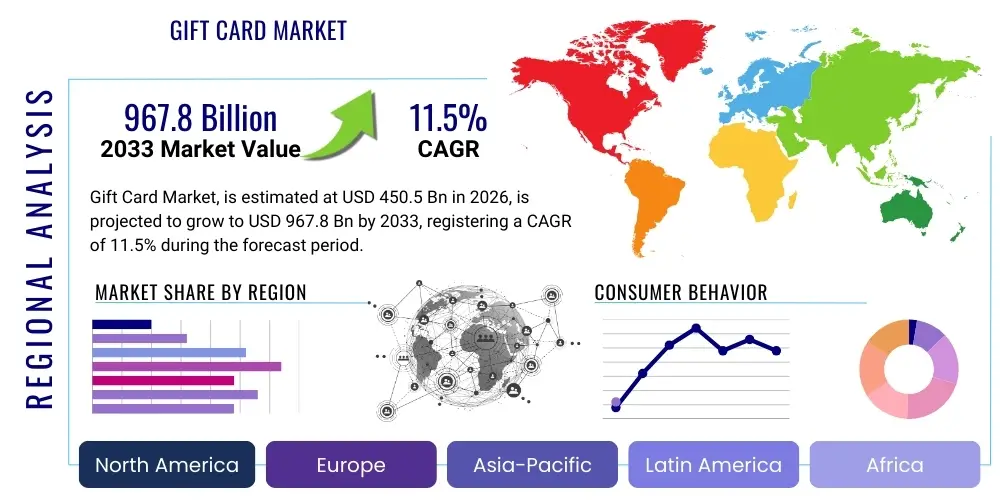

Gift Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437144 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Gift Card Market Size

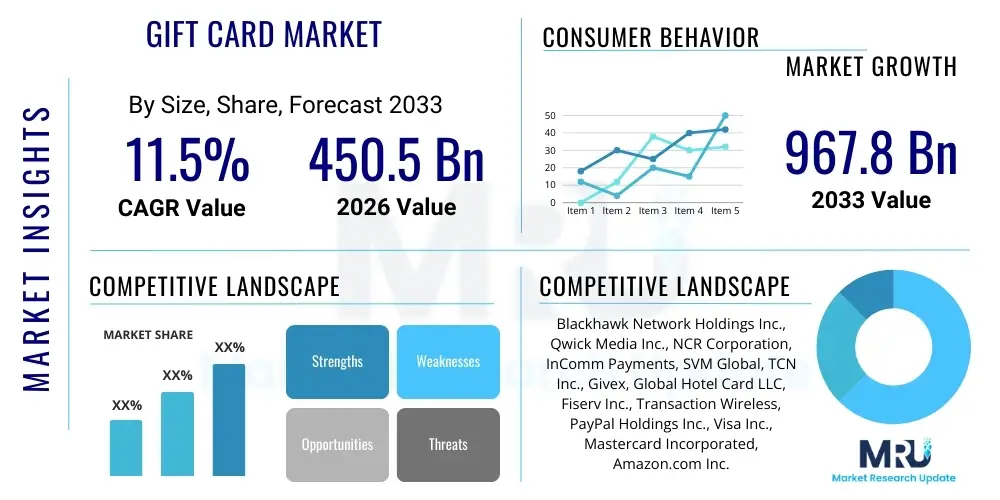

The Gift Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 967.8 Billion by the end of the forecast period in 2033.

Gift Card Market introduction

The Gift Card Market encompasses the issuance and utilization of prepaid stored-value money cards, primarily categorized as either open-loop (accepted by multiple merchants, often branded by major payment networks like Visa or Mastercard) or closed-loop (usable only at a specific retailer or group of associated retailers). These instruments have evolved from traditional plastic cards to highly sophisticated digital formats, including e-gift cards and mobile-based stored value solutions, driving significant transactional volume across global commerce. The fundamental product offers a versatile solution for gifting, corporate rewards, and personal budgeting, providing both convenience and flexibility to the user while simultaneously acting as a crucial revenue stream and customer acquisition tool for businesses.

Major applications of gift cards span retail consumer purchases, corporate incentives such as employee rewards and customer loyalty programs, and promotional campaigns designed to drive foot traffic or online conversion rates. The increasing synergy between gift card systems and digital payment infrastructure, including integration with mobile wallets and point-of-sale (POS) systems, has broadened their applicability beyond physical retail environments. Furthermore, the inherent benefits for merchants, such as reduced cash handling, enhanced security through tokenization, and the potential for ‘breakage’ (unredeemed balances contributing directly to profit), solidify the market's robust growth trajectory. Consumers benefit from the simplicity of a prepaid monetary value that mitigates the uncertainty of traditional physical gifts.

Several driving factors are propelling the expansion of the gift card ecosystem. Foremost among these is the exponential growth of global e-commerce, where digital gift cards offer seamless, instant delivery and redemption capabilities, aligning perfectly with online shopping habits. Additionally, the cultural shift towards non-cash, convenient payment methods, particularly among younger demographics and in developing economies, favors the adoption of prepaid solutions. The B2B sector’s increasing reliance on gift cards for effective, easily trackable incentive management and disbursement programs further contributes to market momentum, establishing gift cards as essential tools for both internal operational efficiency and external customer relationship management.

Gift Card Market Executive Summary

The global Gift Card Market demonstrates dynamic growth, primarily driven by accelerated digital transformation and shifting consumer preference toward non-cash transactions. Key business trends indicate a significant migration from physical plastic cards toward digital and mobile-integrated solutions, often facilitated by QR codes, NFC technology, and integration into existing mobile wallet platforms like Apple Pay and Google Pay. This transition is enhancing security, increasing instant delivery capabilities, and lowering operational costs for issuers. Furthermore, globalization is leading to increased cross-border use of open-loop cards, although regulatory hurdles concerning anti-money laundering (AML) and know-your-customer (KYC) requirements present challenges that vary significantly by jurisdiction. The strategic importance of gift card programs is elevating, moving beyond mere gifting to become central components of retailer omnichannel strategies, connecting online and offline consumer experiences seamlessly.

Regionally, North America remains the most mature and dominant market, characterized by high consumer spending, established retail giants, and sophisticated gift card infrastructure. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth CAGR, fueled by massive penetration of mobile commerce, rapid urbanization, and a large, digitally native population in countries like China and India. European market dynamics are shaped by regulatory fragmentation and a strong preference for proprietary closed-loop systems, though open-loop growth is accelerating due to the standardization efforts under the EU's Payment Services Directive 2 (PSD2). Investment in localized digital platforms and partnerships with regional payment gateways are crucial for market entry and sustained growth across these diverse geographies.

Segmentation trends highlight the robust performance of the digital gift card segment, which consistently outpaces physical card growth due to its convenience and lower environmental footprint. Closed-loop cards, while facing competition from universal open-loop solutions, maintain strong relevance, especially for specific large retailers and restaurant chains, acting as powerful loyalty tools and providing higher profit margins through captive redemption. Application-wise, the corporate sector, encompassing employee rewards, sales incentives, and customer promotions, represents a rapidly expanding segment, increasingly adopting large-volume digital issuance platforms. Technologically, the integration of advanced data analytics and Artificial Intelligence (AI) into issuance and redemption platforms is driving personalized offers and improving fraud detection capabilities, enhancing overall market efficiency and consumer trust.

AI Impact Analysis on Gift Card Market

User inquiries regarding AI's influence on the Gift Card Market predominantly revolve around three critical areas: personalized gifting experiences, enhanced security against fraud, and optimization of marketing and distribution channels. Users are keen to understand how AI can move beyond simple transaction processing to offer true value by analyzing historical purchase data, predicting gifting occasions, and recommending specific card values or retailer options tailored to the recipient's likely preferences, thereby maximizing redemption rates and minimizing card wastage. Another major concern is the sophisticated nature of digital fraud, including phishing attacks and illegal bulk card purchases; users expect AI-powered systems to provide superior real-time anomaly detection and behavioral biometrics to secure prepaid funds. Finally, businesses are exploring how AI can dynamically adjust gift card values or promotional offers based on real-time inventory, seasonality, and competitive pricing, optimizing the financial outcome of gift card programs.

The incorporation of Artificial Intelligence is fundamentally transforming the operational core and customer experience of the gift card ecosystem. By leveraging machine learning models, issuers and retailers can now execute hyper-segmentation of their customer base, creating personalized gift card bundles and targeted promotional campaigns that were previously impossible. AI algorithms analyze millions of data points relating to purchase history, browsing behavior, demographic data, and seasonal patterns to predict the most opportune moment and channel to market a gift card. This data-driven approach significantly improves conversion rates for retailers and ensures that the gift card provides maximum perceived value to the end-user, thereby contributing directly to higher active user rates and increased repeat business after the initial redemption.

Furthermore, AI is instrumental in fortifying the security and compliance frameworks surrounding gift card transactions. Advanced AI systems utilize sophisticated pattern recognition to identify suspicious purchase behaviors—such as rapid, sequential purchases from disparate geographical locations or attempts to load maximum values onto multiple cards simultaneously—often indicative of money laundering or carding schemes. These systems provide instantaneous risk scoring, allowing platforms to block fraudulent transactions or trigger multi-factor authentication seamlessly, maintaining consumer trust in the digital gifting infrastructure. On the operational side, AI-driven chatbots and virtual assistants are optimizing customer service for redemption and balance inquiries, providing 24/7 support and reducing the dependence on human agents, thereby streamlining the entire post-purchase experience and boosting overall platform scalability.

- AI-driven personalization engines enable dynamic pricing and tailored card recommendations based on recipient behavior profiles.

- Machine Learning (ML) algorithms drastically improve real-time fraud detection and anomaly scoring during card issuance and redemption processes.

- Predictive analytics optimize inventory management and forecasting for physical card stock and digital certificate generation.

- AI-powered chatbots enhance customer service, handling instant balance checks and troubleshooting common redemption issues.

- Behavioral biometrics integrated via AI models secure mobile wallet gift card storage and transaction validation.

- Optimization of marketing spend by identifying the most effective distribution channels and promotional timing.

- Automation of regulatory compliance checks (e.g., AML thresholds) for high-value open-loop card issuance.

DRO & Impact Forces Of Gift Card Market

The Gift Card Market is governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the Impact Forces determining its future trajectory. Key drivers include the universal expansion of e-commerce, the increasing deployment of gift cards in the robust corporate rewards and incentive sector (B2B usage), and the inherent convenience and control they offer to consumers compared to traditional cash or physical presents. These drivers generate significant positive impact forces, accelerating volume growth and promoting technological innovation in delivery and security. Conversely, major restraints, such as persistent concerns over fraudulent activities (e.g., card cloning and online scams), regulatory complexities regarding unclaimed property laws (breakage) which vary significantly by state or country, and the high upfront costs associated with integrating complex digital redemption infrastructure, act as decelerating forces that necessitate continuous mitigation strategies and regulatory standardization efforts.

Opportunities within the market are predominantly concentrated in technological integration and new market penetration. The adoption of blockchain technology promises enhanced security, reduced transaction fees, and greater transparency for open-loop systems, potentially disrupting traditional payment processors. Furthermore, the immense, untapped potential in emerging markets, particularly in Latin America and Southeast Asia, where mobile-first banking and informal economies are transitioning rapidly to digital payments, offers substantial avenues for geographic expansion. The strategic shift towards mobile wallets and digital tokenization also presents a significant opportunity to embed gift card functionality directly into everyday digital life, enhancing usability and diminishing reliance on physical formats. These opportunities exert a potent transformative impact, pushing the industry towards higher efficiency and broader acceptance.

The combined impact forces are heavily tilted towards digitalization and B2B growth. The primary driving force remains the digital shift, which not only facilitates instant global delivery but also allows for detailed data collection, enabling issuers to refine marketing and loyalty strategies. The continuous evolution of payment security standards, driven by both regulatory pressure and market competition, compels stakeholders to invest heavily in advanced fraud detection and secure issuance platforms. The net impact is a market characterized by intense competition, rapid technological iteration, and a crucial requirement for seamless integration across multiple retail and payment channels, ensuring that gift cards maintain their relevance as a flexible, secure, and data-rich prepaid solution adaptable to evolving consumer and corporate needs globally.

Segmentation Analysis

The Gift Card Market is broadly segmented based on type, application, end-user, and format, reflecting the diverse ways these instruments are utilized across the global economy. Understanding these segments is crucial for issuers and retailers to tailor their offerings effectively, whether focusing on the high-volume, universal utility of open-loop cards or the loyalty-generating power of closed-loop proprietary cards. The market structure reveals significant differentiation in growth rates, with digital and mobile segments expanding far more rapidly than their physical counterparts, driven by e-commerce penetration and the demand for instant delivery. Furthermore, the application split between B2C gifting and B2B corporate incentives indicates a structural transformation, with the latter showing substantial untapped growth potential due to its professional, repeatable nature and high average transaction value (ATV).

- By Type:

- Open-Loop Gift Cards

- Closed-Loop Gift Cards

- By Format:

- Physical Gift Cards (Plastic, Paper Certificates)

- Digital Gift Cards (E-Gift Cards, Mobile Gift Cards)

- By End-User/Application:

- Retail and Consumer Gifting (B2C)

- Corporate Incentives and Rewards (B2B)

- Marketing and Promotions (Customer Acquisition)

- Employee Rewards and Recognition

- By Retailer Category:

- Department Stores

- Restaurants and Food Services

- Health and Wellness

- Entertainment and Gaming

- Fuel and Utilities

- Specialty Retailers

Value Chain Analysis For Gift Card Market

The value chain for the Gift Card Market is intricate, involving numerous specialized entities from creation to final redemption. Upstream activities begin with the physical card manufacturers (for plastic cards) or software developers (for digital platforms), who specialize in secure printing, encoding, and digital tokenization. These entities ensure the physical integrity and technological functionality of the cards. Concurrently, payment processors and network operators (like Visa, Mastercard, or proprietary closed-loop processors) manage the underlying transactional infrastructure, ensuring secure data routing, authorization, and settlement. The efficiency of the upstream segment is critical, as it dictates the security features and scalability of the entire program.

The middle segment focuses on the issuance and distribution channels. Issuers, typically major retailers, banks, or third-party program managers, manage the card program lifecycle, including design, activation, and regulatory compliance. Distribution channels are highly diversified, encompassing direct sales through physical retail stores, online corporate sales platforms, and third-party gift card malls or racks (e.g., Blackhawk Network). The emergence of direct digital distribution via email and mobile apps has significantly streamlined this process, bypassing traditional logistics constraints. Program managers play a vital role here, linking retailers with distribution networks and ensuring compliance across varying jurisdictions.

Downstream activities center on redemption and consumer interaction. This involves the retailer’s POS system or e-commerce gateway, which must securely accept and validate the card, manage fractional redemptions, and track residual balances. Direct sales channels, where the card is purchased and redeemed at the same location, offer the shortest value chain. However, indirect channels, particularly through major third-party distributors or payment networks, introduce complexity but significantly expand the market reach. The effectiveness of the downstream process is paramount for customer satisfaction and determines the ultimate success and profitability of the gift card program for the issuing retailer, necessitating robust integration with core inventory and accounting systems.

Gift Card Market Potential Customers

The potential customer base for the Gift Card Market is expansive, spanning both the Business-to-Consumer (B2C) and Business-to-Business (B2B) sectors, with each segment presenting distinct purchasing motivations and volume requirements. In the B2C segment, potential customers are primarily individual consumers seeking convenient, universally applicable, or personalized gifts for friends, family, or colleagues on occasions like holidays, birthdays, or special achievements. This segment values ease of purchase, thematic relevance, and the flexibility to allow the recipient to choose their desired item. Open-loop cards often appeal to B2C users due to their broad acceptance, while closed-loop cards from popular brands are favored for targeted gifting, contributing to high seasonal transaction peaks.

The B2B sector represents a significant and steadily growing segment of potential customers, characterized by high volume and recurring usage patterns. These buyers include corporate entities utilizing gift cards for comprehensive employee rewards and recognition programs, aimed at boosting morale, improving retention, and incentivizing performance based on quantifiable metrics. Furthermore, marketing departments use gift cards extensively as customer acquisition incentives, loyalty program payouts, or refunds, recognizing them as an effective, easily trackable, and universally appealing form of non-cash reward. Large organizations, including those in finance, technology, healthcare, and manufacturing, actively purchase large denominations of both physical and digital cards via specialized corporate platforms that require robust reporting and seamless integration with human resources (HR) or sales tracking software.

Beyond traditional corporate use, specialized groups such as educational institutions, non-profit organizations, and government agencies also represent potential buyers. Educational institutions use them for student incentives or contest prizes, while non-profits may use them for donor rewards or assistance programs. These institutional buyers prioritize secure, scalable bulk purchasing capabilities and often prefer digital formats for instant distribution and environmental sustainability. For all potential customers, the criteria for selection increasingly revolve around the security features of the card program, the breadth of retailer acceptance (especially for open-loop solutions), and the quality of the reporting and analytics provided by the issuing platform, which helps them measure the return on investment (ROI) of their gift card expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 967.8 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Blackhawk Network Holdings Inc., Qwick Media Inc., NCR Corporation, InComm Payments, SVM Global, TCN Inc., Givex, Global Hotel Card LLC, Fiserv Inc., Transaction Wireless, PayPal Holdings Inc., Visa Inc., Mastercard Incorporated, Amazon.com Inc., Apple Inc., Google LLC, Safeway Inc., Target Corporation, Walmart Inc., American Express Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Gift Card Market Key Technology Landscape

The technological landscape of the Gift Card Market is rapidly evolving, driven by the imperative for enhanced security, improved efficiency, and seamless omnichannel integration. The shift from magnetic stripe technology to modern, chip-based solutions (EMV) has been a foundational security upgrade, particularly for physical open-loop cards, reducing skimming and cloning risks. However, the most significant technological advancements are centered around digital delivery and payment facilitation. This includes the pervasive use of Near Field Communication (NFC) technology, which enables contactless redemption through mobile wallets, and Quick Response (QR) codes, which are widely adopted in Asia Pacific for instant digital gift card redemption at Point-of-Sale (POS) systems without the need for physical contact or dedicated hardware readers.

Tokenization stands as a critical technology for securing digital gift card data. By replacing sensitive primary account numbers (PANs) with unique digital tokens, tokenization ensures that even if transaction data is intercepted, the underlying financial information remains protected and useless to fraudsters. This is essential for maintaining consumer confidence in mobile and online gift card usage. Furthermore, cloud-based gift card management platforms are becoming standard, offering retailers real-time data analytics on redemption patterns, breakage rates, and campaign performance. These Software-as-a-Service (SaaS) solutions provide the necessary scalability and flexibility for large enterprises running complex, multi-currency, and cross-border gift card programs, reducing reliance on expensive, proprietary on-premise infrastructure.

Looking ahead, blockchain technology and distributed ledger systems (DLT) are emerging as potential game-changers, promising to revolutionize transparency and security in the open-loop segment. Blockchain could facilitate decentralized issuance and tracking of gift card balances, minimizing transactional intermediaries and reducing associated fees, while also providing an immutable record of ownership and transaction history, which could simplify complex regulatory reporting, particularly concerning unclaimed property laws. Additionally, the increasing integration of Application Programming Interfaces (APIs) allows third-party developers to embed gift card purchasing and redemption capabilities directly into specialized apps and loyalty platforms, creating a highly interconnected ecosystem that fosters broader use and greater consumer convenience across varied digital environments.

Regional Highlights

North America: Market Maturity and Innovation Hub

North America, particularly the United States, represents the largest and most established market for gift cards globally. The region is characterized by high average consumer spending, robust retail infrastructure, and a mature regulatory environment. Adoption rates for both open-loop and closed-loop cards are exceptionally high, with gift cards being entrenched in consumer culture, particularly during holiday seasons. Retailers in this region consistently leverage gift card programs as a primary driver for customer acquisition and loyalty. The market's stability is underpinned by advanced payment networks and rapid adoption of mobile wallet technologies. The trend here focuses on integrating personalized digital experiences and sophisticated fraud mitigation systems, often employing AI/ML to secure high-value open-loop products. The sheer volume and frequency of transactions dictate substantial investment in scalable cloud-based processing platforms.

However, the North American market faces ongoing challenges related to regulatory fragmentation, particularly concerning state-level escheatment laws (unclaimed property), which significantly complicate the accounting and liability reporting for multi-state retailers and program managers. Innovation is focused heavily on the B2B segment, where corporations are increasingly utilizing sophisticated platform managers to distribute large volumes of digital gift cards for employee wellness, performance rewards, and sales incentives. This corporate demand necessitates highly customizable platforms capable of integrating with existing HR and payroll systems. The prevalence of major national retail chains further solidifies the closed-loop segment, even as open-loop cards continue to gain traction through ubiquitous acceptance across major payment networks.

Europe: Regulatory Complexity and Digital Growth

The European Gift Card Market is highly fragmented by varying national laws, taxation rules, and currency use, which historically favored closed-loop and localized solutions. However, the market is experiencing strong acceleration, particularly in the UK, Germany, and France, driven by the expansion of cross-border e-commerce and the increasing popularity of pan-European open-loop cards facilitated by harmonized regulations like PSD2. Digital gift cards are gaining dominance, offering a solution to complex physical distribution logistics across diverse countries. The emphasis in Europe is placed heavily on security and consumer protection, often leading to stringent KYC requirements for high-value prepaid cards.

The corporate rewards sector in Europe is expanding rapidly, with multinational companies seeking unified digital platforms to manage incentives across their European operations, requiring compliance with varying local labor laws regarding non-cash compensation. Restraints include the inherent linguistic and cultural barriers that necessitate localized card designs and marketing, adding complexity for pan-European issuers. Technological innovation is focused on ensuring seamless integration with diverse national payment systems and mobile banking apps, supporting instant, secure redemption across the Eurozone. Adoption of contactless technology via mobile phones is particularly high, cementing the preference for digital formats that reduce the friction associated with physical card management.

Asia Pacific (APAC): Mobile-First and Explosive Expansion

The APAC region is the fastest-growing market globally, characterized by massive digital adoption, high mobile penetration, and a burgeoning middle class transitioning rapidly from cash to digital payments. Countries like China, India, and Southeast Asian nations are driving this growth, often bypassing traditional plastic card infrastructure entirely and moving directly to mobile-based QR code and tokenized solutions. Closed-loop cards are extremely popular here, tied closely to dominant e-commerce platforms (e.g., Alibaba, Shopee) and super-apps that integrate messaging, payment, and retail functionality.

The primary growth driver is the young, digitally native population and the vast, quickly expanding e-commerce ecosystem. The preference for instant, secure transactions has made digital gift cards essential components of flash sales and loyalty programs. Challenges include fragmented regulatory environments, varying levels of payment infrastructure sophistication, and a high incidence of digital fraud that requires continuous technological vigilance. Opportunities abound in integrating gift card solutions with micro-payment systems and localized digital wallets, catering to the unique consumer behaviors of each country. The market is highly competitive, with local tech giants often dominating issuance and distribution channels.

Latin America (LATAM) and Middle East & Africa (MEA): Emerging High-Potential Markets

These regions represent emerging markets characterized by significant growth potential, albeit from a smaller base. In LATAM, growth is spurred by increasing financial inclusion, urbanization, and a strong preference for secure prepaid solutions in economies grappling with high cash reliance and varying currency stability. Digital formats are essential here due to infrastructural constraints in physical distribution. The focus is often on open-loop cards to serve the unbanked population or provide easily controllable spending tools.

The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong potential driven by high consumer spending power and rapid technological adoption in mobile payments. Gift cards are popular in the luxury retail and entertainment sectors. Challenges across both LATAM and MEA include developing trusted, standardized distribution networks and overcoming lower consumer trust in digital payment systems compared to mature markets. However, the rapid proliferation of smartphones and government initiatives promoting digital economies provide robust opportunities for sustained high growth rates in both corporate and consumer segments.

- North America: Dominant market share; focus on B2B incentives and AI-driven fraud mitigation.

- Asia Pacific: Highest growth rate; driven by mobile commerce, QR code technology, and super-app integration.

- Europe: Fragmented but accelerating; increasing adoption of open-loop cards under PSD2 framework.

- Latin America: High growth potential driven by financial inclusion and transition away from cash reliance.

- Middle East & Africa: Growth concentrated in GCC countries; strong adoption in high-end retail and entertainment sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Gift Card Market.- Blackhawk Network Holdings Inc.

- Qwick Media Inc.

- NCR Corporation

- InComm Payments

- SVM Global

- TCN Inc.

- Givex

- Global Hotel Card LLC

- Fiserv Inc.

- Transaction Wireless

- PayPal Holdings Inc.

- Visa Inc.

- Mastercard Incorporated

- Amazon.com Inc.

- Apple Inc.

- Google LLC

- Safeway Inc.

- Target Corporation

- Walmart Inc.

- American Express Company

Frequently Asked Questions

Analyze common user questions about the Gift Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between open-loop and closed-loop gift cards?

Open-loop gift cards are issued by major payment networks (e.g., Visa, Mastercard) and can be used anywhere those network cards are accepted, offering universal utility. Closed-loop cards are issued by a specific retailer or brand and are only redeemable at that specific store or group of affiliated locations, functioning primarily as a loyalty tool.

How is the growth of e-commerce affecting the format of gift cards?

The exponential growth of e-commerce is strongly accelerating the shift from physical plastic cards to digital gift card formats (e-gift cards). Digital cards offer instant delivery via email or mobile apps, are environmentally friendlier, and integrate seamlessly with online checkout systems, aligning better with consumer digital shopping habits.

What are the key security challenges facing the digital gift card market?

Key security challenges include sophisticated phishing schemes targeting card credentials, account takeovers, and fraudulent bulk purchases. The industry addresses these risks through advanced security measures such as tokenization, real-time AI-powered fraud detection, and multi-factor authentication during high-value transactions.

Which geographical region is expected to show the highest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to high mobile penetration, rapid urbanization, strong integration of gift cards into dominant super-apps, and accelerating consumer adoption of digital payment methods across emerging economies like India and Southeast Asia.

How do B2B applications contribute to the Gift Card Market size?

B2B applications, including corporate incentives, employee rewards and recognition, and customer loyalty programs, contribute significantly to market size by driving high-volume, recurring purchases, often utilizing high-value open-loop cards, offering scalable and traceable solutions for non-cash compensation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electronic Gift Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Retail Gift Card Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fintech Products, Traditional Products), By Application (Department Stores, Restaurants, Food Supermarkets, Coffee Shops, Discount Stores, Entertainment, Hotels), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager