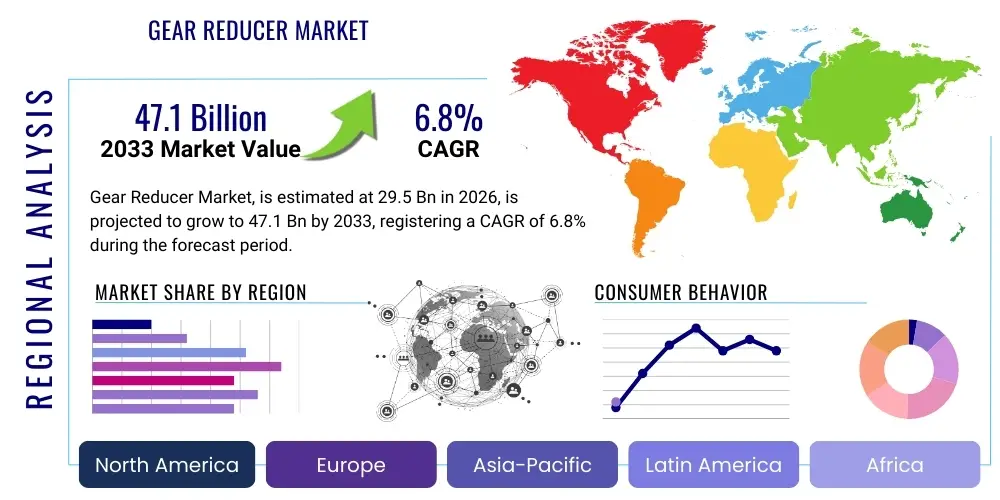

Gear Reducer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439948 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Gear Reducer Market Size

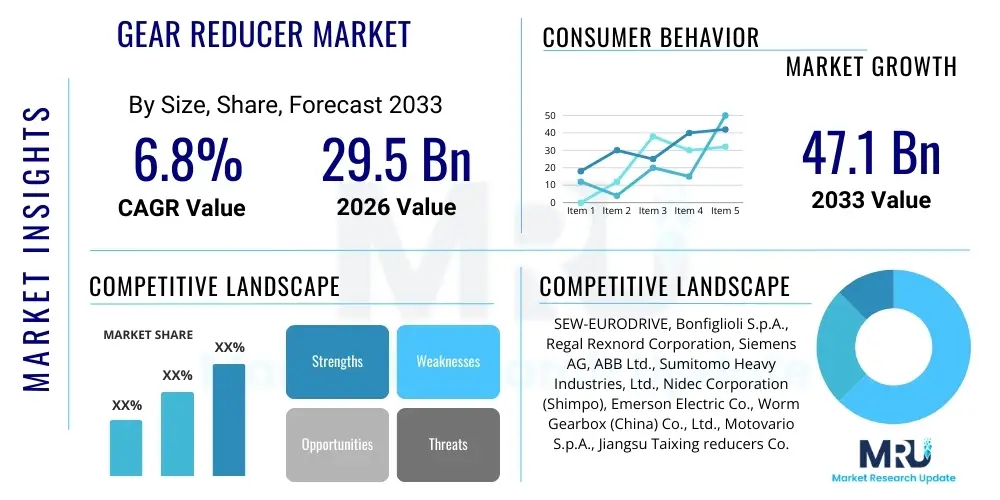

The Gear Reducer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 29.5 Billion in 2026 and is projected to reach USD 47.1 Billion by the end of the forecast period in 2033. This substantial growth is underpinned by increasing industrial automation, robust infrastructure development, and the escalating demand for energy-efficient power transmission solutions across diverse sectors globally. The market's expansion is further fueled by technological advancements leading to more compact, durable, and precise gear reducer units capable of operating in demanding environments, thereby driving their adoption in new and emerging applications within the manufacturing and processing industries.

Gear Reducer Market introduction

The global gear reducer market encompasses the design, manufacturing, and distribution of mechanical devices used to reduce rotational speed and increase torque from a prime mover to an output shaft. These essential components play a critical role in power transmission systems, ensuring optimal operational efficiency and performance across a vast array of industrial machinery and equipment. Gear reducers are fundamentally designed to convert high-speed, low-torque input into low-speed, high-torque output, which is crucial for applications requiring precise control over motion and force. The technological landscape of gear reducers is continuously evolving, focusing on enhanced durability, reduced noise levels, increased efficiency, and compact designs to meet the stringent demands of modern industrial environments. This includes innovations in material science, lubrication technologies, and manufacturing processes that extend the lifespan and reliability of these critical power transmission units.

Product descriptions vary significantly based on the type of gear reducer, including worm, helical, bevel, planetary, and cycloidal variants, each offering unique advantages in terms of efficiency, space utilization, and load-bearing capacity. For instance, helical gear reducers are known for their high efficiency and smooth operation, making them suitable for high-speed applications, while planetary gear reducers offer a compact design with high torque density, ideal for space-constrained installations. Major applications of gear reducers span across virtually every industrial sector, including automotive, construction, mining, material handling, food and beverage processing, wind energy, robotics, and marine industries. In the automotive sector, they are vital for manufacturing processes and assembly lines, whereas in material handling, they power conveyors, cranes, and lifts. The versatility of gear reducers makes them indispensable for machinery that requires precise speed control and torque multiplication, contributing significantly to the operational efficacy of industrial processes.

The benefits derived from integrating gear reducers into industrial systems are manifold. They enable machinery to operate at optimal speeds, prevent overloading of motors, and enhance the overall lifespan of equipment by reducing wear and tear. Furthermore, gear reducers contribute significantly to energy efficiency by allowing motors to run at their most efficient RPM range, consequently lowering operational costs and reducing carbon footprints. Key driving factors for market growth include the global surge in industrial automation and robotics adoption, especially in emerging economies, alongside substantial investments in infrastructure development projects. The increasing emphasis on energy conservation and sustainable manufacturing practices further propels the demand for high-efficiency gear reducers. Moreover, the expanding manufacturing sector, coupled with the need for precise motion control in advanced applications, continues to solidify the market position of gear reducers as indispensable components in modern industrial ecosystems.

Gear Reducer Market Executive Summary

The global gear reducer market is experiencing dynamic growth, propelled by robust business trends centered around industrial modernization and the pervasive adoption of automation technologies across a multitude of sectors. A significant business trend driving market expansion is the burgeoning investment in smart factories and Industry 4.0 initiatives, where gear reducers are integral to the operation of automated assembly lines, robotic systems, and advanced material handling equipment. The manufacturing sector's continuous pursuit of higher productivity, improved operational efficiency, and reduced downtime directly translates into an escalating demand for reliable, high-performance gear reducers. Furthermore, the global supply chain diversification and localized manufacturing efforts are creating new demand pockets, necessitating the setup of new production facilities that inherently require a wide range of power transmission solutions, including various types of gear reducers. Companies are increasingly focusing on customization and modular designs to cater to specific industrial requirements, offering tailored solutions that enhance application-specific performance and flexibility.

Regional trends indicate a substantial shift in manufacturing capabilities and industrial investments, particularly towards Asia Pacific, which is emerging as the dominant market for gear reducers. This region's growth is primarily fueled by rapid industrialization in countries like China, India, and Southeast Asian nations, alongside significant government initiatives supporting infrastructure development and domestic manufacturing. North America and Europe, while mature markets, continue to demonstrate steady demand driven by the replacement of aging infrastructure, the adoption of advanced automation in sophisticated manufacturing processes, and a strong emphasis on energy-efficient solutions. Latin America and the Middle East & Africa regions are also showing promising growth, albeit from a smaller base, attributed to increasing foreign direct investments in industrial setups, mining operations, and burgeoning energy sectors. Each region presents unique market characteristics, influenced by local regulations, industrial development stages, and technological adoption rates, requiring manufacturers to implement tailored market penetration strategies.

Segmentation trends highlight distinct growth patterns across various gear reducer types, applications, and end-use industries. The helical gear reducer segment, for instance, continues to hold a significant market share due owing to its high efficiency and versatility across numerous applications, including conveyors and mixers. Planetary gear reducers are witnessing rapid growth, driven by their compact design, high torque density, and suitability for robotics, aerospace, and heavy-duty machinery where space and power are critical considerations. The increasing complexity of industrial machinery is also fostering demand for customized and application-specific gear reducer solutions, leading to advancements in modular designs and integrated drive systems. From an end-use perspective, the material handling sector consistently remains a prominent consumer, followed closely by the automotive, construction, and food and beverage industries. The renewable energy sector, particularly wind turbines, represents a high-growth segment, demanding specialized gear reducers capable of enduring extreme conditions and ensuring high reliability. These trends collectively paint a picture of a dynamic and evolving market, highly responsive to global industrial advancements and technological innovation.

AI Impact Analysis on Gear Reducer Market

The integration of Artificial intelligence (AI) is poised to significantly transform the gear reducer market by addressing common user questions and evolving expectations regarding operational efficiency, predictive maintenance, and optimized design. Users are increasingly concerned about maximizing the lifespan of their gear reducers, minimizing unexpected downtime, and achieving greater energy efficiency. They question how AI can enable proactive maintenance schedules, move beyond reactive repairs, and provide real-time performance insights. Furthermore, there is a growing expectation for AI to contribute to the design and customization of gear reducers, leading to more application-specific and performance-optimized solutions, thereby reducing the total cost of ownership and improving overall system reliability. AI's potential to analyze vast datasets related to operational parameters, environmental conditions, and historical failure rates offers a compelling answer to these prevalent user concerns, promising a new era of intelligent power transmission solutions.

- AI-driven predictive maintenance algorithms analyze sensor data from gear reducers (vibration, temperature, oil quality) to anticipate potential failures, enabling proactive servicing and significantly reducing unplanned downtime, thereby extending the operational lifespan of the equipment.

- Optimized gear reducer design and manufacturing processes through AI allows for rapid iteration and simulation, leading to more efficient, lighter, and durable components tailored precisely to specific application requirements, enhancing performance and material utilization.

- Improved energy efficiency is achieved as AI systems monitor and adjust gear reducer operation in real-time, ensuring they run at optimal loads and speeds, thus minimizing power consumption and contributing to sustainable industrial practices.

- Enhanced quality control and inspection facilitated by AI-powered vision systems detect microscopic defects during manufacturing, ensuring higher product quality and consistency, which translates into greater reliability for end-users.

- Supply chain optimization and inventory management leverage AI to forecast demand for spare parts and new units, streamlining logistics, reducing lead times, and ensuring timely availability of components for maintenance and new installations.

- AI-powered condition monitoring provides continuous insights into the health and performance of gear reducers, allowing operators to make informed decisions and prevent catastrophic failures, thus improving safety and reducing maintenance costs.

- Development of smart gear reducers with integrated AI capabilities can self-diagnose issues, communicate their status within an Industrial Internet of Things (IIoT) ecosystem, and even autonomously adjust parameters for peak performance, leading to fully autonomous industrial processes.

DRO & Impact Forces Of Gear Reducer Market

The Gear Reducer Market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive landscape. A primary driver for market expansion is the escalating global demand for industrial automation and robotics across manufacturing sectors, demanding precise and reliable power transmission systems. The increasing focus on energy efficiency and sustainable industrial practices further propels the adoption of high-efficiency gear reducers, as they enable machinery to operate at optimal speeds and loads, thereby minimizing energy consumption and operational costs. Moreover, robust investments in infrastructure development, particularly in emerging economies, alongside the growth of end-use industries such as material handling, automotive, construction, and mining, are creating a consistent demand for various types of gear reducers. Technological advancements leading to more compact, lightweight, and durable gear reducer designs capable of handling higher torque densities also act as a crucial market driver, facilitating their integration into a broader range of applications and machinery.

Despite the strong growth drivers, the market faces several significant restraints that could impede its full potential. The high initial cost of advanced and customized gear reducer solutions, especially those incorporating specialized materials or intricate designs, can be a barrier for small and medium-sized enterprises (SMEs) with limited capital. The technical complexity involved in the selection, installation, and maintenance of certain high-performance gear reducers requires specialized expertise, which can be a limiting factor in regions with a shortage of skilled labor. Furthermore, intense competition from local manufacturers offering lower-cost alternatives, albeit sometimes with compromised quality, poses a challenge to established global players. Economic downturns and geopolitical uncertainties can also lead to reduced industrial investments, impacting the overall demand for new machinery and, consequently, gear reducers. The stringent regulatory environment concerning noise, vibration, and energy consumption standards also necessitates continuous innovation and compliance, adding to manufacturing complexities and costs.

However, substantial opportunities exist within the gear reducer market that, if leveraged effectively, can overcome these restraints and foster significant growth. The growing adoption of IoT and Industry 4.0 technologies presents a lucrative opportunity for developing smart gear reducers with integrated sensors for real-time monitoring, predictive maintenance, and remote diagnostics, enhancing their value proposition. The increasing demand for customized gear reducer solutions tailored to specific application needs, particularly in niche sectors like aerospace, medical devices, and specialized robotics, opens avenues for product differentiation and premium pricing. Expansion into untapped geographical markets, especially in regions undergoing rapid industrialization and modernization, represents another key opportunity. Furthermore, strategic collaborations and partnerships between gear reducer manufacturers and automation solution providers can lead to the development of integrated, comprehensive solutions, thereby broadening market reach and enhancing competitive advantage. The continuous focus on research and development to introduce innovative materials, advanced lubrication systems, and modular designs will also unlock new growth prospects.

Segmentation Analysis

The Gear Reducer Market is comprehensively segmented based on various critical parameters, offering a granular view of its diverse landscape and enabling precise market analysis. These segmentations are crucial for understanding market dynamics, identifying growth pockets, and formulating effective business strategies for manufacturers and suppliers alike. The primary segmentation categories typically include Type, Orientation, Torque, Application, and End-Use Industry, each providing unique insights into consumer preferences and industrial demands. This multifaceted approach to market segmentation allows for a detailed examination of specific product categories and their performance within particular vertical markets, highlighting the dominant trends and emerging opportunities across the global spectrum. The intricate nature of power transmission requirements across industries necessitates this granular analysis to accurately reflect the market's complexities and facilitate targeted innovation.

- By Type:

- Helical Gear Reducer: Characterized by high efficiency, smooth operation, and quieter performance due to the angled teeth. Widely used in conveyors, pumps, and mixers.

- Worm Gear Reducer: Offers high reduction ratios in a compact size and excellent shock absorption. Commonly found in elevators, presses, and small conveyors.

- Planetary Gear Reducer: Known for high torque density, compact design, and excellent efficiency. Essential for robotics, wind turbines, and heavy construction equipment.

- Bevel Gear Reducer: Used for changing the direction of shaft rotation, offering good efficiency. Applied in printing machines, agricultural machinery, and marine propulsion.

- Helical-Bevel Gear Reducer: Combines features of helical and bevel gears for angular power transmission with high efficiency and robust design. Utilized in material handling and processing industries.

- Cycloidal Gear Reducer: Offers high precision, high reduction ratios, and resistance to shock loads. Preferred for robotics, machine tools, and automation equipment.

- Parallel Shaft Gear Reducer: Features gears arranged on parallel shafts, providing high efficiency and various reduction ratios. Commonly used in textile machinery, extruders, and general industrial drives.

- Right Angle Gear Reducer: Designed to transmit power at a 90-degree angle, essential for space-constrained applications. Includes worm, bevel, and helical-bevel types.

- Spur Gear Reducer: Simple design, high efficiency for low-speed applications. Found in basic machinery and small-scale automation.

- By Orientation:

- Parallel Shaft: Gears are mounted on shafts that are parallel to each other.

- Right Angle: Shafts are oriented at 90 degrees to each other.

- Inline: Input and output shafts are coaxial.

- By Torque:

- Low Torque: Suited for lighter applications requiring minimal force.

- Medium Torque: Versatile for a wide range of general industrial machinery.

- High Torque: Designed for heavy-duty applications demanding substantial force and robustness.

- By Application:

- Material Handling: Conveyors, Cranes, Lifts, Automated Storage and Retrieval Systems (AS/RS).

- Power Generation: Wind Turbines, Hydro Turbines, Generators.

- Industrial Machinery: Pumps, Mixers, Extruders, Agitators, Presses, Compressors.

- Mining & Construction: Excavators, Crushers, Conveyor systems, Cement mixers.

- Automotive: Assembly lines, Robotic welding, Paint shops, Vehicle manufacturing.

- Food & Beverage: Bottling, Packaging, Processing equipment, Mixers, Fillers.

- Agriculture: Tractors, Harvesters, Irrigation systems, Feed processing.

- Robotics & Automation: Industrial robots, Collaborative robots (cobots), Automated Guided Vehicles (AGVs).

- Marine: Propulsion systems, Winches, Steering gears.

- Aerospace & Defense: Actuators, Landing gear systems, Specialized control surfaces.

- Chemical & Petrochemical: Mixers, Reactors, Pumps, Agitators in hazardous environments.

- Textile: Looms, Spinning machines, Dyeing equipment.

- Paper & Pulp: Paper machines, Rollers, Conveying systems.

- Woodworking: Saws, Planers, Routers, Material transport.

- By End-Use Industry:

- Manufacturing (General): Broad range of production processes.

- Automotive & Transportation: Vehicle production, railway systems, marine vessels.

- Heavy Industry: Mining, Cement, Steel, Metals.

- Food Processing & Packaging: Food and beverage production, pharmaceutical packaging.

- Energy (Renewable & Traditional): Wind, Solar, Hydro, Oil & Gas.

- Construction: Infrastructure projects, building material production.

- Chemical & Petrochemical: Processing, refining, material handling in plants.

- Agriculture: Farming machinery and equipment.

- Logistics & Warehousing: Automated warehouses, distribution centers.

- Marine: Shipping, offshore operations.

- Textile Industry: Fabric production and processing.

- Medical & Pharmaceutical: Sterilization, cleanroom equipment, pharmaceutical production.

- Aerospace: Aircraft manufacturing and maintenance.

Value Chain Analysis For Gear Reducer Market

The value chain for the gear reducer market is an intricate network of activities that spans from raw material sourcing to the ultimate delivery and after-sales support of the final product to the end-user. The upstream analysis primarily involves the procurement of essential raw materials, including various grades of steel alloys, cast iron, aluminum, and specialized plastics and composites for casings and internal components. Key suppliers in this stage include metal foundries, steel mills, and specialized component manufacturers that provide bearings, seals, shafts, and fasteners. The quality and availability of these raw materials directly impact the performance, durability, and cost-effectiveness of the final gear reducer. Strategic partnerships with reliable raw material suppliers are crucial for ensuring consistent quality, managing supply chain risks, and achieving cost efficiencies, especially given the volatility of global commodity markets. Furthermore, the upstream segment also includes the provision of specialized machinery and tooling required for the precision manufacturing of gears, housings, and other intricate parts, necessitating collaboration with advanced machine tool providers.

The core manufacturing stage involves design, engineering, machining, heat treatment, assembly, and quality control. This is where raw materials are transformed into functional gear reducer units. Manufacturers often invest heavily in advanced CNC machining centers, gear cutting equipment, and robotic assembly lines to achieve high precision and efficiency. Research and development activities play a pivotal role here, focusing on improving gear geometry, material science, lubrication systems, and overall product design to enhance performance, reduce noise, increase energy efficiency, and extend lifespan. Quality assurance processes, including rigorous testing for torque capacity, speed accuracy, noise levels, and vibration, are critical to ensure product reliability and compliance with industry standards. Innovation in this stage also extends to modular designs and customization capabilities, allowing manufacturers to adapt their products to a wider range of applications and customer specifications. The ability to innovate and optimize production processes is a key differentiator in the competitive gear reducer market.

Downstream analysis focuses on the distribution, sales, and after-sales services. Gear reducers are distributed through a combination of direct and indirect channels. Direct sales often involve large industrial clients, original equipment manufacturers (OEMs), and project-based sales where customized solutions are required. This channel allows for direct technical support and closer customer relationships. Indirect channels primarily involve a network of authorized distributors, industrial suppliers, and agents who cater to a broader market, including smaller businesses and replacement part demand. These intermediaries provide local stock, immediate availability, and localized technical support, making products accessible across diverse geographical regions. After-sales services, including installation assistance, maintenance, repair, and provision of spare parts, are vital for customer satisfaction and long-term loyalty. The effectiveness of the distribution network and the quality of after-sales support significantly impact market penetration and brand reputation. The rise of e-commerce platforms is also influencing distribution strategies, offering new avenues for reaching a global customer base and streamlining order fulfillment for standard products.

Gear Reducer Market Potential Customers

The potential customers for the Gear Reducer Market are incredibly diverse, spanning virtually every industrial sector that requires mechanical power transmission and motion control. These end-users, or buyers of the product, encompass a wide spectrum from large multinational corporations operating extensive production lines to smaller enterprises running specialized machinery, as well as original equipment manufacturers (OEMs) who integrate gear reducers into their proprietary products. Key customer segments include those involved in heavy industries such as mining, construction, cement, and steel, where robust, high-torque gear reducers are essential for crushers, conveyors, excavators, and various processing equipment operating under extreme loads and harsh environmental conditions. The demand from these sectors is driven by continuous infrastructure development projects and raw material processing, necessitating durable and reliable power transmission solutions to maintain operational continuity and efficiency.

Another significant group of potential customers resides within the manufacturing and automation industries. This includes automotive manufacturers utilizing gear reducers in assembly lines, robotic welding stations, and material handling systems for vehicle production. General manufacturing sectors, including textiles, paper and pulp, plastics, and woodworking, rely heavily on gear reducers for machinery like extruders, mixers, presses, and conveyor belts, where precise speed and torque control are critical for product quality and production efficiency. The rapidly expanding field of industrial automation and robotics is a particularly high-growth customer segment, as advanced robots, Automated Guided Vehicles (AGVs), and sophisticated material handling systems inherently require high-precision, compact gear reducers to achieve accurate and repeatable movements. These customers prioritize characteristics such as low backlash, high positional accuracy, and compact design to maximize robotic performance and integration space.

Beyond traditional manufacturing, the food and beverage industry represents a substantial customer base, requiring gear reducers that meet stringent hygiene standards for applications like mixers, fillers, bottlers, and packaging machinery. The energy sector, encompassing both traditional oil & gas and rapidly growing renewable energy (especially wind power), also constitutes a critical customer segment, demanding specialized gearboxes for pumps, compressors, and large-scale wind turbine generators capable of enduring continuous operation and harsh weather conditions. Furthermore, the marine industry utilizes gear reducers for propulsion systems, winches, and steering gears, while agriculture depends on them for tractors, harvesters, and irrigation equipment. The common thread among all these potential customers is the indispensable need for reliable, efficient, and precise power transmission solutions that gear reducers provide, enabling their machinery to perform optimally, reduce energy consumption, and ensure operational longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 29.5 Billion |

| Market Forecast in 2033 | USD 47.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SEW-EURODRIVE, Bonfiglioli S.p.A., Regal Rexnord Corporation, Siemens AG, ABB Ltd., Sumitomo Heavy Industries, Ltd., Nidec Corporation (Shimpo), Emerson Electric Co., Worm Gearbox (China) Co., Ltd., Motovario S.p.A., Jiangsu Taixing reducers Co., Ltd., Tsubakimoto Chain Co., David Brown Santasalo, Flender GmbH, Nord Drivesystems, Cone Drive Operations, Inc., Altra Industrial Motion Corp., WEG S.A., P.I.V. Drives GmbH, Varvel S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gear Reducer Market Key Technology Landscape

The key technology landscape within the gear reducer market is characterized by continuous innovation aimed at enhancing performance, efficiency, durability, and integration capabilities. A significant area of focus is on advanced materials science, where manufacturers are experimenting with high-strength steel alloys, improved casting techniques, and surface treatments like nitriding and carburizing to increase gear hardness, wear resistance, and load-bearing capacity while simultaneously reducing component weight. The development of specialized composite materials and lighter metals for gear reducer housings is also gaining traction, contributing to more compact and lighter units that are easier to integrate into modern machinery and reduce overall system inertia. This focus on material innovation directly translates into extended service life and reduced maintenance requirements, offering substantial long-term benefits to end-users and improving the total cost of ownership.

Precision manufacturing techniques, including advanced CNC machining, gear grinding, and honing processes, are critical enablers for producing highly accurate gear profiles with tighter tolerances. These precision methods minimize backlash, reduce noise and vibration, and significantly improve the operational efficiency and smooth running of gear reducers. Furthermore, the integration of computational fluid dynamics (CFD) and finite element analysis (FEA) software in the design phase allows engineers to simulate performance under various operating conditions, optimize lubrication flow, and identify potential stress points, leading to more robust and reliable designs. This digital engineering approach accelerates product development cycles and ensures that new gear reducer models meet increasingly stringent performance and reliability standards, making them suitable for high-precision applications such as robotics and aerospace.

The advent of smart technologies and the Industrial Internet of Things (IIoT) represents another transformative aspect of the gear reducer market's technology landscape. Manufacturers are increasingly incorporating sensors (e.g., for temperature, vibration, oil quality) into gear reducers to enable real-time condition monitoring and predictive maintenance. These smart gear reducers can communicate their operational status to a central control system, allowing operators to anticipate potential failures, schedule maintenance proactively, and optimize operational parameters for peak efficiency. This shift towards intelligent, connected components not only enhances reliability and reduces downtime but also opens avenues for advanced data analytics to further refine performance and extend asset lifespan. Additionally, modular design principles are becoming more prevalent, allowing for greater customization and easier interchangeability of components, which simplifies maintenance and reduces inventory costs for industrial clients, reflecting a broader trend towards flexible and adaptable manufacturing solutions.

Regional Highlights

- North America: This region maintains a mature yet consistently growing market, driven by the robust manufacturing sector, particularly in automotive, aerospace, and general industrial machinery. The emphasis on automation and the adoption of Industry 4.0 technologies, especially in the United States and Canada, fuels demand for high-precision and energy-efficient gear reducers. Significant investments in infrastructure modernization and replacement of aging industrial equipment also contribute to market stability and growth.

- Europe: Europe represents a technologically advanced market with a strong focus on precision engineering, energy efficiency, and sustainability. Countries such as Germany, Italy, and France are key manufacturing hubs for gear reducers and their integration into advanced machinery across various industries, including robotics, wind energy, and food processing. Stringent environmental regulations and a drive towards sustainable manufacturing practices further stimulate the demand for high-efficiency and low-emission gear reducer solutions.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market globally, propelled by rapid industrialization, burgeoning manufacturing sectors, and substantial infrastructure development, particularly in China, India, Japan, and South Korea. The region's expanding automotive production, increasing adoption of automation in manufacturing, and significant investments in renewable energy projects (e.g., wind farms) are key drivers. The presence of numerous local and international manufacturers also contributes to a highly competitive and dynamic market landscape.

- Latin America: This region exhibits promising growth, primarily driven by increasing investments in mining, oil and gas, agriculture, and infrastructure projects, particularly in Brazil and Mexico. The rising industrialization and modernization efforts across various sectors are creating new demand for industrial machinery and, consequently, gear reducers. Economic stability and foreign direct investment are crucial for sustaining market expansion in this region.

- Middle East and Africa (MEA): The MEA market is witnessing gradual growth, primarily influenced by investments in the oil and gas sector, infrastructure development, and diversification efforts into non-oil industrial sectors. Countries in the GCC region are investing heavily in new industrial complexes and smart cities, driving demand for heavy-duty and reliable gear reducers. South Africa also plays a significant role with its well-established mining and industrial base. The market's growth is contingent on ongoing economic diversification and industrialization initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gear Reducer Market.- SEW-EURODRIVE

- Bonfiglioli S.p.A.

- Regal Rexnord Corporation

- Siemens AG

- ABB Ltd.

- Sumitomo Heavy Industries, Ltd.

- Nidec Corporation (Shimpo)

- Emerson Electric Co.

- Worm Gearbox (China) Co., Ltd.

- Motovario S.p.A.

- Jiangsu Taixing reducers Co., Ltd.

- Tsubakimoto Chain Co.

- David Brown Santasalo

- Flender GmbH

- Nord Drivesystems

- Cone Drive Operations, Inc.

- Altra Industrial Motion Corp.

- WEG S.A.

- P.I.V. Drives GmbH

- Varvel S.p.A.

Frequently Asked Questions

What is a gear reducer and its primary function?

A gear reducer is a mechanical device designed to reduce the rotational speed from a prime mover (like an electric motor) while simultaneously increasing the output torque. Its primary function is to optimize the speed and force delivered to an application, ensuring machinery operates efficiently and safely, preventing motor overload, and extending equipment lifespan.

What are the main types of gear reducers available in the market?

The main types of gear reducers include helical, worm, planetary, bevel, helical-bevel, and cycloidal. Each type offers specific advantages in terms of efficiency, space utilization, torque capacity, and noise levels, making them suitable for different industrial applications based on their unique gear arrangements and operational characteristics.

Which industries are the largest consumers of gear reducers?

The largest consumers of gear reducers are diverse and span across critical industrial sectors such as material handling, automotive manufacturing, construction, mining, food and beverage processing, power generation (especially wind turbines), and robotics and automation. These industries rely on gear reducers for precise motion control, heavy-duty operations, and efficient power transmission.

How does AI impact the future of the gear reducer market?

AI significantly impacts the gear reducer market by enabling advanced predictive maintenance, optimizing design and manufacturing processes, enhancing energy efficiency through real-time adjustments, and improving quality control. It facilitates the development of smart, connected gear reducers capable of self-diagnosis and seamless integration into Industry 4.0 ecosystems, leading to increased reliability and reduced operational costs.

What are the key factors driving the growth of the gear reducer market?

Key factors driving market growth include the global surge in industrial automation and robotics adoption, increased focus on energy efficiency and sustainable manufacturing, robust investments in infrastructure development, and the continuous expansion of core end-use industries. Additionally, technological advancements leading to more compact, durable, and precise gear reducer designs further fuel market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager