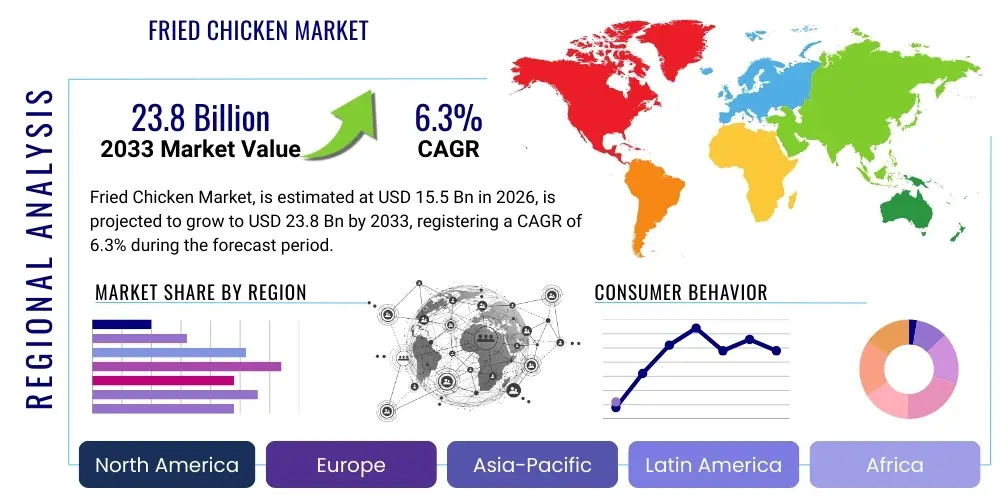

Fried Chicken Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437475 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Fried Chicken Market Size

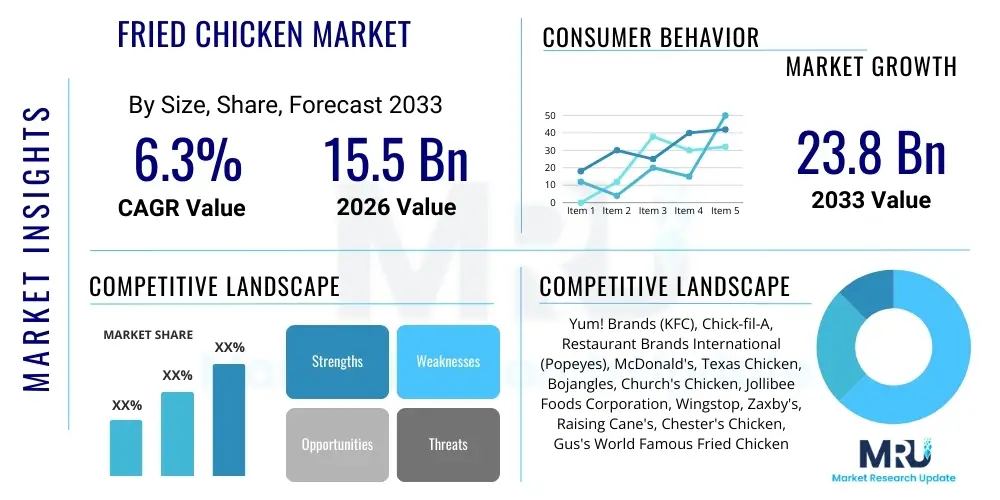

The Fried Chicken Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.8 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for convenient, ready-to-eat protein options, coupled with rapid expansion of Quick Service Restaurant (QSR) chains, particularly across emerging economies in Asia Pacific and Latin America. Market expansion is further fueled by strategic product innovations, including the introduction of specialty flavors, varying spice levels, and the integration of plant-based alternatives addressing evolving consumer preferences.

Fried Chicken Market introduction

The global Fried Chicken Market encompasses all commercial sales of chicken products prepared by deep-frying or pressure-frying, primarily distributed through QSRs, casual dining establishments, and retail grocery channels. This market segment has solidified its position as a global comfort food staple, characterized by high consumer acceptance and strong brand loyalty. The primary product descriptions span traditional bone-in pieces, boneless tenders, wings, and specialized chicken sandwiches. Major applications of fried chicken predominantly reside within the fast-food and catering sectors, serving high-volume, quick-service consumer needs.

Key driving factors accelerating market expansion include rapid urbanization, which elevates the reliance on convenient and speed-of-service meal solutions, and significant investment in supply chain optimization allowing for standardized product quality across diverse geographies. Furthermore, aggressive franchising strategies employed by global market leaders facilitate deep market penetration into previously untapped regions. The inherent benefits to consumers include affordability, quick preparation time, and broad flavor profiles appealing to a wide demographic spectrum, ensuring consistent revenue generation and sustained growth even during periods of economic volatility.

Recent shifts in consumer behavior indicate a rising demand for healthier fried chicken options, compelling manufacturers and restaurants to innovate with preparation methods such as air-frying technology, healthier oil alternatives, and reduced sodium formulations. Simultaneously, the market is leveraging digital transformation, utilizing sophisticated mobile ordering platforms and third-party delivery services to significantly enhance accessibility and customer convenience. The interplay between traditional culinary appeal and modern service delivery mechanisms is positioning the fried chicken sector for robust and sustainable long-term growth across all regional segments.

Fried Chicken Market Executive Summary

The Fried Chicken Market is characterized by intense competition driven by globalized branding and localized menu adaptation. Key business trends include the accelerated expansion of digital ordering infrastructure, where mobile applications and aggregator platforms now account for a substantial portion of total sales, particularly post-2020. Franchising remains the dominant business model, enabling rapid capital-light growth in international territories while maintaining strict quality control. Corporate strategies are increasingly focusing on vertical integration or strong contractual agreements with poultry suppliers to mitigate supply chain risks and stabilize raw material costs, a crucial factor in maintaining attractive profit margins in the QSR space.

Regional trends highlight the Asia Pacific (APAC) region as the epicenter of future market growth, fueled by vast populations, rising middle-class disposable incomes, and the strong cultural acceptance of poultry. While North America and Europe represent mature markets, growth there is sustained through menu diversification, premiumization of offerings, and emphasis on sustainable sourcing practices. Conversely, emerging markets in Latin America and the Middle East & Africa (MEA) are seeing significant entry by major international chains, capitalizing on younger demographics and increasing exposure to Westernized food culture. These regional dynamics necessitate highly tailored marketing and product development strategies.

Segmentation trends reveal substantial growth in the boneless segment, driven by convenience and suitability for snacking and grab-and-go consumption patterns. Furthermore, the market for value-added meals, combining fried chicken with sides and beverages, continues to dominate sales volumes. A notable segment trend is the rapid maturation of the plant-based fried chicken substitute category, responding directly to ethical and health-conscious consumer segments. This focus on product diversity and adapting to functional food demands ensures that the core market maintains relevance while simultaneously capturing niche high-growth segments, thereby diversifying revenue streams for major players.

AI Impact Analysis on Fried Chicken Market

User inquiries regarding Artificial Intelligence (AI) in the Fried Chicken Market predominantly revolve around three critical areas: operational efficiency, personalized customer experience, and supply chain integrity. Users frequently question how AI algorithms can optimize kitchen workflow, specifically predicting peak demand times to minimize food waste and labor costs. There is significant curiosity about AI-driven personalization, asking whether systems can tailor menu recommendations or promotional offers based on individual past purchasing habits and real-time location data. Furthermore, concerns often surface regarding the ethical implications and data security associated with using AI to manage massive volumes of consumer and operational data, highlighting the need for transparent implementation strategies.

AI is fundamentally transforming the operational backbone of the Fried Chicken industry. In the back-of-house (BOH), machine learning models are being deployed for predictive inventory management, forecasting poultry demand with high accuracy based on weather, local events, and historical sales trends, thereby reducing spoilage and ensuring fresh supply. AI-powered robotics are starting to automate repetitive tasks like breading, frying, and packaging, addressing persistent labor shortages and ensuring consistent product quality 24/7. This automated approach standardizes cooking procedures, minimizing the variability inherent in human operations, which is critical for maintaining brand trust across global franchises.

On the customer-facing side, AI engines power sophisticated Customer Relationship Management (CRM) systems. Chatbots handle routine order queries and customer service requests, freeing up human staff. Advanced algorithms analyze order data to segment customers effectively, allowing for highly targeted digital marketing campaigns delivered via mobile apps. This level of personalized engagement, ranging from dynamic pricing based on demand to tailored loyalty rewards, significantly boosts average transaction value and encourages repeat business, directly enhancing overall profitability and market responsiveness within the Fried Chicken sector.

- AI-driven predictive demand forecasting minimizes food waste and optimizes labor scheduling.

- Implementation of AI-powered cooking robotics ensures standardized product quality and overcomes labor constraints.

- Machine learning algorithms enhance supply chain traceability and quality assurance from farm to fryer.

- Personalized menu recommendations and dynamic pricing strategies are managed via AI-enabled CRM systems.

- Automated quality control systems use computer vision to monitor frying oil health and product consistency in real-time.

DRO & Impact Forces Of Fried Chicken Market

The market trajectory for fried chicken is shaped by a powerful confluence of Drivers, Restraints, and Opportunities (DRO). Key Drivers include the exponential growth in global QSR networks, increasing discretionary spending in emerging markets, and the robust demand for comfort foods associated with convenience and perceived value. Counterbalancing these forces are significant Restraints, primarily the persistent consumer concern over the health implications of frequent consumption of deep-fried products, coupled with fluctuating global commodity prices for poultry, feed, and cooking oils, which directly impact operational margins. The primary Opportunities lie in aggressive menu diversification, particularly incorporating plant-based alternatives and leveraging the vast logistical capabilities of third-party food delivery platforms to reach a wider, often decentralized, customer base.

Impact Forces within the market exert considerable pressure on operational and strategic decisions. High buyer power, driven by consumer choice among numerous competing QSR chains, necessitates continuous innovation in pricing and product quality. Supplier power remains moderate to high, especially concerning specialized poultry breeds or sustainable sourcing mandates, requiring long-term contractual agreements to stabilize input costs. Threat of Substitutes is significant, arising not only from competing protein sources (e.g., burgers, pizza) but also from home cooking trends and healthier alternatives like grilled chicken. New entrants face high barriers related to establishing brand recognition, secure supply chains, and substantial capital investment required for franchising, although localized independent operators continue to pose a competitive threat in specific micro-markets.

The strategic deployment of delivery and digital channels acts as a powerful moderating force against internal restraints. By optimizing the consumer experience outside the physical restaurant, market players can mitigate the high cost of real estate and labor associated with traditional dine-in models. Furthermore, focusing on product innovation, such as utilizing proprietary spice blends and advanced frying techniques, helps establish a differentiated market position that justifies premium pricing, thereby insulating key players from the pressures of volatile input costs and intensely competitive price wars, ensuring favorable long-term value generation.

Segmentation Analysis

The Fried Chicken Market is comprehensively segmented based on product type, end-user application, and distribution channel, providing a granular view of consumer behavior and market dynamics. The segmentation reflects evolving dietary preferences and convenience demands worldwide. Product type segmentation distinguishes between bone-in and boneless offerings, with the latter showing faster growth due to its ease of consumption and versatility in meal formats such as wraps and bowls. End-user classification is dominated by Quick Service Restaurants (QSRs), which rely on high throughput and standardized quality, though the full-service and institutional catering segments also contribute significantly, often focusing on higher quality or custom preparations.

Analyzing the market across distribution channels reveals a paradigm shift towards digital platforms. While physical brick-and-mortar restaurants (offline) historically dominated sales, the influence of online ordering via dedicated brand apps and third-party aggregators has accelerated dramatically, especially since 2020. This shift is critical as it influences marketing investment, logistics strategy, and packaging requirements, necessitating specialized solutions to maintain food temperature and texture during transit. Successful market players are those who seamlessly integrate their offline presence with a robust, efficient online delivery ecosystem, ensuring a consistent brand experience across all touchpoints.

Furthermore, segmentation by preparation method, encompassing traditional deep-frying, pressure frying, and increasingly, air-frying, provides insight into consumer health consciousness and technological adoption. The rapid consumer acceptance of diverse flavor profiles—ranging from traditional Southern seasoning to complex international variants like Korean Fried Chicken (KFC)—is also a vital element of segmentation, driving menu innovation and regional differentiation. Understanding these detailed segment flows is paramount for tailored product launches and targeted geographical expansion strategies, ensuring maximum return on investment for marketing and operational resources.

- Product Type:

- Bone-in Chicken

- Boneless Chicken (Tenders, Nuggets, Fillets)

- Wings

- Sandwiches/Burgers

- End-User:

- Quick Service Restaurants (QSR)

- Full-Service Restaurants

- Institutional Catering (Hospitals, Schools)

- Retail (Ready-to-Eat packaged meals)

- Distribution Channel:

- Offline (Dine-in, Takeaway)

- Online (Company App, Third-Party Aggregators)

- Preparation Method:

- Deep Frying

- Pressure Frying

- Air Frying/Oven Preparation (Health-Focused)

Value Chain Analysis For Fried Chicken Market

The Fried Chicken Market value chain begins with highly complex upstream activities, centered on poultry farming, breeding, feed production, and processing. Upstream analysis focuses heavily on the quality and standardization of raw chicken supply, where specialized breeds are often required to meet specific size and texture criteria demanded by QSR specifications. Key challenges at this stage involve ensuring feed quality, managing disease control, and adhering to increasingly stringent animal welfare and sustainability standards imposed by regulatory bodies and consumer groups. Efficiency in the upstream segment dictates cost structure and ultimately, the profitability of the entire downstream operation.

The midstream phase involves rigorous processing, logistics, and distribution. Processors handle slaughtering, cutting, seasoning, and initial freezing or chilling. Distribution channels are highly sophisticated, relying on cold chain logistics to transport raw or pre-prepared products to franchised or corporate restaurant locations globally. Direct distribution models are often used by major players to maintain tight control over inventory and quality, while indirect distribution utilizes third-party logistics (3PL) providers to manage inventory flow to remote locations. The choice of distribution strategy—direct or indirect—significantly impacts speed to market and freshness guarantees.

The final, downstream segment focuses on retail and consumption, primarily through QSRs, which represent the direct sales point to the end-user. Direct channels encompass in-store ordering and company-owned mobile apps, providing the brand with full control over the customer data and transaction experience. Indirect channels heavily involve third-party food delivery aggregators (e.g., DoorDash, Uber Eats), which, while expanding market reach significantly, introduce additional costs (commissions) and reduce the brand's direct relationship with the consumer. Optimization throughout the value chain, from sustainable farming practices to efficient last-mile delivery, is crucial for sustained competitive advantage.

Fried Chicken Market Potential Customers

The core potential customer base for the Fried Chicken Market remains broad, encompassing diverse demographics ranging from families seeking value meals to young urban professionals demanding speed and convenience. Millennials and Gen Z are particularly crucial segments, characterized by high digital engagement and a strong preference for delivered food solutions. These buyers prioritize seamless mobile ordering experiences, customized meal options, and brands that align with perceived ethical sourcing or sustainability commitments. Targeted marketing towards these digital-native consumers focuses heavily on social media engagement and personalized promotional offers tied to loyalty programs.

A second major cohort consists of price-sensitive, large-format families and individuals in developing economies. For these buyers, affordability and portion size are primary purchasing drivers. Potential customers in this category are often served through large meal bundles and aggressive value-pricing strategies, which are essential for driving high sales volume. Market penetration in this segment is achieved primarily through expanding physical store footprints in high-traffic urban and suburban areas and ensuring robust counter-service capabilities to handle peak demand efficiently.

A rapidly expanding segment of potential customers includes health-conscious consumers and flexitarians. Although traditionally not primary buyers of deep-fried products, this segment is increasingly targeted through product innovation, such as the introduction of non-fried preparation methods, plant-based chicken alternatives, and chicken prepared with "better-for-you" ingredients (e.g., lower fat content, specialty oils). Successful engagement with this high-potential segment requires transparent nutritional information and strong marketing emphasis on quality ingredients and innovative culinary techniques that reduce the caloric density of the final product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.8 Billion |

| Growth Rate | 6.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yum! Brands (KFC), Chick-fil-A, Restaurant Brands International (Popeyes), McDonald's, Texas Chicken, Bojangles, Church's Chicken, Jollibee Foods Corporation, Wingstop, Zaxby's, Raising Cane's, Chester's Chicken, Gus's World Famous Fried Chicken, Krispy Krunchy Chicken, Max’s Group, Inc., The Wendy's Company, Shake Shack, Burger King, Domino's Pizza (select offerings), Dicos (China). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fried Chicken Market Key Technology Landscape

The modern Fried Chicken Market relies heavily on proprietary and high-efficiency food service technology designed to maximize throughput while ensuring product consistency and food safety. Core to the kitchen landscape are advanced pressure fryers and high-capacity open fryers equipped with automated oil filtration systems. These technologies significantly extend the lifespan of cooking oil, reducing operational expenses and maintaining the optimal flavor and texture of the chicken. Digital controls integrated into these machines ensure precise temperature regulation and cooking cycles, which is paramount for safety compliance and achieving brand-standard crispness and tenderness across all franchised locations globally.

Beyond the core cooking equipment, the technology landscape is being redefined by digital operational tools. Mobile ordering platforms and Customer Relationship Management (CRM) systems utilizing predictive analytics are central to sales generation and customer retention. Furthermore, supply chain management (SCM) systems are increasingly adopting technologies like Blockchain for enhanced traceability of poultry from the farm to the restaurant. This level of transparency is becoming non-negotiable for addressing consumer demand regarding sourcing ethics and ensuring rapid recall capabilities in the event of food safety issues, thereby mitigating significant reputational risk.

Looking forward, the adoption of robotics and automation is a critical technology trend. Automated dispensing systems for spices and batters ensure precise ingredient usage, minimizing variations often seen in manual preparations. Collaborative robots (cobots) are being piloted in high-volume kitchens to assist with packaging and assembly tasks, addressing increasing labor costs and scarcity. Integration of Internet of Things (IoT) sensors into refrigeration and storage units provides real-time monitoring of environmental conditions, further enhancing food safety and operational compliance, solidifying technology's role as a major competitive differentiator in the QSR space.

Regional Highlights

Regional segmentation is crucial in understanding the diverse consumption patterns and growth drivers within the Fried Chicken Market. North America, particularly the United States, represents a mature but highly competitive market characterized by intense innovation in flavor profiles, sandwich wars, and rapid integration of alternative proteins. Growth here is primarily driven by menu premiumization, leveraging strong brand loyalty, and the continuous expansion of niche, fast-casual concepts focusing on specialized preparations or unique geographical heritage, such as Nashville hot chicken. The sophisticated supply chain infrastructure and high consumer acceptance of delivery services ensure robust sales continuity despite market maturity.

The Asia Pacific (APAC) region is indisputably the high-growth engine for the global market, driven by favorable demographics, urbanization, and rising discretionary spending in major economies like China, India, and Indonesia. Consumers in APAC exhibit a strong preference for fried chicken, often adapted with local flavor profiles (e.g., spicy, sweet glazes common in Korean and Southeast Asian markets). Market leaders prioritize aggressive franchise expansion and localized menu strategies, often incorporating rice meals or regional side dishes alongside traditional fried chicken offerings. The sheer volume of potential consumers and the accelerating adoption of digital ordering platforms guarantee sustained high CAGR for this region throughout the forecast period.

Europe and Latin America present contrasting market dynamics. Europe shows steady, albeit slower, growth, focusing on stringent sustainability and animal welfare standards, compelling QSRs to emphasize ethical sourcing. Demand in Western Europe is also shifting towards smaller portions and perceived higher-quality ingredients. Latin America, however, mirrors the growth characteristics of APAC, driven by strong youth demographics, increasing disposable incomes, and the cultural acceptance of quick and convenient Westernized meals, especially in high-density urban centers like São Paulo and Mexico City. This region provides significant untapped potential for QSR expansion and brand establishment.

- North America: Market maturity; focus on high-margin products, plant-based alternatives, and technological integration in ordering and delivery.

- Asia Pacific (APAC): Highest growth potential; driven by urbanization, localized flavor adoption (e.g., Korean Fried Chicken trend), and extensive franchising in developing nations.

- Europe: Focus on sustainable sourcing, animal welfare certifications, and product innovation to meet health-conscious consumer demands.

- Latin America (LATAM): Rapid expansion fueled by strong middle-class growth, youth population, and rising adoption of QSR dining formats.

- Middle East & Africa (MEA): Growth stimulated by expatriate populations, high digital penetration in key urban hubs, and strong demand for Halal-certified poultry products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fried Chicken Market.- Yum! Brands, Inc. (KFC)

- Chick-fil-A Inc.

- Restaurant Brands International (Popeyes Louisiana Kitchen)

- McDonald's Corporation

- Jollibee Foods Corporation

- Texas Chicken (Church's Texas Chicken)

- Bojangles Restaurants, Inc.

- Wingstop Inc.

- Zaxby's Franchising LLC

- Raising Cane's Chicken Fingers

- Chester's Chicken

- Gus's World Famous Fried Chicken

- Krispy Krunchy Chicken

- Max’s Group, Inc.

- The Wendy's Company

- Shake Shack Enterprises, LLC

- KFC Holdings Japan Ltd.

- Dicos (part of Ting Hsin International Group)

- Nando's Group Holdings Ltd. (Peri-Peri Chicken offerings)

- Craveable Brands (Red Rooster)

Frequently Asked Questions

Analyze common user questions about the Fried Chicken market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Fried Chicken Market?

The global Fried Chicken Market is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 6.3% between 2026 and 2033. This consistent growth is primarily supported by QSR expansion, robust delivery segment performance, and urbanization trends worldwide, particularly in the Asia Pacific region.

How is technology impacting supply chain management in the Fried Chicken industry?

Technology, specifically AI and Blockchain, is revolutionizing supply chain efficiency by enabling highly accurate predictive demand forecasting, thereby reducing raw material spoilage and optimizing inventory levels. Blockchain technology further enhances transparency and traceability of poultry sourcing, meeting consumer and regulatory demands for accountability.

Which market segment is expected to show the fastest growth trajectory?

The Boneless Chicken segment, including tenders, nuggets, and fillets, is projected to exhibit the fastest growth. This is driven by consumer demand for convenience, suitability for on-the-go consumption, and the versatility of boneless products in wraps and customized meal kits across QSR and retail channels.

What are the primary restraints affecting market expansion?

The major restraints include heightened consumer health awareness regarding the caloric and fat content of deep-fried foods, which necessitates product reformulation, and the persistent price volatility of essential commodities like poultry and cooking oils, which directly pressures operating margins for major market players.

How are QSRs adapting to the rise of plant-based protein consumption?

QSR chains are proactively integrating plant-based fried chicken alternatives into their menus, often using specialized proprietary recipes derived from soy, pea, or wheat proteins. This strategy targets flexitarian consumers and aims to capture market share from individuals seeking sustainable and healthier dietary choices without compromising the convenience of QSR dining.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fried Chicken Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Take-out Fried Chicken Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Chicken Breast, Chicken Wings, Chicken Legs, Whole Chicken, Others), By Application (Grown-ups, Children, Elderly Man, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager