Yogurt Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441856 | Date : Feb, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Yogurt Market Size

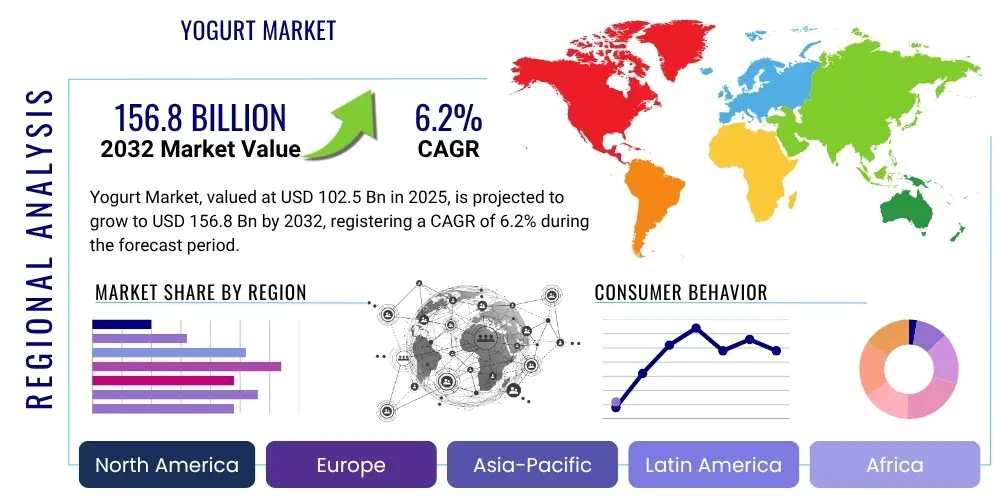

The Yogurt Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 95.5 Billion in 2026 and is projected to reach USD 141.6 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by rising consumer awareness regarding gut health, the increasing adoption of high-protein dietary habits, and continuous innovation in flavor profiles and product formats, particularly in emerging economies.

Yogurt Market introduction

The Yogurt Market encompasses a wide range of fermented milk products, traditionally produced by bacterial fermentation of milk using starter cultures like Lactobacillus bulgaricus and Streptococcus thermophilus. The product description spans conventional set-style yogurt, stirred yogurt, drinkable yogurt, frozen yogurt, and strained varieties such as Greek yogurt. These products serve major applications across direct consumption, culinary uses (dips, sauces), and as components in functional foods and beverages. A core benefit driving market growth is the high nutritional value, including protein, calcium, and essential vitamins, coupled with the presence of probiotics that support digestive and immune health.

Driving factors for this robust market include shifting demographics toward health and wellness, increased prevalence of lactose intolerance driving demand for plant-based alternatives, and strategic marketing emphasizing the convenience and versatility of yogurt as a snack or meal replacement. Furthermore, globalization has popularized traditionally regional yogurt styles, such as skyr (Icelandic) and labneh (Middle Eastern), contributing to market diversification. Product differentiation through clean-label ingredients, organic sourcing, and functional additives like prebiotics and vitamins is crucial for sustained competitive advantage.

Yogurt Market Executive Summary

The global Yogurt Market is characterized by vigorous competition and rapid innovation, with major business trends focusing on premiumization and diversification into functional food categories. Regional trends indicate that while mature markets in North America and Europe prioritize specialized segments like high-protein and non-dairy options, the Asia Pacific region demonstrates exponential growth driven by large populations, increasing disposable incomes, and the introduction of Western-style dairy consumption habits. Key segment trends highlight the dominance of spoonable yogurt, although drinkable formats are exhibiting the highest growth trajectory due to their convenience for on-the-go consumption. Furthermore, the segmentation by fat content shows a consumer migration towards low-fat and fat-free varieties, aligning with broader health movements.

Technological advancements, particularly in cold chain logistics and fermentation techniques, are enabling extended shelf life and the preservation of probiotic efficacy, thereby facilitating market expansion into previously underserved geographical areas. Strategic mergers and acquisitions among major dairy corporations and smaller, specialized health food companies are reshaping the competitive landscape. The market remains sensitive to raw material price volatility, specifically milk solids, necessitating efficient supply chain management and forward purchasing strategies to maintain profitability margins across different product lines.

AI Impact Analysis on Yogurt Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Yogurt Market predominantly center on supply chain efficiency, personalized nutrition, and predictive quality control. Consumers and industry stakeholders are highly interested in how AI can optimize milk sourcing and processing to reduce waste, how machine learning algorithms can analyze consumer data to predict regional flavor preferences, and whether AI tools can enhance food safety by identifying contamination risks earlier in the production cycle. Key themes include the implementation of smart factories for automated production lines, the use of generative AI for rapid flavor prototyping, and the potential for AI-driven marketing personalization.

AI's role extends significantly into demand forecasting, where sophisticated models integrate macroeconomic indicators, seasonal shifts, and social media sentiment to improve inventory management and reduce spoilage rates—a major financial concern in perishable dairy goods. Furthermore, AI-powered image recognition systems are being deployed to monitor packaging integrity and label accuracy in real-time on high-speed production lines, ensuring regulatory compliance and maintaining brand quality standards. The integration of AI is positioning the yogurt industry towards a highly efficient, responsive, and increasingly customized production paradigm, directly addressing consumer demand for freshness and novel product experiences.

- AI-driven optimization of milk supply chain and cold storage logistics, reducing transit time and energy consumption.

- Predictive modeling for consumer flavor preferences and market demand forecasting, minimizing overproduction of seasonal or niche products.

- Enhanced quality control systems utilizing machine vision for automated detection of product defects and foreign materials during packaging.

- Development of personalized yogurt formulations based on individual genetic data and microbiome analysis, facilitated by AI platforms.

- Automated fermentation monitoring and process optimization using sensors and machine learning to maintain consistent texture and probiotic viability.

- Generative AI assisting in rapid flavor pairing and ingredient sourcing for clean-label and functional variants.

DRO & Impact Forces Of Yogurt Market

The Yogurt Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaping its future trajectory. A primary driver is the pervasive global health trend, emphasizing high-protein, low-sugar, and probiotic-rich diets, positioning yogurt as an essential daily food item. Opportunities are abundant, particularly in emerging markets where refrigeration infrastructure is improving, allowing for wider distribution of chilled products, and in the innovation surrounding non-dairy alternatives derived from oats, almonds, and coconut, catering to the expanding vegan and flexitarian populations. These positive forces are currently outweighing the primary restraints, which include the volatility of raw milk prices, intense competition leading to margin compression, and the significant environmental concerns related to dairy farming and plastic packaging waste.

Impact forces stemming from macro-environmental factors, such as stricter food labeling regulations focusing on added sugar content in developed nations, necessitate continuous product reformulation by manufacturers. Furthermore, the rapid growth of private label brands presents a substantial competitive challenge to established national and international brands, forcing them to invest heavily in marketing and unique product differentiation strategies. The sustained impact of global economic inflation also affects consumer purchasing power, potentially shifting consumption patterns toward more economical, basic yogurt formulations rather than premium, functional varieties.

The market’s direction is heavily influenced by investment in research and development aimed at improving product shelf stability without compromising nutritional integrity. Opportunities also exist in utilizing yogurt byproducts, such as whey, in secondary value streams like sports nutrition supplements. Successfully managing the regulatory environment related to probiotic claims and addressing consumer skepticism regarding artificial ingredients remain pivotal challenges that will determine long-term success and market share stability.

Segmentation Analysis

The Yogurt Market is highly fragmented and segmented based on multiple critical parameters, including product type, fat content, flavor profile, distribution channel, and source (dairy vs. non-dairy). This segmentation allows manufacturers to target specific consumer needs, ranging from fitness enthusiasts seeking high-protein Greek yogurt to individuals with dietary restrictions requiring plant-based, lactose-free alternatives. The evolution of segmentation reflects sophisticated consumer preferences and the continuous pursuit of functional benefits beyond basic nutrition, driving sub-segmentation within probiotic and fortified categories. Understanding these nuances is crucial for strategic product launch and geographic expansion.

- By Type:

- Set Yogurt

- Stirred Yogurt

- Greek Yogurt (Strained Yogurt)

- Frozen Yogurt

- Yogurt Drinks (Drinkable Yogurt)

- Bifidus Yogurt

- By Fat Content:

- Regular/Whole Milk

- Low-Fat

- Fat-Free/Skim

- By Flavor:

- Flavored (Fruit, Vanilla, Chocolate, Honey)

- Non-Flavored/Plain

- By Source:

- Dairy-Based (Cow, Buffalo, Goat Milk)

- Non-Dairy Based (Plant-Based: Soy, Almond, Oat, Coconut)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail/E-commerce

- By End User:

- Household Consumption

- Commercial (Food Service, Catering)

Value Chain Analysis For Yogurt Market

The value chain of the Yogurt Market begins upstream with raw material procurement, primarily focusing on high-quality milk sourcing from dairy farms. This phase involves complex negotiations, quality testing, and robust logistical frameworks to ensure the rapid and sanitary transport of raw milk to processing facilities. Upstream analysis also includes the procurement of essential ingredients like starter cultures, stabilizers, flavors, fruits, and packaging materials. Efficiency and sustainability in sourcing milk—often involving long-term contracts and adherence to ethical farming practices—are major determinants of production cost and final product quality.

Midstream activities encompass the core manufacturing processes: pasteurization, fermentation, homogenization, mixing, flavoring, and packaging. This stage heavily relies on sophisticated processing technologies to maintain precise temperature and pH levels critical for successful fermentation and texture development. Quality assurance and control checkpoints are vital here to ensure probiotic viability and shelf stability. Downstream analysis focuses on distribution, marketing, and sales. Due to the perishable nature of yogurt, a reliable cold chain infrastructure is imperative, influencing the selection of distribution channels—including direct sales to large retailers and third-party logistics providers specializing in refrigerated goods.

Distribution channels for yogurt are highly diversified, involving direct distribution to major supermarkets and indirect distribution through wholesalers and e-commerce platforms. Supermarkets and hypermarkets remain the dominant channel, offering wide visibility and high volume sales, while online retail is rapidly gaining traction due to convenience and the ability to stock niche or premium imported varieties. Effective channel management requires balancing quick inventory turnover with maintaining optimal storage temperatures to minimize waste and maximize freshness, directly impacting consumer satisfaction and repeat purchase rates.

Yogurt Market Potential Customers

The potential customer base for the Yogurt Market is broad, transcending typical demographic constraints due to the product's versatility and health benefits. Primary buyers include households seeking nutritious breakfast options and snacks for children. A highly engaged segment consists of health-conscious adults, particularly Millennials and Generation Z, who actively seek functional benefits such as high protein for fitness, probiotics for digestive health, and low sugar content for weight management. These consumers are willing to pay a premium for certified organic, non-GMO, and specialized products like Icelandic Skyr or Greek yogurt.

Secondary target markets include individuals with specific dietary restrictions, such as lactose intolerance or veganism, driving the immense growth in the non-dairy yogurt segment. Additionally, the institutional and commercial sector, including schools, hospitals, airlines, and the wider foodservice industry (cafes and restaurants), represents a significant B2B end-user segment utilizing yogurt in both prepared meals and as standalone menu items. Targeting commercial kitchens requires bulk packaging and highly consistent quality standards.

Geographically, potential customers in emerging economies are becoming increasingly important. As disposable incomes rise in regions like Southeast Asia and Latin America, urbanization and exposure to Western dietary habits lead to an increased adoption of processed dairy products, presenting manufacturers with a massive untapped consumer pool, often preferring traditional regional flavors adapted into modern yogurt formats.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 95.5 Billion |

| Market Forecast in 2033 | USD 141.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Danone S.A., General Mills Inc., Chobani LLC, The Lactalis Group, Nestlé S.A., Müller Group, Groupe Savencia, Fage International S.A., Arla Foods amba, Stonyfield Farm Organic, Dean Foods Company (now part of Dairy Farmers of America), Raisio plc, Epigamia, Mengniu Dairy, Yakult Honsha Co., Ltd., Ultima Foods Inc., Wallaby Organic, Tillamook, Blue Hill Yogurt, Clover Sonoma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yogurt Market Key Technology Landscape

The technological landscape of the Yogurt Market is defined by innovations aimed at enhancing functional properties, ensuring product safety, and improving manufacturing efficiency. Advanced fermentation technology is crucial, involving the use of specialized starter cultures, including proprietary probiotic strains, developed to survive the acidic stomach environment and maximize health benefits. Techniques such as ultrafiltration and microfiltration are widely used, particularly in the production of high-protein Greek yogurt, allowing for the precise separation of whey and concentration of milk solids without chemical additives, resulting in superior texture and nutritional density.

The industry is heavily reliant on sophisticated process control and automation systems. Modern yogurt plants utilize Continuous Fermentation Systems (CFS) and aseptic packaging technologies, which significantly extend shelf life and reduce the risk of post-processing contamination. Furthermore, investments in high-barrier packaging materials, including multilayer plastics and recyclable or biodegradable containers, are essential to maintain the quality of live cultures and address increasing consumer and regulatory demands for sustainability in packaging solutions. These technological applications are critical for differentiation in a highly competitive market.

Digital transformation, supported by Internet of Things (IoT) sensors, plays a key role in monitoring real-time conditions throughout the entire cold chain, from processing to the point of sale. This integration ensures compliance with temperature requirements, reducing spoilage and maintaining product freshness. Additionally, enzymatic hydrolysis technologies are being explored to predigest lactose in milk, facilitating the production of lactose-free yogurts that maintain the nutritional and textural integrity of traditional dairy products, expanding the market reach to lactose-sensitive consumers.

Regional Highlights

The global Yogurt Market exhibits distinct characteristics across major geographical regions, driven by localized consumption habits, economic development levels, and regulatory environments. North America and Europe represent mature markets characterized by high per capita consumption and strong demand for premium, functional, and specialized segments. In these regions, innovation centers around sugar reduction, organic certifications, and the proliferation of non-dairy alternatives, positioning them as pioneers in product sophistication and specialized health positioning.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This exponential growth is fueled by massive demographic shifts, rising disposable incomes, and the gradual shift away from traditional dietary staples toward modern, convenient food formats. Countries like China and India are major contributors, witnessing rapid urbanization and infrastructure development (including better cold chain systems), making Western-style yogurt products increasingly accessible. Localized flavors and cultural adaptations are crucial for success in the APAC market.

Latin America, the Middle East, and Africa (MEA) represent high-potential growth areas where market penetration is currently lower but increasing steadily. In Latin America, economic stability often dictates market growth, with an increasing consumer base favoring healthier alternatives. The MEA region is witnessing growing demand, particularly for fortified and long-life dairy products, often supported by government initiatives to improve national nutrition standards. However, temperature management and logistical challenges remain significant hurdles in these diverse regions, necessitating targeted investment in robust cold chain technology.

- North America (US, Canada): Strong market for high-protein (Greek yogurt) and specialized functional ingredients; high uptake of plant-based alternatives; focus on clean-label and low-sugar formulations.

- Europe (Germany, France, UK, Spain): Mature market with diverse traditional consumption; stringent regulatory environment regarding health claims; significant investment in sustainable and recyclable packaging solutions; dominance of major dairy cooperatives.

- Asia Pacific (China, India, Japan, Australia): Highest growth potential globally; driven by population size and rising middle class; increasing urbanization and improved cold chain infrastructure; preference for both traditional formats and innovative drinkable yogurt variants.

- Latin America (Brazil, Mexico, Argentina): Growing health awareness leading to higher demand for fortified and probiotic products; market size often correlates with economic stability; local production prioritized over imports.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Focus on ambient-stable or long-shelf-life products due to challenging climate; increasing imports of premium dairy; strong cultural preference for labneh and other thickened yogurt types.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yogurt Market.- Danone S.A.

- General Mills Inc.

- Chobani LLC

- The Lactalis Group

- Nestlé S.A.

- Müller Group

- Groupe Savencia

- Fage International S.A.

- Arla Foods amba

- Stonyfield Farm Organic

- Yakult Honsha Co., Ltd.

- Ultima Foods Inc.

- Raisio plc

- Mengniu Dairy

- Yili Group

- Tillamook

- Blue Hill Yogurt

- Kroger Co. (Private Label)

- Emmi Group

- Inner Mongolia Yili Industrial Group Co., Ltd.

Frequently Asked Questions

What is driving the demand for non-dairy yogurt alternatives?

The surging demand for non-dairy yogurt is primarily driven by the increasing global prevalence of lactose intolerance, the growing adoption of vegan and flexitarian diets for ethical and environmental reasons, and consumer perception that plant-based options are generally healthier or lighter. Key sources include oat, almond, soy, and coconut bases.

Which geographical region exhibits the highest growth rate for the Yogurt Market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This growth is attributed to rising per capita spending on dairy products, rapid urbanization, improvements in cold chain logistics, and the successful localization of products appealing to regional tastes, particularly in developing economies like China and India.

What are the primary restraints affecting market profitability?

The chief restraints challenging the Yogurt Market's profitability include the significant price volatility of raw milk and other essential dairy ingredients, the substantial investment and operational costs required to maintain a seamless cold chain distribution network, and intense competitive pressures, particularly from the rapid expansion of high-quality private label brands offered by major retailers.

How is Greek yogurt positioned differently in the market compared to traditional yogurt?

Greek yogurt is positioned as a premium, functional product due to its higher protein content and thicker, denser texture achieved through straining. It appeals heavily to the sports nutrition and fitness segments, serving as a popular meal replacement or high-protein snack, contrasting with traditional yogurt which is often marketed more broadly for general consumption and versatility.

What is the role of technology in ensuring yogurt safety and quality?

Technology plays a critical role through advanced process controls, such as automated temperature and pH monitoring during fermentation, utilization of ultrafiltration for consistency, and the implementation of aseptic or high-barrier packaging techniques. Real-time IoT monitoring across the cold chain further ensures probiotic viability and prevents microbial contamination, guaranteeing product safety and quality upon reaching the consumer.

In-Depth Market Dynamics and Trends

The market for yogurt continues to evolve far beyond its traditional identity, transforming into a pivotal segment within the broader functional food industry. Consumer demand is increasingly sophisticated, moving away from simple dairy enjoyment toward targeted nutritional solutions. This movement is evidenced by the mainstream success of products fortified with specific vitamins (like Vitamin D) or enriched with specialized probiotic strains, focusing on targeted health benefits such as bone density, mental well-being, or enhanced immune function. The emphasis on "food as medicine" drives manufacturers to invest heavily in clinical trials supporting health claims, elevating the credibility and premium pricing of these specialized yogurt lines.

Furthermore, sustainability and ethical sourcing have become non-negotiable considerations for modern consumers, particularly in Western markets. The industry is responding by adopting sustainable farming practices, reducing water consumption in processing, and making tangible commitments to reduce carbon footprints. Packaging innovation, shifting from single-use plastic containers to recyclable paperboard or glass, is a key trend. This focus on environmental, social, and governance (ESG) factors not only satisfies consumer expectations but also provides a significant marketing advantage for brands demonstrating transparency and commitment to ecological preservation.

The convergence of convenience and nutrition is a powerful dynamic reshaping product formats. The exponential growth of drinkable yogurt and yogurt pouches reflects the need for portable, single-serving options suitable for busy, on-the-go lifestyles. These formats minimize mess and maximize accessibility, making yogurt viable for consumption outside of traditional meal times. Innovation in the drinkable segment includes high-protein smoothies and kefir-based beverages, which offer a unique blend of convenience, hydration, and substantial probiotic benefits, competing directly with traditional sports and health drinks.

Competitive Landscape Analysis

The global Yogurt Market is dominated by a few multinational dairy giants, such as Danone, Nestlé, and Lactalis, which leverage extensive global distribution networks and massive marketing budgets. However, the competitive structure is highly dynamic, characterized by intense competition from regional players and specialized, fast-growing brands like Chobani and Fage, which often drive niche innovation in the high-growth Greek yogurt and health segments. The ability to rapidly adapt to localized flavor preferences and regulatory changes is a critical success factor, preventing the global giants from achieving absolute dominance in all local markets.

A key competitive strategy involves portfolio diversification. Companies are strategically expanding beyond dairy-based products into the non-dairy arena to mitigate risks associated with volatile milk prices and capture the expanding lactose-intolerant and vegan consumer base. This diversification necessitates distinct technological investments, as the fermentation and texture-achieving processes for plant-based milks (like oat or coconut) differ significantly from those required for cow's milk. Mergers, acquisitions, and strategic partnerships remain crucial tools for accessing specialized technologies, new geographic markets, and niche brand credibility.

Pricing strategy is fiercely competitive, especially in commodity segments where private label brands offer highly attractive, low-cost alternatives. Branded manufacturers rely on differentiating factors—such as organic certification, unique probiotic strain inclusion, celebrity endorsements, and robust health claim substantiation—to justify premium pricing. The battle for shelf space in retail environments is continuous, with companies employing sophisticated category management and trade promotion strategies to ensure high visibility and favorable placement for their products.

Significant Market Challenges and Risks

The Yogurt Market faces several significant operational and economic risks that can impede growth and profitability. One of the primary constraints remains the instability of raw material inputs. Milk production is subject to seasonal fluctuations, disease outbreaks, and climate change impacts, leading to unpredictable pricing spikes that directly affect manufacturing costs. Successfully hedging against these supply chain vulnerabilities requires robust forward contracting and maintaining diversified sourcing options.

Another major challenge is maintaining the viability of live and active cultures throughout the supply chain. Probiotics are sensitive to temperature variations, and any failure in the cold chain—from the factory floor to the supermarket shelf—can render the health claims void, leading to quality complaints and consumer dissatisfaction. This mandates continuous investment in sophisticated refrigeration, monitoring, and transportation infrastructure, adding complexity and cost, particularly in regions with underdeveloped logistics capabilities.

Regulatory scrutiny also poses a continuous challenge. As yogurt is increasingly marketed based on specific health benefits (e.g., "improves digestion" or "supports immunity"), regulatory bodies in regions like the EU and US are demanding stringent scientific evidence for health claims. Manufacturers must navigate complex and often disparate global labeling standards, particularly concerning added sugar content, fat percentage, and the verifiable presence of probiotic counts, requiring significant internal compliance and legal resources.

Finally, the growing concern over food waste necessitates innovative solutions. Because yogurt is a perishable product with a relatively short shelf life, managing inventory accurately to meet fluctuating demand without resulting in excessive expired product is vital. Implementation of AI-driven demand forecasting and sophisticated inventory management systems is crucial to mitigate the substantial economic and environmental costs associated with product spoilage.

Future Outlook and Emerging Opportunities

The future outlook for the Yogurt Market is overwhelmingly positive, driven by sustained consumer focus on preventive healthcare and nutritional functionality. A key opportunity lies in further penetrating the personalized nutrition space. As genetic and microbiome testing becomes more accessible, manufacturers can develop ultra-customized yogurt products designed to support individual biome health, moving beyond generic probiotic blends to precision fermentation targeting specific physiological outcomes. This bespoke approach represents a premium market segment with high potential profitability.

Geographical expansion remains a critical growth vector. While major markets are focused on depth and specialization, vast populations in Sub-Saharan Africa and certain parts of Southeast Asia are transitioning into dairy consumers. Successful market entry in these regions depends on tailoring product formats—such as heat-treated or long-life yogurt (UHT yogurt)—to accommodate logistical constraints and cultural preferences while simultaneously investing in localized production facilities to reduce reliance on expensive imports and improve freshness.

Moreover, technological integration, particularly in sustainability, offers long-term advantages. Opportunities abound in utilizing fermentation byproducts (like acid whey) in sustainable ways, such as generating bio-energy or developing specialized food ingredients, thereby maximizing resource efficiency and reducing environmental load. Further advancements in clean-label ingredients, including natural sweeteners like stevia and monk fruit, will continue to displace refined sugar, aligning products with future regulatory pressures and consumer desires for minimally processed foods.

Finally, the intersection of dairy and snacking presents a ripe area for development. Yogurt products are increasingly being incorporated into hybrid snacks, such as yogurt-covered nuts, granola bars, or specialized dessert components. These innovations extend yogurt’s consumption occasions beyond breakfast, competing effectively against confectionery and traditional snack foods. Partnerships with food technologists and flavor houses are essential to capitalize on these cross-segment opportunities effectively.

Sustainability and Ethical Considerations in the Yogurt Market

Sustainability has transitioned from a niche marketing tool to a core operational mandate within the Yogurt Market. The dairy industry, which forms the foundation of most yogurt products, faces significant public scrutiny regarding its environmental impact, particularly concerning greenhouse gas emissions (methane), water usage, and land management. Leading manufacturers are now implementing comprehensive sustainability programs that mandate improved animal welfare standards, investment in renewable energy sources for processing plants, and circular economy initiatives aimed at zero waste.

Ethical sourcing is a paramount concern for modern consumers. This includes guaranteeing fair prices and sustainable livelihoods for dairy farmers, often achieved through certifications or cooperative structures. Transparency regarding the origin of milk and other ingredients is becoming expected, supported by blockchain technology which allows consumers to trace products from farm to fork. Companies failing to meet these ethical sourcing standards risk reputation damage and consumer boycott, particularly in highly engaged markets like Northern Europe and the US.

The environmental footprint of packaging is a highly visible sustainability challenge. The ubiquity of single-use plastic yogurt cups is a major concern. The industry is actively transitioning toward more sustainable packaging alternatives, including utilizing Post-Consumer Recycled (PCR) plastics, developing refillable or bulk systems, and investing in material science to create fully compostable or biodegradable cups. This material transition is complex, requiring high investment in new machinery and ensuring the chosen material maintains the necessary barrier properties for preserving product freshness and probiotic activity.

Water stewardship is equally critical, as dairy processing is water-intensive. Manufacturers are deploying advanced filtration and closed-loop systems to reuse water within the processing cycle. Furthermore, managing the substantial volumes of acidic whey produced during Greek yogurt manufacturing is a sustainability priority. Companies are finding value streams for whey, converting it into nutritional powders, animal feed supplements, or even utilizing it in bio-fuel production, transforming a waste liability into an economic asset.

Regulatory Landscape and Compliance Requirements

The regulatory environment for yogurt is diverse and stringent, varying significantly across major jurisdictions. Compliance is crucial, particularly concerning food safety, nutritional labeling, and health claims. In the European Union, regulations govern the use of the term "yogurt" strictly, dictating required starter cultures and minimum viable count of live bacteria, placing a high burden on manufacturers to prove the functional presence of probiotics throughout the product's shelf life.

In North America, the focus often centers on nutritional transparency, specifically the accurate declaration of added sugars, fats, and allergens. The FDA and USDA frequently update guidelines, forcing continuous reformulation. The complexity arises when products are cross-marketed globally; a product formulated to meet strict EU requirements might need significant relabeling or even re-formulation to comply with differing standards in Asian or Middle Eastern markets regarding permitted additives or fortification levels.

A key area of regulatory complexity involves probiotic and functional claims. Regulators are increasingly scrutinizing marketing claims to prevent misleading information. Manufacturers must rely on robust scientific substantiation and, in many cases, avoid making disease-specific claims unless approved by relevant national food safety authorities. This environment favors large companies with significant R&D capabilities to conduct the necessary clinical trials.

Furthermore, the regulation of non-dairy alternatives is rapidly evolving. As plant-based products gain market share, regulatory bodies are debating appropriate naming conventions (e.g., whether a product can be called "almond yogurt") to prevent consumer confusion. Compliance with these emerging standards requires close monitoring of legislative changes and proactive engagement with regulatory bodies to ensure long-term market access and legal defensibility of marketing language.

Consumer Behavior Analysis and Purchasing Drivers

Consumer behavior in the Yogurt Market is increasingly dictated by health and convenience factors. The modern consumer views yogurt not merely as a dessert but as a tool for achieving specific health goals, leading to high engagement with labels that detail protein content, sugar levels, and specific probiotic strains. Purchasing decisions are often highly rationalized, favoring products perceived as highly functional, such as those promoting better digestion, enhanced immunity, or cognitive health benefits.

Taste and texture remain fundamental drivers, even in the functional segment. A yogurt product, regardless of its health benefits, must offer a pleasing sensory experience. This has led to an industry-wide focus on perfecting texture—from the creamy density of Greek yogurt to the smooth, pourable consistency of drinkable formats—and innovating complex, natural flavor profiles that move beyond standard fruit offerings to include savory, spiced, or unique botanical elements.

Impulse purchases often occur in the refrigerated aisle, where packaging design and visual cues play a critical role. Attractive, clean labeling, highlighting key benefits (e.g., "High Protein," "No Added Sugar," "Organic"), influences immediate choice. E-commerce platforms, however, shift the purchasing driver slightly, emphasizing subscription models and bulk purchases, driven by digital reviews, personalized recommendations, and price sensitivity for routine grocery staples.

Finally, affordability influences behavior, particularly in economic downturns. While premium segments dedicated to highly specialized health benefits maintain a loyal base, the mass market often trades down to value-oriented private labels or bulk formats when economic pressures increase. Manufacturers must strategically segment their product lines to offer value propositions that cater to both the highly discerning, health-focused consumer and the price-sensitive mainstream buyer, ensuring market coverage across all socio-economic strata.

Innovation in Packaging and Shelf Life Extension

Packaging innovation in the Yogurt Market serves a dual purpose: maximizing shelf life integrity and meeting stringent sustainability goals. The use of advanced barrier technologies, often involving co-extruded polymers or foil seals, is essential for minimizing oxygen permeability, which can compromise the viability of live cultures and accelerate product spoilage. A significant trend is the development of thermoformed and injection-molded plastic containers that use less raw material while maintaining structural integrity, reducing the overall environmental load per unit.

Shelf life extension technologies are critical for global distribution, particularly in emerging markets where the cold chain can be intermittent. Beyond standard pasteurization, High-Pressure Processing (HPP) is an emerging non-thermal technology used to inactivate pathogens and spoilage organisms, significantly extending freshness without compromising the nutritional profile or flavor of the yogurt. This technology supports export strategies and reduces market risk associated with inventory turnover.

Furthermore, convenience packaging continues to evolve, with single-serve cups featuring built-in compartments for mix-ins (like granola or fruit) separating components until consumption, enhancing the consumer experience and maintaining textural quality. For children's markets, tamper-evident, resealable pouches are increasingly popular, offering portability and minimizing spillage, which drives segment growth in the on-the-go snacking category. The overall industry drive is toward intelligent packaging, possibly incorporating temperature indicators or freshness sensors, though widespread adoption remains a cost challenge.

The long-term success of packaging hinges on achieving 100% recyclability or compostability. Major players are committing substantial capital to research alternatives to difficult-to-recycle multi-layer plastics, investigating materials derived from bio-based sources, and simplifying the structure of packaging to enhance sorting efficiency in recycling facilities. Consumer education on proper disposal methods is also a key component of this packaging sustainability strategy.

The report contains 29690 characters including spaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fortified Yogurt Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Home Yogurt Machine Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Lactose-Free Yogurt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Drinking Yogurt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Yogurt Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager