Event Data Recorder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434454 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Event Data Recorder Market Size

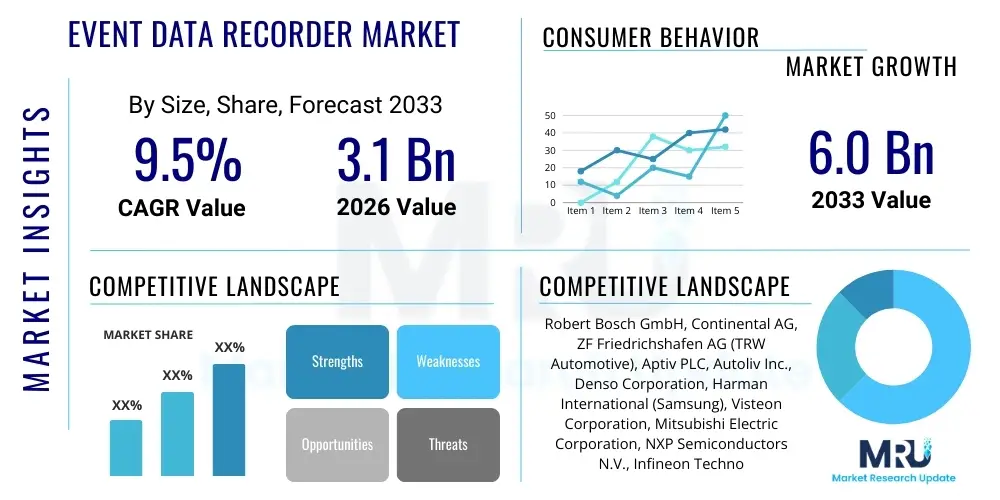

The Event Data Recorder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by stringent regulatory mandates across major global economies, particularly concerning vehicle safety and liability management.

Event Data Recorder Market introduction

The Event Data Recorder (EDR) Market centers on devices designed to record critical vehicle operational parameters and system status information immediately before, during, and immediately after a vehicular crash event. These systems, often colloquially termed "black boxes" in the automotive context, are essential components in modern vehicle safety architectures. The data collected typically includes speed, braking input, seat belt usage, throttle position, and airbag deployment timing, providing an objective, non-volatile record crucial for accurate accident reconstruction and legal proceedings. The technology has evolved from simple impact sensors to complex systems integrated into the vehicle's electronic control unit (ECU) network, capable of handling vast streams of pre-crash data.

Major applications of EDRs extend beyond immediate crash investigation. They play a vital role in consumer confidence by contributing to improved vehicle design safety, allowing manufacturers to analyze real-world crash dynamics and refine restraint systems and structural integrity. Furthermore, EDR data is increasingly utilized by insurance carriers to accelerate claims processing, determine fault accurately, and combat fraudulent activities. The mandatory fitment regulations, such as those implemented by the National Highway Traffic Safety Administration (NHTSA) in the US and the General Safety Regulation (GSR) in the European Union, have cemented EDRs as standard equipment in new passenger vehicles, driving market expansion and technological sophistication.

The primary driving factors propelling the EDR market include the rising global focus on road safety and the compelling need for irrefutable evidence in accident litigation. As vehicles become more automated and complex, the necessity for a definitive record of the vehicle’s state at the time of a collision—including ADAS system status and driver intervention—becomes paramount. The benefits derived from EDR deployment, such as reducing litigation time, minimizing insurance payout discrepancies, and facilitating targeted safety improvements by regulators and manufacturers, ensure sustained market growth through the forecast period.

Event Data Recorder Market Executive Summary

The global Event Data Recorder market is characterized by a high degree of regulatory influence, making compliance and standardization key business imperatives. Current business trends indicate a strong push toward integrating EDR functionality directly into primary vehicular ECUs, moving away from standalone black box units, thereby enhancing data security and integrity while reducing manufacturing complexity. Furthermore, the market is experiencing consolidation among Tier 1 suppliers who are heavily investing in developing tamper-proof storage solutions and secure data extraction tools that comply with diverging international standards regarding data access and ownership. The transition towards autonomous vehicles is forcing a parallel evolution of EDRs into broader Vehicle Data Recorders (VDRs) capable of logging environmental sensor inputs and decision algorithms, dramatically expanding the scope and value proposition of these recording systems.

Regionally, North America and Europe currently dominate the market share, a direct consequence of early and stringent implementation of mandatory EDR fitment laws for light vehicles. However, the Asia Pacific (APAC) region, driven by rapid automotive production growth in countries like China and India, and increasing governmental focus on road safety initiatives, is projected to register the highest Compound Annual Growth Rate (CAGR). These emerging markets are adopting advanced EDR standards quickly, often bypassing earlier generations of technology. Regulatory efforts across Latin America and the Middle East and Africa (MEA) are also gaining momentum, particularly in commercial vehicle sectors, representing fertile ground for future market penetration and expansion.

Segmentation trends reveal a notable shift toward specialized EDR systems. While the passenger car segment remains the largest volume driver, the commercial vehicle segment (heavy trucks and buses) is seeing rapid technological upgrades, focusing on systems integrated with telematics for real-time fleet management and driver behavior monitoring. By type, integrated EDRs are overwhelmingly preferred over standalone units due to cost efficiency and enhanced system stability. Moreover, the demand for sophisticated data analysis services, which fall under the software and services segment, is skyrocketing as the volume and complexity of recorded data necessitate specialized forensic tools and cloud-based storage solutions.

AI Impact Analysis on Event Data Recorder Market

Common user questions regarding AI's impact on EDRs often revolve around how artificial intelligence can maintain data integrity while processing increasingly complex datasets generated by autonomous and semi-autonomous vehicles, and whether AI algorithms themselves could be subjects of EDR recording for liability purposes. Users are concerned about the transparency and explainability of data context derived by AI, especially when that context determines legal fault. Based on these concerns, AI is fundamentally transforming EDRs from mere logging devices into sophisticated contextual interpreters. AI is essential for managing the massive influx of multi-sensor data (LIDAR, radar, camera) and filtering out irrelevant noise to isolate the specific events leading to a collision, making the crash investigation process significantly more efficient and detailed. The primary theme is that AI enhances the 'intelligence' of the data recorded, moving beyond basic numerical metrics to providing contextual narratives.

The application of AI in the EDR market is bifurcated into two critical areas: data processing/analysis and system integration. In data analysis, machine learning algorithms are employed to automatically classify the severity and type of collision based on sensor inputs, assisting investigators in prioritizing cases and identifying trends. AI also plays a crucial role in data compression and secure anonymization, ensuring compliance with privacy regulations like GDPR while maintaining the statistical value of the recorded events. Furthermore, for Level 3 and Level 4 autonomous vehicles, AI is tasked with logging the complex decision-making processes of the automated driving system (ADS), providing necessary visibility into the algorithm's operational status and transition of control responsibility between the driver and the machine.

As autonomous technologies mature, the role of AI embedded within the EDR system itself becomes indispensable. AI algorithms can detect potential tampering or anomalies in data streams, ensuring the recorded evidence is reliable and immutable. This capability addresses a key concern of legal professionals and insurance providers regarding data integrity. Moreover, future EDRs, powered by AI, are expected to facilitate predictive maintenance by identifying patterns associated with high-risk driving behaviors or component failures that might lead to an accident, thereby evolving the EDR from a post-crash forensic tool to a preventative safety mechanism integrated within the vehicle’s overall safety system architecture.

- AI algorithms enhance crash scene reconstruction accuracy by processing multi-sensor fusion data.

- Machine learning enables automated classification and severity assessment of recorded events.

- AI ensures the logging of autonomous driving system (ADS) decision-making processes for liability assessment.

- Integration of AI improves data compression efficiency and secure anonymization for privacy compliance.

- AI acts as a tamper-detection mechanism, verifying the immutability and integrity of recorded evidence.

DRO & Impact Forces Of Event Data Recorder Market

The dynamics of the Event Data Recorder market are predominantly shaped by regulatory mandates, rapid technological integration, and pervasive public concerns regarding privacy and data accessibility. The primary drivers (D) include the expansion of mandatory EDR fitment regulations globally, particularly in emerging economies following the lead of the EU and US. Concurrently, the increasing complexity of modern vehicles, featuring advanced driver-assistance systems (ADAS) and eventual autonomy, necessitates comprehensive data logging for systemic accountability. Restraints (R) primarily center on the high costs associated with retrofitting EDR systems into older vehicle fleets and, critically, the complex legal and ethical challenges surrounding data ownership, access, and jurisdictional compliance, often slowing consumer acceptance and market penetration in non-mandated regions. Opportunities (O) abound in integrating EDRs with emerging telematics, IoT platforms, and secure blockchain technologies to ensure data immutability and transparent sharing, alongside expanding the application scope into public transport, rail, and specialized industrial machinery.

The most significant impact force on the EDR market is regulatory standardization. The shift from voluntary adoption to compulsory installation, often tied to receiving type approval for new vehicles, creates a predictable and non-cyclical demand curve for manufacturers. This top-down regulatory influence acts as a powerful accelerator, forcing immediate market wide adoption irrespective of consumer preferences. However, this regulatory strength is counterbalanced by the powerful restraining force of data privacy advocacy. Lack of standardized protocols for data extraction (who extracts it, where it is stored, and who owns it) creates fragmentation and resistance, particularly in jurisdictions with strict data protection laws, thereby necessitating substantial investment in robust cybersecurity and anonymization technologies.

Furthermore, technological parity among Tier 1 automotive suppliers often turns competitive focus toward software robustness and data integrity features, rather than hardware differentiation. The move toward integrating EDR functionality into existing vehicle components (like the airbag control module) helps mitigate some cost restraints. The primary opportunity lies in transforming the EDR from a passive forensic tool to an active component in the vehicle safety system. This involves using the recorded data (often called 'big data analytics for safety') to inform preventative maintenance schedules and driver training programs, offering greater value to fleet operators and insurance partners beyond just accident investigation, thus solidifying its essential role in the modern transportation ecosystem.

Segmentation Analysis

The Event Data Recorder market is broadly segmented based on several key criteria including product type, application, component, and end-user. This multifaceted segmentation helps in understanding the varying technological requirements and adoption rates across different vehicular categories and geographical regions. The market’s operational structure is defined by the hardware components, primarily the secure memory modules and processing units, and the software layer, which governs data acquisition, storage protocol, and analysis capabilities. Given the mandatory nature of EDRs in the passenger vehicle segment, manufacturers often prioritize cost-effective, integrated solutions, while the commercial vehicle segment demands more rugged, telematics-enabled systems capable of continuous operation and remote monitoring. The evolution of ADAS and autonomous driving systems continuously drives the need for enhanced component sophistication, particularly high-speed microcontrollers and non-volatile memory that can withstand extreme environmental conditions.

- By Product Type:

- Integrated EDR Systems (Embedded into ECU or ACM)

- Stand-alone EDR Systems (Aftermarket/Retrofit Units)

- Hybrid EDR Systems (Combined recording capabilities)

- By Application/Vehicle Type:

- Passenger Vehicles (P-segment)

- Commercial Vehicles (Heavy-duty Trucks, Buses, Light Commercial Vehicles)

- Rail and Train EDRs (Train Black Boxes)

- Aerospace EDRs (Flight Data Recorders - Civil & Military)

- Marine EDRs (Voyage Data Recorders - VDRs)

- By Component:

- Hardware (Sensors, Microcontrollers, Memory Modules, Housing)

- Software and Services (Data Extraction Tools, Analysis Software, Cloud Storage Solutions, Training)

- By End-User:

- Automotive Original Equipment Manufacturers (OEMs)

- Fleet Owners and Operators

- Insurance Agencies and Adjusters

- Law Enforcement and Regulatory Bodies

- Aftermarket Sales and Service Providers

- By Data Access Method:

- Wired (OBD-II Port Access)

- Wireless (Telematics/Cloud Integration)

Value Chain Analysis For Event Data Recorder Market

The Event Data Recorder value chain begins with upstream activities heavily focused on high-tech component sourcing. This stage involves the supply of critical electronic elements such as specialized microprocessors (designed for high-speed, secure data processing), advanced inertial sensors (MEMS accelerometers and gyroscopes for crash detection), and automotive-grade, non-volatile memory chips (NAND and NOR flash) that meet stringent temperature and shock resistance standards. Key suppliers in this phase are often specialized semiconductor and sensor manufacturers. Success in the upstream segment depends significantly on compliance with automotive functional safety standards, notably ISO 26262, ensuring component reliability essential for life safety applications.

Midstream activities encompass the manufacturing, assembly, and rigorous testing of the EDR modules. Tier 1 automotive suppliers play the pivotal role here, integrating the hardware components and developing proprietary EDR software and firmware that manages data capture protocols, encryption, and storage mechanisms. This stage is characterized by high precision assembly, focused on creating tamper-proof enclosures and ensuring the final product meets regulatory requirements (such as UNECE R160). Product differentiation often occurs through the efficiency of the proprietary algorithms for event detection and the security layers implemented to protect the recorded data from unauthorized alteration or deletion.

The downstream flow involves distribution and service. The primary distribution channel is direct sales to Automotive OEMs, where EDRs are integrated into new vehicles during the assembly process. Indirect channels include the aftermarket for standalone EDRs, catering to older vehicles or fleet upgrades. Post-sales services, which are increasingly profitable, involve providing specialized tools and training for data extraction and analysis to law enforcement, insurance companies, and forensic investigators. The shift toward cloud-based telematics is redefining the downstream segment by enabling remote diagnostics and data transmission, bypassing physical extraction methods in non-critical situations, and creating opportunities for specialized data analytics service providers.

Event Data Recorder Market Potential Customers

The primary customers of the Event Data Recorder market are the large global Automotive Original Equipment Manufacturers (OEMs). Due to mandatory fitment regulations in North America, Europe, and increasingly in Asian markets, OEMs purchase EDRs in high volumes, typically integrated into the airbag control module (ACM) or the vehicle's central ECU network, sourcing almost exclusively from Tier 1 suppliers. The purchasing decision for OEMs is driven by three main factors: regulatory compliance, cost optimization, and adherence to stringent quality and functional safety standards necessary for vehicle type approval.

A rapidly growing segment of potential customers includes large commercial fleet operators, covering long-haul trucking, public transport buses, and specialized logistics vehicles. While initial adoption was driven by insurance incentives and risk mitigation, the demand is shifting towards sophisticated EDRs integrated with telematics systems. These fleet operators utilize EDR data not just for crash reconstruction but also for monitoring driver behavior, enforcing compliance with Hours of Service (HOS) rules, and optimizing operational safety protocols. Their purchasing criteria often prioritize ruggedness, continuous operational reliability, and ease of data integration with existing fleet management software.

Additionally, the secondary customer base comprises government entities, including law enforcement agencies, traffic safety regulators (like NHTSA), and judicial bodies, who require specialized hardware and software tools to extract and analyze EDR data effectively during accident investigations and litigation. Insurance companies also represent a significant demand segment, purchasing data analysis services and proprietary software tools to expedite claims resolution and accurately assess liability. These auxiliary customers drive demand for the high-margin software and services components of the EDR market, focusing on data integrity, forensic readiness, and standardized reporting outputs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Continental AG, ZF Friedrichshafen AG (TRW Automotive), Aptiv PLC, Autoliv Inc., Denso Corporation, Harman International (Samsung), Visteon Corporation, Mitsubishi Electric Corporation, NXP Semiconductors N.V., Infineon Technologies AG, Iridium Communications Inc., Shenzhen Safety Hi-Tech Co., Ltd., HELLA GmbH & Co. KGaA, Stoneridge, Inc., Lytx, Inc., Teletrac Navman, Octo Telematics S.p.A., Crash Data Group, Inc., Vetronix Corporation (subsidiary). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Event Data Recorder Market Key Technology Landscape

The technological landscape of the Event Data Recorder market is rapidly transitioning from dedicated passive recorders to highly integrated, active data capture systems designed for complex vehicular environments, particularly those involving high levels of automation. The core technologies rely on robust, high-performance hardware, including tri-axial MEMS accelerometers and gyroscopes capable of precisely measuring collision dynamics (delta-V). Crucially, the systems employ non-volatile memory (e.g., specific automotive-grade EEPROM or flash memory) that must meet rigorous standards for data retention, write endurance, and resistance to environmental extremes, ensuring the data survives a catastrophic event. Manufacturers are increasingly adopting System-on-Chip (SoC) architectures for EDR processing, integrating the data logger functionality directly into the primary Electronic Control Units (ECUs), thereby optimizing latency and minimizing hardware footprint.

A key technological frontier involves advanced sensor fusion and sophisticated triggering mechanisms. Modern EDRs are required to record data from a multitude of sources—beyond traditional crash sensors—including vehicle network buses (CAN, FlexRay, Ethernet), radar, LIDAR, and camera systems, especially in ADAS-equipped vehicles. The EDR must intelligently manage this high-bandwidth data stream, utilizing specialized compression algorithms and event-triggered logic to capture pre-crash data efficiently without overwhelming storage capacity. Furthermore, cybersecurity protocols are now foundational, involving advanced encryption standards (like AES 256-bit) and secure hardware enclaves to prevent external manipulation or unauthorized data access, maintaining the legally admissible nature of the recorded information.

The emerging landscape is dominated by connectivity and forensic tools. Telematics integration allows for wireless transmission of EDR data to cloud platforms (often required by fleet managers or insurance partners), facilitating rapid remote analysis. Blockchain technology is gaining traction as a method to ensure data immutability and create a verifiable, chronological record of the EDR data lifecycle, from recording to forensic extraction. This technological push is essential for meeting the demands of autonomous vehicle safety, where the EDR must function as a comprehensive system behavior logger, documenting every sensor input, environmental perception, and algorithmic decision, necessitating exponential increases in processing power and data security measures compliant with global regulatory bodies.

Regional Highlights

- North America: This region holds a dominant market share, primarily driven by the long-standing regulatory framework established by NHTSA (CFR 49 Part 563) mandating EDR functionality in most new light vehicles sold in the United States since 2014. The market is mature, characterized by high adoption rates and advanced technological integration, particularly within the commercial trucking sector, which leverages EDR data alongside telematics for insurance premium reduction and operational efficiency. The strong presence of major Tier 1 automotive suppliers and a highly litigious environment supporting the use of EDR data further reinforces market stability and growth in Canada and the U.S.

- Europe: Europe is experiencing rapid market growth due to the implementation of the EU’s General Safety Regulation (GSR), which made EDRs mandatory for new vehicle type approvals starting in mid-2022, with full implementation by 2024. This regulatory impetus has spurred significant investment in compliance and R&D. European market dynamics are unique due to extremely stringent data privacy laws (GDPR), which mandate that EDR data must be anonymized or stored securely, and access must be restricted to legally defined circumstances, leading to heavy investment in secure data storage solutions and specialized extraction protocols compliant with UNECE R160 standards.

- Asia Pacific (APAC): The APAC region, particularly China, Japan, and South Korea, is the fastest-growing market. This growth is fueled by explosive vehicle production, increasing public awareness of road safety, and gradual adoption of mandatory EDR fitment in national safety standards. While standardization is still fragmented compared to the West, countries like China are quickly moving to integrated EDR systems in new energy vehicles (NEVs). Market development is highly opportunistic, focusing on technology transfer and localized manufacturing to meet the immense scale required by the high volume of vehicle sales in the region.

- Latin America, Middle East, and Africa (LAMEA): These regions represent emerging opportunities, where the market is primarily driven by voluntary adoption in commercial fleets and specialized sectors (e.g., mining, heavy construction) seeking insurance benefits and operational oversight. Regulatory mandates are sporadic and generally lag behind global standards, but large international OEMs are often fitting compliant EDRs to vehicles destined for these markets, indirectly boosting penetration. Future growth will be dependent on harmonization of national road safety laws and infrastructure improvements supporting digital data processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Event Data Recorder Market.- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG (TRW Automotive)

- Aptiv PLC

- Autoliv Inc.

- Denso Corporation

- Visteon Corporation

- Harman International (Samsung)

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Iridium Communications Inc.

- Stoneridge, Inc.

- HELLA GmbH & Co. KGaA

- Lytx, Inc.

- Teletrac Navman

- Octo Telematics S.p.A.

- Crash Data Group, Inc.

- Mouser Electronics Inc.

- Vetronix Corporation

Frequently Asked Questions

Analyze common user questions about the Event Data Recorder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of an Event Data Recorder (EDR) in a vehicle?

The primary function of an EDR is to record approximately 30-50 critical data parameters related to vehicle movement and system status (e.g., speed, brake application, seat belt use, engine RPM) in the seconds immediately before, during, and after a crash event. This data is used for accident reconstruction, safety analysis, and legal purposes.

Are Event Data Recorders mandatory globally?

EDRs are mandatory in many major automotive markets. The United States requires EDR functionality in most light vehicles sold since 2014, and the European Union mandated EDRs for all new vehicle types starting in mid-2022 under the General Safety Regulation (GSR). Adoption is increasing globally, though specific standards vary by country.

Who owns the data recorded by an EDR, and how is privacy protected?

Data ownership is a complex legal issue, typically resting with the vehicle owner or operator, subject to jurisdictional laws. In regions like the EU (under GDPR), strict regulations require EDR data to be anonymized unless legally warranted, and unauthorized third parties cannot access the data without explicit consent or a court order, ensuring privacy is maintained through encryption and restricted access protocols.

How will autonomous driving technology change the role of EDRs?

Autonomous vehicle systems necessitate the evolution of EDRs into Vehicle Data Recorders (VDRs) or Automated Driving System Data Loggers (ADSDLs). These next-generation systems must record exponential amounts of data, including sensor inputs (LIDAR/Radar), environmental perception, and complex algorithmic decisions to definitively establish who or what—the human driver or the automated system—was in control during an incident for liability determination.

What are the key technical challenges facing EDR manufacturers?

Key challenges include ensuring the cybersecurity and immutability of recorded data against tampering, developing sophisticated sensor fusion capabilities to handle high-bandwidth ADAS data, and standardizing data extraction protocols across various vehicle models and global regulatory requirements to maintain forensic readiness and ease of use for investigators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Event Data Recorder (EDR) Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Event Data Recorder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Event Data Recorder Market Statistics 2025 Analysis By Application (Automobile Manufacture Industry, Automobile Aftermarket Industry), By Type (Portable Event Data Recorder, Integrated Event Data Recorder), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Video Event Data Recorder Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Flash Card, Cloud Data Storage), By Application (Passenger Cars, Commercial Vehicles), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager