the uptake of advanced formulations rather than volume expansion. Market access is heavily influenced by Pharmacy Benefit Managers (PBMs) and insurance formulary placement.

- Europe (Germany, UK, France, Italy): A significant market where UDCA is widely accepted and reimbursed under national health systems (NHS, statutory health insurance). Regulatory scrutiny by the EMA ensures rigorous standards for API purity. Demand is sustained by the high incidence of PBC, particularly in Northern European nations. Price competition is intense, especially in countries with centralized drug procurement systems.

- Asia Pacific (APAC) (China, India, Japan, South Korea): The fastest-growing region, driven by the massive underlying population, increasing diagnosis rates of chronic liver diseases, and expanding access to specialized medical care. China and India are global hubs for high-volume, low-cost synthetic UDCA API manufacturing, providing a competitive advantage. Japan and South Korea represent premium markets with stringent quality requirements and established clinical pathways.

- Latin America (LATAM) (Brazil, Mexico, Argentina): An emerging market experiencing rapid expansion in healthcare investment. Growth is fueled by increasing patient awareness and improving diagnostic services. Market access can be fragmented, reliant on a mix of public health tenders and private hospital sales. Affordability is a major factor, leading to a strong preference for generic, low-cost formulations.

- Middle East and Africa (MEA): A nascent market with significant growth potential, driven by the establishment of advanced medical infrastructure, particularly in the UAE and Saudi Arabia. Market growth is closely tied to import policies and the development of local pharmaceutical distribution networks. While smaller in volume currently, it offers opportunities for manufacturers focused on ethical and high-quality imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ursodeoxycholic Acid Market.- Axcan Pharma Inc. (now part of Salix Pharmaceuticals/Bausch Health)

- Dr. Reddy’s Laboratories Ltd.

- Zambon S.p.A.

- EP Manufacturing Bhd

- Ipca Laboratories Ltd.

- Centaur Pharmaceuticals Pvt. Ltd.

- ICE S.p.A.

- Mitsubishi Tanabe Pharma Corporation

- Sun Pharmaceutical Industries Ltd.

- Mylan N.V. (now Viatris)

- Teva Pharmaceutical Industries Ltd.

- Glenmark Pharmaceuticals Ltd.

- Taj Pharmaceuticals Limited

- Panacea Biotec Ltd.

- Daewoong Pharmaceutical Co. Ltd.

- PharmaScience Inc.

- FDC Limited

- Samjin Pharmaceutical Co., Ltd.

- Hanmi Pharmaceutical Co., Ltd.

- Takeda Pharmaceutical Company Limited

Frequently Asked Questions

Analyze common user questions about the Ursodeoxycholic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application and established status of Ursodeoxycholic Acid (UDCA) in chronic liver disease management?

UDCA is globally recognized as the established first-line therapeutic agent for Primary Biliary Cholangitis (PBC). Its primary application is to slow disease progression, improve liver biochemistry, and delay the need for liver transplantation in PBC patients through its cytoprotective and immunomodulatory actions.

Which source type—synthetic or natural—dominates the current UDCA market and why?

Synthetic UDCA overwhelmingly dominates the market. This shift is driven by enhanced scalability of chemical synthesis, the need for consistent high-purity API, and global regulatory and ethical restrictions increasingly limiting the use of natural, animal-derived (bear bile) sources.

What are the main growth drivers for the UDCA market through 2033?

Key growth drivers include the rising global prevalence of chronic cholestatic liver diseases, the demographic impact of an aging population requiring long-term treatment, and expanding diagnostic capabilities leading to earlier patient identification and therapy initiation, particularly in emerging economies.

How is technological innovation impacting the Ursodeoxycholic Acid market structure?

Technological impact focuses mainly on advanced formulation development, specifically sustained-release (SR) dosage forms designed to improve patient compliance and therapeutic concentration stability. Furthermore, Process Analytical Technology (PAT) is being adopted in manufacturing to ensure high and consistent API quality despite intense generic competition.

What are the major challenges related to pricing and market competition for UDCA manufacturers?

The primary challenges stem from intense price erosion due to the highly genericized nature of the drug and the substantial number of low-cost API producers, mainly located in Asia. Manufacturers must focus on operational efficiency, vertical integration, and securing favorable formulary placement with large procurement groups to maintain profitability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ursodeoxycholic Acid API Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ursodeoxycholic Acid Market Size Report By Type (Synthetic UDCA, Extraction UDCA), By Application (Pharmacy, Health Products), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ursodeoxycholic Acid Drug Product Market Size Report By Type (Capsule, Tablet), By Application (Gallstone, Hepatopathy, Biliary Disease, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ursodeoxycholic Acid API Market Statistics 2025 Analysis By Application (Pharmacy, Health Products), By Type (Synthetic UDCA, Extraction UDCA), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ursodeoxycholic Acid Drug Product (Only Rx) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Capsule, Tablet), By Application (Gallstone, Hepatopathy, Biliary Disease, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager