VAE Redispersible Powder Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443487 | Date : Feb, 2026 | Pages : 245 | Region : Global | Publisher : MRU

VAE Redispersible Powder Market Size

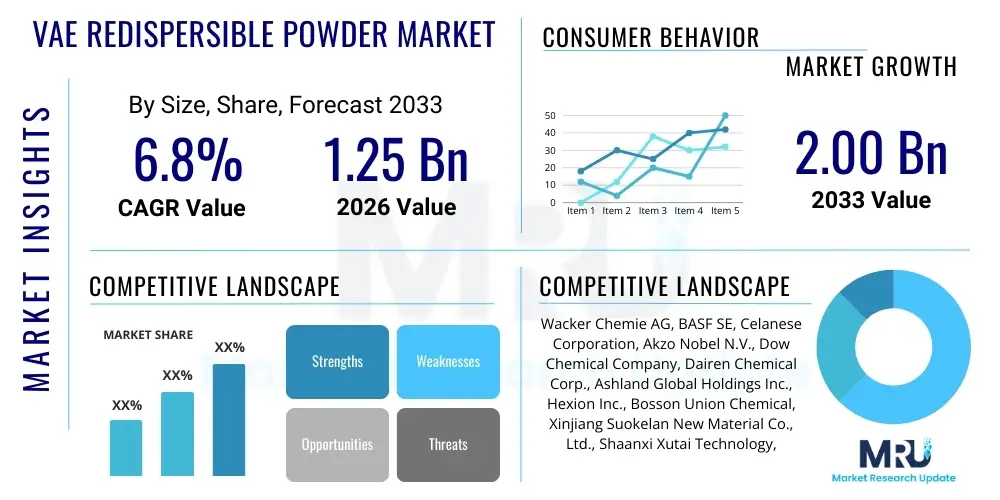

The VAE Redispersible Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

VAE Redispersible Powder Market introduction

The VAE Redispersible Powder (RDP) market encompasses specialized polymer emulsions, primarily based on Vinyl Acetate Ethylene (VAE) copolymers, which are dried into fine powder form and utilized as organic binders in dry mix mortars and various construction materials. VAE RDPs are integral components that significantly enhance the performance characteristics of cementitious systems, providing superior adhesion, flexibility, water resistance, and tensile strength. Their ease of incorporation into dry blends makes them highly desirable in modern construction practices, particularly for applications requiring high durability and improved workability.

The core product, VAE RDP, is synthesized through the polymerization of vinyl acetate and ethylene, followed by a meticulous spray-drying process that encapsulates the polymer particles with a protective colloidal system, often based on polyvinyl alcohol. Upon mixing with water, these powders re-disperse back into stable emulsions, thereby binding the aggregates and fillers within the mortar matrix. Major applications include tile adhesives, external thermal insulation composite systems (ETICS/EIFS), self-leveling compounds, wall putties, and repair mortars. The performance attributes provided by VAE RDP—such as increased cohesion and reduced cracking—are essential for meeting stringent modern building codes and energy efficiency standards worldwide.

The market is predominantly driven by the accelerating pace of global construction activities, rapid urbanization, and massive infrastructure development in emerging economies, notably across the Asia Pacific region. Furthermore, the increasing demand for high-performance and sustainable building materials, coupled with a regulatory push towards energy-efficient construction, strongly favors the adoption of VAE RDP in specialized dry mix applications. The inherent benefits, including extended shelf life of dry mixes and logistical efficiency compared to liquid emulsions, solidify the market position of VAE RDP as a crucial additive in the modern construction chemical landscape.

VAE Redispersible Powder Market Executive Summary

The VAE Redispersible Powder market is poised for robust expansion, fundamentally underpinned by global shifts toward modular, efficient, and durable construction methodologies. Business trends highlight significant investment in advanced spray drying technology to improve powder quality, ensuring better consistency and higher solid content in the final polymer. Manufacturers are focusing on differentiating their product portfolios by developing specialized RDP grades tailored for high-temperature applications, low-VOC requirements, and enhanced hydrophobicity, catering specifically to the sophisticated demands of the European and North American green building sectors. Strategic mergers, acquisitions, and capacity expansions, particularly in Asia, define the competitive landscape as companies seek to secure raw material supply chains and optimize distribution networks.

Regional trends indicate that the Asia Pacific (APAC) region remains the epicenter of market growth, driven by colossal housing projects, extensive infrastructural investments, and burgeoning construction chemical manufacturing hubs, especially in China and India. While APAC leads in volume, Europe and North America demonstrate higher revenue generation per unit due to premium product pricing and widespread adoption of complex applications like External Insulation and Finish Systems (EIFS). European regulations, such as REACH, continue to influence product formulation, driving manufacturers toward environmentally compliant and high-performance, low-emission RDPs, thereby establishing critical benchmarks for global quality standards.

Segmentation trends reveal that the Tile Adhesives and Grouts segment maintains the largest market share, fueled by global flooring material installation growth. However, the EIFS/ETICS segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), reflecting the urgent global focus on building energy efficiency and reduced carbon footprints. In terms of product segmentation, the modified VAE RDP variants, offering tailored performance characteristics such as higher flexibility or superior water repellency, are gaining traction over conventional grades, signaling a shift toward specification-driven procurement across mature markets.

AI Impact Analysis on VAE Redispersible Powder Market

Analysis of common user questions regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the VAE Redispersible Powder sector indicates a primary focus on optimizing complex chemical processes, enhancing supply chain resiliency, and accelerating material innovation. Users frequently inquire about how AI can predict the correlation between raw material input variability (such as ethylene and VAM prices) and the resulting RDP product performance characteristics. Key concerns revolve around the capital expenditure required for implementing AI-driven quality control systems and the capability of ML algorithms to simulate the intricate spray-drying kinetics, which directly influences powder dispersibility and shelf life. Expectations center on AI streamlining R&D cycles for developing novel RDP formulations tailored to specific mortar chemistries, thereby reducing time-to-market for high-performance building materials, and enabling predictive maintenance in high-throughput manufacturing plants to minimize costly downtime and improve energy efficiency.

- AI-driven optimization of polymerization reactor conditions to ensure consistent VAE emulsion quality.

- Machine Learning models predicting the optimal spray-drying parameters (temperature, flow rate) for desired particle size distribution and anti-caking properties.

- Predictive supply chain analytics managing volatility in Vinyl Acetate Monomer (VAM) and ethylene prices, optimizing procurement strategies.

- Automated spectroscopic analysis and image processing for real-time quality control of RDP morphology and dispersibility.

- AI tools accelerating the simulation and testing of new RDP formulations for specific construction applications (e.g., highly flexible tile adhesives).

- Enhanced inventory management systems leveraging AI for demand forecasting in specific regional construction markets.

DRO & Impact Forces Of VAE Redispersible Powder Market

The dynamics of the VAE Redispersible Powder market are fundamentally shaped by a confluence of accelerating drivers and persistent restraints, creating powerful impact forces. The primary driver is the sheer scale of global construction activity, particularly the sustained urbanization and infrastructure spending across emerging economies, which necessitates vast volumes of dry mix mortars. Complementing this is the escalating environmental and regulatory pressure in developed markets demanding superior, long-lasting construction solutions, pushing the adoption of high-quality RDPs in specialized applications like EIFS. These drivers provide significant momentum for market expansion, ensuring steady demand growth from end-users seeking enhanced performance in terms of water resistance and adhesion strength.

However, the market faces notable restraints, chiefly stemming from the inherent volatility and cost fluctuation of key raw materials, specifically Vinyl Acetate Monomer (VAM) and ethylene, which are petrochemical derivatives. These price shifts directly impact manufacturing margins and influence the final pricing of VAE RDPs, occasionally leading to slower adoption rates in price-sensitive construction segments. Furthermore, the technical complexity and high energy consumption associated with the spray-drying process, coupled with the need for specialized storage and transport conditions to maintain powder quality, present logistical and operational challenges that restrain rapid, unqualified market entry.

Opportunities for growth are abundant, particularly in the development and commercialization of bio-based or functionalized RDPs designed for niche applications, such as high-slip resistance flooring or improved compatibility with specific gypsum and anhydrite binders. The substantial, untapped potential in retrofitting and repair markets, especially in aging infrastructure across Europe and North America, offers a long-term revenue stream for high-performance RDP formulations. The net impact force is highly positive; while raw material costs pose cyclical challenges, the overwhelming global necessity for durable, energy-efficient, and easy-to-use construction chemicals ensures continuous innovation and market penetration for VAE RDP products.

Segmentation Analysis

The VAE Redispersible Powder market segmentation provides granular insight into demand patterns, technological preferences, and application-specific requirements. The market is primarily divided based on its chemical composition (Type) and its intended end-use (Application). Segmentation by Type distinguishes between standard (conventional) VAE RDPs, which offer basic adhesion and flexibility, and modified VAE RDPs, which include additives for specialized performance enhancements such as hydrophobicity (water repellency), increased alkali resistance, or improved setting time control. The Application segment is critical, as the performance requirements vary drastically between a standard tile adhesive and a sophisticated external insulation system, driving distinct manufacturing and marketing strategies for each target end-use.

- By Type:

- Conventional VAE RDP

- Modified VAE RDP (e.g., Hydrophobic, Functionalized)

- By Application:

- Tile Adhesives and Grouts

- External Thermal Insulation Composite Systems (ETICS/EIFS)

- Skim Coats/Wall Putties

- Self-Leveling Compounds

- Repair Mortars

- Other Applications (e.g., Joint fillers, waterproofing membranes)

- By End-User:

- Residential Construction

- Commercial Construction

- Infrastructure

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For VAE Redispersible Powder Market

The VAE Redispersible Powder value chain begins with the upstream procurement of essential raw materials, primarily Vinyl Acetate Monomer (VAM), Ethylene, and protective colloids like Polyvinyl Alcohol (PVA). VAM and ethylene are sourced from large petrochemical companies, and their price volatility significantly influences manufacturing costs downstream. The midstream stage involves the chemical synthesis—polymerization of VAM and ethylene to form VAE emulsions—followed by the highly energy-intensive spray-drying process, which converts the liquid emulsion into the final powder product. This manufacturing stage requires significant capital investment in sophisticated drying and blending equipment, placing a high premium on operational efficiency and energy management.

The downstream segment encompasses the distribution and utilization of the RDP. Manufacturers typically rely on a mixed distribution channel: direct sales to major multinational construction chemical formulators and large dry mix producers, and indirect sales through specialized chemical distributors and agents, particularly for serving smaller, localized construction companies. These distributors often manage warehousing and technical support, acting as crucial intermediaries in regional markets. The end-users, primarily dry mix mortar producers, incorporate the VAE RDP into their final formulations (e.g., tile adhesives, plasters), which are then sold to construction contractors and DIY retailers.

The direct channel offers manufacturers greater control over product branding and pricing, fosters closer collaboration for custom formulation development, and is often preferred for high-volume, continuous supply contracts with major global players. Conversely, the indirect channel, leveraging regional distributors, is essential for achieving market penetration in fragmented geographical areas and reducing logistical complexity. Optimization across the entire value chain, particularly mitigating raw material price risk through hedging and optimizing spray-drying processes using advanced analytics, is vital for maintaining competitive advantage and ensuring product quality consistency throughout the market.

VAE Redispersible Powder Market Potential Customers

The primary customers for VAE Redispersible Powder are specialized chemical buyers within the construction industry who utilize the product as a crucial additive to enhance the functional performance of their final construction materials. The largest customer group consists of dry mix mortar manufacturers. These entities produce pre-blended, ready-to-use powdered construction products, such as cement-based tile adhesives, grouts, and self-leveling flooring compounds, where consistent performance and long shelf life are paramount. These customers demand high-quality RDPs that guarantee superior flexibility, water retention, and bond strength when activated on site.

Another significant customer segment includes companies specializing in External Thermal Insulation Composite Systems (ETICS) or Exterior Insulation and Finish Systems (EIFS). For these energy-saving systems, RDPs are integrated into the adhesive and base coat layers to provide exceptional crack bridging capability, weather resistance, and strong adhesion to insulation boards (like EPS or mineral wool) and substrates. Furthermore, producers of wall putties and skim coats represent a broad customer base, particularly in rapidly urbanizing regions, as RDPs improve the surface hardness, crack resistance, and workability of these finishing materials. Infrastructure projects, particularly those involving concrete repair and specialized high-performance mortars for bridges and tunnels, also constitute a niche, high-value customer segment, requiring RDPs with superior durability and alkali resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Wacker Chemie AG, BASF SE, Celanese Corporation, Dow Chemical Company, AkzoNobel N.V., Benson Polymers, Shaanxi Xiwang, Hexion Inc., DCC Group, China Petroleum & Chemical Corporation (Sinopec), VINAVIL S.p.A., Shandong Xindadi, Ashland Global Holdings Inc., Wanwei Group, Organik Kimya, Dairen Chemical Corporation, Gem Polymer, Showa Denko K.K. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VAE Redispersible Powder Market Key Technology Landscape

The technological landscape of the VAE Redispersible Powder market is dominated by advancements in polymerization techniques and optimization of the spray-drying process, which collectively determine the final product’s quality, shelf stability, and application performance. In polymerization, focus areas include achieving a narrow particle size distribution (PSD) in the original emulsion and introducing functional monomers to create highly modified copolymers, enhancing specific properties such as adhesion to difficult substrates or resistance to saponification. Manufacturers are increasingly utilizing sophisticated reaction control systems to ensure uniformity in VAE composition, thereby improving the consistency of the RDP performance in the field, a crucial factor for major construction formulators.

The most critical technology remains the industrial-scale spray drying operation. Innovations here center on improving energy efficiency, reducing operational costs, and perfecting the encapsulation process. Modern spray dryers employ advanced atomization technologies and precise temperature control mechanisms to minimize polymer degradation while ensuring the formation of spherical, easily redispersible particles. Furthermore, anti-caking technology is paramount; specialized inorganic additives (often mineral fillers) and surface treatment agents are continually refined to prevent the thermoplastic polymer particles from fusing during storage and transport, especially in hot and humid environments characteristic of tropical construction zones.

A burgeoning technological area involves the development of low-VOC and formaldehyde-free formulations, aligning with global green building initiatives and stringent regulations, particularly in Western markets. Producers are also leveraging advanced analytical techniques, such as thermal analysis and electron microscopy, to better understand the microstructure and hydration mechanism of RDPs within cementitious matrices. This research drives the development of next-generation RDPs that offer multi-functional benefits, combining superior binding strength with integral waterproofing capabilities, pushing the boundaries of dry mix mortar performance and expanding the potential applications beyond traditional plastering and tiling.

Regional Highlights

The global VAE Redispersible Powder market exhibits significant regional divergence in terms of consumption volume, product maturity, and regulatory influence. Asia Pacific (APAC) currently holds the dominant share in both production capacity and consumption volume, a trend driven by unparalleled infrastructure investment and burgeoning residential construction sectors, particularly in China, India, and Southeast Asian nations. The rapid pace of urbanization in these regions necessitates quick, cost-effective, and high-quality construction solutions, making VAE RDPs an indispensable additive in dry mix manufacturing. While price sensitivity is higher in APAC compared to Western markets, the sheer scale of demand ensures this region will remain the principal growth engine throughout the forecast period. Furthermore, regional governments are increasingly adopting modern building codes that favor high-performance materials, stimulating the demand for better RDP grades.

Europe represents a mature yet high-value market, characterized by stringent environmental regulations (like the EU's REACH framework) and a strong emphasis on energy efficiency through systems like ETICS (External Thermal Insulation Composite Systems). The European market demands premium, specialized RDP products that offer enhanced water repellency, exceptional crack bridging, and low-VOC content. Growth in Europe is primarily driven not by new construction volume, but by extensive renovation, repair, and retrofit projects aimed at upgrading aging building stock to meet stringent climate targets. This focus on long-term durability and specialized performance ensures that manufacturers operating in this region must continually innovate in terms of sustainable chemistry and application-specific functionality.

North America demonstrates steady growth, propelled largely by residential repair and remodeling activities, alongside increasing infrastructure investments. The adoption of VAE RDPs is robust in high-performance tile installation systems and specialized patching compounds. While manufacturing capacity is often lower here compared to APAC and Europe, the region benefits from a reliable supply chain and a strong focus on high-quality proprietary formulations. Latin America and the Middle East & Africa (MEA) are emerging regions experiencing moderate growth. Growth in the MEA region is strongly tied to large-scale, capital-intensive public works projects and the need for building materials that can withstand harsh, extreme climatic conditions, driving demand for specialized, robust RDP formulations that offer exceptional thermal stability and durability.

- Asia Pacific (APAC): Dominant market share fueled by infrastructure development, massive urbanization, and high-volume dry mix production in China and India.

- Europe: High-value market focused on premium, low-VOC RDPs; growth driven by strict ETICS/EIFS regulations, renovation, and sustainable building standards.

- North America: Steady demand anchored by residential renovation, specialized tile adhesives, and growing focus on resilient, high-performance construction systems.

- Latin America (LATAM): Emerging potential due to increasing modernization of construction practices and rising use of ready-mix mortars.

- Middle East and Africa (MEA): Growth dependent on large government-backed construction projects and the need for materials resilient to extreme temperatures and high salinity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VAE Redispersible Powder Market.- Wacker Chemie AG

- BASF SE

- Celanese Corporation

- Dow Chemical Company

- AkzoNobel N.V.

- Benson Polymers

- Shaanxi Xiwang

- Hexion Inc.

- DCC Group

- China Petroleum & Chemical Corporation (Sinopec)

- VINAVIL S.p.A.

- Shandong Xindadi

- Ashland Global Holdings Inc.

- Wanwei Group

- Organik Kimya

- Dairen Chemical Corporation

- Gem Polymer

- Showa Denko K.K.

- Kuraray Co., Ltd.

- Synthomer Plc

Frequently Asked Questions

Analyze common user questions about the VAE Redispersible Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is VAE Redispersible Powder (RDP) and how does it function in construction materials?

VAE RDP is a white, free-flowing powder made by spray-drying Vinyl Acetate Ethylene polymer emulsions. It acts as an organic binder in dry mix mortars, re-dispersing upon mixing with water to form a stable polymer film that enhances adhesion, flexibility, tensile strength, and water resistance in materials like tile adhesives and plasters.

Which application segment drives the highest demand for VAE RDP?

The Tile Adhesives and Grouts segment typically constitutes the largest market share globally, driven by widespread residential and commercial flooring installation. However, the External Thermal Insulation Composite Systems (ETICS/EIFS) application is experiencing the fastest growth rate due to global mandates for building energy efficiency.

What are the primary factors restraining growth in the VAE RDP market?

The main restraining factor is the high degree of price volatility observed in key petrochemical raw materials, specifically Vinyl Acetate Monomer (VAM) and ethylene. Fluctuations in these input costs directly impact manufacturing profitability and the affordability of the final dry mix products for end-users.

How do regional trends differ between APAC and European VAE RDP markets?

APAC dominates in terms of high-volume consumption driven by new infrastructure and urbanization, often prioritizing cost efficiency. Conversely, Europe is a high-value market where demand is driven by stringent regulatory compliance (e.g., low-VOC) and premium products required for extensive renovation and energy-saving ETICS applications.

What technological advancements are influencing VAE RDP product quality?

Key technological advancements include optimization of the spray-drying process for superior particle size distribution and improved energy efficiency, development of specialized anti-caking additives for better shelf life stability, and the introduction of functionalized monomers for enhanced properties like high hydrophobicity and chemical resistance.

The VAE Redispersible Powder market is an essential component of the global construction chemicals industry, intrinsically linked to the macroeconomic performance of the building sector worldwide. Its growth trajectory is stable and predictable, largely secured by the ongoing necessity for durable, modern construction materials that simplify site operations and meet escalating performance standards. The inherent advantages of RDPs over liquid emulsions, primarily concerning transport, storage, and ease of use in dry mix formulations, guarantee their continued widespread adoption across all geographies. Furthermore, the push towards sustainability and energy conservation globally ensures that specialized, high-performance RDP grades, particularly those designed for External Thermal Insulation Composite Systems (ETICS), will see accelerated demand.

The competition within this market is characterized by a few major global chemical giants, such as Wacker and Celanese, alongside numerous strong regional players, especially prevalent in the rapidly expanding APAC region. These companies continually invest in R&D to enhance the technical characteristics of their powders—focusing on better adhesion under variable environmental conditions, increased resistance to water penetration, and improved alkali resistance necessary for long-term compatibility with cementitious materials. Innovation is focused not just on the polymer chemistry itself, but also on the encapsulation and surface treatment technologies that prevent agglomeration during storage, which is a key differentiator in highly humid markets.

Analyzing the supply side reveals that dependency on petrochemical feedstocks remains a central vulnerability. Strategic market players are mitigating this risk by establishing integrated production facilities, securing long-term contracts for VAM and ethylene, and diversifying their product lines to offer alternatives during periods of extreme price volatility. Moreover, the increasing adoption of automated manufacturing and quality control systems, often leveraging AI and advanced sensors, is enhancing production consistency and reducing operational waste. This focus on efficiency and quality control is critical for maintaining market credibility, particularly when supplying large, multinational construction chemical manufacturers who require strict adherence to performance specifications across their global operations. The future growth will be defined by the successful commercialization of highly specialized, functional RDPs that address specific, previously unmet needs in advanced construction applications, such as large format tile setting and high-speed self-leveling flooring.

The segment related to skim coats and wall putties, while less demanding in terms of polymer load compared to tile adhesives, represents a huge volume market, particularly in developing nations where interior finishing is often a manual, high-labor process. VAE RDPs improve the workability and sandability of these finishes, leading to smoother surfaces and fewer defects. The demand in this segment is directly correlated with new housing starts and renovation cycles. The push for pre-mixed, high-quality wall finishes—moving away from traditional site-mixed plasters—is a significant trend benefiting VAE RDP producers. Manufacturers are optimizing RDP grades for compatibility with gypsum and lime-based systems, broadening the applicability beyond traditional cementitious matrices.

In terms of end-user classification, the Infrastructure sector, covering bridges, tunnels, and public utilities, demands the highest performance and durability standards. RDPs used here are often specialized blends formulated to resist severe weathering, freeze-thaw cycles, and chemical attacks. While this segment is smaller in volume than residential construction, it offers substantially higher margins and requires strong technical collaboration between the RDP supplier and the engineering firm or construction contractor. The growth potential is significant as governments worldwide commit substantial stimulus funding toward upgrading and repairing aging transport and utility infrastructure, necessitating advanced repair and structural mortars.

The technological evolution also includes breakthroughs in creating "hybrid" RDPs, which combine VAE with other polymer types, such as styrene-butadiene or acrylics, to achieve tailored performance characteristics not possible with pure VAE. For instance, hybrid RDPs might offer superior UV resistance for exterior applications or highly specialized adhesion to difficult substrates like wood or metals, further expanding the addressable market for powdered binders. These technical innovations underscore the market's maturity and its responsiveness to complex material science challenges posed by modern architectural demands and increasingly severe climate conditions.

Sustainability is rapidly transitioning from a niche concern to a foundational market driver. Consumers and regulatory bodies are demanding VAE RDP formulations that reduce embodied carbon, minimize chemical emissions (low-VOC, APEO-free), and contribute to certified green building standards (e.g., LEED, BREEAM). Leading manufacturers are dedicating significant resources to formulating bio-based RDP precursors or utilizing renewable energy sources in their highly energy-intensive spray-drying operations. This commitment to 'green chemistry' is not merely a marketing strategy but a prerequisite for maintaining market access in environmentally conscious regions like Northern Europe. The resulting product differentiation based on sustainability metrics is expected to create new competitive tiers and command premium pricing, ensuring long-term shareholder value creation for environmentally responsible producers.

The impact of digital transformation extends beyond AI into sophisticated data management systems that track product performance across the supply chain. Manufacturers are implementing Internet of Things (IoT) sensors within their production facilities to gather real-time data on temperature, moisture content, and chemical reactions. This data is then utilized to create digital twins of the spray-drying process, allowing for predictive quality adjustments before defects occur. This level of digital integration ensures batch-to-batch consistency, which is vital for multinational dry mix producers who rely on a standardized VAE RDP quality globally. The move towards highly automated, data-driven manufacturing represents a structural shift from traditional chemical processing towards smart production, increasing both throughput and yield efficiency.

Furthermore, localized production capacity expansion is a defining strategy, particularly in APAC and LATAM, aimed at circumventing increasing logistical complexities and tariffs associated with global shipping. By establishing production hubs closer to major consumption centers, manufacturers can offer competitive pricing, reduce lead times, and better tailor product specifications to specific local climate and construction material requirements (e.g., compatibility with regionally available cements and aggregates). This regionalization strategy requires significant capital deployment but provides a critical hedge against global trade instability and optimizes the time-to-market for locally customized VAE RDP formulations, strengthening supplier relationships within specific geographic markets.

The overall outlook remains robust due to the intrinsic value proposition of VAE RDPs—delivering superior performance and handling properties in dry mix formulations. As global construction standards continue to rise, moving away from low-performance traditional materials towards industrialized, high-quality chemical additives, the demand floor for VAE RDP remains high. While raw material cost pressures will persist, the ability of leading players to innovate, integrate advanced technologies, and satisfy stringent environmental criteria ensures sustained market expansion and the maintenance of healthy profit margins for specialized, functionalized product grades throughout the forecast period.

In the context of competitive strategy, key players are heavily investing in technical service centers globally. Since the proper dosage and blend of VAE RDP significantly affect the final mortar properties, providing expert application guidance to dry mix manufacturers acts as a powerful non-price competitive tool. These technical centers focus on optimizing customer formulations, troubleshooting compatibility issues with regional aggregates, and demonstrating the measurable performance benefits of high-grade VAE RDPs, thereby cementing long-term supplier-customer relationships and building brand loyalty. This service-oriented approach mitigates the risk of customers switching to cheaper, lower-quality substitutes based solely on price, emphasizing the total value delivered by the polymer additive.

Specific to the Latin American market, the growth of VAE RDP usage is closely linked to the formalization of the construction sector. As economies mature and regulatory oversight increases, the shift from site-mixed mortars to factory-produced dry mixes accelerates. This structural change provides a substantial opportunity for RDP producers. In countries like Brazil and Mexico, the need for earthquake-resistant and weather-resilient structures further increases the demand for high-performance additives that provide necessary flexibility and bond strength, making VAE RDP a preferred choice over cheaper alternatives, despite potential local economic volatility.

The Middle East and Africa (MEA) region presents unique challenges and opportunities. Extreme heat requires RDP formulations with exceptional open time and heat resistance to prevent premature drying and loss of workability. Furthermore, high salinity in coastal regions necessitates products with high alkali stability and corrosion resistance. Consequently, the demand here is highly skewed towards specialized, functionalized VAE RDPs capable of maintaining performance under severe environmental stress. Large-scale government projects, such as those related to Vision 2030 in Saudi Arabia, are massive drivers of specialized construction chemical demand, offering substantial contract opportunities for technically proficient RDP suppliers.

The market's resilience is also bolstered by the relatively high entry barriers inherent in VAE RDP production. Establishing and operating a large-scale, efficient spray-drying facility requires considerable capital investment, specialized engineering expertise, and established supply chain relationships for VAM and ethylene. These factors limit the ability of small, nascent chemical companies to compete effectively at scale, thereby concentrating market share among established global and regional leaders who possess the technological know-how and financial muscle to maintain consistent, high-quality output and navigate complex regulatory environments across continents.

In summary, the VAE Redispersible Powder market is fundamentally a derived demand market driven by the robust dynamics of the global construction industry. Its future is characterized by technological refinement, aggressive geographical expansion into emerging markets, and a crucial shift toward sustainable and highly functionalized product offerings that address increasingly specific performance criteria set by modern architectural and engineering demands. The ongoing balancing act between raw material cost management and continuous product innovation will define the competitive success of key players in the coming decade.

The detailed analysis of the VAE Redispersible Powder Market reveals a sophisticated ecosystem of chemical production, application technology, and specialized logistics. The integration of advanced polymer science with mechanical engineering, specifically in the spray-drying process, underscores the technical complexity that differentiates market leaders. As construction methodologies evolve towards rapid, modular, and energy-efficient systems, the role of VAE RDP as a performance-enhancing binder will only intensify. The shift is irreversible: modern construction requires the precision and guaranteed performance characteristics that only industrialized chemical additives can provide, solidifying the long-term prospects for this essential market segment.

The continuous pursuit of enhanced product longevity, particularly in repair and maintenance mortars, is generating substantial R&D activity. RDPs designed for concrete restoration must exhibit superior adhesion to aged concrete substrates and possess the elasticity required to accommodate thermal and structural movements without cracking. This segment relies heavily on highly modified VAE grades that offer tailored viscoelastic properties. Furthermore, regulatory bodies across the globe are scrutinizing the long-term environmental impact of construction materials, pushing manufacturers toward biodegradable or closed-loop production cycles, which will significantly shape investment decisions over the next five years.

The commercial strategy for VAE RDP producers must be dual-focused: maintaining cost leadership in commodity RDP grades to serve the high-volume APAC market, while simultaneously investing in specialized, premium grades with unique features (e.g., extreme hydrophobicity for waterproofing or special compatibility with bio-based aggregate alternatives) to maximize margins in mature Western markets. This strategic bifurcation allows companies to capture both volume growth and high-margin revenue streams, ensuring a balanced and resilient market presence.

The impact of digitalization, extending beyond manufacturing efficiency, is now reaching customer engagement. Digital tools are being developed to help dry mix manufacturers precisely calculate the required RDP dosage and predict the resulting performance characteristics based on their regional cement and aggregate sources. These services, offered by leading RDP suppliers, strengthen their position as technical partners rather than mere material vendors, fostering deeper, long-term commercial relationships and increasing the switching costs for customers considering alternative suppliers.

Finally, the threat of substitution, primarily from alternative polymer chemistries such as pure acrylics or styrene-butadiene, remains moderate. While alternatives exist, VAE RDPs maintain a unique cost-to-performance ratio that is difficult to replicate, especially regarding the balance of adhesion, flexibility, and affordability. Continued process optimization and capacity expansion ensure that VAE remains the dominant polymer choice for the vast majority of dry mix mortar applications worldwide, ensuring the market's fundamental stability and sustained growth trajectory.

The focus on infrastructure projects, particularly in developing nations, highlights the need for specialized construction chemistry that can accelerate build times without compromising structural integrity. VAE RDPs are integral in formulations for high-early-strength mortars and specialized grouts used in precast segment assembly and road repair. The ability of the powder to enhance rapid strength development while minimizing shrinkage cracking is a performance attribute highly valued in time-critical infrastructure applications. This demand niche is less susceptible to fluctuations in residential housing markets, providing a reliable, steady revenue stream for specialized product manufacturers.

Furthermore, the global shift towards mass timber construction and other unconventional building materials necessitates VAE RDPs engineered for compatibility with non-cementitious substrates. Developing RDPs that offer reliable, long-term adhesion to materials like engineered wood products or composite panels opens up entirely new market segments. This innovation trajectory requires intensive material science research, pushing RDP manufacturers further into the realm of custom chemical solutions, moving away from standardized commodity production.

The challenge of supply chain volatility, exacerbated by recent global events, has forced a critical reevaluation of sourcing strategies. Manufacturers are increasingly looking to diversify their raw material procurement across multiple geographical regions to enhance security of supply and buffer against localized geopolitical risks or trade restrictions. This diversification, while increasing initial logistical complexity, is viewed as essential risk management in a market heavily reliant on volatile petrochemical derivatives like VAM and ethylene.

Looking ahead, the successful integration of circular economy principles will be paramount. Leading companies are exploring methods to recover and reuse polymer residues from manufacturing processes or developing RDPs that facilitate the recycling of construction waste by improving the separation characteristics of dried mortars. While challenging, achieving measurable sustainability gains in this area will be a key competitive advantage, particularly in attracting institutional buyers and satisfying shareholder demands for Environmental, Social, and Governance (ESG) compliance.

In conclusion, the VAE RDP market is characterized by robust underlying demand, driven by modernization in construction and strict performance mandates. The market leaders are defined by their ability to manage complex raw material supply chains, invest continuously in highly energy-efficient spray drying technologies, and specialize their product offerings to meet the diverse and stringent requirements of global construction segments, from high-volume tiling to specialized infrastructure repair.

The technological push towards multi-functional VAE RDPs is one of the most exciting aspects of the market evolution. These advanced powders are formulated to provide two or more performance benefits simultaneously, such as combining high adhesion with enhanced antifungal properties for wet areas, or superior flexibility with intrinsic dirt-repellency for exterior facades. This 'all-in-one' approach simplifies the formulation process for dry mix manufacturers, reduces their inventory complexity, and ensures reliable performance under highly variable construction site conditions, driving premiumization across the product portfolio.

Geopolitically, the growth of local chemical industries in Southeast Asia and India continues to reshape the competitive dynamics. Local producers, backed by government incentives and lower operational costs, are challenging the dominance of Western multinational corporations in high-volume, standard RDP segments. However, the premium and specialty RDP grades, which require decades of accumulated expertise in complex polymerization and modification, remain firmly controlled by the established global leaders. This division necessitates tailored strategic responses based on the target product grade and regional market maturity.

The role of certification and standardization bodies (e.g., ISO, CE marking, local building standards) is becoming increasingly impactful. Compliance with these standards is mandatory for market entry in many developed economies, acting as a quality filter. VAE RDP producers must not only meet these standards but often exceed them to secure the trust of architects, specifiers, and large engineering firms who require guaranteed material performance throughout the projected lifespan of the structure, further emphasizing quality control and testing documentation.

Finally, the commercial health of the VAE RDP market is strongly correlated with the overall confidence in the global housing and public works sectors. Despite cyclical downturns in construction activity, the long-term trajectory is positive. The shift towards industrialized, pre-packaged dry materials globally, away from inconsistent on-site mixing, provides an underlying structural advantage that ensures sustained demand for high-quality, reliable polymeric additives like VAE Redispersible Powder.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- VAE Redispersible Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- VAE Redispersible Powder Market Statistics 2025 Analysis By Application (Exterior Insulation and Finish Systems, Construction and Tile Adhesives, Putty Powder, Dry-mix Mortars, Self-leveling Flooring Compounds, Caulks, Other Applications), By Type (Hydrophobic VAE Powder, Waterproof VAE Powder, Ordinary VAE Powder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager