Flame Retardant Adhesives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431569 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flame Retardant Adhesives Market Size

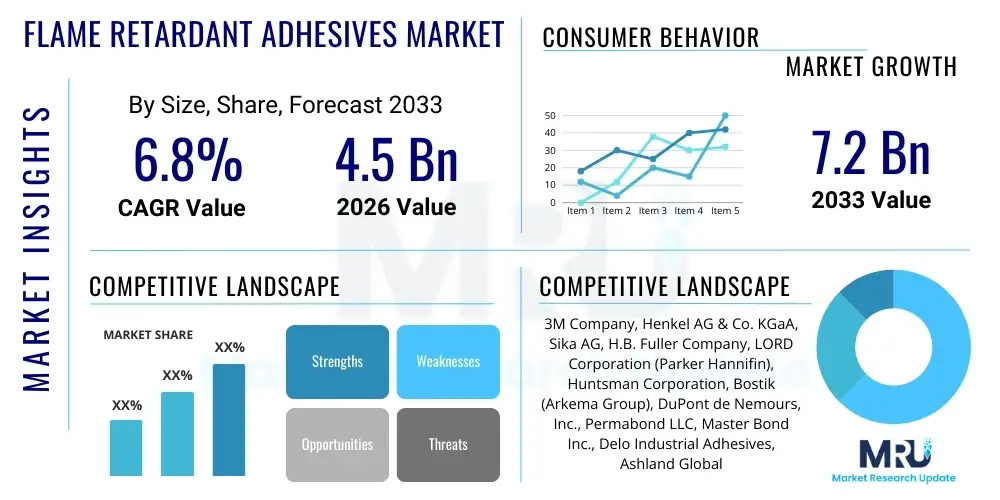

The Flame Retardant Adhesives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Flame Retardant Adhesives Market introduction

Flame retardant adhesives are specialized polymeric bonding agents engineered to inhibit or suppress combustion when exposed to high temperatures or direct flames. These materials incorporate various flame-suppressing additives, such as halogenated compounds, phosphorus derivatives, or intumescent fillers, which work by creating a protective char layer, cooling the substrate, or releasing non-combustible gases upon thermal decomposition. The primary function is to enhance the safety and resilience of assemblies in high-risk environments, ensuring compliance with increasingly stringent fire safety standards mandated across global industries. The efficacy of these adhesives is critical in preventing the rapid spread of fire, thereby extending evacuation time and reducing structural damage in end-use applications.

The product description encompasses a wide range of chemical formulations, including epoxy, silicone, polyurethane, acrylic, and cyanacrylates, each modified with flame retardant characteristics. The selection of the base polymer depends heavily on the required performance characteristics, such as adhesion strength, temperature resistance, flexibility, and compatibility with the materials being bonded. Major applications are concentrated in industries where fire safety is paramount, including aerospace, automotive (especially electric vehicles), construction, and electronics manufacturing. These adhesives are integral in securing insulation, bonding composite panels, sealing critical electronic components, and assembling cabin interiors in transportation sectors.

The benefits derived from the adoption of flame retardant adhesives are multifaceted, centering predominantly on enhanced public and operational safety. Key advantages include reduced smoke emission toxicity, improved thermal stability, and adherence to rigorous certifications such as UL94, FAR 25.853, and various building codes. Driving factors for market growth include the mandatory implementation of fire safety regulations, particularly in high-density public areas and mass transit systems. Furthermore, the rapid expansion of the Electric Vehicle (EV) market demands specialized thermal and fire management solutions for battery packs, significantly boosting the requirement for non-flammable bonding agents. Technological advancements leading to non-halogenated (green) flame retardants are also accelerating market uptake as industries seek sustainable yet effective fire suppression solutions.

Flame Retardant Adhesives Market Executive Summary

The global Flame Retardant Adhesives Market is characterized by robust growth driven by converging safety regulations and structural shifts in key end-use sectors, notably the electrification of transport and the increased use of composite materials in construction and aerospace. Business trends indicate a strong move toward sustainable and environmentally compliant formulations, with manufacturers heavily investing in research and development to replace traditional halogenated systems with phosphorus-based, nitrogen-based, or mineral-based non-halogenated alternatives. Strategic alliances and mergers focused on expanding niche application expertise, such as battery assembly solutions, are defining the competitive landscape. Supply chain resilience, particularly concerning critical raw materials like specialty polymers and unique flame retardant fillers, remains a vital consideration for sustained market success.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by rapid infrastructure development, exponential growth in electronics manufacturing (especially 5G equipment), and burgeoning automotive production, particularly in China and India, where regulatory frameworks are progressively tightening. North America and Europe, driven by stringent fire codes like NFPA and REACH, represent mature markets focused on high-performance, specialized applications in aerospace and high-speed rail. Demand in these established regions centers on performance adhesives for complex material substrates and high-temperature environments, pushing innovation towards thermoset chemistries like high-performance epoxies and silicones.

Segment trends underscore the dominance of the epoxy segment due to its superior mechanical strength and versatility, coupled with its ease of modification using fire-retardant additives. However, the silicone segment is experiencing accelerated growth, driven by its unparalleled thermal stability and flexibility, making it ideal for sealing applications in high-heat environments, particularly battery housings and engine compartments. By end-use, the automotive and transportation sector is leading consumption, directly correlating with the mandated fire safety requirements for electric vehicle battery enclosures and passenger compartment materials. The construction sector also presents a significant growth avenue, spurred by global urbanization and increased governmental scrutiny on fire resistance in commercial and residential buildings.

AI Impact Analysis on Flame Retardant Adhesives Market

User queries regarding the impact of Artificial Intelligence (AI) and machine learning (ML) on the Flame Retardant Adhesives Market frequently revolve around three core themes: accelerated material discovery, optimization of formulation processes, and predictive performance modeling. Users are keen to understand how AI can reduce the lengthy R&D cycle typically associated with developing new fire-safe chemical compounds, particularly non-halogenated alternatives, which often require complex compositional balances. Concerns also focus on whether AI can help manufacturers meet stringent, evolving regulatory standards more quickly by accurately simulating adhesive performance under various thermal loads and failure conditions. Expectations include AI-driven process optimization to reduce batch-to-batch variability and enhance the consistency and cost-effectiveness of high-performance flame retardant systems.

AI's primary influence is seen in the realm of Material Informatics. ML algorithms are employed to screen vast libraries of potential chemical structures and additive combinations (such as novel intumescent systems or nanoscale fillers) to predict their flame retardancy mechanisms (e.g., char formation quality, heat release rate) before physical synthesis. This predictive capability dramatically minimizes the number of costly and time-consuming laboratory experiments required. Furthermore, AI tools are used for supply chain optimization, predicting demand fluctuations for specialized raw materials, and managing the complex inventory required for producing diverse adhesive formulations tailored for specific end-use compliance requirements (e.g., low smoke, low toxicity standards for aerospace).

- AI accelerates the discovery and design of novel, sustainable non-halogenated flame retardant chemistries.

- Machine Learning optimizes adhesive formulation composition, predicting optimal additive loading for required fire performance (e.g., UL94 V-0).

- Predictive maintenance analytics, driven by AI, monitor the long-term thermal degradation and reliability of installed adhesives in critical infrastructure.

- AI enhances manufacturing efficiency by optimizing reaction parameters (temperature, pressure, curing time) in complex polymer synthesis.

- Generative design tools assist in simulating the fire response of bonded assemblies, ensuring compliance with complex multi-layered regulatory standards.

DRO & Impact Forces Of Flame Retardant Adhesives Market

The market dynamics for flame retardant adhesives are heavily influenced by a balanced interplay of stringent regulatory demands (Drivers), high formulation complexity and cost (Restraints), and burgeoning technological shifts in end-use sectors (Opportunities). The central impact force is the ever-increasing societal demand for safety, which is translated into mandatory, complex governmental regulations governing materials used in public transport and infrastructure. These regulations effectively act as the primary, non-negotiable driver, compelling widespread adoption across all geographies, regardless of cost implications. The shift toward sustainable, non-halogenated solutions is a secondary, critical impact force, restructuring the competitive landscape and requiring significant R&D investment.

Drivers include the accelerating electrification of vehicles, necessitating sophisticated thermal runaway mitigation solutions for battery modules; the stringent fire safety requirements imposed by aerospace and rail industries (e.g., requirements for low heat release and smoke density); and the globalization of building codes requiring better fire resistance in structural components and insulation systems. Restraints are primarily centered on the high cost associated with specialty flame retardant additives and the difficulty in maintaining the base adhesive's mechanical properties (like bond strength and flexibility) while incorporating high levels of flame-suppressing fillers. Furthermore, the regulatory scrutiny concerning the potential toxicity and environmental impact of certain legacy halogenated flame retardants presents a major constraint, necessitating costly and complex reformulation efforts.

Opportunities are strongly concentrated in developing advanced, multi-functional adhesives that offer both fire resistance and enhanced thermal management properties, essential for electronics and EV applications. The development of intumescent adhesives that expand upon heating to form a robust, insulating char layer provides a compelling opportunity for applications involving composite materials. Impact forces show that the pressure to innovate will remain high, driven by the dual need for superior safety performance and environmental compliance, ensuring that premium, high-performance, non-halogenated products will command significant market share and drive revenue growth throughout the forecast period.

Segmentation Analysis

The Flame Retardant Adhesives Market is strategically segmented based on crucial dimensions, including chemistry type, flame retardant mechanism (Additive Type), end-use industry, and form. This segmentation provides a granular view of market dynamics, revealing specific growth pockets driven by technical requirements and regulatory compliance within specialized applications. The market is primarily dominated by thermoset chemistries like Epoxy and Polyurethane, valued for their superior structural integrity and high-temperature performance, though the increasing demand for flexible and low-smoke solutions is boosting the Silicones and Acrylics segments significantly.

Segmentation by additive type highlights the transition away from traditional Halogenated systems towards non-halogenated alternatives. Phosphorus-based and mineral-based systems (like Aluminum Trihydrate, ATH, and Magnesium Hydroxide, MDH) are gaining traction due to their lower toxicity profiles and effectiveness, particularly in high-volume applications like construction and automotive. The choice of segmentation is fundamentally dictated by the specific fire protection standards applicable to the end-use environment, such as the need for low heat release rates in aircraft interiors versus the need for robust structural fire stops in commercial buildings.

- By Chemistry:

- Epoxy

- Polyurethane

- Silicone

- Acrylic

- Cyanoacrylate

- Others (Phenolic, Polyimide)

- By Additive Type:

- Halogenated

- Non-Halogenated

- Phosphorus-Based

- Mineral-Based (ATH, MDH)

- Nitrogen-Based

- Intumescent Systems

- By End-Use Industry:

- Automotive & Transportation (EV Batteries, Rail, Marine)

- Aerospace

- Building & Construction (Insulation, Composites)

- Electrical & Electronics (Potting, Encapsulation)

- Others (Filtration, Textiles)

- By Form:

- Liquid

- Paste

- Film/Tape

Value Chain Analysis For Flame Retardant Adhesives Market

The value chain for the Flame Retardant Adhesives Market is complex, beginning with the sourcing of specialized raw materials, moving through sophisticated chemical synthesis, and culminating in highly regulated end-use applications. Upstream analysis involves the procurement of base polymers (e.g., Bisphenol A derivatives for epoxy, isocyanates for polyurethane) and, critically, high-performance flame retardant additives (FRAs). The quality and consistency of FRAs, particularly specialized non-halogenated compounds like microencapsulated red phosphorus or nanoscale intumescent fillers, significantly dictate the final product performance and cost. Manufacturers in the upstream segment face constant pressure to develop sustainable, cost-effective FRAs that comply with international environmental standards such as RoHS and REACH, requiring deep technical expertise in material science.

The central phase involves formulation and manufacturing, where adhesive producers blend base polymers with catalysts, curing agents, and FRAs to achieve specific fire ratings (e.g., UL94 V-0) and mechanical properties. This manufacturing process often requires specialized mixing equipment to ensure homogeneous dispersion of fillers and rigorous quality control to maintain batch consistency, which is vital for certifications in highly regulated sectors like aerospace. Distribution channels are varied, spanning both direct and indirect routes. Direct sales are common for high-volume, custom-formulated structural adhesives supplied to large OEMs in the aerospace and EV sectors, where technical support and application expertise are critical components of the transaction. The use of specialized distributors and regional agents is prevalent for smaller customers and standardized product lines used in construction and general assembly, ensuring broader market penetration and efficient logistical handling of temperature-sensitive or reactive products.

Downstream analysis focuses on end-use application processes, including automated dispensing, curing, and testing within customer facilities. The performance of these adhesives is directly verified through rigorous fire testing (e.g., cone calorimetry, smoke density tests) specific to the application environment. Potential risks in the value chain include volatility in commodity chemical pricing, geopolitical disruption affecting key raw material supply (like rare earth minerals used in some catalysts), and the continuous need to update formulations in response to tightening fire safety codes. Successful companies prioritize vertical integration or robust long-term contracts with key FRA suppliers to mitigate supply chain risk and ensure consistent access to proprietary additive technologies.

Flame Retardant Adhesives Market Potential Customers

The primary consumers and end-users of flame retardant adhesives span highly regulated, safety-critical industries that necessitate adherence to strict flammability standards. These customers are typically large Original Equipment Manufacturers (OEMs) and major contractors who integrate the adhesives into finished goods or large construction projects. Key buyers include global aerospace manufacturers (e.g., for bonding interior cabin structures, insulation, and composite elements), automotive tier suppliers focused on EV battery assembly and powertrain components, and rolling stock manufacturers for mass transit systems (trains and metros) that demand stringent fire resistance (e.g., EN 45545-2 compliance).

Beyond transportation, the building and construction sector represents a massive customer base, particularly for commercial and high-rise construction, where these adhesives are used in structural glazing, fire-stop systems, and bonding thermal insulation (e.g., cladding panels). Electrical and electronics manufacturers constitute another significant customer segment, using specialized potting and encapsulation adhesives to protect sensitive components from thermal runaway and fire spread within devices, particularly high-power servers, telecommunication equipment, and consumer electronics. These customers seek multi-functional products that not only offer fire safety but also superior dielectric properties, thermal conductivity, and mechanical resilience.

The decision-making process among these potential customers is heavily influenced by certification, long-term performance data, and supplier technical support. Buyers require extensive documentation proving compliance with multiple international and local safety standards. Therefore, the most successful suppliers are those who can provide fully certified, application-specific solutions, often working collaboratively with the customer during the design and engineering phase to ensure the adhesive system is optimized for the specific substrate and operational environment, thereby minimizing the risk of costly rework or regulatory non-compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, LORD Corporation (Parker Hannifin), Huntsman Corporation, Bostik (Arkema Group), DuPont de Nemours, Inc., Permabond LLC, Master Bond Inc., Delo Industrial Adhesives, Ashland Global Holdings Inc., Illinois Tool Works Inc. (ITW), Dow Inc., Wacker Chemie AG, Avery Dennison Corporation, Cytec Solvay Group, Aica Kogyo Co. Ltd., Mitsubishi Chemical Corporation, Chemence Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Adhesives Market Key Technology Landscape

The technological landscape of the Flame Retardant Adhesives Market is primarily defined by the continuous evolution of additive chemistry aimed at achieving superior fire performance without sacrificing mechanical properties or environmental compliance. A critical technological trend is the development of advanced intumescent systems, which are polymeric formulations containing active ingredients that, upon heating, swell and form a thick, insulating char layer. This char barrier effectively prevents heat transfer to the underlying substrate and limits the release of flammable gases. Innovations in intumescent technology focus on enhancing the char quality (density, strength, integrity) and reducing the activation temperature to ensure rapid fire mitigation, particularly crucial for lightweight composite bonding in aerospace and high-speed rail.

Another dominant technological shift involves the development and commercialization of next-generation non-halogenated flame retardants (NHFRs). While mineral fillers like Aluminum Trihydrate (ATH) and Magnesium Hydroxide (MDH) remain the volumetric staples, the market is seeing increased adoption of highly efficient phosphorus and nitrogen-based chemistries, such as phosphonates and melamine derivatives. These NHFRs operate via gas-phase or condensed-phase mechanisms at lower loading levels compared to mineral fillers, allowing formulators to maintain better flow properties and mechanical strength in the final adhesive product. Furthermore, the integration of nanotechnology, utilizing carbon nanotubes or graphene oxide as synergistic additives, is being explored to enhance both the thermal conductivity (for heat dissipation in electronics) and the flame retardancy of adhesive systems, promising multi-functional materials.

In terms of application technology, there is a substantial focus on optimizing the curing and dispensing mechanisms to support high-volume manufacturing, especially in the automotive sector. This includes the development of fast-curing, two-component epoxy and polyurethane systems that can be robotically dispensed with precision, alongside UV-curable and dual-cure systems for electronics encapsulation, offering rapid processing times while ensuring robust fire safety characteristics. The ability to bond dissimilar, highly engineered substrates (such as plastics to metals or advanced composites) while maintaining fire ratings under dynamic mechanical stress is a constant driver for technological innovation in structural flame retardant adhesives.

Regional Highlights

The global Flame Retardant Adhesives Market exhibits significant geographical variations driven by differing regulatory environments, industrial output, and technology adoption rates.

- Asia Pacific (APAC): APAC is projected to be the most rapidly expanding region, primarily led by massive investments in infrastructure development, rapid urbanization, and the region's status as a global manufacturing hub for electronics and automotive components. Countries like China, South Korea, and Japan are at the forefront of Electric Vehicle (EV) battery production, which inherently demands high volumes of specialized, thermally conductive, flame retardant adhesives for structural assembly and thermal runaway mitigation within battery packs. Increasingly strict localized fire safety codes, particularly in commercial and high-rise construction, further solidify APAC’s market dominance.

- North America: North America is a mature market characterized by stringent, standardized fire safety codes (e.g., NFPA, OSHA) that govern materials used in commercial buildings, aerospace, and defense applications. The market is defined by a preference for high-performance, specification-grade adhesives, particularly non-halogenated epoxies and silicones used in aircraft interiors (FAR 25.853 compliance) and complex electronic devices. The robust presence of major aerospace OEMs and a growing focus on sustainable building practices drive consistent demand for certified, premium products.

- Europe: Europe is characterized by comprehensive and proactive environmental and safety legislation, notably REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), which mandates the phase-out of many traditional halogenated flame retardants. This regulatory pressure fuels demand for innovative, sustainable, phosphorus and nitrogen-based NHFR adhesives. The region’s significant investments in high-speed rail (requiring EN 45545-2 compliant materials) and advanced manufacturing, particularly in Germany and France, ensure Europe remains a key market focusing on technological advancement and high-standard compliance.

- Latin America (LATAM): The LATAM market is growing steadily, primarily driven by investments in transportation infrastructure and a rising volume of construction projects, particularly in Brazil and Mexico. Market growth is often dependent on the alignment of local standards with international codes (such as NFPA and UL standards). The adoption rate is moderate, with cost-effectiveness playing a more significant role in material selection compared to North America or Europe, leading to continued demand for more cost-efficient, though compliant, adhesive systems.

- Middle East and Africa (MEA): The MEA region is witnessing growth spurred by large-scale commercial and residential construction projects, particularly in the UAE and Saudi Arabia. Demand is high for adhesives used in high-performance building cladding and insulation systems due to high climate temperatures and increasing emphasis on public safety in rapidly developing urban centers. The market is fragmented, with growth concentrated in high-capital investment sectors like oil & gas, infrastructure, and specialized fire protection systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Adhesives Market.- 3M Company

- Henkel AG & Co. KGaA

- Sika AG

- H.B. Fuller Company

- LORD Corporation (Parker Hannifin)

- Huntsman Corporation

- Bostik (Arkema Group)

- DuPont de Nemours, Inc.

- Permabond LLC

- Master Bond Inc.

- Delo Industrial Adhesives

- Ashland Global Holdings Inc.

- Illinois Tool Works Inc. (ITW)

- Dow Inc.

- Wacker Chemie AG

- Avery Dennison Corporation

- Cytec Solvay Group

- Aica Kogyo Co. Ltd.

- Mitsubishi Chemical Corporation

- Chemence Ltd.

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Adhesives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between halogenated and non-halogenated flame retardant adhesives?

Halogenated adhesives contain chlorine or bromine, which suppress fire via a gas-phase mechanism by chemically interrupting the combustion reaction. Non-halogenated adhesives (NHFRs), utilizing phosphorus, nitrogen, or minerals (like ATH), work primarily through condensed-phase mechanisms, creating a protective char layer or cooling the substrate, offering lower smoke density and reduced toxicity, aligning with current environmental regulations like REACH.

Which end-use industry drives the highest demand for flame retardant adhesives?

The Automotive and Transportation sector currently drives the highest demand, particularly due to the massive global shift toward Electric Vehicles (EVs). Flame retardant adhesives are critically required for bonding and encapsulating EV battery components to prevent thermal runaway and ensure fire containment, adhering to strict automotive safety standards.

What regulatory standards govern the use of flame retardant adhesives in North America?

Key regulatory standards in North America include UL94 (Underwriters Laboratories), which rates the flammability of plastics and component materials, and specific aerospace standards like FAR 25.853, which mandates fire resistance for aircraft interior materials. Building codes, often based on NFPA (National Fire Protection Association) criteria, also dictate material flammability in construction.

How does intumescent technology function in flame retardant adhesives?

Intumescent adhesives contain chemicals that undergo a controlled chemical reaction when exposed to heat, causing them to swell significantly and form a robust, multi-cellular carbonaceous char layer. This highly insulating char acts as a physical barrier, preventing heat transfer and blocking the release of combustible decomposition gases from the underlying material.

What role does silicone chemistry play in the Flame Retardant Adhesives Market?

Silicone-based flame retardant adhesives are highly valued for applications requiring exceptional thermal stability and flexibility, such as sealing and gasketing in high-heat areas like engine bays and battery packs. Their inherent resistance to extreme temperatures and low smoke properties make them critical for encapsulation and potting in the electronics and EV sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager