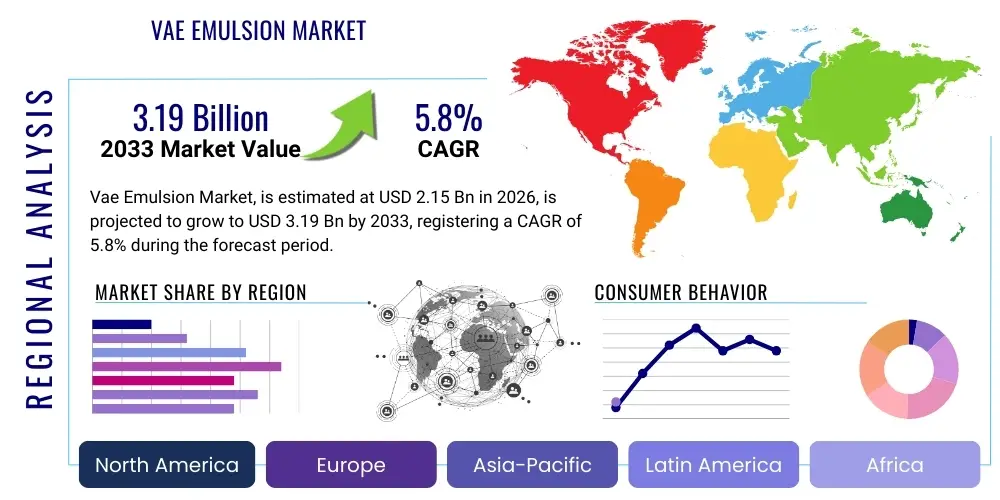

Vae Emulsion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434667 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Vae Emulsion Market Size

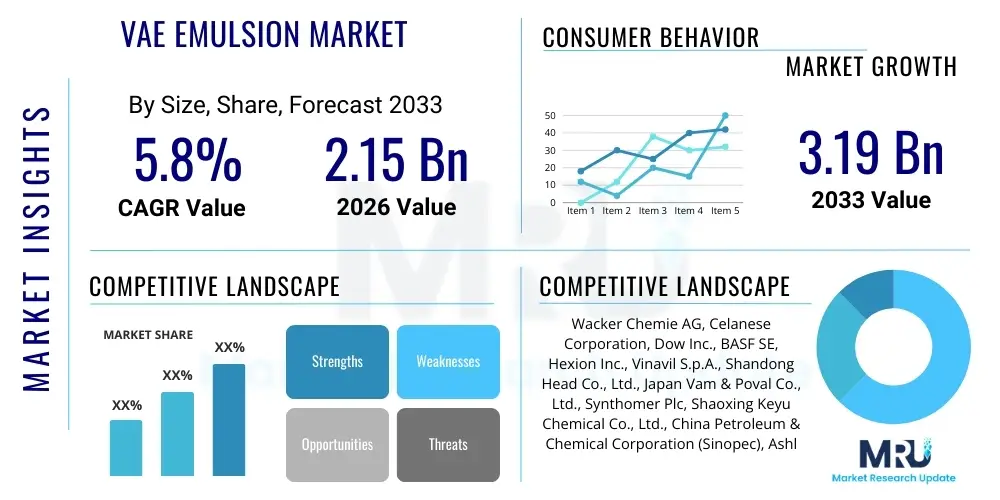

The Vae Emulsion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 3.19 Billion by the end of the forecast period in 2033.

Vae Emulsion Market introduction

Vinyl Acetate Ethylene (VAE) emulsions represent a crucial segment within the specialty chemicals market, characterized by their superior binding properties, flexibility, and reduced environmental impact compared to traditional solvent-based polymers. VAE emulsions are copolymers synthesized from vinyl acetate and ethylene monomers, resulting in water-based dispersions that offer an excellent balance of adhesion, water resistance, and low minimum film-forming temperature (MFFT). Their versatility makes them indispensable across various industrial applications, particularly in sectors focused on sustainable and high-performance material solutions. The inherent properties of VAE, such as exceptional toughness and elasticity, ensure robust performance in demanding environments, propelling their adoption globally.

The primary applications of VAE emulsions span numerous large industries, including architectural coatings (paints), adhesives, nonwovens, paper and packaging, and cement modification in construction. In the coatings sector, VAE polymers enable the formulation of low Volatile Organic Compound (VOC) paints that meet stringent regulatory standards while offering excellent scrub resistance and durability. For the adhesives industry, VAE provides strong wet tack and cohesive strength, making them ideal for woodworking, labeling, and specialized industrial bonding applications. This broad applicability, driven by consumer and regulatory demands for safer and greener materials, solidifies VAE’s position as a foundational material in modern manufacturing.

Key driving factors fueling market expansion include the rapid growth of the global construction industry, especially in Asia Pacific, where infrastructure development is accelerating. Furthermore, increasing consumer preference for environmentally friendly, water-based products is phasing out solvent-based alternatives, directly benefiting the VAE market. The benefit profile—including high binding capability, superior mechanical stability, and cost-effectiveness—ensures that VAE remains the preferred choice for manufacturers seeking performance without compromising sustainability goals. The continuous innovation in polymerization techniques also allows producers to tailor specific grades of VAE for highly specialized, high-margin applications.

Vae Emulsion Market Executive Summary

The VAE Emulsion Market is currently defined by robust business trends centered on sustainability and technological refinement. Key manufacturers are focusing heavily on developing specialty grades tailored for high-performance applications, such as redispersible polymer powders (RDPs) derived from VAE, which are critical for dry-mix mortars in the construction sector. Mergers and acquisitions remain a central strategy for market consolidation and geographical expansion, particularly as established players seek to secure raw material supply chains and expand their footprint in emerging economies. The overarching business goal is to optimize production efficiency while minimizing the environmental footprint, aligning with global ESG (Environmental, Social, and Governance) investment criteria. This strategic focus ensures sustained growth even amidst fluctuating raw material prices, notably ethylene and vinyl acetate monomer (VAM).

Regionally, the Asia Pacific (APAC) market dominates both consumption and production, driven by colossal growth in construction and textile industries, particularly in China and India. North America and Europe, while mature markets, exhibit steady growth fueled primarily by stringent environmental regulations favoring VAE over other alternatives and high demand for premium architectural coatings and specialty adhesives. Market competition is intense, requiring companies to differentiate through high-quality product portfolios and localized supply chain resilience. Emerging regional trends indicate significant investment in localized VAE manufacturing facilities across Southeast Asia and Latin America to mitigate long-distance shipping costs and tariffs, thereby enhancing market accessibility and responsiveness.

Segment trends highlight the dominance of the construction application segment, where VAE-based RDPs are seeing unprecedented adoption due to their ability to enhance the durability, flexibility, and workability of concrete and plasters. By type, the general-purpose VAE emulsion segment holds the largest share, but the specialty VAE formulations, designed for demanding applications like automotive adhesives or textile stiffeners, are projected to record the highest CAGR. The shift towards sustainable packaging materials also drives the demand for VAE in paper and board coating applications, emphasizing low migration and biodegradability. These segmentation dynamics underscore a market that is mature yet continuously evolving toward specialization and premiumization.

AI Impact Analysis on Vae Emulsion Market

User queries regarding AI's influence on the VAE Emulsion Market predominantly revolve around optimizing chemical synthesis, predicting raw material price volatility, and enhancing quality control in production. Users are keenly interested in how Artificial Intelligence can stabilize manufacturing processes, specifically addressing questions about using machine learning models to fine-tune polymerization parameters—such as temperature, pressure, and catalyst dosage—to achieve precise molecular weight distribution and particle size, crucial factors dictating VAE performance. A secondary theme concerns the integration of predictive analytics for supply chain management, enabling better forecasting of demand fluctuations in key end-use sectors like construction and textiles, thereby minimizing inventory costs and reducing waste associated with overproduction. The consensus expectation is that AI will initially impact operational efficiency before directly influencing product innovation.

The core challenge identified in user discourse is the integration cost and the requirement for specialized data scientists within traditionally conservative chemical manufacturing environments. Despite these hurdles, there is strong anticipation regarding AI's ability to create "digital twins" of VAE reactors. These models would simulate real-time performance under varying conditions, drastically cutting down physical R&D time for new specialty VAE formulations. Furthermore, AI-driven image recognition systems are being explored to automate quality checks on the final emulsion product, ensuring consistency in viscosity and solid content, critical parameters for industrial end-users. The deployment of smart sensor technology coupled with AI analytics is expected to yield substantial reductions in energy consumption during the drying and mixing phases of VAE production.

- AI-driven optimization of polymerization kinetics for targeted VAE polymer properties.

- Machine learning models used for predictive maintenance of reactor equipment, minimizing downtime.

- Enhanced raw material procurement strategies via predictive analytics on VAM and ethylene pricing.

- Automation of quality control processes using computer vision to analyze emulsion consistency.

- Development of "digital twin" simulations to accelerate R&D cycles for new VAE grades.

- Improved supply chain forecasting based on real-time market signals from construction and coatings sectors.

DRO & Impact Forces Of Vae Emulsion Market

The VAE Emulsion Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, resulting in significant impact forces. The primary drivers include the escalating global demand for sustainable and low-VOC construction materials and coatings, propelled by stricter environmental legislation across developed economies. The versatility of VAE, allowing its use in applications ranging from high-performance adhesives to specialized nonwoven binders, provides a substantial growth platform. However, the market faces significant restraints, chiefly the volatility and dependence on fossil fuel-derived raw materials, specifically vinyl acetate monomer (VAM) and ethylene, which are subject to geopolitical tensions and fluctuating crude oil prices. Additionally, the increasing competition from alternative, bio-based latex polymers poses a long-term challenge to VAE market share, requiring continuous innovation to maintain competitive advantage.

Opportunities for growth are abundant, particularly in emerging applications such as functional coatings for lithium-ion battery components and specialized binders for technical textiles. The increasing penetration of Redispersible Polymer Powders (RDPs) in Asian and Latin American construction markets presents a clear path for sustained volume growth. Furthermore, manufacturers are exploring bio-based VAE alternatives to mitigate dependency on petroleum-derived inputs, offering a crucial opportunity to align product offerings with future sustainability mandates. The impact forces are thus dominated by the 'Green Transition,' where regulatory pressure acts as a powerful driver, pushing the industry toward sustainable sourcing and manufacturing practices, making operational efficiency and environmental compliance non-negotiable competitive factors.

The collective impact forces suggest a market trajectory where high-performance and environmental attributes are paramount. Regulatory incentives for green building materials strengthen the VAE position in construction, while the inherent cost volatility of feedstocks necessitates rigorous hedging and diversification strategies. Companies prioritizing vertical integration or securing long-term supply contracts for VAM will gain a significant competitive edge. Furthermore, the market is continually subject to technological impact forces, where innovations improving water resistance and heat stability open up new, previously inaccessible high-value applications, such as exterior insulation finishing systems (EIFS) and specialized automotive assembly adhesives.

Segmentation Analysis

The VAE Emulsion market segmentation provides a granular view of market dynamics based on chemistry, application, and end-use characteristics. The market is primarily divided by type into standard grades, offering general-purpose binding and coating capabilities, and specialty grades, which are engineered for superior performance in demanding conditions like high humidity or extreme temperature fluctuations. Application segmentation highlights the dominance of architectural coatings and adhesives, while the end-user segmentation clearly indicates the construction and packaging sectors as the primary consumption hubs. Understanding these segments is vital for strategic planning, allowing companies to allocate resources effectively toward fast-growing or high-margin niche areas, such as the increasing demand for high-solids VAE emulsions in sustainable rigid packaging.

- By Type:

- Standard VAE Emulsions

- High Solids VAE Emulsions

- Specialty VAE Emulsions (e.g., Ultra-low VOC)

- Redispersible Polymer Powders (RDPs)

- By Application:

- Adhesives (Woodworking, Packaging, Tapes & Labels)

- Coatings (Architectural Paints, Industrial Coatings)

- Construction Materials (Tile Adhesives, Self-leveling Compounds, Mortars)

- Nonwovens & Textiles (Diaper Backings, Carpet Backing)

- Paper & Packaging (Paper Coatings, Board Lamination)

- By End-User Industry:

- Construction and Infrastructure

- Packaging

- Automotive and Transportation

- Textiles and Nonwovens

- Consumer Goods

Value Chain Analysis For Vae Emulsion Market

The VAE Emulsion value chain begins with the upstream procurement of essential raw materials, principally vinyl acetate monomer (VAM) and ethylene, which are derived from petrochemical feedstocks. This upstream stage is characterized by high capital investment and reliance on major chemical producers who often integrate vertically to secure supply. Fluctuations in crude oil prices directly impact VAM and ethylene costs, posing the initial level of risk in the value chain. Successful VAE producers maintain strong relationships with major VAM suppliers or engage in internal production to mitigate supply disruption and price volatility. Efficient synthesis processes and advanced catalyst technology are crucial at this stage to ensure high yield and purity of the resulting polymer emulsion.

The central stage involves the manufacturing and formulation of VAE emulsions through advanced emulsion polymerization techniques. Manufacturers focus on optimizing process parameters to control critical product attributes like particle size, solid content, and minimum film formation temperature (MFFT), thereby tailoring the VAE product for specific end-use requirements (e.g., highly flexible VAE for nonwovens vs. rigid VAE for construction additives). Quality assurance and regulatory compliance (e.g., REACH, FDA standards for food contact packaging) are paramount during manufacturing. Distribution channels for VAE emulsions are multi-faceted, utilizing both direct sales to large, integrated industrial end-users (e.g., major paint manufacturers) and indirect distribution through specialized chemical distributors and agents, particularly in fragmented markets or for smaller customers.

Downstream activities involve the incorporation of the VAE emulsion into final products. Direct sales channels are common for bulk orders where technical support and customized formulations are required, especially for large construction chemical formulators. Indirect channels, utilizing regional distributors, are essential for penetrating geographically dispersed small-to-medium enterprises (SMEs) in coatings and adhesives. The final step involves the end-user application, where product performance dictates repeat purchase decisions. Key factors at the downstream level include technical service responsiveness, reliable delivery logistics, and the ability of the VAE product to enhance the sustainability profile of the end-user’s final goods, thereby linking back environmental performance to the overall value delivered.

Vae Emulsion Market Potential Customers

Potential customers for VAE emulsions are widely diversified across major industrial sectors, seeking water-based, versatile, and environmentally compliant binding agents. The largest segments of buyers are companies operating in the construction sector, including manufacturers of dry-mix mortars, tile adhesives, grouts, and cementitious waterproofing membranes, who rely heavily on VAE-based Redispersible Polymer Powders (RDPs) for enhancing mechanical properties and application workability. Another significant customer base comprises architectural and protective coatings manufacturers, who demand high-quality VAE emulsions for formulating low-VOC interior and exterior paints that provide superior adhesion and durability, satisfying both regulatory and consumer performance criteria.

The adhesives and sealants industry represents a rapidly expanding customer segment, where VAE is used in everything from high-speed packaging applications and bookbinding to specialized pressure-sensitive tapes and labels. These customers require VAE grades offering rapid setting times, strong wet tack, and flexibility for diverse substrate bonding. Furthermore, manufacturers in the paper and packaging industry are crucial buyers, utilizing VAE for coating applications that improve printability, barrier properties, and moisture resistance of paperboard and corrugated materials, increasingly focusing on sustainable and recyclable packaging solutions.

A smaller, but high-value customer base exists within the nonwovens and textiles sectors. Nonwoven manufacturers, producing items like hygiene products, medical gowns, and technical wipes, use VAE as a binder to impart strength and absorbency. Textile companies employ VAE for stiffening, sizing, and specialized finishes. In essence, any manufacturing operation requiring a safe, high-performance, water-based polymer to bind, coat, or modify materials is a potential customer, driving robust demand for customized VAE formulations tailored to specific processing equipment and end-product specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 3.19 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, Celanese Corporation, Dow Inc., BASF SE, Hexion Inc., Vinavil S.p.A., Shandong Head Co., Ltd., Japan Vam & Poval Co., Ltd., Synthomer Plc, Shaoxing Keyu Chemical Co., Ltd., China Petroleum & Chemical Corporation (Sinopec), Ashland Global Holdings Inc., Arkema S.A., Dairen Chemical Corporation, FORS Chemical Co., Ltd., Kuraray Co., Ltd., Benson Polymer Industries, Sumitomo Chemical Co., Ltd., Clariant AG, Organik Kimya. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vae Emulsion Market Key Technology Landscape

The VAE Emulsion market is characterized by a technology landscape focused on advancing emulsion polymerization techniques to achieve specific performance enhancements. A crucial area of technological development involves the synthesis of ultra-low or zero-VOC VAE emulsions, achieved primarily by optimizing initiator systems and using specialized surfactants that reduce the concentration of residual monomers. This aligns with the global shift towards green chemistry. Another key focus is the development of VAE grades with enhanced compatibility and stability when mixed with cementitious systems, which is vital for high-performance Redispersible Polymer Powders (RDPs) used in self-leveling floors and specialized facade mortars. Manufacturers are leveraging advanced particle engineering to control the morphology and glass transition temperature (Tg) of the polymer particles, thereby tailoring the emulsion's flexibility and binding strength.

Advanced reactor technology, including continuous stirred-tank reactors (CSTRs) and semi-batch processes, is continually being refined to improve production efficiency and scalability while ensuring precise control over the copolymerization reaction between vinyl acetate and ethylene. Technological innovation is also directed towards developing VAE grades that offer superior water resistance and adhesion to difficult substrates, such as plastics and metals, opening up avenues in automotive assembly and industrial lamination. Furthermore, the integration of digital tools and process analytical technology (PAT) into manufacturing facilities allows for real-time monitoring and adjustment of reaction conditions, maximizing product consistency and minimizing off-spec batches, thereby supporting the high-quality demands of specialty applications.

A burgeoning technological trend is the exploration of bio-based feedstocks to partially replace VAM, aiming to reduce the polymer's dependence on fossil fuel sources and improve its long-term sustainability profile. While challenging due to performance requirements and cost implications, research into utilizing bio-ethylene derivatives represents a critical path for future innovation. In addition to formulation chemistry, sophisticated drying technologies, such as spray drying, are essential for the efficient and cost-effective production of high-quality RDPs, requiring significant investment in energy-efficient equipment to maintain competitiveness in the dry-mix construction chemicals sector.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily fueled by massive infrastructure investment and rapid urbanization in countries like China, India, and Southeast Asia. The robust demand in the construction sector for dry-mix mortars and high-performance adhesives, coupled with expansion in the textile and nonwovens industries, makes this region a critical hub for both consumption and localized production capacity expansion.

- North America: This region is characterized by high market maturity and stringent environmental regulations, driving the demand for specialty, ultra-low VOC VAE emulsions in architectural coatings and premium adhesives. Innovation in sustainable building practices and retrofitting older structures sustains steady growth, with a strong focus on high-quality, long-lasting construction materials.

- Europe: Similar to North America, the European market is highly regulated, prioritizing sustainability and safety. Demand is concentrated on high-specification VAE grades for EIFS (Exterior Insulation Finishing Systems) and for meeting REACH compliance requirements in adhesives and packaging. Western Europe exhibits stable, value-driven growth, while Eastern Europe presents moderate expansion opportunities in newer construction markets.

- Latin America (LATAM): LATAM represents an emerging growth region, driven by expanding construction activities in Brazil and Mexico. The market is gradually shifting from solvent-based systems to water-based VAE, reflecting increasing environmental awareness and economic development, though price sensitivity remains a key factor influencing product selection.

- Middle East and Africa (MEA): Growth in MEA is highly dependent on large-scale government-funded infrastructure projects, particularly in the GCC countries. The climate demands VAE formulations with superior heat stability and water resistance for use in specialized coatings and cement modification, resulting in targeted demand for high-performance specialty VAE products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vae Emulsion Market.- Wacker Chemie AG

- Celanese Corporation

- Dow Inc.

- BASF SE

- Hexion Inc.

- Vinavil S.p.A.

- Shandong Head Co., Ltd.

- Japan Vam & Poval Co., Ltd.

- Synthomer Plc

- Shaoxing Keyu Chemical Co., Ltd.

- China Petroleum & Chemical Corporation (Sinopec)

- Ashland Global Holdings Inc.

- Arkema S.A.

- Dairen Chemical Corporation

- FORS Chemical Co., Ltd.

- Kuraray Co., Ltd.

- Benson Polymer Industries

- Sumitomo Chemical Co., Ltd.

- Clariant AG

- Organik Kimya

Frequently Asked Questions

Analyze common user questions about the Vae Emulsion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of VAE emulsions over traditional polymer binders?

VAE emulsions offer significant advantages due to their water-based, low Volatile Organic Compound (VOC) nature, making them environmentally friendly. They provide excellent flexibility, superior adhesion, and robust water resistance, crucial for durable architectural coatings and high-performance cement modification in construction, often outperforming alternatives like pure PVA (Polyvinyl Acetate) in demanding applications.

How does the volatility of VAM and ethylene impact VAE emulsion pricing and supply chains?

Since Vinyl Acetate Monomer (VAM) and Ethylene are the primary, petrochemical-derived feedstocks for VAE, their price volatility—influenced by crude oil markets and geopolitical factors—directly translates to fluctuations in VAE emulsion manufacturing costs. This requires VAE producers to implement advanced hedging strategies and focus on maximizing production efficiency to stabilize final product pricing for consumers.

Which application segment drives the highest demand and growth rate for the VAE market?

The construction industry, particularly the segment utilizing Redispersible Polymer Powders (RDPs) derived from VAE, drives the highest volume and growth. RDPs are essential for enhancing the performance of dry-mix mortars, tile adhesives, and self-leveling compounds, meeting the rising global demand for efficient, durable, and ready-to-use construction chemicals, especially in emerging Asian markets.

What role do environmental regulations play in the adoption of VAE emulsions?

Environmental regulations, particularly those limiting VOC content in coatings and adhesives (e.g., in North America and Europe), are the most significant market drivers. VAE emulsions naturally comply with these stringent standards because they are water-based and typically contain minimal or zero VOCs, accelerating their substitution for older, solvent-based binding systems across various industrial applications.

What technological trends are shaping the future development of VAE products?

Future VAE product development focuses on creating specialty grades with enhanced functionality, including superior hydrophobic properties for exterior applications and improved thermal stability. Key technological trends involve ultra-low VOC synthesis, utilizing advanced particle engineering to control polymer morphology, and exploring bio-based or partially renewable raw materials to further improve the material's environmental footprint and long-term sustainability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Vae Emulsion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- VAE Emulsion Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Commonality VAE emulsion, Waterproofness VAE emulsion), By Application (Building Industry, Pain and Coatings, Adhesives, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager