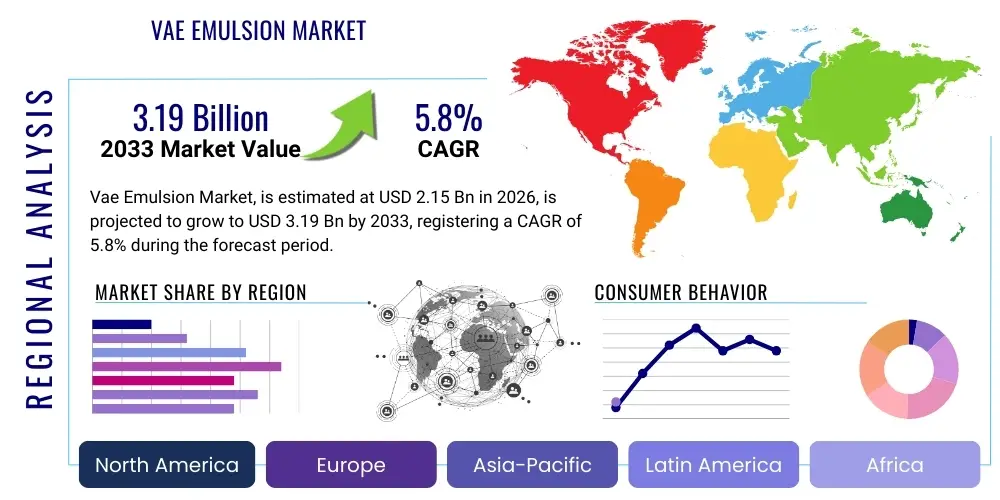

Vae Emulsion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443120 | Date : Feb, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Vae Emulsion Market Size

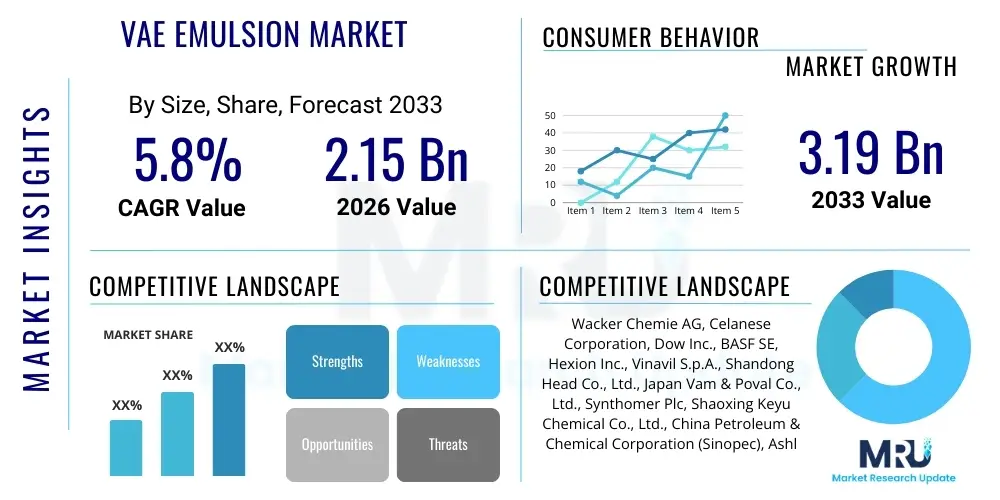

The Vae Emulsion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.8 Billion in 2026 and is projected to reach $4.2 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating demand for high-performance, low-Volatile Organic Compound (VOC) materials across major industrial sectors, particularly construction and packaging. VAE emulsions offer superior flexibility, adhesion, and water resistance compared to traditional polymer dispersions, making them highly desirable for sustainable and durable product manufacturing.

The valuation reflects robust investment in infrastructure and housing projects globally, especially in emerging economies of Asia Pacific, where VAE is extensively utilized in paints, coatings, and cement modification. Furthermore, stringent environmental regulations promoting the shift from solvent-based adhesives and coatings to water-based systems are providing a critical tailwind. Market leaders are focusing on capacity expansion and developing specialized grades tailored for niche applications, such as high-solids emulsions for demanding industrial assembly processes.

Vae Emulsion Market introduction

Vinyl Acetate Ethylene (VAE) emulsion is a copolymer dispersion synthesized from vinyl acetate monomer and ethylene gas, resulting in a versatile, water-based polymer. It serves as a foundational binder in numerous industrial and consumer products due to its exceptional film-forming characteristics, strong adhesive properties, and inherent flexibility. VAE emulsions are inherently thermoplastic and exhibit excellent resistance to light, heat, and aging, distinguishing them from homopolymers like polyvinyl acetate (PVA). These characteristics allow VAE to bridge the performance gap between traditional stiff binders and softer, more elastomeric materials, leading to widespread adoption in complex formulations.

Major applications of VAE emulsions span critical sectors including paints and coatings, where they improve scrub resistance and durability; adhesives, especially for packaging, bookbinding, and woodworking due to superior tack and shear strength; and construction, where they modify cement mortars, enhance plaster flexibility, and serve as binders for non-woven fabrics. The primary benefit of using VAE is its contribution to sustainability, as it is a water-based system that significantly reduces VOC emissions compared to solvent-borne alternatives, aligning with global green building standards. Key driving factors include the rapid urbanization and infrastructure development in Asian countries, coupled with the increasing consumer preference for durable, environmentally compliant, and aesthetically pleasing finishing materials in residential and commercial spaces.

Vae Emulsion Market Executive Summary

The VAE Emulsion Market is undergoing a strategic shift characterized by intense focus on specialized high-performance products and sustainable manufacturing practices. Business trends indicate aggressive merger and acquisition activities among key players aiming to consolidate regional market share and acquire advanced polymerization technologies, particularly those relating to low-formaldehyde and formaldehyde-free formulations. Furthermore, operational optimization targeting energy efficiency in the polymerization process is a significant investment area, driven by rising raw material (ethylene and vinyl acetate monomer) costs. The competitive landscape is evolving towards offering complete solutions rather than just raw materials, involving partnerships with end-users to co-develop customized VAE grades for specific application requirements like high-humidity environments or temperature resistance.

Regionally, Asia Pacific (APAC) remains the undisputed epicenter of demand, driven by massive investments in residential and commercial construction in China, India, and Southeast Asia. The region benefits from both high production capacity and robust consumption across textiles and packaging. North America and Europe, while mature markets, are experiencing growth predominantly through regulatory compliance, driving the substitution of older, high-VOC chemistries with VAE systems in decorative paints and technical adhesives. Segment trends show particularly strong expansion in the adhesives sector, fueled by the booming e-commerce industry requiring high-speed, reliable packaging solutions, and in the textile segment for improving the hand feel and durability of non-woven products.

AI Impact Analysis on Vae Emulsion Market

User queries regarding AI's impact on the VAE Emulsion Market predominantly center on optimization, predictive modeling, and enhanced material discovery. Key concerns revolve around how AI can manage the complexity of emulsion polymerization kinetics, predict formulation stability under various environmental conditions, and optimize the supply chain for volatile raw materials like VAM. Users are keen to understand if AI can significantly accelerate the development lifecycle of new VAE grades with specific properties (e.g., higher solid content, better freeze-thaw stability) without extensive physical experimentation. The consensus expectation is that AI integration will lead to higher batch consistency, reduced waste, and a faster time-to-market for sustainable VAE products, making production more agile and cost-effective in the face of fluctuating raw material prices and demanding performance specifications.

AI is set to revolutionize R&D by simulating complex monomer interactions and optimizing catalyst selection, drastically reducing the trial-and-error approach currently prevalent in polymer science. Machine learning algorithms can process vast datasets related to reaction parameters (temperature, pressure, agitation speed) and final product performance (viscosity, particle size distribution, adhesion strength) to derive optimal manufacturing protocols. This predictive capability extends to quality control, where real-time sensor data monitored by AI can detect minor deviations in batch production, ensuring strict compliance with customer specifications and minimizing off-spec material generation. Furthermore, AI applications in logistics will predict demand fluctuations across various end-user industries, optimizing inventory levels of finished VAE emulsions and crucial raw feedstocks, thus mitigating supply chain risks and improving overall market responsiveness.

- AI-driven optimization of polymerization kinetics for maximized yield and reduced energy consumption.

- Predictive maintenance schedules for polymerization reactors and processing equipment, minimizing unplanned downtime.

- Machine learning applied to formulation design, accelerating the creation of novel VAE grades with enhanced properties like improved water resistance or low-temperature flexibility.

- Enhanced quality control through real-time monitoring and anomaly detection in batch processing using integrated sensor data.

- Supply chain risk management and demand forecasting for volatile raw materials (VAM and ethylene) using advanced analytics.

DRO & Impact Forces Of Vae Emulsion Market

The VAE Emulsion Market is strategically influenced by a powerful combination of drivers, restraints, and opportunities that collectively shape its growth trajectory. The primary driver is the global regulatory impetus favoring sustainable and low-VOC construction and industrial materials, pushing industries away from polluting solvent-based alternatives. VAE emulsions inherently comply with these regulations, offering superior performance in water-based systems. This driver is amplified by significant growth in the residential and commercial construction sectors worldwide, especially in developing nations, creating sustained demand for VAE in paints, coatings, and cement modification. These strong demand fundamentals create a significant positive impact force, ensuring consistent investment in VAE production capabilities and technological advancements designed to enhance product performance characteristics such as adhesion on challenging substrates and long-term durability in external applications.

However, the market faces significant restraints, chiefly stemming from the volatility and escalating costs of key raw materials, specifically vinyl acetate monomer (VAM) and ethylene, which are petrochemical derivatives. Price fluctuations in these feedstocks directly impact the profitability and pricing stability of VAE emulsions, sometimes hindering market penetration in cost-sensitive applications. Furthermore, the complexity and energy intensity of the emulsion polymerization process require high capital investment and technical expertise, creating barriers to entry for new players and adding to operational costs. The market must also contend with competition from alternative polymer dispersions like pure acrylics and styrene-butadiene rubber (SBR) lattices, which, while offering different property profiles, compete intensely based on cost and specific application requirements, particularly in demanding construction environments.

Opportunities for expansion are primarily centered on developing VAE products with enhanced sustainability profiles, such as bio-based or partially renewable VAE derivatives and totally formaldehyde-free formulations, addressing increasingly stringent global health and environmental standards. The growing demand for specialized, high-solid VAE emulsions suitable for advanced packaging and high-speed assembly adhesives presents a lucrative avenue for innovation. Furthermore, penetrating emerging application areas like specialized protective textiles, medical device adhesives, and advanced battery components, where VAE’s inherent flexibility and strong binding characteristics are advantageous, provides significant long-term growth potential. The net impact force is highly positive, suggesting that the potent drivers, particularly environmental mandates and construction demand, currently outweigh the cost-related restraints, sustaining the positive growth momentum projected for the forecast period.

Segmentation Analysis

The VAE Emulsion Market is meticulously segmented based on end-use application, technology employed, and geographical regions to provide a nuanced understanding of market dynamics and targeted growth opportunities. Segmentation by application highlights the distinct performance requirements of sectors like construction, adhesives, and textiles, enabling manufacturers to optimize product portfolios. The technology breakdown often differentiates between standard VAE grades and specialized formulations, such as low-VOC or formaldehyde-free variants, which command premium pricing and cater to regulatory compliance needs. Analyzing these segments helps stakeholders identify high-growth niches, allocate resources effectively for R&D, and tailor marketing strategies to specific industry needs, ranging from large-volume industrial packaging adhesives to small-batch, high-performance architectural coatings.

- By Application:

- Paints and Coatings (Architectural Coatings, Industrial Coatings, Specialty Paints)

- Adhesives (Packaging Adhesives, Wood Adhesives, Pressure Sensitive Adhesives, Bookbinding Adhesives)

- Construction (Cement Modification, Grout Additives, Waterproofing Membranes, Plaster)

- Textiles and Non-Wovens (Binding Agents, Fabric Finishing)

- Paper and Packaging (Paper Coatings, Corrugated Board Manufacturing)

- Others (Sealants, Medical Applications)

- By End-User Industry:

- Construction

- Packaging

- Automotive

- Textile

- Paper

- By Solids Content:

- Low Solids Content (below 50%)

- Medium Solids Content (50% - 60%)

- High Solids Content (above 60%)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Vae Emulsion Market

The VAE Emulsion value chain begins intensely upstream with the procurement of critical raw materials, primarily vinyl acetate monomer (VAM) and ethylene, alongside smaller volumes of stabilizers, initiators, and surfactants. VAM and ethylene pricing volatility, influenced heavily by global petrochemical markets and oil prices, exerts substantial pressure on the profitability of VAE manufacturers. Given that these materials represent a significant portion of the production cost, strategic long-term procurement contracts and backward integration into monomer production are crucial competitive advantages. The manufacturing stage involves complex, energy-intensive emulsion polymerization processes requiring specialized high-pressure reactors and stringent process control to ensure consistent particle size distribution and stability of the final emulsion. Efficiency improvements in this stage, often aided by continuous reaction processes, are key to maintaining cost competitiveness and reducing the environmental footprint.

Midstream activities involve formulation and compounding, where VAE emulsions are often customized with additives to meet specific customer requirements, such as adjusting viscosity, freeze-thaw stability, or tackiness for niche adhesive applications. Distribution channels are varied, involving both direct sales to large industrial customers (such as major paint and coatings manufacturers or large-scale construction chemical producers) and indirect sales through a network of specialized chemical distributors, particularly for smaller enterprises and regional markets. Direct distribution allows for better technical support and deeper collaboration on product specifications, which is vital for high-performance applications. Conversely, the extensive network of indirect distributors provides broad market reach and inventory management capabilities across diverse geographical areas, allowing producers to effectively service the highly fragmented adhesives and small construction chemical markets.

Vae Emulsion Market Potential Customers

The primary consumers of VAE emulsions are large-scale chemical formulators and manufacturers operating in high-volume industrial sectors, seeking reliable, high-performance, and environmentally compliant binders. The construction industry represents the largest buyer segment, utilizing VAE for cement and mortar modification to improve flexibility and bonding, in waterproof membranes, and as the core binder in architectural coatings. These customers require VAE grades that offer superior adhesion to concrete and masonry, as well as excellent durability under variable weather conditions. Demand is particularly high from producers of exterior insulation finishing systems (EIFS) and specialized flooring adhesives, driven by stringent building efficiency codes.

The second major group of buyers comprises adhesive manufacturers, servicing the packaging, woodworking, and pressure-sensitive adhesive markets. Packaging companies, fueled by the global e-commerce boom, demand high-speed setting, strong bond strength, and food-contact approved VAE dispersions for carton and box sealing. Woodworking customers seek VAE for durable furniture assembly and laminating applications. Additionally, the textile and non-woven industries are significant end-users, requiring VAE as a binder for fiber mats, disposable hygiene products, and specialized fabric finishes, prioritizing softness, resilience, and wash fastness in their formulations. Technical expertise and consistent batch quality are paramount for all these discerning industrial customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.8 Billion |

| Market Forecast in 2033 | $4.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, Celanese Corporation, BASF SE, Arkema S.A., Dow Inc., Synthomer plc, Benson Polymers, Vinavil S.p.A., Shandong Vast Chemical, Hexion Inc., Showa Denko K.K., Dairen Chemical Corporation, China Petroleum & Chemical Corporation (Sinopec), Reichhold LLC, LyondellBasell Industries, Kuraray Co., Ltd., ExxonMobil Chemical Company, Lotte Chemical Corporation, Shaanxi Bodi Chemical Co., Ltd., Ashland Global Holdings Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vae Emulsion Market Key Technology Landscape

The technological landscape of the VAE Emulsion Market is primarily defined by continuous innovation focused on improving sustainability, enhancing functional performance, and optimizing manufacturing efficiency. The foundational technology remains high-pressure, continuous emulsion polymerization, which allows for the efficient incorporation of ethylene into the vinyl acetate polymer chain, ensuring consistent copolymerization and precise control over the ethylene content—a critical factor determining the final film properties, such as flexibility, glass transition temperature (Tg), and elasticity. Recent technological advancements emphasize the move towards high-solids emulsions (above 60% solid content) which reduce transportation costs and drying times for end-users, while maintaining low viscosity and stability, posing a significant challenge that producers are addressing through advanced reactor design and specialized surfactant systems.

A major focus area is the development of ultra-low VOC and formaldehyde-free VAE grades. Traditionally, VAE emulsions sometimes required the use of formaldehyde releasers as biocides or stabilizers, but increasing regulatory scrutiny has necessitated the complete removal of these components. Leading manufacturers are investing heavily in new proprietary initiator systems and alternative stabilization chemistries that provide equivalent or superior microbial resistance without generating harmful byproducts. This shift is crucial for maintaining market access, particularly in Western European and North American architectural coatings and indoor air quality sensitive applications, such as children's toys and medical products. Furthermore, the industry is exploring bio-based VAE polymers, where a portion of the vinyl acetate is substituted with derivatives sourced from renewable feedstocks, although this technology is still in the nascent stage and scalability remains a hurdle due to cost and performance parity issues.

Another crucial technological trend is the advancement in reactor control and monitoring systems. Modern VAE production leverages sophisticated in-line analytical techniques and process automation to precisely manage reaction conditions like pH, temperature gradients, and monomer dosing rates. This precision is vital for creating narrow particle size distributions, which directly influence the rheological properties and application behavior of the emulsion, particularly its stability during high-shear mixing or freeze-thaw cycles. The application of artificial intelligence and machine learning in process control is emerging as a disruptive technology, enabling real-time fault detection and predictive quality assurance, ensuring that every batch meets the increasingly complex technical specifications demanded by diverse industrial customers globally.

Regional Highlights

The global VAE Emulsion Market exhibits distinct regional consumption and production patterns, driven primarily by local construction activity and environmental regulations. Asia Pacific (APAC) stands as the dominant region, accounting for the largest share of both consumption and production capacity. This dominance is attributable to rapid industrialization, massive infrastructure investments, and booming residential construction, particularly in India, China, and the ASEAN nations. VAE is highly sought after in APAC for its cost-effectiveness and performance in cement modification and low-cost architectural paints, making local manufacturing capacity critical for meeting regional demand. The region benefits from lower operational costs and the presence of several large, vertically integrated chemical producers.

North America and Europe represent mature markets characterized by steady, quality-driven growth, heavily influenced by stringent environmental regulations. Demand in these regions is primarily for high-value, specialized VAE grades—specifically ultra-low VOC, formaldehyde-free, and high-solid content emulsions—used in premium architectural coatings, specialized adhesives, and sophisticated construction chemicals. European demand, in particular, is catalyzed by the EU's REACH regulation and indoor air quality mandates, driving rapid substitution away from solvent-based systems. Manufacturers in these regions focus on technological superiority and supply chain reliability rather than sheer volume.

Latin America and the Middle East & Africa (MEA) are emerging regions that promise high future growth, albeit from a smaller base. MEA growth is closely tied to large-scale oil revenue-funded infrastructure projects and the expansion of the regional packaging industry, requiring construction-grade and adhesive-grade VAE. Latin America, led by Brazil and Mexico, demonstrates increasing adoption of water-based coatings and adhesives driven by local manufacturing expansion and improved construction standards. However, these regions often rely heavily on imports, making them sensitive to global shipping and raw material price fluctuations, which occasionally restricts market penetration.

- Asia Pacific (APAC): Market leader driven by rapid urbanization, extensive construction projects, and large-scale manufacturing output across China and India.

- Europe: High-value market segment focused exclusively on low-VOC, formaldehyde-free, and sustainable VAE formulations mandated by strict environmental standards.

- North America: Stable growth driven by renovations, strong residential housing starts, and regulatory compliance pushing transition to water-based systems, especially in architectural coatings.

- Latin America: Emerging market with potential in Brazil and Mexico, utilizing VAE in packaging adhesives and construction chemicals, but sensitive to economic volatility.

- Middle East & Africa (MEA): Growth tied to infrastructure development and industrial expansion in Gulf Cooperation Council (GCC) countries, primarily for construction and sealant applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vae Emulsion Market.- Wacker Chemie AG

- Celanese Corporation

- BASF SE

- Arkema S.A.

- Dow Inc.

- Synthomer plc

- Benson Polymers

- Vinavil S.p.A.

- Shandong Vast Chemical

- Hexion Inc.

- Showa Denko K.K.

- Dairen Chemical Corporation

- China Petroleum & Chemical Corporation (Sinopec)

- Reichhold LLC

- LyondellBasell Industries

- Kuraray Co., Ltd.

- ExxonMobil Chemical Company

- Lotte Chemical Corporation

- Shaanxi Bodi Chemical Co., Ltd.

- Ashland Global Holdings Inc.

Frequently Asked Questions

Analyze common user questions about the Vae Emulsion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is VAE Emulsion and its primary application in the construction industry?

VAE Emulsion, or Vinyl Acetate Ethylene copolymer, is a water-based polymer dispersion widely used in construction as a binder. Its primary application involves modifying cement mortars, plasters, and tile adhesives to enhance flexibility, improve adhesion to various substrates, and increase water resistance and durability.

How do stringent VOC regulations impact the demand for VAE Emulsions?

Stringent regulations limiting Volatile Organic Compounds (VOCs) are a primary driver for VAE demand. As a water-based system, VAE is inherently low-VOC, making it the preferred sustainable alternative to traditional, high-VOC solvent-based binders and coatings in North American and European markets.

Which geographical region dominates the consumption of VAE Emulsions?

The Asia Pacific (APAC) region dominates the consumption of VAE Emulsions, primarily fueled by extensive urbanization and massive investments in residential, commercial, and infrastructure construction projects across key economies like China and India, alongside strong growth in regional manufacturing.

What are the main raw material concerns affecting VAE production costs?

The primary raw material concern is the significant price volatility and reliance on petrochemical markets for vinyl acetate monomer (VAM) and ethylene. Fluctuations in crude oil prices and monomer supply chain stability directly impact the manufacturing cost and overall pricing structure of VAE emulsions globally.

What are 'high-solid' VAE emulsions and why are they gaining market traction?

High-solid VAE emulsions contain a higher percentage (typically above 60%) of polymer content by weight. They are gaining traction because they reduce drying time for end-users, minimize shipping costs, and improve efficiency in high-speed applications like packaging adhesives and industrial coatings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vae Emulsion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- VAE Emulsion Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Commonality VAE emulsion, Waterproofness VAE emulsion), By Application (Building Industry, Pain and Coatings, Adhesives, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager