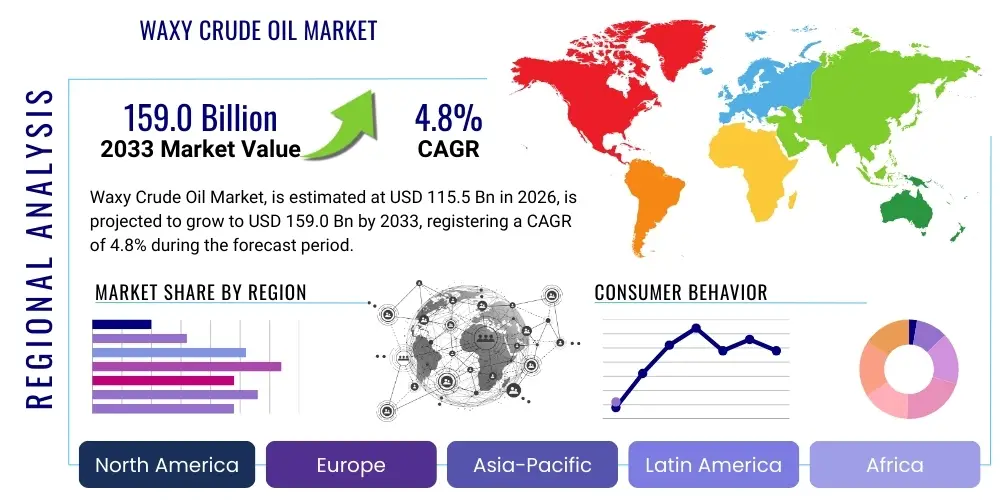

Waxy Crude Oil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436938 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Waxy Crude Oil Market Size

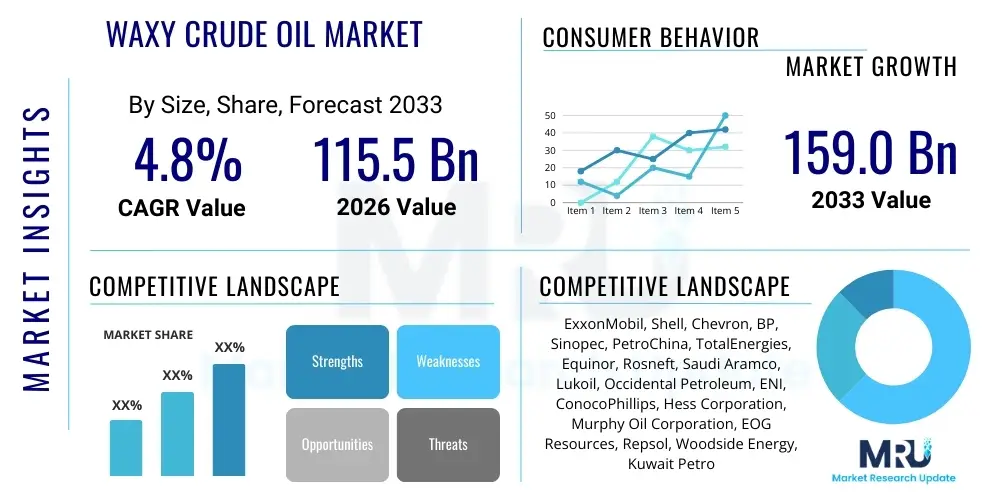

The Waxy Crude Oil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 115.5 Billion in 2026 and is projected to reach USD 159.0 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the increasing global exploration and production activities in non-conventional oil fields, where waxy crude reserves are often abundant, coupled with technological advancements in flow assurance and pipeline management that mitigate the inherent transportation challenges associated with high paraffin content.

Waxy Crude Oil Market introduction

Waxy crude oil, characterized by a high content of long-chain n-paraffins (waxes), presents unique challenges and opportunities within the global petroleum industry. The physical properties of this crude, particularly its high pour point and increased viscosity at lower temperatures, necessitate specialized handling, transportation, and refining processes. Geographically, significant reserves of waxy crude are concentrated in regions such as Southeast Asia, West Africa, and parts of the Russian Federation, driving regional market dynamics. The product description centers on crude oils that require thermal or chemical treatment to prevent wax precipitation and gelling, which can severely impede flow and lead to pipeline blockages.

Major applications for refined waxy crude derivatives include the production of high-quality lubricating oils, paraffin waxes used in packaging and cosmetics, and specific transportation fuels. The inherent chemical structure, rich in straight-chain hydrocarbons, makes it an excellent feedstock for petrochemical cracking processes, although the initial processing cost remains a key consideration. The benefits of processing waxy crude include access to vast, previously uneconomical oil reserves and the production of highly valuable specialty products derived from the wax content, contributing significantly to the overall value chain profitability.

Driving factors for market expansion include the depletion of light, sweet crude reserves globally, pushing exploration efforts toward heavier and waxy streams. Furthermore, substantial investments in flow assurance technologies, such as advanced pour point depressants, heat tracing systems, and specialized pipeline coatings, have made the extraction and transport of waxy crude oil economically viable on a larger scale. Regulatory support for energy security in major consuming nations also encourages the development of all available domestic crude oil sources, including those that are highly waxy.

Waxy Crude Oil Market Executive Summary

The Waxy Crude Oil Market is characterized by robust business trends centered on technological innovation and supply chain resilience. Key companies are increasingly investing in proprietary flow improvers and sophisticated rheology management systems to minimize operational expenditure related to pipeline heating and pigging operations. Consolidation among specialized chemical providers and pipeline operators focused on Arctic or deep-sea environments is shaping the competitive landscape. A notable trend is the integration of advanced sensors and real-time monitoring systems into existing pipeline infrastructure to predict and prevent wax deposition, moving the industry toward a proactive maintenance model rather than reactive troubleshooting, thereby maximizing efficiency and throughput.

Regionally, the market exhibits divergent trends. Asia Pacific, particularly China and India, represents the largest growth segment due to burgeoning demand for petrochemical feedstock and lubricants, alongside domestic production efforts in countries like Malaysia and Indonesia. North America and Europe maintain a mature but technologically advanced market, focusing on optimizing refinery processes to handle varying waxy crude inputs and meeting stringent environmental regulations. The Middle East and Africa (MEA) region is witnessing heightened activity, especially in West Africa (e.g., Nigeria and Angola), where substantial offshore waxy crude discoveries require massive capital investments in subsea flowline heating and insulation technologies.

Segment trends reveal that the Flow Improvers and Pour Point Depressants segment is expected to dominate technology adoption, driven by their cost-effectiveness and ease of application compared to massive infrastructure investments like fully insulated pipelines. In terms of end-use, the Petrochemical segment is growing faster than the Refineries segment, fueled by the global demand for specialty waxes and high-performance polyolefins derived from waxy residues. The market for long-distance pipeline transport solutions, incorporating advanced heating and insulation layers, continues to grow, reflecting the necessity of transporting waxy crude from remote extraction sites to major refining hubs often located thousands of kilometers away.

AI Impact Analysis on Waxy Crude Oil Market

Common user questions regarding AI's impact on the Waxy Crude Oil Market frequently revolve around predictive maintenance, optimization of flow assurance chemical dosing, and enhancing seismic data interpretation for better resource identification. Users express significant interest in how AI can solve the long-standing problem of unpredictable wax deposition rates, which currently lead to expensive unscheduled shutdowns and high energy costs for heating pipelines. Key themes include the implementation of machine learning models to forecast pour point changes based on fluctuating ambient and pipeline temperatures, optimizing refinery blending operations to handle varying feedstock quality, and integrating vast datasets from downhole sensors to improve upstream operational efficiency. Users are cautiously optimistic, focusing on AI as a tool for cost reduction and risk mitigation rather than radical transformation.

The application of Artificial Intelligence and Machine Learning (ML) is fundamentally changing how operators manage the challenges inherent in Waxy Crude Oil production and transportation. AI algorithms are being deployed to analyze real-time data streams encompassing pressure, temperature, flow rate, and chemical composition within pipelines. This predictive capacity allows operators to precisely determine the optimal time for pigging operations or the exact dosage requirement for chemical pour point depressants, moving away from time-based or fixed-rate dosing, which often results in waste or insufficient wax mitigation. This precision directly translates into lower operating costs and significantly reduced downtime, improving the overall asset reliability profile.

Furthermore, beyond flow assurance, AI is contributing substantially to the exploration and production phases. Deep learning models are capable of processing complex geological and geophysical data far faster and more accurately than traditional methods, helping identify reservoir characteristics, including the wax content profile of newly discovered crude sources. In refining, AI optimization software manages complex fractionation units, minimizing the energy intensity required to separate high-value wax components and maximizing yield from the waxy residue, ensuring that refiners can maintain profitability even with fluctuating global crude prices and varying waxy feedstock sources.

- AI optimizes flow assurance by predicting wax deposition rates and advising on optimal pigging schedules.

- Machine Learning enhances reservoir characterization, estimating wax content and crude properties during exploration.

- AI minimizes chemical consumption by calculating precise Pour Point Depressant (PPD) dosing requirements in real-time.

- Predictive maintenance using AI reduces unscheduled downtime associated with pipeline gelling and blockage.

- Deep Learning models optimize refinery blending strategies for waxy crude feedstock to maximize product yield and quality.

DRO & Impact Forces Of Waxy Crude Oil Market

The market dynamics for Waxy Crude Oil are fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by significant technological and economic impact forces. A primary driver is the increased global reliance on non-conventional oil sources due to the maturation of conventional fields, forcing the industry to develop technologies to handle complex crudes, including those with high wax content. Simultaneously, the restraints are significant, dominated by the high capital expenditure required for specialized infrastructure, such as fully insulated pipelines and heating stations, and the elevated operational costs associated with continuous flow assurance management and chemical procurement, often limiting the profitability of marginal waxy crude fields.

Opportunities for growth are concentrated in the development and commercialization of next-generation flow assurance technologies, including bio-based wax inhibitors and autonomous pipeline inspection drones equipped with advanced sensors for early detection of deposition. Furthermore, the rising demand for high-quality specialty waxes in industries like pharmaceuticals, cosmetics, and industrial lubricants offers a significant margin-enhancement opportunity for refiners processing waxy crude. The primary impact forces include fluctuating global crude oil prices, which directly influence the economic viability of processing challenging crude types, and increasingly stringent environmental regulations regarding the discharge of chemical additives, pushing innovation towards greener, more sustainable flow assurance solutions.

Specifically, the high viscosity and pour point of waxy crude act as a persistent restraint, mandating costly mitigation steps throughout the supply chain. However, breakthroughs in nanotechnology applied to crude oil flow modification present a transformative opportunity, potentially reducing dependency on traditional thermal solutions. The geopolitical environment, impacting oil supply routes and energy security policies, also acts as a critical external impact force, favoring regions with secure, domestically sourced waxy crude reserves, despite the associated technical complexities. Overall, the market remains balanced between the necessity of utilizing vast global waxy reserves and the persistent technical challenges of managing their transportation and refining.

Segmentation Analysis

The Waxy Crude Oil Market segmentation provides a detailed framework for understanding the diverse applications, technological solutions, and end-user industries driving market demand and expenditure. The market is primarily segmented based on the technologies deployed to mitigate wax deposition, the ultimate application of the refined products derived from waxy crude, and the specific industries that consume the final specialty products. Technological segmentation is crucial because the choice of flow assurance method—ranging from thermal management and mechanical pigging to chemical inhibition using specialized additives—significantly impacts capital investment and operational efficiency, reflecting the technological maturity of the respective region or operation.

Further analysis focuses on the application segments, where Waxy Crude Oil serves as a vital feedstock not only for standard fuels but also, and increasingly importantly, for high-value petrochemical intermediates and lubricants. The presence of high n-paraffin content, usually a challenge in transport, becomes an asset in the refining stage for specific high-melting-point waxes and premium lubrication bases. This duality in processing requirements—mitigation for transport versus utilization for specialty products—drives distinct investment patterns across the value chain, from upstream operators focused on flow to downstream refiners focused on yield maximization.

The end-use segmentation highlights the growing dependence of key sectors like the oil and gas exploration, energy generation, and specialized manufacturing industries on the reliable supply of waxy crude derivatives. Demand elasticity varies across these sectors; for instance, the demand for specialty waxes in the packaging and candle industries shows different cyclical patterns compared to the demand for transportation fuel. Understanding these segments is vital for stakeholders planning investments in refinery upgrades or chemical manufacturing facilities dedicated to servicing the evolving requirements for Waxy Crude Oil management and utilization.

- By Technology:

- Chemical Inhibitors (Pour Point Depressants, Wax Dispersants)

- Thermal Management (Heat Tracing, Insulated Pipelines, Heating Stations)

- Mechanical Methods (Pipeline Pigging, Scrapers)

- Dilution (Blending with Light Crude or Solvents)

- By Application:

- Refineries (Fuel Production, Cracking)

- Petrochemicals (Specialty Waxes, Polymers, Lubricant Base Oils)

- Transportation Fuel (Diesel, Jet Fuel)

- By End-Use Industry:

- Oil & Gas Exploration and Production

- Energy Sector

- Manufacturing and Specialty Chemicals

- By Geographical Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Waxy Crude Oil Market

The value chain for Waxy Crude Oil is distinct from conventional crude due to the specialized processes required immediately after extraction. The upstream segment involves intensive exploration activities focused on identifying reserves and the subsequent production phase, which often requires incorporating advanced downhole heating or specialized pump systems to maintain crude flow integrity even before it reaches the surface facilities. Flow assurance planning is paramount in this stage, determining the optimal method (e.g., subsea insulation, continuous chemical injection) to transport the oil from the wellhead to the primary collection terminal. Key decisions here involve significant capital expenditure on sophisticated equipment and specialized personnel capable of managing high-pressure, high-temperature operations often found in deepwater waxy crude environments.

The midstream phase, focused on transportation, represents the highest cost and technical hurdle in the waxy crude value chain. This phase involves extensive pipeline networks, often employing heat tracing or thick insulation layers, dedicated heating stations located strategically along the pipeline route, and the constant input of flow improvers or diluents. Distribution channels are highly specialized, often relying on long-term contracts with chemical suppliers (for indirect costs) and pipeline maintenance specialists. Direct distribution primarily involves movement from the field to a coastal terminal via owned or leased pipelines, and then onto specialized tankers equipped with heating coils, capable of maintaining the crude above its pour point during long-distance maritime transport.

Downstream analysis centers on the refining and processing facilities. Waxy crude requires specific configurations, such as deep-cut vacuum units and solvent dewaxing plants, to efficiently separate the desirable high-value wax components and specialty lubricant base oils from the fuel fractions. The downstream profitability heavily relies on the ability to efficiently convert the high paraffin content into marketable, high-margin products, thereby offsetting the high upstream and midstream transportation costs. The final distribution of refined products involves conventional channels, but the specialty wax and lubricant components often pass through niche distributors targeting specific industrial or cosmetic manufacturing sectors.

Waxy Crude Oil Market Potential Customers

Potential customers, or end-users/buyers, of Waxy Crude Oil and its derivatives are primarily large-scale industrial entities deeply integrated into the energy and materials supply chains. The most significant direct buyers are major global oil refining companies and integrated petrochemical corporations that possess the specialized infrastructure required for handling and processing high-wax content feedstock. These customers seek waxy crude not just for conventional fuel production, but critically for its inherent capacity to yield high-quality lubricant base stocks and paraffin waxes, which command premium pricing in global markets. Their purchasing decisions are driven by the crude's composition, particularly the Wax Appearance Temperature (WAT) and the potential yield of value-added products.

Beyond the direct processors, key indirect customers include specialty chemical manufacturers and industrial lubricant blenders. Specialty chemical companies rely on the high-purity waxes (e.g., microcrystalline and refined paraffin waxes) derived from waxy crude for applications ranging from tire manufacturing and packaging materials to pharmaceuticals and cosmetics. Industrial lubricant blenders utilize the high Viscosity Index (VI) base oils produced via hydrocracking waxy crude residues to formulate premium engine oils and industrial fluids designed for extreme operating conditions. These downstream industries represent a stable, high-value demand segment for waxy crude derivatives.

Furthermore, the operators of long-distance oil and gas pipelines, particularly those traversing cold climates or deep-sea environments, are essential customers for flow assurance service providers and chemical vendors within the waxy crude ecosystem. Although they do not purchase the crude oil itself, they are critical buyers of the ancillary services, equipment, and chemical inhibitors (such as Pour Point Depressants and flow improvers) necessary to ensure the continuous and safe transport of waxy crude. Their purchasing decisions are focused on operational safety, efficiency, and compliance with environmental standards related to chemical usage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Billion |

| Market Forecast in 2033 | USD 159.0 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, Chevron, BP, Sinopec, PetroChina, TotalEnergies, Equinor, Rosneft, Saudi Aramco, Lukoil, Occidental Petroleum, ENI, ConocoPhillips, Hess Corporation, Murphy Oil Corporation, EOG Resources, Repsol, Woodside Energy, Kuwait Petroleum Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waxy Crude Oil Market Key Technology Landscape

The Waxy Crude Oil market is heavily reliant on technological innovation to overcome the substantial challenges posed by high paraffin content. The key technology landscape is bifurcated into upstream/midstream flow assurance solutions and downstream specialized refining processes. For flow assurance, chemical inhibitors form a primary technological pillar. This includes the development of highly effective, multi-functional Pour Point Depressants (PPDs) and wax crystal modifiers that interfere with the nucleation and growth of wax particles, thereby maintaining fluidity below the natural pour point. Recent advancements focus on polymeric PPDs that are effective across a wider range of crude compositions and are increasingly environmentally friendly, minimizing regulatory complications related to discharge in marine environments.

Another dominant technological area is advanced thermal management, crucial for long-distance transport and subsea operations where ambient temperatures are low. This includes highly sophisticated heat tracing systems, often using electric resistance or circulating hot fluid systems, integrated with thick, high-performance insulation materials. The shift is towards Vacuum Insulated Tubing (VIT) and highly efficient Subsea Production Systems (SPS) designed to minimize heat loss over significant distances, allowing oil to remain above the Wax Appearance Temperature (WAT). The implementation of computational fluid dynamics (CFD) modeling has become integral to designing these systems, accurately predicting heat profiles and ensuring thermal integrity throughout the pipeline lifecycle.

In the downstream sector, the technology landscape is defined by the specialized refining units required to handle waxy residues. Key technologies include catalytic hydrocracking and solvent dewaxing. Hydrocracking processes convert heavy, waxy residues into lighter, higher-value products like high-quality lubricant base oils (Group III), demanding specific catalyst formulations resistant to the high nitrogen and sulfur content often associated with heavier crudes. Solvent dewaxing, while mature, continues to evolve with more energy-efficient solvents and improved filtration techniques to maximize the recovery of high-purity paraffin waxes, catering to specialized industrial and consumer markets. The successful deployment of these technologies is critical for unlocking the full economic potential of waxy crude oil.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market segment, primarily driven by substantial domestic waxy crude production in countries like Indonesia and China, coupled with massive refining capacity expansion in India and China. The region is characterized by high consumption of specialty waxes and lubricants, making it a critical hub for downstream processing technology adoption. Demand for energy security necessitates the development of indigenous waxy crude reserves, requiring significant investment in both onshore and offshore flow assurance systems.

- North America: This region is a major consumer and technological leader, although its own production of extremely waxy crude is relatively lower than other regions. The focus here is on sophisticated flow assurance R&D, particularly in chemical inhibition and advanced pipeline monitoring systems (AI/ML integration). North American refiners utilize waxy crude imports to diversify feedstock and produce premium lubricant base oils that meet strict domestic automotive specifications.

- Europe: Characterized by stringent environmental regulations, the European market drives innovation towards environmentally benign flow assurance chemicals. The region is heavily reliant on imported waxy crude from Russia, West Africa, and the Middle East. Key activity centers around specialized refineries optimizing dewaxing processes and high-technology manufacturing of pipeline insulation components and monitoring equipment.

- Middle East and Africa (MEA): MEA is a major production region, especially along the West African coast (Nigeria, Angola), where deepwater waxy crude extraction is common. This mandates high capital expenditure on subsea heating and insulation technologies. The Middle East, while known for lighter crudes, is increasingly exploring deeper and non-conventional fields, leading to rising waxy crude output and subsequent investment in export pipeline solutions.

- Latin America (LAMEA): Countries like Brazil (deepwater Pre-salt fields) and Venezuela possess substantial waxy crude reserves. Market growth is closely tied to national oil company investment cycles and their ability to secure necessary financing for complex deepwater production infrastructure, particularly regarding subsea flowline heating and integrity management against wax deposition.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waxy Crude Oil Market.- ExxonMobil

- Shell (Royal Dutch Shell plc)

- Chevron Corporation

- BP plc (British Petroleum)

- Sinopec (China Petroleum & Chemical Corporation)

- PetroChina Company Limited

- TotalEnergies SE

- Equinor ASA

- Rosneft PJSC

- Saudi Aramco

- Lukoil

- Occidental Petroleum Corporation

- ENI S.p.A.

- ConocoPhillips

- Hess Corporation

- Murphy Oil Corporation

- EOG Resources, Inc.

- Repsol S.A.

- Woodside Energy Group Ltd

- Kuwait Petroleum Corporation (KPC)

Frequently Asked Questions

Analyze common user questions about the Waxy Crude Oil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary flow assurance methods used to transport waxy crude oil?

The primary methods include chemical inhibition using Pour Point Depressants (PPDs) and wax dispersants, thermal management through pipeline heating or insulation (heat tracing), mechanical cleaning via pigging operations, and dilution by blending the waxy crude with a lighter, less viscous crude oil or solvent before transport.

How does the high wax content affect the profitability of waxy crude compared to light crude?

While waxy crude faces higher lifting and transportation costs due to mandatory flow assurance measures, its refining process can yield high-value products like specialty paraffin waxes and premium Group III lubricant base oils, often leading to enhanced downstream profitability that offsets the increased upstream operational expenses.

Which geographical region holds the largest growth potential for waxy crude oil utilization?

The Asia Pacific (APAC) region, driven by countries like China, India, and Indonesia, holds the largest growth potential. This is due to rapidly expanding petrochemical sectors demanding specialty waxes and lubricants, coupled with significant domestic waxy crude production reserves requiring advanced processing and flow management solutions.

What role does technology play in mitigating wax deposition in subsea pipelines?

Technology is crucial, particularly through the use of advanced subsea thermal management systems, including highly efficient insulation (like Vacuum Insulated Tubing) and active heating coils. Additionally, real-time monitoring and AI-driven predictive modeling optimize chemical injection rates to prevent wax precipitation under deepwater temperature and pressure conditions.

What are Pour Point Depressants (PPDs) and why are they critical in the waxy crude market?

PPDs are chemical additives designed to modify the crystal structure of waxes as they precipitate, preventing them from forming an interlocking network (gelling). They are critical because they lower the crude oil's pour point, allowing it to remain fluid and transportable at temperatures lower than its natural solidification point, thereby reducing the dependency on expensive pipeline heating systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager