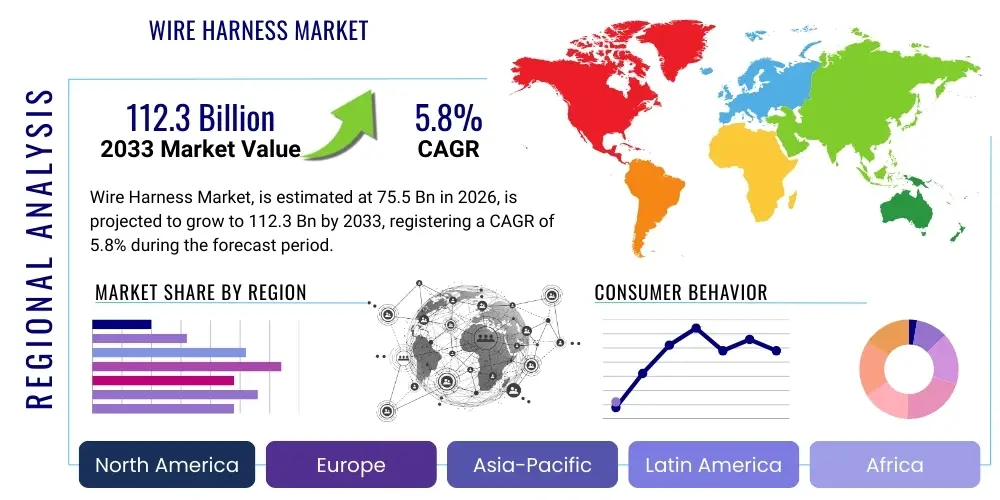

Wire Harness Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443563 | Date : Feb, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Wire Harness Market Size

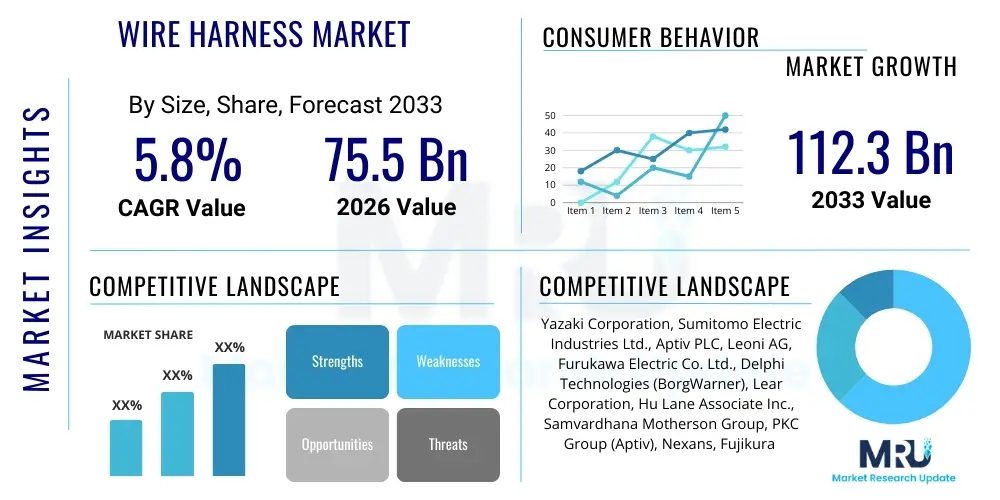

The Wire Harness Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 75.5 Billion in 2026 and is projected to reach USD 112.3 Billion by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the surging production of electric vehicles (EVs) globally, coupled with the increasing complexity of electronic systems integrated across various industrial and consumer applications. The inherent need for structured, protected, and efficient electrical connectivity across mission-critical systems ensures sustained demand for high-quality wire harnesses.

Market valuation growth reflects significant investment in advanced manufacturing techniques, including automation and robotics, which improve harness precision and durability, particularly in harsh operating environments like engine bays or aerospace structures. Furthermore, the miniaturization trend in electronics requires specialized, high-density wire harnesses, opening lucrative avenues for manufacturers specializing in fine-gauge wiring and complex routing solutions. The shift towards lightweight materials, such as aluminum conductors, aimed at reducing vehicle weight and improving fuel efficiency (or EV range), is a secondary factor bolstering market value realization over the forecast period.

Wire Harness Market introduction

The Wire Harness Market encompasses the design, manufacture, and distribution of assemblies comprising wires, cables, connectors, and terminals bound together by straps, cable ties, conduit, or lacing, tailored to transmit power, control signals, and data within complex electronic and electrical systems. These harnesses serve a vital function in organizing, protecting, and simplifying large electrical circuits, ensuring reliable operation and reducing the risk of short circuits or misconnections. The primary product description centers around custom-engineered solutions that meet strict specifications for temperature resistance, vibration tolerance, and electromagnetic compatibility (EMC), essential for performance in high-stakes environments such as automotive, aerospace, and medical devices. The core value proposition of a wire harness lies in its ability to consolidate numerous individual wires into a single, cohesive unit, optimizing installation time and space utilization while enhancing safety.

Major applications of wire harnesses span across the automotive sector, where they are integral to chassis wiring, engine management, infotainment systems, and battery packs in EVs. Beyond automotive, these assemblies are crucial in industrial machinery, telecommunications infrastructure, heavy equipment, and consumer electronics, including washing machines and air conditioning units. The benefits derived from utilizing wire harnesses include reduced installation error rates, improved maintenance accessibility, superior durability compared to loose wiring, and overall better organization of electrical systems, which is paramount for troubleshooting and long-term reliability. The robust construction ensures protection against abrasion, moisture, and chemical exposure, extending the lifespan of the entire system.

The market is significantly driven by the accelerating global transition to electric and hybrid vehicles, which utilize highly complex, high-voltage wire harnesses to manage battery-to-motor power flow and internal thermal management systems. Simultaneously, the proliferation of the Internet of Things (IoT) and smart manufacturing initiatives (Industry 4.0) increases the demand for sophisticated data transmission harnesses in factory automation and robotics. Regulatory standards emphasizing safety, efficiency, and weight reduction in key end-use sectors, such as ISO and SAE standards, also continually push manufacturers to innovate in materials science and assembly precision, ensuring the market remains dynamic and growth-oriented.

Wire Harness Market Executive Summary

The global Wire Harness Market is experiencing robust growth driven predominantly by transformative shifts in the automotive and industrial sectors, particularly the accelerating electrification trend and the adoption of advanced automation technologies. Business trends indicate a strong focus among leading manufacturers on developing specialized, high-performance harnesses capable of handling high voltage and high-speed data transmission required by next-generation vehicles and industrial robots. Strategic partnerships and mergers & acquisitions are increasingly common as companies seek to expand their geographical footprint and acquire expertise in novel materials, such as lightweight aluminum alloys and high-temperature polymers, to meet stringent weight and thermal management requirements. The competitive landscape is characterized by intense innovation in insulation technology and connector design, aiming for modularity and reduced assembly complexity for OEMs.

Regionally, Asia Pacific (APAC) continues to dominate the market, fueled by its status as the global manufacturing hub for automobiles and electronics, notably in China, Japan, and South Korea, which host major automotive production lines and rapidly scaling EV battery manufacturing facilities. North America and Europe demonstrate substantial growth, primarily attributed to strict regulatory pushes toward EV adoption, significant investments in aerospace and defense systems, and the implementation of sophisticated factory automation setups. These established markets are prioritizing premium, high-reliability harnesses for specialized applications, driving demand for technologically advanced products rather than sheer volume, contrasting slightly with the volume-driven growth observed in developing APAC economies.

Segment trends reveal that the Automotive segment remains the largest end-user, but significant high-growth opportunities are emerging from the Industrial Machinery and Telecommunications sectors, driven by 5G network rollouts and the modernization of manufacturing plants. By type, the Wire and Cable Assembly sub-segment dominates, but the specialty High-Voltage Harness segment is projected to show the highest CAGR due to its direct linkage with EV battery architecture. Overall, the market trajectory suggests a pivot toward specialized, customized solutions that prioritize miniaturization, high data bandwidth, and resilience against environmental stresses, steering market stakeholders towards higher-value product offerings.

AI Impact Analysis on Wire Harness Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Wire Harness Market primarily revolve around three key themes: optimization of manufacturing processes, predictive maintenance of installed harnesses, and AI's role in complex harness design and routing for autonomous systems. Users frequently ask if AI can reduce the current high labor intensity associated with harness assembly, especially customization. There is also significant interest in how machine learning algorithms can analyze field data to predict harness failures (e.g., insulation wear, connection degradation) before they occur, improving overall system reliability, particularly in critical automotive and aerospace applications. Furthermore, users are keen to understand if AI-driven simulation tools can streamline the highly iterative and complex task of designing optimal 3D wiring layouts within constrained spaces, a critical requirement for autonomous vehicles packed with numerous sensors and ECUs.

The adoption of AI and machine learning (ML) within the wire harness value chain is focused on enhancing efficiency and quality control, thereby indirectly affecting market structure by favoring highly automated manufacturers. In the production phase, AI-powered vision systems are being deployed for real-time defect detection during crimping, stripping, and assembly, leading to superior quality assurance compared to traditional manual inspections. This technological integration not only minimizes human error but also enables rapid identification and correction of inconsistencies in large-volume production lines. Consequently, the reliance on highly skilled manual labor for quality inspection is decreasing, shifting the workforce focus toward system maintenance and data analysis, which enhances manufacturing scalability and profitability.

In the design domain, generative AI tools are beginning to assist engineers in optimizing wire routing within vehicles and complex machinery, considering constraints like thermal management, electromagnetic interference (EMI) shielding, and space limitations. These tools can iterate through thousands of potential layouts significantly faster than human designers, resulting in harnesses that are lighter, shorter, and easier to install, directly influencing the cost structure and performance characteristics of the final product. For end-users, especially in the growing autonomous vehicle sector, AI contributes to robust system management by analyzing sensor data transmitted through the harnesses, ensuring the integrity of mission-critical data pathways. This systemic reliance on data quality underscores the escalating need for high-specification, error-free wiring assemblies, pushing market demand toward premium, high-data-rate harnesses.

- AI-powered vision systems for real-time quality inspection during assembly and crimping processes.

- Machine learning algorithms optimizing cutting and routing sequences, minimizing material waste.

- Predictive maintenance analytics using sensor data to forecast potential harness failures in operational systems.

- Generative design tools optimizing complex 3D routing paths for reduced weight and EMI shielding effectiveness.

- Automation of tedious tasks such as wire identification and sorting through robotic process automation (RPA) integrated with AI recognition.

- Enhanced supply chain visibility and demand forecasting through AI-driven analytics, ensuring optimal inventory management of raw materials (copper, polymers, connectors).

DRO & Impact Forces Of Wire Harness Market

The Wire Harness Market is fundamentally shaped by a confluence of powerful Drivers, significant Restraints, and transformative Opportunities, collectively defining the Impact Forces that govern its trajectory. Key drivers include the exponential growth in vehicle electrification globally, leading to higher demand for complex, high-voltage battery harnesses and specialized wiring for power distribution units (PDUs). Furthermore, the rapid expansion of data centers and the 5G infrastructure rollout necessitates high-speed, high-bandwidth data harnesses and integrated cabling solutions. These technological shifts are overlaid by an increasing focus on safety and regulatory compliance across all major sectors, requiring manufacturers to continuously upgrade material standards and testing protocols, fueling demand for premium products.

However, the market faces considerable restraints, primarily stemming from the inherent complexity and high manual labor requirement in the manufacturing process, particularly for customized or low-volume specialty harnesses. The volatility in raw material prices, specifically copper and various polymer insulation compounds, introduces cost instability, challenging profit margins, especially in highly competitive, commoditized segments. Additionally, the development and integration of highly automated manufacturing processes require substantial upfront capital investment, which presents a barrier to entry and a challenge for smaller players attempting to compete with large, diversified market leaders. The stringent quality standards in industries like aerospace also mandate extensive certification and validation processes, slowing down the pace of technological deployment.

Opportunities for growth are robust, centered around the ongoing material innovation aimed at weight reduction, such as the adoption of aluminum conductors and composite insulation materials, crucial for increasing EV range and reducing aerospace fuel consumption. The rise of smart factory automation (Industry 4.0) provides a fertile ground for sophisticated industrial harnesses designed for robotic arms and sensor arrays, demanding extreme durability and flexibility. Furthermore, expansion into new emerging markets in Southeast Asia and Latin America, coupled with the increasing digitalization of healthcare systems requiring specialized medical device harnesses, opens new revenue streams. The collective impact forces indicate a long-term growth trajectory characterized by increasing technological sophistication, premium pricing for specialized products, and continuous pressure on manufacturers to innovate in labor-saving automation technologies.

Segmentation Analysis

The Wire Harness Market is comprehensively segmented based on Type, Material, Application, and End-Use Industry, providing a granular view of market dynamics and identifying key growth pockets. This segmentation is crucial for stakeholders to align their product development strategies with specific industry requirements, such as the high-temperature resilience needed in aerospace or the high-voltage isolation required in battery electric vehicles. The structure helps in differentiating between high-volume, standard products (like those used in consumer appliances) and low-volume, high-value specialized harnesses (like those for surgical robotics), each exhibiting distinct price sensitivities and competitive pressures. Detailed analysis of these segments highlights the accelerating shift toward specialized, durable, and lightweight solutions.

By analyzing the segments, it is clear that the demand profile for wire harnesses is diversifying rapidly. While traditional automotive applications remain central, the highest growth rates are projected in segments tied to futuristic technologies, including high-speed data transmission assemblies essential for autonomous driving and advanced communication infrastructure. Material segmentation underscores the industry's response to sustainability and efficiency demands, with substantial R&D expenditure focused on alternatives to traditional copper, such as aluminum and lighter polymer jacketing. Understanding the interplay between these segmentation criteria allows businesses to focus resources on segments promising superior returns and resilience against economic fluctuations.

- By Type:

- Wire and Cable Assembly

- Customized Wire Harness

- Ribbon Cable Assembly

- High-Voltage Harness

- By Material:

- Copper

- Aluminum

- Other Conductive Materials

- By Application:

- Power Distribution

- Data Transmission

- Signal Transmission

- By End-Use Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles, Electric Vehicles)

- Aerospace & Defense

- Industrial (Machinery, Robotics, Automation)

- Telecommunications

- Consumer Electronics & Appliances

- Medical Devices

Value Chain Analysis For Wire Harness Market

The Wire Harness Market value chain is structured sequentially, beginning with upstream raw material suppliers and culminating in installation and aftermarket services for end-users. The upstream segment is dominated by suppliers of conductive materials (copper and aluminum wire rod manufacturers), insulation polymers (PVC, polyethylene, silicone, Teflon), and specialized components such as connectors, terminals, and fasteners. Price volatility and supply chain resilience in this segment are critical, as the cost of copper significantly influences the final product price. Key strategic challenges at the upstream stage involve securing long-term supply contracts and managing quality assurance for specialized, high-performance insulation materials required for harsh environment applications like high-voltage battery packs.

The midstream involves the core manufacturing process, where wire and cable assembly specialists, along with dedicated wire harness manufacturers, transform raw materials into complex, customized assemblies. This stage is characterized by high labor intensity, though increasing automation is observed in stripping, cutting, and basic assembly tasks. Direct distribution channels typically involve manufacturers selling directly to major Original Equipment Manufacturers (OEMs), particularly in automotive and aerospace, where customized design and strict quality controls necessitate close collaboration. Indirect channels utilize specialized distributors and value-added resellers (VARs) to serve smaller industrial customers and the aftermarket sector, offering logistical support and regional accessibility.

The downstream segment primarily consists of the end-use industries, including major automotive assemblers, aerospace manufacturers, industrial machinery producers, and telecom equipment providers, who integrate the harnesses into their final products. Post-sales service and aftermarket support, including repair kits and diagnostic tools related to the installed wiring system, also constitute a vital part of the downstream value chain. Profitability in the midstream is enhanced by moving toward high-mix, low-volume specialized harnesses, which command better pricing compared to mass-produced, standardized assemblies. Strategic imperatives for manufacturers across the value chain include vertical integration, particularly into connector manufacturing, to gain control over crucial component sourcing and design iteration, thus improving overall quality and reducing time-to-market.

Wire Harness Market Potential Customers

The potential customer base for the Wire Harness Market is broad and highly diversified, spanning multiple industries that require organized, reliable, and protected electrical and data pathways. The largest and most influential customer segment remains the global Automotive Industry, encompassing manufacturers of internal combustion engine vehicles (ICE), electric vehicles (EVs), hybrid electric vehicles (HEVs), and specialized commercial vehicles (trucks, buses, construction equipment). Within automotive, the shift toward EVs makes battery and powertrain system integrators crucial buyers of high-voltage wiring, representing a high-growth, high-value customer profile. These customers prioritize compliance with stringent electromagnetic compatibility (EMC) standards and durability under extreme thermal cycling.

The Industrial sector represents another substantial customer base, including manufacturers of factory automation equipment, robotics, CNC machines, and heavy machinery. These buyers demand harnesses that can withstand repetitive movement, chemical exposure, and mechanical stress, often requiring flexible and high-flex-life cables. Furthermore, the Telecommunications industry, particularly entities involved in 5G network infrastructure deployment, are major buyers of high-frequency and fiber optic integrated harnesses for base stations and data center cabling. These customers value high data transfer rates, low signal loss, and compact design solutions tailored for dense installations.

In the high-reliability segment, the Aerospace and Defense industry constitutes a critical, albeit smaller-volume, customer segment. Aircraft and defense contractors require harnesses manufactured to extremely high specifications, utilizing specialized, lightweight, fire-resistant materials capable of performing reliably under extreme pressure, temperature, and vibration conditions for decades. Similarly, medical device manufacturers represent a high-value customer group, purchasing highly miniaturized, sterile, and biocompatible harnesses for imaging equipment, diagnostic tools, and surgical robots. These customers prioritize precision, reliability, and certifications such as ISO 13485, defining the purchasing criteria for specialized harness providers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.5 Billion |

| Market Forecast in 2033 | USD 112.3 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yazaki Corporation, Sumitomo Electric Industries Ltd., Aptiv PLC, Leoni AG, Furukawa Electric Co. Ltd., Delphi Technologies (BorgWarner), Lear Corporation, Hu Lane Associate Inc., Samvardhana Motherson Group, PKC Group (Aptiv), Nexans, Fujikura Ltd., Coroplast Fritz Müller GmbH & Co. KG, Alpine Electronics Inc., Molex LLC, TE Connectivity, Aisin Seiki Co. Ltd., Koppel Steel, THB Group, Yura Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wire Harness Market Key Technology Landscape

The technological landscape of the Wire Harness Market is rapidly evolving, moving away from traditional manual assembly toward sophisticated, automated manufacturing techniques and advanced material utilization. A pivotal technology involves robotics and automation integrated with Computer Numerical Control (CNC) machinery for precision processes such as wire cutting, stripping, terminal crimping, and insertion. These automated systems enhance quality consistency, significantly reduce cycle times, and mitigate the high labor dependency historically associated with harness production. Furthermore, manufacturers are increasingly implementing advanced testing equipment, including sophisticated continuity and circuit resistance testers that utilize embedded software for rapid, comprehensive quality verification, ensuring adherence to zero-defect mandates, especially for safety-critical automotive systems.

Material innovation represents another cornerstone of the technological landscape, primarily driven by the imperative for lightweighting. This includes the rising adoption of aluminum conductors, often combined with specialized anti-corrosion coatings and junction points, to replace heavier copper harnesses, crucial for extending the range and performance of electric vehicles. Concurrently, the development of high-performance polymer insulation materials, such as cross-linked polyethylene (XLPE) and specialized fluoropolymers, enables harnesses to operate reliably under extreme temperature variations and offers enhanced chemical resistance, making them suitable for engine compartments and industrial environments. The technology related to specialized high-voltage shielding and thermal management is also paramount for EV battery harness design, incorporating robust jacketing and specific shielding layers to manage high currents and minimize electromagnetic interference (EMI).

Digitalization and smart manufacturing principles (Industry 4.0) are fundamentally reshaping the operational technology within the market. This includes the deployment of intelligent manufacturing execution systems (MES) and integrated CAD/CAM software that link design schematics directly to automated assembly lines, optimizing production flows and facilitating rapid customization. Furthermore, the use of virtual reality (VR) and augmented reality (AR) technologies is gaining traction for training complex manual assembly tasks and for visualizing 3D wire routing in tight spatial constraints before physical prototyping. This integration of digital twins and advanced simulation tools significantly reduces design errors and accelerates the time-to-market for complex, novel harness designs required by autonomous and highly connected systems.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Momentum: APAC maintains its dominant position in the global Wire Harness Market, largely due to its status as the world's largest production base for automobiles, consumer electronics, and industrial machinery. Countries like China, Japan, South Korea, and increasingly India and Southeast Asian nations, are witnessing aggressive investment in high-volume manufacturing capabilities. The rapid penetration of Electric Vehicles (EVs) in China, coupled with massive government support for domestic EV production and charging infrastructure, drives unparalleled demand for high-voltage harnesses. Furthermore, the expansion of local semiconductor and electronics manufacturing contributes significantly to the demand for ribbon and specialized data transmission cables, positioning APAC as the primary volume driver for the foreseeable future.

- North America's Focus on High-Value and Specialized Segments: North America represents a mature, high-value market characterized by stringent quality requirements in its dominant sectors: Automotive (especially premium and electric vehicles), Aerospace & Defense, and advanced Medical Devices. Growth here is spurred by regulatory mandates for vehicle safety and efficiency, pushing OEMs toward lighter, complex wiring systems. Significant government and private investment in defense programs necessitate high-reliability, customized harnesses capable of extreme environmental tolerance. The market prioritizes technological sophistication, often leading the global adoption curve for technologies like aluminum conductors and miniaturized assemblies.

- Europe's Sustainability and EV-Centric Demand: The European market is heavily influenced by stringent environmental regulations and aggressive commitments to vehicle electrification, particularly within the EU. This regulatory environment fuels robust demand for high-voltage and energy-efficient harnesses tailored for EVs and plug-in hybrids. Europe is also a key center for industrial automation and specialized machinery production, driving steady demand for industrial-grade, flexible wiring assemblies. Key regional manufacturers focus intensely on sustainable sourcing and recyclable materials, aligning with the EU's Green Deal objectives, which influences material choices and manufacturing processes within the wire harness supply chain.

- Latin America's Emerging Industrialization Needs: Latin America, particularly Brazil and Mexico, demonstrates solid growth potential tied to ongoing industrialization and significant foreign investment in automotive assembly plants. Mexico, due to its proximity to the US market and favorable trade agreements, serves as a crucial manufacturing hub for automotive harnesses destined for North America. While the market is highly price-sensitive, increasing local manufacturing of consumer appliances and light commercial vehicles ensures sustained demand. The focus in this region often remains on cost-effective, high-volume production, with gradual adoption of advanced harness technologies.

- Middle East and Africa (MEA) Infrastructure Development: The MEA region's demand is largely dictated by substantial governmental investments in infrastructure projects, including transportation networks, power generation facilities, and telecommunications upgrades (including 5G rollout in the GCC countries). The rapid expansion of new commercial construction, coupled with growing aerospace requirements, particularly in the UAE and Saudi Arabia, creates pockets of high demand for industrial and specialized wiring solutions. While smaller in overall market size, the region offers significant long-term opportunities tied to diversification efforts away from oil economies and subsequent industrial modernization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wire Harness Market.- Yazaki Corporation

- Sumitomo Electric Industries Ltd.

- Aptiv PLC

- Leoni AG

- Furukawa Electric Co. Ltd.

- Lear Corporation

- Samvardhana Motherson Group

- PKC Group (Aptiv)

- Delphi Technologies (BorgWarner)

- Molex LLC (Koch Industries)

- TE Connectivity

- Nexans

- Fujikura Ltd.

- Coroplast Fritz Müller GmbH & Co. KG

- Hu Lane Associate Inc.

- THB Group

- Aisin Seiki Co. Ltd.

- Koppel Steel

- Yura Corporation

- Nippon Seisen Cable Ltd.

Frequently Asked Questions

Analyze common user questions about the Wire Harness market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Wire Harness Market?

Market growth is primarily driven by the accelerating global transition towards Electric Vehicles (EVs), which require complex, high-voltage battery harnesses. Additionally, the proliferation of electronic content in conventional vehicles and the expansion of smart manufacturing (Industry 4.0) demanding robust industrial automation wiring are significant growth catalysts.

How is the adoption of aluminum impacting the wire harness industry?

Aluminum is increasingly adopted as a lightweight alternative to copper, particularly in the automotive sector, to reduce overall vehicle weight and improve fuel efficiency or battery range. This shift requires specialized connection technologies and handling processes to mitigate corrosion risks and ensure long-term durability and conductivity.

What are the major challenges faced by wire harness manufacturers?

Key challenges include managing the high dependence on manual labor for specialized assembly, mitigating the volatility of raw material prices (especially copper), and overcoming the stringent regulatory requirements and extensive validation processes necessary for high-reliability applications like aerospace and medical devices.

Which geographical region dominates the global Wire Harness Market?

Asia Pacific (APAC) dominates the global market, led by high-volume automotive and consumer electronics manufacturing in countries such as China, Japan, and South Korea. APAC remains the largest consumer and producer due to massive EV production capacity and general industrial scale.

What role does automation play in the future of wire harness manufacturing?

Automation, particularly through robotics and AI-powered vision systems, is crucial for improving assembly precision, enhancing quality control, and reducing manufacturing costs. Automation is essential for meeting the demands for complex, high-mix, low-volume harness production required by modern, technologically advanced end-use applications.

The market analysis indicates a high degree of correlation between the advancement of electronic systems across sectors and the complexity demanded of wire harnesses. The ongoing global pursuit of energy efficiency and autonomous capabilities guarantees continuous innovation in materials and manufacturing processes within the wire harness industry. The focus on lightweighting, particularly the transition from copper to aluminum, represents a critical shift, compelling manufacturers to invest heavily in new tooling and specialized connection technologies. This material evolution is not merely a cost-saving measure but a fundamental requirement for meeting performance metrics in high-growth segments like electric vehicles and urban air mobility (UAM). Market competitiveness is increasingly defined by the ability of firms to offer integrated solutions that combine high-speed data transmission capabilities with robust power distribution in a smaller, lighter package. The integration of advanced diagnostics and sensor technology within the harnesses themselves, creating 'smart harnesses,' is an emerging trend that will provide predictive maintenance capabilities to end-users, dramatically reducing downtime in mission-critical applications.

In the automotive sphere, which remains the single largest end-user, the architectural shift from centralized electronic control units (ECUs) to zonal architectures is fundamentally altering harness design philosophy. Zonal architectures utilize fewer, shorter, and highly standardized harnesses connecting to local computing zones, contrasting sharply with the long, complex traditional wiring looms. This structural change demands a rapid redesign cycle and investment in standardized, modular connector systems, presenting both a challenge and a massive opportunity for manufacturers capable of adapting quickly. The complexity of routing hundreds of wires and cables, often involving high-frequency data lines alongside high-current power lines, requires sophisticated electromagnetic compatibility (EMC) testing and shielding solutions, which are becoming standard features in premium harness offerings. This technical specialization raises the barrier to entry and favors established market players with deep R&D capabilities and existing relationships with Tier 1 automotive suppliers.

The industrial and aerospace segments further emphasize the demand for extreme reliability and customization. In industrial automation, harnesses must withstand millions of bending cycles and exposure to abrasive chemicals, necessitating specialized jacket materials like PUR and TPE. The proliferation of IoT sensors and robotic arms in factories requires harnesses capable of managing both power and high-speed industrial Ethernet protocols (e.g., EtherCAT, PROFINET) within a single assembly. For the aerospace sector, safety is paramount, driving demand for harnesses that meet rigorous flammability, smoke, and toxicity standards (FST), often utilizing specialized materials like PTFE and PEEK. The long service life expected of aerospace and defense equipment means manufacturers must guarantee material stability and connection integrity over decades, requiring meticulous quality control and traceability throughout the manufacturing process. These specialized requirements contribute significantly to the overall market value, offsetting some of the volume-driven price pressure seen in commodity segments like consumer appliances.

The geographical analysis reveals distinct market dynamics influenced by local economic and regulatory environments. While APAC drives manufacturing volume, North America and Europe are pivotal for technological adoption and high-value product demand. In Europe, the strict recycling and environmental regulations, exemplified by directives such as RoHS and REACH, heavily influence material selection, pushing manufacturers toward halogen-free, sustainable insulation compounds. In contrast, the high-growth markets of developing APAC nations focus on scaling production efficiency, often leading to rapid adoption of entry-level automation technologies to keep pace with soaring local and export demand. The competitive environment is intensely global, yet specialization remains key. Tier 1 suppliers like Yazaki and Sumitomo leverage their scale and strong OEM relationships, while smaller, niche players thrive by focusing on ultra-specialized applications, such as medical robotics or high-performance military equipment, where customization and certified quality outweigh volume considerations.

Future growth will be significantly impacted by advancements in wireless technology and the potential for replacement of physical wiring in certain non-critical applications. However, for power distribution and high-reliability, high-speed backbone data transfer—especially in safety-critical systems like autonomous vehicle steering or industrial power trains—physical wire harnesses will remain indispensable due to their proven reliability, immunity to external interference, and power capacity. Therefore, the focus remains on optimizing the physical harness through miniaturization, improved material science, and enhanced assembly automation. The long-term success of market participants hinges on their ability to integrate digital tools (AI, ML) into both the design (generative routing) and manufacturing (predictive quality control) phases, ensuring they can deliver complex, zero-defect assemblies at a competitive cost structure, tailored to the rapidly changing demands of vehicle electrification and industrial digitalization. The shift to zonal architectures in automotive electrical systems mandates flexibility in manufacturing to accommodate constant changes in harness specifications and complexity.

Furthermore, the Wire Harness Market is critically dependent on advancements in connector and terminal technology. The integrity of the harness relies heavily on secure, environmentally sealed, and reliable connection points. The demand for increasingly robust and miniaturized connectors is growing, driven by space constraints in modern electronic assemblies. For high-speed data transmission required by advanced driver-assistance systems (ADAS) and infotainment, specialized shielding techniques within the harness and corresponding high-performance connectors (e.g., HSD, FAKRA) are essential to prevent data loss and cross-talk interference. Manufacturers are focusing on modular connector systems that allow easier field maintenance and reduce assembly time on the OEM line. This holistic view, encompassing not just the wire bundle but the entire connectivity system, defines the competitive edge in supplying high-tech industries. The adoption of standardized protocols for communication, such as CAN, LIN, and increasingly Ethernet, influences the required wire gauges, twisting configurations, and overall harness topology, demanding adaptable and standardized production equipment.

Sustainability and circular economy principles are increasingly influencing procurement decisions, particularly in Europe. Customers are placing a higher value on harnesses produced using materials that have lower environmental footprints, including recyclable plastics and ethically sourced metals. This trend is driving innovation in insulation polymers that offer high performance without resorting to environmentally hazardous additives. Moreover, manufacturers are exploring end-of-life strategies for harnesses, designing them for easier disassembly and material recovery, which will become a necessity under tightening global environmental regulations. The integration of advanced sensors directly within the harness structure to monitor temperature, stress, and electrical load represents another high-value segment, transforming the harness from a passive connectivity component into an active data source for system diagnostics. These 'smart harnesses' offer significant benefits in reliability monitoring for complex systems, justifying a premium price point and offering a strategic differentiator for suppliers.

In terms of strategic industry structure, backward integration into copper processing or connector manufacturing provides key competitive advantages, offering stability against supply chain disruptions and enabling manufacturers to customize connection solutions precisely to the harness specifications. Conversely, forward integration, involving offering installation services or integrated module assembly, allows manufacturers to capture a greater share of the downstream value. The market is consolidating, with major Tier 1 suppliers leveraging their global scale and integrated service offerings to secure long-term, high-volume contracts with global OEMs. This consolidation emphasizes the importance of scale, global manufacturing footprint, and technological differentiation in securing market leadership. The entry of specialized startups focusing solely on complex aluminum welding and connection technology also signals the intense focus on solving specific material challenges within the industry, ensuring that innovation remains highly decentralized and competitive.

The demand landscape is heavily influenced by economic cycles in the end-use industries, particularly automotive production volumes. While the long-term trend remains positive due to electrification, short-term volatility in vehicle sales, global trade disruptions, and changes in consumer spending patterns can directly impact harness order books. Furthermore, geopolitical tensions affect supply chains, especially the sourcing of rare earth elements (used in specific connectors or sensors) and critical polymers. Manufacturers must therefore prioritize risk mitigation strategies, including multi-sourcing arrangements and localizing production capabilities closer to major assembly hubs. The transition to electric vehicles is also shifting the geographical center of gravity for manufacturing, pushing harness production closer to new Gigafactories and EV assembly lines, particularly in Eastern Europe, North America, and specific regions within China. This localization strategy aims to reduce complex logistics and expedite just-in-time delivery, which is essential for high-volume automotive production. The overall market is poised for structural transformation driven by sustainability, automation, and vehicle electrification mandates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager