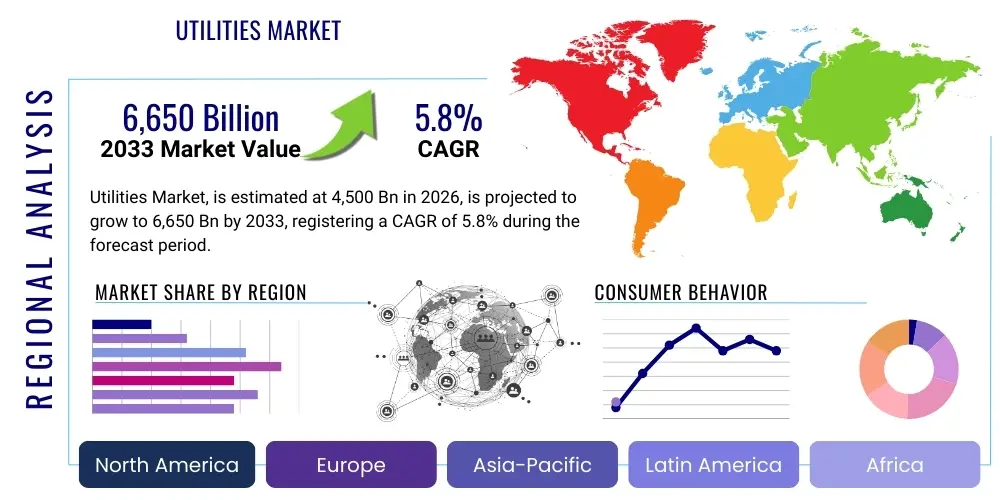

Utilities Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441117 | Date : Feb, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Utilities Market Size

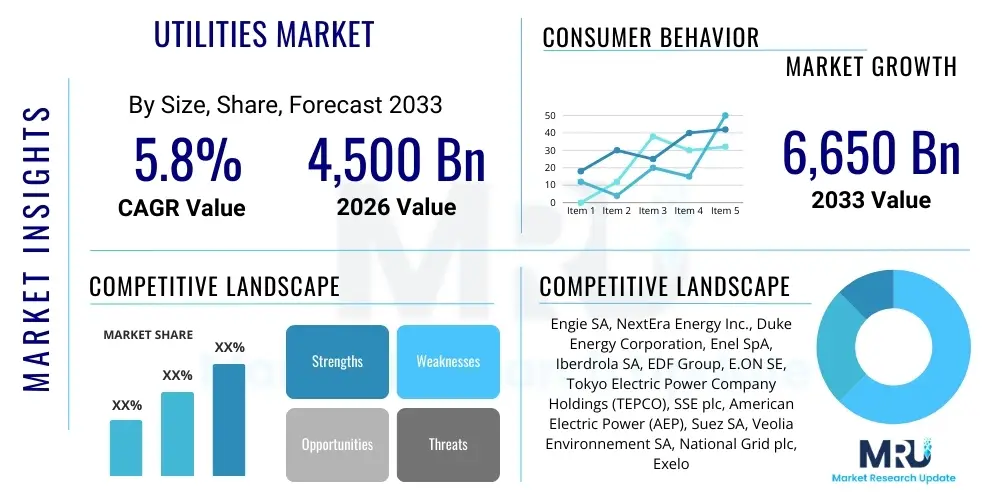

The Utilities Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% (CAGR) between 2026 and 2033. The market is estimated at USD 4,500 Billion in 2026 and is projected to reach USD 6,650 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by increasing global energy demand, accelerated urbanization, and significant governmental investments in modernizing aging infrastructure, particularly in emerging economies. The shift towards sustainable and renewable energy sources, coupled with advancements in smart grid technologies, establishes a foundational momentum for sustained market expansion throughout the forecast period.

Market valuation reflects the aggregated revenue streams derived from various utility services, including electricity generation and distribution, natural gas supply, water treatment and distribution, and comprehensive waste management solutions. The critical nature of these services ensures a resilient market structure, often insulated from short-term economic fluctuations. Furthermore, regulatory frameworks globally are increasingly focusing on decarbonization, which necessitates massive capital expenditure into renewable integration and grid hardening, thereby significantly contributing to the overall market size growth and technological adoption rates across all utility subsectors.

The calculation of market size incorporates both direct utility services and the ancillary technologies and infrastructure required for operation, such as metering systems, advanced control software, and network modernization tools. Future market expansion will be heavily influenced by the speed of digital transformation, particularly the deployment of Artificial Intelligence (AI) for load forecasting and predictive maintenance. Geographically, Asia Pacific is expected to exhibit the highest growth rates due to rapid industrialization and population growth, positioning it as a pivotal region driving the global utilities expenditure landscape.

Utilities Market introduction

The Utilities Market encompasses the essential services necessary for modern societal and industrial functioning, primarily categorized into Electric Power, Natural Gas, Water & Wastewater, and Solid Waste Management. These sectors involve the complex processes of production, transmission, distribution, and consumption of resources, ensuring consistent supply and efficient resource management. Major applications span residential consumption, large-scale industrial operations, commercial infrastructure, and public services like street lighting and transportation systems. The sector is characterized by high barriers to entry, significant capital intensity, and stringent regulatory oversight designed to ensure reliability, safety, and affordability for end-users globally. The continuous modernization of transmission networks and the push for decentralization through distributed energy resources (DERs) are redefining traditional utility business models.

Key benefits provided by a well-functioning utilities market include improved quality of life, enhanced economic productivity through stable energy supply, and adherence to public health standards via clean water and effective waste disposal. The market is currently undergoing a transformative period driven by technological innovation aimed at enhancing operational efficiency and reducing environmental impact. The integration of Internet of Things (IoT) devices, advanced analytics, and cloud computing is enabling the transition towards 'smart utilities,' facilitating real-time monitoring, automated response systems, and sophisticated demand-side management programs. This technological evolution is crucial for managing intermittent renewable energy sources effectively and maintaining grid stability.

Driving factors for the utilities market include relentless population growth, necessitating expanded capacity and infrastructure investment, especially in high-density urban areas. Global climate change mitigation efforts mandate a shift away from carbon-intensive energy production, accelerating the adoption of wind, solar, and hydroelectric power. Furthermore, government policies promoting infrastructure resilience against natural disasters and cyber threats compel utilities to upgrade their physical and digital assets. Regulatory mandates promoting competition and consumer choice, particularly in electricity markets, also contribute to innovation and growth, pushing utilities to offer more tailored and efficient service offerings.

Utilities Market Executive Summary

The Utilities Market is witnessing profound business transformation driven by decarbonization targets, decentralization of energy production, and pervasive digitalization. Key business trends include the vertical integration of renewable energy producers by established utility conglomerates, strategic investments in grid modernization (Smart Grid initiatives), and the development of new service models centered around energy efficiency and demand response. Utilities are increasingly shifting from purely asset-heavy operational models to service-oriented frameworks, utilizing data analytics to create personalized customer engagement and optimize resource allocation. Mergers and acquisitions focused on securing advanced energy storage capabilities and digital platform providers are also central to current market strategies, ensuring utilities remain competitive amidst evolving regulatory landscapes and rising consumer expectations for transparency and sustainability.

Regionally, the market exhibits highly varied growth patterns influenced by local energy policies and resource availability. North America and Europe are leading the charge in smart grid deployment and regulatory frameworks supporting renewable energy penetration, focusing on complex grid flexibility and stability challenges. Asia Pacific, spurred by massive infrastructural projects and burgeoning industrial demand in countries like China and India, represents the largest potential for capacity expansion across all utility segments. Conversely, regions in Latin America and the Middle East and Africa are seeing growth concentrated in electrification efforts, water scarcity solutions, and the initial deployment of large-scale solar projects, often backed by significant international development funding aimed at improving basic access to reliable utility services.

Segment trends highlight the exceptional growth within the renewable energy sector, overshadowing traditional fossil fuel generation segments. Within the electricity segment, transmission and distribution investments are outpacing generation expenditures as the focus shifts to grid resilience and handling two-way power flow from distributed sources. The water and wastewater segment is prioritizing advanced monitoring technologies (leak detection) and tertiary treatment solutions to address increasing water stress and regulatory compliance regarding effluent quality. Solid waste management is seeing significant shifts towards circular economy principles, boosting the market for recycling infrastructure, waste-to-energy conversion facilities, and enhanced materials recovery systems driven by increasingly stringent landfill regulations.

AI Impact Analysis on Utilities Market

User inquiries concerning the impact of Artificial Intelligence (AI) in the Utilities Market frequently revolve around three core themes: operational efficiency gains, cybersecurity vulnerability, and the future workforce required to manage highly automated systems. Users commonly ask how AI can predict equipment failures (predictive maintenance), optimize the integration of intermittent renewables, and improve customer service interaction through sophisticated chatbots and personalized recommendations. Concerns often focus on the reliability of AI models in managing critical infrastructure, the necessary investments in data infrastructure, and the ethical implications of data privacy when monitoring energy consumption patterns. Expectations center on AI delivering significant cost reductions, superior grid reliability, and the ability to handle increasingly complex, decentralized energy systems without human intervention, leading to a substantial enhancement in overall service quality and resource utilization efficiency.

AI is fundamentally transforming utility operations by enabling real-time decision-making capabilities that were previously unattainable. This transformation extends from the generation side, where machine learning algorithms optimize fuel consumption and scheduling for traditional plants, to the distribution network, where AI manages voltage fluctuations and congestion in microgrids. The ability of AI to process vast amounts of sensor data (from smart meters, weather patterns, and asset conditions) allows utilities to move from reactive maintenance schedules to proactive, condition-based interventions, dramatically reducing unplanned outages and extending asset life cycles. This predictive capability is seen as the single most critical application of AI for utility resilience in the next decade.

Furthermore, the integration of AI is crucial for addressing the increasing complexity introduced by climate variability and the integration of distributed energy resources (DERs). AI models are essential for accurate load forecasting, especially when integrating highly volatile sources like solar and wind power, ensuring that the grid remains balanced and stable. In customer-facing applications, natural language processing (NLP) and machine learning are utilized to enhance customer relationship management (CRM) systems, automate billing inquiries, and provide tailored energy-saving advice, thereby improving the overall customer experience and reducing the operational burden on utility contact centers. However, the successful deployment of AI relies heavily on robust data governance and significant investment in cloud computing infrastructure to handle the necessary computational load.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failure, minimizing downtime and optimizing maintenance scheduling.

- Optimized Grid Management: Real-time analysis of load and generation patterns ensures optimal power flow, voltage control, and seamless integration of renewable energy sources.

- Improved Cybersecurity: AI-driven systems detect and respond to anomalous network activity indicative of cyber threats faster than traditional perimeter defenses.

- Advanced Demand Forecasting: Machine learning models predict energy demand with higher accuracy, critical for resource planning and reducing operational costs.

- Customer Service Automation: Deployment of intelligent chatbots and virtual assistants for instant query resolution and personalized energy advice.

- Asset Performance Management (APM): Continuous monitoring and scoring of asset health to prioritize capital expenditure and life extension programs.

- Fault Detection and Isolation: Rapid identification of fault locations in transmission and distribution networks, significantly reducing outage durations.

DRO & Impact Forces Of Utilities Market

The dynamics of the Utilities Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. Major drivers include the global mandate for decarbonization, leading to massive investments in renewable energy infrastructure and the associated transmission necessary to handle long-distance power flow. Rapid technological advancements, such as the maturation of smart grid technologies, energy storage solutions (especially battery storage), and sophisticated sensor networks, provide the foundation for improved operational efficiency and reliability. Additionally, government initiatives globally, aimed at strengthening infrastructure resilience against climate change impacts and modernizing outdated grids, provide consistent financial stimulus to the market, ensuring continuous capital expenditure and fostering innovation in system optimization and control methodologies.

Restraints primarily stem from the enormous capital requirements necessary for modernizing extensive, legacy infrastructure, which often involve decades-long asset lifecycles and slow return on investment. Regulatory complexities and the necessity for lengthy approval processes for new projects (especially transmission lines and large-scale power plants) can impede timely deployment of essential upgrades. Furthermore, the inherent volatility of commodity prices (natural gas, coal, uranium) continues to pose financial risks, while increasing threats from sophisticated cyberattacks on critical infrastructure require substantial and continuous cybersecurity investment, acting as a financial drag and operational concern. Public resistance to infrastructure placement (NIMBYism) also remains a persistent challenge, delaying essential expansion projects.

Opportunities abound, specifically driven by the necessity for digital transformation across all utility segments. The burgeoning market for distributed energy resources (DERs) and microgrids offers new revenue streams and enhances grid resilience, moving control closer to the consumption point. The implementation of circular economy principles in waste management and wastewater treatment presents substantial commercial opportunities for resource recovery and reuse. Finally, emerging markets, particularly in Sub-Saharan Africa and Southeast Asia, represent vast, untapped potential for utility expansion as nations prioritize universal access to reliable electricity and clean water, necessitating the deployment of both centralized and decentralized, off-grid solutions, often leapfrogging older technologies directly into advanced digital systems.

Segmentation Analysis

The Utilities Market is segmented based on the type of service, application, technology deployed, and geographical region. This detailed segmentation allows for precise analysis of market dynamics, growth pockets, and competitive strategies within specific utility subsectors. Service segmentation clearly delineates the distinct operational and regulatory requirements across electricity, gas, water, and waste management. Application segmentation provides insights into end-user behavior, distinguishing between the stable demand of the residential sector and the cyclical or intensive requirements of the industrial sector. Technology segmentation, increasingly vital, tracks the adoption of advanced solutions like smart metering, IoT platforms, and specialized software that define future operational capabilities and efficiency gains within the industry. Understanding these segments is crucial for strategic resource allocation and identifying high-growth investment areas.

The electricity segment is the largest, typically further segmented by generation source (fossil fuels, nuclear, renewables) and infrastructural component (transmission, distribution, retail). The fastest growing segments are those related to renewable integration, particularly utility-scale battery storage and transmission upgrades required to connect remote clean energy generation sites to major load centers. The water and wastewater segment is highly fragmented but focuses intensely on infrastructure replacement (pipeline networks), advanced metering infrastructure (AMI) to combat non-revenue water loss, and sludge treatment technologies. Regulatory pressures related to PFAS removal and water reuse are accelerating investment in specialized purification technologies across municipal and industrial applications.

Geographic segmentation remains essential due to the highly localized nature of utility regulation and resource availability. While mature markets focus on digital transformation and asset replacement, emerging markets prioritize fundamental capacity expansion and the implementation of initial grid structures. The varying levels of digitalization maturity directly influence investment strategies, with utilities in advanced economies often investing heavily in sophisticated software for predictive analytics and cybersecurity, while those in developing regions focus on implementing basic AMI systems and establishing reliable distribution networks. This heterogeneity necessitates tailored market entry and operational strategies for multinational utility providers and technology vendors looking to penetrate specific regional markets effectively.

- By Utility Type:

- Electric Power (Generation, Transmission, Distribution)

- Natural Gas (Extraction, Pipeline Transport, Distribution)

- Water and Wastewater (Water Treatment, Distribution Networks, Sewage Treatment)

- Solid Waste Management (Collection, Landfill Operations, Recycling, Waste-to-Energy)

- By Application/End-User:

- Residential

- Commercial

- Industrial (Manufacturing, Petrochemical, Mining)

- Public/Government Sector

- By Technology:

- Smart Grid Technology (Advanced Metering Infrastructure (AMI), Distribution Automation)

- Energy Storage Solutions (Lithium-ion, Flow Batteries, Pumped Hydro)

- Data Analytics and AI Platforms

- Cybersecurity Solutions

- Water Leak Detection Systems

- By Generation Source (Applicable to Electric Power):

- Renewables (Solar, Wind, Hydroelectric, Geothermal)

- Fossil Fuels (Coal, Natural Gas)

- Nuclear Power

Value Chain Analysis For Utilities Market

The utilities value chain is a complex structure that typically involves upstream resource acquisition, midstream processing and transmission, and downstream distribution and retail services. Upstream analysis focuses on the sourcing and preparation of primary resources—for electricity, this involves fuel extraction (coal, gas) or resource harvesting (wind, solar site development); for water, it involves catchment and initial treatment. The upstream segment is heavily influenced by global commodity markets and environmental regulations concerning resource exploitation and sourcing sustainability. Key challenges in this phase include securing long-term supply agreements and managing geopolitical risks associated with resource dependent countries. The shift towards renewable sources necessitates significant upstream investment in large-scale solar and wind farm development, requiring specific land rights, permitting, and grid interconnection processes.

The midstream segment involves the physical movement of the processed resource to the end-users, encompassing high-voltage transmission lines, natural gas pipelines, and large water conveyance tunnels. This stage is characterized by massive capital expenditure on infrastructure and highly specialized engineering required to ensure system integrity and efficiency over long distances. Downstream analysis covers the distribution networks (low-voltage lines, local pipes, gas mains) that connect to individual homes and businesses, along with the retail arm responsible for billing, customer service, and market operations. Downstream activities are highly competitive in deregulated markets, focusing heavily on customer retention, tariff optimization, and offering value-added services like energy auditing and smart home integration.

Distribution channels in the utilities market are primarily direct, characterized by regulated monopolies or established utility companies providing services directly to consumers. However, market liberalization in various regions (e.g., European electricity markets) has introduced indirect channels, where independent retailers purchase energy wholesale and resell it to consumers, often differentiating themselves through renewable sourcing or pricing structures. Technology plays a crucial role in distribution, with Advanced Metering Infrastructure (AMI) serving as the key link for real-time data exchange, enabling dynamic pricing and load management. The movement towards decentralized energy systems (microgrids, behind-the-meter generation) is simultaneously shortening and complicating the traditional distribution path, creating new peer-to-peer distribution models in certain jurisdictions.

Utilities Market Potential Customers

Potential customers, or end-users/buyers, in the Utilities Market span the entire economic spectrum, categorized broadly into residential, commercial, industrial, and public sectors, each with distinct consumption patterns and service requirements. Residential customers form the largest base by volume, characterized by relatively stable, predictable demand cycles influenced by time-of-day and seasonal weather patterns. These customers are highly sensitive to retail pricing and increasingly seek solutions for energy efficiency, smart home integration, and localized renewable energy options (rooftop solar). Utilities are targeting this segment with personalized digital engagement tools and demand response programs to manage peak loads effectively.

The commercial sector, including offices, retail establishments, educational institutions, and healthcare facilities, exhibits moderate-to-high energy intensity and often requires customized contracts and sophisticated energy management services. Commercial entities are primary adopters of energy efficiency retrofits, building automation systems, and sometimes small-scale, on-site co-generation capabilities to reduce operational costs and enhance sustainability profiles. Their purchasing decisions are often driven by regulatory mandates for energy performance disclosure and corporate sustainability goals, making them key targets for non-commodity utility services.

Industrial customers, such as manufacturers, chemical plants, and data centers, represent the highest volume and density of consumption, demanding extremely reliable and high-quality power supply for continuous operation. Utilities engage with this segment through large-scale, long-term power purchase agreements (PPAs) and specialized pricing structures. This segment is highly focused on process optimization, often integrating utility services directly into their production lines (e.g., high-purity water for semiconductors). Industrial customers are increasingly investing in private utility infrastructure or seeking direct access to renewable power sources to meet their operational resilience and decarbonization commitments, presenting opportunities for specialized utility service providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Billion |

| Market Forecast in 2033 | USD 6,650 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Engie SA, NextEra Energy Inc., Duke Energy Corporation, Enel SpA, Iberdrola SA, EDF Group, E.ON SE, Tokyo Electric Power Company Holdings (TEPCO), SSE plc, American Electric Power (AEP), Suez SA, Veolia Environnement SA, National Grid plc, Exelon Corporation, Xcel Energy Inc., Consolidated Edison Inc., RWE AG, China Three Gorges Corporation, Ørsted A/S, AES Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Utilities Market Key Technology Landscape

The Utilities Market technology landscape is characterized by a rapid shift toward digitalization and connectivity, fundamentally transforming how resources are managed and delivered. Key foundational technologies include the Internet of Things (IoT), which enables ubiquitous sensor deployment across transmission lines, pipelines, and consumer meters, generating massive datasets necessary for real-time monitoring and asset health assessment. This data is the lifeblood of modern utilities, driving the implementation of Advanced Metering Infrastructure (AMI) and Distribution Automation (DA) systems that allow for remote control, load balancing, and rapid fault identification. Furthermore, the increasing reliance on operational technology (OT) networks necessitates robust, specialized cybersecurity solutions designed to protect critical control systems from sophisticated state-sponsored and criminal threats, shifting security from a perimeter defense model to a zero-trust architecture.

Complementary to connectivity is the widespread adoption of sophisticated data processing tools, primarily Artificial Intelligence (AI) and Machine Learning (ML). These analytical capabilities are critical for predictive maintenance, optimizing the integration of variable renewable energy sources, and managing the complexity of grid edge devices (Distributed Energy Resources). Digital Twin technology is emerging as another crucial tool, creating virtual replicas of physical utility assets and entire networks. These twins allow utility engineers and planners to simulate the effects of extreme weather, capacity upgrades, or operational changes in a safe environment before real-world deployment, significantly reducing risk and speeding up infrastructure modernization cycles. The deployment of these technologies requires substantial investment in cloud computing infrastructure for data storage and processing scalability.

In the water segment, the technology focus is on preventing non-revenue water (NRW) loss and enhancing water quality monitoring. This involves acoustic sensor technology for leak detection in aging pipe networks and advanced sensors combined with spectroscopy for immediate detection of contaminants. For waste management, technologies are centering on automation, including robotics for sorting recycled materials and advanced thermal processing (waste-to-energy conversion) technologies that reduce reliance on landfills. Across all segments, the emphasis is on developing integrated platform solutions that unify disparate IT (Information Technology) and OT (Operational Technology) systems, providing a single operational view that maximizes efficiency and improves system resilience in the face of escalating operational and environmental challenges.

Regional Highlights

- North America: This region is defined by significant smart grid infrastructure investments, particularly in the US, driven by aging infrastructure replacement mandates and the need to integrate substantial volumes of intermittent solar and wind power. Regulatory environments, while varied across states and provinces, generally encourage utility modernization and cybersecurity enhancements. The focus is heavily on improving transmission resilience and implementing advanced distribution automation to manage grid complexity. Canada is heavily invested in hydroelectric power and transitioning away from fossil fuels, while the US market is complexly regulated, spurring innovation in competitive wholesale markets and energy storage technologies.

- Europe: Europe stands as a global leader in decarbonization and market liberalization. The region exhibits high penetration rates of renewable energy and decentralized generation, pushing utilities to adopt sophisticated network management solutions (Smart Grids 2.0). The European Green Deal mandates further deep electrification and hydrogen integration, creating immense opportunities in green hydrogen production and associated infrastructure. Strong regulatory frameworks promoting cross-border energy trading and energy efficiency dictate high levels of investment in digital platforms and grid interconnectivity projects across member states, driving technological adoption focused on achieving net-zero targets by mid-century.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing utilities market globally, driven by explosive economic growth, rapid urbanization, and a continuous need for electrification access. China and India are central to this growth, focusing on massive capacity expansion (both conventional and renewable), significant urban water supply projects, and major investments in Ultra High Voltage (UHV) transmission networks. While some regions prioritize basic access and centralized infrastructure, developed economies like Japan and South Korea are leading in advanced smart city deployments, energy storage research, and nuclear decommissioning, presenting a highly heterogeneous market landscape.

- Latin America (LATAM): The LATAM market growth is driven by addressing electricity access deficits, particularly in remote areas, and the large-scale harnessing of natural resources (hydroelectric and solar potential). Political and economic instability in certain countries can pose investment risks, but regulatory reforms aimed at attracting private capital, especially in renewable energy auctions and water concessions, are opening up the market. Emphasis is placed on transmission expansion to connect remote generation sites and reducing high rates of technical and non-technical losses (theft and leakage) through improved metering and network security.

- Middle East and Africa (MEA): The Middle East is characterized by substantial governmental investment in diversifying its energy mix away from hydrocarbons, focusing heavily on large-scale solar power projects (e.g., in the UAE and Saudi Arabia) and desalination for water security. Africa's growth is predominantly centered on electrification through decentralized, off-grid solutions (mini-grids, solar home systems) and international aid-funded clean water initiatives. Utility investment here is often aimed at establishing foundational infrastructure and utilizing mobile technology for metering and payment systems, adapting to unique logistical and economic challenges inherent in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Utilities Market.- Engie SA

- NextEra Energy Inc.

- Duke Energy Corporation

- Enel SpA

- Iberdrola SA

- EDF Group

- E.ON SE

- Tokyo Electric Power Company Holdings (TEPCO)

- SSE plc

- American Electric Power (AEP)

- Suez SA

- Veolia Environnement SA

- National Grid plc

- Exelon Corporation

- Xcel Energy Inc.

- Consolidated Edison Inc.

- RWE AG

- China Three Gorges Corporation

- Ørsted A/S

- AES Corporation

Frequently Asked Questions

Analyze common user questions about the Utilities market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving growth in the global Utilities Market?

The primary drivers include aggressive global decarbonization mandates and the resultant transition to renewable energy sources, continuous expansion of smart grid technologies for operational efficiency, and massive infrastructure modernization programs aimed at replacing aging utility assets in developed economies and providing basic access in emerging markets. These drivers ensure sustained capital investment across electricity, water, and waste sectors.

How is digitalization impacting the operational resilience of utility companies?

Digitalization, particularly through AI, IoT, and advanced data analytics, is fundamentally enhancing utility operational resilience. It enables proactive predictive maintenance to prevent outages, facilitates real-time monitoring and control of decentralized energy resources, and significantly improves system responsiveness to severe weather events, thereby minimizing service interruptions and increasing grid stability and security.

Which geographical region holds the highest growth potential for the Utilities Market?

Asia Pacific (APAC) holds the highest growth potential, primarily driven by rapid industrialization, massive urbanization, and increasing population density in economies like China, India, and Southeast Asian nations. This necessitates extensive capital investment in both expanding generation capacity and modernizing transmission and distribution networks for all utility services (electricity, water, and gas).

What is the role of energy storage solutions in the future of the electric Utilities Market?

Energy storage solutions, particularly utility-scale batteries, are critical enablers for integrating intermittent renewable sources (solar and wind) into the grid reliably. They stabilize the frequency and voltage of the grid, defer costly transmission and distribution upgrades, and provide peaking power during high demand, fundamentally supporting the shift toward a flexible, decarbonized power system.

What are the main regulatory challenges currently faced by the Utilities Market?

The main challenges involve navigating complex and often conflicting regulatory mandates related to environmental compliance (emission reduction), ensuring fair rate of return on vast capital expenditures (especially for grid modernization), and adapting market structures to accommodate decentralized energy generation and increased consumer choice, all while managing cybersecurity mandates for critical infrastructure protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Energy and Utilities Construction Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Thermoplastic Pipe Market Size Report By Type (Reinforced Thermoplastic Pipe (RTP), Thermoplastic Composite Pipe (TCP), , Polyethylene (PE) Pipe, Poly Vinyl Chloride (PVC) Pipe, Polypropylene Pipe (PP), Polyvinylidene Fluoride (PVDF), Others), By Application (Oil & Gas, Water & Wastewater, Mining & Dredging, Utilities & Renewables), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- PC System Utilities Software Market Size Report By Type (System Utilities, Storage Device Management Utilities, Miscelaneous Utilities), By Application (For Business PCs, For Personal PCs), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Internet of Things (IoT) Security Market Size Report By Type (Network Security, Endpoint Security, Cloud Security, Others), By Application (Building and Home Automation, Supply Chain Management, Patient Information Management, Energy and Utilities Management, Customer Information Security, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Underground Utilities Mapping Services Market Statistics 2025 Analysis By Application (Oil and Gas, Electricity, Government and Public Safety, Construction, Telecommunication, Others), By Type (Electromagnetic Location (EML), Ground Penetrating Radar (GPR), Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager