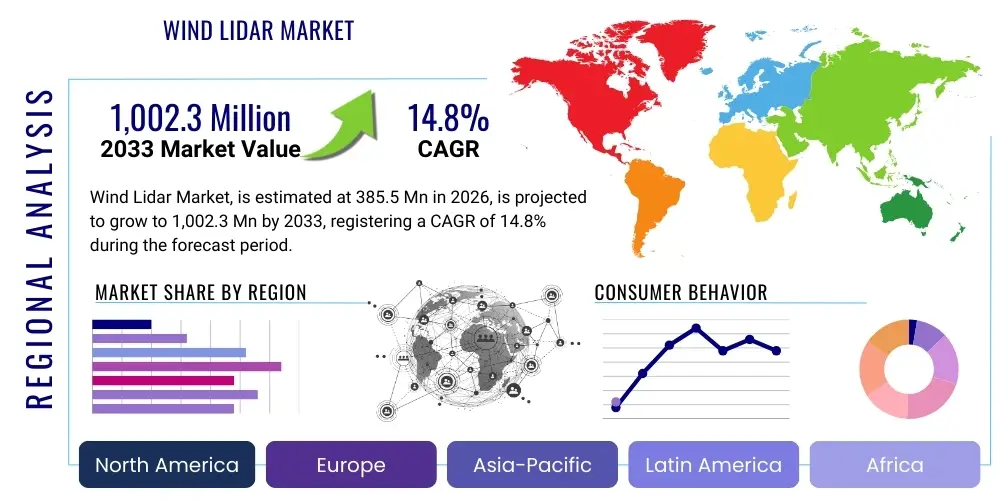

Wind Lidar Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441635 | Date : Feb, 2026 | Pages : 241 | Region : Global | Publisher : MRU

Wind Lidar Market Size

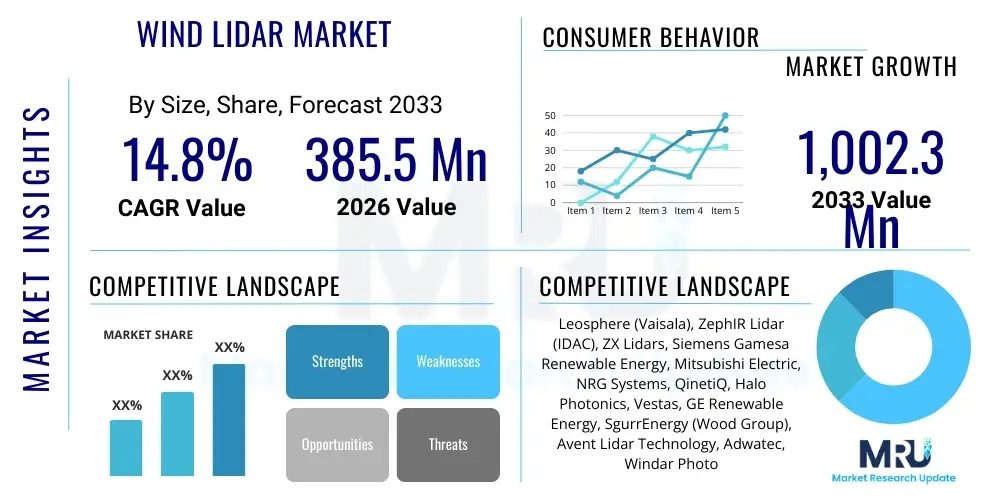

The Wind Lidar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.8% between 2026 and 2033. The market is estimated at $385.5 Million in 2026 and is projected to reach $1,002.3 Million by the end of the forecast period in 2033.

Wind Lidar Market introduction

The Wind Lidar Market encompasses advanced remote sensing instruments that utilize laser technology to measure wind speed, direction, and turbulence across various altitudes and distances. This technology has become indispensable in the modern renewable energy sector, primarily serving the comprehensive needs of wind farm developers, operators, and regulatory bodies. Wind Lidar systems operate on the Doppler effect principle, sending pulses of laser light into the atmosphere and analyzing the backscattered light from aerosol particles carried by the wind. The resulting frequency shift allows for highly accurate, non-intrusive wind vector measurements, offering significant advantages over traditional mechanical anemometers and meteorological masts, particularly in complex terrain or offshore environments where conventional methods are cost-prohibitive or logistically challenging.

The key applications driving market expansion include wind resource assessment (WRA) for new project development, turbine power performance verification, and real-time wind farm control and optimization. For WRA, Lidar provides high-resolution vertical wind profiles crucial for calculating bankable energy yield estimates. In operational phases, nacelle-mounted Lidar is increasingly used to actively manage the pitch and yaw of turbines, mitigating turbulence and maximizing energy capture, thereby significantly enhancing the overall efficiency and longevity of assets. The core benefits derived from Wind Lidar deployment involve reduced uncertainty in energy production forecasting, lower costs associated with monitoring (especially offshore where Floating Lidar Systems or FLS are revolutionizing data collection), and the ability to gather crucial atmospheric data necessary for advanced grid management and short-term energy predictions.

Major driving factors fueling the accelerated adoption of Wind Lidar include the global push toward decarbonization and the subsequent massive growth in offshore wind energy projects. Offshore installations, which require detailed and stable wind data at high altitudes (often exceeding 150 meters), rely heavily on Lidar due to the impossibility of installing tall met masts economically. Furthermore, technological advancements leading to system miniaturization, increased robustness, and lower unit costs are making Lidar accessible for a broader range of applications, including turbulence monitoring for aviation safety and atmospheric research. The stringent regulatory environment regarding turbine certification and performance guarantees also mandates the high-accuracy measurement capabilities that only Lidar technology can consistently deliver, ensuring market growth across established and emerging wind power geographies.

Wind Lidar Market Executive Summary

The Wind Lidar Market is experiencing robust acceleration, primarily driven by critical shifts in the global energy landscape, notably the unprecedented growth in the offshore wind sector and the increasing necessity for highly accurate, digitally integrated wind data. Business trends indicate a strong move away from standalone Lidar units towards integrated solutions, where Lidar data streams are combined with advanced data analytics and predictive modeling tools, often leveraging Artificial Intelligence (AI) to optimize wind farm performance dynamically. Key industry players are focusing on developing floating Lidar systems (FLS) that drastically reduce the logistical complexity and cost of offshore resource assessment, leading to faster development cycles for large-scale maritime projects. Furthermore, strategic mergers and acquisitions, such as major sensor manufacturers integrating Lidar specialists, are consolidating technology access and driving standardization, allowing for greater scalability and wider acceptance among major utilities and independent power producers (IPPs).

Regionally, the market growth is heavily segmented. Asia Pacific (APAC), particularly China and India, is emerging as the fastest-growing region due to massive governmental commitments to renewable energy expansion and ambitious offshore development goals in markets like Taiwan, South Korea, and Japan. Europe maintains its position as the market leader in terms of technological maturity and installed base, driven by the mature North Sea and Baltic Sea wind markets, where Lidar is a standard tool for operational efficiency and planning. North America is characterized by significant investment in utility-scale onshore projects and increasingly complex onshore terrain analysis, demanding highly specialized ground-based and scanning Lidar units to accurately map wind flows and minimize project uncertainty.

Segment trends reveal that the Nacelle-mounted Lidar segment is expected to witness the highest deployment rates in the near term, as these systems provide immediate, actionable data for turbine control and power curve optimization, offering rapid return on investment. Conversely, the Floating Lidar Systems (FLS) segment is seeing the highest value growth due to their high unit cost and critical role in de-risking multi-billion dollar offshore projects. By application, the Wind Resource Assessment (WRA) segment remains the foundational revenue stream, although the Power Performance Verification and Control segment is quickly gaining ground as operators shift focus from project development to long-term operational excellence and profitability maximization. The continuous evolution toward fiber-optic Lidar systems over traditional bulk-optic setups is also a key segmentation trend, promising enhanced reliability and lower maintenance requirements.

AI Impact Analysis on Wind Lidar Market

Common user questions regarding the impact of AI on the Wind Lidar market center on how AI can handle the massive, complex datasets generated by scanning Lidar systems, particularly concerning turbulence modeling and wake effects. Users frequently inquire about the reliability of AI-driven predictive maintenance based on Lidar measurements, asking if machine learning models can accurately forecast component failures or optimal maintenance schedules better than traditional statistical models. Furthermore, there is strong interest in the feasibility of fully autonomous wind farms where AI utilizes real-time Lidar data for dynamic, active wake steering and collective control of multiple turbines to maximize farm-level energy yield. The underlying concern revolves around integrating AI's black-box complexity with the highly regulated and capital-intensive nature of the wind industry, seeking assurances regarding transparency and certification standards for AI-validated data.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the value proposition of Wind Lidar technology, shifting its role from a passive measurement tool to an active predictive and prescriptive asset. AI algorithms are essential for processing the large volumes of spatio-temporal data generated by modern Lidar systems, especially in applications like complex terrain modeling or analyzing wind farm wake interactions. By applying deep learning techniques, analysts can extract subtle patterns in wind flow that traditional methods often miss, leading to vastly improved uncertainty reduction in energy yield assessments—a crucial factor for project financing. This enhanced analytical capability allows for more accurate forecasting and optimized micro-siting of turbines within a farm boundary.

Moreover, AI uses Lidar data to revolutionize wind farm operations and maintenance (O&M). Lidar measurements provide detailed information on inflow conditions and structural loads experienced by turbine blades. ML models process this data to perform predictive maintenance, identifying anomalies indicative of potential component stress or failure before visual or physical inspection detects them. This proactive approach significantly reduces downtime and maintenance costs. The ultimate impact lies in enabling active turbine control (known as wake steering), where AI uses Lidar inputs to dynamically adjust the yaw of upstream turbines to mitigate wake effects on downstream turbines, collectively boosting the efficiency of the entire wind farm—a technological leap that promises significant increases in overall farm output.

- AI enables highly advanced data fusion, integrating Lidar data with SCADA, satellite imagery, and meteorological models for holistic environmental awareness.

- Machine Learning algorithms significantly reduce measurement uncertainty in Wind Resource Assessment (WRA) by processing complex atmospheric turbulence patterns.

- Predictive maintenance is optimized as AI analyzes Lidar-derived load and flow data to forecast turbine component stress and failure probability.

- AI facilitates active wake steering and collective wind farm control by dynamically adjusting turbine parameters based on real-time Lidar wind field mapping.

- Natural Language Processing (NLP) integration is used to streamline report generation and data interpretation, accelerating decision-making for asset managers.

- Cloud-based AI platforms allow for remote calibration, diagnostics, and instant algorithm updates, enhancing system reliability and accessibility.

DRO & Impact Forces Of Wind Lidar Market

The Wind Lidar Market is strongly propelled by the escalating demand for highly accurate wind data, primarily driven by the global imperative to transition to renewable energy and the expansion of offshore wind developments, where Lidar offers the only economically viable path to collect bankable data. Simultaneously, the market faces restraints, chiefly high capital expenditure required for initial purchase and deployment, complex regulatory frameworks regarding Lidar data acceptance in certain markets, and the performance degradation of systems in extreme environmental conditions (e.g., heavy fog, rain, or salt spray). However, significant opportunities exist in the commercialization of Floating Lidar Systems (FLS), the increasing use of Lidar for short-term power forecasting (especially grid stability applications), and integration into advanced urban climate monitoring systems. These factors create a complex matrix of impact forces, where the technological advancement and increasing standardization act as powerful forces neutralizing the restraints related to cost and data skepticism, ensuring a positive long-term growth trajectory.

The primary driving force remains the increasing investment in large-scale renewable projects, specifically offshore wind, coupled with the critical need to de-risk these multi-billion dollar investments. Lidar technology offers a superior method for obtaining accurate, finance-grade wind measurements compared to traditional methods, directly lowering the cost of capital for developers. Impact forces supporting growth include technological maturity, miniaturization of components, and the move towards solid-state Lidar architectures, which enhance durability and reduce maintenance needs. The standardization efforts led by organizations like DNV and IEC regarding Lidar data acceptance for power curve measurements further cement its role as an industry necessity. These drivers exert a constant upward pressure on market adoption.

Restraints are primarily economic and technical. The high upfront cost of advanced scanning Lidar units often creates a barrier to entry for smaller developers or independent consultants. Technically, ensuring reliable, continuous performance in harsh marine environments remains a challenge, requiring specialized materials and complex housing. Opportunities, however, abound, specifically in emerging markets like Southeast Asia and Latin America, which are just beginning their large-scale wind energy transitions. Furthermore, the convergence of Lidar with 5G technology and the Industrial Internet of Things (IIoT) promises real-time, cloud-integrated data processing, opening new revenue streams outside of traditional wind farm applications, such as atmospheric research and pollution tracking, further diversifying the market's growth potential.

Segmentation Analysis

The Wind Lidar market segmentation provides a granular view of product specialization, deployment environments, and targeted end-use applications, reflecting the complex and diverse needs of the global wind energy sector. Segmentation by deployment type is critical, distinguishing between nacelle-mounted units used for operational optimization, ground-based systems crucial for resource assessment and power performance testing, and the highly specialized Floating Lidar Systems (FLS) indispensable for preliminary offshore site data collection. Analyzing the market by application highlights the distinct value propositions, ranging from the fundamental stage of resource assessment and prospecting to the advanced stage of real-time power forecasting and grid integration. The underlying technological components, specifically the type of laser source and data processing methodology, further differentiate offerings based on accuracy, range, and operational robustness, guiding procurement decisions across various project lifecycles.

- By Product Type:

- Coherent Doppler Lidar (CDL)

- Pulsed Lidar

- Continuous Wave (CW) Lidar

- Fiber-optic Lidar

- By Deployment Type:

- Ground-based Lidar Systems (Static and Scanning)

- Nacelle-mounted Lidar Systems

- Floating Lidar Systems (FLS)

- Airborne and Drone-mounted Lidar

- By Application:

- Wind Resource Assessment (WRA) and Prospecting

- Power Performance Testing (PPT) and Verification

- Wind Farm Control and Optimization (Wake Steering)

- Short-term Wind Power Forecasting

- Atmospheric Research and Meteorology

- By Measurement Range:

- Short Range (Nacelle and Turbulence)

- Medium Range (Onshore WRA)

- Long Range (Offshore WRA and Forecasting)

Value Chain Analysis For Wind Lidar Market

The value chain for the Wind Lidar market is highly specialized, beginning with the upstream supply of core photonic components, extending through complex system integration, and culminating in the highly specialized downstream services sector. The upstream segment is dominated by specialized manufacturers providing high-specification components, including high-power laser diodes, sophisticated fiber optics, advanced photodetectors, and complex optical systems (lenses and mirrors). The quality and reliability of these components are paramount, as they dictate the Lidar system's measurement accuracy, range, and durability, especially under harsh environmental stress. This segment requires high R&D investment and expertise in precision engineering and materials science.

The middle segment of the value chain involves the Lidar manufacturers (OEMs) who focus on system design, software development, calibration, and final assembly. This stage adds significant value through proprietary signal processing algorithms, robust housing design, and user interface development. Distribution channels are generally dual: direct sales to large Original Equipment Manufacturers (OEMs) like major turbine manufacturers (who integrate nacelle Lidar directly into their products) and sales through specialized integration partners or consulting firms who handle project-specific deployment, maintenance, and data services for smaller developers or site owners. The complexity of deployment, particularly for Floating Lidar Systems (FLS), necessitates specialized logistics and installation expertise.

The downstream activities are centered on the end-users and the highly specialized consultancy services they require. End-users, such as utility companies, IPPs, and wind farm developers, purchase the Lidar units and subsequently rely on specialized technical consultants for data acquisition campaigns, analysis, reporting, and integration of Lidar data into financial and operational models. This post-sales service sector, which includes maintenance, recalibration, and software support, constitutes a rapidly growing and high-margin segment of the value chain. Direct and indirect channels both play critical roles; direct sales ensure high control and margin for OEMs, while the indirect channel, leveraging global consultancies and local partners, ensures market penetration and localized support across diverse regulatory environments, particularly in emerging markets where complex customs and regulatory hurdles exist.

Wind Lidar Market Potential Customers

The primary customers for Wind Lidar technology are entities deeply involved in the development, operation, and financing of wind energy projects, requiring highly precise wind measurements to minimize uncertainty and maximize profitability. End-Users/Buyers include major international utility companies and Independent Power Producers (IPPs) who utilize Lidar for large-scale pre-construction wind resource assessments and for ongoing power performance verification and operational optimization of their existing assets. These large organizations often require integrated, network-enabled Lidar solutions capable of generating bankable data accepted by financial institutions.

Another crucial customer segment consists of global wind turbine Original Equipment Manufacturers (OEMs), such as Vestas, Siemens Gamesa, and GE Renewable Energy. These companies are major buyers of nacelle-mounted Lidar systems, which they integrate directly into their turbine control systems to enhance power curve efficiency, reduce fatigue loads, and offer advanced warranty guarantees to their clients. Furthermore, specialized meteorological services, research institutions, and environmental monitoring agencies purchase Lidar for atmospheric research, pollution tracking, and short-term weather forecasting models that extend beyond pure energy applications. Consultancy firms specializing in renewable energy assessment act as significant intermediaries and buyers, acquiring Lidar units to execute site assessment campaigns on behalf of smaller developers and investors globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385.5 Million |

| Market Forecast in 2033 | $1,002.3 Million |

| Growth Rate | 14.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Leosphere (Vaisala), ZephIR Lidar (IDAC), ZX Lidars, Siemens Gamesa Renewable Energy, Mitsubishi Electric, NRG Systems, QinetiQ, Halo Photonics, Vestas, GE Renewable Energy, SgurrEnergy (Wood Group), Avent Lidar Technology, Adwatec, Windar Photonics, EOLOS Floating Lidar Solutions, OceanScan, Wuxi Greatek, Wuhan Xinyarui Technology, 3D-P, OWC, Pentalum, Lockheed Martin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wind Lidar Market Key Technology Landscape

The technological landscape of the Wind Lidar market is highly dynamic, centered on enhancing measurement accuracy, increasing operational range, and achieving greater system robustness, especially for offshore and remote applications. The dominant technology remains Coherent Doppler Lidar (CDL), which offers high signal-to-noise ratios crucial for long-range wind profiling. However, there is a distinct shift towards fiber-optic based Lidar systems, which leverage advancements in telecommunications-grade optical fibers and components. These fiber-based systems are inherently more compact, rugged, and reliable than traditional bulk-optic systems, significantly simplifying integration into nacelles and minimizing the footprint required for ground-based units, thereby lowering maintenance needs and operational expenses over the system lifecycle.

Pulsed Lidar technology is undergoing significant improvements, particularly in systems designed for longer ranges, essential for comprehensive offshore resource assessment where wind profiles often need to be measured up to 300 meters above the sea surface. Continuous Wave (CW) Lidar, on the other hand, remains dominant in high-frequency measurements, primarily used in nacelle-mounted configurations to capture rapid changes in wind velocity immediately upstream of the turbine blades for active control purposes. A crucial development across all Lidar types is the advancement in signal processing and computational fluid dynamics (CFD) integration. This allows raw Lidar data to be quickly processed into highly refined 3D wind field maps, offering unprecedented detail on wake characteristics and atmospheric shear, essential for optimizing farm layout and control strategies.

Miniaturization and the push towards solid-state components represent major technological trends that define the competitive landscape. Efforts are underway to reduce the size and weight of Lidar sensors, enabling easier deployment on smaller platforms, such as drones for complex site mapping, and reducing the structural load on turbine nacelles. Furthermore, the convergence of Lidar with sophisticated GPS and Inertial Measurement Units (IMUs) is critical for Floating Lidar Systems (FLS), allowing accurate motion compensation necessary to isolate atmospheric wind movement from platform movement, ensuring data quality remains finance-grade even in harsh sea states. This relentless focus on ruggedization and data integrity underpins the market's technological evolution.

Regional Highlights

- Europe: Europe represents the most mature and technologically advanced market for Wind Lidar, largely driven by the pioneering establishment of the North Sea and Baltic Sea offshore wind industries. Countries like Germany, the UK, and Denmark were early adopters of Lidar for both resource assessment and power performance testing, often mandated by strict governmental and financial standards. The region leads in the deployment of Floating Lidar Systems (FLS), supported by substantial EU funding for deep-water offshore projects. Strict carbon reduction targets and high levels of grid penetration necessitate accurate short-term wind forecasting, ensuring sustained demand for advanced Lidar applications and associated data services.

- North America (NA): The US market is characterized by significant onshore wind development, often occurring in complex terrain (mountainous regions or areas prone to high wind shear). This complexity necessitates the use of advanced scanning Lidar systems for accurate resource assessment, driving the segment for high-power, ground-based units. The recent emphasis on offshore wind development on the East and West Coasts, backed by federal and state incentives, is rapidly increasing the demand for FLS technology. Canada also contributes to market growth through large-scale utility projects requiring sophisticated wind flow analysis.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled primarily by the massive renewable energy commitments of China, India, and emerging markets like Vietnam, Taiwan, and South Korea. China, in particular, is both a massive consumer and a rapidly advancing manufacturer of Lidar systems, driving global competition and lowering component costs. The rapid growth of offshore wind in Taiwan and South Korea demands large volumes of FLS, making the region a critical hub for Lidar deployment and innovation related to monsoons and typhoons.

- Latin America (LATAM): Growth in LATAM is concentrated in countries like Brazil, Chile, and Mexico, where extensive onshore wind farms are being developed, often in remote or inaccessible locations. Lidar deployment solves logistical challenges associated with installing traditional meteorological infrastructure in these areas. While the market size is currently smaller than in established regions, the high potential for green energy projects and increasing foreign investment signal strong future adoption, particularly for portable and solar-powered ground Lidar units.

- Middle East and Africa (MEA): The MEA market is nascent but shows potential, especially in South Africa, Morocco, and select Gulf Cooperation Council (GCC) countries investing heavily in renewable energy diversification. Lidar is primarily used here for large-scale green hydrogen projects and utility-scale wind farm development in desert environments. Technical challenges related to dust, sand, and high temperatures require highly ruggedized Lidar systems, driving demand for specialized, environmentally hardened products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wind Lidar Market.- Leosphere (Vaisala)

- ZephIR Lidar (IDAC)

- ZX Lidars

- Siemens Gamesa Renewable Energy

- Mitsubishi Electric

- NRG Systems

- QinetiQ

- Halo Photonics

- Vestas

- GE Renewable Energy

- SgurrEnergy (Wood Group)

- Avent Lidar Technology

- Adwatec

- Windar Photonics

- EOLOS Floating Lidar Solutions

- OceanScan

- Wuxi Greatek

- Wuhan Xinyarui Technology

- 3D-P

- OWC

- Pentalum

- Lockheed Martin

- AeroVironment

Frequently Asked Questions

Analyze common user questions about the Wind Lidar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Wind Lidar over traditional meteorological masts?

The primary advantage of Wind Lidar is its ability to conduct high-resolution, non-intrusive measurements of wind speed and direction at multiple heights, up to hundreds of meters, without the need for expensive, time-consuming construction of tall masts, especially crucial for offshore and complex onshore sites.

How are Floating Lidar Systems (FLS) impacting offshore wind development?

FLS dramatically reduces the cost and timeline associated with collecting bankable wind resource data offshore. By providing reliable data from stable, ocean-based platforms, FLS lowers project development risk and accelerates investment decisions for multi-billion dollar maritime wind farms.

What are the key differences between nacelle-mounted and ground-based Lidar systems?

Nacelle-mounted Lidar is used for real-time turbine control, power curve optimization, and assessing inflow conditions directly impacting the rotor, while ground-based Lidar is typically used for pre-construction wind resource assessment (WRA) over a broad area and greater vertical profiling range.

Is Wind Lidar data considered bankable for project financing?

Yes, major industry standards bodies (e.g., IEC, DNV) have established strict certification protocols for Lidar units and data campaigns, ensuring that Lidar measurements, when properly validated and deployed, are widely accepted by financial institutions for energy yield assessments.

How is Artificial Intelligence (AI) being used to enhance Lidar performance?

AI processes the large, complex datasets generated by scanning Lidar to accurately model wind farm wake effects, optimize turbine positioning, and enable active wake steering, significantly improving farm-level energy production efficiency beyond traditional methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Coherent Doppler Wind Lidar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Wind Lidar Market Size Report By Type (Compact Lidar, Large-scale Coherent Doppler Lidar System), By Application (Wind Power, Aviation Weather, Weather & Climate, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Wind Lidar Market Statistics 2025 Analysis By Application (Wind Power, Aviation Weather, Weather & Climate), By Type (Compact Lidar, Large-scale Coherent Doppler Lidar System), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager