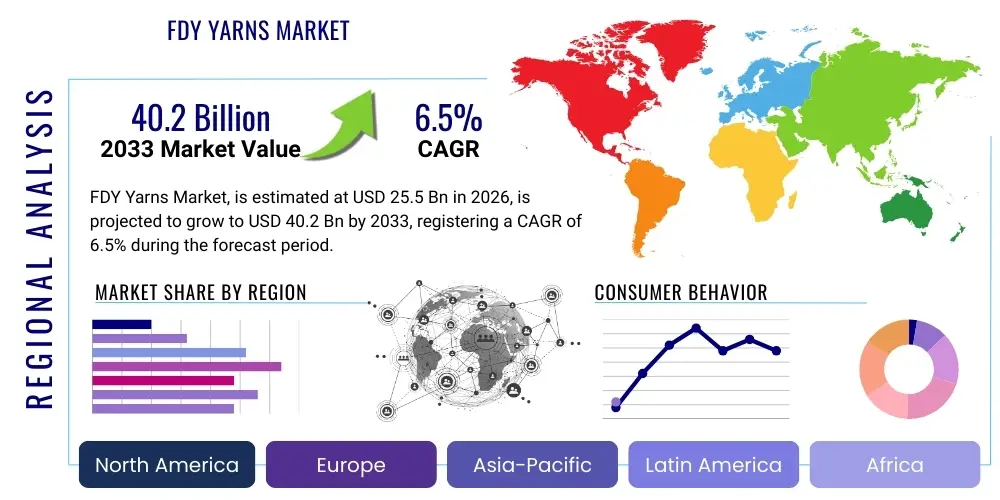

FDY Yarns Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439263 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

FDY Yarns Market Size

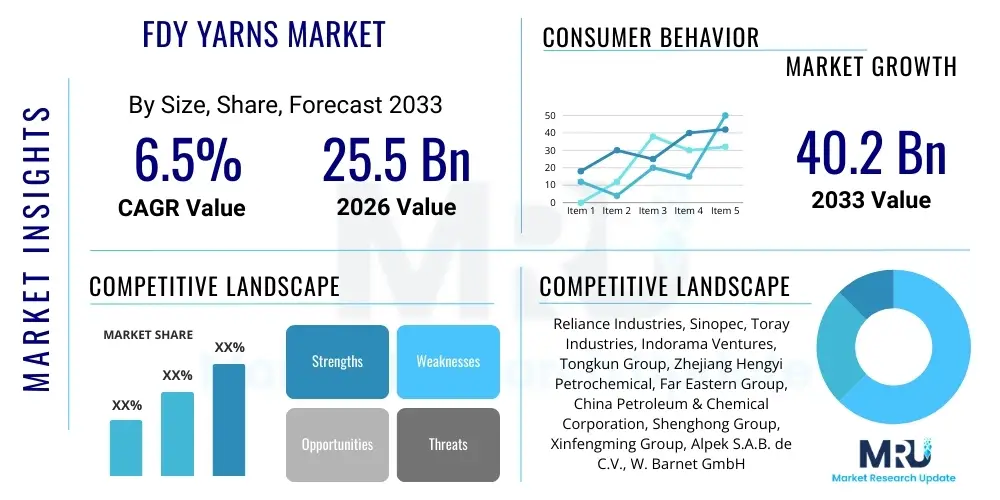

The FDY Yarns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 billion in 2026 and is projected to reach USD 29.5 billion by the end of the forecast period in 2033.

FDY Yarns Market introduction

The Fully Drawn Yarns (FDY) market encompasses the production and distribution of polyester filament yarns that are fully oriented and crystallized during the spinning process, resulting in yarns with high tenacity, excellent dimensional stability, and uniform dyeing characteristics. These superior properties make FDY a preferred material across various sectors, ranging from high-fashion apparel to robust industrial applications. The manufacturing process involves melt spinning of polyester polymer, followed by a drawing stage where the yarn is stretched and heated to align molecular chains, thereby imparting strength and luster without further texturizing. This controlled process ensures that FDY exhibits minimal shrinkage and superior aesthetic appeal compared to other yarn types.

Major applications for FDY yarns span a broad spectrum, notably in the textile industry where they are extensively used for weaving and knitting fabrics for apparel such as shirts, dresses, sportswear, and intimate wear. Beyond clothing, FDY finds critical roles in home furnishings for curtains, upholstery, and carpets, owing to its durability and resistance to wrinkles. Industrially, it is crucial for automotive interiors, luggage, and technical textiles, providing resilience and longevity. The inherent benefits of FDY include its smooth, lustrous appearance, high strength-to-weight ratio, excellent color fastness, and resistance to abrasion and chemicals, which collectively contribute to its widespread adoption.

The market's growth is predominantly driven by several key factors. The expanding global apparel and fashion industry, fueled by evolving consumer preferences and rapid urbanization, consistently demands high-quality, cost-effective synthetic fibers. Furthermore, the increasing adoption of FDY in technical textiles for automotive, medical, and geotextile applications, where performance and durability are paramount, significantly contributes to market expansion. Technological advancements in polymerization and spinning processes, leading to enhanced yarn properties and sustainable production methods, also act as strong accelerators for market growth, ensuring FDY remains a versatile and indispensable material in modern manufacturing.

FDY Yarns Market Executive Summary

The FDY Yarns market is experiencing dynamic shifts, driven by evolving consumer demands for performance-driven textiles and sustained industrial growth. Business trends indicate a strong focus on innovation, with manufacturers investing in advanced production technologies to enhance yarn quality, reduce manufacturing costs, and improve environmental footprints. Strategic partnerships and collaborations across the value chain, from raw material suppliers to end-product manufacturers, are becoming increasingly vital to optimize supply chains and penetrate new markets effectively. Furthermore, the emphasis on sustainable and recycled polyester FDY yarns is gaining momentum, reflecting a global shift towards eco-conscious manufacturing practices and consumer preferences for environmentally friendly products, influencing R&D priorities and capital investments.

Regional trends highlight Asia Pacific as the undisputed leader in both production and consumption, primarily driven by the colossal textile manufacturing bases in China, India, and Southeast Asian countries, coupled with burgeoning domestic demand. North America and Europe are characterized by a focus on high-performance and specialty FDY yarns, catering to sophisticated end-use applications such as advanced sportswear, automotive textiles, and technical fabrics, often with stringent regulatory standards for sustainability and product safety. Latin America and the Middle East & Africa regions are emerging as significant growth frontiers, stimulated by industrialization, infrastructure development, and rising disposable incomes, leading to increased demand for both conventional and specialized FDY products in local markets.

Segmentation trends reveal robust growth across various product types, with polyester FDY dominating due to its cost-effectiveness and versatile applications. The market is further segmented by denier size, which dictates its suitability for different fabric weights and textures, and by color, including raw white and dope-dyed options that offer advantages in terms of water and energy savings during fabric production. End-use applications like apparel and home furnishings continue to be major revenue generators, while industrial textiles, including non-wovens and composites, represent high-growth segments demanding specialized FDY properties. The continuous innovation in these segments, particularly towards technical textiles and functional apparel, underscores the market's adaptability and future growth potential.

AI Impact Analysis on FDY Yarns Market

User queries regarding the impact of AI on the FDY Yarns market frequently revolve around its potential to revolutionize manufacturing efficiency, supply chain predictability, and product innovation. Common themes include the optimization of production parameters to reduce waste and energy consumption, the integration of smart sensors for real-time quality control, and the leveraging of predictive analytics for demand forecasting and inventory management. Users are particularly interested in how AI can contribute to more sustainable production practices, enable customization at scale, and enhance the overall competitiveness of FDY yarn manufacturers in a dynamic global market. There is a palpable expectation that AI will drive significant operational improvements and open new avenues for product development and market responsiveness.

- Enhanced Production Efficiency: AI algorithms can analyze vast datasets from spinning machines, identifying optimal operating parameters for speed, temperature, and tension, thereby minimizing defects, reducing energy consumption, and increasing overall yield in FDY yarn manufacturing processes.

- Predictive Maintenance: AI-powered sensors integrated into machinery can monitor equipment health in real-time, predicting potential failures before they occur, which reduces unscheduled downtime, prolongs machine lifespan, and optimizes maintenance schedules, ensuring continuous production of FDY yarns.

- Quality Control and Inspection: AI vision systems can rapidly inspect FDY yarns for uniformity, strength, and absence of defects with higher precision and consistency than human inspection, leading to superior product quality and reduced material wastage.

- Supply Chain Optimization: AI leverages machine learning to forecast demand with greater accuracy, optimizing inventory levels of raw materials and finished FDY yarns. This minimizes storage costs, reduces stockouts, and enhances responsiveness to market fluctuations.

- Sustainable Manufacturing: AI can simulate and optimize manufacturing processes to reduce water, energy, and chemical usage, particularly in dope-dyeing processes, by predicting the precise amount of dye required, thereby contributing to more environmentally friendly FDY yarn production.

- Customization and New Product Development: AI tools can analyze market trends and consumer preferences to inform the development of new FDY yarn variants with specific performance attributes (e.g., moisture-wicking, anti-bacterial). This enables rapid prototyping and mass customization of specialized FDY products.

- Labor Augmentation and Training: AI systems can assist human operators by providing real-time data analysis and recommendations, reducing the cognitive load, and facilitating faster training for new employees on complex FDY manufacturing procedures, thereby improving workforce productivity and safety.

DRO & Impact Forces Of FDY Yarns Market

The FDY Yarns market is shaped by a confluence of drivers, restraints, and opportunities that collectively define its trajectory and impact forces. Among the primary drivers is the escalating global demand for textiles and apparel, fueled by population growth, urbanization, and rising disposable incomes across emerging economies. The inherent properties of FDY yarns, such as high tenacity, dimensional stability, and smooth finish, make them indispensable for a wide range of applications from fashion to technical textiles. Furthermore, continuous innovation in polymer science and manufacturing technologies, leading to enhanced performance characteristics and cost efficiencies, significantly propels market expansion, attracting new investments and diversifying product offerings within the FDY segment.

Despite robust growth, the market faces significant restraints. Volatility in raw material prices, particularly for purified terephthalic acid (PTA) and monoethylene glycol (MEG), which are petroleum derivatives, directly impacts production costs and profit margins for FDY manufacturers. Intense competition from alternative synthetic fibers and natural fibers also poses a challenge, requiring FDY producers to continually innovate and differentiate their products based on performance and value. Environmental concerns related to the energy-intensive production process and the disposal of non-biodegradable polyester fibers exert pressure for more sustainable manufacturing practices and the adoption of recycled content, leading to regulatory scrutiny and increased operational complexities.

Opportunities within the FDY Yarns market are substantial and diverse. The burgeoning demand for technical textiles in automotive, medical, geotextile, and sportswear sectors offers a high-growth avenue for specialized FDY yarns with enhanced functionalities like flame retardancy, UV resistance, and antimicrobial properties. The increasing focus on sustainability presents a significant opportunity for manufacturers to invest in eco-friendly production methods, closed-loop recycling processes, and bio-based polyester FDY yarns, appealing to environmentally conscious consumers and brands. Additionally, the expansion of e-commerce platforms and digital supply chain solutions can streamline market access and distribution, enabling FDY manufacturers to reach a broader customer base and optimize logistics, fostering greater market penetration and efficiency.

Segmentation Analysis

The FDY Yarns market is comprehensively segmented to provide granular insights into its diverse components, allowing for targeted strategic planning and market analysis. This segmentation typically encompasses various dimensions including the type of material, denier size, color variants, and critically, the myriad of end-use applications. Understanding these segments is crucial for identifying specific market niches, assessing competitive landscapes, and forecasting future growth areas within the broader FDY ecosystem. Each segment presents unique demand drivers, technological requirements, and competitive dynamics, reflecting the versatility and adaptability of FDY yarns across different industries and consumer preferences globally.

- By Material Type

- Polyester FDY: The predominant material, known for its strength, durability, and cost-effectiveness.

- Nylon FDY: Offers superior elasticity and abrasion resistance, often used in specialized applications.

- Polypropylene FDY: Lighter and hydrophobic, ideal for outdoor and moisture-resistant fabrics.

- By Denier Size

- Fine Denier (below 75D): Used for lightweight, delicate fabrics like lingerie, innerwear, and fine apparel.

- Medium Denier (75D-300D): Versatile for general apparel, home textiles, and some industrial uses.

- Coarse Denier (above 300D): Applied in heavy-duty textiles such as upholstery, carpets, and industrial fabrics.

- By Color Type

- Raw White FDY: Undyed yarns, offering flexibility for post-dyeing by fabric manufacturers.

- Dope-Dyed FDY: Yarns colored during the extrusion process, providing superior colorfastness and environmental benefits due to reduced water and energy consumption.

- By End-Use Application

- Apparel: Extensive use in shirts, dresses, sportswear, activewear, and intimate apparel.

- Home Furnishings: Employed in curtains, upholstery, carpets, bedspreads, and decorative fabrics.

- Industrial Textiles: Critical for automotive fabrics, seat belts, luggage, geotextiles, medical textiles, and ropes.

- Others: Includes specific technical textile applications, non-woven fabrics, and specialty products.

Value Chain Analysis For FDY Yarns Market

The value chain for the FDY Yarns market is a complex network spanning raw material procurement to final product distribution, characterized by distinct upstream and downstream activities. Upstream activities begin with the sourcing of essential petrochemical derivatives, primarily Purified Terephthalic Acid (PTA) and Monoethylene Glycol (MEG), which serve as the foundational monomers for polyester production. These raw materials are then subjected to polymerization to create polyester chips or granules. The quality and cost-efficiency of these initial stages are paramount, as they directly influence the properties and competitiveness of the subsequent FDY yarn production. Suppliers in this segment, often large chemical companies, play a crucial role in maintaining supply stability and ensuring consistent material specifications, forming the backbone of the entire production process.

Midstream activities involve the actual manufacturing of FDY yarns from the polyester chips. This stage encompasses melt spinning, drawing, and winding processes, where advanced machinery and precise technical expertise are critical for producing yarns with desired denier, tenacity, luster, and evenness. Manufacturers constantly strive for process optimization, energy efficiency, and waste reduction to maintain competitive pricing and meet stringent quality standards. Innovation in this segment often focuses on developing specialized FDY variants with enhanced functionalities, such as antimicrobial properties, UV resistance, or recycled content. The ability of these manufacturers to consistently deliver high-quality, customized FDY yarns is a key differentiator in the market, bridging the gap between raw material suppliers and end-product producers.

Downstream activities concentrate on the distribution and utilization of FDY yarns by various end-use industries. Distribution channels are typically diverse, ranging from direct sales to large textile mills and fabric manufacturers to indirect channels involving distributors, agents, and wholesalers who serve smaller weaving and knitting units. Direct sales often facilitate customized orders and closer collaboration, particularly for specialized industrial applications, allowing for tailored technical support and just-in-time delivery. Indirect channels provide broader market reach and cater to fragmented demand, leveraging established logistics networks. The efficiency of these distribution networks is vital for timely delivery and cost-effectiveness, enabling the FDY yarns to be transformed into finished products such as apparel, home furnishings, and industrial textiles, ultimately reaching the final consumer.

FDY Yarns Market Potential Customers

The primary potential customers and end-users of FDY yarns represent a diverse spectrum of industries, each with specific requirements that FDY's inherent properties can uniquely address. At the forefront are textile mills and fabric manufacturers, who are the direct buyers and processors of FDY yarns. These entities transform the yarns into a vast array of woven, knitted, and non-woven fabrics destined for various applications. Their purchasing decisions are heavily influenced by yarn quality, consistency, denier specifications, color options (raw white or dope-dyed), and crucially, price competitiveness. The ability of FDY to offer high-strength, low-shrinkage, and excellent dyeability makes it a fundamental raw material for these manufacturers, enabling them to produce durable and aesthetically pleasing textiles.

Within the textile ecosystem, distinct segments emerge as significant buyers. The apparel manufacturing industry, encompassing both fast fashion and high-end brands, is a massive consumer of FDY for creating everything from activewear and sportswear to formal wear and casual garments, valuing its drape, wrinkle resistance, and comfort. Similarly, manufacturers of home furnishings, including producers of curtains, upholstery fabrics, carpets, and bedding, rely on FDY for its durability, resistance to wear and tear, and ease of maintenance, ensuring product longevity and aesthetic appeal in residential and commercial settings. These segments demand consistent supply, a wide range of deniers and lusters, and increasingly, sustainable and eco-friendly FDY options to meet evolving consumer preferences and regulatory standards.

Beyond traditional textiles, the industrial and technical textiles sector represents a rapidly expanding customer base for specialized FDY yarns. This includes automotive manufacturers who use FDY for interior fabrics, seat covers, and headliners, where resilience and safety are paramount. Medical textile producers leverage FDY for surgical gowns, bandages, and other sterile applications due to its hygienic properties and strength. Furthermore, manufacturers of geotextiles, agricultural textiles, filtration fabrics, and protective workwear are significant purchasers, demanding FDY yarns with specific performance attributes such as UV resistance, chemical stability, and enhanced tear strength. This diverse industrial demand underscores FDY's versatility and its critical role in advanced material applications, making these specialized manufacturers key strategic customers for FDY producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Reliance Industries Limited, Zhejiang Hengyi Group Co., Ltd., Indorama Ventures Public Company Limited, Tongkun Group Co., Ltd., China Petrochemical Corporation (Sinopec), Xinfengming Group Co., Ltd., Shenghong Group, Far Eastern New Century Corporation, Formosa Plastics Corporation, DAK Americas LLC, Filatex India Limited, Sasa Polyester Sanayi A.Ş., TORAY INDUSTRIES, INC., INVISTA, SRF Limited, Jiangsu Sanfangxiang Group Co., Ltd., Bombay Dyeing and Manufacturing Company Ltd., Vardhman Textiles Limited, Shandong Xiangda Fibers Co., Ltd., Huvis Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

FDY Yarns Market Key Technology Landscape

The FDY Yarns market is characterized by a dynamic and continuously evolving technology landscape, primarily driven by the imperative to enhance product performance, optimize production efficiency, and minimize environmental impact. Central to this landscape are advancements in polyester polymerization processes, which focus on creating higher quality polymer chips with improved melt flow properties, reduced impurities, and enhanced molecular weight distribution. These upstream technological innovations directly translate into superior yarn quality, including increased tenacity, improved dye uptake, and better processability during the spinning stage. Furthermore, research into bio-based and recycled polyester feedstocks is gaining traction, representing a significant technological shift towards sustainable manufacturing paradigms and circular economy principles.

In the yarn manufacturing phase, spinning and drawing technologies are continuously refined. High-speed spinning technologies enable faster production rates while maintaining or even improving yarn uniformity and physical properties. Innovations in spinneret design and quenching systems lead to more consistent filament formation and reduced breakage rates. The drawing process, crucial for imparting strength and stability to FDY, benefits from advanced temperature control systems and precise tension management, ensuring uniform molecular orientation across all filaments. Furthermore, sophisticated online monitoring systems, often incorporating sensor arrays and data analytics, provide real-time feedback on yarn quality parameters, allowing for immediate adjustments and minimizing production of off-spec material, thereby boosting overall operational efficiency and reducing waste.

Beyond core manufacturing, the integration of automation and digitalization stands out as a transformative technological trend. Robotics are increasingly being employed for material handling, package winding, and palletizing, reducing labor costs and improving workplace safety. The adoption of Industry 4.0 principles, including the Internet of Things (IoT) and artificial intelligence (AI), allows for comprehensive data collection, predictive maintenance of machinery, and optimization of entire production lines. These digital technologies facilitate smart factories where processes are interlinked and self-optimizing, leading to greater flexibility, higher throughput, and enhanced ability to produce customized FDY yarns. Moreover, advanced dope-dyeing technologies are reducing water and energy consumption compared to conventional dyeing, aligning with global sustainability goals and expanding the market for pre-colored FDY yarns.

Regional Highlights

- Asia Pacific (APAC): Dominates the global FDY Yarns market due to the presence of major textile manufacturing hubs in countries like China, India, and Vietnam. This region benefits from lower labor costs, extensive production capacities, and a rapidly expanding domestic consumer base, driving significant demand for FDY in apparel, home textiles, and industrial applications. Continuous investments in new production facilities and technological upgrades further solidify its leading position.

- Europe: Characterized by a strong focus on high-performance and specialty FDY yarns, particularly for technical textiles, automotive interiors, and premium fashion. European manufacturers emphasize sustainability, product innovation, and compliance with stringent environmental regulations. Demand is driven by sophisticated industries requiring advanced material properties and a preference for quality over volume.

- North America: Exhibits a robust market for FDY yarns, with demand concentrated in high-value applications such as activewear, industrial textiles, and automotive. The region is marked by a strong emphasis on research and development, aiming to produce advanced functional FDY yarns and sustainable solutions. Local production is often supplemented by imports, balancing cost-effectiveness with specialized requirements.

- Latin America: An emerging market for FDY Yarns, driven by increasing industrialization, growing apparel consumption, and expanding home furnishing sectors in countries like Brazil and Mexico. While local production capacities are developing, the region also relies on imports to meet diverse application demands. The market growth is linked to economic stability and rising disposable incomes.

- Middle East and Africa (MEA): Shows promising growth potential, particularly with investments in textile manufacturing infrastructure in countries like Turkey and Egypt, alongside increasing demand for apparel and home textiles driven by population growth and urbanization. The region is also exploring opportunities in technical textiles, supported by government initiatives to diversify economies beyond oil.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the FDY Yarns Market.- Reliance Industries Limited

- Zhejiang Hengyi Group Co., Ltd.

- Indorama Ventures Public Company Limited

- Tongkun Group Co., Ltd.

- China Petrochemical Corporation (Sinopec)

- Xinfengming Group Co., Ltd.

- Shenghong Group

- Far Eastern New Century Corporation

- Formosa Plastics Corporation

- DAK Americas LLC

- Filatex India Limited

- Sasa Polyester Sanayi A.Ş.

- TORAY INDUSTRIES, INC.

- INVISTA

- SRF Limited

- Jiangsu Sanfangxiang Group Co., Ltd.

- Bombay Dyeing and Manufacturing Company Ltd.

- Vardhman Textiles Limited

- Shandong Xiangda Fibers Co., Ltd.

- Huvis Corporation

Frequently Asked Questions

Analyze common user questions about the FDY Yarns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are FDY Yarns and their primary characteristics?

FDY Yarns, or Fully Drawn Yarns, are polyester filament yarns that undergo a complete drawing process during manufacturing, resulting in a highly oriented and crystallized structure. Their primary characteristics include high tenacity, excellent dimensional stability, a smooth and lustrous appearance, superior color fastness, and good resistance to wrinkles and abrasion. These properties make them ideal for applications requiring strength, durability, and aesthetic appeal, distinguishing them from partially oriented or textured yarns by their finished, ready-to-use form directly from the spinning process.

Which industries are the largest consumers of FDY Yarns?

The largest consumers of FDY Yarns are primarily the apparel industry, home furnishings industry, and the growing industrial and technical textiles sector. In apparel, FDY is extensively used for sportswear, casual wear, and intimate apparel due to its smooth drape and durability. For home furnishings, it is crucial for upholstery, curtains, and carpets where its resilience and aesthetic qualities are highly valued. The industrial sector utilizes FDY for automotive fabrics, geotextiles, medical textiles, and luggage, leveraging its high strength and specific functional properties to meet demanding performance requirements across diverse applications.

What factors are driving the growth of the FDY Yarns market?

The growth of the FDY Yarns market is primarily driven by several key factors. These include the expanding global demand for textiles and apparel, fueled by rising disposable incomes and changing fashion trends, particularly in emerging economies. The increasing adoption of FDY in technical textiles for automotive, medical, and construction applications due to its superior performance characteristics also contributes significantly. Furthermore, continuous technological advancements in manufacturing processes leading to improved yarn properties, coupled with a growing emphasis on sustainable production methods and recycled polyester FDY, are strong accelerators for market expansion and innovation.

What are the key challenges faced by FDY Yarns manufacturers?

FDY Yarns manufacturers face several key challenges. One significant challenge is the volatility in raw material prices, particularly for petrochemical derivatives like PTA and MEG, which directly impacts production costs and profit margins. Intense competition from alternative synthetic and natural fibers also necessitates continuous innovation and differentiation. Furthermore, increasing environmental concerns regarding the non-biodegradable nature of polyester and the energy-intensive production process lead to stringent regulatory pressures and a demand for more sustainable manufacturing practices, requiring substantial investment in eco-friendly technologies and materials to maintain market competitiveness.

How is sustainability impacting the FDY Yarns market?

Sustainability is profoundly impacting the FDY Yarns market by driving innovation and shaping consumer preferences. Manufacturers are increasingly focusing on developing recycled polyester FDY yarns, utilizing post-consumer or post-industrial waste to reduce reliance on virgin petrochemicals and minimize environmental footprint. There is also a growing emphasis on optimizing production processes to reduce water, energy, and chemical consumption, particularly through advanced dope-dyeing technologies. This shift towards sustainable practices is influenced by consumer demand for eco-friendly products, corporate social responsibility initiatives, and stricter environmental regulations, creating new opportunities for market differentiation and long-term growth in the sustainable FDY segment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- FDY Yarns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- FDY Yarns Market Statistics 2025 Analysis By Application (Home Textiles, Apparel, Automotive Fabrics), By Type (Row White, Semi Dull, Trilobal Bright), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager