WIFI Test Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 442161 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

WIFI Test Equipment Market Size

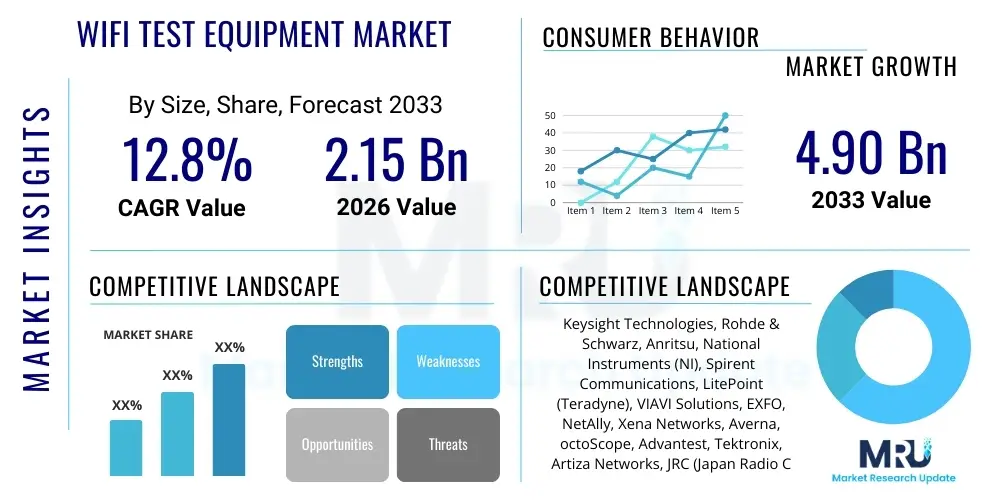

The WIFI Test Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.5 Billion in 2026 and is projected to reach $2.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is primarily driven by the accelerated global deployment of advanced Wi-Fi standards, particularly Wi-Fi 6 (802.11ax), Wi-Fi 6E, and the nascent commercialization of Wi-Fi 7 (802.11be), all of which necessitate more complex and accurate testing solutions. The demand for seamless, high-speed connectivity across various sectors, including enterprise networking, telecommunications infrastructure, and consumer electronics manufacturing, establishes a robust foundation for market expansion.

The transition toward higher frequency bands, such as the 6 GHz spectrum utilized by Wi-Fi 6E and Wi-Fi 7, introduces significant challenges for traditional testing methodologies. Market players are heavily investing in developing sophisticated instruments capable of measuring parameters like high-density channel capacity, massive MIMO performance, and ultra-low latency metrics required by next-generation applications like augmented reality (AR), virtual reality (VR), and high-definition streaming. Furthermore, the increasing complexity of chipset designs and the integration of multiple wireless technologies (e.g., Bluetooth, cellular) within single devices require versatile, multi-standard test platforms, thereby accelerating the replacement cycle for legacy equipment and fueling revenue generation for specialized test vendors.

WIFI Test Equipment Market introduction

WIFI Test Equipment encompasses a specialized category of electronic measurement instruments designed to validate, certify, troubleshoot, and optimize wireless fidelity (Wi-Fi) network performance, device functionality, and protocol conformance based on the IEEE 802.11 family of standards. These essential tools range from simple handheld spectrum analyzers and network troubleshooters to sophisticated benchtop signal generators, vector signal analyzers, and complete conformance test systems used in research and development (R&D) laboratories, manufacturing lines, and field installation settings. The primary objective is to ensure interoperability, reliability, and speed across Wi-Fi enabled devices and infrastructure, mitigating potential connectivity issues and guaranteeing adherence to stringent regulatory requirements.

Major applications for these instruments span the entire wireless ecosystem. In the telecommunications sector, they are indispensable for testing customer premises equipment (CPE) and access points (APs) before deployment. Consumer electronics manufacturers rely on them for verifying the performance of smartphones, laptops, IoT devices, and wearables integrated with Wi-Fi modules. Additionally, the increasing complexity of industrial IoT (IIoT) and automotive networking heavily utilizes specialized Wi-Fi testing apparatus to ensure mission-critical, low-latency communication. The core benefit derived from robust Wi-Fi testing is the assurance of quality of service (QoS) and user experience, which is paramount in today’s hyper-connected environment.

Driving factors for this market include the global surge in internet traffic and connected devices, necessitating continuous upgrades to higher capacity Wi-Fi standards. Government initiatives supporting smart city infrastructure and widespread broadband penetration further mandate the deployment of reliable Wi-Fi networks. The continuous evolution of 802.11 standards, pushing boundaries in throughput and spectral efficiency, forces test equipment providers to innovate rapidly, creating a sustained demand cycle for advanced, high-precision measurement tools capable of handling Orthogonal Frequency-Division Multiple Access (OFDMA), Multi-User MIMO (MU-MIMO), and the wider channel bandwidths associated with 6 GHz operation.

WIFI Test Equipment Market Executive Summary

The WIFI Test Equipment market is experiencing robust momentum, fundamentally driven by the pervasive rollout of Wi-Fi 6/6E and the impending adoption of Wi-Fi 7 across consumer and enterprise segments. Business trends indicate a significant shift towards software-defined test methodologies, which offer greater flexibility, scalability, and integration with automated testing environments (ATE). Key players are prioritizing the development of modular test platforms that can accommodate future wireless standards without necessitating complete hardware overhauls, thereby providing cost-effective and future-proof solutions to manufacturers facing rapid technological obsolescence. Furthermore, the rise of remote work and the reliance on cloud infrastructure have spurred demand for field-testing solutions and network performance monitoring tools that ensure high-quality connectivity beyond traditional office spaces.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the highest growth rate, fueled by its dominance in global electronics manufacturing and the massive investment in 5G and accompanying Wi-Fi infrastructure expansion, particularly in countries like China, South Korea, and Japan. North America and Europe, while mature, remain crucial markets characterized by high adoption rates of advanced standards (Wi-Fi 6E) and stringent quality requirements in R&D sectors, leading to strong demand for high-end, precision benchtop instruments. Segmentation trends highlight the accelerating growth of the standard-based segment, specifically 802.11ax (Wi-Fi 6/6E), as vendors scramble to certify new products, driving high volumes of sales for manufacturing line testers and specialized conformance systems.

AI Impact Analysis on WIFI Test Equipment Market

User queries regarding the impact of Artificial Intelligence (AI) on the WIFI Test Equipment Market predominantly focus on how AI can enhance automation, accelerate fault detection, and optimize network troubleshooting processes. Users are concerned with transitioning from manual, repetitive testing sequences to intelligent, adaptive testing frameworks. Key expectations revolve around AI’s ability to predict component failures, analyze massive datasets generated during performance testing (such as throughput, latency, and jitter logs), and automatically generate optimal test vectors based on device specifications and operational environment simulations. The central theme emerging from user questions is the need for smart testing solutions that drastically reduce time-to-market while improving the accuracy and reliability of complex Wi-Fi certification processes.

AI integration is fundamentally transforming the capabilities of modern Wi-Fi testing instruments. By applying machine learning (ML) algorithms, test equipment can now analyze subtle variations in RF signal characteristics that human operators or static thresholds might miss, leading to proactive identification of potential interoperability issues or manufacturing defects. This capability is particularly vital for testing ultra-high-speed, complex standards like Wi-Fi 7, where intricate parameters like multi-link operation (MLO) require highly nuanced performance validation. AI tools also enhance field deployment testing by intelligently correlating environmental interference patterns with observed network performance degradation, allowing for rapid, data-driven optimization of access point placement and configuration in complex urban or industrial settings.

Furthermore, AI facilitates Generative Engine Optimization (GEO) in the research phase by simulating thousands of complex, real-world network load scenarios that would be impractical to test physically. This allows developers to rigorously validate device performance under stress before production, significantly reducing post-launch failures and improving overall product quality. The integration of AI-powered diagnostics into both hardware and software layers of test equipment represents a critical differentiation strategy for vendors, moving beyond simple measurement towards predictive analysis and automated decision-making in the testing workflow, thereby offering unparalleled efficiency gains to their enterprise clients.

- AI enables predictive maintenance and fault isolation in test setups, minimizing equipment downtime.

- Machine Learning algorithms optimize test plan generation, focusing on high-risk parameters and critical paths.

- Automated performance degradation analysis using AI accelerates troubleshooting and root cause identification for latency and throughput issues.

- AI-driven simulation tools allow for rigorous virtual testing of complex Wi-Fi 7 features like Multi-Link Operation (MLO) under varying channel conditions.

- Integration of smart analytics into field testing equipment for real-time network health assessment and configuration optimization.

- Enhanced spectral efficiency analysis by leveraging deep learning models to distinguish between noise, interference, and desired signals with higher precision.

DRO & Impact Forces Of WIFI Test Equipment Market

The WIFI Test Equipment Market is shaped by a powerful confluence of drivers, constraints, and opportunities, collectively forming the market’s impact forces. Key drivers include the exponential rise in data consumption and the corresponding necessity for faster, more reliable wireless connectivity, pushing the industry towards the adoption of Wi-Fi 6E and Wi-Fi 7. This technological evolution requires significant investment in new testing infrastructure capable of handling wider bandwidths (up to 320 MHz), higher modulation schemes (1024-QAM to 4096-QAM), and operational frequencies in the newly opened 6 GHz band. The rapid proliferation of IoT devices across smart homes, industrial environments, and healthcare systems further acts as a primary catalyst, demanding specialized equipment for testing large-scale device interoperability and low-power communication standards.

However, the market faces notable restraints, primarily centered around the high initial capital expenditure associated with purchasing sophisticated, state-of-the-art testing systems. Benchtop and modular systems designed for Wi-Fi 7 often involve complex software licensing and specialized hardware components, creating financial barriers, especially for smaller manufacturers or emerging economies. Furthermore, the extremely rapid evolution of the IEEE 802.11 standards creates a challenge for test equipment vendors to keep pace, risking technological obsolescence shortly after product launch. This requires continuous R&D investment, placing financial pressure on market participants and slowing the standardization process for next-generation testing protocols, which acts as a temporal restraint on mass deployment.

Opportunities abound in leveraging the global deployment of 5G networks, as the convergence of cellular and Wi-Fi technologies (e.g., 5G offloading) creates a new requirement for integrated, cross-technology testing solutions. The burgeoning field of industrial automation and smart manufacturing (Industry 4.0) offers a lucrative niche for robust, reliable Wi-Fi testing equipment that can validate mission-critical, deterministic wireless performance. Furthermore, the transition toward subscription-based software services and remotely accessible cloud-based testing platforms (Test-as-a-Service or TaaS) presents an opportunity for vendors to generate recurring revenue streams while reducing the high upfront costs for end-users. The major impact forces thus manifest as a cycle of innovation driven by technological necessity, countered by high development costs and regulatory complexity.

Segmentation Analysis

The WIFI Test Equipment Market is meticulously segmented based on Type, Application, and Standard, reflecting the diverse requirements of the end-user landscape, from R&D labs requiring ultra-precision analysis to manufacturing floors needing speed and automation, and field technicians demanding portability and ease of use. The segmentation by Type delineates the form factor and operational environment, distinguishing between sophisticated benchtop systems, portable handheld devices, and flexible, modular PXI-based solutions. The Application segmentation clearly defines the key end-use industries, highlighting the critical role of these tools in telecommunications and consumer electronics manufacturing.

Analyzing the market through the lens of Standards is perhaps the most dynamic segmentation currently, demonstrating the market's response to technological advancements. The strong shift from legacy Wi-Fi 5 (802.11ac) testing to mandatory Wi-Fi 6 (802.11ax) and emerging Wi-Fi 7 (802.11be) compliance testing is a primary driver of purchasing decisions and product development priorities. This segmented structure ensures that vendors can tailor their offerings—whether comprehensive, multi-channel vector signal generators for R&D on Wi-Fi 7 or high-throughput manufacturing testers for Wi-Fi 6 access points—to the highly specific needs and budget constraints of different customer verticals and technological maturity levels globally, facilitating highly targeted marketing and sales strategies.

- By Type:

- Benchtop WIFI Testers

- Portable/Handheld WIFI Testers

- Modular WIFI Testers (PXI/VXI/ATCA)

- By Component:

- Hardware (Analyzers, Generators, Accessories)

- Software (Measurement Libraries, Automation Suites)

- By Standard:

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6/6E (802.11ax)

- Wi-Fi 7 (802.11be)

- Other Legacy Standards

- By Application:

- Research and Development (R&D)

- Manufacturing and Quality Assurance (QA)

- Field Testing and Installation

- By End-User Industry:

- Telecommunications

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Healthcare and Medical Devices

- Enterprise Networking

Value Chain Analysis For WIFI Test Equipment Market

The value chain for the WIFI Test Equipment Market begins with the Upstream segment, dominated by highly specialized semiconductor and component manufacturers. These providers supply the critical RF components, high-speed digital processing chips (FPGAs/ASICs), and precision analog-to-digital/digital-to-analog converters necessary for constructing high-fidelity signal measurement and generation instruments. The quality and performance of these core components directly dictate the accuracy and bandwidth capabilities of the final test equipment. Strong relationships between test equipment manufacturers and key component suppliers are vital for maintaining technological leadership, especially as testing requirements shift to higher frequencies (6 GHz and beyond) and wider instantaneous bandwidths required by Wi-Fi 7.

The Midstream segment involves the core activities of the test equipment vendors themselves, encompassing R&D, system integration, software development (including measurement libraries and automation tools), and final instrument assembly. This stage is characterized by intense intellectual property development, focusing on proprietary algorithms for signal analysis, calibration techniques, and user interface optimization. Distribution channels represent a critical juncture in the value chain, utilizing both direct and indirect methods. Direct sales are preferred for high-value, complex modular systems sold to major R&D labs and Tier 1 manufacturers, ensuring personalized technical support and integration services. Indirect channels, involving authorized distributors and value-added resellers (VARs), efficiently reach smaller enterprises, system integrators, and field service companies, particularly for standardized or handheld products.

The Downstream segment comprises the end-users: the telecommunications companies, consumer electronics giants (OEMs), defense contractors, and network installers who utilize the equipment. Effective customer support, ongoing calibration services, and timely software updates are paramount in this final stage to ensure the longevity and reliability of the purchased assets. The value chain is inherently complex, relying heavily on seamless integration between precision hardware engineering and sophisticated, rapidly evolving measurement software, making continuous innovation in both the upstream component supply and midstream integration crucial for market success.

WIFI Test Equipment Market Potential Customers

The primary customers for WIFI Test Equipment are organizations heavily involved in the design, manufacture, deployment, and maintenance of Wi-Fi-enabled products and network infrastructures. Consumer electronics manufacturers constitute a massive segment, requiring high-throughput, automated testing systems to validate the performance and conformance of smartphones, tablets, smart home devices (IoT), and wearables before mass production. These entities prioritize speed, repeatability, and cost-effectiveness in their manufacturing line test setups, driving demand for dedicated, integrated testers capable of rapid pass/fail analysis for thousands of devices daily. The move to Wi-Fi 6E/7 mandates hardware upgrades for these manufacturing lines, representing a significant short-term sales opportunity.

Another crucial customer segment is the telecommunications sector, including fixed-line operators, mobile network operators (MNOs), and internet service providers (ISPs). These customers rely on Wi-Fi test equipment for R&D of next-generation CPE (Customer Premises Equipment like routers and gateways), network planning, field installation validation, and ongoing network performance troubleshooting. Their demand often focuses on high-precision field analyzers and sophisticated benchtop systems used in pre-standardization research. Furthermore, regulatory and certification bodies (such as the Wi-Fi Alliance and various national spectrum authorities) act as critical customers, purchasing high-end conformance test benches to ensure devices comply with legal and interoperability standards, acting as gatekeepers for market entry and ensuring adherence to the latest 802.11 specifications, particularly concerning spectral masks and power output limits in unlicensed bands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.5 Billion |

| Market Forecast in 2033 | $2.7 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Keysight Technologies, Rohde & Schwarz, Anritsu Corporation, LitePoint (Teradyne), Spirent Communications, VIAVI Solutions, National Instruments (NI), EXFO, NetScout Systems, Teledyne LeCroy, Art-of-Test GmbH, OctoScope, Trescal, TWTG, VTT Technical Research Centre of Finland Ltd., Averna, Guangzhou Mornsun, Telewave, Aeroflex (Cobham), PCTEL. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

WIFI Test Equipment Market Key Technology Landscape

The technological landscape of the WIFI Test Equipment Market is defined by the necessity to accurately measure complex, multi-gigabit wireless protocols operating across congested spectrums, particularly focusing on the recently allocated 6 GHz band. A central technology is Vector Signal Analysis (VSA) combined with Vector Signal Generation (VSG), which forms the backbone of precision benchtop testing. Modern VSA instruments must possess extremely low Error Vector Magnitude (EVM) floor characteristics and high phase noise performance to reliably measure the sophisticated 1024-QAM and 4096-QAM modulation schemes employed by Wi-Fi 6 and Wi-Fi 7, respectively. The capability to handle ultra-wide bandwidths, up to 320 MHz in Wi-Fi 7, dictates the adoption of high-speed digitizers and real-time spectrum analysis features.

Software-defined instrumentation (SDI) and modular platforms, such as PXI (PCI eXtensions for Instrumentation), represent another critical technology trend. SDI allows test solutions to be primarily driven by software, enabling rapid updates for new standards (like evolving Wi-Fi 7 specifications) without requiring costly hardware replacements. Modular systems offer unparalleled flexibility for R&D labs and high-volume manufacturers who need scalable solutions capable of parallel testing multiple devices using techniques like Multi-User MIMO (MU-MIMO) and testing Multi-Link Operation (MLO). Furthermore, the integration of advanced automation software, often utilizing Python or similar scripting languages, allows for complex test sequences to be executed with minimal human intervention, enhancing both speed and repeatability in manufacturing environments.

The integration of advanced network emulation capabilities is also rapidly gaining prominence. Network simulators allow device manufacturers to test their products under highly realistic, controlled, and repeatable network conditions, including congestion, interference, and dynamic channel changes. This is crucial for validating critical Wi-Fi 7 features such as Coordinated Spatial Reuse (CSR) and low-latency performance required for demanding applications like cloud gaming and industrial control. Moreover, the focus on Over-The-Air (OTA) testing in shielded chambers has intensified, driven by the increasing complexity of integrated antenna systems (beamforming), necessitating specialized anechoic test setups and robust test fixtures that can accurately characterize device performance across diverse spatial configurations, ensuring optimal field performance.

Regional Highlights

Geographic analysis reveals diverse market dynamics across major regions, driven by varying rates of technological adoption, manufacturing concentration, and infrastructure spending. The Asia Pacific (APAC) region is forecasted to lead the market in terms of growth and sheer volume. This dominance stems from its position as the global hub for consumer electronics manufacturing, particularly in China, Taiwan, and South Korea, which drives massive demand for high-throughput, automated manufacturing-line testers for Wi-Fi modules and finished goods. Furthermore, aggressive government-backed investments in 5G and fiber-optic broadband deployment across the region naturally pull through associated demand for advanced Wi-Fi infrastructure testing.

North America holds a substantial share, characterized by high investment in sophisticated R&D and early adoption of cutting-edge technologies. The concentration of leading technology companies and semiconductor design houses in the US dictates a strong, sustained demand for high-precision, benchtop VSA/VSG systems for designing and verifying Wi-Fi 7 chipsets. The European market mirrors North America in terms of technological maturity, with stringent regulatory requirements and high standards for network performance driving demand, particularly in sectors like automotive (for vehicle-to-everything or V2X communication testing) and industrial automation (IIoT), where network reliability is mission-critical.

The Latin America (LATAM), Middle East, and Africa (MEA) regions represent emerging markets characterized by ongoing infrastructure modernization and increasing digital transformation initiatives. While capital spending on highly advanced equipment might lag, there is significant growth in demand for portable and handheld field-testing equipment necessary for the widespread installation and maintenance of new Wi-Fi 5 and Wi-Fi 6 access points in rapidly expanding urban centers and commercial properties, offering targeted opportunities for vendors specializing in ruggedized, cost-effective field solutions.

- Asia Pacific (APAC): Dominant region driven by large-scale consumer electronics manufacturing; high demand for automated manufacturing testers; significant governmental investment in 5G and Wi-Fi 6/7 infrastructure deployment in countries like China and South Korea.

- North America: Leader in R&D and early technology adoption (Wi-Fi 7 chipset development); high demand for precision benchtop and modular testing systems; focus on aerospace, defense, and high-tech enterprise networking applications.

- Europe: Strong growth in specialized sectors like automotive connectivity (V2X), Industry 4.0, and smart homes; emphasis on compliance and regulatory testing; significant presence of key test equipment vendors and standardization bodies.

- Latin America (LATAM): Growing market driven by infrastructure upgrades and expanding internet access; demand focused on cost-effective, portable equipment for field installation and troubleshooting.

- Middle East and Africa (MEA): Emerging market driven by smart city projects and digitalization efforts; increasing need for network monitoring and performance validation tools in telecom service provider deployments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the WIFI Test Equipment Market.- Keysight Technologies

- Rohde & Schwarz

- Anritsu Corporation

- LitePoint (Teradyne)

- Spirent Communications

- VIAVI Solutions

- National Instruments (NI)

- EXFO

- NetScout Systems

- Teledyne LeCroy

- Art-of-Test GmbH

- OctoScope

- Trescal

- TWTG

- VTT Technical Research Centre of Finland Ltd.

- Averna

- Guangzhou Mornsun

- Telewave

- Aeroflex (Cobham)

- PCTEL

Frequently Asked Questions

Analyze common user questions about the WIFI Test Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the WIFI Test Equipment market?

The predominant growth factor is the global transition and mass commercialization of advanced Wi-Fi standards, specifically Wi-Fi 6 (802.11ax) and the emerging Wi-Fi 7 (802.11be). These standards require new, sophisticated testing equipment capable of validating performance in the 6 GHz spectrum, handling complex features like 4096-QAM modulation, and supporting wider channel bandwidths up to 320 MHz, necessitating significant hardware and software upgrades across R&D and manufacturing sectors.

How is Wi-Fi 7 (802.11be) affecting the design requirements for new test equipment?

Wi-Fi 7 mandates test equipment capable of operating accurately across the newly utilized 6 GHz band and handling extremely wide 320 MHz channels. Test solutions must support critical new features like Multi-Link Operation (MLO) and 4096-QAM modulation, requiring higher measurement fidelity, lower Error Vector Magnitude (EVM) floors, and increased instantaneous bandwidth capabilities in signal analyzers and generators, pushing vendors toward modular and software-defined instrumentation (SDI).

Which geographical region represents the largest demand for WIFI Test Equipment?

The Asia Pacific (APAC) region currently holds the largest market share and is expected to exhibit the highest CAGR. This is primarily due to the region's concentration of global electronics manufacturing and its aggressive investment in deploying next-generation networking infrastructure, driving immense volume demand for automated manufacturing test solutions and conformance certification tools in countries such as China, South Korea, and Taiwan.

What role does Artificial Intelligence (AI) play in modern Wi-Fi testing?

AI, leveraging machine learning (ML), is integrated into test equipment to enhance automation, optimize complex test plan generation, and accelerate root cause analysis. AI algorithms analyze massive datasets generated during performance tests to predict failures, identify subtle anomalies in RF signals missed by traditional methods, and ensure faster time-to-market by streamlining validation and quality assurance processes for complex wireless devices.

What is the difference between benchtop and modular WIFI testing solutions?

Benchtop solutions are typically high-precision, integrated instruments (like VNAs or VSAs) offering comprehensive analysis, primarily used in specialized R&D environments. Modular solutions (e.g., PXI systems) offer scalable, flexible, and often more cost-effective platforms that allow users to mix and match different instrument cards (e.g., source, analyzer, digital I/O) to build custom systems optimized for high-volume manufacturing testing or complex multi-device parallel testing requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- WIFI Test Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- WiFi Test Equipment Market Statistics 2025 Analysis By Application (Household, Commercial), By Type (Desktop WiFi Test Equipment, Handheld WiFi Test Equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager