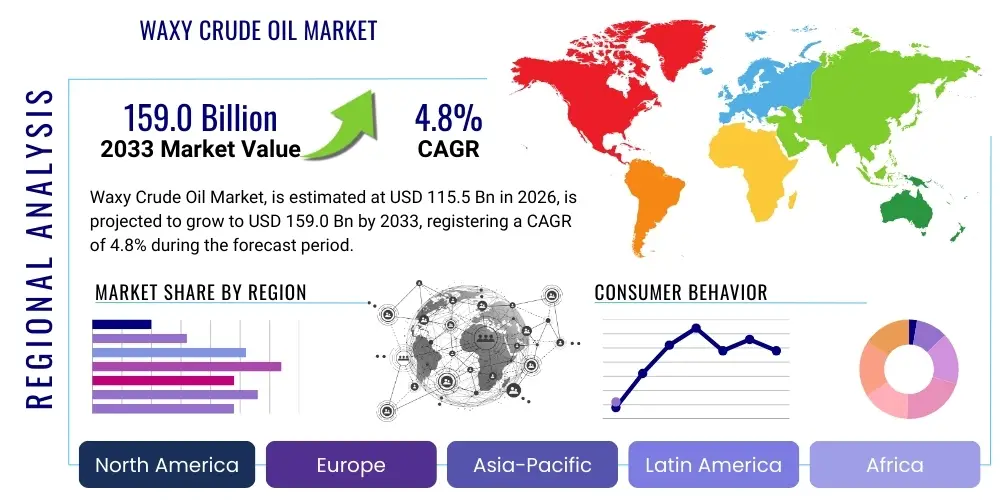

Waxy Crude Oil Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442905 | Date : Feb, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Waxy Crude Oil Market Size

The Waxy Crude Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 155.0 Billion in 2026 and is projected to reach USD 214.5 Billion by the end of the forecast period in 2033.

Waxy Crude Oil Market introduction

Waxy crude oil, characterized by a high content of paraffin wax, typically exceeding 5% by weight, presents unique challenges and opportunities within the global petroleum industry. The presence of long-chain n-alkanes dictates the rheological behavior of the crude, leading to a high pour point and Wax Appearance Temperature (WAT). This physical characteristic is critical because, below the WAT, wax crystals begin to form, and below the pour point, the oil can transition into a gelled state, severely restricting or stopping flow in pipelines and storage facilities. Effective market participation necessitates specialized handling, including advanced thermal management, high-specification chemical treatment, and rigorous mechanical cleaning procedures, collectively known as flow assurance strategies. The need for these complex solutions significantly elevates the operational expenditure (OPEX) and capital expenditure (CAPEX) compared to handling light, non-waxy crudes. However, the abundance of these reserves in major producing regions, especially in deepwater offshore fields and remote terrestrial locations, ensures their continued strategic importance in the global energy mix, driving ongoing investment in mitigation technologies.

The core product in this market remains the crude feedstock itself, classified by its high paraffinic nature, which impacts its refining pathway. Major applications of waxy crude oil span the production of transportation fuels such as gasoline, diesel, and jet fuel, although the processing requires dedicated dewaxing units to ensure the final products meet stringent cold flow specifications, such as Cloud Point and Cold Filter Plugging Point (CFPP). Crucially, the high wax content is a valuable attribute for non-fuel derivatives. Waxy crude serves as the ideal feedstock for high-quality lubricant base oils (Group I, II, and III), yielding high viscosity index (VI) products essential for modern high-performance engines. Furthermore, it is the primary source for specialty waxes, including industrial paraffin wax and microcrystalline wax used in packaging, candles, and cosmetics. This dual application potential—both for energy and high-value chemical products—provides strong foundational stability to the market, allowing refiners to capitalize on price volatility through yield flexibility.

Driving factors propelling the Waxy Crude Oil Market growth include the pervasive need for energy resource diversification and the increasing technological feasibility of developing previously inaccessible reserves. Global energy demand, particularly from industrializing nations in Asia, compels major oil companies to monetize deepwater resources where waxy crude is often encountered. Key technological advancements, particularly in the realm of high-performance polymer chemistry for Pour Point Depressants (PPDs) and innovative pipeline insulation materials, have effectively lowered the economic threshold for waxy crude development. Furthermore, the robust demand for specialty downstream products, especially premium lubricant base oils driven by stricter engine emission standards, provides a significant pull factor. Strategic geopolitical objectives focused on securing stable, long-term national energy supplies further accelerate exploration and production activities in regions known for large waxy crude deposits, solidifying the market’s expansion trajectory through sustained infrastructure investment.

Waxy Crude Oil Market Executive Summary

The Waxy Crude Oil Market is characterized by intense technological competition centered on enhancing flow assurance reliability and reducing total operational costs across the midstream sector. Current business trends indicate a shift towards comprehensive, integrated solutions rather than isolated chemical or thermal treatments. This involves substantial investments in digital oilfield technologies, leveraging real-time data from downhole sensors and pipeline networks to predict wax formation kinetics with greater precision. Major integrated oil companies are increasingly adopting a "preventative maintenance" ethos, using advanced simulation tools to optimize pigging schedules and chemical injection points, thereby minimizing the risk of catastrophic blockages that lead to millions in lost production and remediation efforts. Furthermore, the market structure is seeing increased collaboration between E&P firms, specialized engineering procurement and construction (EPC) companies, and chemical providers, fostering joint development agreements to create crude-specific flow solutions that offer superior performance and environmental compliance, driving innovation in sustainable polymers.

Regionally, the market dynamics are highly differentiated based on indigenous supply characteristics and consumer demand patterns. The Asia Pacific region, led by China and India, not only accounts for a substantial portion of global energy consumption but also hosts complex refining centers capable of processing waxy feedstocks into high-value derivatives, positioning it as the primary market growth engine. In contrast, North America and Europe emphasize optimization and safety within existing mature infrastructure, often employing complex subsea thermal management systems and sophisticated integrity management protocols, particularly in the deep waters of the Gulf of Mexico and the challenging environment of the North Sea. The emerging markets of the Middle East and Africa are focusing on unlocking deepwater exploration potential off the coasts of nations like Brazil, Nigeria, and Angola, necessitating large-scale, greenfield investment in robust, long-distance heated or chemically-treated pipelines to transport the produced waxy crude to export terminals, thus defining the regional supply growth narrative for the coming decade and shifting global trade routes towards APAC consumer hubs.

Segment trends underscore the rising significance of chemical treatment, specifically the use of advanced polymer-based Pour Point Depressants (PPDs), which offer a flexible and often lower CAPEX solution compared to installing heated pipelines. While Pipelines remain the dominant transportation segment due to capacity and efficiency, the Tanker and Shipping segment is increasingly relying on specialized vessels equipped with enhanced heating coils and sophisticated insulation to prevent cargo solidification during long voyages through variable climatic zones. Application trends firmly highlight the Lubricants and Specialty Waxes sector as a key value driver; as global specifications for lubricants become more demanding, the inherent quality advantages offered by waxy crude feedstock ensure this segment maintains a premium pricing structure and robust growth trajectory, mitigating some of the economic risks associated with crude price fluctuations in the lower-margin transportation fuels segments. This segmentation analysis reveals a market pivot towards efficiency, specialization, and the maximization of high-value product yields.

AI Impact Analysis on Waxy Crude Oil Market

The discourse surrounding the application of Artificial Intelligence (AI) and Machine Learning (ML) in the Waxy Crude Oil Market is dominated by the pursuit of operational excellence and risk mitigation across the entire production and transportation lifecycle. Stakeholders are keen to understand how sophisticated algorithms can move beyond simple threshold alarms to genuinely predictive modeling of complex multiphase flow dynamics. Specific common user questions include inquiries into the feasibility of AI models integrating heterogeneous data sources—such as pressure-temperature readings, flow rate metrics, chemical inhibitor concentrations, and crude assay laboratory results—to generate a comprehensive digital twin of the pipeline network. This digital twin would enable prescriptive analysis, recommending precise timing and location for chemical treatments or heat application, thereby reducing energy waste and ensuring continuous flow. Furthermore, there is significant user interest in how AI can be deployed to optimize blending strategies, determining the economically most advantageous mix of waxy and non-waxy crudes to meet delivery specifications without incurring excessive treatment costs, fundamentally transforming decision-making from empirically-based procedures to data-driven strategic optimization.

The deployment of AI is specifically targeting the high uncertainties and high-cost factors inherent in waxy crude handling, primarily through predictive analytics focused on flow assurance and preventative maintenance. Traditional flow assurance relied heavily on scheduled maintenance or reactive responses to pressure drops. AI models, conversely, learn the complex non-linear relationship between operating conditions and wax deposition rates, offering real-time forecasts that drastically increase the efficiency of anti-waxing measures. For instance, ML algorithms can process petabytes of historical sensor data and environmental variables to predict not only when wax might form but also the rate and location of the formation with sufficient lead time to adjust operational parameters, such as increasing flow rate (shear stress management) or injecting a precise dose of Pour Point Depressant. This shift from calendar-based maintenance to condition-based maintenance represents a massive opportunity for operating expenditure reduction and asset longevity extension, particularly in hard-to-access subsea pipelines, making previously marginal fields economically viable.

Beyond the midstream, AI integration extends into the refining sector, where optimization challenges are severe due to the variable nature of waxy crude input. AI systems are being developed to optimize refinery processing units, such as hydrocracking and catalytic dewaxing units, by constantly adjusting operating temperatures and catalyst regeneration cycles based on the real-time composition of the feedstock. This level of dynamic process control maximizes the yield of high-value components (e.g., Group III base oils) while minimizing energy input and waste streams. Consequently, the key expectations from users are concentrated on AI’s ability to minimize human error, automate complex decision-making processes, provide superior transparency into internal pipeline conditions, and unlock latent economic value from these challenging crude resources, thereby ensuring sustained profitability even during periods of commodity price volatility and increasing competitive pressures from alternative energy sources.

- AI-driven Predictive Flow Assurance: Utilizing machine learning models to predict wax deposition rates in real-time based on fluid composition, temperature profiles, and flow dynamics, enabling proactive chemical injection and minimizing the energy cost associated with maintaining heat in pipelines.

- Optimized Chemical Dosage: Employing AI algorithms to determine the minimum effective concentration of Pour Point Depressants (PPDs) required by analyzing complex rheological data, achieving significant reduction in chemical procurement costs and minimizing environmental impact from additive usage.

- Automated Pipeline Monitoring: Integrating AI with Internet of Things (IoT) sensors, acoustic monitoring, and specialized fiber optics for continuous surveillance of subsea and terrestrial pipeline conditions, providing instantaneous detection and classification of anomalies indicative of impending wax buildup or physical stress.

- Enhanced Refining Efficiency: Applying sophisticated AI in refinery process control to dynamically optimize fractionating column parameters and catalytic dewaxing units when processing waxy crude, maximizing the yield of high-value distillates and specialty waxes while optimizing energy consumption.

- Risk Management and Logistics: Using AI to model complex transportation and inventory logistics, considering highly variable ambient temperature conditions, and scheduling preventative pigging operations based on predictive risk matrices rather than fixed timelines, thereby significantly improving overall supply chain reliability and reducing demurrage costs.

- Digital Twin Modeling: Creating high-fidelity digital representations of entire pipeline networks, allowing operators to run 'what-if' scenarios related to flow rate changes, temperature fluctuations, and chemical treatment responses, leading to superior operational planning and crisis preparedness, thereby extending asset life.

DRO & Impact Forces Of Waxy Crude Oil Market

The market trajectory for Waxy Crude Oil is fundamentally governed by a tripartite framework of Drivers, Restraints, and Opportunities, which collectively create powerful Impact Forces influencing investment decisions. A primary Driver is the compelling geological reality that vast, economically significant oil reserves, particularly in new deepwater frontier areas and challenging cold climates, often contain high concentrations of paraffinic waxes, making their exploitation inevitable for sustained global energy supply. This is coupled with robust technological advancements, where innovations in custom-synthesized polymeric Pour Point Depressants (PPDs) and robust thermal insulation materials have significantly enhanced the technical feasibility and economic attractiveness of transporting these challenging fluids over long distances. Moreover, the superior value derived from the downstream processing of waxy crude, specifically in high-performance lubricants and specialty waxes, creates a strong economic incentive that counterbalances the inherent operational complexities of the upstream and midstream sectors, fueling continued market expansion and justifying the required technical specialization.

Conversely, significant Restraints impede accelerated market growth and necessitate high barriers to entry. Paramount among these is the exceptionally high Capital Expenditure (CAPEX) required for specialized infrastructure, including the necessity for heated or heavily insulated pipelines and dedicated subsea flow management systems, which must be engineered to withstand rigorous operational demands and extreme thermal fluctuations. The ongoing operational risks associated with wax deposition—leading to potential pipeline blockages, erosion, and high energy costs for heating—pose persistent threats to production continuity and asset integrity. Furthermore, increasing global regulatory scrutiny regarding the environmental impact of chemical additives used for flow assurance, combined with mandates for stricter pipeline safety and integrity management, imposes additional compliance costs and often restricts the selection of cost-effective chemical solutions, compelling the industry towards expensive, environmentally advanced alternatives, particularly in European and North American markets.

The principal Opportunities reside in developing next-generation, sustainable flow assurance solutions and maximizing the monetization of high-value derivative products. Specifically, the development of eco-friendly, bio-degradable chemical inhibitors, including novel nanoparticle-based wax anti-deposition agents, represents a massive market opening that addresses both regulatory constraints and performance demands simultaneously. Furthermore, the increasing global demand for high-specification Group III lubricants, driven by the expanding fleet of modern, fuel-efficient engines, ensures a robust, premium market for waxy crude derivatives. These internal market dynamics are powerfully shaped by external Impact Forces: Economic forces (oil price stability underpins multi-billion dollar infrastructure investment); Technological forces (AI, CFD, and advanced materials science define operational feasibility); and Regulatory forces (environmental standards dictate the permissible range of flow assurance techniques). The interplay of these forces mandates that successful market participants adopt a strategy emphasizing resilience, continuous technological innovation, and sustainable operational practices throughout the entire value chain to mitigate risk and capture premium value effectively.

Segmentation Analysis

The comprehensive segmentation of the Waxy Crude Oil Market is essential for understanding the specific dynamics influencing technological adoption, investment allocation, and geographic market size. Segmentation by Flow Assurance Technology is perhaps the most crucial classification, highlighting the operational preference and maturity of various technical solutions. Chemical treatment, often relying on polymer science, offers flexibility and lower initial capital outlay, making it suitable for short-term or marginal fields, while continuous innovation drives efficiency gains. Thermal methods, though capital intensive, provide reliable long-term flow assurance for critical, high-volume trunk lines and deepwater risers, justifying the high CAPEX through decades of uninterrupted service. This differentiation allows for precise analysis of R&D focus areas and projected expenditure based on the physical characteristics of the crude and the operating environment. The selection criteria for these technologies are highly dependent on factors such as crude viscosity, WAT, pipeline length, ambient temperature, and economic metrics like return on investment and risk profile, necessitating a highly tailored approach for every major project.

Segmentation by Application is central to evaluating the downstream value proposition of waxy crude. While transportation fuels represent the largest volume consumption segment, the highest margin and growth potential lie within the Lubricants and Specialty Waxes categories. Refineries strategically invest in complex hydrocracking and dewaxing units specifically to exploit the high paraffin content inherent in waxy crude, transforming it into premium base oils required for next-generation engine lubricants with superior viscosity indices. The Specialty Waxes segment, including high-purity paraffin and microcrystalline waxes used in industries ranging from food packaging to pharmaceuticals, provides a critical revenue stream that hedges against volatility in global fuel prices. The ability of waxy crude to yield these high-value products sustains its commercial viability even when benchmark crude prices are depressed, fostering specialized refining hubs near major waxy crude sources globally and promoting specialized infrastructure development.

Furthermore, segmentation by Transportation Method reveals critical infrastructural dependencies and logistical challenges. Pipelines, being the most cost-efficient and highest volume transport method, drive the demand for sophisticated fixed infrastructure solutions, including large-scale heating stations and advanced insulation systems, particularly across extensive terrestrial networks or deep subsea environments. The Tankers and Shipping segment, vital for global trade, demands specialized vessel modifications, such as reinforced heating coils and advanced inert gas systems to prevent cargo solidification and subsequent cleaning difficulties during transit between regions with disparate climates. The dynamics within these segments clearly illustrate that the market is not uniform but rather a specialized ecosystem where technical expertise in flow assurance dictates market entry and sustained operational success, requiring continuous technological upgrades to meet stringent reliability and environmental safety standards across global operations.

- By Flow Assurance Technology:

- Chemical Treatment (Pour Point Depressants, Wax Inhibitors, Viscosity Modifiers, Hydrate Inhibitors)

- Thermal Methods (Insulated Pipelines, Electrical Heat Tracing, Hot Oil Circulation Systems, Subsea Heating)

- Mechanical Methods (High-Efficiency Pigging, Scrapers, Coiled Tubing Intervention)

- Blended Methods (Strategic Blending with Lower-Pour-Point Crudes)

- By Application:

- Transportation Fuels (Gasoline, Diesel, Jet Fuel, Heavy Fuel Oil)

- Lubricants and Base Oils (Group I, II, III Base Oils for Automotive and Industrial Applications)

- Specialty Waxes (Paraffin Wax, Microcrystalline Wax, Petroleum Jelly, Candle Manufacturing Feedstock)

- Other Distillates and Residues (Asphalt, Petrochemicals Feedstock)

- By Transportation Method:

- Pipelines (Long-Distance Trunk Lines, Subsea Flowlines, Gathering Networks)

- Tankers and Shipping (Specialized Heated Maritime Vessels, Storage Terminals)

- Rail and Truck (Local and Regional Transportation of Processed Waxy Residues and Blended Products)

- By Geographic Region:

- North America (US Gulf of Mexico, Canadian Reserves)

- Europe (North Sea, Caspian Region)

- Asia Pacific (APAC) (China, Indonesia, Australia, Malaysia)

- Latin America (LATAM) (Brazil, Venezuela, Mexico)

- Middle East and Africa (MEA) (West Africa Deepwater, Specific Middle Eastern Fields)

Value Chain Analysis For Waxy Crude Oil Market

The value chain for waxy crude oil begins with the Upstream exploration and production phase, where the presence of high paraffin content necessitates early and costly technical solutions. Initial operations often involve deploying sophisticated downhole chemical injection systems and utilizing advanced materials for subsea flowlines to mitigate the immediate risk of wax precipitation upon cooling. The high capital expenditure required for deepwater drilling and specialized completion techniques in waxy fields dictates that only projects with significant reserve potential and favorable geological characteristics move forward. Upstream success hinges on accurate reservoir modeling and the ability to maintain continuous, high-pressure flow from the wellhead to the gathering manifold, minimizing static periods which promote rapid gelation. Strategic decisions concerning thermal vs. chemical pre-treatment made at this stage profoundly influence the subsequent operational costs throughout the midstream phase, emphasizing risk mitigation at the point of extraction.

The Midstream sector, encompassing transportation and storage, represents the segment where flow assurance risks are most acute and where the majority of technological innovation is applied. This phase includes specialized pipeline infrastructure, such as electrically heated or highly insulated trunk lines, and the operational deployment of specialized chemical dosing equipment and pigging regimes. Effective Midstream operations require precise rheological monitoring and often rely on complex scheduling to ensure the crude remains above its pour point and Wax Appearance Temperature (WAT) consistently. Distribution channels are highly dependent on the volume and destination. Large international volumes often move via specialized, heated tankers or long-distance proprietary pipelines (direct channel), whereas smaller, regional transfers might use rail or truck transport for specialized refined products. The successful management of the Midstream segment is key to unlocking the economic value of waxy crude, as efficiency gains directly translate to reduced lifting costs and increased export competitiveness globally.

Downstream analysis focuses on refining and marketing, converting the waxy feedstock into high-value products. Refineries capable of processing waxy crude gain a competitive advantage by maximizing the yield of Group II and Group III lubricant base oils through processes like hydrocracking and catalytic dewaxing. These processes are inherently more complex and capital-intensive than standard fuel refining, requiring specialized catalysts and high operating pressures to effectively remove paraffinic components without compromising final product quality. The end marketing phase involves selling these differentiated products—premium lubricants and specialty industrial waxes—to B2B industrial customers (automotive, manufacturing, consumer goods). The ability of the refiner to integrate smoothly with global specialty chemical markets, thereby monetizing the high-paraffin content fully, determines the ultimate profitability of the waxy crude stream. This integration creates a semi-closed loop where the downstream demand for specialty products directly influences the commercial viability of upstream waxy crude projects and long-term investment decisions.

Waxy Crude Oil Market Potential Customers

The core customer base for the Waxy Crude Oil Market includes large multinational Integrated Oil Companies (IOCs), which manage the entire value chain from extraction to specialty product manufacturing, ensuring internal consumption. Key potential buyers are independent refining entities, particularly those in the Asia Pacific region (e.g., in Singapore, South Korea, India), that have invested heavily in conversion capacity capable of handling high-wax input to produce high-specification lubricant base stocks and petroleum waxes. These refiners are primarily motivated by the strategic advantage of securing a reliable, specialized feedstock that allows them to produce higher-margin products compared to conventional fuel refining. The growing demand for advanced synthetic and semi-synthetic lubricants, fueled by stringent automotive performance standards globally, makes refiners with waxy crude processing capabilities highly competitive and crucial market participants.

A secondary, yet crucial, customer segment comprises specialty chemical manufacturers and additive providers. While they do not purchase the crude directly for processing, their role is essential for market viability. Companies like BASF, Clariant, and Schlumberger’s chemical divisions are critical B2B partners, serving as end-users of market intelligence and suppliers of essential chemical flow improvers (PPDs, wax inhibitors) that make the crude transportable. Their customers, in turn, are the pipeline operators and E&P companies who rely on these specialized solutions to maintain flow integrity. Furthermore, large international crude traders and logistics companies (e.g., Vitol, Glencore) act as intermediary buyers, requiring specialized knowledge in managing the thermal and chemical properties of waxy crude during global maritime transport to guarantee safe and timely delivery to international refining centers. Their operational requirements drive demand for specialized shipping and storage solutions, reinforcing the necessity for expert flow assurance services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 155.0 Billion |

| Market Forecast in 2033 | USD 214.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell Plc, Chevron Corporation, BP p.l.c., TotalEnergies SE, Sinopec, PetroChina, Saudi Aramco, Equinor ASA, ConocoPhillips, ENI S.p.A., Reliance Industries Limited, PTT Public Company Limited, Lukoil, Baker Hughes, Halliburton, Schlumberger, BASF SE, Clariant, Nalco Water (Ecolab) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waxy Crude Oil Market Key Technology Landscape

The technological framework underpinning the Waxy Crude Oil Market is a complex synthesis of chemical engineering, materials science, and digital intelligence, all aimed at solving the fundamental problem of wax deposition and flow restriction. The most critical aspect involves specialized chemical additives, notably Pour Point Depressants (PPDs) and Wax Crystal Modifiers (WCMs). Current research is heavily focused on developing high-efficiency, multi-functional polymers—often based on polyethylene-vinyl acetate (EVA) or maleic anhydride derivatives—that are effective at low concentrations and across broad temperature ranges. The shift is towards bespoke molecular design, where polymers are engineered to specifically interact with the unique paraffin chain length distribution of a particular crude type, optimizing performance and reducing the cost per barrel treated. Further chemical innovation includes the use of flow improvers that reduce the crude’s viscosity, thereby decreasing pumping energy requirements, offering a highly flexible, low-CAPEX solution for flow assurance across varied operational settings.

In terms of physical infrastructure, the Thermal Technology Landscape is dominated by advanced pipeline heating and insulation solutions. For deepwater subsea flowlines, technologies such as Pipe-in-Pipe (PIP) systems utilizing highly efficient insulation materials (e.g., syntactic foam or aerogels) are standard to passively maintain temperatures above the WAT. Active thermal management involves Electrical Trace Heating (ETH) systems, particularly for short tie-backs and risers, or complex hot oil circulation loops designed for restartability after extended shutdowns. Recent technological improvements focus on reducing the thermal conductivity and increasing the longevity of insulation materials, maximizing passive heat retention and minimizing the substantial energy expenditure required for active heating. The economic viability of many deep offshore projects is directly tied to the performance and reliability of these specialized, high-cost thermal engineering solutions, requiring meticulous computational fluid dynamics (CFD) modeling during the design phase to ensure long-term integrity and efficiency under extreme pressure and temperature conditions.

The integration of digital technology, particularly IoT and advanced sensing, forms the third vital component of the landscape. High-resolution sensors are deployed to monitor internal pipeline conditions, including localized temperature drops, pressure fluctuations, and acoustic signatures indicative of wax buildup. This data feeds into sophisticated AI-driven algorithms capable of performing predictive maintenance analysis, moving the industry away from historical or scheduled cleaning cycles. Key technologies include fiber optic distributed temperature sensing (DTS) and real-time rheometers deployed in-line, providing continuous, granular data about the crude's flow characteristics and potential risks. This digital transformation enables precise, condition-based interventions, optimizing the timing of pigging operations or chemical injections. By leveraging this combination of predictive models, high-performance chemistry, and robust thermal insulation, the industry is systematically de-risking the exploitation of waxy crude resources, ensuring reliable, safe, and cost-effective transport to global refining centers despite inherent geological challenges.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the engine of growth for the Waxy Crude Oil Market, propelled by continuous industrial expansion and burgeoning domestic energy needs. Countries like China and India are both major producers and consumers, with significant waxy crude reserves in offshore areas (e.g., Bohai Bay, South China Sea) and onshore fields. The region’s refining industry has specialized capabilities in high-paraffin processing, driven by the massive demand for lubricants and specialty waxes in manufacturing and transportation sectors. Investment here is focused on both maximizing existing asset efficiency and building new, specialized long-distance pipelines to connect remote production sites to refining hubs.

- North America: North America presents a highly sophisticated, technology-intensive market. While production of ultra-heavy crude dominates certain regions, significant waxy crude is found in deepwater assets in the Gulf of Mexico (GoM) and specific Canadian fields. Market activity is dominated by investment in subsea flow assurance technology, relying heavily on sophisticated thermal insulation (e.g., Pipe-in-Pipe) and advanced modeling to manage the complex logistics of deepwater tie-backs. Regulatory compliance, particularly related to safety and spill prevention, drives the implementation of cutting-edge real-time monitoring and integrity management systems, ensuring high operational reliability in mature fields.

- Europe: The European market, particularly centered around the North Sea and adjacent basins, faces the dual challenge of high operating costs and stringent environmental directives. Waxy crude production requires highly specialized subsea infrastructure designed for extremely cold environments. The focus is on R&D for environmentally benign chemical flow improvers that minimize ecological impact while maintaining high performance. Europe also serves as a crucial innovation hub for lubricant technology, driving consistent demand for the high-quality base oils derived from waxy crude refining, thereby reinforcing the specialized nature of its downstream sector.

- Middle East and Africa (MEA): This region is characterized by immense untapped potential, specifically in West Africa (Nigeria, Angola) where deepwater exploration frequently yields waxy crude. The primary driver is the necessity for infrastructure development, often necessitating large, high-capacity export pipelines and storage facilities designed to handle high pour point crude under high ambient temperatures that still fluctuate seasonally. MEA governments are actively seeking foreign direct investment (FDI) and partnerships to unlock these reserves, making it a critical area for large-scale, greenfield flow assurance project awards over the forecast period.

- Latin America (LATAM): LATAM market dynamics are largely influenced by major deepwater discoveries, notably Brazil’s pre-salt fields, which often contain waxy crude that requires robust technical solutions. The market is driven by state-owned enterprises (SOEs) focusing on maximizing domestic resource utilization and minimizing import dependence. Investment is concentrated on developing robust subsea production systems, utilizing customized chemical inhibitors, and ensuring adequate thermal management for long-distance flowlines connecting offshore platforms to coastal processing terminals, highlighting a strong reliance on specialized technical service providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waxy Crude Oil Market.- ExxonMobil

- Shell Plc

- Chevron Corporation

- BP p.l.c.

- TotalEnergies SE

- Sinopec

- PetroChina

- Saudi Aramco

- Equinor ASA

- ConocoPhillips

- ENI S.p.A.

- Reliance Industries Limited

- PTT Public Company Limited

- Lukoil

- Baker Hughes

- Halliburton

- Schlumberger

- BASF SE

- Clariant

- Nalco Water (Ecolab)

Frequently Asked Questions

Analyze common user questions about the Waxy Crude Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary flow assurance challenges associated with waxy crude oil?

The primary challenge is managing the high pour point and Wax Appearance Temperature (WAT), which cause paraffin wax crystallization and subsequent gelation or solidification, leading to pipeline blockages, increased pump pressure requirements, and costly downtime if not proactively mitigated using thermal, chemical, or mechanical methods. Effective mitigation is paramount for operational continuity.

How do Pour Point Depressants (PPDs) function in waxy crude handling?

PPDs are specialty chemical additives composed of polymers that modify the crystalline structure of precipitated wax. They co-crystallize with the paraffin molecules, inhibiting the formation of a rigid, interlocking wax lattice, which maintains the crude oil's fluidity and ensures continuous, low-pressure flow during pipeline and maritime transportation below its natural pour point.

Which geographical region exhibits the fastest growth in the waxy crude oil market?

The Asia Pacific (APAC) region is projected to register the fastest growth, driven by substantial domestic production in countries like China and Indonesia, coupled with massive refining capacity expansion geared towards exploiting the high-value lubricant and specialty wax yields derived from waxy crude feedstock.

What role does technology play in making waxy crude commercially viable?

Technology is crucial, particularly advanced thermal management (insulated pipes), customized high-performance chemical solutions (PPDs, wax inhibitors), and AI-driven predictive maintenance (flow modeling). These innovations minimize operational risks, reduce transportation costs, and optimize downstream yields, transforming technically challenging waxy reserves into economically competitive assets.

Is waxy crude oil more valuable than non-waxy crude oil?

While waxy crude often demands higher upfront capital and operational costs for handling, its high paraffin content translates to greater potential value downstream. It is the preferred feedstock for producing superior Group II/III base oils for lubricants and specialty waxes, often commanding premium prices compared to light, sweet crudes primarily used for simple transportation fuels, thus enhancing overall profit margins for specialized refiners.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Waxy Crude Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Waxy Crude Oil Market Statistics 2025 Analysis By Application (Petroleum Fuel, Lubricants and Greases, Wax, Bitumen and Petroleum Coke, Solvents and Petrochemicals), By Type (Medium Waxy Crude Oil, Light Waxy Crude Oil), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager