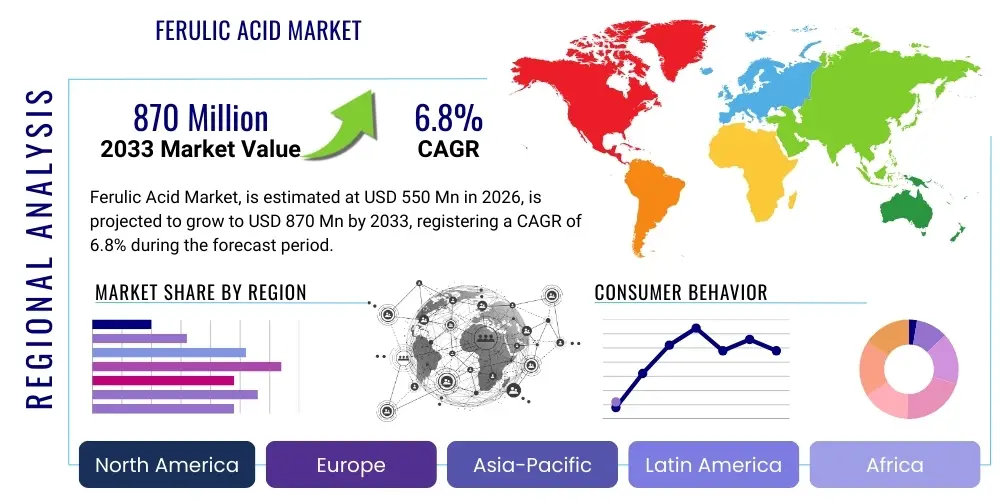

Ferulic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434894 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Ferulic Acid Market Size

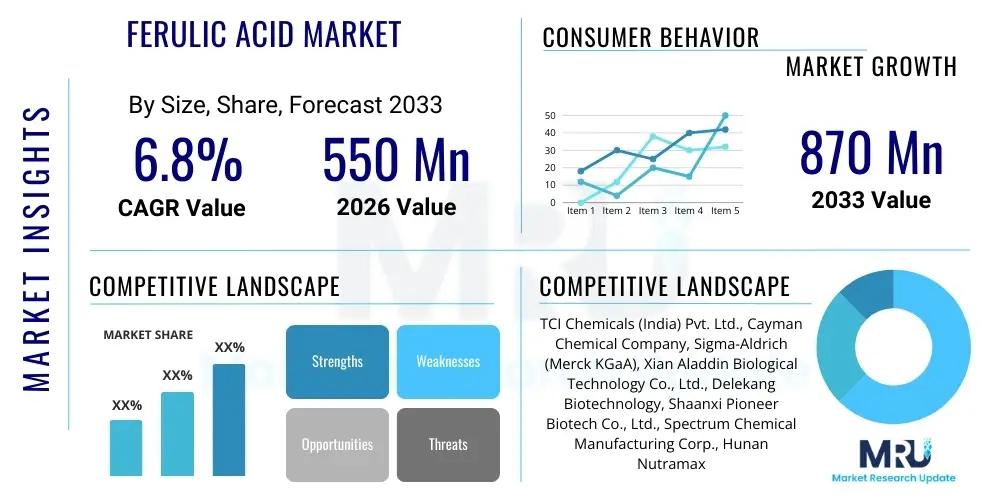

The Ferulic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $550 Million USD in 2026 and is projected to reach $870 Million USD by the end of the forecast period in 2033.

Ferulic Acid Market introduction

Ferulic acid, scientifically known as 4-hydroxy-3-methoxycinnamic acid, is a powerful phytochemical belonging to the hydroxycinnamic acid class. It is naturally abundant in the cell walls of plants, particularly in cereals like oats, rice, and wheat, where it provides structural integrity and antioxidant protection against environmental stressors. Its chemical structure, which includes both a phenolic ring and an unsaturated carboxylic acid side chain, grants it exceptional free-radical scavenging properties. This dual functionality allows ferulic acid to effectively neutralize multiple types of free radicals, making it a critical ingredient in formulations requiring high oxidative stability and anti-aging benefits. The extraction process typically involves alkaline hydrolysis or enzymatic methods from agricultural byproducts, positioning it as a sustainable bio-based compound.

The primary driver for the Ferulic Acid Market lies in its increasing adoption within the high-growth sectors of cosmetics and personal care. Recognized for its ability to stabilize notoriously volatile antioxidants like Vitamin C (L-ascorbic acid) and Vitamin E, ferulic acid significantly enhances the photoprotective capacity of sunscreens and anti-aging serums. When incorporated into topical formulations, it reduces the formation of thymine dimers in skin cells, thereby offering a secondary layer of defense against UV-induced damage and photoaging. This synergistic effect with other vitamins is highly valued by dermatologists and consumers seeking enhanced efficacy in skincare products, leading to its premium positioning in the cosmeceutical segment.

Beyond skincare, ferulic acid serves significant roles in the nutraceutical and pharmaceutical industries. In nutraceuticals, it is marketed as a dietary supplement due to its potential cardiovascular benefits, including reducing platelet aggregation and regulating cholesterol levels. Furthermore, its application in the food and beverage industry as a natural preservative and flavoring agent is expanding, replacing synthetic alternatives. Pharmaceutical research continues to explore its neuroprotective and anti-inflammatory properties, particularly in treating chronic diseases. The diversity of its applications, spanning aesthetic enhancement, systemic health improvement, and food preservation, collectively fuels the sustained demand across major global economies.

- Product Description: A naturally occurring phenolic compound derived from plant cell walls, known primarily for its potent antioxidant and UV-protective properties.

- Major Applications: Cosmeceuticals (anti-aging serums, sunscreens), Nutraceuticals (dietary supplements), Pharmaceuticals (anti-inflammatory treatments), and Food & Beverage preservation.

- Benefits: Provides superior antioxidant protection, stabilizes other vitamins (C and E), enhances UV photoprotection, exhibits anti-inflammatory and potential neuroprotective effects.

- Driving Factors: Surging consumer demand for natural, bio-based ingredients; increasing awareness regarding UV damage and photoaging; and expansion of the functional food and beverage market.

Ferulic Acid Market Executive Summary

The global Ferulic Acid Market is characterized by robust growth, primarily driven by the escalating demand for high-performance, science-backed ingredients in the personal care industry, especially in North America and Europe. Business trends indicate a strong shift towards synthetic production methods to ensure purity and scale, although natural extraction remains prominent for premium, certified organic products. Key manufacturers are focusing on backward integration to secure raw material supply (rice bran, corn bran) and investing heavily in research and development to unlock new delivery systems, such as nano-emulsions and liposomal encapsulation, which improve stability and bioavailability in complex cosmetic matrices. Strategic collaborations between ferulic acid suppliers and major cosmetic formulators are defining the competitive landscape, aiming to introduce innovative formulations with patented synergistic antioxidant complexes.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, propelled by burgeoning middle-class populations in China and India who are increasingly spending on premium imported and domestic skincare products. Regulatory environments in key regions, particularly the EU and the US, are supportive, classifying ferulic acid as Generally Recognized as Safe (GRAS) or acceptable for use in high concentrations, which encourages product innovation. Conversely, high extraction costs from natural sources and price volatility in raw agricultural materials present ongoing challenges. To mitigate this, manufacturers are strategically locating production facilities near agricultural hubs to optimize supply chain efficiency and reduce logistical overheads.

Segment-wise, the synthetic ferulic acid segment currently dominates the market share due to its consistent quality and scalability, catering primarily to mass-market cosmetic and supplement producers. However, the natural segment is expected to exhibit a higher CAGR, supported by the clean label movement and rising consumer preference for sustainable sourcing. Application analysis confirms that the cosmeceutical segment holds the largest revenue share, consistently leveraging ferulic acid’s strong reputation as a gold standard anti-photoaging agent. The dietary supplement segment is rapidly expanding, fueled by increasing health consciousness and the aging population seeking preventative health solutions based on powerful plant-derived antioxidants.

- Business Trends: Increased focus on synthetic large-scale production, strategic partnerships between ingredient suppliers and end-product manufacturers, and investment in specialized encapsulation technologies to improve product stability.

- Regional Trends: North America and Europe lead in consumption value, driven by established cosmetic industries, while APAC exhibits the highest growth rate due to rapidly expanding consumer bases and rising disposable incomes.

- Segments Trends: Synthetic ferulic acid dominates volume, but natural ferulic acid is poised for rapid value growth spurred by clean label demands; the cosmeceutical application remains the largest revenue contributor.

AI Impact Analysis on Ferulic Acid Market

Common user questions regarding AI's influence on the Ferulic Acid Market frequently revolve around optimizing complex extraction processes, accelerating new product formulation development, and predicting ingredient stability under various environmental conditions. Consumers and industry professionals are keenly interested in how machine learning can enhance the yield of natural extraction from biomass, thereby lowering production costs and improving sustainability metrics. Furthermore, there is significant inquiry into AI's role in drug discovery, specifically utilizing deep learning models to screen ferulic acid derivatives for enhanced neuroprotective or anti-cancer activities, which could unlock substantial future pharmaceutical demand for the compound. The overall consensus highlights expectations that AI will serve as a catalyst for efficiency, personalized cosmetic formulation, and novel application discovery.

AI and machine learning algorithms are being increasingly deployed in R&D to simulate molecular interactions and predict the synergistic effects of ferulic acid when combined with other active ingredients, such as peptides or specialized vitamins. This predictive modeling capability significantly reduces the time and cost associated with traditional wet-lab experimentation, accelerating the time-to-market for novel cosmetic and nutraceutical formulations. For instance, AI can optimize the concentration ratios needed to achieve maximum photoprotection while minimizing formulation instability, a persistent challenge when working with delicate antioxidant compounds. This precision engineering enabled by AI provides a distinct competitive edge to companies that adopt these sophisticated digital tools in their product development pipelines.

In manufacturing, AI-driven process optimization is transforming upstream operations. Predictive maintenance protocols, powered by sensor data and machine learning, ensure that extraction and purification equipment operates at peak efficiency, minimizing downtime and energy consumption. Furthermore, AI is crucial for quality control, instantly analyzing chromatographic data to ensure the purity levels of synthesized or extracted ferulic acid meet stringent regulatory requirements for both cosmetic and pharmaceutical grades. Supply chain logistics also benefit significantly; AI algorithms predict demand fluctuations across global regions, allowing manufacturers to optimize inventory levels and transportation routes, thereby ensuring a reliable supply chain crucial for this high-demand functional ingredient.

- AI-Driven Formulation: Machine learning models predict optimal combinations and concentrations of ferulic acid with synergists (Vitamins C/E) for maximum efficacy and stability.

- Enhanced Extraction Efficiency: AI algorithms optimize parameters (pH, temperature, enzyme dosage) in enzymatic or alkaline hydrolysis processes to maximize yield from agricultural byproducts.

- Quality Assurance: Automated visual inspection and spectral analysis powered by AI ensure consistent high purity and compliance with strict cosmetic and pharmaceutical standards.

- Accelerated Drug Discovery: Deep learning models screen ferulic acid derivatives for novel biological activities (e.g., neuroprotection, anti-tumor effects) potentially opening new market avenues.

- Personalized Skincare: AI platforms utilize consumer skin data to recommend customized cosmetic formulations containing tailored concentrations of ferulic acid.

DRO & Impact Forces Of Ferulic Acid Market

The Ferulic Acid Market is heavily influenced by a confluence of internal market dynamics and external technological advancements that dictate its growth trajectory and stability. The primary driving force is the global shift toward preventative healthcare and natural cosmetic solutions, positioning ferulic acid as a premium, effective antioxidant ingredient. Concurrent restraints include the high initial cost and technical complexity associated with natural extraction methods, leading to reliance on price-volatile agricultural raw materials like rice bran. However, technological opportunities, particularly the development of high-yield biotechnological production routes (e.g., microbial fermentation), promise to overcome current scaling and cost hurdles, offering a pathway to sustainable, low-cost synthetic alternatives that maintain high purity. These impact forces shape strategic investment decisions across the value chain, from raw material procurement to final product formulation.

The core market growth is sustained by positive consumer perception and substantiated clinical evidence supporting ferulic acid's role in neutralizing oxidative stress, particularly photo-oxidation. Increased health awareness regarding the long-term damage caused by pollution and UV radiation has solidified its status in daily skincare routines, generating steady demand from multinational cosmetic corporations. Furthermore, regulatory bodies increasingly favor naturally derived, non-toxic ingredients over synthetic petrochemical alternatives, providing a regulatory tailwind for natural ferulic acid suppliers. The compounding impact of these drivers ensures that market growth is fundamentally sound and resilient to minor economic fluctuations, reinforcing its position as a staple ingredient.

Conversely, the market faces significant restraints, including intense competition from alternative, cheaper antioxidants like Vitamin E (Tocopherol) or synthetic BHT (Butylated hydroxytoluene) in non-premium segments. Shelf-life instability in certain aqueous formulations also poses a challenge, necessitating complex encapsulation or stabilization techniques, which adds to the final product cost. To capitalize on future growth, companies must actively pursue opportunities in biomanufacturing. Successful implementation of highly efficient microbial strains for fermentation-based ferulic acid synthesis would dramatically reduce the dependency on agricultural commodity markets, stabilize pricing, and enable massive scale-up to meet the rapidly accelerating global demand from both the food and cosmetic sectors, thereby transforming the market structure.

- Drivers (D): Surging demand for advanced anti-aging and photoprotective cosmeceuticals; increasing consumer preference for natural, plant-derived ingredients; supportive clinical evidence validating synergistic antioxidant activity with Vitamin C.

- Restraints (R): High production cost and technical complexity of natural extraction; instability in certain formulations leading to product efficacy loss; competition from cost-effective synthetic antioxidants.

- Opportunity (O): Development of highly scalable, cost-effective microbial fermentation/biotechnology routes; expansion into pharmaceutical applications targeting neurodegenerative and inflammatory diseases; leveraging nanotechnology for improved bioavailability.

- Impact Forces: High R&D intensity required for stabilization technologies; strict quality standards in pharmaceutical and cosmetic industries dictating purity; reliance on agricultural commodities (rice, corn bran) impacting supply chain vulnerability.

Segmentation Analysis

The Ferulic Acid Market is comprehensively segmented based on its source, method of production, end-use application, and geographical region, providing a detailed view of current demand patterns and future growth pockets. Source segmentation differentiates between natural extraction, primarily from agricultural byproducts such as rice bran and sugar beet pulp, and synthetic manufacturing, typically involving chemical synthesis routes. The application analysis is critical, revealing that the market’s primary engine remains the high-value cosmetic and personal care sector, followed closely by the expanding dietary supplement segment driven by global wellness trends. Understanding these segments is crucial for manufacturers to tailor their production scale, purity levels, and marketing strategies to specific industry requirements.

- By Source:

- Natural (e.g., Rice Bran, Wheat Bran, Sugar Beet)

- Synthetic

- By Purity Grade:

- Pharmaceutical Grade (Highest Purity)

- Cosmetic Grade

- Food Grade

- By Application:

- Cosmetics and Personal Care (Anti-aging, Sunscreens, Serums)

- Nutraceuticals and Dietary Supplements (Antioxidant capsules, Functional foods)

- Pharmaceuticals

- Food and Beverages (Preservatives, Flavoring agents)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Ferulic Acid Market

The value chain for ferulic acid begins with the upstream segment involving the sourcing and processing of raw materials. For natural ferulic acid, this entails securing consistent supplies of agricultural residues such as rice bran, corn bran, or sugar beet pulp from farming communities and large-scale agricultural processors. The critical step involves the industrial extraction process—either chemical hydrolysis (alkaline treatment) or enzymatic hydrolysis—followed by complex purification and crystallization to achieve the required purity grade (food, cosmetic, or pharmaceutical). For synthetic ferulic acid, the upstream process involves sourcing chemical precursors, typically requiring specialized chemical manufacturing capabilities to ensure synthesis quality and high yield. Efficiency at this stage is paramount, as raw material costs and processing complexity significantly determine the final ingredient price.

The midstream operations focus on bulk production, stabilization, and distribution. Manufacturers often specialize in proprietary purification technologies to meet specific client needs, particularly in the high-purity pharmaceutical grade segment. Stabilization technologies, such as microencapsulation or liposomal preparation, are frequently applied here to protect the ferulic acid molecule from degradation during transport and formulation. Distribution channels are bifurcated: direct sales channels involve ingredient suppliers selling large volumes directly to major multinational cosmetic houses or pharmaceutical companies; indirect channels utilize specialized chemical distributors and regional agents who manage inventory, small orders, and localized technical support for smaller and medium-sized enterprises (SMEs) globally.

The downstream segment encompasses the end-use application industries. Cosmetic manufacturers represent the largest downstream consumer, incorporating ferulic acid into finished goods like serums, moisturizers, and sunscreens, where branding and clinical efficacy studies are essential for market penetration. Nutraceutical companies integrate it into capsules or functional beverage matrices. The final stage involves retail and consumer sales, where product marketing emphasizes the scientifically proven antioxidant benefits and stability advantages offered by the inclusion of ferulic acid. A highly efficient, stable distribution network is essential to ensure that the delicate finished products reach consumers without compromising active ingredient integrity.

Ferulic Acid Market Potential Customers

The primary consumers and buyers of ferulic acid are concentrated within highly regulated industries that prioritize ingredient efficacy and quality assurance, spanning health, wellness, and aesthetic domains. The largest customer base resides in the cosmeceutical sector, primarily encompassing international beauty and personal care giants that manufacture premium anti-aging, UV protection, and skin brightening products. These buyers demand high-purity, cosmetic-grade ferulic acid, often requiring specific stability certifications and regulatory compliance documentation. Their purchasing criteria are heavily weighted towards ingredient synergy, particularly the tested stability and efficacy enhancement ferulic acid provides to Vitamin C formulations, making them strategic long-term partners for suppliers.

The second major cohort consists of nutraceutical and dietary supplement manufacturers. These customers focus on incorporating ferulic acid into functional foods, beverages, and oral capsules, leveraging its systemic antioxidant and potential cardiovascular health benefits. Purity and food-grade safety certifications (e.g., GRAS status) are non-negotiable for these buyers. Furthermore, specialized chemical wholesalers and regional distributors act as essential intermediaries, serving smaller formulation laboratories, contract manufacturers, and localized cosmetic brands that require smaller batch sizes and extensive technical support regarding formulation challenges and dosage recommendations. These intermediaries consolidate demand from numerous small buyers.

Lastly, the pharmaceutical and specialty chemical research sectors represent high-value, albeit lower volume, customers. Pharmaceutical companies purchase pharmaceutical- grade ferulic acid for R&D purposes, exploring its applications in treating conditions related to oxidative stress, inflammation, and neurodegeneration. These buyers require the utmost level of purity, comprehensive impurity profiling, and robust intellectual property protection. The demand from this segment is cyclical but crucial for driving future, high-margin applications, indicating the long-term potential of the ingredient beyond the established cosmetic uses.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550 Million USD |

| Market Forecast in 2033 | $870 Million USD |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TCI Chemicals (India) Pvt. Ltd., Cayman Chemical Company, Sigma-Aldrich (Merck KGaA), Xian Aladdin Biological Technology Co., Ltd., Delekang Biotechnology, Shaanxi Pioneer Biotech Co., Ltd., Spectrum Chemical Manufacturing Corp., Hunan Nutramax Inc., TS-BIOTECH, Hubei Jusheng Technology Co., Ltd., Solvay S.A., BASF SE, Givaudan SA, DSM Nutritional Products, Wuxi AppTec Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Ferulic Acid Market Key Technology Landscape

The technological landscape of the Ferulic Acid Market is defined by continuous innovation aimed at overcoming the challenges of cost, purity, and stability inherent in producing and formulating this powerful ingredient. Historically, the primary technology relied upon was alkaline hydrolysis, which involves treating lignocellulosic materials (like rice bran) with a strong base to release ferulic acid. While effective, this chemical method often yields inconsistent purity and necessitates extensive purification steps. The subsequent introduction of enzymatic hydrolysis, utilizing specific enzymes (e.g., feruloyl esterases), offered a gentler, more environmentally friendly alternative, yielding higher purity ferulic acid suitable for premium cosmetic and food applications, albeit often at a higher processing cost.

The current frontier of innovation lies in advanced biotechnology, specifically microbial fermentation and synthetic biology. Researchers are successfully engineering microorganisms, such as certain yeasts or bacteria, to synthesize ferulic acid directly from inexpensive carbon sources (e.g., glucose) in a controlled bioreactor environment. This method promises unmatched scalability, cost efficiency, and purity consistency, significantly reducing dependency on agricultural commodity pricing and seasonal variability. The success of large-scale biomanufacturing techniques will fundamentally disrupt the synthetic versus natural market dynamics, potentially creating a "nature-identical" ferulic acid at competitive prices for high-volume markets like nutraceuticals and general cosmetics.

Equally critical are the downstream formulation technologies focused on protecting the ferulic acid molecule during storage and application. Ferulic acid is susceptible to degradation, particularly when exposed to light or combined with water in certain pH ranges. To address this, sophisticated delivery systems like microencapsulation, nano-emulsions, and liposomal carriers are widely employed. These technologies enclose the active ingredient within a protective sphere, enhancing its penetration into the skin, improving its stability when paired with Vitamin C and E, and extending the shelf life of the final product. Continuous improvement in these encapsulation methods is vital for maintaining product efficacy and consumer confidence in ferulic acid-based formulations.

Regional Highlights

Regional dynamics play a crucial role in shaping the Ferulic Acid Market, with distinct consumption patterns and production capabilities characterizing each major geographical area. North America, particularly the United States, represents the largest revenue-generating market. This dominance is attributable to the high consumer expenditure on premium anti-aging and sun protection products, coupled with the strong presence of major cosmetic research and development hubs. Regulatory frameworks in the US are generally supportive, and consumer awareness regarding the benefits of complex antioxidant therapies (like CF formulations combining Vitamin C, Vitamin E, and Ferulic Acid) is exceptionally high. The market here is driven by innovation and quick adoption of advanced, scientifically validated ingredients.

Europe holds a substantial market share, defined by rigorous clean label standards and strong regulatory preference for natural and ethically sourced ingredients. Countries like France, Germany, and the UK demonstrate high demand, especially in the organic and certified natural cosmetic segments. European manufacturers are leaders in enzymatic extraction technologies and sustainable sourcing practices. The enforcement of strict cosmetic directives ensures that ferulic acid used in European products is of consistently high quality, focusing on both efficacy and environmental impact. The nutraceutical segment in Europe is also rapidly expanding, driven by proactive public health initiatives and aging demographics seeking dietary antioxidant supplements.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This accelerated growth is fueled by rapidly increasing disposable incomes, urbanization, and a burgeoning interest in specialized skincare and internal wellness products across China, South Korea, and India. Furthermore, APAC is a major hub for raw material sourcing (rice and wheat production), making it a significant manufacturing base for natural ferulic acid suppliers. As local cosmetic and nutraceutical companies in APAC expand their portfolios to compete with Western brands, the demand for high-quality functional ingredients like ferulic acid is expected to surge dramatically, prompting increased investment in local production capacities.

- North America: Market leader in value, driven by high consumer adoption of premium cosmeceuticals and strong R&D infrastructure for anti-photoaging products.

- Europe: High demand for naturally sourced ingredients; strict quality control; rapid growth in the nutraceutical sector due to an emphasis on proactive health.

- Asia Pacific (APAC): Fastest-growing region, characterized by expanding domestic cosmetic industries, rising disposable incomes, and proximity to key agricultural raw material sources (rice bran).

- Latin America (LATAM): Emerging market, showing increasing interest in affordable yet effective personal care products, with Brazil acting as a major consumer hub.

- Middle East & Africa (MEA): Growth driven by increased awareness of sun protection needs and rising luxury cosmetic consumption in Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Ferulic Acid Market.- TCI Chemicals (India) Pvt. Ltd.

- Cayman Chemical Company

- Sigma-Aldrich (Merck KGaA)

- Xian Aladdin Biological Technology Co., Ltd.

- Delekang Biotechnology

- Shaanxi Pioneer Biotech Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Hunan Nutramax Inc.

- TS-BIOTECH

- Hubei Jusheng Technology Co., Ltd.

- Solvay S.A.

- BASF SE

- Givaudan SA

- DSM Nutritional Products

- Wuxi AppTec Co. Ltd.

- Bio-Rad Laboratories Inc.

- Sichuan Xieli Pharmaceutical Co., Ltd.

- Novozymes A/S (Enzyme suppliers impacting natural yield)

- Evonik Industries AG

- Lonza Group AG

Frequently Asked Questions

Analyze common user questions about the Ferulic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of ferulic acid in anti-aging skincare products?

Ferulic acid serves two primary functions in skincare: it acts as a potent antioxidant, neutralizing free radicals induced by UV radiation and pollution, and critically, it stabilizes other highly effective but volatile antioxidants, specifically Vitamin C (L-ascorbic acid) and Vitamin E. This synergy significantly boosts the photoprotective efficiency of topical formulations, effectively minimizing oxidative skin damage and premature aging caused by environmental stressors.

Is synthetic ferulic acid chemically identical and equally effective as natural ferulic acid?

Yes, when manufactured to high purity standards, synthetic ferulic acid is chemically identical to the naturally derived molecule (4-hydroxy-3-methoxycinnamic acid) and offers comparable efficacy in cosmetic and nutraceutical applications. Synthetic production often allows for greater control over purity, consistency, and scalability, addressing supply chain fluctuations inherent in agricultural sourcing, making it a preferred choice for large-volume industrial applications while maintaining clinical performance.

Which application segment holds the largest share in the Ferulic Acid Market?

The Cosmetics and Personal Care application segment currently holds the largest revenue share of the global Ferulic Acid Market. This dominance is driven by the widespread use of ferulic acid in high-value, premium anti-aging serums and sunscreens, often marketed for its proven ability to triple the effectiveness of Vitamin C/E antioxidant combinations and provide superior protection against photo-oxidation and environmental damage.

What major technological advancement is expected to impact the future pricing of ferulic acid?

The major technological advancement expected to stabilize and potentially lower the long-term cost of ferulic acid is the implementation of large-scale microbial fermentation and synthetic biology techniques. Biomanufacturing allows for the sustainable, high-yield production of pure ferulic acid from inexpensive sugar sources, reducing reliance on cost-volatile agricultural byproducts and streamlining complex purification processes, thereby enabling greater market accessibility.

How does ferulic acid contribute to the food and beverage industry beyond just preservation?

While ferulic acid is an effective natural preservative due to its antimicrobial and antioxidant properties, its contribution to the food industry extends to its role as a functional ingredient and flavor precursor. In functional foods and beverages, it enhances the product’s health profile by delivering systemic antioxidant benefits. Furthermore, it acts as a key precursor in the synthesis of vanillin, a valuable flavoring agent, leveraging its natural presence in plant materials for flavor enhancement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Ferulic Acid Vanillin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Natural Ferulic Acid (CAS 1135-24-6) Market Size Report By Type (Ordinary Quality, High Quality), By Application (Food, Cosmetic, Pharmaceutical Intermediates, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Ferulic Acid Market Size Report By Type (Synthesis, Natural), By Application (Food, Cosmetic, Pharmaceutical intermediates), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Natural Vanillin Market Statistics 2025 Analysis By Application (Chocolate and Candy, Beverages, Medicine), By Type (Vanilla Bean Extract, Eugenol Synthesis, Ferulic Acid Synthesis), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager