Food Storage Containers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440102 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Food Storage Containers Market Size

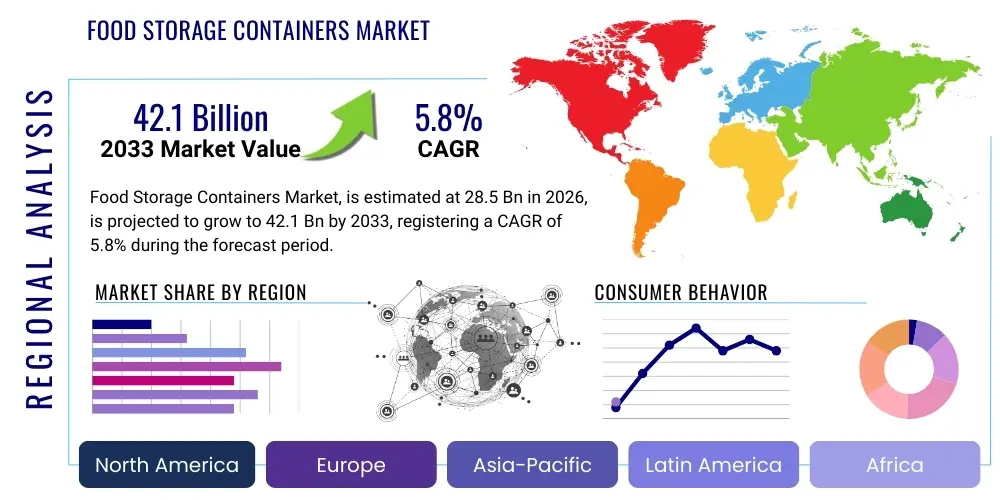

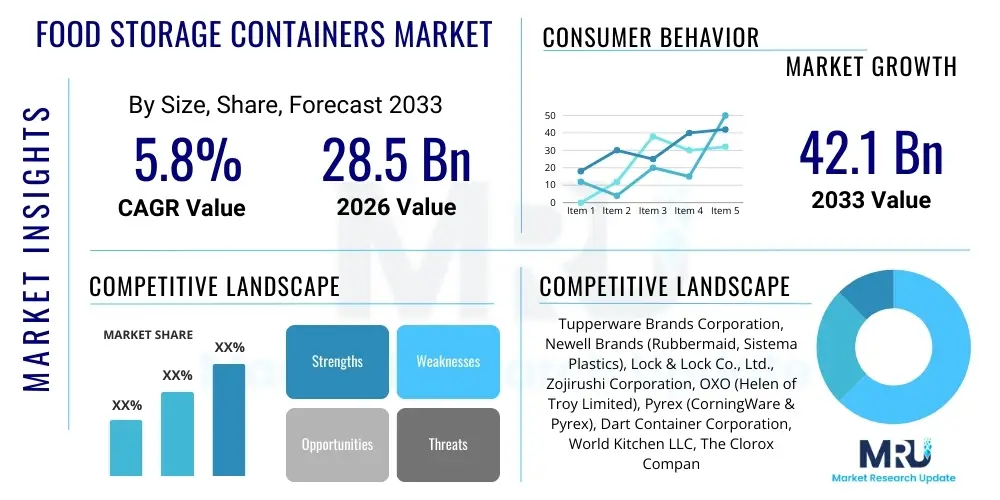

The Food Storage Containers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 42.1 Billion by the end of the forecast period in 2033.

Food Storage Containers Market introduction

The global Food Storage Containers market encompasses a vast and essential category of products designed for the hygienic, safe, and efficient preservation of food items across various environments. These products range from basic airtight containers to advanced vacuum-sealing systems, serving critical functions in extending the shelf life of raw ingredients, cooked meals, and prepared foods. Their primary role involves safeguarding food from contaminants, moisture, and air, preventing spoilage, maintaining nutritional value, and preserving freshness. This market's comprehensive product offering significantly contributes to minimizing food waste at consumer and commercial levels, improving overall food safety standards, and facilitating organized storage solutions in both household and professional kitchens. The continuous evolution of materials and designs ensures that containers meet specific demands for durability, ease of use, and aesthetic appeal.

The applications of food storage containers are incredibly diverse, permeating residential, commercial, and institutional sectors. Within residential settings, these containers are indispensable for daily meal preparation, batch cooking, safe storage of leftovers, packing lunches for work or school, and maintaining an organized pantry or refrigerator. For the commercial sector, including restaurants, cafes, catering services, and food manufacturers, containers are vital for inventory, pre-preparation, and compliance with stringent health and safety regulations. These applications collectively underscore the foundational benefits of employing high-quality food storage solutions: significantly enhanced food safety through robust protection, substantial reduction in food waste by preserving items longer, optimized kitchen efficiency through better organization, and unparalleled convenience for end-users, especially with features like portability, microwave-safe designs, and freezer-compatibility.

The market's robust growth trajectory is propelled by several interwoven factors. Foremost among these is the escalating global awareness and concern over food waste, stimulating widespread adoption of effective preservation strategies. An observable surge in home cooking, driven by health consciousness, economic considerations, and the desire for personalized meals, has boosted demand for versatile and reliable storage solutions. Furthermore, increasing urbanization, coupled with the need for efficient use of limited living and kitchen spaces, drives innovation in compact and stackable container designs. Technological advancements in material science are continuously introducing containers with superior properties such as enhanced longevity, improved sealing mechanisms, and eco-friendly compositions. Concurrently, evolving food safety regulations across commercial and institutional sectors mandate the use of appropriate, certified storage solutions, acting as a powerful market accelerator. The inherent convenience offered by lightweight, durable, and leak-proof containers for modern, on-the-go lifestyles also serves as a significant and enduring driver of market expansion, catering to the dynamic needs of contemporary consumers globally.

Food Storage Containers Market Executive Summary

The Food Storage Containers market is currently navigating a period of significant transformation, marked by several prominent business trends. A central theme is the heightened focus on sustainability, compelling manufacturers to invest heavily in eco-friendly materials such as recycled plastics, bio-based polymers, glass, and durable stainless steel. This shift is not merely regulatory but strongly influenced by evolving consumer values prioritizing environmental responsibility. Consequently, product innovation now often centers on recyclability, reusability, and reduced carbon footprints. Digitization is another critical trend, with a gradual integration of smart features, like QR codes for inventory tracking or even early concepts of IoT-enabled containers, aimed at enhancing convenience and efficiency in food management for both households and commercial entities. The rapid expansion of e-commerce platforms has also profoundly impacted the distribution landscape, offering broader product accessibility and fostering a competitive environment that encourages continuous product differentiation and value-added services.

Regional dynamics within the Food Storage Containers market highlight diverse growth trajectories and consumer preferences. North America and Europe continue to be mature yet highly lucrative markets, characterized by high disposable incomes, a strong emphasis on health and wellness, and well-established food safety standards. These regions lead in the adoption of premium and aesthetically appealing containers, alongside a growing demand for sustainable and technologically advanced solutions. Conversely, the Asia Pacific region is demonstrating the most accelerated growth, largely attributable to rapid urbanization, a burgeoning middle class, and increasing awareness regarding food hygiene and proper storage practices. Countries like China and India present immense untapped potential, fueled by expanding modern retail infrastructure and evolving consumer lifestyles. Latin America, the Middle East, and Africa are also witnessing steady market expansion, driven by economic development and the gradual modernization of food preparation and storage habits, often favoring cost-effective and durable options.

Segmentation trends offer granular insights into market specificities. Material-wise, while conventional plastic containers retain a dominant market share due to their cost-effectiveness and versatility, there is a clear and accelerating pivot towards glass and silicone. This shift is primarily propelled by consumer health concerns regarding plastic chemicals and a desire for more durable, non-reactive, and environmentally friendly alternatives. In terms of product type, traditional 'boxes and bins' remain foundational for general storage, but specialized categories such as vacuum seal containers, meal prep solutions, and smart portion control containers are experiencing exponential demand growth, reflecting changing dietary habits and busy lifestyles. The residential application segment holds the largest share, yet the commercial sector (foodservice, retail, institutional) is expanding rapidly, driven by stringent regulatory compliance and operational efficiency needs in large-scale food handling. This comprehensive trend analysis underscores a market in constant evolution, adapting to global shifts in consumer behavior, environmental consciousness, and technological advancements.

AI Impact Analysis on Food Storage Containers Market

User inquiries regarding AI's impact on Food Storage Containers converge on key themes: proactive food freshness enhancement, significant waste reduction, intelligent inventory optimization, and deeply personalized consumer experiences. There is palpable curiosity among consumers and businesses about how AI could evolve storage solutions from passive receptacles into active, responsive systems capable of monitoring food quality, predicting spoilage, and even suggesting optimal consumption timelines. Users frequently ask about the feasibility of integrating smart sensors and data analytics for real-time insights into food conditions. Furthermore, businesses are keen to understand AI's capability in streamlining complex inventory control for large-scale operations, mitigating costly overstocking and spoilage, while individuals seek personalized guidance on maximizing freshness based on their unique purchasing and cooking habits. The overarching expectation is that AI will introduce unprecedented levels of efficiency, sustainability, and convenience, fundamentally reimagining traditional food preservation practices into dynamic, data-driven processes.

- AI-powered Freshness Monitoring Systems: Integration of advanced sensors (e.g., gas, temperature, humidity) directly into containers. AI analyzes real-time data to predict food spoilage accurately, alerting users to optimal consumption windows and preventing waste.

- Predictive Inventory Management & Smart Reordering: AI analyzes consumption patterns, purchase habits, and external factors to optimize grocery lists. For commercial use, AI systems track stock levels, automating reordering and ensuring minimal waste and optimal stock rotation.

- Personalized Storage Recommendations & Usage Insights: AI platforms provide tailored advice on optimal storage conditions for specific food items, considering type, freshness, and planned usage, leading to more efficient household food management.

- Enhanced Supply Chain & Manufacturing Efficiency: AI in manufacturing optimizes production lines, predicts equipment maintenance, and improves quality control. In the supply chain, AI enhances logistics, forecasts demand, and optimizes distribution routes, reducing costs and environmental impact.

- Smart Kitchen Ecosystem Integration: Future IoT-enabled, AI-driven containers could communicate seamlessly with other smart kitchen appliances, creating a cohesive ecosystem for comprehensive food management, meal planning, and waste reduction strategies.

- Advanced Material Development Acceleration: AI and machine learning accelerate R&D in new, sustainable, and high-performance materials for containers. AI simulates molecular interactions, predicting material properties to discover novel bioplastics, advanced glass composites, or self-healing materials.

- Consumer Engagement & Education Platforms: AI-driven mobile applications enhance consumer engagement by offering recipe suggestions based on stored ingredients, nutritional tracking, and educational content on best preservation practices.

- Dynamic Pricing and Waste Reduction in Retail: In retail, AI could integrate with smart packaging/container systems to dynamically adjust pricing of perishable goods approaching spoilage dates, incentivizing purchase and significantly reducing in-store food waste.

- Robotic Integration for Commercial Operations: AI-powered robotics in commercial kitchens or food processing plants automate loading, unloading, and organizing containers, improving efficiency, reducing labor costs, and ensuring consistent hygiene.

- Food Quality and Safety Assurance: AI can analyze data from smart containers to detect early signs of bacterial growth or chemical changes compromising food safety, providing an additional layer of protection for public health and regulatory compliance.

DRO & Impact Forces Of Food Storage Containers Market

The Food Storage Containers market is dynamically shaped by a compelling combination of Drivers, Restraints, and Opportunities, collectively forming its core impact forces. A primary driver is the escalating global concern over food waste, galvanizing consumers and businesses to adopt more proactive and efficient preservation methods. This concern is further amplified by rising food costs and a growing awareness of environmental sustainability. The increasing prevalence of home cooking, meal preparation, and an on-the-go lifestyle globally significantly fuels demand for diverse, portable, and durable storage solutions that cater to convenience and health consciousness. Moreover, rapid urbanization trends necessitate efficient space-saving storage, while advancements in material science continually introduce improved container properties. Stringent food safety regulations, particularly in the commercial and institutional sectors, mandate certified and hygienic storage practices, thereby bolstering market expansion and technological adoption.

Despite these powerful drivers, the market faces several notable restraints. A significant challenge stems from the environmental impact of plastic waste, leading to increased scrutiny and regulatory pressures for manufacturers to transition towards more sustainable alternatives. This often involves higher production costs, which can translate into elevated consumer prices, impacting market accessibility. The intense competitive landscape, characterized by numerous global and local players, often results in price erosion and compressed profit margins, particularly in the mass-market plastic segment. Consumer perceptions regarding the potential health risks associated with certain plastic materials also act as a restraint, driving a gradual but steady shift towards premium-priced glass and silicone options. Furthermore, the sheer variety and fragmentation of product offerings can sometimes overwhelm consumers, making informed purchasing decisions challenging and potentially leading to sub-optimal choices that do not meet their long-term storage needs. The initial investment required for high-quality, comprehensive, and specialized food storage systems can also be a deterrent for budget-conscious consumers or smaller businesses.

Conversely, the market is rich with substantial opportunities for innovative growth and strategic expansion. The most compelling opportunity lies in the continued research, development, and commercialization of eco-friendly and sustainable materials, including advanced bioplastics, post-consumer recycled content, and fully biodegradable solutions. These innovations directly address environmental concerns and resonate strongly with a growing segment of environmentally conscious consumers. The burgeoning landscape of smart home technologies presents a fertile ground for integrating Artificial Intelligence (AI) and Internet of Things (IoT) capabilities into food storage solutions, offering features such as real-time freshness monitoring and automated inventory management. Furthermore, the expanding commercial foodservice sector, driven by heightened hygiene standards, operational efficiency requirements, and the proliferation of meal delivery services, offers a robust and continually growing demand segment. Companies can also strategically capitalize on the rapid market expansion in emerging economies, where increasing disposable incomes, modernization of food preparation practices, and rising awareness of food safety create fertile ground for introducing both affordable and technologically advanced food storage solutions tailored to regional preferences and economic capacities.

Segmentation Analysis

The Food Storage Containers market undergoes extensive segmentation based on critical parameters such as material, type, application, and capacity, providing a granular view of consumer preferences and industry adoption. This segmentation helps in understanding the diverse needs across residential and commercial sectors, allowing manufacturers to tailor product development and marketing strategies. The analysis highlights the dominance of certain materials like plastic due to its cost-effectiveness and versatility, while also showcasing the rapid growth in premium segments such as glass and silicone, driven by health consciousness and sustainability concerns. Understanding these segments is crucial for identifying untapped opportunities and navigating the competitive landscape, from basic everyday storage to advanced preservation systems.

- By Material: This segment categorizes containers based on their primary construction material, significantly influencing durability, safety, cost, and reusability.

- Plastic: Encompasses various polymers such as Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), and Tritan. Valued for its lightweight nature, affordability, and impact resistance.

- Glass: Primarily borosilicate glass and soda-lime glass, favored for its non-porous, non-reactive, and easy-to-clean properties, making it ideal for health-conscious consumers and high-end applications.

- Metal: Dominated by stainless steel and aluminum, chosen for their exceptional durability, resistance to corrosion, and often used in commercial settings or for specific storage needs like dry goods.

- Silicone: Known for its flexibility, non-stick properties, and wide temperature resistance, making it suitable for freezer-to-oven applications and collapsible designs.

- Others: Includes innovative and traditional materials such as ceramic, bamboo, wood, and a growing category of bio-based materials (e.g., PLA from corn starch) for eco-friendly alternatives.

- By Type: This segment classifies containers based on their design, form factor, and intended primary use, reflecting diverse functional requirements.

- Boxes & Bins: The most common type, versatile for general storage, pantry organization, and refrigerator management.

- Bags & Wraps: Includes reusable silicone bags, plastic wrap alternatives, and specific produce bags designed for short-term freshness or on-the-go convenience.

- Bottles & Jars: Used primarily for liquids, sauces, dry goods, and canning, available in various sizes and sealing mechanisms.

- Canisters: Often taller, cylindrical containers typically used for dry goods like flour, sugar, coffee, or snacks, emphasizing airtight seals.

- Vacuum Seal Containers: Advanced solutions that remove air to create a vacuum, significantly extending the shelf life of perishable foods.

- Meal Prep Containers: Designed with multiple compartments and often stackable, specifically for portion control and preparing meals in advance.

- Specialty Containers: A broad category including spice jars, produce keepers with ventilation features, cereal dispensers, and specific baking storage solutions.

- By Application: This segment differentiates between the primary end-users, highlighting distinct market needs and volume requirements.

- Residential: Encompasses individual households, families, and personal use, driven by home cooking trends, meal prepping, and kitchen organization needs.

- Commercial: Includes high-volume users such as the Foodservice industry (restaurants, cafes, catering, hotels), Retail (supermarkets, deli counters, pre-packaged foods), and Institutional sectors (hospitals, schools, corporate canteens, government facilities) where durability, compliance, and efficiency are paramount.

- By Capacity: This segment categorizes containers based on their internal volume, catering to different portion sizes and storage quantities.

- Small (Less than 500 ml): Ideal for sauces, condiments, snacks, baby food, or small portion control.

- Medium (501 ml to 1500 ml): Most versatile for individual meals, leftovers, and general refrigerator storage.

- Large (Greater than 1500 ml): Suited for bulk storage of dry goods, large batch cooking, or commercial ingredient management.

Value Chain Analysis For Food Storage Containers Market

The value chain of the Food Storage Containers market represents a complex, multi-stage process, meticulously detailing the journey from raw material extraction to final consumer use. The upstream segment of this chain is anchored by the sourcing and processing of essential raw materials. This includes petrochemical companies providing various plastic polymers such as polypropylene, polyethylene, and polyethylene terephthalate, which are fundamental to the most widely used containers. Simultaneously, glass manufacturers supply sand, soda ash, and limestone, crucial for glass-based solutions, while metal suppliers provide stainless steel and aluminum for specialized durable containers. Silicone manufacturers contribute flexible and heat-resistant materials. The quality, consistency, and cost-effectiveness of these raw materials are paramount, directly influencing manufacturing feasibility and final product attributes. A growing emphasis on sustainable sourcing, incorporating recycled content and bio-based plastics, is reshaping supplier relationships and driving innovation in material science at this foundational stage, aiming to minimize environmental footprints throughout the product lifecycle.

Moving further along the value chain, the manufacturing and assembly phase constitutes a critical transformation point. Here, specialized food storage container manufacturers employ advanced production techniques such as injection molding for plastics, glass blowing and pressing, and metal stamping and forming. These processes are designed to create products that meet stringent quality standards regarding durability, airtightness, and food safety. Following production, containers undergo rigorous quality control inspections, packaging, and branding. Branding and design are increasingly important for product differentiation in a highly competitive market, encompassing aspects like ergonomics, aesthetic appeal, and modularity. This stage also involves the integration of additional components such as specialized lids, sealing gaskets, and locking mechanisms, which are often sourced from a network of component suppliers. Continuous investment in automation and lean manufacturing principles at this stage is crucial for cost efficiency and scalability.

The downstream segment primarily focuses on distribution, sales, and post-purchase activities. Distribution channels are highly diversified, catering to both direct and indirect market access. Direct channels typically involve manufacturers supplying large commercial clients such as restaurant chains, catering services, or institutional buyers, often through bulk orders or specialized contracts. This also includes direct-to-consumer sales via brand-owned e-commerce platforms. Indirect channels, which dominate the residential market, leverage an extensive network comprising wholesalers, regional distributors, large hypermarkets, supermarkets, specialty kitchenware stores, department stores, and increasingly, major online retail platforms. The efficiency of these distribution networks, coupled with effective logistics and supply chain management, is pivotal for ensuring widespread product availability and timely delivery. The final stage involves consumer engagement, post-purchase support, and feedback loops that inform future product development and marketing strategies. The proliferation of e-commerce has fundamentally redefined this segment, offering unparalleled market reach but also intensifying competition and placing a premium on robust digital marketing, efficient last-mile delivery, and seamless customer service experiences.

Food Storage Containers Market Potential Customers

The Food Storage Containers market caters to an exceptionally broad and diverse base of potential customers, strategically segmented into distinct residential and commercial categories, each characterized by unique purchasing motivations and operational requirements. Within the residential segment, the potential customer base is expansive, encompassing individual households, nuclear and extended families, single-person households, students living independently, and a growing demographic of health-conscious consumers engaged in active lifestyles. These individuals frequently participate in home cooking, meal prepping for dietary management or convenience, and actively seek efficient solutions for storing leftovers, organizing their pantries, and preserving fresh produce. Key drivers for this segment include the desire for prolonged food freshness, reduction of household food waste, convenience for packed lunches or on-the-go meals, and an increasing demand for aesthetically pleasing, durable, and eco-friendly container options that complement modern kitchen designs and sustainable living practices.

The commercial segment represents an equally significant and highly varied group of potential customers, spanning the entire breadth of the foodservice industry, diverse retail establishments, and numerous institutional facilities. This includes, but is not limited to, fine-dining restaurants, casual cafes, catering companies, hotels, bakeries, fast-food chains, and industrial food processing plants. These commercial entities require robust, food-grade certified containers for large-scale ingredient storage, pre-batch cooking, precise portion control, efficient food transportation, and maintaining strict adherence to public health and safety regulations. Retailers, such as large supermarket chains, independent grocery stores, and deli counters, also represent a substantial customer group, utilizing containers for pre-packaged meals, bulk food display, and inventory management. Furthermore, institutional clients, including hospitals, schools, corporate cafeterias, military facilities, and government-run canteens, rely on durable, easy-to-clean, and high-capacity food storage solutions to manage their extensive meal preparation, serving, and distribution operations, where hygiene and operational efficiency are paramount.

Beyond these established categories, several emerging and niche customer segments present significant growth opportunities. Specialized meal kit delivery services and pre-made food providers require specific, often customized, packaging solutions that ensure food integrity and freshness during transit. Outdoor enthusiasts, campers, hikers, and frequent travelers form another segment seeking portable, lightweight, leak-proof, and highly durable containers that can withstand varying environmental conditions. Moreover, the health and wellness industry continues to drive demand for specialized portion-controlled containers tailored for specific diet plans, fitness regimens, and nutritional management. As global lifestyles continue to evolve, coupled with shifting regulatory landscapes towards greater sustainability and enhanced food safety, the definition and needs of potential customers for food storage containers are constantly expanding. Understanding the intricate pain points, value propositions, and unique preferences of each customer group is fundamentally critical for manufacturers and suppliers to successfully penetrate and achieve sustainable growth across the diverse and expanding applications of this market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 42.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tupperware Brands Corporation, Newell Brands (Rubbermaid, Sistema Plastics), Lock & Lock Co., Ltd., Zojirushi Corporation, OXO (Helen of Troy Limited), Pyrex (CorningWare & Pyrex), Dart Container Corporation, World Kitchen LLC, The Clorox Company (Glad), SC Johnson & Son, Inc. (Ziploc), Berry Global Inc., Reynolds Consumer Products Inc., Genpak LLC, Anchor Hocking Company, Aladdin (PMI), Catergator, Cambro Manufacturing Co., Viking Range, LLC, Progressive International, Crate and Barrel Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Food Storage Containers Market Key Technology Landscape

The technological landscape of the Food Storage Containers market is characterized by relentless innovation aimed at significantly enhancing product functionality, ensuring superior safety standards, and championing environmental sustainability. A cornerstone of this technological evolution lies in advanced material science. Extensive research and development efforts are concentrated on creating next-generation polymers that offer superior barrier properties, thereby extending food freshness more effectively, alongside improved durability, resistance to staining, and odor absorption. The strategic shift towards sustainable materials is paramount, driving innovation in bioplastics derived from renewable resources, the widespread incorporation of post-consumer recycled (PCR) content in plastics, and the development of fully biodegradable polymers that minimize ecological footprints. Similarly, advancements in glass technology have resulted in more robust, thermal-shock-resistant, and aesthetically versatile options, while silicone innovations offer enhanced flexibility, non-stick attributes, and broader temperature stability, making them suitable for a diverse range of freezing, cooking, and storage applications.

Beyond material composition, manufacturing processes and design methodologies are also undergoing significant technological transformation. The adoption of precision injection molding, advanced blow molding techniques, and sophisticated sealing technologies enables the production of containers with truly airtight, leak-proof seals, and effective vacuum-sealing capabilities, which are crucial for optimal food preservation. Computer-aided design (CAD) and computer-aided manufacturing (CAM) software are integral to developing ergonomic, stackable, and modular container systems that maximize storage efficiency in modern, often compact, kitchen and commercial spaces. Features such as easy-open mechanisms, secure locking lids, and microwave/dishwasher compatibility are continually refined through engineering improvements, focusing on user convenience and safety. The increasing demand for customization and specialized container designs for specific food items further propels these manufacturing and design innovations, allowing for tailored solutions like ventilated produce keepers or specialized herb preservers that leverage specific environmental controls.

The nascent yet rapidly expanding frontier of smart technologies represents another pivotal aspect of the technological landscape. This includes the integration of Internet of Things (IoT) capabilities and Artificial Intelligence (AI) into food storage solutions. Examples include containers embedded with micro-sensors that actively monitor internal conditions such as temperature, humidity, and even gas levels (e.g., ethylene), transmitting real-time data to connected mobile applications. These smart features allow for dynamic tracking of food freshness, provide predictive spoilage alerts, and facilitate intelligent inventory management, transforming passive storage into an active, data-driven process. Technologies like RFID tags and QR codes are increasingly being deployed in commercial settings for automated stock rotation, comprehensive traceability, and improved operational efficiency. The synergy between advanced materials, intelligent manufacturing, and smart digital integration is progressively transforming the food storage container from a mere utility item into a sophisticated, interconnected tool that actively contributes to smarter food management, reduced waste, and enhanced consumer health and convenience, marking a significant evolution in the market's technological trajectory.

Regional Highlights

- North America: This region represents a mature and highly innovative market, characterized by significant consumer awareness regarding food safety, hygiene, and the critical importance of food waste reduction. The robust popularity of meal prepping, bulk buying, and a strong culture of health-conscious eating drive consistent demand. Consumers in the U.S. and Canada show a pronounced preference for branded, high-quality, durable, and often aesthetically sophisticated storage solutions. The market here leads in the adoption of technologically advanced and sustainable products, with substantial contributions from both residential households and the expansive commercial foodservice sector, supported by well-established retail infrastructures and a thriving e-commerce ecosystem.

- Europe: The European market demonstrates steady and robust growth, primarily propelled by stringent food safety regulations, a deeply ingrained cultural emphasis on sustainability, and a widespread embrace of eco-friendly and reusable products. Countries such as Germany, the United Kingdom, France, Italy, and the Nordic nations are key contributors, showcasing increasing demand for premium glass, durable stainless steel, and reusable silicone containers, often driven by government initiatives and strong consumer environmental consciousness. The region also exhibits a strong trend towards organized home living and efficient kitchen management, further bolstering the demand for integrated and modular food storage systems.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, APAC's market expansion is fueled by unprecedented rates of urbanization, rapidly increasing disposable incomes among a burgeoning middle class, and a heightened awareness of food hygiene and proper preservation techniques. Major economies like China, India, Japan, Australia, and South Korea are pivotal markets. This region is experiencing a surge in demand driven by the expansion of modern retail formats, the growth of the foodservice and hospitality sectors, and a cultural shift towards more westernized food preparation and storage practices. Local manufacturers are also innovating to produce region-specific designs that cater to diverse culinary traditions and storage needs, balancing affordability with growing quality expectations.

- Latin America: This region exhibits a steady growth trajectory, influenced by improving economic conditions, a gradual increase in household disposable incomes, and the modernization of kitchen practices. Brazil, Mexico, and Argentina stand out as leading markets, where there is a growing preference for both affordable and durable plastic containers for everyday use, alongside an emerging interest in more premium, organized, and aesthetically pleasing storage solutions. The expansion of supermarkets and hypermarkets, coupled with increasing consumer exposure to global trends, contributes to the rising adoption of varied food storage container types.

- Middle East and Africa (MEA): An evolving market presenting considerable untapped potential, the MEA region's growth is supported by accelerating urbanization, rising living standards, and the significant expansion of the hospitality, tourism, and foodservice sectors. Countries like the UAE, Saudi Arabia, and South Africa are key regional players, where demand spans both functional and aesthetically appealing products for home use and robust, compliant solutions for commercial entities. The region is also observing a gradual shift towards modern food preservation techniques, driven by increasing awareness about food safety and the benefits of reduced food spoilage, creating new opportunities for market penetration by international and local brands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Food Storage Containers Market.- Tupperware Brands Corporation

- Newell Brands (Rubbermaid, Sistema Plastics)

- Lock & Lock Co., Ltd.

- Zojirushi Corporation

- OXO (Helen of Troy Limited)

- Pyrex (CorningWare & Pyrex)

- Dart Container Corporation

- World Kitchen LLC

- The Clorox Company (Glad)

- SC Johnson & Son, Inc. (Ziploc)

- Berry Global Inc.

- Reynolds Consumer Products Inc.

- Genpak LLC

- Anchor Hocking Company

- Aladdin (PMI)

- Catergator

- Cambro Manufacturing Co.

- Viking Range, LLC

- Progressive International

- Crate and Barrel Holdings

Frequently Asked Questions

What are the primary drivers for the Food Storage Containers market growth?

The market is primarily driven by an escalating global awareness and concerted efforts to significantly reduce food waste, the growing popularity of home cooking, meal preparation, and batch cooking for health and convenience. Furthermore, the demand for versatile, portable, and durable solutions for on-the-go lifestyles, coupled with increasingly stringent food safety regulations in commercial sectors, are key propelling factors. Innovations in sustainable materials and smart storage technologies also play a crucial role in accelerating market expansion.

How is the market segmented by material, and which segment currently dominates?

The Food Storage Containers market is segmented by material into Plastic (including PP, PE, PET), Glass (borosilicate and soda-lime), Metal (stainless steel, aluminum), Silicone, and Other innovative bio-based materials. Plastic containers currently hold the largest market share due to their widespread affordability, lightweight nature, and versatility. However, the glass and silicone segments are experiencing substantial and rapid growth, primarily driven by heightened consumer health consciousness and a growing preference for more durable, non-reactive, and environmentally friendly alternatives.

What is the expected impact of AI on the future of food storage containers?

Artificial Intelligence is poised to profoundly transform food storage by introducing intelligent features such as real-time freshness monitoring through integrated smart sensors, predictive inventory management to proactively minimize waste, and highly personalized storage recommendations tailored to individual consumer needs. AI integration aims to evolve passive storage methods into active, data-driven systems that significantly enhance food safety, extend shelf life, and promote more sustainable and efficient overall food management practices, bridging the gap between convenience and advanced preservation.

Which geographical regions are key contributors to the Food Storage Containers market's performance, and what factors drive their growth?

North America and Europe are significant, mature markets driven by high consumer awareness of food safety, established meal prepping trends, and a preference for premium, sustainable products. Asia Pacific is the fastest-growing region, propelled by rapid urbanization, rising disposable incomes, and increasing food hygiene awareness. Latin America and the Middle East & Africa regions show steady growth, influenced by improving economic conditions and the gradual adoption of modern food storage practices, often balancing cost-effectiveness with emerging quality demands.

What are the primary challenges or restraints influencing the Food Storage Containers market?

Key challenges include pressing environmental concerns related to plastic waste and the urgent need for more sustainable material alternatives, which often entails higher production costs. The market also faces intense competition, leading to significant price sensitivity and pressure on profit margins. Consumer perceptions regarding the safety and longevity of certain materials, especially plastics, and the initial investment required for high-quality, specialized storage systems can also act as notable restraints on market growth and widespread adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Household Food Storage Containers Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Household Food Storage Containers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Metal, Glass, Plastic), By Application (Grain Mill Products, Fruits and Vegetables, Bakery Products, Meat Processed Products, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager