Fume Hood Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434449 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Fume Hood Market Size

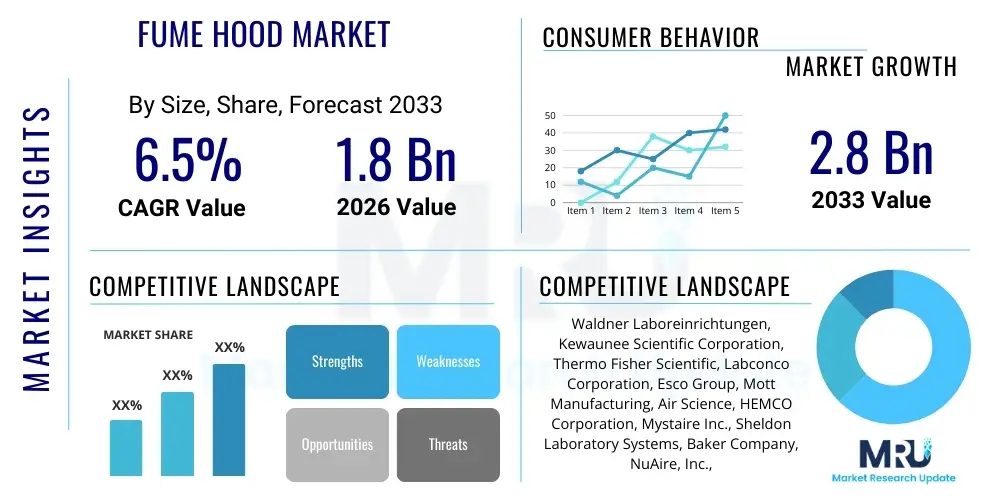

The Fume Hood Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 billion in 2026 and is projected to reach USD 2.8 billion by the end of the forecast period in 2033.

Fume Hood Market introduction

Fume hoods are essential pieces of laboratory ventilation equipment designed to protect users from inhaling toxic fumes, hazardous dust, and volatile vapors generated during experimental procedures. These devices function by drawing air from the laboratory environment and exhausting it outside after filtration or directing it through a ducted system. The fundamental principle revolves around creating a containment area where airflow management ensures chemical pollutants are safely handled, thereby maintaining a safe working environment and complying with stringent occupational health and safety regulations enforced globally.

The product portfolio encompasses various designs, including constant air volume (CAV) and variable air volume (VAV) fume hoods, along with ductless systems that utilize filtration media like activated carbon or HEPA filters. Major applications span across highly regulated sectors such as pharmaceuticals, biotechnology, chemicals, and academic research institutions where handling hazardous substances is routine. The increasing investment in R&D activities, particularly in emerging economies, coupled with expanding regulatory mandates focused on laboratory safety standards, are the primary driving factors propelling market expansion.

Key benefits derived from implementing advanced fume hood systems include enhanced personnel protection, minimized risk of cross-contamination, and improved energy efficiency, particularly with VAV systems that modulate airflow based on sash height or operational needs. The ongoing technological evolution emphasizes integrated monitoring systems, ergonomic designs, and sustainable operational features, positioning the fume hood market as critical infrastructure supporting global scientific advancement and industrial quality control. Continuous innovation focuses on optimizing capture efficiency and reducing the overall environmental footprint of laboratory operations.

Fume Hood Market Executive Summary

The Fume Hood Market is experiencing robust growth driven by accelerating global investment in pharmaceutical R&D, stringent safety regulations governing laboratory environments, and the increasing adoption of energy-efficient ventilation technologies like Variable Air Volume (VAV) systems. Business trends indicate a strong shift toward customization, where manufacturers are integrating smart features, such as remote monitoring and predictive maintenance capabilities, to enhance operational efficiency and compliance tracking for end-users. Consolidation among major vendors and strategic partnerships focused on sustainable laboratory design practices are defining the competitive landscape, emphasizing total cost of ownership reduction rather than initial capital expenditure.

Regionally, North America and Europe maintain dominance, primarily due to established pharmaceutical and biotechnology sectors and well-defined safety standards (e.g., ANSI/ASHRAE 110 testing). However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth is fueled by substantial government initiatives to boost domestic drug manufacturing, the proliferation of contract research organizations (CROs), and increasing foreign direct investment in research infrastructure across countries like China and India. Market saturation concerns in developed economies are offset by replacement cycles driven by technological upgrades favoring high-efficiency models.

Segment trends highlight the critical importance of ducted fume hoods, which currently command the largest market share due to their superior performance in handling highly toxic or volatile chemicals. Nonetheless, the ductless segment is gaining traction, particularly in educational and light-duty research settings, owing to ease of installation, mobility, and lower infrastructure costs. By material, stainless steel and polypropylene remain favored choices, reflecting the need for corrosion resistance and durability across diverse laboratory applications, further cementing the market's focus on material science advancements tailored for specific chemical resistance profiles.

AI Impact Analysis on Fume Hood Market

User queries regarding the impact of Artificial Intelligence (AI) on the Fume Hood Market primarily revolve around how smart technology can enhance safety protocols, optimize energy consumption, and streamline compliance documentation. Users are keenly interested in predictive maintenance capabilities—specifically, if AI algorithms can anticipate filter saturation or fan failure, thus minimizing downtime and maintaining optimal containment levels. Furthermore, questions frequently address the potential for AI-driven sensors to dynamically adjust airflow rates based on real-time detection of chemical concentrations or operational parameters, moving beyond conventional VAV systems to achieve near-perfect energy efficiency and user protection. The overarching theme is the transition from passive ventilation equipment to active, intelligent safety platforms.

AI integration is expected to revolutionize Fume Hood operation by enabling highly sophisticated monitoring and control systems. Machine learning algorithms, trained on historical usage data and environmental conditions, can optimize fan speeds and sash positions more accurately than fixed protocols, ensuring compliance with standards while drastically reducing energy consumption—a significant operational cost in laboratory settings. This level of optimization minimizes the laboratory's overall environmental impact and extends the lifespan of critical components by operating them within precise parameters. Furthermore, AI platforms can automatically generate detailed audit trails and regulatory reports, reducing the administrative burden associated with compliance management in highly regulated sectors.

The application of computer vision and AI in fume hood technology also extends to enhancing user safety through behavioral analysis. Cameras and sensors integrated into the hood can monitor operator movements, identifying unsafe practices (such as rapid sash movements or leaning into the hood) and providing immediate feedback or alerts. This proactive approach significantly reduces human error-related incidents. As laboratories increasingly move towards digitalization, AI acts as the central intelligence layer, connecting fume hoods with building management systems (BMS) and laboratory information management systems (LIMS) to create a holistic, interconnected, and inherently safer research ecosystem, driving demand for 'smart lab' infrastructure upgrades.

- AI enables predictive maintenance, forecasting equipment failure (fans, filters) to ensure continuous operational safety.

- Machine learning optimizes Variable Air Volume (VAV) system performance, achieving 15-30% energy savings through dynamic airflow adjustments.

- Integrated AI sensors monitor real-time chemical concentrations, providing immediate feedback for containment integrity.

- AI facilitates automated regulatory reporting and compliance documentation, generating auditable usage logs.

- Computer vision systems enhance user safety by monitoring and correcting unsafe operational behaviors near the sash.

- Smart integration links fume hoods to broader Building Management Systems (BMS) for centralized resource management and efficiency.

DRO & Impact Forces Of Fume Hood Market

The Fume Hood Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive dynamics and growth trajectory of the sector. The primary driver remains the continuous and substantial investment in life sciences R&D globally, especially in emerging fields such as genomics and personalized medicine, requiring expanded and modernized laboratory infrastructure. Simultaneously, strict governmental and international regulations (e.g., OSHA, ACGIH, EN 14175) mandating workplace safety and proper hazardous substance containment act as powerful market accelerators. These regulatory forces necessitate the routine upgrade and replacement of older, inefficient hoods with compliant, high-performance models, ensuring sustained demand across all major geographies.

Despite strong drivers, the market faces significant restraints, chiefly the high initial capital expenditure associated with installing ducted fume hood systems, including complex ventilation infrastructure and specialized HVAC requirements. Furthermore, the substantial operational cost associated with energy consumption, particularly for Constant Air Volume (CAV) systems which exhaust large volumes of conditioned air, often deters small to medium-sized research facilities from investing in top-tier equipment. The specialized nature of installation and maintenance, requiring certified technicians, also contributes to the overall complexity and cost structure, particularly in remote or underdeveloped regions, limiting immediate market penetration.

Opportunities for growth are abundant, focusing heavily on sustainability and technological innovation. The increasing global focus on green building initiatives and energy efficiency provides a strong tailwind for Variable Air Volume (VAV) and high-performance/low-flow fume hoods, positioning them as the future standard. Moreover, the emergence of ductless fume hoods, offering flexibility and cost-effectiveness without permanent ventilation systems, opens up new market segments, particularly in educational laboratories and quality control settings. Finally, the integration of Internet of Things (IoT) sensors and smart monitoring capabilities presents a lucrative opportunity for manufacturers to offer value-added services, optimizing hood performance remotely and transitioning the business model toward solutions-based offerings rather than mere equipment sales.

Segmentation Analysis

The Fume Hood Market is systematically segmented based on product type, design, material, and end-user application, allowing for a granular analysis of market dynamics and targeted strategic development. Product segmentation differentiates between Ducted and Ductless Fume Hoods, reflecting the requirement for either permanent exhaust systems (Ducted) crucial for handling highly volatile chemicals or filtered recirculation systems (Ductless) favored for flexibility and lower installation costs. The Design classification focuses on air flow mechanics, primarily contrasting Constant Air Volume (CAV) hoods, which offer simplicity and reliability, with the more complex, yet significantly more energy-efficient, Variable Air Volume (VAV) hoods. This structure helps identify areas of intense technological investment and shifting procurement trends.

Material segmentation is vital due to the harsh chemical environment in which these devices operate, classifying hoods based on construction from Stainless Steel, Polypropylene, Fiberglass Reinforced Plastic (FRP), or other chemically resistant compounds. Stainless steel remains dominant in pharmaceutical and high-heat applications, while polypropylene is increasingly preferred in educational and specialized research where resistance to aggressive acid environments is paramount. Furthermore, the End-User analysis separates demand based on organizational requirements, distinguishing between academic institutions, governmental research bodies, pharmaceutical and biotechnology companies, and industrial sectors such as chemical manufacturing and food testing laboratories. Each segment possesses distinct regulatory requirements, budget constraints, and operational needs that drive specific product type adoption.

The strategic importance of effective segmentation lies in understanding the complex purchasing criteria of large end-users, particularly the pharmaceutical sector which demands high containment integrity and documented performance, favoring certified VAV ducted systems. Conversely, academic settings often prioritize affordability and ease of maintenance, leading to higher adoption rates of both conventional CAV systems and ductless options. Analyzing these preferences allows manufacturers to tailor marketing messages, R&D investments (e.g., focusing on ergonomic sash designs for universities or high-corrosion materials for industrial applications), and regional distribution channels to maximize market penetration and ensure compliance specificity across different laboratory environments.

- By Type:

- Ducted Fume Hoods

- Ductless Fume Hoods

- By Design:

- Constant Air Volume (CAV) Fume Hoods

- Variable Air Volume (VAV) Fume Hoods

- Auxiliary Air Fume Hoods

- By Material:

- Stainless Steel Fume Hoods

- Polypropylene Fume Hoods

- Fiberglass Reinforced Plastic (FRP) Fume Hoods

- Others (Epoxy Resin, Phenolic Resin)

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutions

- Chemical and Petrochemical Industry

- Food & Beverage Testing Laboratories

- Others (Forensics, Environmental Testing)

Value Chain Analysis For Fume Hood Market

The value chain for the Fume Hood Market begins with the upstream segment, primarily involving the sourcing of specialized raw materials critical for containment integrity and chemical resistance. This includes high-grade metals (stainless steel), engineering plastics (polypropylene, PVC), and sophisticated materials for specialized components like sash glass (tempered or laminated), control systems, and filtration media (activated carbon, HEPA filters). Key upstream activities focus heavily on quality control and material certification, ensuring components meet strict industry standards for corrosion resistance and structural durability. Due to the high-performance requirements, supply chain resilience and strategic sourcing of corrosion-resistant liners and structural composites are paramount to maintaining production capacity and product quality.

The midstream phase encompasses the manufacturing and assembly processes, which are complex and precision-driven. This stage involves the fabrication of the hood body, the integration of advanced airflow mechanics (e.g., VAV controllers, sensors, fan motors), and rigorous performance testing (e.g., ASHRAE 110 containment tests) to certify safety and efficiency. Manufacturers often rely on specialized engineering expertise to design and produce baffles and plenums that ensure uniform airflow and minimize turbulence, critical for effective containment. Direct distribution channels are often favored for large-scale, customized projects, where manufacturers handle sales, installation, and commissioning directly with the end-user, ensuring system integration with the building's HVAC infrastructure.

The downstream segment focuses on distribution, installation, and after-market services. Distribution involves both direct sales channels, particularly for sophisticated VAV systems requiring high levels of technical support, and indirect channels through specialized laboratory equipment distributors and regional resellers, often used for standard CAV or ductless models. Installation and commissioning are highly technical services, requiring factory-trained personnel to validate performance upon site setup. Critical downstream revenue streams are generated through maintenance contracts, calibration services, and the recurring sale of replacement filters and spare parts, establishing a continuous service relationship with the end-users long after the initial purchase.

Fume Hood Market Potential Customers

The primary customers for Fume Hoods are entities that routinely conduct operations involving hazardous chemicals, volatile solvents, or biological agents requiring localized ventilation and containment. The largest segment remains the pharmaceutical and biotechnology industry, encompassing major drug developers, contract manufacturing organizations (CMOs), and contract research organizations (CROs). These customers require high-performance, often VAV-enabled, ducted fume hoods to ensure regulatory compliance during drug discovery, formulation, and quality control testing, necessitating strict adherence to GLP (Good Laboratory Practice) standards and documented containment efficacy.

Academic and governmental research institutions represent another crucial customer base. Universities, polytechnics, and government laboratories (e.g., national institutes of health, environmental agencies) purchase fume hoods for educational purposes, basic research, and large-scale public health studies. While academic institutions may be more budget-sensitive, leading to a higher penetration of standard CAV and cost-effective ductless hoods, the overall volume of these installations remains consistently high due to the necessity of equipping new teaching and research facilities worldwide. Their purchasing decisions are often centralized and highly influenced by institutional safety protocols and available funding cycles.

Beyond life sciences, the chemical and petrochemical industries constitute a substantial end-user group, utilizing fume hoods for product development, quality assurance, and material testing, frequently requiring specialized, highly corrosion-resistant materials (e.g., FRP or polypropylene) to withstand aggressive industrial chemicals. Furthermore, emerging customers include food and beverage testing laboratories, forensic science facilities, and environmental testing centers, all of which require specialized containment for sample preparation and analysis. The growing emphasis on quality assurance and safety standards across all industrial sectors ensures a diversified and resilient customer demand portfolio for advanced containment solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Waldner Laboreinrichtungen, Kewaunee Scientific Corporation, Thermo Fisher Scientific, Labconco Corporation, Esco Group, Mott Manufacturing, Air Science, HEMCO Corporation, Mystaire Inc., Sheldon Laboratory Systems, Baker Company, NuAire, Inc., Telstar, Shimadzu Corporation, Yamato Scientific Co., Ltd., Flow Science, PSA Laboratory Furniture, Waldner Holding GmbH & Co. KG, AML Systems, Sentry Air Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fume Hood Market Key Technology Landscape

The technological landscape of the Fume Hood Market is continuously evolving, driven primarily by the need for enhanced safety, improved energy efficiency, and seamless integration into modern laboratory management systems. Variable Air Volume (VAV) technology remains the most critical advancement, utilizing sophisticated sensors and controllers to dynamically modulate the exhaust airflow rate based on the fume hood sash position. This innovation, compared to older Constant Air Volume (CAV) systems, can drastically reduce the volume of conditioned air exhausted, leading to significant energy savings and lower operational costs. Further refinements in VAV systems include faster response times and enhanced fail-safe mechanisms to ensure containment integrity is never compromised, even during rapid operational changes.

Another major technological development involves the optimization of internal aerodynamic design. Manufacturers are increasingly using Computational Fluid Dynamics (CFD) modeling during the design phase to optimize baffle geometry, slotted openings, and airfoils. This results in ultra-low flow and high-performance hoods that can achieve safe containment at lower face velocities, minimizing air turbulence at the hood face and improving overall capture efficiency. These designs often incorporate proprietary sash stops and aerodynamic entry shapes to guide airflow smoothly, thereby reducing the probability of plume escape and minimizing the energy required to maintain safety standards.

The burgeoning trend of Laboratory 4.0 has led to the integration of Internet of Things (IoT) sensors and digital monitoring systems. Modern fume hoods are equipped with embedded microprocessor controllers, humidity/temperature sensors, and pressure monitors that communicate real-time performance data to centralized Building Management Systems (BMS). This connectivity enables remote diagnostics, automated alerts for filter saturation or fan irregularities, and facilitates the collection of data required for predictive maintenance protocols. Digitalization transforms the fume hood from a passive safety device into an active, data-generating asset, crucial for maintaining sophisticated, energy-efficient, and compliant research environments.

Regional Highlights

North America holds the largest share of the Fume Hood Market, propelled by the presence of a robust, highly funded pharmaceutical and biotechnology sector, particularly in the United States. The region benefits from stringent regulatory enforcement by bodies like OSHA and adherence to standards such as ASHRAE 110, which necessitate regular upgrades and certified performance. High levels of R&D expenditure, combined with institutional support for modernizing university and government laboratories, drive sustained demand for advanced, energy-efficient VAV fume hoods and customized containment solutions. Furthermore, established infrastructure and technological readiness support the immediate adoption of smart, IoT-enabled laboratory equipment.

Europe represents a mature and technologically advanced market, second only to North America in terms of market value. Growth is underpinned by strong centralized R&D funding (e.g., Horizon Europe programs) and rigorous compliance requirements mandated by European standards (EN 14175 series). Germany, the UK, and France are pivotal markets, driven by leading chemical industries and biomedical research centers. The European emphasis on sustainability and energy efficiency significantly boosts the adoption of high-performance, low-flow fume hood designs and fosters innovation in environmentally conscious laboratory design and construction protocols.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily attributed to rapidly expanding economies like China and India, which are witnessing massive investments in domestic pharmaceutical manufacturing, contract research, and academic infrastructure expansion. Increasing awareness of occupational safety standards, often driven by international collaborations and multinational company presence, forces local facilities to adopt globally accepted containment solutions. While cost sensitivity remains a factor, driving demand for basic Ducted and Ductless models, the influx of advanced research facilities is rapidly increasing the uptake of complex VAV systems in key industrial and research clusters across the region.

- North America: Dominant market share due to high R&D spending in biotech and strict adherence to ANSI/ASHRAE standards; high adoption of smart VAV systems.

- Europe: Strong regulatory framework (EN 14175) and focus on sustainability driving demand for high-efficiency and low-energy consumption models; significant market in Germany and the UK.

- Asia Pacific (APAC): Highest CAGR driven by infrastructure expansion, government investment in pharmaceutical production (India, China), and increasing acceptance of global safety protocols.

- Latin America (LAMEA): Emerging market characterized by gradual adoption of modern safety equipment, driven by foreign investment in mining and chemical processing sectors.

- Middle East and Africa (MEA): Growth tied to burgeoning petrochemical research centers and health sciences initiatives, often favoring specialized corrosion-resistant hoods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fume Hood Market.- Waldner Laboreinrichtungen

- Kewaunee Scientific Corporation

- Thermo Fisher Scientific

- Labconco Corporation

- Esco Group

- Mott Manufacturing

- Air Science

- HEMCO Corporation

- Mystaire Inc.

- Sheldon Laboratory Systems

- The Baker Company

- NuAire, Inc.

- Telstar

- Shimadzu Corporation

- Yamato Scientific Co., Ltd.

- Flow Science

- PSA Laboratory Furniture

- Waldner Holding GmbH & Co. KG

- AML Systems

- Sentry Air Systems

Frequently Asked Questions

Analyze common user questions about the Fume Hood market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Ducted and Ductless Fume Hoods?

Ducted fume hoods connect to a building's exhaust system, removing hazardous air directly outside, suitable for highly volatile or toxic chemicals. Ductless fume hoods use internal filtration (e.g., carbon filters) to clean the air before returning it to the lab, offering mobility and lower installation costs, best suited for light-duty or specific chemical applications.

How do Variable Air Volume (VAV) systems enhance Fume Hood operation?

VAV systems utilize sensors and automated dampers to adjust the exhaust air volume proportional to the sash height. This dynamic modulation ensures constant face velocity, maintaining safety while significantly reducing energy consumption compared to Constant Air Volume (CAV) systems, which run at full capacity regardless of the operational need.

Which industry segment is the largest end-user for advanced Fume Hoods?

The pharmaceutical and biotechnology industry is the largest end-user segment, driven by stringent regulatory requirements (GLP/GMP) for handling highly sensitive and hazardous materials during drug discovery, formulation, and quality control processes. This sector typically demands certified high-performance VAV and ducted systems.

What major regulatory standards govern Fume Hood performance globally?

Globally recognized standards include ANSI/ASHRAE 110 (North America), which defines test methods for performance, and the European standard EN 14175, which specifies construction and testing requirements. Compliance with these standards is critical for safety certification and procurement across international laboratories.

What impact does IoT and AI technology have on the Fume Hood Market?

IoT sensors facilitate real-time monitoring of airflow, temperature, and filter saturation, enabling remote diagnostics and automated reporting. AI algorithms use this data for predictive maintenance, optimizing VAV performance, and ensuring energy efficiency, transforming traditional hoods into smart, integrated laboratory safety assets.

What materials are commonly used in Fume Hood construction and why?

Common materials include Stainless Steel, preferred for high-heat applications and durability, and Polypropylene, chosen for its excellent chemical resistance, particularly against aggressive acids and bases often used in educational and specialized chemical synthesis labs. Fiberglass Reinforced Plastic (FRP) is also used for specific corrosive environments.

Is there a growing trend toward using ductless fume hoods in industrial settings?

Yes, while ducted hoods remain standard for high-toxicity applications, ductless models are seeing increasing adoption in industrial quality control and light-duty sample preparation areas. This is primarily due to their modularity, ease of relocation, and avoidance of complex HVAC integration, offering a flexible containment solution where chemical usage is limited or filtered effectively.

How does the increasing focus on sustainability affect Fume Hood purchasing decisions?

Sustainability is a major driver, shifting purchasing decisions toward ultra-low flow, high-performance, and VAV fume hoods. These systems significantly reduce the air exchange rates of the laboratory, minimizing the energy required to condition the makeup air, aligning with corporate and governmental green building mandates and reducing long-term operational costs.

What is the role of Computational Fluid Dynamics (CFD) in modern fume hood design?

CFD modeling is used during the design phase to simulate airflow patterns, pressure drops, and potential turbulence inside and around the fume hood. This allows manufacturers to optimize baffle placement and airfoil design, maximizing containment efficiency at lower face velocities, which contributes directly to energy savings and improved safety performance.

What are the key restraint factors limiting the Fume Hood Market growth?

The primary restraint is the high initial capital investment required for installing ducted systems, including associated infrastructure and HVAC modifications. Additionally, the substantial operational cost related to the high energy consumption needed to exhaust conditioned air, particularly in large facilities utilizing older CAV technology, presents a financial barrier.

How does the value chain manage the distribution of Fume Hoods?

Distribution relies on a hybrid model: direct channels are favored for complex VAV and custom projects requiring manufacturer installation and commissioning support. Indirect channels, utilizing specialized laboratory equipment dealers, handle standard, off-the-shelf models and provide wider market reach, especially in developing regions.

What is the significance of the ASHRAE 110 testing method?

ASHRAE 110 is the industry-recognized standard test method used to evaluate and certify the containment performance of a fume hood. It involves releasing tracer gas (usually sulfur hexafluoride) inside the hood and measuring its concentration at the operator's breathing zone, ensuring the hood meets specified safety thresholds under operating conditions.

How is the Fume Hood Market performing in the Asia Pacific (APAC) region?

APAC is the fastest-growing regional market, driven by massive investments in domestic pharmaceutical R&D, expansion of educational facilities, and growing awareness of occupational safety. Countries like China and India are leading this growth, transitioning from basic lab equipment to advanced containment solutions supported by governmental initiatives.

What are auxiliary air fume hoods and where are they typically used?

Auxiliary air hoods supply unconditioned or partially conditioned air from an external source directly to the hood's face. They are designed to save energy by reducing the volume of expensive, fully conditioned air exhausted from the laboratory space, making them common in climates where heating or cooling costs are high, though they are less prevalent than modern VAV systems.

What are the key considerations for customers when selecting a Fume Hood material?

Selection is based on the corrosivity of the chemicals being handled, temperature requirements, and ease of decontamination. Polypropylene is chosen for high acid/base resistance, while stainless steel is vital where fire resistance or heavy-duty use is expected. Chemical resistance charts must be consulted to ensure material compatibility with operational solvents.

How does the Fume Hood Market address potential filter saturation risks in ductless systems?

Modern ductless hoods incorporate electronic monitoring systems, often with AI integration, that constantly measure the saturation level of the carbon or HEPA filters. These systems provide audible and visual alarms, and often automated notifications via network connectivity, alerting the user when filters require replacement to maintain safety compliance and effective containment.

What opportunities exist in the aftermarket segment of the Fume Hood Market?

The aftermarket segment is highly lucrative, revolving around maintenance, calibration, certification, and the replacement of critical components. Recurring revenues are driven by the mandated annual testing (e.g., ASHRAE 110 recertification) and the continuous need for replacement filters and sash components, particularly for large installed bases globally.

How are Fume Hood manufacturers addressing the ergonomic concerns of users?

Manufacturers are focusing on ergonomic improvements such as vertical and horizontal sliding sashes that reduce physical strain, counterbalanced mechanisms for easy operation, and integrated glare-free lighting. Control panels are also being designed for intuitive access and display, improving user comfort and encouraging safe operating practices.

What factors contribute to the high operational costs of traditional Fume Hoods?

The primary contributor to high operational cost is the large volume of conditioned air (heated or cooled) that Constant Air Volume (CAV) systems exhaust from the building 24/7. Replacing this conditioned air with fresh air requires significant energy expenditure by the HVAC system, making the running costs far exceed the initial purchase price over the hood’s lifespan.

What is the expected long-term impact of digitalization (Lab 4.0) on Fume Hood design?

Digitalization will lead to Fume Hoods becoming fully integrated, predictive safety nodes. Future designs will feature standardized communication protocols, built-in data logging for compliance automation, and AI-driven control systems capable of adjusting ventilation based on scheduled experiments or chemical inventory, leading to self-optimizing laboratory environments.

How do pharmaceutical CMOs differ from academic labs in their Fume Hood requirements?

CMOs (Contract Manufacturing Organizations) require hoods that meet stringent GMP (Good Manufacturing Practice) standards, focusing on cleanability, validation documentation, and high containment integrity for scale-up processes. Academic labs, conversely, prioritize versatility, ease of student use, and cost-effectiveness for educational and basic research activities.

What role does noise reduction play in modern Fume Hood technology?

Noise reduction is a significant consideration for user comfort and laboratory acoustics. Manufacturers utilize quieter fan technologies, acoustically insulated plenums, and optimized ductwork design to minimize noise output, adhering to international noise level standards to create a better working environment for research personnel.

What is the market relevance of walk-in fume hoods?

Walk-in fume hoods are specialized, large-scale containment devices necessary for handling oversized equipment, performing distillations, or housing robotics and pilot plant setups that cannot fit into standard benchtop hoods. Their market relevance is concentrated in industrial chemical processing, pilot manufacturing, and large governmental research facilities where scale is critical.

How is the Fume Hood Market addressing increasing concerns about potential terrorist threats or intentional releases?

The market is responding by developing high-containment enclosures and specialized toxic gas cabinets, which are designed for robust containment under extreme conditions. Furthermore, integration with central building security systems allows for rapid shutdown or increased exhaust filtration in response to detected threats or intentional chemical releases, enhancing overall building resilience.

What impact does the growth of specialized research areas like nanotechnology have on Fume Hood design?

Nanotechnology research requires specialized containment to handle ultrafine particles, which necessitates the integration of high-efficiency HEPA or ULPA filters even in ducted hoods (to protect the environment). The design must also prevent particle deposition, leading to smoother internal surfaces and dedicated nanoparticle handling systems within the hood.

How can users verify the long-term containment integrity of their fume hoods?

Long-term containment integrity is verified through annual or biennial performance certifications, typically employing the ASHRAE 110 tracer gas test. Additionally, ongoing monitoring of face velocity and pressure differentials using integrated digital monitors ensures that day-to-day operational fluctuations do not compromise the hood's containment capacity.

What are the emerging market opportunities in developing economies for Fume Hoods?

Developing economies present vast opportunities as they rapidly establish pharmaceutical manufacturing bases and modernize academic institutions. The initial focus is often on robust, cost-effective standard ducted and ductless hoods, paving the way for eventual upgrades to VAV systems as infrastructure and safety awareness mature, offering a sustained, phased growth path for manufacturers.

How are manufacturers ensuring chemical resistance in the lining materials?

Lining materials are selected based on the end-user application. High-grade phenolic resins, epoxy resins, and specialized polypropylene blends are used for extreme chemical resistance. Manufacturers rigorously test these materials against common corrosive agents (acids, bases, solvents) to guarantee long-term performance and prevent catastrophic equipment failure.

What is the role of airfoils in the performance of a modern fume hood?

The airfoil, located at the bottom front edge of the hood opening, is crucial for guiding air smoothly and uniformly into the hood chamber. It minimizes turbulent eddies that can cause chemical vapors to escape into the breathing zone and improves overall capture efficiency, especially when the operator is actively working at the hood face.

How does the total cost of ownership (TCO) factor into Fume Hood procurement?

TCO is increasingly crucial, moving purchasing focus away from low upfront costs towards long-term operational efficiency. VAV systems, despite a higher initial price, offer significantly lower TCO due to reduced energy consumption and potential savings on HVAC capacity, making them economically favorable over their 15-20 year lifespan compared to energy-intensive CAV models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fume Hood Air Flow Monitors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fume Hood Market Size Report By Type (Ductless Fume Hoods, Ducted Fume Hoods), By Application (Undergraduate Teaching Labs, Industrial and Biomedical Research Labs, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fume Hood Air Flow Monitors Market Statistics 2025 Analysis By Application (Life Science and Pharmaceutical, Hospitals and Laboratories, Universities and Academics, Government Facilities, Others), By Type (Fume Hood Digital Air Flow Monitor, Fume Hood Analog Air Flow Monitor), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Ductless Fume Hood Market Statistics 2025 Analysis By Application (Undergraduate Teaching Labs, Industrial and Biomedical Research Labs), By Type (With Secondary Carbon Filter, With Secondary HEPA Filter, Standard Model, The standard model ductless fume hood is projected to account for the largest sales volume market share. This segment accounteds for 78% share.), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fume Hood Market Statistics 2025 Analysis By Application (Undergraduate Teaching Labs, Industrial and Biomedical Research Labs), By Type (Ductless Fume Hoods, Ducted Fume Hoods), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager