Fabric Cutting Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433165 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fabric Cutting Machines Market Size

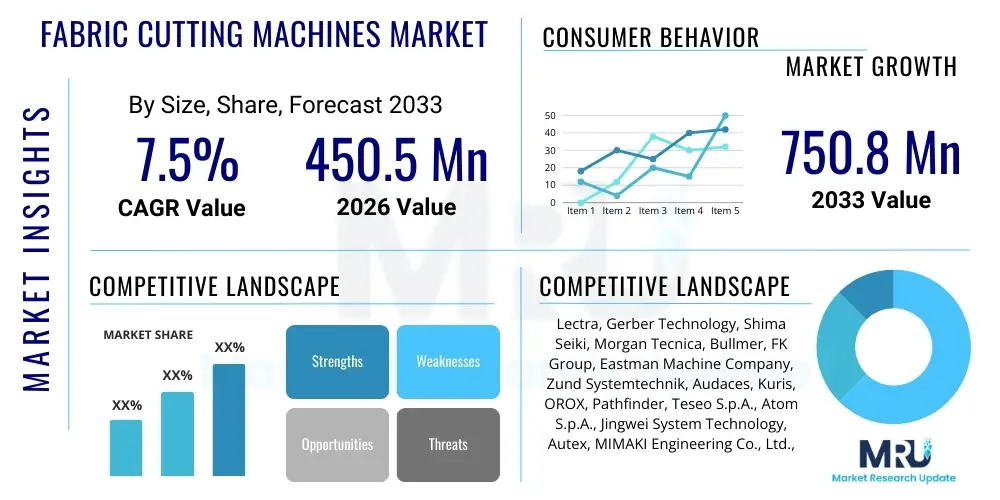

The Fabric Cutting Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 750.8 Million by the end of the forecast period in 2033.

Fabric Cutting Machines Market introduction

The Fabric Cutting Machines Market encompasses the specialized industrial equipment designed for precise, high-volume, and efficient cutting of various textile materials, composites, and technical fabrics used across diverse manufacturing sectors. These machines range from traditional manual systems to highly sophisticated, computer numerically controlled (CNC) automated cutters, including laser, waterjet, plasma, and reciprocating knife technologies. The primary objective of these systems is to maximize material yield, ensure dimensional accuracy, and significantly reduce labor costs and processing time in high-throughput environments.

Product descriptions within this market focus heavily on automation levels, speed capabilities (meters per minute), cutting thickness range, and compatibility with advanced pattern recognition software. Major applications span the apparel and fashion industry, demanding precision for mass garment production; the automotive sector, utilized for seating, airbags, and interior components; and specialized industrial textiles for defense, aerospace, and protective gear. The evolution toward digital transformation and Industry 4.0 principles is fundamentally reshaping the capabilities offered by modern fabric cutting solutions.

The core benefits derived from adopting advanced fabric cutting machines include superior edge quality, minimal material wastage due to optimized nesting algorithms, rapid changeover times between different fabric types, and improved workplace safety compared to manual cutting processes. Key driving factors propelling market expansion are the increasing demand for customized and fast fashion, the necessity for production flexibility in complex supply chains, and rising labor costs in developing economies, making automation a critical investment for competitive advantage globally.

Fabric Cutting Machines Market Executive Summary

The Fabric Cutting Machines Market is characterized by a strong shift toward full automation and integration with digital manufacturing ecosystems, driven primarily by the global demand for faster turnaround times and mass customization. Business trends indicate intensified R&D efforts focused on developing multi-tool cutting heads capable of handling diverse materials—from delicate silks to heavy-duty carbon fiber composites—and enhancing software robustness for seamless integration with CAD/CAM systems. Furthermore, manufacturers are increasingly adopting subscription models for maintenance and software updates, ensuring recurring revenue streams and optimal operational efficiency for end-users. Sustainability concerns are also shaping business strategies, prompting the development of machines that facilitate zero-waste production through advanced material optimization algorithms.

Regionally, Asia Pacific (APAC) remains the dominant market segment, fueled by the massive concentration of textile and automotive manufacturing hubs, particularly in China, India, and Vietnam. However, North America and Europe are experiencing high growth in the adoption of high-precision automated cutters, particularly within the technical textiles and luxury apparel segments, as companies repatriate production or focus on high-value, niche manufacturing. Political stability, trade agreements, and fluctuating labor costs significantly influence investment decisions regarding the location of new automated cutting facilities across these regions, driving localized innovation in machine design tailored for specific geographical material standards.

Segmentation trends highlight the rapid expansion of the automated cutting machine segment, particularly laser and reciprocating knife systems, which offer unparalleled speed and precision compared to traditional manual methods. The laser cutting sub-segment is gaining traction due to its clean-edge finish for synthetic materials and non-contact operation, minimizing material distortion. Application-wise, the automotive industry shows accelerated adoption, driven by complex component shapes required for advanced interiors and the integration of technical fabrics requiring stringent quality control. The move towards specialized composite cutting machinery for aerospace and defense applications also represents a high-value, albeit niche, growth vector within the industrial application segment.

AI Impact Analysis on Fabric Cutting Machines Market

User queries regarding the integration of Artificial Intelligence (AI) into fabric cutting machines frequently center on efficiency gains, predictive maintenance, and the optimization of highly complex nesting patterns. The primary concern users voice is related to the immediate quantifiable return on investment (ROI) derived from AI-driven automation, specifically asking how AI algorithms can dramatically reduce fabric wastage compared to current sophisticated optimization software. Furthermore, there is significant interest in AI's role in real-time quality control, where machine vision systems powered by AI are expected to detect minute fabric defects or misalignments instantly, stopping the cut before costly material damage occurs. Expectations also involve using AI to predict machine component failures based on operational data (temperature, vibration, motor loads), thereby maximizing uptime and scheduling maintenance proactively, moving the industry beyond traditional reactive maintenance models.

- AI-driven Predictive Maintenance: Minimizes downtime by analyzing sensor data to forecast component failure, leading to scheduled, preventative servicing.

- Advanced Nesting Optimization: Utilizes machine learning to generate optimal cutting layouts, significantly surpassing human capability in reducing material waste.

- Real-Time Quality Control: AI vision systems detect fabric flaws, pattern inaccuracies, or dimensional errors during the cutting process, ensuring output integrity.

- Adaptive Cutting Parameters: Algorithms automatically adjust cutting speed, pressure, and blade oscillation based on real-time fabric properties (density, elasticity, weave structure).

- Autonomous Workflow Management: AI coordinates material handling, spreading, cutting, and sorting post-processing, creating fully autonomous production cells.

DRO & Impact Forces Of Fabric Cutting Machines Market

The Fabric Cutting Machines Market dynamics are primarily shaped by the dual demands of increasing production efficiency and the necessity for material optimization in an environment of volatile raw material costs. Drivers, such as the rapid growth of the apparel industry in Asia Pacific and the increasing focus on advanced manufacturing techniques (Industry 4.0), mandate the transition from manual to automated systems to meet global scalability requirements. Simultaneously, restraints, particularly the high initial capital investment required for sophisticated CNC cutting systems and the need for highly skilled technicians for operation and maintenance, pose significant barriers to entry for smaller manufacturers. However, opportunities abound in emerging markets where governments are promoting localized manufacturing and through the specialized application of cutting technology in high-growth sectors like electric vehicle components and medical textiles, which require highly precise technical fabric processing.

The inherent impact forces acting upon the market underscore the competitive pressure to innovate continually. Technological advancements, particularly the fusion of mechatronics with advanced software, exert a strong positive force, increasing machine utility and lifespan. Economic fluctuations, especially currency exchange rates and global trade policies, act as moderating forces, affecting the procurement cost of imported machinery and the export potential of manufactured goods. The threat of substitutes, while low in the high-volume industrial sector (as specialized machinery is difficult to replicate manually), requires constant technological differentiation. Overall, the dominant force remains the cost-benefit analysis of automation versus manual labor, where rising global labor costs persistently drive automation adoption despite high upfront investment costs.

Market saturation in basic manual cutting systems contrasts sharply with the high demand for advanced, automated solutions, forcing companies to continuously invest in R&D focusing on speed, precision, and multi-tool capabilities. Furthermore, global sustainability initiatives are imposing regulatory pressure to minimize textile waste, making machines with superior nesting algorithms significantly more attractive. These overlapping forces necessitate a strategic balance between offering cost-effective, high-throughput systems and developing ultra-precise specialty cutters for technical textiles, thus expanding the market’s vertical scope and maintaining robust growth projections throughout the forecast period.

Segmentation Analysis

The Fabric Cutting Machines Market is broadly segmented based on technology, product type, application, and level of automation, reflecting the diverse needs of the global textile and manufacturing industries. Understanding these segments is crucial for market participants to tailor their product offerings, particularly as the demand shifts from basic cutting functionality towards integrated, specialized production solutions. The differentiation between manual, semi-automatic, and fully automatic systems dictates the achievable throughput and the necessary investment level, directly influencing adoption rates in different geographical regions and economic tiers of manufacturing. The dominance of knife-based cutting across general apparel production is gradually being challenged by laser and waterjet technologies in specialized industrial applications requiring superior edge sealing or handling of complex composite structures.

- By Technology:

- Automated Cutting (CNC)

- Manual and Semi-Automatic Cutting

- By Product Type:

- Reciprocating Knife Cutters

- Laser Cutters

- Waterjet Cutters

- Plasma Cutters

- Die Cutters

- By Application:

- Apparel and Footwear Industry

- Automotive Industry (Interiors, Airbags, Composites)

- Industrial Textiles (Awnings, Tarpaulins, Technical Fabrics)

- Furniture and Upholstery

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Fabric Cutting Machines Market

The value chain for the Fabric Cutting Machines Market begins with upstream suppliers providing critical components such as high-precision motors, sophisticated sensor systems, cutting tools (blades, laser optics), and advanced CNC controllers and software. These suppliers play a vital role in determining the final performance characteristics and reliability of the machinery. High dependency on specialized software vendors for nesting algorithms and CAD/CAM integration is a key feature of this upstream segment. Manufacturers then focus on R&D, design, assembly, and testing, utilizing their core competence in mechanical engineering and control systems integration to create differentiated cutting solutions that maximize speed and material utilization.

The distribution channel is multifaceted, relying heavily on specialized industrial equipment distributors who provide local sales, installation, and after-sales support—a critical requirement given the complexity of the machinery. Direct sales are often utilized for large, custom orders placed by major multinational corporations in the automotive or aerospace sectors, allowing manufacturers to maintain direct control over pricing and service delivery. Indirect channels, through regional agents or value-added resellers (VARs), dominate sales to small and medium enterprises (SMEs), particularly in emerging APAC markets, where local presence and tailored financial solutions are essential for closing deals.

Downstream analysis focuses on the end-users: the textile, apparel, automotive, and industrial fabric manufacturers. The long-term value in this market shifts from the initial sale to recurring revenue streams derived from consumables (blades, protective parts, optics) and service contracts (software updates, predictive maintenance). The efficiency gains and material savings delivered to the downstream customers determine the perceived value of the machine, making ongoing technical support and performance optimization a non-negotiable part of the total product offering and strongly influencing future purchasing decisions and brand loyalty.

Fabric Cutting Machines Market Potential Customers

The potential customers for fabric cutting machines are organizations demanding high precision, repeatability, and volume throughput in the processing of flexible materials. The primary buyer segment remains the apparel and garment manufacturing sector, ranging from fast-fashion mass producers requiring high-speed reciprocating knife cutters to luxury brands utilizing precise laser cutters for intricate patterns. These customers prioritize maximizing fabric yield and minimizing labor input to maintain competitive pricing in a highly globalized consumer market, making automation a direct strategic imperative for sustained profitability.

A rapidly expanding segment of buyers includes automotive interior component manufacturers, who require highly accurate cutting of leather, upholstery fabrics, and technical materials for airbags and insulation, driven by strict safety and quality standards. These customers frequently invest in waterjet or specialized oscillating knife systems capable of handling thick, multi-layered materials without fraying. Furthermore, specialized industrial producers focusing on aerospace composites, defense textiles, and outdoor gear (tents, tarpaulins) are high-value customers for advanced, multi-axis cutting technologies that can process stiff, difficult-to-cut materials like carbon fiber prepregs or aramids with extreme precision and minimal heat affect.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 750.8 Million |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lectra, Gerber Technology, Shima Seiki, Morgan Tecnica, Bullmer, FK Group, Eastman Machine Company, Zund Systemtechnik, Audaces, Kuris, OROX, Pathfinder, Teseo S.p.A., Atom S.p.A., Jingwei System Technology, Autex, MIMAKI Engineering Co., Ltd., Summa nv, Assyst GmbH, Liju Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fabric Cutting Machines Market Key Technology Landscape

The technology landscape of the Fabric Cutting Machines Market is dominated by Computer Numerically Controlled (CNC) systems that provide unparalleled accuracy and speed compared to older mechanical cutters. The primary technological advancements focus on the cutting methodology itself, differentiating between mechanical (reciprocating knife, ultrasonic knife, die), thermal (laser, plasma), and high-pressure fluid (waterjet) techniques. Reciprocating knife technology remains the workhorse for high-volume flexible fabric cutting in the apparel industry, continually improving through faster servo motor control and self-sharpening mechanisms to maintain edge integrity across large ply counts.

Laser cutting technology represents the fastest growing niche, particularly for synthetic materials, as it provides a sealed, clean edge, eliminating fraying—a critical requirement for technical fabrics and composites. Recent innovations in laser systems include dynamic beam steering and vision recognition systems that adjust the cutting path in real-time to compensate for fabric distortion or print misalignment. Waterjet technology, although less prevalent than knife or laser systems, is vital for applications requiring cutting without heat introduction, such as ballistic materials or sensitive technical laminates, offering high precision through abrasive garnet injection or pure water streams.

Beyond the cutting head, the most significant technological evolution involves integrated software and automation. Modern systems incorporate highly sophisticated nesting software utilizing proprietary algorithms or AI to achieve near-perfect material utilization. Furthermore, machines are now integrated with automated loading (spreading tables) and unloading systems (labeling and sorting conveyors), transitioning the cutting process from a standalone operation to a fully automated, connected part of the digital supply chain, thereby improving traceability and reducing human intervention errors.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in terms of market volume and deployment of fabric cutting machines, driven by its established position as the world's largest manufacturing base for apparel, footwear, and consumer electronics. Countries like China and India are major consumers, not only due to high production volumes but also due to rapid modernization efforts replacing older, manual equipment with high-speed automated CNC cutters to offset rising domestic labor costs and enhance export competitiveness.

- North America: This region exhibits a strong demand for high-end, specialized cutting machines, particularly in the automotive, aerospace, and defense sectors, which prioritize precision and capability to handle technical textiles and advanced composite prepregs. The emphasis here is less on volume and more on technological sophistication, with a high adoption rate of laser and waterjet systems for high-value applications.

- Europe: Europe represents a mature market focusing on high-quality, sustainable production and integrated Industry 4.0 solutions. Western European nations, especially Germany and Italy, are centers for machinery innovation, driving demand for flexible manufacturing systems that can handle small-batch, customized orders efficiently, often employing highly sophisticated multi-tool heads.

- Latin America (LATAM): The LATAM market is characterized by moderate growth, primarily centered in key textile manufacturing countries like Brazil and Mexico. The demand is often for semi-automatic and entry-level automated solutions, driven by domestic consumption and localized production, with investment decisions highly sensitive to economic stability and import duties.

- Middle East and Africa (MEA): This region is an emerging market with potential, particularly in countries focusing on building domestic manufacturing capabilities (e.g., Turkey, South Africa). Investment is sporadic but focused on modernizing newly established industrial parks, often leapfrogging older technologies directly into advanced automation to establish competitive global supply chains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fabric Cutting Machines Market.- Lectra

- Gerber Technology

- Shima Seiki Mfg., Ltd.

- Morgan Tecnica S.p.A.

- Bullmer GmbH

- FK Group

- Eastman Machine Company

- Zund Systemtechnik AG

- Audaces

- Kuris Spezialmaschinen GmbH

- OROX Group

- Pathfinder Australia Pty Ltd

- Teseo S.p.A.

- Atom S.p.A.

- Jingwei System Technology Co., Ltd.

- Autex

- MIMAKI Engineering Co., Ltd.

- Summa nv

- Assyst GmbH

- Liju Group

Frequently Asked Questions

Analyze common user questions about the Fabric Cutting Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Fabric Cutting Machines Market?

The Fabric Cutting Machines Market is projected to grow at a CAGR of 7.5% between 2026 and 2033, driven primarily by increased automation adoption in the apparel and automotive sectors globally.

Which technology segment holds the largest share in the Fabric Cutting Machines Market?

The Automated Cutting (CNC) technology segment, particularly high-speed reciprocating knife cutters, holds the largest market share due to its efficiency and ability to handle high ply counts required for mass production in the textile industry.

How does AI impact the operational efficiency of modern fabric cutting machines?

AI significantly enhances operational efficiency through advanced nesting algorithms for material optimization (reducing fabric waste) and implementing predictive maintenance protocols, maximizing machine uptime and minimizing unplanned costly downtime.

Which application segment is expected to drive the highest growth in machine adoption?

The Automotive Industry application segment is expected to drive significant growth, fueled by the demand for precise cutting of technical textiles, composites, and specialized interior materials required for safety components like airbags and seating structures.

What are the primary restraints affecting the growth of the Fabric Cutting Machines Market?

The primary restraints include the high initial capital investment required for purchasing advanced automated CNC systems and the necessity for specialized technical skills to operate and maintain these complex, integrated production technologies.

What is the difference between laser cutting and reciprocating knife cutting in textiles?

Reciprocating knife cutting uses a physical blade suitable for layered, flexible materials, offering high throughput for apparel. Laser cutting uses concentrated light to vaporize material, providing a sealed, non-fraying edge, ideal for synthetic fabrics and technical textiles where thermal sealing is advantageous.

Why is the Asia Pacific region the dominant market for fabric cutting machines?

APAC dominates the market due to its massive scale of textile and garment manufacturing, high population density of production facilities, and ongoing strategic efforts to modernize and automate production lines to maintain global competitiveness.

How critical is CAD/CAM integration for automated cutting systems?

CAD/CAM integration is critically important as it enables the direct translation of digital design patterns into executable cutting instructions, streamlining the design-to-production workflow, ensuring pattern accuracy, and facilitating complex nesting optimization.

What type of fabric cutting machine is best suited for cutting composite materials like carbon fiber?

Waterjet cutters are highly preferred for technical composites, including carbon fiber, as they utilize high-pressure water (often with abrasive additives) to achieve precise cuts without generating heat, thereby preventing delamination or material alteration, which is a risk with laser or plasma systems.

Do fabric cutting machine manufacturers offer software subscription services?

Yes, many leading manufacturers, such as Lectra and Gerber Technology, are increasingly moving towards offering software and maintenance services through subscription or cloud-based models, providing continuous access to updated nesting algorithms and diagnostic tools.

What is Answer Engine Optimization (AEO) in the context of this market report?

AEO focuses on structuring content to directly and concisely answer user queries, making key data points readily extractable by search engines and generative AI tools, enhancing the report's discoverability and utility for market analysts seeking specific information.

How does the shift towards technical textiles influence machine design?

The demand for cutting technical textiles necessitates machines with greater rigidity, enhanced precision, and specialized tooling (e.g., ultrasonic knives, multi-layer handling systems) to accommodate non-traditional materials like aramid fibers, insulation, and high-strength industrial fabrics that are stiffer or more abrasive than traditional apparel fabrics.

What role do servo motors play in modern fabric cutting machines?

Servo motors are essential components, providing highly precise and dynamic control over the cutting head and material positioning systems. They ensure the machine can maintain high speed while executing intricate patterns with micron-level accuracy, crucial for complex nesting and intricate pattern matching.

Is sustainability a major concern for fabric cutting machine buyers?

Yes, sustainability is a growing concern. Buyers prioritize machines that offer superior nesting efficiency, as minimizing fabric waste directly translates into lower material consumption and reduced environmental impact, aligning with global corporate social responsibility goals.

What is the primary factor driving automation adoption in the apparel sector?

The primary factor is the necessity to overcome rapidly rising labor costs in traditional manufacturing regions, coupled with the need for flexibility and rapid response capabilities required by the fast-fashion market to remain globally competitive.

How do trade agreements affect the Fabric Cutting Machines Market?

Trade agreements significantly affect the market by influencing tariffs on imported machinery and the overall volume of textile goods being traded globally. Favorable agreements can stimulate investment in advanced machinery in participating regions, while protectionist policies may restrict technology transfer.

Which segments represent key opportunities for new market entrants?

Key opportunities exist in developing specialized, affordable automated systems for Small and Medium Enterprises (SMEs) in emerging economies, and in niche markets focusing on advanced AI-powered nesting software solutions that are agnostic to the machine hardware.

What differentiates a semi-automatic cutter from a fully automatic one?

A fully automatic cutter manages all steps, including material spreading, cutting, and often sorting, without human intervention, relying entirely on integrated CNC systems. A semi-automatic cutter requires manual input for spreading or manipulating the material before the cutting process begins.

How is the market addressing the need for skilled maintenance labor?

Manufacturers are addressing this constraint by incorporating remote diagnostics, Augmented Reality (AR) guided maintenance tutorials, and modular designs that simplify component replacement, reducing the dependency on highly specialized, permanently stationed technicians.

What is the typical lifespan of an industrial fabric cutting machine?

The typical operational lifespan of a high-quality industrial CNC fabric cutting machine is between 10 to 15 years, provided regular preventive maintenance and timely software and component upgrades are performed throughout its usage period.

What impact does the growth of electric vehicles (EVs) have on this market?

The growth of EVs increases demand for high-precision cutting machines to process specialized materials for battery insulation, lightweight interior composites, and advanced acoustic dampening fabrics, pushing the requirement for technical textile cutting capacity.

Are plasma cutters commonly used for fabric cutting?

Plasma cutters are generally not used for traditional flexible textile fabrics due to the high heat output and risk of material damage. They are primarily reserved for extremely thick or rigid industrial materials and composites, often in heavy industrial applications outside of mainstream apparel.

What key characteristics are buyers looking for in new cutting machine purchases?

Buyers prioritize high cutting speed, maximum precision and repeatability, superior material yield through advanced nesting software, minimal changeover time between jobs, and robust reliability with minimal operational downtime.

How does the implementation of Industry 4.0 benefit the fabric cutting process?

Industry 4.0 principles allow fabric cutting machines to communicate seamlessly with other systems (ERP, inventory control, CAD), enabling real-time data analysis, centralized control, automated scheduling, and adaptive production workflows based on immediate demand signals.

What is the role of sensor technology in fabric cutting machines?

Sensor technology, including vision systems and embedded load cells, plays a crucial role in monitoring material presence, detecting defects, maintaining optimal cutting depth, compensating for fabric movement or distortion, and gathering performance data for predictive maintenance algorithms.

How significant is the furniture and upholstery segment for the market?

The furniture and upholstery segment is significant, requiring specialized cutting machines—often large-format oscillating knife or die cutters—to handle heavy, thick materials like leather and dense foams with high accuracy, minimizing costly material waste in high-end furnishings.

What competitive strategies are major players adopting in the market?

Major players are focusing on strategic acquisitions to expand technological portfolios, investing heavily in AI and software integration, establishing strong global service networks, and offering flexible financing or leasing options to capture SME market share.

How do material costs act as a driving factor for automation?

High material costs exert immense pressure on manufacturers to minimize waste. This drives the adoption of automated cutting systems with sophisticated nesting software, as the significant material savings often outweigh the high capital expenditure for the machine itself.

What is the difference between oscillating knife cutting and ultrasonic knife cutting?

Oscillating knife cutting uses a mechanically moving blade suitable for many fabric types. Ultrasonic knife cutting uses high-frequency vibration applied to the blade, which reduces friction and is particularly effective for cutting and sealing synthetic materials simultaneously, preventing edge fraying.

Are used or refurbished fabric cutting machines a viable market segment?

Yes, the market for used or refurbished machines is viable, particularly in budget-sensitive emerging markets and among smaller manufacturers, offering a lower entry cost into automated cutting technology, although often lacking the latest software and connectivity features.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ultrasonic Fabric Cutting Machines Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fabric Cutting Machines Market Statistics 2025 Analysis By Application (Garment, Textile), By Type (Semi-Automatic, Fully Automatic), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fabric Cutting Machines Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Semi-Automatic, Fully Automatic), By Application (Garment, Textile, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager