Forging Press Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431667 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Forging Press Machine Market Size

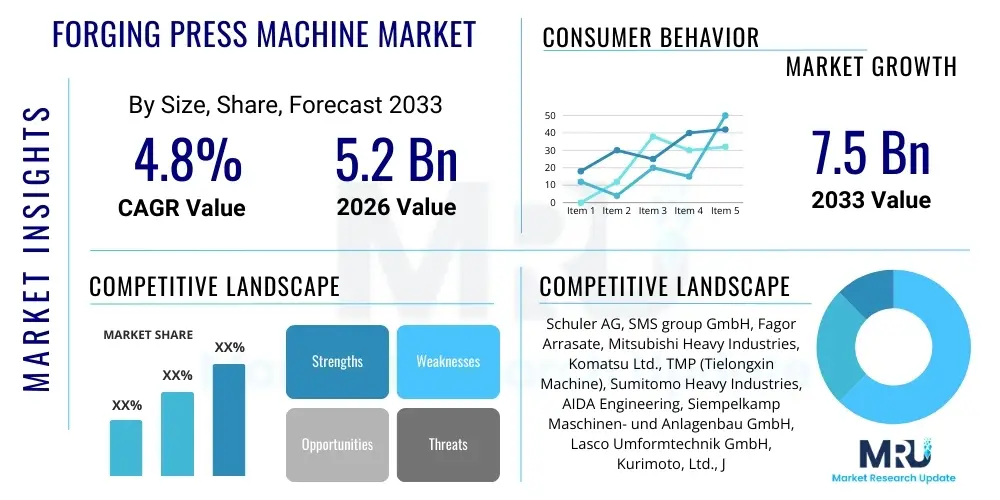

The Forging Press Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Forging Press Machine Market introduction

The Forging Press Machine Market encompasses the global industry dedicated to the manufacturing, sales, and servicing of equipment used for shaping metallic materials through compressive forces, a process known as forging. Forging presses, which include hydraulic, mechanical, and servo presses, are vital components in heavy industries, delivering high-strength, fatigue-resistant, and geometrically precise components essential for sectors like automotive, aerospace, defense, and oil & gas. These machines transform metal blanks (billets) into finished parts by applying immense pressure, optimizing material grain structure, and improving mechanical properties far beyond those achievable through casting or machining alone.

Product descriptions vary significantly based on operational mechanisms; hydraulic presses offer greater control over ram speed and pressure, ideal for complex shapes and exotic alloys, while mechanical presses are favored for high-speed, high-volume production of smaller components due to their energy efficiency and fixed stroke capabilities. The key applications center around producing critical components such as engine components (crankshafts, connecting rods), structural airframe parts, gears, and fasteners. The primary benefit derived from using forging presses is the production of materials with superior strength-to-weight ratios and enhanced longevity, which is increasingly crucial for lightweighting initiatives in the transportation sector.

The market growth is fundamentally driven by the escalating demand from the global automotive industry, particularly the transition toward Electric Vehicles (EVs) which still require precision forged components for chassis and motor assemblies, although the component mix shifts. Furthermore, robust expansion in aerospace production, coupled with significant infrastructural development worldwide—especially in Asia Pacific—necessitates continuous investment in high-tonnage forging capacity. Technological advancements, notably the integration of servo-driven systems, are also driving factors, offering unparalleled precision, energy savings, and operational flexibility compared to traditional equipment.

Forging Press Machine Market Executive Summary

The global Forging Press Machine Market is characterized by a strong convergence of industrial automation and material science advancements, driving robust business trends focused on optimizing production throughput and part quality. Key business trends include the rising adoption of intelligent forging solutions incorporating sensors and IoT capabilities for real-time monitoring and predictive maintenance. There is a discernible shift towards servo presses due to their superior efficiency, precise energy control, and noise reduction benefits, positioning them as the future standard, particularly in developed economies seeking sustainable manufacturing solutions. Furthermore, market competition is intensifying, prompting key players to invest heavily in R&D to enhance tonnage capacity and integrate adaptive forging controls that can compensate for material variations during the stamping process.

Regionally, the market exhibits highly asymmetrical growth patterns. Asia Pacific (APAC) dominates the market share, driven primarily by massive governmental investment in infrastructure, rapid industrialization in countries like China and India, and the sheer volume of automotive production. North America and Europe, while slower in terms of volume growth, lead in technological adoption, particularly focusing on high-precision forging for the aerospace and high-end automotive sectors. These regions prioritize automation and advanced materials processing, often demanding specialized hydraulic presses capable of handling titanium and nickel alloys. Regulatory pressures concerning environmental standards and worker safety in the West also push manufacturers toward closed-die forging systems that minimize waste and energy consumption.

Segment trends reveal that the mechanical press segment maintains a stronghold in mass production environments due to lower upfront cost and high cycle rates, although the hydraulic segment is rapidly gaining traction due to operational flexibility and superior force control crucial for complex components. Based on tonnage, the mid-range capacity (1,000 to 5,000 tons) is witnessing the highest demand, aligning with the core requirements of automotive manufacturing for chassis and transmission parts. However, the requirement for ultra-high tonnage presses (above 10,000 tons) remains steady, driven exclusively by niche aerospace, defense, and heavy machinery applications, creating high-barrier entry opportunities for specialized manufacturers.

AI Impact Analysis on Forging Press Machine Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Forging Press Machine Market overwhelmingly focus on operational efficiency, predictive failure prevention, and process optimization. Common questions revolve around how AI can enhance die life, minimize material waste, and automate quality inspection in real-time. The collective concern centers on the capital expenditure required for retrofitting older machinery with necessary sensors and edge computing capabilities, versus the long-term Return on Investment (ROI) derived from reduced downtime and improved yield. Users seek tangible examples of AI-driven control systems that dynamically adjust parameters (temperature, pressure, speed) during the forging cycle to ensure consistent metallurgical properties, particularly important when processing high-value, temperature-sensitive alloys like specialty steels and superalloys. Expectations are high for AI to transition the forging process from a highly skilled, experience-based operation to a data-driven, autonomous manufacturing cell.

- AI integration enables sophisticated predictive maintenance scheduling, significantly reducing unexpected machine failure by analyzing vibration, temperature, and pressure anomalies.

- Machine Learning (ML) algorithms optimize forging parameters (stroke, dwell time, lubrication) based on material input variability, ensuring consistent product quality and minimizing scrap rates.

- Computer vision and deep learning techniques facilitate real-time, in-line quality inspection, identifying surface defects, dimensional inconsistencies, and potential flaws invisible to human inspectors.

- AI assists in optimizing die design and utilization through sophisticated simulation models, predicting wear patterns and enabling adaptive adjustments to extend tooling life.

- Supply chain management within the forging sector benefits from AI-driven demand forecasting, optimizing raw material procurement and production scheduling for efficiency.

DRO & Impact Forces Of Forging Press Machine Market

The Forging Press Machine Market operates under a dynamic interplay of propelling drivers, significant structural restraints, and evolving opportunities, all shaped by macroeconomic and technological impact forces. The primary drivers include the mandatory requirements for lightweighting in the automotive sector to meet stringent emission norms, boosting demand for precise, high-strength forged components. Concurrently, the robust growth of the aerospace sector globally, requiring high-integrity parts for modern aircraft, sustains demand for high-tonnage hydraulic presses capable of handling advanced materials. Restraints predominantly involve the extremely high initial capital investment required for installing forging presses and the subsequent high operational expenditure associated with specialized maintenance and skilled labor. Additionally, the complex nature of the forging process and susceptibility to energy price fluctuations pose persistent challenges.

Opportunities are largely concentrated in the emerging adoption of Industry 4.0 technologies, such as IoT sensors and real-time process control, which enhance operational efficiencies and pave the way for smart factories. The rise of electric vehicles, while shifting demand away from traditional powertrain components, creates new forging opportunities in battery casings, structural components, and advanced motor shafts, requiring high precision cold and warm forging. The key impact forces dictating market movement include global trade policies affecting raw material tariffs (like steel and aluminum), environmental regulations driving the need for energy-efficient servo technology, and technological competition from alternative manufacturing methods such as advanced casting and additive manufacturing (AM), which require the forging industry to innovate continuously to maintain competitive advantage.

Segmentation Analysis

The Forging Press Machine Market is comprehensively segmented based on technology type, force capacity (tonnage), application, and end-user industry, reflecting the diverse manufacturing requirements across the global industrial landscape. The segmentation framework is crucial for strategic market planning, allowing manufacturers to tailor their product offerings—ranging from high-speed mechanical presses to highly precise hydraulic systems—to specific industry needs such as high-volume automotive production or low-volume, high-value aerospace component fabrication. Understanding these segments helps identify pockets of high growth, particularly the rapid uptake of sophisticated servo technology across various tonnage classes, which is redefining efficiency standards within the sector.

- By Technology Type:

- Mechanical Presses (Crank Presses, Screw Presses)

- Hydraulic Presses

- Servo Presses

- By Force Capacity (Tonnage):

- Up to 1,000 Tons

- 1,001 Tons – 5,000 Tons

- 5,001 Tons – 10,000 Tons

- Above 10,000 Tons (Ultra-High Tonnage)

- By Application/Forging Type:

- Hot Forging

- Warm Forging

- Cold Forging

- By End-User Industry:

- Automotive (Passenger Vehicles, Commercial Vehicles)

- Aerospace and Defense

- General Industrial Machinery

- Oil & Gas

- Railways and Shipping

Value Chain Analysis For Forging Press Machine Market

The value chain for the Forging Press Machine Market is anchored by the specialized expertise required at each stage, beginning with upstream raw material sourcing and culminating in sophisticated post-sale services. Upstream analysis focuses on the procurement of high-quality components, including specialized high-strength steel alloys for machine frames, precision hydraulic cylinders, sophisticated electronic control units (PLCs), and complex gear assemblies. Key suppliers in the upstream segment are highly specialized in heavy engineering components and must meet stringent quality and durability standards, impacting the overall reliability and cost of the finished press machine. Effective management of this upstream flow is critical, as disruptions or price volatility in steel and specialized components can directly impact the profitability and lead times of original equipment manufacturers (OEMs).

The core segment of the value chain involves the design, manufacturing, assembly, and testing of the press machines by OEMs. This stage is capital-intensive and requires significant intellectual property regarding forging metallurgy and mechanical engineering. Following manufacturing, the distribution channel plays a crucial role. Direct sales channels are often employed for high-tonnage, custom-built presses sold directly to large multinational forging houses and Tier 1 suppliers, facilitating closer technical communication and customization. Indirect channels, involving authorized distributors and regional agents, are more common for standardized, lower-to-mid tonnage machines, offering local support, spare parts inventory, and faster installation services across diverse geographic markets, particularly crucial for penetrating the dispersed SME manufacturing sector.

Downstream analysis centers on the end-users and the subsequent need for maintenance, die tooling services, and modernization packages. After-sales service is a high-margin activity, involving preventative maintenance contracts, critical spare parts supply, and technology upgrades (e.g., retrofitting older presses with new servo drives or IoT sensors). The competitive advantage in the downstream market often lies in the OEM's ability to provide rapid, global technical support and specialized application engineering expertise. Furthermore, the longevity of these machines necessitates robust maintenance agreements, making the ongoing relationship with the customer vital for sustained revenue generation throughout the press's extensive lifecycle.

Forging Press Machine Market Potential Customers

The primary customers and end-users of forging press machines are those industries requiring components with exceptional structural integrity, high fatigue resistance, and precise dimensional control, where failure is not an option. The most significant customer segment is the global automotive industry, including both Original Equipment Manufacturers (OEMs) and their network of Tier 1 and Tier 2 suppliers. These entities utilize forging presses extensively for producing safety-critical parts such as steering knuckles, wheel hubs, axles, crankshafts, and connecting rods, with a growing focus on structural battery components for electric vehicles. The automotive sector demands high-speed, reliable mechanical and servo presses capable of continuous, high-volume operation to meet massive global production targets.

The aerospace and defense sector represents the highest value customer base, characterized by low volume but extremely high material integrity requirements. These customers, including airframe manufacturers and specialized aerospace component suppliers, invest heavily in ultra-high tonnage hydraulic presses to forge components from exotic materials like titanium, Inconel, and various superalloys crucial for engine turbines, landing gear, and structural fittings. The purchase decision in this sector is driven by precision capabilities, traceability, and the press manufacturer's certification credentials rather than solely cost, often leading to bespoke machine designs and long procurement cycles.

Other substantial customer segments include manufacturers of heavy machinery, such as construction equipment (e.g., bulldozers, excavators), agricultural machinery, and industrial gearboxes. These industries require robust components that can withstand high stress and heavy loads, often relying on large, durable hydraulic presses for heavy-duty shaft and gear forging. Additionally, the global oil and gas industry maintains consistent demand for forged components—such as valves, flanges, and piping connectors—that must operate reliably under extreme pressures and temperatures, supporting a steady, albeit cyclical, demand for specialized forging equipment compliant with industry-specific standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler AG, SMS group GmbH, Fagor Arrasate, Mitsubishi Heavy Industries, Komatsu Ltd., TMP (Tielongxin Machine), Sumitomo Heavy Industries, AIDA Engineering, Siempelkamp Maschinen- und Anlagenbau GmbH, Lasco Umformtechnik GmbH, Kurimoto, Ltd., J&H Machine Tools, ERIE Press Systems, Qingdao Hefa Group, China National Erzhong Group Co. (Deyang), Heilongjiang Hada, Ajax Manufacturing Co., Beckwood Press Co., Phoenix Hydraulics, DENN S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Forging Press Machine Market Key Technology Landscape

The technology landscape within the Forging Press Machine Market is undergoing a rapid evolution, moving away from purely mechanical or hydraulic systems toward integrated, intelligent solutions centered on achieving precision, flexibility, and energy efficiency. Servo Press Technology stands as the most critical disruptive innovation, replacing traditional flywheel-driven mechanical systems with high-torque, direct-drive electric motors. This transition allows for complete, customizable control over the ram speed and position throughout the stroke, enabling complex forging profiles, reducing noise levels, and offering substantial energy recovery capabilities, thereby lowering operational costs and increasing the lifespan of tooling. The incorporation of advanced control systems, utilizing high-speed PLCs and sophisticated human-machine interfaces (HMIs), ensures repeatable accuracy and seamless integration into automated production lines.

Alongside servo presses, the adoption of Industry 4.0 paradigms is fundamentally reshaping how forging operations are managed. Key technological deployments include sophisticated sensing packages—such as acoustic sensors, thermal cameras, and vibration monitors—integrated directly into the press structure and tooling. These sensors feed real-time operational data into centralized manufacturing execution systems (MES) and cloud-based analytical platforms. This data aggregation enables comprehensive process monitoring, immediate anomaly detection, and the implementation of predictive maintenance protocols that significantly minimize unplanned downtime, which is exceptionally costly in high-tonnage forging operations. Furthermore, sophisticated simulation software (Finite Element Analysis, or FEA) is now routinely used during the design and planning phase to model material flow, predict thermal stress, and optimize die geometry, drastically reducing the number of costly physical tryouts.

Moreover, the integration of automation technologies, particularly high-payload industrial robotics, is essential for maximizing the utilization rates of forging presses. Robotic systems handle the high-temperature material billets, transferring them accurately between heating furnaces, pre-forming stages, and the final press dies, minimizing human exposure to hazardous environments and ensuring rapid cycle times. Further technological advancements focus on heating mechanisms, with induction heating replacing traditional furnace technologies in many cold and warm forging applications due to its speed, precision, and localized heat control. This combination of advanced machine design, sensor technology, intelligent software, and high-speed material handling defines the cutting edge of modern forging press capability, focusing on achieving zero-defect production in highly demanding industries.

Regional Highlights

The global Forging Press Machine Market exhibits distinct regional dynamics driven by local industrial bases, regulatory environments, and investment cycles. Asia Pacific (APAC) stands as the undisputed powerhouse, commanding the largest market share and demonstrating the highest growth trajectory. This dominance is fundamentally supported by the region's massive manufacturing capacity, particularly in China, which serves as a global hub for automotive production, heavy industrial components, and infrastructure development. India and Southeast Asian nations are also experiencing significant industrial expansion, fueling consistent demand for new, mid-to-high capacity forging presses. The APAC market is primarily driven by volume and cost-effectiveness, though there is a growing shift toward advanced hydraulic and servo presses to enhance quality and meet export standards.

North America is characterized by high investment in advanced, automated forging systems, prioritizing technology integration over sheer volume expansion. The region's market is primarily driven by the robust aerospace and defense sectors, which demand specialized, high-tonnage presses for complex alloy forging, and the recovery/retooling cycles of the domestic automotive industry, which focuses heavily on lightweighting. Manufacturers in the U.S. and Canada show a strong preference for presses equipped with IoT capabilities, emphasizing data-driven operational efficiency and superior quality control to maintain global competitiveness against lower-cost production regions.

Europe represents a mature but technologically sophisticated market, focused heavily on precision engineering, compliance with strict environmental regulations, and the production of high-value components for premium automotive brands and highly regulated aerospace applications. European demand is overwhelmingly centered on energy-efficient servo technology and customized hydraulic presses that offer granular control and low noise pollution. Germany, Italy, and France are key contributors, investing in machine modernization and advanced tooling systems to maintain their leading position in high-specification component manufacturing. Investment is also strong in R&D collaboration between machine builders and material scientists to handle next-generation alloys efficiently.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets with high variability. LATAM’s market growth is tied to automotive manufacturing (especially Brazil and Mexico) and regional industrial development. MEA, particularly the GCC countries, sees demand driven by the oil & gas sector and ongoing large-scale infrastructure and defense projects, necessitating durable, heavy-duty hydraulic presses. Growth in these regions is often influenced by commodity prices and foreign direct investment, making the market highly sensitive to global economic shifts, though the long-term outlook remains positive due to diversification efforts.

- Asia Pacific (APAC): Market leader due to high-volume automotive manufacturing, rapid infrastructure development, and substantial government investment in industrial capacity, led by China and India.

- North America: Focuses on technological adoption, high precision forging for aerospace and defense, and lightweight material processing, demanding advanced automation and predictive maintenance features.

- Europe: Driven by strict regulatory standards (emission/safety), mature automotive and aerospace supply chains, and a strong preference for highly efficient servo press technology and bespoke hydraulic solutions.

- Latin America (LATAM): Growth linked to regional automotive production and natural resource extraction industries, with Brazil and Mexico as primary demand centers.

- Middle East & Africa (MEA): Demand heavily reliant on the oil & gas sector, defense industries, and emerging construction infrastructure projects requiring heavy-duty forging capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Forging Press Machine Market.- Schuler AG

- SMS group GmbH

- Fagor Arrasate

- Mitsubishi Heavy Industries

- Komatsu Ltd.

- TMP (Tielongxin Machine)

- Sumitomo Heavy Industries

- AIDA Engineering

- Siempelkamp Maschinen- und Anlagenbau GmbH

- Lasco Umformtechnik GmbH

- Kurimoto, Ltd.

- J&H Machine Tools

- ERIE Press Systems

- Qingdao Hefa Group

- China National Erzhong Group Co. (Deyang)

- Heilongjiang Hada

- Ajax Manufacturing Co.

- Beckwood Press Co.

- Phoenix Hydraulics

- DENN S.A.

Frequently Asked Questions

Analyze common user questions about the Forging Press Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Forging Press Machine Market?

The central factor is the continuous global drive for vehicle lightweighting in the automotive industry to meet stringent fuel efficiency and emission standards, requiring high-strength, precise forged components for chassis and powertrain systems, coupled with sustained growth in the aerospace sector.

How are Servo Presses disrupting the traditional Forging Press Market?

Servo presses are disrupting the market by offering unparalleled operational flexibility, customizable ram speed profiles, significantly higher energy efficiency compared to mechanical or hydraulic systems, and enhanced precision, positioning them as the preferred technology for complex and high-value forging applications.

Which region dominates the global market share for Forging Press Machines?

Asia Pacific (APAC) currently dominates the global market share, driven primarily by the high concentration of automotive manufacturing facilities, rapid industrialization, and major infrastructure investments in countries such as China and India.

What are the key restraint challenges facing manufacturers in this market?

Key restraint challenges include the extremely high initial capital expenditure required for purchasing and installing heavy-duty forging presses, the high ongoing maintenance costs, and the necessity of highly specialized, skilled labor to operate and program the increasingly complex machinery.

How is Industry 4.0 influencing the operation and maintenance of forging presses?

Industry 4.0 influences forging presses through the integration of IoT sensors and AI-driven predictive maintenance systems, allowing for real-time monitoring of machine health, optimization of operational parameters, and a significant reduction in unplanned downtime by forecasting potential component failures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hot Forging Press Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Forging Press Machine Market Statistics 2025 Analysis By Application (Automobile Industry, Space, Equipment Manufacturing Industry), By Type (< 10000 KN, 10000-100000 KN, > 100000 KN), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager