Fluorine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433429 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Fluorine Market Size

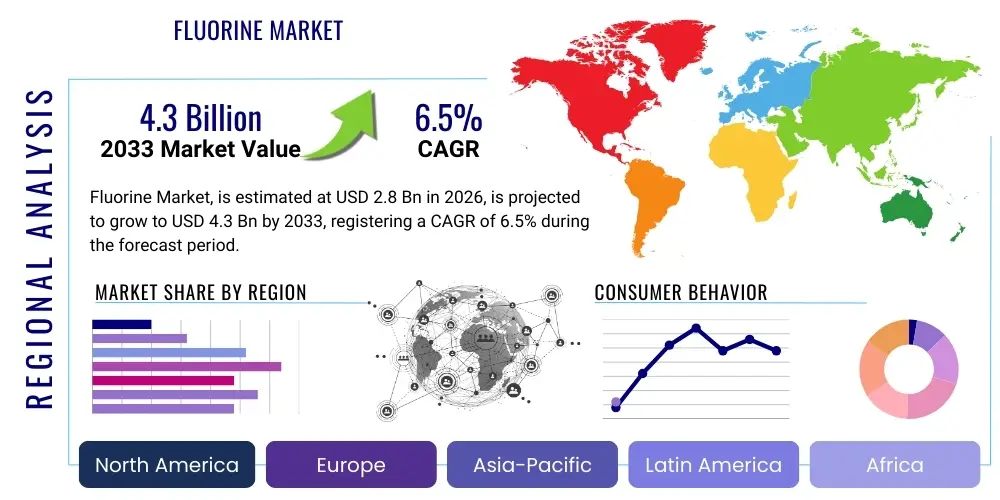

The Fluorine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.3 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for fluoropolymers and specialized fluorochemicals utilized extensively in high-growth sectors such as semiconductors, electric vehicles (EVs), and advanced healthcare technologies. The increasing stringency of environmental regulations, particularly regarding the phase-down of older, high-Global Warming Potential (GWP) hydrofluorocarbons (HFCs), simultaneously necessitates substantial investment in new, low-GWP fluorine-based solutions, thereby fueling market value growth across all major geographies.

Market valuation reflects the critical role fluorine and its derivatives play as essential intermediaries in multiple industrial syntheses, ranging from aluminum smelting to pharmaceutical active ingredient production. The continuous shift towards miniaturization in electronics and the requirement for highly durable, chemically resistant materials in harsh industrial environments further solidify the indispensable nature of fluorine compounds. Furthermore, geopolitical shifts influencing supply chain resilience, especially concerning key raw material sources like fluorspar, are increasingly factored into market dynamics, prompting strategic vertical integration among major market participants to secure long-term operational stability and maintain competitive pricing strategies within this highly specialized commodity market.

Fluorine Market introduction

The Fluorine Market encompasses the production, distribution, and consumption of elemental fluorine (F₂) and its vast array of derivatives, known collectively as fluorochemicals, which are essential building blocks for modern industrial applications. Elemental fluorine, a highly reactive halogen, is primarily produced via the electrolysis of potassium bifluoride (KHF₂) dissolved in anhydrous hydrofluoric acid (HF). The resultant fluorochemicals range from simple inorganic compounds like hydrofluoric acid (HF) and sulfur hexafluoride (SF₆) to complex organic fluoropolymers and specialized gases. These products are critical for enabling technologies that require exceptional thermal stability, chemical inertness, low friction, and non-stick properties, characteristics uniquely conferred by the fluorine atom’s strong electronegativity and small atomic size.

Major applications of fluorine derivatives span across diverse high-value industries. In refrigeration and air conditioning, fluorine is integral to the production of refrigerants (HFCs, HFOs), though this segment is undergoing a rapid transition toward environmentally benign alternatives. In metallurgy, hydrogen fluoride is vital for the production of aluminum and uranium. Perhaps the most prominent applications lie in advanced materials, where fluoropolymers like PTFE (Polytetrafluoroethylene), FEP (Fluorinated Ethylene Propylene), and PVDF (Polyvinylidene Fluoride) are used in aerospace components, chemical processing equipment, and electrical insulation. The pharmaceutical and agrochemical industries also heavily rely on fluorination processes, as incorporating fluorine atoms can dramatically improve the efficacy, selectivity, and metabolic stability of drug molecules, accounting for a significant percentage of blockbuster drugs containing fluorine.

Driving factors for sustained market expansion include the exponential growth in the demand for Electric Vehicle (EV) batteries, which utilize high-performance fluoropolymers and lithium salts (like LiPF₆) as essential components in electrolytes and separators to ensure safety and longevity. Additionally, the semiconductor manufacturing industry, demanding ultra-pure etching and cleaning gases such as Nitrogen Trifluoride (NF₃) and Sulfur Hexafluoride (SF₆), continues its robust expansion globally, directly correlating with increased fluorine consumption. Regulatory mandates enforcing the transition to low-GWP refrigerants (Hydrofluoroolefins or HFOs) represent another powerful driver, compelling chemical producers to invest heavily in new generation fluorine derivatives, solidifying the market's trajectory towards sustainable, high-performance applications.

Fluorine Market Executive Summary

The global Fluorine Market is currently defined by a duality: simultaneous innovation driven by regulatory mandates and significant volatility stemming from raw material constraints and geopolitical trade tensions. Business trends indicate a robust strategic shift among major manufacturers towards vertical integration, securing control over the upstream supply of fluorspar, which is currently concentrated in limited geographical areas, primarily China and Mexico. This integration strategy is designed to mitigate price fluctuations and ensure stable production capacity for high-margin derivatives like HFO refrigerants and specialized fluoropolymers crucial for next-generation technologies. Furthermore, corporate strategies emphasize portfolio diversification, moving away from legacy, environmentally constrained products (like older HFCs) and focusing R&D expenditure on high-purity fluorine gases and novel fluorinated materials specifically tailored for high-temperature fuel cells and advanced medical devices.

Regional trends highlight Asia Pacific (APAC), particularly China, Japan, and South Korea, as the dominant force in both production capacity and consumption demand, largely attributable to the concentrated presence of semiconductor manufacturing, electronics assembly, and the rapidly scaling EV battery ecosystem in the region. North America and Europe, while being mature markets, are leading in the technological transition toward low-GWP alternatives and are characterized by stringent environmental oversight that necessitates continuous innovation in fluorine handling and waste management. Investment in new fluorine chemical production facilities is heavily concentrated in APAC to support the regional supply chains, while Western markets focus on high-barrier specialized production and recycling technologies to improve material circularity and reduce reliance on imported fluorspar.

Segment trends reveal that the fluoropolymers segment remains the fastest-growing and most valuable component of the market, driven by its indispensable role in electronics, corrosion protection, and construction. However, the fluorocarbon segment is experiencing the most significant disruptive change, rapidly pivoting from HFCs to HFOs, marking a massive investment cycle in proprietary technology and manufacturing scale-up. The specialty chemicals segment, including pharmaceutical intermediates and agrochemicals, exhibits stable, high-margin growth, insulated partially from commodity price fluctuations due to the intellectual property surrounding end products. Overall, the market is shifting from bulk commodity production towards highly specialized, performance-driven fluorine chemistry, demanding higher levels of purity and tailored solutions for niche applications.

AI Impact Analysis on Fluorine Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fluorine Market predominantly center on optimizing complex chemical synthesis processes, predicting material performance under extreme conditions, and enhancing supply chain resilience through predictive analytics. Key concerns revolve around how AI can accelerate the discovery of new, sustainable fluorinated compounds (especially low-GWP alternatives) and how machine learning (ML) models can be applied to manage the inherent safety risks associated with handling highly reactive fluorine and its precursors like hydrofluoric acid. Users are particularly interested in AI's role in computational chemistry to screen potential fluorinated drug candidates and optimize reaction parameters, thereby reducing the time and cost associated with experimental R&D in this specialized field. Expectations are high that AI will transform production efficiency, enabling real-time fault detection and predictive maintenance across highly capital-intensive fluorine production facilities, ultimately improving product yield and consistency for high-purity applications like electronics gases.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failure in reactors and handling systems, minimizing downtime in highly corrosive environments typical of fluorine production facilities.

- Accelerated Material Discovery: Employing computational chemistry and AI screening to rapidly identify and optimize novel fluorinated compounds (e.g., new HFO refrigerants, advanced battery electrolytes) with superior performance and reduced environmental impact.

- Supply Chain Optimization: Using generative models and predictive analytics to manage the volatile supply of fluorspar and hydrofluoric acid, ensuring raw material availability and mitigating trade-related risks.

- Process Control Enhancement: Implementing AI-based control systems for real-time monitoring and adjustment of complex, multi-stage fluorination reactions to maintain ultra-high purity required for semiconductor and pharmaceutical applications.

- Safety and Risk Management: Deploying computer vision and advanced analytics to monitor safety protocols, detect leaks, and simulate hazardous event responses in high-risk fluorine handling areas.

- Quality Assurance Automation: Automated spectral analysis and quality checks using machine learning to verify the high purity standards of specialized fluorine gases and fluoropolymers before shipment to sensitive end-users.

DRO & Impact Forces Of Fluorine Market

The Fluorine Market is primarily propelled by persistent demand from the high-technology sectors (Drivers), yet is simultaneously constrained by dependency on a concentrated raw material supply and stringent safety regulations (Restraints). Opportunities emerge mainly through the accelerating global transition to green energy and mandatory environmental regulations, which necessitate new fluorine-based solutions (Opportunities). These dynamics collectively exert substantial pressure on market participants, driving competitive strategies and shaping long-term investment priorities (Impact Forces). The balance between mandated phase-outs of legacy products and the R&D intensity required to develop next-generation fluorochemicals dictates the competitive landscape and market entry barriers, emphasizing technological leadership as a key differentiator.

Key drivers include the massive scale-up of the semiconductor industry, demanding specialty fluorine gases for etching and deposition, coupled with the irreversible adoption of electric vehicles, which fundamentally require fluorinated materials for critical battery components such as binders, separators, and LiPF₆ electrolytes. The pharmaceutical industry's reliance on fluorination to enhance drug efficacy ensures a stable, high-value demand stream. However, the market faces significant restraints, principally the limited global availability of high-grade fluorspar (CaF₂) and the complex, energy-intensive processes required for conversion into hydrofluoric acid (HF). Furthermore, the substantial capital required for constructing and maintaining safe, compliant fluorine handling facilities, combined with high energy consumption during electrolysis, constitutes a significant barrier to entry, consolidating market power among established players.

Significant opportunities lie in the development and commercialization of Hydrofluoroolefins (HFOs) and other ultra-low GWP refrigerants, driven by global climate agreements like the Kigali Amendment, necessitating complete market transformation within the next decade. Another promising area is the application of advanced fluoropolymers in high-temperature environments, such as fuel cells and aerospace applications, where standard materials fail. Impact forces are currently dominated by regulatory shifts, particularly in the EU and North America, dictating phase-down timelines for greenhouse gases, forcing manufacturers to rapidly innovate and retrofit existing facilities or develop entirely new synthesis routes. Geopolitical instability impacting the raw material supply chain also serves as a critical impact force, prompting companies to actively seek diversification of fluorspar sources and invest in fluorine recycling technologies to enhance circularity and reduce primary resource dependency.

Segmentation Analysis

The Fluorine Market is comprehensively segmented based on product type, application, and end-use industry, reflecting the diverse and specialized nature of fluorine chemistry. This segmentation is crucial for understanding market dynamics, as each derivative type serves distinct industries with varying growth rates and regulatory exposures. The primary product categories—inorganic fluorides, fluorocarbons, and fluoropolymers—exhibit contrasting maturity levels and growth trajectories. Fluoropolymers, known for their high performance and durability, drive the high-end specialty market, while the fluorocarbon segment faces continuous structural change due to global environmental policies impacting refrigerants and foam blowing agents. Analyzing these segments provides strategic insights into investment opportunities and areas facing potential disruption or regulatory obsolescence.

- By Derivative Type:

- Inorganic Fluorides (e.g., HF, SF₆, AlF₃, NF₃)

- Fluorocarbons (e.g., HFCs, HCFCs, HFOs)

- Fluoropolymers (e.g., PTFE, PVDF, FEP, FKM)

- Specialty Fluorochemicals (e.g., fluorinated intermediates for pharma/agro, ionic liquids)

- By Application:

- Refrigeration and Air Conditioning

- Aluminum Production (Metallurgy)

- Chemical Processing and Industrial Use

- Semiconductors and Electronics

- Pharmaceutical and Agrochemicals

- Automotive and Transportation (including EV batteries)

- Construction and Architecture

- By End-Use Industry:

- Automotive & Aerospace

- Chemical Manufacturing

- Electrical & Electronics

- Healthcare and Life Sciences

- Energy and Power Generation

Value Chain Analysis For Fluorine Market

The Fluorine Market value chain is inherently complex and resource-intensive, starting from the extraction of fluorspar (calcium fluoride, CaF₂) in the upstream segment. This initial phase is highly concentrated geographically, with mining operations demanding significant geological expertise and regulatory compliance, particularly in environmental stewardship. The transformation of fluorspar into Acid-Grade Fluorspar (ADF) and subsequent reaction with sulfuric acid to produce anhydrous hydrofluoric acid (HF) forms the foundational chemical step. The upstream control over high-quality fluorspar reserves provides immense strategic leverage, defining cost structures and market accessibility for downstream players. Ensuring a secure, ethical, and sustainable sourcing strategy at this stage is paramount for maintaining long-term profitability and supply stability throughout the entire fluorine ecosystem.

The midstream process involves the synthesis and processing of intermediate fluorine chemicals using HF as the primary building block. This stage is characterized by high technological complexity and significant safety requirements, as HF is highly corrosive and toxic. Midstream activities include the conversion of HF into various inorganic fluorides (like cryolite for aluminum smelting or NF₃ for electronics) and the complex organic synthesis required to produce monomers for fluoropolymers and various fluorocarbon derivatives. Efficiency in catalysis, reaction engineering, and strict purification protocols are essential in this phase, particularly for applications like semiconductors, where impurities are measured in parts per billion. The competitiveness of midstream players hinges on proprietary technology, optimized process flow, and economies of scale achievable through large, integrated chemical complexes.

The downstream segment encompasses the formulation, compounding, distribution, and end-use application of finished fluorine products. Distribution channels are highly specialized; for bulk commodity chemicals (like refrigerants), a global network of distributors and wholesalers is used, often involving specialized logistics for pressurized gases or hazardous liquids. For high-performance fluoropolymers and specialty pharmaceutical intermediates, direct engagement with end-user manufacturers is common, often involving technical support and customized material formulations. Indirect channels play a role in supplying smaller processors and regional markets. The final value creation is realized at the end-user stage (e.g., EV manufacturers, pharmaceutical companies) where the unique properties of fluorine compounds translate directly into product performance, safety, and durability, thus validating the high value addition across the chain.

Fluorine Market Potential Customers

The primary customers for fluorine and its derivatives are large industrial enterprises operating in sectors requiring exceptional material performance, thermal stability, and chemical inertness. These potential buyers are categorized by their need for high-specification products, ranging from essential processing aids to critical components. Key customer segments include chemical companies (buying HF as a feedstock), semiconductor manufacturers (purchasing ultra-high purity etching gases), and global automotive OEMs and their battery suppliers (requiring specialized fluoropolymers and electrolytes). The purchasing decisions in these sectors are rarely based solely on price but are heavily weighted by product purity, regulatory compliance (especially GWP values), consistent supply reliability, and demonstrated technical performance in extreme operating environments.

Furthermore, significant demand originates from the construction sector, utilizing fluoropolymers in architectural membranes, high-performance coatings, and cable insulation due to their exceptional weatherability and fire resistance. The healthcare and life sciences sectors represent a stable, high-margin customer base, purchasing fluorinated intermediates for drug synthesis and specialized fluorinated liquids used in medical diagnostics and surgical applications. These customers are characterized by extremely rigorous qualification procedures and long-term supply contracts, prioritizing compliance with Good Manufacturing Practice (GMP) and supply chain transparency above all other factors, reflecting the critical nature of these materials in life-saving products.

The evolving customer landscape is increasingly focused on sustainability. Potential customers are now prioritizing suppliers who can demonstrate reduced carbon footprints, offer products derived from recycled fluorine materials, or provide substitutes that comply with the strictest environmental directives (e.g., the transition from sulfur hexafluoride (SF₆) in switchgear to greener alternatives). This shift means that chemical procurement teams are integrating environmental, social, and governance (ESG) metrics into their supplier selection criteria, thereby making sustainability performance a new, critical determinant of supplier-customer relationships across the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chemours Company, Solvay S.A., 3M Company, Daikin Industries Ltd., Honeywell International Inc., Arkema S.A., Gujarat Fluorochemicals Limited (GFL), Halocarbon Products Corporation, Kanto Denka Kogyo Co., Ltd., Linde plc, Air Products and Chemicals Inc., Dongyue Group, Sinochem Lantian Co., Ltd., Central Glass Co., Ltd., SRF Limited, Asahi Glass Co. (AGC), Air Liquide S.A., Mexichem (Orbia), Mitsubishi Chemical Corporation, Jiangsu Sanmei Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorine Market Key Technology Landscape

The technological landscape of the Fluorine Market is defined by the necessity for safe, efficient, and environmentally compliant synthesis methods. A cornerstone technology remains the electrolysis of KHF₂ in anhydrous HF for generating elemental fluorine, a process demanding precise temperature control and highly corrosion-resistant materials (e.g., Monel) due to the extreme reactivity of F₂. Significant technological advancements are being made in process safety engineering and automation to minimize human exposure and ensure operational integrity. Crucially, the industry is investing heavily in continuous flow reactors and microreactor technology for small-scale, high-purity fluorine handling, particularly in the synthesis of complex pharmaceutical intermediates, where precise control over highly selective fluorination reactions (like electrophilic and nucleophilic fluorination) is essential to maximize yield and purity.

Another dominant technological trend involves the development of proprietary catalytic systems for HFO production. Unlike previous generations of fluorocarbons, HFO synthesis requires highly efficient and selective catalysts to achieve the desired double-bond structure, which is crucial for reducing Global Warming Potential (GWP) to near-zero levels. Leading companies are protecting intellectual property related to these catalysts and the specialized reaction conditions necessary for large-scale, cost-effective HFO manufacturing. Furthermore, in the fluoropolymer sector, technological focus is shifting toward polymerization techniques that allow for tighter control over molecular weight distribution and functionalization, enabling the creation of ultra-thin films and highly durable composites essential for semiconductor fabrication and aerospace applications, often requiring specialized emulsion polymerization processes.

Sustainability-focused technological innovation, driven by AEO and GEO principles, is increasingly critical. This includes the development of robust fluorine capture and recycling technologies, particularly for specialty gases used in electronics (e.g., recovery and purification of NF₃ and SF₆ from abatement systems) and the recycling of used fluoropolymers from end-of-life products like industrial coatings and wiring. Novel separation technologies, such as advanced membranes and adsorption techniques, are also being explored to purify hydrofluoric acid streams and recover valuable fluorine content from industrial waste streams. These technologies not only address regulatory pressures but also provide a strategic alternative to fluctuating fluorspar commodity prices, securing resource independence for high-volume manufacturers and enhancing the market’s overall circular economy profile.

Regional Highlights

The consumption and production landscape of the Fluorine Market is geographically stratified, with distinct regional dynamics driven by local industrial concentration, regulatory frameworks, and access to raw materials. Asia Pacific (APAC) stands as the undeniable leader in both consumption volume and manufacturing capacity, primarily due to the centralization of global electronics, semiconductor, and EV battery supply chains within countries like China, South Korea, and Japan. This region dictates global pricing and supply stability for many fluorine derivatives, particularly those essential for high-tech manufacturing. Europe and North America, while having mature production capabilities, are focusing intensely on R&D, implementing the most stringent environmental regulations (such as the EU F-Gas Regulation), and driving the technological shift towards low-GWP products like HFOs. Latin America and MEA remain primarily net importers of refined fluorine products, though certain MEA nations play a vital role in aluminum production, requiring significant quantities of aluminum fluoride and synthetic cryolite.

- Asia Pacific (APAC): Dominates market growth fueled by the rapid expansion of EV battery manufacturing and massive investment in semiconductor fabrication plants (Fabs). China is the largest consumer and producer of both fluorspar and refined fluorochemicals.

- North America: Characterized by high-value specialty chemical production, robust R&D in pharmaceuticals and aerospace materials, and a mandatory regulatory transition away from high-GWP HFCs under domestic climate policies.

- Europe: A highly regulated market where the EU F-Gas regulation dictates rapid adoption of HFOs. Strong focus on fluoropolymer use in infrastructure, construction, and high-performance automotive components.

- Latin America: Important consumer for refrigerant gases in cooling applications and a source for fluorspar (Mexico), providing critical upstream supply to global markets, often facing logistical challenges for export.

- Middle East and Africa (MEA): Growth driven by infrastructure projects, air conditioning demand, and large-scale primary aluminum smelting operations, requiring steady imports of aluminum fluoride.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorine Market.- Chemours Company

- Solvay S.A.

- 3M Company

- Daikin Industries Ltd.

- Honeywell International Inc.

- Arkema S.A.

- Gujarat Fluorochemicals Limited (GFL)

- Halocarbon Products Corporation

- Kanto Denka Kogyo Co., Ltd.

- Linde plc

- Air Products and Chemicals Inc.

- Dongyue Group

- Sinochem Lantian Co., Ltd.

- Central Glass Co., Ltd.

- SRF Limited

- Asahi Glass Co. (AGC)

- Air Liquide S.A.

- Mexichem (Orbia)

- Mitsubishi Chemical Corporation

- Jiangsu Sanmei Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fluorine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major regulatory factors are influencing the shift in fluorocarbon demand?

The primary influence is the Kigali Amendment to the Montreal Protocol and regional legislation like the EU F-Gas Regulation. These agreements mandate a phasedown of high-Global Warming Potential (GWP) hydrofluorocarbons (HFCs), accelerating demand for ultra-low GWP alternatives such as Hydrofluoroolefins (HFOs) across refrigeration and air conditioning sectors globally.

How does the Fluorspar supply chain affect the global Fluorine Market?

Fluorspar (CaF₂) is the critical upstream raw material, and its supply is geographically concentrated, primarily in China, Mexico, and Vietnam. Any geopolitical tension, trade restriction, or depletion of high-grade reserves can cause significant volatility in the price of anhydrous hydrofluoric acid (HF) and subsequently impact the production costs of all downstream fluorochemicals and fluoropolymers.

What role do fluoropolymers play in the growth of the Electric Vehicle (EV) industry?

Fluoropolymers like PVDF and PTFE are essential for EV battery components. They are used as binders and separators due to their superior chemical resistance, thermal stability, and electrochemical performance. Furthermore, fluorinated salts like LiPF₆ are critical components of non-aqueous battery electrolytes, making fluorinated materials indispensable for high-performance and safe EV batteries.

Which segments exhibit the highest growth potential in the Fluorine Market?

The highest growth potential is concentrated in the specialized applications segment, specifically specialty fluorine gases for semiconductor etching (e.g., NF₃) and high-performance fluoropolymers used in aerospace, medical devices, and clean energy infrastructure (e.g., fuel cells). The shift towards HFOs also represents a high-growth transitional market segment.

What technological advancements are crucial for the sustainability of fluorine chemistry?

Crucial technological advancements involve developing catalytic processes for low-GWP HFOs, enhancing fluorine recycling and recovery techniques for industrial waste streams (especially electronics gases), and improving the safety and efficiency of elemental fluorine handling through advanced automation and continuous flow chemistry methods to reduce environmental footprint and operational risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fluorine Aromatic PI Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nitrogen Trifluoride(Nf3) And Fluorine Gas(F2) Market Size Report By Type (Chemical Synthesis, Electrolyzing Synthesis), By Application (Semiconductor Chips, Flat Panel Displays, Solar Cells, Uranium Enrichment, Sulfur Hexafluoride, Electronic Cleaning), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Fluorine Aromatic Pi Film Market Size Report By Type (25m), By Application (Flexible Display Substrates, Solar Cell, Flexible Printed Circuit Boards, Aerospace), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fluorine Gas (F2) Market Statistics 2025 Analysis By Application (Electronics Industry, Solar Cells, Chemicals Production), By Type (Industrial Grade Fluorine, Electronic Grade Fluorine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fluorine Market Statistics 2025 Analysis By Application (Electronics Industry, Solar Cells, Chemicals Production), By Type (Industrial Grade Fluorine, Electronic Grade Fluorine), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager