Ferro Vanadium Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433423 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Ferro Vanadium Market Size

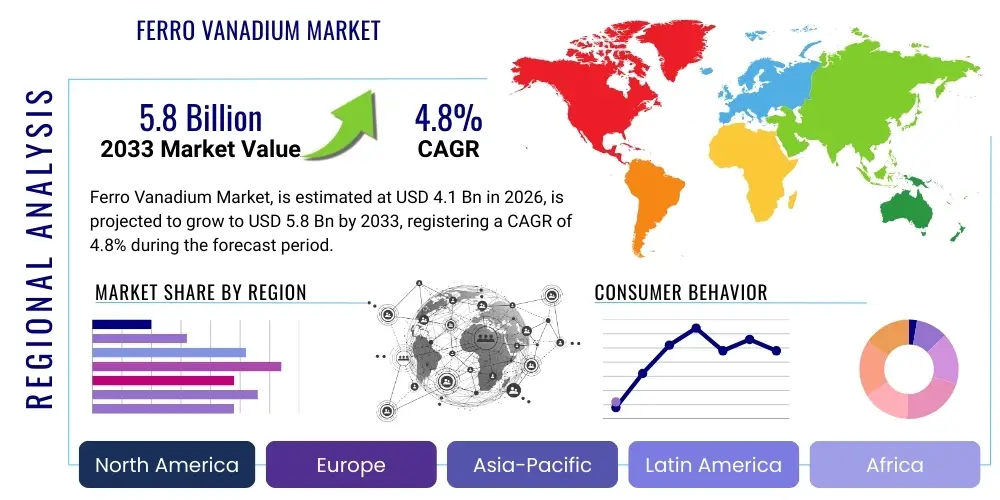

The Ferro Vanadium Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 5.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global demand for high-strength, low-alloy (HSLA) steel, particularly within rapidly expanding infrastructure and automotive manufacturing sectors across Asia Pacific. The essential properties imparted by ferro vanadium, such as increased tensile strength, enhanced resistance to wear and fatigue, and improved weldability, position it as an indispensable alloying agent for critical applications in construction, aerospace, and energy infrastructure, ensuring sustained market expansion over the coming years. Furthermore, strategic stockpiling and increasing geopolitical stability concerns surrounding key vanadium producing regions influence price volatility and supply chain considerations, which in turn impact the overall market valuation.

Ferro Vanadium Market introduction

Ferro Vanadium (FeV) is an iron-vanadium alloy, commonly produced through the silicothermic reduction of vanadium pentoxide (V2O5) in the presence of iron scrap, or via the alumino-thermic process. It typically contains between 35% and 80% vanadium, with FeV 50 and FeV 80 being the most commercially relevant grades, offering distinct advantages depending on the end-use application. This critical ferroalloy is primarily utilized in the metallurgical industry, serving as a powerful grain refiner and hardening additive. The primary benefit derived from incorporating ferro vanadium is the significant improvement in the mechanical properties of steel, transforming standard steel into specialized grades required for high-stress environments. These attributes are crucial for industries relying on robust, lightweight, and durable metallic materials, thereby establishing ferro vanadium as a pivotal component in modern industrialization and infrastructure development projects globally. The intrinsic value of vanadium as an alloying element, coupled with efficient production processes, maintains its central role in the ferrous metallurgy landscape.

Major applications of ferro vanadium center around specialized steel production, including tool steel, high-speed steel, and structural steel used in large-scale construction. Beyond steel, ferro vanadium is also crucial in the production of high-performance titanium alloys used extensively in the aerospace industry, specifically for jet engine components and airframe structures where extreme durability and resistance to thermal stress are mandatory. The driving factors propelling market growth include the robust resurgence of the global construction sector, particularly in emerging economies focusing on mega-infrastructure projects, and the accelerating transition in the automotive sector towards producing lighter, more fuel-efficient vehicles that require HSLA steel for chassis and engine parts. Additionally, the nascent but high-potential application of vanadium in redox flow batteries (VRFBs) offers a long-term diversification opportunity, although metallurgical demand remains the dominant driver in the immediate forecast horizon. The stringent quality standards in critical infrastructure necessitate the consistent and reliable supply of high-grade ferro vanadium, intensifying competition among producers focused on process efficiency and purity.

The benefits of using ferro vanadium are profound and multifaceted, primarily revolving around economic efficiency and material performance enhancement. By adding a small percentage of vanadium, manufacturers can achieve significantly higher yield strength and greater fatigue life in their metallic products, often allowing for material reduction without compromising structural integrity—a key objective in achieving lighter assemblies in transportation. Furthermore, vanadium exhibits excellent resistance to hydrogen embrittlement and high-temperature creep, making it indispensable for pipelines, pressurized vessels, and power generation equipment. Regulatory pressures mandating improved energy efficiency and reduced carbon footprints in manufacturing processes inadvertently support the demand for ferro vanadium-enhanced materials, as these materials contribute to overall longevity and performance optimization of industrial assets. The market dynamics are highly responsive to global economic indicators, particularly steel output and capital expenditure in heavy industries, creating a cyclical yet upward trending demand profile for this essential alloy.

- Product Description: Ferro Vanadium is a master alloy used primarily to improve the strength, toughness, and wear resistance of steel and other ferrous alloys.

- Major Applications: Structural steel, automotive components (HSLA steel), tool steel, and titanium alloys for aerospace.

- Benefits: Increased tensile strength, improved wear resistance, enhanced fatigue life, and high-temperature stability.

- Driving Factors: Growth in global construction and infrastructure development, expansion of the automotive sector, and technological advancements in specialized steel manufacturing.

Ferro Vanadium Market Executive Summary

The global Ferro Vanadium market is currently characterized by moderate growth, primarily underpinned by resilient demand from the steel industry, which accounts for the vast majority of its consumption. Business trends highlight a strong correlation between the market performance of ferro vanadium and global crude steel production figures, particularly the output of high-strength, low-alloy steel grades. Key operational trends include increasing vertical integration among major producers, aiming to secure long-term access to vanadium ore resources, primarily located in regions such as China, Russia, and South Africa. Furthermore, sustained efforts towards optimizing production metallurgy, specifically focusing on energy efficiency and reducing the environmental impact of extraction and processing, are critical competitive differentiators. Price volatility, dictated by upstream raw material costs (vanadium pentoxide) and global commodity trading patterns, remains a crucial risk factor that businesses actively manage through hedging and diversified sourcing strategies. The emergence of environmental regulations regarding slag disposal also pressures companies to invest in cleaner processing technologies and recycling initiatives.

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of Ferro Vanadium consumption, overwhelmingly driven by China's dominant position in crude steel manufacturing, extensive urbanization, and massive infrastructural investment programs. While China provides the bulk of both supply and demand, the growth rate in emerging APAC economies like India and Southeast Asia is accelerating, fueled by government initiatives targeting national infrastructure upgrades and robust residential construction. Europe and North America, while exhibiting slower absolute growth, maintain significant market shares due to high-value applications in specialized industries like aerospace, premium automotive manufacturing, and defense, which require stringent material specifications and consistent quality. Regional market trends also show North American and European industries emphasizing the recycling of steel containing vanadium to mitigate supply chain risks and achieve sustainability targets, slightly dampening primary ferro vanadium demand but supporting circular economy models.

Segmentation trends indicate that the FeV 50 grade commands the largest market share due to its balanced cost-effectiveness and applicability in mass-produced structural steels. However, the FeV 80 segment is forecasted to experience the highest growth rate, reflecting the increased requirement for specialized, high-performance alloys in demanding sectors such as aerospace and advanced tooling, where superior mechanical properties justify the higher cost. In terms of application segmentation, the construction and infrastructure segment is projected to maintain market dominance, but the automotive sector is showing rapid growth, driven by mandates for vehicle lightweighting to meet stringent emission standards. Future market evolution is expected to pivot slightly towards non-steel applications, particularly in energy storage solutions, though the short-to-medium term growth remains intrinsically linked to traditional ferrous metallurgy and the stability of the global industrial economy. Companies are strategically investing in capacity expansion in low-cost production zones to maintain competitiveness against fluctuating raw material prices and geopolitical uncertainties.

AI Impact Analysis on Ferro Vanadium Market

User inquiries regarding AI's impact on the Ferro Vanadium market primarily revolve around three central themes: optimizing mining and extraction efficiency, enhancing metallurgical process control, and predicting market price fluctuations. Users are keenly interested in how Artificial Intelligence can mitigate the high operating costs associated with vanadium mining and V2O5 conversion. Concerns also focus on whether predictive AI models can stabilize the notoriously volatile pricing of ferro vanadium by providing more accurate forecasts of both steel demand and primary resource availability. Furthermore, there is significant curiosity about the implementation of machine learning (ML) in advanced steel manufacturing, specifically to fine-tune the precise additions of ferro vanadium required for specific HSLA steel compositions, ensuring quality control and minimizing waste, which is crucial given the high cost of the alloy. The overall expectation is that AI will introduce efficiencies across the value chain, leading to better resource utilization and potentially lower end-product costs, while offering better risk management tools for traders and producers.

The adoption of AI in the upstream segment, particularly in exploration and geological modeling, is improving the accuracy of resource identification and optimizing mining routes, thereby reducing operational expenditure and increasing recovery rates from complex ores. This direct efficiency gain translates into stabilized input costs for ferro vanadium producers over the long term. Midstream, AI and advanced analytics are being integrated into smelting and refining processes. Sophisticated algorithms monitor real-time data from furnaces, including temperature, chemical composition, and energy consumption, allowing for instantaneous adjustments to maximize yield, purity, and energy efficiency. This is vital in controlling the quality of FeV 50 and FeV 80 grades, which are highly sensitive to processing parameters. Predictive maintenance schedules, managed by AI, reduce unexpected downtime of critical high-temperature equipment, further ensuring reliable supply.

In the downstream steel industry, AI-powered quality control systems use computer vision and sensor data to analyze the microstructure of steel produced with ferro vanadium. These systems can detect subtle variations and ensure that the final alloy possesses the targeted tensile strength and mechanical properties. This precision is invaluable for demanding sectors like aerospace, where material failure is unacceptable. For market analysis, AI algorithms process vast amounts of geopolitical, economic, and commodity trading data to generate highly accurate price forecasts for vanadium and ferro vanadium, enabling better strategic purchasing and inventory management for end-users and improved hedging strategies for suppliers. While AI does not directly alter the chemical function of ferro vanadium, its role as an optimization tool across the entire supply chain dramatically enhances efficiency, reduces environmental footprint, and improves market predictability.

- AI-driven optimization of vanadium ore extraction and processing metallurgy to enhance yield and reduce energy consumption.

- Implementation of Machine Learning models for predictive maintenance in high-temperature ferroalloy production facilities.

- Advanced analytics tools providing more accurate, real-time forecasting of ferro vanadium price volatility based on global steel demand indicators.

- AI integration into HSLA steel production for precise alloy composition control, ensuring optimal mechanical properties and minimizing material waste.

- Automated quality control using AI vision systems to analyze the microstructure and purity of manufactured steel components.

DRO & Impact Forces Of Ferro Vanadium Market

The Ferro Vanadium market is governed by a confluence of critical drivers (D), significant restraints (R), emerging opportunities (O), and potent impact forces. The primary drivers stem from the continuous global urbanization trend and massive investment in infrastructure renewal, demanding huge volumes of HSLA steel for bridges, skyscrapers, and industrial facilities. This demand is intrinsically linked to population growth and economic development, particularly in Asia. However, the market faces substantial restraints, chiefly characterized by the extreme price volatility of vanadium raw materials (V2O5), which directly impacts the profitability and stability of ferro vanadium producers and increases procurement risks for end-users. Furthermore, the market's reliance on primary resource extraction in a few concentrated geographical areas introduces significant geopolitical and supply chain risks. The current dynamics suggest that while long-term demand growth is solid, short-term market stability is frequently undermined by external commodity factors.

Opportunities for market expansion are notably present in technological shifts towards high-performance materials and novel energy storage solutions. The increasing adoption of titanium alloys in the burgeoning commercial space exploration sector and advanced defense platforms presents a niche, high-value opportunity for high-purity ferro vanadium. More critically, the long-duration energy storage segment, driven by the requirement for grid stabilization in renewable energy landscapes, is exploring Vanadium Redox Flow Batteries (VRFBs). Should VRFB technology achieve mass commercial viability and lower costs, it would introduce a completely new, potentially massive demand vector, fundamentally altering the existing market structure dominated by metallurgy. Simultaneously, enhancing recycling technologies for vanadium-containing slag and spent catalysts offers producers a sustainable and domestically secure secondary source of raw material, mitigating reliance on primary ore imports.

The key impact forces acting upon the market include stringent environmental regulations concerning mining and processing waste, which increase operational costs and favor producers utilizing cleaner technologies. Geopolitical instability in major producing nations (e.g., South Africa, China, Russia) acts as a powerful external shock, affecting supply chain reliability and driving price spikes. Furthermore, the substitution threat, although limited due to vanadium's unique properties, is a persistent force. While niobium or molybdenum can occasionally serve as substitutes in some steel grades, they typically do not provide the same combination of fine-grain structure and strengthening mechanisms as vanadium, limiting their pervasive impact. The overall trajectory is heavily influenced by global capital expenditure cycles, particularly those related to construction and military modernization programs, which exert powerful, often sudden, demand changes on the market supply equilibrium.

Segmentation Analysis

The Ferro Vanadium market segmentation is primarily structured around the concentration of vanadium content (grade), the final product application, and the geographical region of consumption. Understanding these segments is crucial for strategic planning, as different grades cater to distinct needs—FeV 50 serves general structural purposes, optimizing cost and performance, while FeV 80 is reserved for specialized, high-specification applications where superior material properties are non-negotiable. The segmentation by application reveals the market's dependence on the cyclical yet massive steel industry, with infrastructure and automotive sectors being the core revenue drivers. This segmentation allows producers to tailor their marketing and distribution efforts, focusing on regions or end-use industries experiencing heightened capital investment and growth. Furthermore, tracking segmental growth rates helps identify emerging consumer profiles, such as those in the nascent energy storage industry, guiding future capacity allocation and research investment towards higher-growth, specialized segments.

Segmentation by process route, though less common in market reporting, is becoming increasingly relevant due to environmental and efficiency concerns. The primary routes—alumino-thermic reduction versus silicon reduction—yield products with subtle differences in impurity levels, influencing their suitability for ultra-high purity applications like aerospace alloys. The transition towards secondary sources, or recycling of vanadium-bearing materials, also forms a critical part of the supply-side segmentation, impacting overall sustainability metrics and supply stability. The dominance of the FeV 50 grade reflects the bulk requirement of the global construction steel market, making it the highest volume segment. Conversely, regional segmentation underscores the massive industrial output of Asia Pacific, contrasting sharply with the specialized, high-value consumption patterns observed in mature Western markets like North America and Europe, where demand is stable but less volume-intensive.

Strategic segmentation analysis suggests that while the volume growth will continue to be driven by infrastructural development in APAC, the value growth and profit margins may increasingly stem from the niche, high-purity FeV 80 market catering to advanced mobility (electric vehicles requiring lightweight structures) and specialized industrial tooling. The continuous innovation in steel metallurgy, demanding alloys with ever-finer control over mechanical characteristics, ensures the perpetuation of grade-based segmentation. Overall, a comprehensive segmentation strategy provides stakeholders with a granular view of market dynamics, enabling targeted investment in production capacity, distribution networks, and R&D initiatives aligned with specific end-user requirements and regional economic realities, ultimately mitigating exposure to generalized commodity risks.

- By Grade:

- Ferro Vanadium 50 (FeV 50)

- Ferro Vanadium 80 (FeV 80)

- Others (FeV 35, FeV 60)

- By Application:

- High-Strength Low-Alloy (HSLA) Steel

- Tool Steel

- Full Alloy Steel

- Cast Iron

- Titanium Alloys

- Others (Chemicals, Energy Storage)

- By End-Use Industry:

- Construction and Infrastructure

- Automotive and Transportation

- Aerospace and Defense

- Industrial Tools and Machinery

- Chemical and Energy

Value Chain Analysis For Ferro Vanadium Market

The value chain for the Ferro Vanadium market begins with upstream activities focused on the mining and processing of primary vanadium resources, predominantly magnetite ores, shales, and crude oil residues/spent catalysts. Upstream analysis involves high capital intensity, requiring extensive infrastructure for mining, crushing, concentration, and roasting to produce Vanadium Pentoxide (V2O5), the crucial intermediate product. This segment is characterized by a high degree of geographical concentration, often leading to oligopolistic supply conditions and significant exposure to regulatory and environmental compliance costs. Key strategic objectives in the upstream segment revolve around maximizing V2O5 recovery rates, optimizing energy consumption during roasting, and ensuring stable relationships with large-volume consumers to secure long-term offtake agreements. The high cost of specialized purification techniques required to remove impurities determines the quality and cost structure passed down the chain. Vertical integration often starts here, where miners control the subsequent V2O5 production to capture greater margin.

The midstream segment involves the conversion of V2O5 into Ferro Vanadium alloy, primarily through thermo-reduction processes (alumino-thermic or silico-thermic) in electric arc furnaces. This conversion stage is technically sophisticated, requiring precise temperature control and specific reducing agents to achieve the required FeV grade (e.g., 50% or 80% vanadium content) and low residual impurity levels. Manufacturing facilities are typically located near large steel production hubs or raw material sources to minimize logistics costs. Distribution channels in this segment are robust, utilizing both direct sales to major integrated steel mills (downstream analysis) and indirect sales through specialized global ferroalloy traders and distributors who cater to smaller foundries and non-steel applications. Direct channels emphasize long-term, customized contracts ensuring just-in-time delivery and technical support, whereas indirect channels provide broader market reach and flexibility, particularly across diverse geographical regions lacking significant local production.

Downstream analysis focuses on the large-scale industrial end-users, predominantly integrated steel manufacturers and specialty alloy producers, who incorporate FeV into their melts to impart desired mechanical properties. The application dictates the volume and grade of FeV purchased; for instance, high-volume construction requires FeV 50, while aerospace alloys utilize high-purity FeV 80. The consumption side is highly inelastic in the short term, as substitution is technically challenging. The final products—HSLA steel, tool steel, titanium components—are then distributed globally to sectors such as construction (using structural steel), automotive (for chassis and engine components), and aerospace. The value captured downstream is immense, given the critical nature of the enhanced materials. Efficiency in the downstream distribution relies heavily on reliable logistics networks, especially for bulk shipping of steel products. The overall value chain demonstrates high interdependency, with upstream supply stability being paramount to downstream manufacturing reliability and profitability.

Ferro Vanadium Market Potential Customers

The primary and most substantial potential customers for Ferro Vanadium are integrated steel manufacturers globally, particularly those specializing in the production of high-performance steel grades. These large industrial entities serve as the foundational buyers, utilizing vast quantities of FeV as an essential micro-alloying element to produce High-Strength Low-Alloy (HSLA) steel required for robust infrastructure projects such as bridges, large commercial buildings, and high-pressure oil and gas pipelines. The end-user/buyers in this segment are characterized by high volume, consistent demand, and stringent quality requirements driven by international standards (e.g., ASTM, ISO). Their purchasing decisions are heavily influenced by long-term price stability, supply reliability, and technical specifications, making long-term procurement contracts common practice.

A secondary, yet rapidly expanding, customer base exists within the transportation sector, encompassing automotive manufacturers and aerospace component producers. Automotive companies, driven by global mandates for reduced vehicle weight and improved crash safety, are high-volume buyers of HSLA steel that incorporates ferro vanadium for lighter chassis and body structures. Aerospace and defense contractors, conversely, are low-volume but high-value consumers, purchasing ultra-high-purity ferro vanadium for the creation of specialized titanium alloys used in crucial engine parts and structural airframe components where thermal resistance and fatigue strength are paramount. These customers prioritize quality, traceability, and material certifications above price fluctuations, often requiring specialized FeV 80 grade alloys.

Emerging potential customer segments include manufacturers focusing on industrial tooling, heavy machinery, and, increasingly, advanced energy storage solutions. Tool steel manufacturers utilize ferro vanadium for its ability to significantly enhance the hardness and wear resistance of cutting tools and dies, serving the global manufacturing industry. Furthermore, companies investing in grid-scale energy storage, particularly those developing and deploying Vanadium Redox Flow Batteries (VRFBs), represent a high-potential future customer base. While currently niche, if VRFB technology achieves widespread adoption, these energy companies will become significant consumers of vanadium compounds, directly influencing the demand for processed vanadium, indirectly bolstering the market dynamics for ferroalloys and related upstream products. The diversity of the customer landscape ensures a degree of resilience for the market against downturns in any single industrial segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EVRAZ, Bushveld Minerals, Largo Inc., AMG Advanced Metallurgical Group N.V., Glencore, Tremond Metals and Alloys, HBIS Group, China Vanadium Titano-Magnetite Mining, Interalloys Trading, Reade Advanced Materials, Hickman, Williams & Company, TCI Powder Metals, Met-Mex Peñoles, Sichuan Goldstar Vanadium, Atlantic Vanadium. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferro Vanadium Market Key Technology Landscape

The technology landscape for the Ferro Vanadium market is centered on enhancing efficiency, purity, and sustainability across the entire production cycle, starting from ore processing. A critical technology is the refinement of the primary extraction methods, particularly optimizing the roasting and leaching processes applied to vanadium-bearing magnetite ore. Modern facilities increasingly utilize fluidized bed roasting technology, which offers superior thermal efficiency and allows for better control over the oxidation process required to convert vanadium compounds into soluble V2O5. Advances in hydrometallurgy, specifically solvent extraction and ion exchange techniques, are pivotal in achieving the ultra-high purity levels of V2O5 necessary for specialized FeV 80 and chemical applications, ensuring minimal contamination from elements like sulfur and phosphorus which can compromise the final alloy quality. The continuous pursuit of cleaner and more energy-efficient roasting technologies is a major theme, driven by regulatory pressure to reduce environmental footprints and lower substantial energy costs associated with high-temperature processing. This focus on chemical process refinement directly translates into higher-quality and more cost-competitive FeV production.

In the conversion phase—turning V2O5 into Ferro Vanadium—the primary technologies remain the alumino-thermic and silico-thermic reduction methods. However, innovation is focused on process control and automation. Modern induction melting furnaces are replacing older electric arc furnaces in some high-specification production environments, offering finer temperature uniformity and reduced atmospheric contamination, which is crucial for achieving high purity in FeV 80. Furthermore, advancements in specialized refractories and continuous monitoring systems, often leveraging the AI techniques previously discussed, enable producers to maintain tighter tolerances on alloy composition, reducing variability and waste. A significant technological push is also directed towards utilizing secondary resources. Improved pyro-metallurgical and hydro-metallurgical processes are being developed to efficiently recover vanadium from steel slag, fly ash, and spent catalysts. These recycling technologies not only diversify the supply base but also address the environmental challenge of waste disposal, offering a sustainable, cyclical source of vanadium for FeV production, thus mitigating supply chain risks associated with primary mining.

The downstream technology landscape, while not directly involving FeV production, dictates the demand for specific grades. Advances in steelmaking, particularly the adoption of Electric Arc Furnaces (EAFs) over Basic Oxygen Furnaces (BOFs) in many mature markets, influence the ferroalloy injection technologies. Precise metering systems are essential for accurately adding the required trace amounts of FeV during the alloying stage to achieve the fine-grain structure and specific mechanical properties needed for HSLA steel. Furthermore, the development of Vanadium Redox Flow Battery (VRFB) technology represents a disruptive non-metallurgical technological application. VRFB research focuses on enhancing electrolyte stability, improving membrane performance, and increasing energy density. While this technology uses vanadium compounds (vanadium electrolytes) rather than FeV, its growth would fundamentally alter the global vanadium supply-demand balance, driving investment across the entire vanadium extraction and processing sector to meet potentially massive electrochemical demand.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for Ferro Vanadium globally, primarily driven by China, which is both the world's largest producer and consumer of crude steel. Massive ongoing urbanization, government-led infrastructure projects (e.g., China's Belt and Road Initiative, India's infrastructure push), and the dominant position of Asian nations in global automotive manufacturing fuel the exceptional demand for HSLA steel. Southeast Asian countries, including Vietnam and Indonesia, are emerging as significant secondary growth engines due to rapid industrialization.

- North America: This region is characterized by stable, high-value demand, predominantly from the specialized steel sectors catering to aerospace, defense, and high-end energy (oil and gas pipelines). While volume growth is slower compared to APAC, the emphasis on quality and technological advancement (e.g., high-purity FeV 80 for titanium alloys) ensures the region maintains a significant market share by value. The market is also strongly influenced by recycled content mandates and domestic regulatory standards.

- Europe: Similar to North America, the European market is mature and focuses heavily on high-specification applications, particularly premium automotive manufacturing (requiring advanced lightweight steel) and sophisticated industrial machinery. Environmental regulations are particularly stringent here, driving high technological investment in cleaner production methods and favoring companies that utilize efficient, low-emission processes for ferro vanadium manufacturing and alloying.

- Latin America (LATAM): Growth in LATAM is closely tied to domestic infrastructure development, mining activities, and fluctuating commodity prices. Brazil is a key consumer due to its large domestic steel industry. Economic instability in some nations, however, can introduce volatility, making it a market with high potential but significant short-term risk factors.

- Middle East and Africa (MEA): This region is crucial primarily due to the concentration of primary vanadium resources, particularly in South Africa, which is a major global producer. Demand is growing modestly, fueled by regional construction projects and oil and gas infrastructure expansion, requiring high-strength piping and structural components. South Africa's role as a major global exporter heavily influences international supply dynamics and pricing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferro Vanadium Market.- EVRAZ

- Bushveld Minerals

- Largo Inc.

- AMG Advanced Metallurgical Group N.V.

- Glencore

- Tremond Metals and Alloys

- HBIS Group

- China Vanadium Titano-Magnetite Mining

- Interalloys Trading

- Reade Advanced Materials

- Hickman, Williams & Company

- TCI Powder Metals

- Met-Mex Peñoles

- Sichuan Goldstar Vanadium

- Atlantic Vanadium

- Cangzhou Dahua Group Co., Ltd.

- Sanbao Resources

- GfE (Gesellschaft für Elektrometallurgie)

- Steel Plantech Co., Ltd.

- RIMA Industrial S/A

Frequently Asked Questions

Analyze common user questions about the Ferro Vanadium market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of demand in the Ferro Vanadium market?

The primary driver is the global demand for High-Strength Low-Alloy (HSLA) steel, which is essential for massive infrastructure and construction projects, particularly in Asia Pacific, where urbanization and capital expenditure on mega-projects are escalating.

How does Ferro Vanadium contribute to steel performance?

Ferro Vanadium acts as a potent micro-alloying agent that significantly improves the mechanical properties of steel, specifically increasing tensile strength, enhancing resistance to fatigue, and refining grain structure, making the resulting steel lighter and more durable.

What are the key risks associated with the Ferro Vanadium supply chain?

Key risks include extreme price volatility of upstream raw materials (vanadium pentoxide), high geographical concentration of primary mining resources (mainly China, Russia, South Africa), and geopolitical instability affecting reliable ore supply.

Is there a significant alternative application for Ferro Vanadium outside of metallurgy?

Yes, the most significant emerging alternative application is in the development of Vanadium Redox Flow Batteries (VRFBs) for large-scale, long-duration energy storage, a sector poised for substantial growth due to renewable energy integration.

Which grade of Ferro Vanadium holds the largest market share by volume?

Ferro Vanadium 50 (FeV 50) holds the largest market share by volume because it is the most cost-effective grade used widely in general structural and construction steel applications globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ferro Vanadium Alloy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Ferro Vanadium Market Size By Regional (Europe, North America, South America, Asia Pacific, Middle East And Africa), Industry Growth Opportunity, Price Trends, Competitive Shares, Market Statistics and Forecasts 2025 - 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager