Fans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431389 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fans Market Size

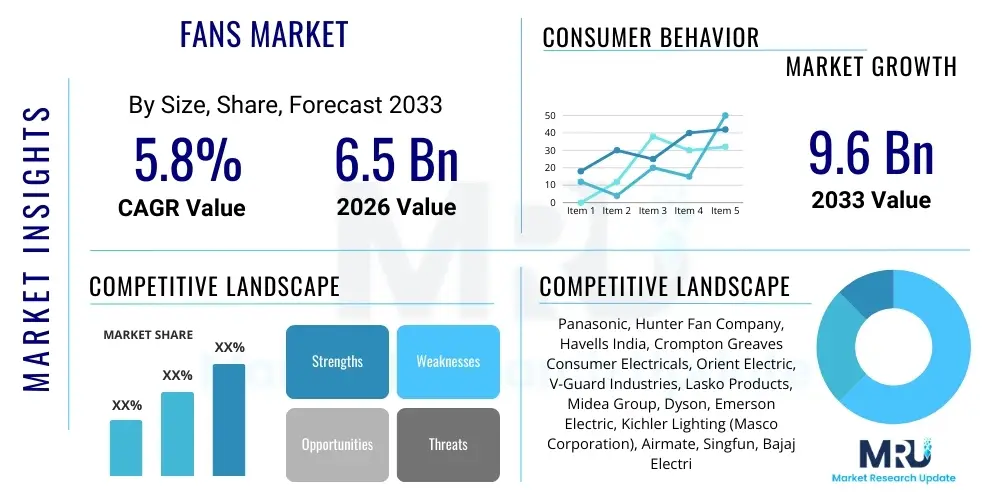

The Fans Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Fans Market introduction

The global fans market encompasses a diverse range of mechanical devices designed to circulate air, provide cooling, ventilation, or remove stale air. Products range from basic household cooling appliances like ceiling and pedestal fans to sophisticated industrial ventilation systems and exhaust solutions. Historically, the market was driven by basic necessity in regions experiencing high temperatures; however, recent growth is strongly influenced by urbanization, rising disposable incomes in emerging economies, and the increasing adoption of energy-efficient and smart home technologies. The fundamental application remains climate control and air quality management across residential, commercial, and industrial sectors.

Major applications of fans span residential comfort, commercial establishment climate management (such as hotels, offices, and retail spaces), and crucial industrial processes (including dust extraction, fume removal, and equipment cooling). Benefits associated with modern fans extend beyond simple air movement; they include improved energy efficiency through the use of Brushless Direct Current (BLDC) motors, enhanced comfort levels, reduction in HVAC load when used synergistically, and better indoor air quality (IAQ) when integrated with filtration or exhaust capabilities. The versatility of fan products, from decorative ceiling fixtures to powerful industrial blowers, ensures a perpetually relevant market presence.

Key driving factors propelling market expansion include rapid global construction activities, particularly in Asia Pacific, necessitating robust HVAC and ventilation solutions. Furthermore, increasing consumer awareness regarding sustainable and low-power cooling alternatives, such as BLDC fans which consume significantly less energy than conventional AC induction motor fans, is stimulating replacement cycles and new purchases. Regulatory mandates concerning energy efficiency standards in appliances also play a crucial role, forcing manufacturers to innovate and introduce high-efficiency models, thereby consistently refreshing the product landscape and sustaining market growth.

Fans Market Executive Summary

The global Fans Market is characterized by resilient growth, driven primarily by strong residential demand, particularly in densely populated and warmer regions like the Asia Pacific. Business trends indicate a significant shift towards premiumization, where consumers are increasingly willing to invest in fans equipped with advanced features such as IoT connectivity, remote operation, advanced aerodynamics for silent functioning, and integrated lighting solutions. Manufacturers are focusing heavily on supply chain resilience and expanding direct-to-consumer (D2C) channels to maintain margins and gain direct consumer insights. Furthermore, sustainable manufacturing practices and the integration of recycled materials are emerging as crucial competitive differentiators, aligning with global environmental concerns.

Regional trends highlight the dominance of the Asia Pacific (APAC) market, fueled by massive infrastructure projects, burgeoning middle-class populations, and persistent high ambient temperatures requiring continuous cooling solutions. North America and Europe, while slower in unit volume growth compared to APAC, exhibit higher demand for premium, smart, and architecturally integrated fans, driven by rigorous energy efficiency standards and high penetration rates of smart home ecosystems. The Middle East and Africa (MEA) are also experiencing accelerated growth, particularly in the industrial and commercial segments, due to large-scale construction associated with economic diversification initiatives and urbanization efforts.

Segmentation trends demonstrate robust growth in the BLDC fan segment, which is rapidly replacing traditional AC fans due to superior energy savings and longer lifespan, addressing critical consumer concerns about electricity costs. By application, the residential segment remains the largest consumer, but the commercial segment is witnessing the fastest transformation through adoption of high-efficiency ventilation and air circulation systems compliant with stringent building codes. Distribution trends show a steady migration towards online retail channels, offering greater product variety, competitive pricing, and convenience, although physical retail remains vital for consumers requiring immediate fulfillment or detailed product demonstrations.

AI Impact Analysis on Fans Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fans Market primarily revolve around predictive maintenance, energy optimization, and enhanced user personalization. Users frequently ask how AI can make fans "smarter" than simple IoT integration, inquiring about autonomous operation based on environmental data (temperature, humidity, air quality), and the potential for AI algorithms to anticipate failure points in high-duty industrial fans. A core concern is the value proposition of these sophisticated AI-enabled devices versus their higher initial cost, and the data privacy implications associated with connected home monitoring systems. Key expectations center on achieving optimal energy consumption profiles without constant manual intervention, and seamlessly integrating fans into complex smart home ecosystems via machine learning algorithms that understand usage patterns.

The integration of AI transforms the fan from a simple mechanical device into an intelligent environmental actuator. In the residential sector, AI models process inputs from sensors (internal and external) and learn occupant behavior patterns—such as preferred temperature ranges at specific times of the day or seasonal variations—to autonomously adjust speed and oscillation, ensuring maximum comfort with minimal energy use. This level of optimization surpasses standard thermostat control by factoring in real-time localized air movement needs, leading to significant efficiencies, particularly when fans are used in conjunction with centralized air conditioning systems to minimize cooling stratification.

In the industrial and commercial spheres, AI’s primary impact is preventative maintenance and operational efficiency. Large industrial fans and ventilation systems are critical assets; unexpected failure can lead to expensive downtime. AI algorithms analyze vibration, temperature, and current draw data patterns in real-time to detect subtle anomalies indicative of impending mechanical failure (such as bearing degradation or motor issues), allowing facility managers to schedule maintenance proactively rather than reactively. This predictive capability minimizes operational risk, extends asset life, and optimizes maintenance budgets, representing a substantial value addition in high-throughput environments like manufacturing plants and data centers.

- AI enables predictive maintenance by analyzing operational sensor data (vibration, temperature) to forecast mechanical failure.

- Machine learning algorithms optimize fan speed and airflow based on real-time environmental conditions and learned occupant behavioral patterns.

- AI facilitates seamless integration into complex smart building management systems (BMS) for centralized climate control.

- Generative design methods utilizing AI accelerate the development of highly aerodynamic and silent fan blade geometries.

- Natural Language Processing (NLP) enhances voice control interfaces, allowing for more intuitive and context-aware operation.

- AI-driven energy management reduces power consumption by precisely matching fan output to the actual cooling or ventilation requirement.

DRO & Impact Forces Of Fans Market

The trajectory of the Fans Market is shaped by a confluence of accelerating drivers, structural restraints, and emerging opportunities, all unified by pervasive impact forces. Key drivers include global climate change leading to extended and more intense heatwaves, necessitating reliable cooling solutions, and rapid infrastructural development in developing nations. Restraints primarily involve the high upfront cost of advanced technologies such as BLDC motors and smart features, particularly in cost-sensitive markets, alongside competitive pressure from alternative cooling methods like evaporative coolers or portable air conditioners. Opportunities arise from the untapped potential of retrofitting older commercial buildings with energy-efficient ventilation systems and expanding into niche high-tech applications such as server farm cooling. These factors are critically influenced by regulatory mandates for energy efficiency and consumer disposable income fluctuations.

Drivers

Rising global temperatures due to climate change represent the most fundamental driver for the fans market, ensuring persistent demand for air circulation devices across all sectors. As temperatures soar, particularly in urban environments affected by the heat island effect, reliance on mechanical cooling becomes indispensable for maintaining livable conditions and productivity. This demand is further amplified by the accelerating pace of global urbanization, leading to denser populations residing in smaller spaces, which necessitates efficient, compact, and often silent cooling solutions. The continued expansion of residential and commercial real estate, especially in high-growth economies of Asia and Latin America, directly translates into increased unit sales of fans for initial installation.

Technological advancements in motor efficiency, notably the commercial viability and widespread adoption of Brushless Direct Current (BLDC) technology, are driving market growth by offering superior value proposition. BLDC fans consume significantly less electricity—up to 50–60% lower than conventional fans—addressing the critical consumer pain point of escalating electricity bills. This energy savings proposition encourages widespread consumer uptake and accelerates the replacement cycle of older, less efficient models. Furthermore, stringent government energy efficiency standards and appliance labeling programs globally incentivize manufacturers to prioritize BLDC technology, reinforcing its market dominance and driving sustained growth.

The increasing penetration of smart home technology ecosystems is creating new demand for interconnected, feature-rich fans. Consumers are seeking devices that integrate seamlessly with existing smart hubs, allowing for voice control, scheduling, and remote operation via smartphone applications. This shift elevates the fan from a mere utility device to an integrated component of a sophisticated home automation system. Coupled with growing disposable incomes in key emerging markets, this preference for advanced, high-convenience appliances ensures continuous innovation and premiumization in the residential fan segment.

- Persistent global warming trends and increasing frequency of heatwaves.

- Rapid urbanization and expanding construction activities globally.

- Widespread adoption of high-efficiency BLDC motor technology.

- Increasing consumer disposable income driving demand for premium, smart fans.

- Stringent governmental energy efficiency regulations and mandates.

Restraints

A primary restraint on market expansion is the strong competitive threat posed by alternative cooling technologies, most notably portable and split air conditioning units. Although fans are significantly more energy-efficient, air conditioners offer actual temperature reduction, which is often prioritized by consumers in extreme climates or during peak summer months. This competition, coupled with falling prices of compact AC units, particularly in developing economies, can limit the market penetration and average selling price (ASP) of high-end, non-cooling fan products, especially in the residential sector where cost-sensitivity is high.

The relatively high initial manufacturing cost associated with advanced fan features, such as integrated IoT sensors, Wi-Fi modules, and especially BLDC motor components, acts as a significant deterrent, particularly in price-sensitive mass markets. While the long-term operational savings of BLDC fans are substantial, the initial higher purchase price can restrict adoption among lower-income demographics. Furthermore, the inherent longevity and low maintenance requirement of standard AC fans mean that replacement cycles can be extended, leading to slower market saturation for newer technologies, thereby dampening immediate market volume growth.

Another structural constraint involves the complexity of integrating diverse smart fan protocols and ensuring interoperability within disparate smart home standards (e.g., Apple HomeKit, Google Home, Amazon Alexa). Fragmentation in technology standards can confuse consumers and lead to poor user experiences, thereby slowing the adoption rate of connected fan technology. Additionally, concerns regarding data security and privacy associated with internet-connected appliances present a psychological barrier to adoption for some segments of the population, requiring manufacturers to invest heavily in robust cybersecurity measures and transparent data handling practices.

- Intense competition from air conditioning units and evaporative coolers.

- High initial purchase price of BLDC and smart fans relative to traditional models.

- Extended lifespan of traditional fans leading to slower replacement cycles.

- Fragmentation and lack of seamless interoperability in smart home technology standards.

- Supply chain volatility and rising commodity costs impacting manufacturing expenses.

Opportunity

A significant opportunity lies in the expanding demand for specialized, high-performance fans for industrial and commercial applications, such as High-Volume Low-Speed (HVLS) fans and ventilation systems designed for warehouses, factories, and agricultural settings. HVLS fans are extremely effective at energy-efficient circulation over large areas, making them indispensable for facilities seeking to maintain productivity while managing large energy loads. The global proliferation of e-commerce and logistics hubs further fuels this demand, as large distribution centers require robust, continuous, and efficient ventilation solutions, presenting a lucrative niche for specialized fan manufacturers.

The substantial opportunity within the retrofit and replacement market, particularly in established economies like North America and Europe, cannot be overlooked. As older commercial and residential buildings strive to meet modern sustainability targets and energy codes, there is a massive installed base of inefficient AC fans ripe for replacement with superior BLDC and smart models. Energy service companies (ESCOs) and government incentive programs focused on improving building energy performance act as strong facilitators for this replacement wave, providing steady, high-margin revenue streams for manufacturers focusing on energy-star-rated products.

Furthermore, product diversification into integrated smart appliances offers substantial growth avenues. This includes fans with integrated air purification (HEPA filters), dehumidification capabilities, or advanced germicidal UV light sterilization features. As global health awareness regarding indoor air quality (IAQ) remains heightened following recent global events, consumers are increasingly seeking multi-functional devices that address air circulation and health concerns simultaneously. Developing and marketing these IAQ-focused fan systems allows companies to tap into a higher-value segment and differentiate their offerings from standard cooling appliances.

- Growing demand for specialized industrial fans (HVLS) for large facilities and warehouses.

- Massive retrofit and replacement market potential in developed economies driven by energy efficiency mandates.

- Product innovation incorporating air purification, humidification, and sterilization features.

- Expansion into niche markets like specialized cooling for data centers and server farms.

- Leveraging sustainable materials and circular economy models to attract eco-conscious consumers.

Impact Forces

The most prominent impact force acting on the fans market is the governmental and regulatory pressure concerning energy efficiency. Directives like the European Union's Ecodesign requirements or similar standards in the US and Asia mandate minimum efficiency levels for fans, directly influencing design and manufacturing processes and forcing a rapid shift away from outdated AC technology towards BLDC motors. This regulatory framework drives capital expenditure towards R&D and ensures a constantly evolving product pipeline focused on sustainability.

The second major force is consumer behavior shift towards connected living and digitalization. The expectation for seamless integration, remote management, and personalized experiences is non-negotiable for premium products. This force compels manufacturers not only to integrate IoT but also to build user-friendly software platforms, impacting the entire value chain from product design to customer support and aftermarket services.

A third significant force is the global supply chain instability, exacerbated by geopolitical tensions and transportation bottlenecks. Since many key electronic components (like BLDC drivers and microcontrollers) are sourced internationally, disruptions can lead to significant cost increases, delays, and inventory management challenges. This compels manufacturers to diversify their supplier base and explore localized manufacturing hubs, impacting operational strategy and pricing structures.

- Rigorous governmental energy efficiency standards.

- Rapid evolution and integration requirements of smart home IoT ecosystems.

- Fluctuations in commodity prices (copper, steel, plastics).

- Consumer awareness and demand for improved indoor air quality (IAQ).

Segmentation Analysis

The Fans Market is extensively segmented based on criteria such as product type, motor technology, application, and distribution channel, providing a granular view of market dynamics and growth pockets. Product type segmentation distinguishes between ceiling fans, which are typically permanent fixtures, and portable fans (like pedestal, table, and floor fans), offering flexibility. Motor technology segmentation is undergoing a critical transition, with the high-efficiency BLDC segment demonstrating accelerated growth compared to conventional AC induction motors. This analysis is crucial for stakeholders to identify high-growth segments where technological innovation yields the highest return on investment and aligns with sustainability goals.

The application segmentation is crucial, differentiating between the high-volume residential sector, the increasingly regulated commercial sector (offices, retail, hospitality), and the specialized, robust industrial sector (manufacturing, logistics, data centers). Each application segment has distinct requirements regarding fan size, airflow capacity, durability, and operational hours, influencing product design and pricing strategy. Distribution channel analysis confirms the growing importance of e-commerce platforms, offering global reach and competitive pricing, while brick-and-mortar stores maintain relevance for immediate purchases and specialized industrial equipment sales requiring complex logistics and consultation.

Understanding these segments allows market participants to tailor their offerings effectively. For instance, the residential segment demands aesthetic appeal and silence, while the industrial segment prioritizes durability and energy efficiency over decorative features. The fastest-growing segment in terms of value is projected to be the Smart/IoT-enabled fan category, particularly within ceiling and floor fans, reflecting the pervasive influence of digitalization across household appliances. This segmented approach ensures that manufacturers can deploy targeted marketing campaigns and product development efforts toward the most promising market niches.

- By Product Type:

- Ceiling Fans

- Portable Fans (Table, Pedestal, Floor)

- Wall-mounted Fans

- Exhaust Fans

- Industrial Fans (Axial, Centrifugal, HVLS)

- By Technology/Motor Type:

- AC Induction Motor Fans

- Brushless Direct Current (BLDC) Motor Fans

- Smart/IoT Enabled Fans

- By Application:

- Residential

- Commercial (Offices, Retail, Hospitality)

- Industrial (Manufacturing, Warehousing, Energy)

- By Distribution Channel:

- Online Retail

- Offline Retail (Hypermarkets, Specialty Stores, Dealer Networks)

Value Chain Analysis For Fans Market

The Fans Market value chain begins with upstream analysis, focusing on the sourcing of critical raw materials and components. Key inputs include metals (copper, aluminum, steel) for motor windings, shafts, and housing, and various polymers (plastics) for blades and body structures. The motor component manufacturing—especially for BLDC motors involving magnets, electronic controls, and PCBs—is highly specialized and often outsourced to component suppliers in Asia. Efficient sourcing and stable pricing of these commodities are critical to maintaining manufacturer margins. Geopolitical risks and trade tariffs affecting metal prices or electronic component availability have a direct and immediate impact on the final product cost.

Midstream activities involve core manufacturing, assembly, quality control, and testing. Fan manufacturers, ranging from large multinational conglomerates to regional specialists, focus on optimizing assembly lines, implementing lean manufacturing practices, and integrating advanced automation to reduce labor costs and improve product consistency. Product design, especially aerodynamic engineering for noise reduction and energy optimization, is a core value-added activity at this stage. Manufacturers must continually invest in R&D to incorporate new materials and advanced motor technologies (like BLDC) to remain competitive and compliant with evolving energy standards.

Downstream analysis covers distribution, sales, and aftermarket services. The distribution channel is bifurcated into direct and indirect routes. Direct distribution typically involves selling specialized industrial fans or high-end commercial HVAC solutions directly to large enterprises, contractors, or builders. Indirect distribution dominates the residential market, relying heavily on hypermarkets, consumer electronics stores, specialty lighting stores, and the rapidly growing e-commerce platforms. Effective supply chain management, ensuring timely logistics and inventory turnover, is crucial. Aftermarket services, including warranties, installation support, and maintenance for industrial units, contribute significantly to customer satisfaction and lifetime value.

Upstream Analysis: Raw material extraction (metals, plastics) and component manufacturing (motors, electronic controls). The focus is on secure, cost-effective, and sustainable sourcing. Downstream Analysis: The final stages involve reaching the end consumer. E-commerce platforms provide a wide reach (indirect), while specialized distributors handle complex industrial projects (direct). Aftermarket service quality strongly influences brand loyalty and replacement decisions. Distribution Channel Focus:

- Direct Channels: Sales to large industrial users, construction firms, and OEMs requiring customized solutions.

- Indirect Channels: Mass market retail (online and offline), leveraging the logistical networks of large retailers and e-tailers to achieve high volume sales.

Fans Market Potential Customers

The potential customer base for the Fans Market is extraordinarily broad, encompassing every sector that requires air circulation, ventilation, or cooling assistance. The largest volume segment consists of residential consumers, ranging from low-income households purchasing basic portable fans for localized cooling to affluent consumers investing in premium, designer ceiling fans with smart features and BLDC technology. This residential segment is driven by comfort needs, energy saving goals, and aesthetic preferences, making product diversity and branding crucial for success.

The commercial sector represents a high-value customer group, including hospitality (hotels, restaurants), retail spaces (malls, supermarkets), and corporate offices. These customers prioritize fans that offer silent operation, seamless integration with building management systems, and high aesthetic appeal to complement interior design. For commercial buyers, regulatory compliance regarding ventilation standards and adherence to local fire codes also significantly influence purchasing decisions, favoring suppliers capable of providing integrated HVAC and ventilation solutions.

The industrial sector constitutes the most specialized customer group, comprising manufacturing plants, power generation facilities, data centers, mining operations, and large logistics warehouses. These customers require heavy-duty, durable, high-airflow fans (such as axial, centrifugal, and HVLS fans) designed for continuous operation in harsh environments, often requiring explosion-proof or chemically resistant specifications. Purchasing decisions here are primarily driven by reliability, performance metrics (CFM, static pressure), and total cost of ownership (TCO) based on energy efficiency and maintenance costs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic, Hunter Fan Company, Havells India, Crompton Greaves Consumer Electricals, Orient Electric, V-Guard Industries, Lasko Products, Midea Group, Dyson, Emerson Electric, Kichler Lighting (Masco Corporation), Airmate, Singfun, Bajaj Electricals, Broan-NuTone, Casablanca Fan Company, Reventech, Greenheck, TPI Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fans Market Key Technology Landscape

The technology landscape of the Fans Market is rapidly evolving, moving decisively away from traditional mechanical engineering reliance toward integrating advanced electronics and digital connectivity. The most influential technological shift is the widespread adoption of Brushless Direct Current (BLDC) motors. Unlike conventional AC induction motors, BLDC motors use permanent magnets and electronic commutation, resulting in significantly higher energy efficiency (up to 60% savings), quieter operation, and a longer operational lifespan. This technology is foundational for meeting modern energy standards and is driving the premiumization of both residential ceiling and portable fans.

Beyond motor efficiency, the integration of Internet of Things (IoT) capabilities defines the modern fan market. Smart fans incorporate Wi-Fi modules, allowing users to control settings, schedules, and monitor energy usage via dedicated mobile applications or voice assistants (e.g., Alexa, Google Assistant). These devices often include environmental sensors to detect temperature, humidity, and volatile organic compounds (VOCs), enabling automated adjustments. This convergence of cooling devices with connected home ecosystems is shifting consumer expectations towards personalized comfort and seamless automation, demanding robust cybersecurity features and reliable cloud connectivity.

Furthermore, advancements in materials science and aerodynamics are continually enhancing fan performance. Computational Fluid Dynamics (CFD) modeling is extensively used during the design phase to optimize blade shape and angle, minimizing air resistance and noise generation while maximizing airflow (Cubic Feet per Minute - CFM). This results in quieter, more powerful fans that consume less energy. In the industrial segment, innovations focus on robust construction materials and specialized impeller designs, such as airfoil blades, to handle high pressure or corrosive environments effectively, ensuring operational continuity in demanding application areas.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, driven by high population density, rapid industrialization (especially in China, India, and Southeast Asia), and persistent high temperatures. The demand is massive across all segments, particularly for ceiling and portable fans in the residential sector. Government initiatives promoting energy-efficient appliance use, coupled with rising disposable incomes, accelerate the adoption of premium BLDC models.

- North America: This region is characterized by high penetration of smart home technology and a strong demand for high-end, designer fans. Market growth is primarily driven by replacement cycles targeting energy efficiency improvements and the adoption of technologically advanced, IoT-enabled products. The US market, in particular, adheres to stringent energy regulations (like ENERGY STAR), favoring premium and imported high-efficiency units.

- Europe: Growth is steady, focused heavily on ventilation, exhaust fans, and high-performance commercial solutions, driven by rigorous building codes and IAQ (Indoor Air Quality) regulations. The adoption rate of energy-efficient fans is high, motivated by ambitious carbon reduction targets across the European Union. Smart fans are popular, particularly those integrated into larger residential and commercial HVAC systems.

- Latin America (LATAM): Market expansion is spurred by increasing urbanization, rising middle-class expenditure, and infrastructure investments. While price sensitivity remains a factor, the demand for cooling appliances is robust due to tropical and subtropical climates. The market shows potential for high growth in both residential and small-to-medium enterprise (SME) commercial segments.

- Middle East and Africa (MEA): Growth is primarily fueled by large construction projects (commercial, residential, and industrial) tied to economic diversification efforts in the Gulf Cooperation Council (GCC) states. Extreme heat conditions mandate reliable, durable cooling and ventilation solutions. The industrial segment, particularly for oil and gas and data centers, represents a key high-value market requiring specialized industrial fans.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fans Market.- Panasonic Corporation

- Hunter Fan Company

- Havells India Ltd.

- Crompton Greaves Consumer Electricals Ltd.

- Orient Electric Limited

- V-Guard Industries Ltd.

- Lasko Products, LLC

- Midea Group Co., Ltd.

- Dyson Limited

- Emerson Electric Co.

- Kichler Lighting (Masco Corporation)

- Airmate Electrical (Shenzhen) Co., Ltd.

- Singfun Electric Group Co., Ltd.

- Bajaj Electricals Ltd.

- Broan-NuTone, LLC

- Casablanca Fan Company

- Reventech Systems

- Greenheck Fan Corporation

- Delta Electronics, Inc.

- TPI Corporation

Frequently Asked Questions

Analyze common user questions about the Fans market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Fans Market?

The primary driver is the accelerating consumer adoption of energy-efficient Brushless Direct Current (BLDC) motor fans, which offer significant operational cost savings and meet increasingly strict governmental energy efficiency standards globally, combined with persistent global temperature increases.

How do BLDC fans compare to traditional AC fans in terms of efficiency and cost?

BLDC fans are significantly more energy-efficient, typically consuming 50% to 60% less power than AC fans. While their initial purchase price is higher, the long-term cost of ownership is lower due to reduced electricity bills and extended motor lifespan.

Which geographical region holds the largest market share for fan sales?

The Asia Pacific (APAC) region currently holds the largest market share, fueled by high population density, rapid urbanization, high ambient temperatures, and extensive construction and infrastructure development across countries like China and India.

What role does IoT technology play in modern fan market trends?

IoT enables smart fans to integrate into home automation systems, offering features like remote control, voice activation, scheduling, and automatic adjustments based on environmental sensors (temperature, humidity), enhancing user convenience and optimizing energy usage.

What are the key differences between residential, commercial, and industrial fan market needs?

Residential needs focus on aesthetics, quiet operation, and comfort; Commercial needs prioritize low noise, integration with BMS, and compliance with public space ventilation; Industrial needs emphasize high airflow capacity (CFM), durability, and resistance to harsh operating environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fans and Blowers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Smoke Exhaust Fans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Indoor Rotary Fans Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Mine Ventilation Equipment Market Size Report By Type (Fans & Blowers, Refrigeration & Cooling Systems, Heating, Others), By Application (Coal Mining, Metal Mining), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Auto Ventilated Seats Market Size Report By Type (Radial Fans Seats, Axial Fans Seats), By Application (OEM, Aftermarket), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager