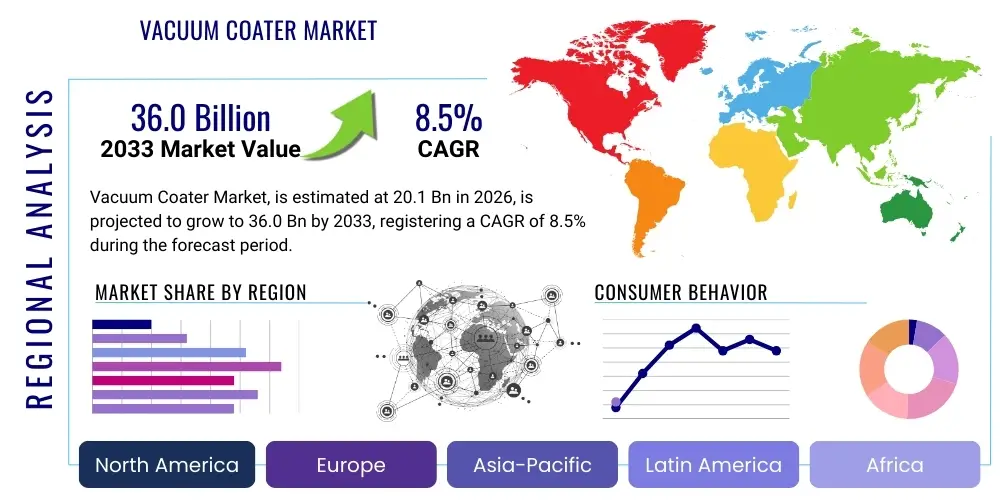

Vacuum Coater Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443013 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Vacuum Coater Market Size

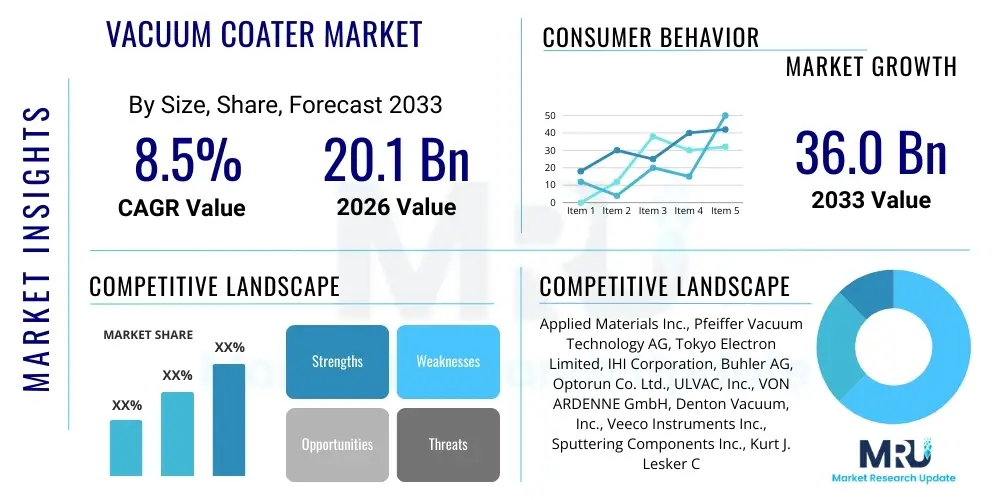

The Vacuum Coater Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 20.1 Billion in 2026 and is projected to reach USD 36.0 Billion by the end of the forecast period in 2033. This growth is fundamentally driven by the escalating demand for high-performance, precision-coated components across critical high-tech industries, particularly semiconductors, consumer electronics, and renewable energy. The necessity for superior material protection, enhanced functional properties like electrical conductivity, optical clarity, and thermal resistance, mandates the use of advanced vacuum deposition techniques, solidifying the market’s expansion trajectory. Geographical shifts in manufacturing prowess, predominantly toward the Asia Pacific region, further fuel the installation base of new, high-throughput vacuum coating systems.

Vacuum Coater Market introduction

The Vacuum Coater Market encompasses the technologies and equipment utilized to deposit thin films of various materials onto substrates under high-vacuum conditions. This crucial process, central to modern manufacturing, involves techniques such as Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), and Atomic Layer Deposition (ALD), each offering unique capabilities for film thickness, adhesion, and uniformity. Vacuum coaters are indispensable machines designed to create highly controlled environments where material vaporization, transport, and condensation occur with atomic precision, enabling the fabrication of complex microelectronic structures, durable industrial coatings, and specialized optical films. The complexity of these systems ranges from batch processing chambers to fully integrated, continuous in-line systems used for high-volume production in semiconductor fabrication plants (fabs) and large-scale architectural glass coating operations. The inherent benefit of vacuum coating lies in its ability to achieve pristine film quality and excellent material purity, which is unattainable through conventional liquid-based coating methods, thereby ensuring the longevity and performance of the treated components.

Major applications for vacuum coating equipment span across diverse high-growth sectors. In the electronics industry, coaters are vital for manufacturing integrated circuits, flat panel displays (FPDs), and flexible OLED screens, providing barrier films and conductive layers essential for device functionality and reliability. The automotive sector utilizes these systems for decorative metallic finishes, wear-resistant coatings on engine components, and thermal control layers on glass. Furthermore, the burgeoning solar energy industry relies heavily on vacuum coaters for depositing transparent conductive oxides (TCOs) and absorber layers onto photovoltaic cells, optimizing energy conversion efficiency. The persistent market growth is directly linked to the rapid innovation cycle within consumer electronics, the continuous push for electric vehicle adoption requiring specialized battery and component coatings, and the stringent quality standards demanded by the aerospace and medical device industries where reliability is paramount.

Driving factors for this market are multi-faceted, stemming primarily from technological demands for miniaturization and performance enhancement. The increasing complexity of semiconductor devices, requiring ultra-thin and defect-free films (often achieved through ALD), necessitates continuous investment in advanced coating equipment. Concurrently, the rising consumer expectation for durable, scratch-resistant coatings on mobile devices and aesthetic, functional films in architectural and automotive applications boosts demand. Benefits derived from vacuum coating—including superior corrosion resistance, enhanced hardness, reduced friction, and precise optical properties—make it a preferred technology over conventional methods. The continuous development of new coating materials and optimized processing techniques, such as High-Power Impulse Magnetron Sputtering (HiPIMS), further sustains the market momentum, offering improved film density and deposition rates crucial for manufacturing scalability and cost reduction.

Vacuum Coater Market Executive Summary

The Vacuum Coater Market is characterized by robust growth, primarily propelled by intense technological advancements in material science and a significant surge in capital expenditure across global semiconductor and display manufacturing sectors. Business trends indicate a clear shift toward highly automated, modular, and energy-efficient coating systems capable of handling large-area substrates and specialized flexible materials. Key market players are strategically focusing on developing hybrid coating systems that integrate multiple deposition techniques (e.g., PVD and PECVD) within a single platform to maximize process flexibility and throughput, addressing the complex requirements of next-generation device fabrication. Furthermore, the emphasis on sustainability is driving innovation in processes that minimize waste and reduce the environmental footprint, creating a demand for low-temperature processing and non-toxic material sources. The market landscape remains highly competitive, with established players leveraging deep patent portfolios and extensive service networks, while specialized smaller firms often focus on niche, high-precision applications like medical implants or optical communication components.

Regionally, the Asia Pacific (APAC) continues to dominate the market, anchored by colossal manufacturing hubs in China, South Korea, Taiwan, and Japan, which collectively account for the majority of global semiconductor foundries, FPD production, and solar panel fabrication. This regional dominance is reinforced by continuous government investments in establishing local high-tech supply chains and massive infrastructural projects that require high-performance coated materials. North America and Europe, while having smaller manufacturing volumes compared to APAC, maintain leadership in research and development (R&D), focusing heavily on innovative deposition techniques, materials for advanced packaging, and specialized aerospace and defense applications, driving demand for high-end, customized R&D and small-scale production coaters. The Middle East and Africa (MEA) region is emerging, driven primarily by investments in solar power generation and architectural glass construction projects, though starting from a lower base.

Segment trends reveal that Physical Vapor Deposition (PVD) remains the largest segment by revenue, due to its widespread use across automotive, general industrial, and tool coating applications, offering a balance of cost-effectiveness and performance. However, Atomic Layer Deposition (ALD) is projected to exhibit the highest CAGR, driven by its unparalleled capability to produce ultra-thin, conformal films required for sub-10nm nodes in semiconductor manufacturing and advanced battery electrodes. Application-wise, the electronics and semiconductor segment holds the largest market share, directly correlated with the global digitalization trend and persistent demand for computing power. The thin-film solar and flexible electronics segments are poised for accelerated growth, reflecting the global transition toward renewable energy sources and innovative device form factors. The competitive intensity is also promoting standardization efforts in equipment interfaces and process control software, streamlining integration into automated factory environments.

AI Impact Analysis on Vacuum Coater Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Vacuum Coater Market frequently center on enhancing process stability, optimizing film quality uniformity across large substrates, and enabling predictive maintenance to maximize equipment uptime. Key concerns involve the necessity for substantial data infrastructure to train effective AI models, the integration complexity with legacy coating equipment, and the specialized skill set required to manage and interpret AI-driven process controls. Users anticipate that AI and machine learning will revolutionize operational efficiency by identifying subtle process deviations that human operators or traditional Statistical Process Control (SPC) methods often miss. They expect AI to facilitate real-time recipe adjustments, significantly reducing scrap rates in high-value manufacturing segments like advanced packaging and silicon wafer production. Furthermore, there is considerable interest in AI’s role in automating complex chamber cleaning procedures and optimizing material usage, directly addressing the high operational costs associated with vacuum coating processes.

The deployment of sophisticated sensor arrays and enhanced data logging capabilities within next-generation vacuum coaters is establishing the foundational dataset necessary for robust AI model training. This includes high-frequency monitoring of plasma density, gas flow rates, temperature profiles, and power consumption signatures. AI algorithms, particularly deep learning networks, are being trained to correlate these multivariate process inputs with resulting film properties (e.g., thickness, refractive index, stress levels), thereby creating closed-loop control systems. This transition from reactive quality control to proactive process optimization represents a paradigm shift in how thin-film deposition is managed. The primary benefit is achieving tighter process windows and significantly improving wafer-to-wafer and batch-to-batch repeatability, which is paramount for high-yield manufacturing in the demanding semiconductor industry.

Another major theme is the application of AI in minimizing equipment downtime through predictive analytics. Vacuum coaters are complex machines with numerous moving parts and thermal components susceptible to degradation. Machine learning models can analyze vibration data, current signatures, and historic performance logs to predict component failure (e.g., vacuum pump degradation, cathode erosion) long before catastrophic failure occurs. This allows maintenance to be scheduled precisely during planned outages, avoiding costly emergency shutdowns and optimizing the replacement cycle for expensive consumables. Ultimately, AI integration transforms vacuum coating equipment from rigid, predefined processing tools into adaptive, self-optimizing manufacturing assets, enhancing capital utilization and driving down the total cost of ownership (TCO) for end-users across all application segments, from PVD tool coating to highly specialized ALD processes for memory chips.

- AI-driven real-time process parameter optimization for enhanced film uniformity and reduced material waste.

- Predictive maintenance schedules enabled by machine learning models analyzing sensor data (vibration, temperature, power) to maximize coater uptime.

- Automated defect classification and root cause analysis, utilizing computer vision and AI to quickly identify and address microscopic film flaws.

- Optimization of deposition recipes and chamber conditioning cycles, leading to faster ramp-up times and increased throughput.

- Integration of digital twins for simulating coating processes and testing new materials or geometries before physical implementation.

DRO & Impact Forces Of Vacuum Coater Market

The market dynamics for vacuum coaters are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the Impact Forces guiding investment and innovation within the industry. The primary driver is the accelerating pace of technological evolution in consumer electronics and semiconductor fabrication, demanding increasingly sophisticated coating solutions for miniaturization and performance enhancement. Restraints include the extremely high capital expenditure required for advanced coating systems, particularly those incorporating ALD or highly customized PVD equipment, alongside the operational complexity and high maintenance costs associated with maintaining ultra-high vacuum environments. Opportunities are abundant in the expansion of green technologies, such as advanced thin-film solar cells and solid-state batteries, which necessitate new deposition materials and processes, creating substantial demand for specialized, next-generation coater platforms. These forces dictate strategic choices for manufacturers regarding R&D focus, geographical market entry, and partnership formation.

Drivers: A paramount driver is the relentless growth in semiconductor capital expenditure, driven by Moore's Law and the rise of advanced packaging technologies (e.g., 3D NAND, FinFET, chiplets), all of which rely heavily on precise, high-aspect ratio vacuum deposition. The global transition to electric vehicles (EVs) is generating significant demand for vacuum coaters used in the production of battery components, specialized sensors, and lightweight structural coatings. Furthermore, the persistent requirement for superior functional surfaces in high-wear environments, such as cutting tools (e.g., TiN, TiAlN coatings) and medical devices (biocompatible PVD layers), provides a stable foundational demand segment. The consumer appetite for highly durable and aesthetically pleasing finishes on smartphones, wearables, and architectural glass further contributes to the volume demand for both large-area and batch coating systems. These drivers are fundamentally linked to global macroeconomic growth and the continuous push toward pervasive digitalization and sustainable technology adoption.

Restraints: Significant barriers to entry and expansion exist due to the technological sophistication and the corresponding high initial investment cost of modern vacuum coating equipment. The complexity of operating and maintaining these systems requires highly specialized technical expertise, which presents a challenge in regions with limited skilled labor pools. Moreover, the proprietary nature of many coating processes and materials often leads to reliance on specific equipment vendors, limiting flexibility for end-users. Economic uncertainties and geopolitical tensions, particularly regarding global supply chains for critical components like vacuum pumps, controllers, and specific target materials, can lead to volatility in manufacturing costs and delivery timelines. Finally, stringent regulatory requirements, particularly concerning the disposal of hazardous materials used in some CVD and etching processes, add operational complexity and cost burden.

Opportunities: Key market opportunities revolve around the development and commercialization of sustainable and high-efficiency coating technologies. The increasing adoption of Atomic Layer Deposition (ALD) outside of traditional semiconductor applications, such as in advanced battery manufacturing and encapsulation of flexible electronics, represents a significant growth vector. There is a strong market pull for coating systems optimized for large-area flexible substrates (Roll-to-Roll coating) to support the growth of flexible OLEDs and flexible solar technologies. Furthermore, the rising need for high-performance optical coatings (e.g., anti-reflective, low-emissivity) in augmented reality (AR) devices and specialized sensing equipment provides lucrative niche markets. Technological advancement in hybrid systems, combining the benefits of multiple techniques (e.g., HiPIMS and conventional sputtering), allows manufacturers to offer versatile and highly productive machinery, capitalizing on the need for integrated solutions.

Segmentation Analysis

The Vacuum Coater Market is comprehensively segmented based on technology type, application sector, material utilized, and geographical region, providing a detailed understanding of market dynamics and growth potential across various dimensions. Technology segmentation, including Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), and Atomic Layer Deposition (ALD), is crucial as it dictates the film properties, substrate suitability, and cost structure for end-users. PVD, being the most versatile and cost-effective for general industrial coatings, holds the largest share, while ALD, favored for its superior conformality and thickness control, commands the premium segment driven by semiconductor needs. Application segmentation highlights the electronics and semiconductor industry as the most significant consumer, though the rapid expansion of the automotive and energy sectors ensures diversified demand across the forecast period. The increasing demand for specific functional attributes, such as enhanced wear resistance or optical clarity, dictates the choice of materials and the configuration of the coating equipment.

Analysis by material showcases the dominance of metallic materials (e.g., aluminum, titanium) and metal oxides (e.g., SiO2, TiO2) used extensively in protective and optical coatings, respectively. However, the fastest growth is observed in specialized compound semiconductors and novel ceramic materials critical for advanced electronic and energy storage applications, requiring highly controlled and often high-temperature deposition processes. The adoption of roll-to-roll (R2R) coating systems specifically for large-area flexible polymer substrates marks an important segmentation trend, catering to the booming market for flexible displays, smart textiles, and packaging barriers. Furthermore, the market differentiates between standard batch coaters, which are cost-effective for tool coating and smaller volumes, and fully automated, cassette-to-cassette systems designed for ultra-high cleanliness and efficiency in high-volume microelectronics fabrication environments. Understanding these segment interactions is vital for manufacturers to tailor their product offerings and R&D investments effectively.

- By Technology Type:

- Physical Vapor Deposition (PVD)

- Chemical Vapor Deposition (CVD)

- Atomic Layer Deposition (ALD)

- Plasma Enhanced Chemical Vapor Deposition (PECVD)

- Others (e.g., Ion Plating, Sputtering, Evaporation)

- By Application:

- Electronics and Semiconductor (IC manufacturing, displays, advanced packaging)

- Automotive (Engine components, exterior/interior aesthetics, sensors)

- Aerospace and Defense (Thermal barriers, wear-resistant coatings)

- Optics and Glass (Anti-reflection, low-emissivity, filters)

- Medical Devices (Biocompatible coatings, surface modification)

- Tool Coating (Cutting tools, molds, dies)

- Energy (Solar panels, fuel cells, batteries)

- By Coating Material:

- Metals and Alloys

- Oxides and Nitrides (Ceramics)

- Polymers and Organics

- Compound Semiconductors

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Vacuum Coater Market

The value chain of the Vacuum Coater Market is sophisticated and highly specialized, beginning with upstream raw material suppliers and progressing through highly specialized equipment manufacturing to end-user applications. The upstream segment involves the supply of crucial components and materials, including high-purity target materials (e.g., titanium, gold, aluminum, specialized ceramic precursors), advanced vacuum pumps (turbomolecular, cryopumps), precise power supplies, and sophisticated process monitoring sensors (quartz crystal microbalances, residual gas analyzers). The reliability and purity of these upstream components directly impact the final film quality and the operational stability of the coater. Component manufacturers must adhere to extremely high standards of precision and cleanliness, especially those catering to the semiconductor industry, creating a market dominated by a few specialized global suppliers. Pricing and availability of high-purity target materials, often tied to global commodity markets, significantly influence the cost structure of coating operations.

The midstream segment is dominated by the original equipment manufacturers (OEMs) of the vacuum coating systems. These companies specialize in the design, assembly, testing, and integration of complex vacuum chambers, deposition sources (magnetrons, e-beam guns), load-lock mechanisms, and integrated software control systems. Differentiation among OEMs is achieved through technological innovation, such as developing proprietary source designs (e.g., HiPIMS sources) or specialized handling systems (e.g., roll-to-roll mechanics). After manufacturing, the equipment moves through distribution channels. Direct sales models are prevalent for highly complex, expensive systems (e.g., semiconductor ALD tools) due to the necessity for deep technical consultation, customization, and extensive post-sale installation and training services. For standardized or high-volume batch coaters used in industrial tool coating, indirect channels involving regional distributors or system integrators are more common, providing local support and faster delivery times.

The downstream segment consists of the diverse end-user industries, including captive coating operations within major semiconductor firms and specialized commercial coating service providers (job shops). Commercial coaters leverage a variety of equipment to offer contract coating services to smaller manufacturers who cannot justify the capital expenditure for their own machines. Feedback from these downstream users regarding performance metrics, such as film adhesion, wear life, and throughput, is critical, driving the innovation loop back to the midstream OEMs. The overall value chain is characterized by high capital intensity, strong intellectual property protection, and a necessity for close collaboration between equipment manufacturers and material suppliers to meet the rapidly evolving demands of advanced manufacturing applications, particularly in optics and high-frequency electronics.

Vacuum Coater Market Potential Customers

Potential customers for vacuum coater systems span a broad spectrum of high-technology and industrial sectors where surface modification and precision thin-film deposition are critical requirements for product functionality and longevity. The most significant segment of buyers comprises semiconductor fabrication plants (Fabs), including integrated device manufacturers (IDMs) and pure-play foundries, which require cutting-edge ALD and high-precision PVD tools for critical front-end-of-line (FEOL) and back-end-of-line (BEOL) processes in microchip production. These customers prioritize high throughput, ultra-low defect rates, and maximum uptime, justifying premium pricing for advanced equipment. Another major group includes manufacturers of flat panel displays (FPDs), encompassing OLED, LCD, and micro-LED technologies, who purchase large-area sputtering and evaporation systems for depositing conductive and barrier layers onto glass or flexible substrates.

Beyond electronics, key buyers are prominent players in the automotive industry, specifically suppliers of advanced lighting, sensor components, and engine parts, utilizing PVD for decorative finishes, thermal barrier coatings, and protective layers to enhance fuel efficiency and component lifespan. The aerospace sector represents a critical, high-value customer base, demanding highly specialized coaters for applying thermal protection, erosion resistance, and radar-absorbing materials onto critical aircraft and satellite components. Furthermore, the medical device industry constitutes a growing segment, requiring coaters for biocompatible coatings (e.g., DLC, Nitrides) on surgical tools and implants, ensuring patient safety and device performance. These diverse customer needs drive customization in coater design, from cleanroom compatibility and automation levels to specific deposition chamber configurations and process recipes, tailored to the unique regulatory and operational environment of each end-user industry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.1 Billion |

| Market Forecast in 2033 | USD 36.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Applied Materials Inc., Pfeiffer Vacuum Technology AG, Tokyo Electron Limited, IHI Corporation, Buhler AG, Optorun Co. Ltd., ULVAC, Inc., VON ARDENNE GmbH, Denton Vacuum, Inc., Veeco Instruments Inc., Sputtering Components Inc., Kurt J. Lesker Company, Shincron Co., Ltd., Mustang Vacuum Systems, Inc., AIXTRON SE, CVD Equipment Corporation, MKS Instruments, Inc., Oerlikon Balzers (OC Oerlikon), Leybold GmbH (Atlas Copco), KLA Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vacuum Coater Market Key Technology Landscape

The technological landscape of the Vacuum Coater Market is characterized by intense innovation focused on achieving higher film quality, better deposition rates, and improved process control, particularly moving towards atomic-level precision. Core technologies like Physical Vapor Deposition (PVD) remain vital but have evolved significantly. Modern PVD systems frequently incorporate advanced techniques such as High-Power Impulse Magnetron Sputtering (HiPIMS). HiPIMS utilizes very high power densities applied in short pulses, resulting in a high fraction of ionized material flux. This significantly enhances the plasma density, leading to denser, smoother, and better-adhering films, particularly valuable for advanced tool coatings and semiconductor interconnect layers. The integration of plasma sources, alongside the sputtering targets, allows for greater control over the ion energy and substrate bias, further optimizing film morphology and stress, which is critical for multilayer structures used in advanced optical coatings and data storage devices.

Chemical Vapor Deposition (CVD) and its variant, Plasma Enhanced Chemical Vapor Deposition (PECVD), are foundational for depositing complex compound films, often used for barrier layers and insulating films in microelectronics. Recent technological advancements in CVD focus on reducing deposition temperatures and optimizing precursor chemistries to enhance selectivity and conformality on high-aspect ratio features. PECVD, in particular, is undergoing innovation to achieve lower ion damage during deposition, essential for sensitive materials like those used in flexible electronics and biomedical applications. Furthermore, hybrid coating systems, which integrate both PVD and CVD capabilities within a single chamber or cluster tool, are gaining traction. These systems offer unparalleled flexibility, allowing manufacturers to create complex, multi-functional coatings by seamlessly transitioning between different deposition techniques, thereby reducing substrate handling and contamination risks in high-cleanliness environments like semiconductor manufacturing cleanrooms.

The fastest-growing and most technologically challenging segment is Atomic Layer Deposition (ALD). ALD represents the pinnacle of vacuum coating technology, offering angstrom-level control over film thickness and perfect conformality, regardless of the substrate’s topography. This is achieved through sequential, self-limiting chemical reactions, providing uniform coverage inside extremely deep and narrow structures, indispensable for high-density memory (DRAM, 3D NAND) and advanced logic devices below 10nm nodes. Current technological efforts in ALD are centered on developing Spatial ALD (SALD) and Roll-to-Roll ALD (R2R-ALD). SALD drastically increases throughput by performing the precursor pulsing spatially rather than sequentially in time, making it viable for high-volume applications like barrier layers on flexible OLED displays. R2R-ALD is key for scaling up production of thin-film batteries and flexible solar applications. Continued advancements in precursor delivery systems and thermal management for ALD will dictate its penetration into non-semiconductor markets where high-precision barrier films are increasingly demanded for performance and durability.

Regional Highlights

- Asia Pacific (APAC): APAC is undeniably the dominant global market for vacuum coaters, accounting for the largest share of equipment installations and revenue. This dominance is driven by the region's position as the world's primary manufacturing hub for electronics, semiconductors (particularly Taiwan, South Korea, and China), flat panel displays, and solar photovoltaic panels. Significant government investment in domestic semiconductor self-sufficiency, notably in China, fuels massive capital expenditure on advanced PVD and ALD tools. South Korea and Japan continue to lead in high-end display and R&D coating applications. The high volume manufacturing needs result in strong demand for high-throughput, automated cluster tools, establishing APAC as the benchmark for operational efficiency and technological scaling in vacuum coating.

- North America: North America holds a substantial market share characterized by its leadership in advanced R&D, specialized defense applications, and a resurgent focus on domestic semiconductor manufacturing (driven by initiatives like the CHIPS Act). The market here is concentrated on high-value, complex systems, often customized for aerospace components, medical devices, and next-generation silicon photonics or quantum computing research. Demand is typically for advanced ALD, HiPIMS PVD, and highly flexible R&D systems rather than mass production volumes. The region is also a key center for the development and commercialization of new coating materials and proprietary process technologies.

- Europe: The European market is robustly supported by strong automotive, industrial tooling, and mechanical engineering sectors, particularly in Germany and Switzerland. Europe is a global leader in protective and wear-resistant coatings (tool coating segment), favoring advanced PVD and plasma-assisted CVD technologies to enhance the life and performance of cutting tools and engine components. Furthermore, stringent environmental regulations drive demand for green coating technologies and processes that minimize harmful chemicals. The region also maintains a significant presence in high-end optical coating for scientific instruments and industrial lasers, prioritizing precision and repeatability.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets characterized by focused growth. In MEA, the primary growth catalyst is large-scale infrastructure projects, leading to demand for architectural glass coating (low-emissivity films) and substantial investment in solar energy generation (thin-film solar PVs). LATAM sees localized growth driven by internal industrialization, particularly in the automotive and general manufacturing sectors in Brazil and Mexico, leading to increasing utilization of batch PVD coaters for industrial applications. While smaller in scale, these regions offer future potential as their industrial base expands and high-tech manufacturing gradually localizes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vacuum Coater Market.- Applied Materials Inc.

- Pfeiffer Vacuum Technology AG

- Tokyo Electron Limited

- IHI Corporation

- Buhler AG

- Optorun Co. Ltd.

- ULVAC, Inc.

- VON ARDENNE GmbH

- Denton Vacuum, Inc.

- Veeco Instruments Inc.

- Sputtering Components Inc.

- Kurt J. Lesker Company

- Shincron Co., Ltd.

- Mustang Vacuum Systems, Inc.

- AIXTRON SE

- CVD Equipment Corporation

- MKS Instruments, Inc.

- Oerlikon Balzers (OC Oerlikon)

- Leybold GmbH (Atlas Copco)

- KLA Corporation

Frequently Asked Questions

Analyze common user questions about the Vacuum Coater market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference and application focus between PVD, CVD, and ALD technologies in the Vacuum Coater Market?

PVD (Physical Vapor Deposition) is versatile, cost-effective, and primarily used for durable industrial coatings, protective layers (tool coating), and basic microelectronic interconnects, offering high deposition rates. CVD (Chemical Vapor Deposition) uses gas reactions for complex compound films (oxides, nitrides) at higher temperatures, essential for certain barrier and dielectric layers. ALD (Atomic Layer Deposition) offers unparalleled atomic-level control and conformality, crucial for manufacturing sub-10nm feature sizes in advanced semiconductor memory and logic, where precision is paramount over speed.

Which end-user segment is driving the highest growth rate for advanced vacuum coating equipment, and why?

The Electronics and Semiconductor segment is driving the highest growth, specifically demanding high-end ALD and advanced PVD systems. This acceleration is due to the requirements of advanced packaging, 3D NAND flash memory, and logic circuits that necessitate ultra-thin, highly conformal films (sub-5nm thickness) and low-temperature processing for sensitive materials, driving substantial capital investment from leading foundries in APAC and North America.

How is the Vacuum Coater Market addressing the increasing need for sustainable manufacturing practices?

The market is shifting toward more sustainable processes by developing low-temperature deposition techniques (e.g., Plasma ALD, low-temperature PECVD) to reduce energy consumption. Furthermore, there is a focus on optimizing precursor utilization, implementing closed-loop cleaning cycles, and improving equipment reliability through predictive maintenance (AI), which minimizes waste generation and lowers the overall environmental footprint associated with thin-film fabrication.

What is the role of High-Power Impulse Magnetron Sputtering (HiPIMS) in modern PVD technology?

HiPIMS represents a significant technological upgrade in PVD, employing high-power, short-pulse operation to generate a high fraction of ionized coating material. This results in significantly denser, smoother, and better-adhering films compared to conventional sputtering, improving performance in demanding applications such as wear-resistant tool coatings, decorative finishes, and complex semiconductor metallization layers, thereby enhancing product longevity and quality.

What are the major capital investment challenges faced by new entrants utilizing vacuum coating technology?

New entrants face significant challenges stemming from the high initial capital expenditure required for sophisticated vacuum coating equipment, the complexity of proprietary process recipes and materials, and the need for a highly skilled workforce to manage and maintain ultra-high vacuum conditions and specialized thin-film processes. This creates high barriers to entry, particularly in advanced microelectronics applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Packaging Vacuum Coater Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Vacuum Coater Market Statistics 2025 Analysis By Application (Automotive, Electronics, Packaging, Optical & Glass), By Type (Vacuum Evaporation Coating Machine, Vacuum Sputtering Coating Machine, Chemical Vapor Deposition (CVD) Coating Machine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager