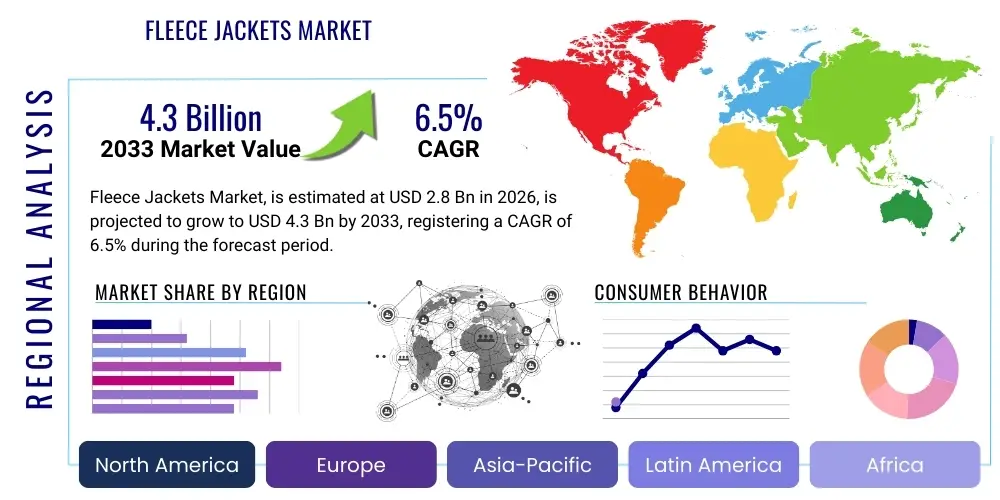

Fleece Jackets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436982 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fleece Jackets Market Size

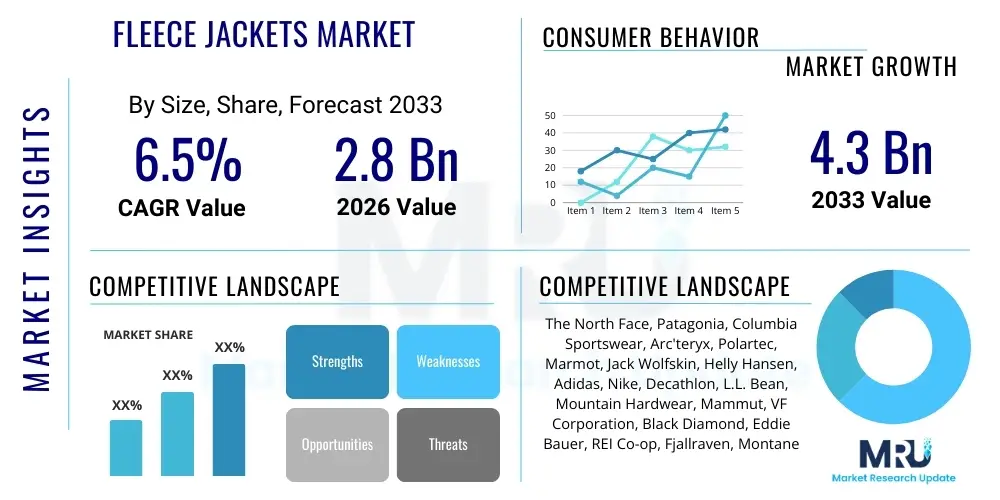

The Fleece Jackets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033.

Fleece Jackets Market introduction

The Fleece Jackets Market encompasses a wide range of insulated outerwear primarily constructed from synthetic fibers, predominantly polyethylene terephthalate (PET) fleece, renowned for its exceptional warmth-to-weight ratio, hydrophobic properties, and quick-drying characteristics. These garments are integral to layering systems across diverse climatic conditions, transitioning from technical performance apparel used in mountaineering and skiing to ubiquitous casual wear known as athleisure. The core mechanism of fleece involves trapping air within lofted synthetic fibers, providing superior insulation without the bulk associated with traditional wool or down products. Key product variants include microfleece, mid-weight fleece, and heavy-duty thermal fleece, each catering to specific temperature ranges and activity levels. The market structure is highly fragmented, featuring dominance by large outdoor apparel companies alongside specialized performance brands and fast-fashion retailers.

Major applications of fleece jackets span outdoor recreational activities, including hiking, camping, and climbing, where reliable insulation and moisture management are critical factors influencing purchasing decisions. Furthermore, fleece has found significant adoption in military and uniform applications due to its durability and ease of maintenance. The rising consumer awareness regarding sustainability has spurred innovation in material science, leading to the increased use of recycled PET bottles in manufacturing processes, significantly reducing the environmental footprint associated with virgin plastic production. This shift towards circularity, coupled with the functional benefits of fleece—such as breathability and lightweight warmth—serves as a primary market driver across all end-user segments.

The market trajectory is significantly influenced by global fashion trends, particularly the continued mainstream acceptance of functional, comfortable clothing for everyday use. Driving factors include the increasing participation rates in outdoor leisure activities globally, especially among the younger demographic, who prioritize versatility and technical performance. Additionally, technological advancements related to anti-pilling treatments, enhanced wind resistance membranes, and improved thermal efficiency without added mass are continuously improving the value proposition of modern fleece products. The persistent need for accessible, durable, and highly insulating mid-layer garments ensures sustained demand, positioning fleece jackets as a foundational element within the global apparel industry.

Fleece Jackets Market Executive Summary

The global Fleece Jackets Market demonstrates robust growth, propelled primarily by enduring trends in outdoor participation and the sustained global influence of the athleisure movement. Business trends highlight a significant shift toward Direct-to-Consumer (D2C) channels, allowing brands greater control over pricing and customer experience, alongside a pronounced emphasis on supply chain transparency and ethical sourcing. Major industry players are increasingly engaging in strategic acquisitions of specialized material science companies or smaller, sustainably-focused brands to enhance their product portfolios and meet evolving consumer expectations for eco-friendly performance wear. The increasing cost of high-quality virgin polyester and regulatory pressures regarding plastic waste are accelerating investments in chemical and mechanical recycling infrastructure, marking sustainability as a key competitive differentiator rather than merely a niche offering. Furthermore, brands are leveraging advanced digital tools, including AI-driven demand forecasting and personalized marketing campaigns, to optimize inventory levels and target specific consumer micro-segments effectively.

Regionally, the market presents a dichotomy: mature markets like North America and Western Europe are characterized by high substitution rates and a demand for premium, technically advanced, and ethically produced fleece, often integrating specialized features such as Gore-Tex Infinium or highly specialized lofted structures like those offered by brands focused on specific expedition requirements. Conversely, the Asia Pacific region, particularly China and India, represents the fastest-growing market, fueled by rapidly rising disposable incomes, urbanization, and the expanding penetration of international retail chains. This regional growth is primarily volume-driven, focusing on accessible mid-range products, although the demand for premium performance wear is also surging among the newly affluent segments embracing international outdoor sports and travel culture. Governments in various regions are also contributing to market stability through procurement of standardized fleece garments for public sector employees and military use, ensuring a baseline demand for basic, durable products.

Segmentation trends reveal a strong consumer preference for recycled and bio-based material compositions, with the Recycled Polyester Fleece segment experiencing above-average growth rates. Within the application segment, specialized technical fleece designed for mountaineering (e.g., hard-face fleece providing increased abrasion resistance) commands higher price points due to superior performance characteristics and brand equity. Distribution channels continue to evolve, with e-commerce platforms consolidating their dominance, offering vast product selection and competitive pricing, which challenges traditional brick-and-mortar sports retailers to provide enhanced experiential shopping and personalized fitting services. The mid-weight and microfleece segments remain the most volume-intensive, serving the broad casual and layering market, while luxury brands are incorporating fleece into high-fashion outerwear, further blurring the lines between technical gear and urban apparel.

AI Impact Analysis on Fleece Jackets Market

Common user inquiries concerning the impact of Artificial Intelligence (AI) on the Fleece Jackets Market primarily revolve around optimizing operational efficiency, enhancing product customization, and driving sustainable material innovation. Users frequently ask how AI can predict specific color or style trends months in advance to minimize overstocking, whether generative AI can simulate the performance characteristics of new textile blends before physical prototyping, and if AI algorithms can audit supply chains to ensure ethical sourcing of materials like recycled polyester. The key themes summarized from these concerns highlight a strong expectation that AI will fundamentally transform the industry’s response rate to consumer demand, vastly improve material and labor utilization, and provide granular transparency regarding environmental compliance and sourcing integrity. Consumers and industry stakeholders expect AI to bridge the gap between rapidly changing consumer preferences and the typically long lead times inherent in textile production.

The immediate and most tangible impact of AI is observed in supply chain management and predictive analytics. AI models analyze vast datasets encompassing historical sales, real-time climate data, social media sentiment, and macroeconomic indicators to generate highly accurate demand forecasts, particularly crucial for seasonal items like fleece jackets. This predictive capability directly influences inventory planning, helping manufacturers deploy optimal stock levels across global distribution centers and minimizing the need for drastic discounting or resource-intensive disposal of unsold inventory. Furthermore, machine learning algorithms are being employed to optimize the cutting patterns in garment manufacturing, significantly reducing fabric waste (known as ‘end-of-roll’ waste), thereby improving both cost efficiency and environmental performance.

Looking forward, AI is set to revolutionize material development and consumer interaction. Through computational material science, AI can simulate the thermal conductivity, breathability, and durability of hypothetical polymer structures, accelerating the discovery and development of next-generation sustainable fleece alternatives, such as bio-based or fully chemically recyclable materials. On the consumer side, AI-powered recommendation engines and virtual try-on technologies are enhancing the online shopping experience, ensuring customers select the correct size and style, which in turn reduces product returns—a significant logistical and environmental burden for the industry. This integration of AI creates a more responsive, efficient, and ultimately more consumer-centric market ecosystem for fleece jackets.

- AI-driven demand forecasting optimizes seasonal inventory levels and reduces manufacturing waste by up to 15%.

- Machine learning algorithms enhance quality control by identifying microscopic fabric flaws in production.

- Generative AI assists in rapid pattern design and virtual prototyping of technical features like wind resistance paneling.

- AI integration supports granular traceability, verifying the origin and processing standards of recycled PET materials.

- Personalized recommendation systems increase conversion rates and decrease return logistics costs for e-commerce retailers.

DRO & Impact Forces Of Fleece Jackets Market

The Fleece Jackets Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth trajectory, generating significant impact forces. Key drivers include the global expansion of the outdoor sports and leisure industry, catalyzed by increased health consciousness and government initiatives promoting national parks and outdoor access. The versatility of fleece as a multi-functional layering piece, adaptable across various activities from urban commuting to extreme alpine environments, provides sustained market momentum. Additionally, the proliferation of athleisure culture continues to integrate performance characteristics into everyday wear, driving demand for comfortable yet technically proficient apparel. These drivers exert a positive force, encouraging brands to invest in premium and specialized textile manufacturing.

Conversely, significant restraints pose challenges to market expansion and profitability. The primary constraint is the market's entrenched reliance on petrochemical derivatives (polyester), which creates vulnerability to volatile crude oil prices and ongoing global efforts to reduce plastic consumption. Although the industry is pivoting toward recycled materials, the cost and infrastructure required for large-scale, high-quality material recycling remain substantial barriers, particularly for smaller manufacturers. Furthermore, the market faces intense competition from substitute products, including performance wool (e.g., Merino) and advanced down alternatives, which occasionally offer superior compressibility or weight characteristics. The fast-fashion segment’s mass production of low-cost, disposable fleece products also depresses overall average selling prices (ASPs) and increases environmental scrutiny on the industry as a whole.

Opportunities for high-value growth are centered on sustainability and technological differentiation. The push towards genuinely circular product lifecycles, involving chemically recyclable polymers and bio-based fleece alternatives (e.g., derived from sugarcane or corn starch), presents a premium market opportunity. Furthermore, integrating smart textile technologies, such as embedded heating elements or biometric sensors, transforms fleece jackets into high-tech outerwear, appealing to technologically savvy consumers. The major impact forces are exerted by consumer demand for transparency and ethical production; brands failing to meet high environmental, social, and governance (ESG) standards risk significant reputational damage and market share erosion. Conversely, brands that successfully innovate in material sustainability and technical performance are positioned to command leading market positions and benefit from the willingness of discerning consumers to pay premium prices for verifiable environmental responsibility and superior functionality.

Segmentation Analysis

The Fleece Jackets Market is meticulously segmented to address the varied functional and aesthetic demands of consumers across different use cases and demographic groups. Segmentation is typically performed based on product type, material composition, end-user application, and distribution channel. Analyzing these segments provides crucial insights into price elasticity, regional preference variations, and the pace of technological adoption. The key differentiating factors often lie in the weight and loft of the fleece, which directly correlate with insulating capacity, and the finishing treatments applied, such as DWR (Durable Water Repellent) coatings or anti-static applications. Understanding these granular segments allows businesses to tailor product development, pricing strategies, and marketing efforts efficiently to capture specific niche markets, such as specialized mountaineering apparel versus general lifestyle layering.

- Product Type:

- Microfleece Jackets

- Mid-weight Fleece Jackets

- Heavy-duty Thermal Fleece Jackets

- Fleece Vests

- Fleece Hoodies

- Material Composition:

- Virgin Polyester Fleece

- Recycled Polyester (rPET) Fleece

- Bio-based/Plant-derived Fleece

- Blended Fleece (e.g., with Spandex, Wool, or Nylon)

- Performance Fleece (e.g., Polartec Power Grid, Thermal Pro)

- Application:

- Outdoor Recreation (Hiking, Camping, Skiing)

- Casual Wear/Lifestyle

- Sports and Fitness

- Tactical/Military and Uniform

- Distribution Channel:

- Offline (Specialty Retail Stores, Department Stores, Hypermarkets)

- Online (E-commerce Portals, Company Websites, Third-Party Marketplaces)

- End-User:

- Men

- Women

- Children

Value Chain Analysis For Fleece Jackets Market

The value chain of the Fleece Jackets Market commences with the Upstream Analysis, which focuses heavily on the procurement of raw materials, primarily polyester polymers or recycled PET flakes. This stage involves the chemical processing necessary to produce high-quality fibers suitable for knitting. Key activities include polymerization, spinning, and texturizing, which determine the fleece's eventual loft, anti-pilling resistance, and thermal efficiency. Strategic partnerships between apparel brands and specialized textile material scientists (e.g., DuPont, Polartec licensees) are crucial at this stage to ensure consistent quality and drive sustainable material substitution, particularly the integration of complex chemical recycling processes which require significant capital investment and technical expertise.

The Midstream processes constitute the core manufacturing phase, involving knitting or weaving the fabric, followed by intensive finishing treatments. Finishing is critical; it includes brushing the fabric surface to create the characteristic soft pile, shearing, and applying performance enhancements such as DWR, windproof lamination, or moisture-wicking agents. Assembly, cutting, and stitching follow, often taking place in centralized manufacturing hubs in Southeast Asia due to favorable labor costs and established supply ecosystems. Quality control throughout this stage is paramount, as variations in brushing technique directly impact the fleece’s thermal retention and comfort, distinguishing premium technical fleece from mass-market variants.

The Downstream analysis involves the distribution channel, which is characterized by a mix of direct and indirect selling models. Indirect distribution relies on wholesalers, specialized outdoor goods retailers (e.g., REI, Decathlon), and large department store chains. Direct distribution, increasingly favored by major brands, utilizes proprietary e-commerce platforms and flagship retail stores, enabling higher margins, better inventory control, and direct access to consumer data. The choice of channel significantly impacts brand perception; high-end technical fleece often relies on specialty retailers who provide expert product knowledge, while high-volume casual fleece is dominated by online marketplaces offering pricing competitiveness and convenience, completing the value cycle from raw polymer to the final consumer garment.

Fleece Jackets Market Potential Customers

The Fleece Jackets Market targets a diverse and expansive customer base, categorized primarily by their end-user application and purchasing motivations. The most significant segment comprises Outdoor Enthusiasts and Technical Users, including mountaineers, hikers, skiers, and campers, who require fleece jackets as essential components of their layering system. These buyers prioritize technical specifications such as high loft, breathability, quick drying capabilities, and packability. They are often brand-loyal and willing to pay premium prices for innovations from recognized performance brands that guarantee durability and reliability in extreme conditions, focusing heavily on certifications and specialized fabric technologies like Polartec Power Dry or high-density grids designed for specific thermal mapping.

A second major segment is the Casual and Athleisure Consumer, representing the largest volume demand. These customers utilize fleece jackets for everyday comfort, light activity, and urban commuting. Their purchase decisions are typically influenced by factors like style, color, perceived softness, and affordability. This segment drives the growth of microfleece and fleece hoodies sold through general retailers, e-commerce giants, and fast-fashion outlets. The emphasis here shifts from extreme technical performance to general utility, aesthetic appeal, and perceived value. The widespread adoption of remote work and the sustained casualization of workplace attire further reinforces the demand from this large demographic.

Additionally, Institutional Buyers and Uniform Sectors constitute a stable base of potential customers. This includes military forces, law enforcement agencies, emergency medical services, and large corporations that procure bulk orders of standardized, durable fleece jackets as part of their employee or personnel uniform requirements. For these institutional customers, factors such as flame resistance (in specialized applications), conformity to specific color codes (e.g., tactical black, olive green), and long-term durability are prioritized over fashion trends. The procurement process in this segment is often characterized by long-term contracts and adherence to strict performance and safety standards, providing predictable revenue streams for specialized manufacturers capable of meeting large-scale technical specifications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The North Face, Patagonia, Columbia Sportswear, Arc'teryx, Polartec, Marmot, Jack Wolfskin, Helly Hansen, Adidas, Nike, Decathlon, L.L. Bean, Mountain Hardwear, Mammut, VF Corporation, Black Diamond, Eddie Bauer, REI Co-op, Fjallraven, Montane |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fleece Jackets Market Key Technology Landscape

The technological landscape of the Fleece Jackets Market is dominated by material science innovations aimed at enhancing thermal efficiency, reducing environmental impact, and improving durability. Core technology providers, such as Polartec, specialize in proprietary fabric constructions, including grid fleece technology (e.g., Power Grid), which minimizes fabric mass while maximizing warmth through strategically placed lofted zones that promote efficient air circulation and moisture wicking. Recent advances focus on 'hard-face' technology, where the exterior of the fleece is treated or laminated to increase abrasion resistance, making the fabric suitable for wearing under heavy backpacks without pilling or premature wear, effectively bridging the gap between soft fleece and hard-shell performance.

Furthermore, significant technological resources are being dedicated to achieving true material circularity. This involves investment in advanced chemical recycling infrastructure capable of depolymerizing used polyester fleece garments back into their original monomer building blocks, which can then be repolymerized into new, high-quality fleece fiber without degradation in performance—a critical improvement over traditional mechanical recycling, which often results in lower-grade fiber. Manufacturers are also exploring the use of Tencel (lyocell) and other wood-pulp-based fibers blended with polyester to introduce biodegradability components and enhance natural moisture management properties, providing a pathway to hybrid sustainable materials that reduce dependency on petroleum-based input.

Beyond material composition, manufacturing technologies play a vital role. Techniques such as ultrasonic welding and seamless knitting are replacing traditional stitching in certain premium segments, resulting in lighter garments with reduced bulk and minimal points of potential abrasion or failure, which is crucial for technical users. The application of sophisticated anti-pilling and anti-static finishes remains a standard technological requirement, ensuring the jacket maintains its aesthetic and functional integrity over a long product lifespan. Moreover, the integration of Phase Change Materials (PCMs) into fleece fibers, although still nascent, represents a high-potential frontier, allowing the fabric to dynamically regulate the wearer's temperature by absorbing, storing, and releasing heat based on microclimatic changes, moving fleece from a passive insulator to an active thermal regulator.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, innovation, and distribution of fleece jackets globally, influenced by climate, disposable income, and prevailing outdoor culture. North America holds a dominant market share, characterized by a large, established outdoor recreation industry and high consumer awareness regarding technical apparel. Brands here prioritize high-end performance fleece and sustainable sourcing, driven by consumer demand for premium, multi-functional items. The US market, in particular, exhibits high purchasing power and a culture deeply integrated with hiking, skiing, and camping, necessitating specialized gear. Furthermore, the strong presence of military and institutional buyers ensures stable demand for standardized tactical fleece variants, reinforcing the region's market value.

Europe represents a technologically sophisticated market, focused intensely on material innovation and sustainability regulation. European consumers, particularly in Scandinavian countries and Germany, demand fleece products manufactured under rigorous environmental and ethical standards, driving rapid adoption of recycled and bio-based materials. The market is split between technical outdoor wear (driven by the Alps and Nordic environments) and fashion-forward casual wear. Regulatory frameworks, such as EU directives targeting microplastic shedding, are compelling manufacturers to invest heavily in advanced textile finishing technologies and filtration systems to preemptively address future environmental legislation.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, primarily attributed to the expanding middle class, increasing discretionary spending on leisure activities, and the rapid development of retail infrastructure in countries like China, India, and South Korea. While the demand for affordable, mid-range fleece drives volume, there is a burgeoning segment of affluent consumers adopting premium Western outdoor brands for mountaineering and high-altitude travel. Urbanization also fuels demand for stylish, comfortable outerwear suitable for cold urban climates. Investment in localized manufacturing capabilities within APAC is rapidly expanding, making the region crucial for both consumption and global supply.

- North America: Dominant market for premium technical fleece and institutional procurement; high focus on brand loyalty and integrated performance features.

- Europe: Leader in sustainable material adoption and compliance with stringent environmental regulations; strong demand for ethically sourced and highly technical garments.

- Asia Pacific (APAC): Fastest-growing region, driven by urbanization and rising middle-class disposable income; key manufacturing hub and emerging market for international outdoor brands.

- Latin America (LATAM): Emerging market with localized growth opportunities in countries with significant mountain ranges (e.g., Chile, Argentina); price sensitivity is higher, favoring value-oriented options.

- Middle East and Africa (MEA): Niche market focusing on specialized gear for cold desert climates or high-altitude travel; significant institutional demand from military and oil/gas sectors operating in varied climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fleece Jackets Market.- The North Face (VF Corporation)

- Patagonia Inc.

- Columbia Sportswear Company

- Arc'teryx (Amer Sports)

- Polartec LLC

- Marmot (Newell Brands)

- Jack Wolfskin

- Helly Hansen

- Adidas AG

- Nike Inc.

- Decathlon Group

- L.L. Bean

- Mountain Hardwear

- Mammut Sports Group AG

- VF Corporation (Others Brands)

- Black Diamond Equipment

- Eddie Bauer

- REI Co-op

- Fjallraven (Fenix Outdoor)

- Montane

Frequently Asked Questions

Analyze common user questions about the Fleece Jackets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary material used in modern high-performance fleece jackets?

The primary material is specialized polyester, often derived from recycled polyethylene terephthalate (rPET), engineered into high-loft, lightweight fibers that excel at trapping heat while efficiently wicking moisture away from the body, enhancing thermal regulation during physical activity.

How are sustainable fleece options changing the market dynamics?

Sustainable fleece, including 100% recycled polyester and emerging bio-based polymers (plant-derived), is rapidly becoming a key competitive differentiator, satisfying increasing consumer demand for eco-friendly apparel and reducing the industry's reliance on virgin petrochemical resources.

What is the difference between microfleece and heavy-duty thermal fleece?

Microfleece is extremely lightweight and thin, designed primarily for mild insulation or as a base layer, emphasizing comfort and minimal bulk. Heavy-duty thermal fleece features a higher density and loft, offering maximum insulation for extreme cold weather use, often including wind-resistant treatments.

Which geographical region exhibits the fastest growth rate for fleece jacket consumption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, propelled by rapid urbanization, increasing disposable incomes, and the growing adoption of Western-style outdoor recreation and athleisure clothing across major economies like China and India.

What technological advancements are enhancing the durability of fleece jackets?

Key durability advancements include advanced anti-pilling treatments applied during finishing, and the development of hard-face fleece technologies that integrate highly abrasion-resistant exterior surfaces to prevent wear and tear, significantly extending the garment's lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager