Fuel Distribution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434177 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Fuel Distribution Market Size

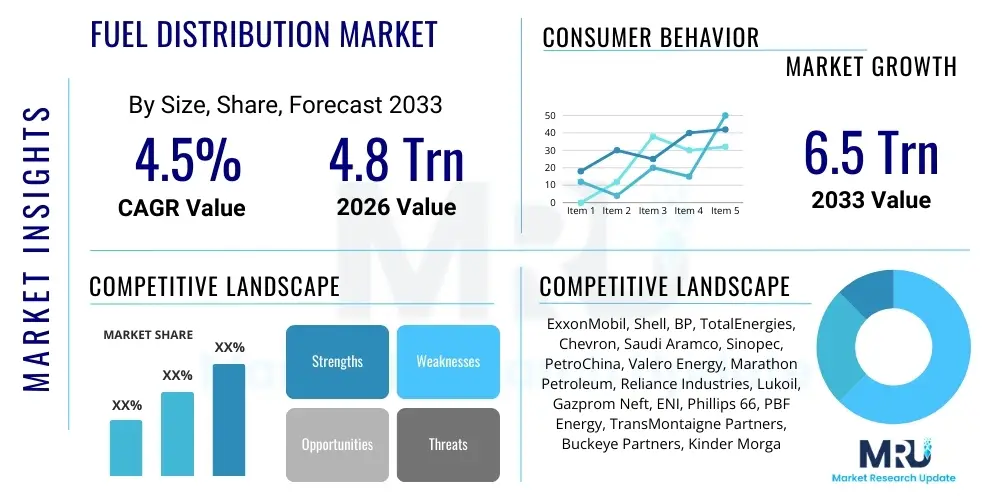

The Fuel Distribution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Trillion in 2026 and is projected to reach USD 6.5 Trillion by the end of the forecast period in 2033. This consistent expansion is primarily driven by persistent global demand for traditional hydrocarbon fuels, particularly in emerging economies undergoing rapid industrialization, coupled with the critical need for continuous modernization of distribution infrastructure worldwide to enhance efficiency and safety across the supply chain.

Fuel Distribution Market introduction

The Fuel Distribution Market encompasses the complex logistical processes, infrastructure, and services required to transport refined petroleum products, natural gas, and increasingly, renewable fuels, from production facilities (refineries, processing plants) to end-users (retail stations, industrial consumers, power generation utilities). This sector is foundational to global economic stability, ensuring reliable energy access for transportation, manufacturing, and heating needs. Key activities involve storage terminal management, pipeline operations, maritime shipping, rail transport, and road tanker logistics, all governed by stringent regulatory and environmental compliance standards.

The operational scope of the market is broad, covering diverse product categories such as gasoline, diesel, jet fuel, liquefied natural gas (LNG), and various biofuels. Major applications span across the entire energy consuming ecosystem, including commercial transportation (road, air, marine), heavy industry, agriculture, and defense sectors. The efficiency and resilience of fuel distribution networks directly impact fuel costs and energy security on a national and international level, making investment in infrastructure protection and optimization paramount.

Benefits derived from efficient fuel distribution include minimized supply chain losses, reduced operational costs for end-users, and enhanced energy security through diversified supply routes. Driving factors propelling the market include increasing urbanization and vehicle parc growth in Asia Pacific and Africa, the rising global trade requiring maritime fuel, and technological advancements focusing on digitalization and automation within distribution logistics. Furthermore, the transition toward cleaner fuels, such as LNG and hydrogen, necessitates new specialized distribution infrastructure, opening new avenues for market growth.

Fuel Distribution Market Executive Summary

The global Fuel Distribution Market is undergoing significant transformative shifts influenced by decarbonization mandates, geopolitical instability impacting supply security, and rapid technological integration aimed at maximizing operational efficiency. Business trends highlight a strong focus on asset rationalization, with major oil companies divesting non-core terminal assets while simultaneously investing heavily in upgrading pipeline integrity and digital twin technologies for predictive maintenance. Consolidation among midstream infrastructure providers is also observed, driven by the need for economies of scale and cross-regional infrastructure integration to handle complex, multi-modal transportation requirements.

Regional trends indicate that the Asia Pacific (APAC) region remains the primary growth engine, fueled by burgeoning energy demand from countries like India and China, requiring massive investments in new import terminals and domestic pipeline networks. Conversely, Europe is characterized by a strong regulatory push towards the distribution of alternative and low-carbon fuels, leading to significant structural changes in existing supply chains, favoring LNG bunkering infrastructure and nascent hydrogen distribution hubs. North America continues to leverage its extensive, mature pipeline network, focusing on modernizing security protocols and integrating smart sensing technologies to monitor long-distance crude and refined product transport.

Segment trends demonstrate robust growth in the transportation sector, particularly for high-grade diesel and jet fuel, mirroring global trade and air traffic recovery. However, the most dynamic shifts occur within the infrastructure segment, where investment is tilting away from purely road-based logistics towards enhanced pipeline capacity and marine distribution solutions (such as large-scale product tankers for intercontinental movements). Furthermore, the natural gas distribution segment, particularly LNG, is expanding rapidly as it serves as a critical bridge fuel, necessitating new regasification terminals and localized distribution grids for industrial and power generation applications.

AI Impact Analysis on Fuel Distribution Market

Common user questions regarding AI's impact on fuel distribution revolve around how advanced analytics can enhance efficiency, mitigate catastrophic failures, and manage the complexity introduced by incorporating volatile new energy sources like hydrogen and advanced biofuels. Users frequently inquire about the reliability of AI-driven demand forecasting, the feasibility of autonomous last-mile delivery systems using AI-optimized routes, and the security implications of integrating Machine Learning (ML) models into critical infrastructure Supervisory Control and Data Acquisition (SCADA) systems. The underlying concerns focus on minimizing operational downtime and ensuring pipeline and terminal security against physical and cyber threats through intelligent monitoring systems.

The deployment of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is fundamentally revolutionizing the core processes of fuel distribution by providing unparalleled optimization capabilities across the supply chain. AI models process massive datasets derived from sensors, weather patterns, historical consumption rates, and traffic congestion to generate highly accurate predictive demand forecasts. This intelligence allows distributors to optimize inventory levels at storage terminals, minimize deadhead mileage in trucking operations, and dynamically schedule product movements through pipeline networks, thus drastically reducing operational costs and minimizing the risk of localized shortages or surpluses.

Furthermore, AI is crucial in predictive maintenance and asset integrity management, which are critical components of secure fuel distribution. ML algorithms analyze continuous stream data from pipeline inspection gauges (PIGs), pressure sensors, and visual monitoring tools to detect subtle anomalies, corrosion points, or potential leaks long before they escalate into major incidents. This shift from time-based or reactive maintenance to predictive maintenance significantly extends the lifespan of expensive infrastructure assets, enhances worker safety, and substantially reduces environmental risks associated with fuel spills. AI-powered surveillance also improves security monitoring at critical infrastructure points like refineries and storage tanks, identifying unauthorized access patterns in real-time.

- Enhanced Demand Forecasting: Utilizing ML to predict consumption patterns and optimize inventory management across disparate geographic locations.

- Predictive Maintenance: Analyzing sensor data from pipelines and storage tanks to identify failure risks before they occur, improving asset uptime.

- Logistics and Route Optimization: Employing AI algorithms to determine the most efficient, safest, and fastest routes for road, rail, and marine distribution, minimizing fuel consumption and transit time.

- Security Monitoring and Threat Detection: Integrating AI into SCADA systems to monitor network traffic and physical access points, identifying and neutralizing cyber and physical security threats instantaneously.

- Autonomous Operations: Development of autonomous vehicles and drones for inspection and potentially last-mile delivery or terminal operations, guided by sophisticated AI navigation systems.

DRO & Impact Forces Of Fuel Distribution Market

The dynamics of the Fuel Distribution Market are shaped by powerful Drivers (D), significant Restraints (R), strategic Opportunities (O), and pervasive Impact Forces, collectively determining the sector's trajectory. Key drivers include sustained global energy demand, especially from developing economies, the necessity for robust energy security following geopolitical conflicts, and governmental mandates requiring infrastructure modernization. Conversely, major restraints encompass high capital expenditure requirements for new infrastructure, increasingly stringent environmental regulations targeting carbon footprint reduction, and volatile commodity pricing that complicates long-term investment planning and operational budgeting.

Strategic opportunities within the market are centered around the energy transition, specifically the development and deployment of infrastructure for transitional fuels like Liquefied Natural Gas (LNG) and emerging zero-carbon fuels such as green hydrogen and sustainable aviation fuels (SAF). The integration of digital technologies, including IoT sensors, Big Data analytics, and specialized supply chain software, presents a substantial opportunity for increasing operational efficiency, reducing human error, and creating more transparent and traceable supply lines, particularly vital for compliance and auditing purposes.

Impact forces significantly influencing the sector include accelerating climate change policies, which push companies toward decarbonization and diversification away from traditional hydrocarbons; rapid technological adoption, necessitating skilled labor retraining and cybersecurity investments; and complex geopolitical shifts, such as trade wars, sanctions, and regional conflicts, which constantly redraw optimal supply routes and create market uncertainty. Regulatory mandates governing safety standards for pipeline and tanker operations also act as a crucial, ongoing impact force, requiring continuous compliance monitoring and costly operational adjustments to meet evolving international standards.

Segmentation Analysis

The Fuel Distribution Market is highly heterogeneous and segmented based on the type of fuel distributed, the infrastructure utilized for transportation, and the end-user application. Understanding these segments is crucial for strategic market participation, as each segment possesses unique regulatory frameworks, technological requirements, and capital intensity profiles. The diversity of energy sources now being transported, ranging from conventional petroleum products to advanced biofuels and nascent hydrogen, adds complexity to network planning and asset specialization. For instance, the distribution of LNG requires cryogenic handling and specialized terminals, distinctly different from the ambient conditions required for gasoline pipelines.

The market is broadly categorized into product segmentation (e.g., Gasoline, Diesel, Jet Fuel, Natural Gas) and infrastructure segmentation (e.g., Pipelines, Trucking, Marine), with end-user segmentation determining the final point of consumption. The shift towards electrification in road transport, for example, disproportionately affects the gasoline and diesel distribution segments, pushing distributors to explore diversification into services like electric vehicle (EV) charging station integration or focusing on non-road segments like marine and aviation where alternative fuels are developing slower but require specific, dedicated distribution channels.

Furthermore, geographic segmentation is critical, reflecting differences in consumption patterns, regulatory regimes, and available infrastructure maturity. Developed regions like North America and Europe possess extensive pipeline networks and sophisticated terminal operations, emphasizing optimization and safety upgrades. In contrast, high-growth regions like APAC and MEA prioritize rapid infrastructure expansion, often relying more heavily on marine and trucking logistics to quickly meet escalating domestic demand before comprehensive pipeline networks can be established, creating diverse investment and operational landscapes across the global market.

- By Fuel Type:

- Gasoline (Petrol)

- Diesel Fuel

- Aviation Fuel (Jet Fuel, Avgas)

- Natural Gas (LNG, CNG)

- Liquefied Petroleum Gas (LPG)

- Biofuels (Ethanol, Biodiesel, Sustainable Aviation Fuel - SAF)

- Hydrogen (Emerging)

- By Infrastructure/Mode of Transport:

- Pipelines (Oil and Gas)

- Trucking/Tankers (Road Transport)

- Rail Tank Cars

- Marine Vessels (Tankers, Barges)

- Storage Terminals and Depots

- By End-User:

- Transportation Sector (Road Freight, Personal Vehicles, Aviation, Shipping)

- Industrial Sector (Manufacturing, Mining)

- Commercial Sector (Retail Outlets, Service Stations)

- Residential Sector (Heating Oil, LPG)

- Power Generation Utilities

Value Chain Analysis For Fuel Distribution Market

The value chain of the Fuel Distribution Market is characterized by a sequential flow of activities starting from the point of resource extraction and concluding at the final point of consumption, involving complex logistics and ownership transfers. Upstream activities primarily involve crude oil and natural gas exploration, production, and subsequent refining or processing into usable fuel products. This stage is dominated by major integrated oil companies (IOCs) and National Oil Companies (NOCs), establishing the crucial raw material inputs for the distribution network. The efficiency and scale of refining capacity directly influence the volume and type of products that enter the distribution pipeline.

The core of the distribution value chain lies in the midstream sector, which encompasses transportation, storage, and wholesale activities. This involves significant capital investment in fixed assets like pipelines, storage terminals, and transport fleets (trucks, ships, rail). Distribution channels are primarily segmented into direct and indirect routes. Direct distribution involves large contracts supplying industrial plants, power stations, or major airlines straight from the terminal. Indirect distribution relies on an extensive network of intermediary wholesalers and retailers (such as branded service stations) to reach the fragmented consumer market. The coordination of these channels, often managed through sophisticated IT systems, is vital for maintaining supply stability.

Downstream activities focus on marketing, retail sales, and customer service. This includes operating service station networks, bulk sales to commercial entities, and managing pricing strategies. The ownership structure in the downstream segment is highly fragmented, featuring small independent operators alongside multinational oil company brands. Profit margins are often tight in the downstream sector, leading to increased pressure for operational efficiency and diversification into non-fuel retail offerings. The integration of digital payment systems and loyalty programs further optimizes the final interaction point with the end consumer, completing the value transfer process.

Fuel Distribution Market Potential Customers

Potential customers for fuel distribution services are highly diversified, ranging from massive, globally interconnected industries to individual residential consumers, all requiring reliable energy delivery tailored to specific needs and regulatory environments. The largest and most demanding customer base resides within the Transportation Sector, specifically commercial road freight companies, logistics providers, and public transport operators that rely entirely on consistent diesel and gasoline supply to maintain operational schedules. Similarly, global aviation and maritime shipping industries require vast quantities of jet fuel and bunker fuel, often demanding specialized, high-volume delivery capabilities at major ports and airports worldwide.

The Industrial and Manufacturing Sectors represent another crucial customer segment, utilizing fuels like heavy fuel oil, natural gas, and propane for heating, power generation, and critical industrial processes such as cement production, steelmaking, and chemical manufacturing. These customers typically require bulk deliveries and often engage in long-term supply contracts, emphasizing price stability and guaranteed supply reliability. The transition to cleaner energy also means that distributors must increasingly cater to industrial customers shifting towards LNG or bio-LPG to meet decarbonization targets.

Furthermore, the Commercial and Retail segments, including independent and branded service stations, convenience stores, and heating oil distributors supplying residential areas, constitute the final-mile customer base. This segment requires highly efficient, scheduled logistics to prevent stock-outs, coupled with robust safety protocols for handling and storage. Governments and defense organizations also serve as major customers, demanding secure, strategic fuel reserves and distribution capabilities for military and emergency response operations, highlighting the critical role of distributors in national security infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Trillion |

| Market Forecast in 2033 | USD 6.5 Trillion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ExxonMobil, Shell, BP, TotalEnergies, Chevron, Saudi Aramco, Sinopec, PetroChina, Valero Energy, Marathon Petroleum, Reliance Industries, Lukoil, Gazprom Neft, ENI, Phillips 66, PBF Energy, TransMontaigne Partners, Buckeye Partners, Kinder Morgan, Enterprise Products Partners, Plains All American Pipeline, Sunoco Logistics Partners, Magellan Midstream Partners. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fuel Distribution Market Key Technology Landscape

The technology landscape within the Fuel Distribution Market is increasingly defined by the integration of digital tools designed to improve operational safety, enhance infrastructure resilience, and reduce logistical inefficiencies. Supervisory Control and Data Acquisition (SCADA) systems remain foundational, providing centralized remote monitoring and control over geographically dispersed pipeline, terminal, and storage facilities. However, these systems are now being upgraded with advanced analytics capabilities and fortified cybersecurity layers to protect against sophisticated external threats, which is critical given the interconnectedness of energy infrastructure.

The proliferation of the Internet of Things (IoT) is a major technological driver, enabling the deployment of countless sensors along distribution routes and within storage tanks. These sensors monitor parameters such as pressure, temperature, vibration, and flow rates in real-time, feeding massive datasets back into centralized platforms. This data forms the basis for machine learning models that execute predictive maintenance tasks and optimize inventory management by providing highly granular, real-time visibility into product movement. IoT adoption significantly reduces human intervention in routine monitoring, minimizing safety risks and optimizing staffing requirements.

Furthermore, specialized technologies supporting the future energy mix are gaining prominence. For instance, advanced composites and materials science are crucial for developing high-pressure, corrosion-resistant pipelines necessary for transporting hydrogen. Additionally, blockchain technology is emerging as a solution for enhanced transparency and tracking of biofuels and other renewable energy sources, ensuring regulatory compliance and verifying the provenance of environmentally sensitive products across complex, multi-party supply chains. Digital Twins, virtual replicas of physical infrastructure, are also being used for rigorous simulation and testing of maintenance and expansion scenarios without impacting live operations.

Regional Highlights

Regional dynamics heavily influence investment strategies and operational mandates across the Fuel Distribution Market, reflecting variances in energy consumption, regulatory maturity, and infrastructure age. North America, characterized by its mature and extensive pipeline network, focuses primarily on optimizing existing assets, improving cybersecurity protocols for cross-border infrastructure, and accommodating increased domestic crude and natural gas output. The region is seeing significant investment in storage capacity expansion, particularly for crude oil and NGLs (Natural Gas Liquids), driven by export opportunities and complex energy trading strategies.

The Asia Pacific (APAC) region stands out for its unmatched growth trajectory, driven by rapid urbanization, industrial expansion in China and India, and increasing regional air traffic. Distribution investment in APAC is heavily directed towards constructing new LNG receiving terminals, establishing coastal tank farms, and expanding road and rail connectivity to meet soaring demand. Unlike North America and Europe, many APAC nations face infrastructure deficits, requiring major greenfield investments that are often supported by government-led initiatives to secure energy independence and supply diversity.

Europe’s regional market is uniquely influenced by stringent climate targets and the urgent need to diversify away from traditional pipeline gas sources following geopolitical events. The focus here is on decommissioning older fossil fuel infrastructure while rapidly developing distribution capabilities for low-carbon alternatives. This includes building LNG import terminals, developing small-scale LNG bunkering infrastructure for marine transport, and pioneering regulatory frameworks and pilot projects for the blending and distribution of green hydrogen via existing or newly constructed gas grids. This regulatory-driven transition makes the European market highly dynamic yet structurally challenging for conventional fuel distributors.

- North America: Focus on pipeline modernization, cybersecurity enhancement, and substantial growth in NGL and crude oil export infrastructure, leveraging vast domestic reserves.

- Europe: Driven by environmental mandates; characterized by rapid adoption of LNG infrastructure, significant investment in logistics for biofuels and SAF, and the development of initial hydrogen distribution networks.

- Asia Pacific (APAC): Highest growth market due to industrialization and massive consumption spikes; investment concentrated on new marine terminals, expansion of trucking logistics, and foundational pipeline construction in high-density areas.

- Middle East and Africa (MEA): Vital production hub focusing on export efficiency, with significant investments in dedicated refinery-to-port pipelines and large-scale tanker loading facilities.

- Latin America (LATAM): Market characterized by fragmented regulatory environments and significant investment requirements for infrastructure repair and expansion, often focused on improving internal logistics efficiency and reducing fuel theft.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fuel Distribution Market.- ExxonMobil Corporation

- Royal Dutch Shell plc

- BP p.l.c.

- TotalEnergies SE

- Chevron Corporation

- Saudi Aramco

- China Petroleum & Chemical Corporation (Sinopec)

- PetroChina Company Limited

- Valero Energy Corporation

- Marathon Petroleum Corporation

- Reliance Industries Limited

- PJSC Lukoil

- Gazprom Neft PJSC

- Eni S.p.A.

- Phillips 66

- PBF Energy Inc.

- TransMontaigne Partners L.P.

- Buckeye Partners, L.P.

- Kinder Morgan, Inc.

- Enterprise Products Partners L.P.

- Plains All American Pipeline, L.P.

- Magellan Midstream Partners, L.P.

- Sunoco LP

- Vitol Group

- Glencore plc

Frequently Asked Questions

Analyze common user questions about the Fuel Distribution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary modes of fuel distribution utilized globally?

The primary modes are pipelines, which offer high volume, low-cost transport for long distances; marine vessels (tankers and barges) for intercontinental and coastal transport; and road tankers (trucking) for last-mile delivery and regional distribution. Rail transport is also critical for moving large volumes across regions where pipeline infrastructure is absent or inadequate.

How is the energy transition impacting investments in fuel distribution infrastructure?

The energy transition is diverting capital investment toward infrastructure specialized for low-carbon fuels. This includes building facilities for Liquefied Natural Gas (LNG) bunkering, upgrading pipeline materials for hydrogen compatibility, and establishing dedicated supply chains for advanced biofuels (e.g., Sustainable Aviation Fuel - SAF), while conventional infrastructure focuses on optimization and resilience.

What are the main regulatory challenges faced by fuel distribution companies?

Key regulatory challenges include increasingly strict environmental standards regarding emissions and leak prevention, compliance with complex cross-border transportation regulations, adherence to volatile safety mandates (particularly for hazardous materials), and stringent requirements for infrastructure maintenance and integrity testing mandated by governmental bodies.

How does digitalization improve the efficiency and safety of fuel distribution?

Digitalization improves efficiency through AI-powered logistics optimization, minimizing empty return trips and reducing transit times. Safety is enhanced through the integration of IoT sensors and predictive maintenance algorithms that monitor pipeline health in real-time, proactively identifying potential failures, and bolstering cybersecurity protocols for operational control systems (SCADA).

Which geographic region is expected to lead market growth and why?

The Asia Pacific (APAC) region is projected to lead market growth through 2033. This is primarily driven by massive, sustained energy demand resulting from ongoing rapid industrialization, high population growth, and expanding commercial air and road transportation needs across major economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fuel Distribution Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fuel Distribution Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Gasoline (petrol), Diesel, CNG, Others), By Application (Gas Lighting, Cooking, Heating, Power Generation, Transport Fuel), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager