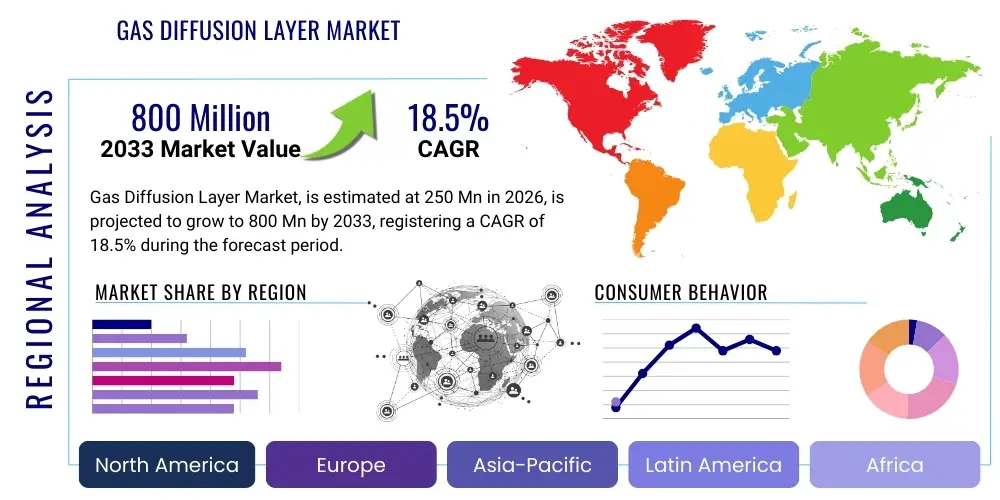

Gas Diffusion Layer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439674 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Gas Diffusion Layer Market Size

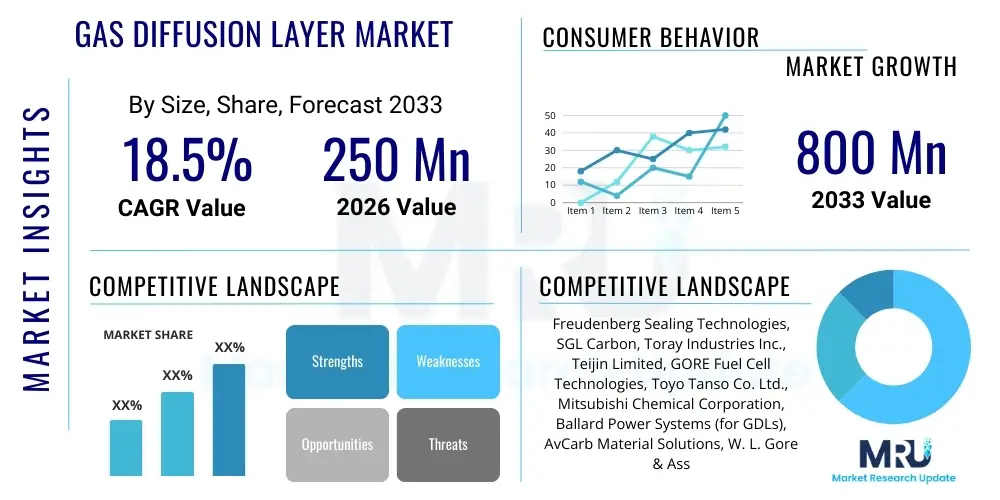

The Gas Diffusion Layer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 250 million in 2026 and is projected to reach USD 800 million by the end of the forecast period in 2033.

Gas Diffusion Layer Market introduction

The Gas Diffusion Layer (GDL) market is a critical component within the burgeoning clean energy sector, primarily driven by the advancements and increasing adoption of fuel cells and electrolyzers. GDLs are porous materials, typically made from carbon fiber paper or cloth, that serve multiple vital functions within these electrochemical devices. Their primary role is to facilitate the efficient transport of reactants (hydrogen, oxygen) to the catalyst layer and products (water) away from it, while also providing electrical conductivity, mechanical support, and thermal management. The performance of a fuel cell or electrolyzer is intricately linked to the design and properties of its GDL, making it a focal point for research and development aimed at improving efficiency, durability, and cost-effectiveness. As global efforts to decarbonize energy systems intensify, the demand for high-performance GDLs is experiencing significant growth, driven by both stationary and mobile applications of fuel cell technology, as well as the escalating need for green hydrogen production through electrolysis.

The product description for Gas Diffusion Layers emphasizes their highly specialized structure, which balances porosity, hydrophobicity, electrical conductivity, and mechanical strength. These layers are engineered to manage gas flow, electron conduction, and water removal effectively, crucial for preventing flooding or drying out of the catalyst layer, which can severely impair device performance. Major applications of GDLs include Proton Exchange Membrane (PEM) fuel cells, Solid Oxide Fuel Cells (SOFCs), Direct Methanol Fuel Cells (DMFCs), and various types of electrolyzers such as PEM electrolyzers, which are instrumental in hydrogen production. Benefits derived from optimized GDLs include enhanced power density, prolonged operational lifespan of fuel cells and electrolyzers, improved energy conversion efficiency, and reduced overall system costs due to better performance-to-cost ratios. These advantages directly contribute to the economic viability and wider deployment of hydrogen and fuel cell technologies across diverse industries.

Driving factors for the GDL market are multifaceted, stemming from global climate change mitigation initiatives, increasing investments in renewable energy infrastructure, and supportive government policies aimed at promoting hydrogen as a clean energy carrier. The automotive sector's shift towards electric vehicles, particularly hydrogen fuel cell electric vehicles (FCEVs), represents a substantial growth impetus for GDLs. Similarly, the growing demand for portable power solutions, backup power systems, and uninterruptible power supplies (UPS) that leverage fuel cell technology further fuels market expansion. Research and development efforts focused on innovative GDL materials and manufacturing techniques, such as advanced carbon materials, surface treatments, and novel pore structures, are continuously enhancing performance and reducing production costs, thereby making GDLs more competitive and attractive for widespread commercial adoption. The increasing awareness and adoption of green hydrogen production methodologies also signify a robust market trajectory for GDL components in electrolyzers.

Gas Diffusion Layer Market Executive Summary

The Gas Diffusion Layer (GDL) market is experiencing robust growth, primarily propelled by the escalating demand for clean energy solutions and the rapid advancement of hydrogen fuel cell and electrolyzer technologies. Business trends indicate a strong focus on strategic partnerships, mergers, and acquisitions among GDL manufacturers and material suppliers, aimed at enhancing technological capabilities, expanding production capacities, and securing supply chains to meet the anticipated surge in demand from the automotive, stationary power, and portable electronics sectors. Companies are heavily investing in R&D to develop next-generation GDLs with improved durability, higher power density, and lower cost through novel material compositions, surface modifications, and advanced manufacturing processes, recognizing that performance and cost are critical differentiators in this evolving landscape. Furthermore, a discernible trend towards vertical integration is emerging, with some fuel cell and electrolyzer manufacturers seeking greater control over their GDL supply to ensure consistent quality and optimize system integration, underscoring the GDL's foundational role in overall device performance. This competitive environment fosters innovation, driving down costs and improving the efficiency of GDLs, which in turn contributes to the broader commercial viability of hydrogen technologies.

Regional trends highlight distinct growth patterns and strategic importance across different geographies. Asia Pacific, led by countries such as China, Japan, and South Korea, is emerging as a dominant market, driven by substantial government investments in hydrogen infrastructure, ambitious national decarbonization goals, and a strong manufacturing base for fuel cells and FCEVs. Europe is also a key player, with the European Union's comprehensive hydrogen strategy fostering significant investments in green hydrogen production and fuel cell deployment, particularly in Germany, France, and the UK. North America, particularly the United States and Canada, is witnessing accelerated growth due to supportive policies like tax credits for clean energy technologies, increasing private sector investments in hydrogen hubs, and a growing emphasis on fuel cell applications in heavy-duty transport and industrial sectors. These regional dynamics are shaped by varying policy landscapes, technological readiness, and economic incentives, creating diverse opportunities and challenges for GDL market participants. The Middle East and Africa and Latin America are nascent but promising markets, driven by long-term energy diversification strategies and the potential for green hydrogen exports.

Segmentation trends within the GDL market reveal a dynamic shift towards specialized materials and applications. Based on material, carbon paper and carbon cloth GDLs continue to dominate, but there is increasing exploration and adoption of composite materials and advanced treatments to enhance properties like hydrophobicity, electrical conductivity, and mechanical robustness. In terms of application, Proton Exchange Membrane Fuel Cells (PEMFCs) and PEM Electrolyzers represent the largest and fastest-growing segments, reflecting their widespread use in automotive, stationary power, and green hydrogen production. Other segments such as Direct Methanol Fuel Cells and Solid Oxide Fuel Cells also contribute, albeit with niche requirements. End-user segmentation shows a strong presence from the automotive industry, followed by the industrial sector (including material handling and backup power), and the energy sector (for power generation and hydrogen production). The increasing demand for higher performance and longer lasting GDLs across these segments is pushing manufacturers to innovate, focusing on customization and application-specific solutions. This granular segmentation allows market players to identify high-growth areas and tailor their product development and marketing strategies accordingly, optimizing their competitive positioning.

AI Impact Analysis on Gas Diffusion Layer Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Gas Diffusion Layer (GDL) market frequently revolve around how AI can enhance GDL performance, reduce manufacturing costs, accelerate material discovery, and optimize operational efficiency for fuel cells and electrolyzers. Users often inquire about specific AI applications, such as predictive modeling for material properties, automation in manufacturing, and AI-driven design of novel GDL structures. There's also significant interest in AI's role in quality control, failure prediction, and extending the lifespan of GDLs within operational devices. Concerns often include the data requirements for effective AI implementation, the cost of integrating AI technologies, and the skill gap for deploying and managing AI systems in this highly specialized field. Users generally expect AI to revolutionize GDL development by enabling faster iteration cycles, identifying optimal material combinations, and fine-tuning manufacturing parameters to achieve unprecedented levels of efficiency and durability, ultimately making hydrogen technologies more commercially viable and widespread.

- AI-driven material discovery and optimization: Accelerates the identification of novel GDL materials with superior properties like enhanced porosity, hydrophobicity, and electrical conductivity through high-throughput screening and predictive modeling, significantly reducing R&D cycles.

- Predictive modeling for GDL performance: Utilizes machine learning algorithms to forecast GDL behavior under various operating conditions, enabling optimized design for specific fuel cell or electrolyzer applications and preventing potential issues like flooding or drying out.

- Automated manufacturing process optimization: AI algorithms monitor and adjust manufacturing parameters (e.g., carbon fiber weaving, coating processes, pressing) in real-time, improving consistency, reducing waste, and increasing production efficiency, leading to lower manufacturing costs.

- Quality control and defect detection: AI-powered computer vision systems can rapidly inspect GDLs for defects, ensuring high product quality and reducing the need for manual, time-consuming inspections, thus enhancing reliability and throughput.

- Real-time monitoring and predictive maintenance: AI integrates with sensors in operating fuel cells and electrolyzers to monitor GDL degradation, predict potential failures, and recommend maintenance schedules, thereby extending device lifespan and reducing downtime.

- Custom GDL design based on application data: AI can analyze specific operational requirements and historical data to generate bespoke GDL designs tailored for particular applications, maximizing efficiency and durability for diverse use cases from automotive to stationary power.

- Supply chain optimization: AI models can forecast demand for GDL components, optimize inventory levels, and manage supplier relationships, improving efficiency and resilience across the entire GDL supply chain.

DRO & Impact Forces Of Gas Diffusion Layer Market

The Gas Diffusion Layer (GDL) market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively form the impact forces shaping its trajectory. A primary driver is the accelerating global transition towards clean energy and decarbonization, fueled by stringent environmental regulations and national commitments to reduce greenhouse gas emissions. This paradigm shift directly propels the demand for hydrogen fuel cells in transportation, stationary power, and portable electronics, alongside a robust increase in green hydrogen production via electrolyzers, all of which critically rely on high-performance GDLs. Significant government incentives, subsidies, and supportive policies for hydrogen infrastructure development and fuel cell adoption across major economies further stimulate market growth. Furthermore, continuous advancements in material science and manufacturing technologies are leading to the development of more efficient, durable, and cost-effective GDLs, which in turn enhances the overall competitiveness and attractiveness of fuel cell and electrolyzer systems. The inherent benefits of fuel cells, such as high energy density, rapid refueling, and zero tailpipe emissions, also serve as strong market drivers, especially for heavy-duty vehicles and industrial applications where electrification through batteries faces limitations. The increasing awareness and adoption of hydrogen as a viable energy carrier across diverse industrial sectors also contributes substantially to market expansion.

Despite the strong tailwinds, the GDL market faces several significant restraints. One major challenge is the relatively high manufacturing cost of GDLs, primarily due to the specialized materials (e.g., carbon fibers, noble metal coatings) and complex production processes required to achieve the precise porosity, hydrophobicity, and electrical conductivity specifications. This cost contributes to the overall expensive nature of fuel cell and electrolyzer systems, which can hinder widespread commercial adoption, particularly in cost-sensitive markets. Another restraint is the limited long-term durability and stability of current GDLs under harsh operating conditions, such as high temperatures, varying humidity levels, and repeated start-stop cycles, which can lead to degradation and reduced lifespan of the electrochemical devices. This necessitates frequent replacement or advanced research into more resilient materials. Additionally, the nascent stage of hydrogen infrastructure in many regions, including production, storage, and distribution networks, poses a bottleneck for the broader deployment of fuel cell applications, thereby indirectly impacting GDL demand. The availability of alternative clean energy technologies, such as battery electric vehicles, also presents a competitive restraint, as policy and consumer preferences can shift towards established or more cost-effective alternatives. Furthermore, the complexities associated with scaling up GDL production to meet potentially massive future demand present both technological and logistical hurdles.

Opportunities within the GDL market are abundant and promising. The ongoing research and development into novel materials, such as bio-based carbons, graphene composites, and innovative coatings, present significant avenues for creating GDLs with superior performance characteristics and lower manufacturing costs. The development of advanced manufacturing techniques like additive manufacturing (3D printing) for intricate GDL structures could revolutionize production, enabling mass customization and enhanced efficiency. The expanding application scope of hydrogen and fuel cell technologies beyond traditional automotive uses, into areas such as drones, maritime transport, aviation, and grid-scale energy storage, opens up new market segments for GDL manufacturers. Moreover, the increasing focus on the circular economy and sustainable manufacturing practices offers opportunities for developing recyclable or sustainably sourced GDL materials, aligning with global environmental goals and attracting environmentally conscious investors and consumers. Strategic collaborations between GDL manufacturers, material scientists, fuel cell integrators, and academic institutions are crucial for accelerating innovation and commercialization. The growing momentum behind green hydrogen initiatives worldwide, driven by renewable energy integration, signifies a massive, long-term opportunity for GDLs in electrolyzers. Finally, the potential for GDLs to contribute to the efficiency and cost reduction of other electrochemical systems, beyond fuel cells and electrolyzers, also represents a diversification opportunity.

Segmentation Analysis

The Gas Diffusion Layer market is segmented across various critical dimensions including material type, application, and end-user, providing a granular view of its diverse landscape and growth drivers. Understanding these segments is crucial for market participants to identify lucrative niches, tailor product development, and strategize market entry and expansion. The material segmentation primarily focuses on the composition of the GDL, as different materials offer distinct properties crucial for performance under varying operational conditions. Application segmentation delineates the specific uses of GDLs within different electrochemical devices, with fuel cells and electrolyzers being the predominant categories, each having unique demands for GDL characteristics. Finally, end-user segmentation classifies the industries or sectors that ultimately utilize products incorporating GDLs, ranging from automotive to stationary power, highlighting the diverse adoption patterns of hydrogen and fuel cell technologies. Each segment influences market dynamics differently, driven by technological advancements, regulatory frameworks, and specific industry needs.

- By Material Type

- Carbon Paper GDLs

- Carbon Cloth GDLs

- Metal Foam GDLs

- Polymer-based GDLs

- Composite GDLs

- By Application

- Proton Exchange Membrane Fuel Cells (PEMFCs)

- Proton Exchange Membrane Electrolyzers (PEM Electrolyzers)

- Direct Methanol Fuel Cells (DMFCs)

- Solid Oxide Fuel Cells (SOFCs)

- Others (e.g., Regenerative Fuel Cells, Microbial Fuel Cells)

- By End-User

- Automotive (Fuel Cell Electric Vehicles - FCEVs)

- Stationary Power (Backup Power, Combined Heat and Power - CHP)

- Portable Power (Consumer Electronics, Drones)

- Industrial (Material Handling, Hydrogen Production, Chemical Processing)

- Marine

- Aerospace

- By Thickness

- Less than 100 micrometers

- 100-200 micrometers

- Greater than 200 micrometers

- By Porosity

- Low Porosity

- Medium Porosity

- High Porosity

Value Chain Analysis For Gas Diffusion Layer Market

The value chain for the Gas Diffusion Layer (GDL) market is a complex ecosystem, beginning with the sourcing of raw materials and culminating in the integration of GDLs into finished fuel cell and electrolyzer systems. Upstream analysis involves the procurement and processing of fundamental raw materials, primarily high-purity carbon fibers, which form the foundational structure of most GDLs. Key suppliers in this stage include carbon fiber manufacturers, often specializing in industrial-grade carbon precursors. Other critical raw materials include binders, hydrophobic agents (like PTFE), and various coating materials that impart specific properties such as enhanced electrical conductivity or water management capabilities. The quality and cost of these upstream components significantly impact the final GDL product's performance and market competitiveness. Research and development activities at this stage focus on novel material synthesis and processing techniques to reduce costs, improve material properties, and ensure supply chain stability, as disruptions in carbon fiber production can have ripple effects throughout the GDL manufacturing process.

Midstream activities involve the specialized manufacturing and processing of raw materials into finished GDLs. This stage encompasses several critical steps: the formation of carbon fiber paper or cloth substrates, followed by various treatment processes such as calendering (to control thickness and porosity), impregnation with hydrophobic polymers, and coating with microporous layers (MPL) containing carbon black and binders. These steps require sophisticated machinery and precise control to achieve the desired structural, electrical, and transport properties. GDL manufacturers often possess proprietary technologies and expertise in these processes, representing a significant barrier to entry. Quality control and testing are paramount at this stage to ensure GDLs meet stringent performance specifications required for fuel cell and electrolyzer applications. Innovation in manufacturing processes, such as advanced coating techniques, roll-to-roll processing for scalability, and additive manufacturing for customized GDL architectures, plays a crucial role in enhancing efficiency, reducing production costs, and improving product performance. Collaboration between material scientists and manufacturing engineers is essential to optimize these complex processes and ensure high-volume production capabilities.

Downstream analysis focuses on the distribution channels and the ultimate end-users of GDLs. Once manufactured, GDLs are typically sold to fuel cell stack manufacturers, electrolyzer integrators, and research institutions. The distribution channel can be direct, where GDL manufacturers supply directly to large-scale OEMs and system integrators, allowing for closer collaboration, customization, and technical support. Indirect channels may involve distributors or specialized suppliers who cater to smaller manufacturers, R&D labs, or niche applications, offering a broader reach and logistical support. The critical factors at this stage include efficient logistics, inventory management, and technical support services to assist customers with integration challenges. End-users span diverse sectors, including automotive (for Fuel Cell Electric Vehicles), stationary power (for backup power, combined heat and power systems), portable electronics, and industrial applications (for green hydrogen production). The direct channel often facilitates long-term partnerships and joint development agreements, ensuring GDL specifications are perfectly aligned with the demanding requirements of high-performance fuel cell and electrolyzer systems, whereas indirect channels serve to broaden market access and address diverse, smaller-scale needs effectively.

Gas Diffusion Layer Market Potential Customers

The potential customers for the Gas Diffusion Layer market are diverse and span across various industries that are either developing, manufacturing, or deploying electrochemical devices, primarily fuel cells and electrolyzers. The most significant customer base comprises manufacturers of Proton Exchange Membrane (PEM) fuel cells and PEM electrolyzers. These companies require high-quality GDLs for their core products, which are then integrated into larger systems. Automotive OEMs and their tier-1 suppliers focused on hydrogen Fuel Cell Electric Vehicles (FCEVs) represent a substantial segment, as GDLs are critical components in the fuel cell stacks powering these vehicles. The increasing investment in FCEV development and production by major global automakers directly translates into high demand for advanced GDLs that can offer durability, efficiency, and cost-effectiveness under dynamic driving conditions. Similarly, manufacturers of stationary power generation systems, including backup power units, uninterruptible power supplies (UPS), and combined heat and power (CHP) systems that utilize fuel cell technology, are key customers, seeking GDLs that ensure long-term reliability and performance.

Beyond the automotive and stationary power sectors, the rapidly expanding green hydrogen economy is creating a robust demand from electrolyzer manufacturers. Companies specializing in PEM electrolyzers, which are essential for producing hydrogen from renewable electricity, are significant purchasers of GDLs. These customers prioritize GDLs that can withstand high current densities and harsh electrochemical environments to maximize hydrogen production efficiency and extend the lifespan of their electrolyzer stacks. Industrial users focused on material handling, such as forklift manufacturers and operators adopting fuel cell-powered equipment, also constitute a growing customer segment. These applications benefit from the quick refueling and consistent power output of fuel cells, making GDLs a crucial element in their energy systems. Furthermore, manufacturers of portable power devices, including those for consumer electronics, drones, and specialized military applications, represent niche but important customers seeking lightweight, high-performance GDLs to enable compact and efficient fuel cell solutions for their products.

Academic institutions and research and development laboratories worldwide are also consistent potential customers for GDLs. These entities acquire GDLs for fundamental research into fuel cell and electrolyzer mechanisms, material science investigations, and the development of next-generation electrochemical devices. Their demand often involves smaller quantities but requires a wide variety of GDL specifications for experimental purposes. Lastly, companies involved in hydrogen infrastructure development, even if not directly manufacturing fuel cells or electrolyzers, often engage in pilot projects or demonstrations that require these technologies, thereby becoming indirect drivers of GDL demand. As the global energy landscape continues to shift towards hydrogen, the customer base for GDLs is expected to broaden further, encompassing new applications in marine, aerospace, and grid-scale energy storage, all seeking GDLs that can deliver enhanced performance, reliability, and cost advantages to accelerate the energy transition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Freudenberg Sealing Technologies, SGL Carbon, Toray Industries Inc., Teijin Limited, GORE Fuel Cell Technologies, Toyo Tanso Co. Ltd., Mitsubishi Chemical Corporation, Ballard Power Systems (for GDLs), AvCarb Material Solutions, W. L. Gore & Associates, CeTech Co., Ltd., BASF SE (material supply), 3M Company (material supply), DuPont (material supply), FuelCell Energy Inc. (for in-house GDLs), Johnson Matthey (catalyst coated GDLs), Neah Power Systems, Solvay, Umicore, IHI Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gas Diffusion Layer Market Key Technology Landscape

The Gas Diffusion Layer (GDL) market's technology landscape is characterized by continuous innovation aimed at enhancing the performance, durability, and cost-effectiveness of fuel cells and electrolyzers. A foundational technology involves the sophisticated manufacturing of carbon-based substrates, primarily carbon paper and carbon cloth, which form the backbone of most GDLs. Technologies such as papermaking processes for carbon fibers and weaving techniques for carbon cloth are crucial for achieving the desired porosity, mechanical strength, and electrical conductivity. These processes are constantly being refined to optimize fiber orientation, density, and overall structural integrity. Further technological advancements revolve around surface treatments and modifications. This includes the application of hydrophobic agents, most commonly polytetrafluoroethylene (PTFE) impregnation, which creates a network of pores that allow for efficient gas transport while preventing liquid water flooding. The precise control over the PTFE loading and distribution is a critical technology, influencing the GDL's water management capabilities, which are paramount for stable device operation.

Another pivotal technological area is the development and application of microporous layers (MPLs). MPLs are thin coatings, typically composed of carbon black particles and a hydrophobic binder, applied to one side of the GDL, usually facing the catalyst layer. The technology behind MPLs is complex, focusing on achieving a finely tuned pore structure that further enhances water removal from the catalyst layer, improves electrical contact, and reduces ohmic losses. Advanced coating techniques, such as spray coating, doctor blading, and decal transfer, are employed to deposit these layers uniformly and with controlled thickness. Research in MPL technology is exploring novel carbon materials like graphene and carbon nanotubes to improve conductivity and durability, as well as alternative binders and fabrication methods to reduce costs and complexity. The integration of advanced diagnostics and characterization techniques, such as X-ray computed tomography (X-CT), scanning electron microscopy (SEM), and electrochemical impedance spectroscopy (EIS), is also a key technological enabler, allowing researchers and manufacturers to precisely understand and optimize GDL structures and properties at microscopic levels, informing material design and process improvements.

Emerging technologies are set to further revolutionize the GDL market. Additive manufacturing, specifically 3D printing techniques, is gaining traction for creating GDLs with highly customized and optimized pore networks and flow fields that are difficult to achieve with traditional methods. This technology offers the potential for tailored GDL structures that can significantly boost mass transport and water management efficiency for specific applications. Furthermore, the development of composite GDLs, which combine different materials (e.g., carbon fibers with metal foams or polymer supports) to leverage synergistic properties, represents a significant technological frontier. These composites aim to overcome limitations of single-material GDLs, offering improved mechanical robustness, enhanced electrical conductivity, or superior corrosion resistance. The use of advanced functional coatings, beyond basic hydrophobicity, that can impart catalytic activity, anti-fouling properties, or intelligent response to environmental changes, is also an area of active research. These cutting-edge technologies collectively aim to push the boundaries of GDL performance, making fuel cells and electrolyzers more efficient, durable, and economically viable for widespread adoption in the global clean energy transition.

Regional Highlights

- North America: This region, particularly the United States and Canada, is witnessing significant growth in the Gas Diffusion Layer market, driven by increasing government support for hydrogen and fuel cell technologies, including tax credits and funding for hydrogen hubs. Major automotive manufacturers are investing heavily in Fuel Cell Electric Vehicles (FCEVs), alongside expanding industrial applications for fuel cells in material handling and backup power. Robust research and development activities in academic and corporate sectors also contribute to technological advancements and market expansion. The region's focus on decarbonization and energy independence solidifies its position as a key market.

- Europe: The European market is characterized by ambitious hydrogen strategies and substantial investments from the European Union, making it a frontrunner in green hydrogen production and fuel cell deployment. Countries like Germany, France, and the UK are leading with national hydrogen roadmaps, fostering both research into advanced GDLs and large-scale projects for fuel cell applications in transport, industry, and power generation. Strict emission regulations and a strong commitment to renewable energy integration are key drivers for GDL demand across the continent.

- Asia Pacific (APAC): APAC is projected to be the largest and fastest-growing market for Gas Diffusion Layers, primarily led by strong government initiatives and substantial investments in hydrogen and fuel cell technologies in countries such as China, Japan, and South Korea. These nations have established comprehensive strategies for FCEV adoption, hydrogen production, and fuel cell deployment in various sectors, including power generation and industrial processes. The region's large manufacturing base and growing energy demand further accelerate market growth and technological innovation in GDLs.

- Latin America: While a nascent market, Latin America shows growing potential, particularly in countries with significant renewable energy resources suitable for green hydrogen production, such as Chile and Brazil. Early-stage investments in hydrogen pilots and long-term energy diversification strategies are gradually creating opportunities for GDL suppliers. The region is expected to experience gradual growth as hydrogen infrastructure develops and adoption of fuel cell technologies increases.

- Middle East and Africa (MEA): The MEA region is emerging as a significant hub for green hydrogen production, leveraging abundant solar and wind resources to create export opportunities. Countries like Saudi Arabia and the UAE are making substantial investments in large-scale green hydrogen projects, which directly translates to a future demand for GDLs in electrolyzer applications. While fuel cell adoption is still in early stages, the region's strategic focus on diversifying its energy mix and becoming a global leader in green hydrogen positions it for considerable long-term growth in the GDL market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gas Diffusion Layer Market.- Freudenberg Sealing Technologies

- SGL Carbon

- Toray Industries Inc.

- Teijin Limited

- GORE Fuel Cell Technologies

- Toyo Tanso Co. Ltd.

- Mitsubishi Chemical Corporation

- Ballard Power Systems

- AvCarb Material Solutions

- W. L. Gore & Associates

- CeTech Co., Ltd.

- BASF SE

- 3M Company

- DuPont

- FuelCell Energy Inc.

- Johnson Matthey

- Neah Power Systems

- Solvay

- Umicore

- IHI Corporation

Frequently Asked Questions

What is a Gas Diffusion Layer (GDL) and why is it important in fuel cells and electrolyzers?

A Gas Diffusion Layer (GDL) is a porous material, typically carbon-based, that facilitates the transport of reactants and products, conducts electrons, and manages water within fuel cells and electrolyzers. It is crucial for maintaining optimal performance, preventing flooding or drying, and ensuring the durability of these electrochemical devices, acting as an interface between the catalyst layer and the flow field plates.

What are the primary applications driving the growth of the GDL market?

The primary applications driving GDL market growth are Proton Exchange Membrane (PEM) fuel cells for automotive (Fuel Cell Electric Vehicles), stationary power, and portable electronics, as well as PEM electrolyzers for green hydrogen production. Increasing global efforts towards decarbonization and supportive government policies for hydrogen technologies are fueling demand across these sectors.

What materials are commonly used to manufacture Gas Diffusion Layers?

Common materials used for GDLs include carbon paper and carbon cloth, often treated with hydrophobic polymers like PTFE (polytetrafluoroethylene) to manage water effectively. Research is also exploring advanced materials such as metal foams, polymer-based composites, and graphene-enhanced structures to improve performance and reduce costs.

What are the key challenges facing the Gas Diffusion Layer market?

Key challenges for the GDL market include the relatively high manufacturing cost of specialized materials and complex processes, limitations in long-term durability under harsh operating conditions, and the need for further advancements in hydrogen infrastructure to support widespread adoption of fuel cell and electrolyzer technologies.

How is Artificial Intelligence (AI) expected to impact the future of GDL development?

AI is expected to significantly impact GDL development by accelerating material discovery, optimizing manufacturing processes for cost and efficiency, enabling predictive modeling of GDL performance, enhancing quality control through automated inspection, and facilitating the design of customized GDLs for specific applications, thereby improving overall fuel cell and electrolyzer efficiency and lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hydrogen Fuel Cell Gas Diffusion Layer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Hydrogen Fuel Cell Gas Diffusion Layer Market Statistics 2025 Analysis By Application (Hydrogen-oxygen Fuel Cell, Hydrocarbon Fuels Cell), By Type (Carbon Paper Type, Carbon Cloth Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager