Glass Microfiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434162 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Glass Microfiber Market Size

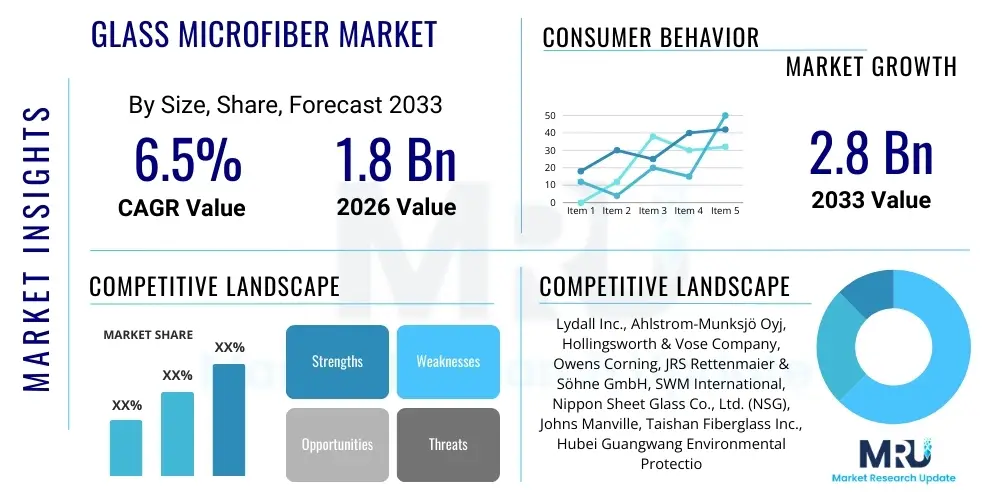

The Glass Microfiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by escalating global demand for high-efficiency filtration media, particularly in the Heating, Ventilation, and Air Conditioning (HVAC) sector and stringent regulatory standards imposed on industrial emissions across developed and rapidly industrializing economies.

The valuation reflects the critical role glass microfibers play across diverse high-performance applications, where their unique physical properties—such as high surface area, excellent thermal insulation capabilities, and inherent chemical resistance—are indispensable. Furthermore, the growing adoption of Glass Microfiber Separator (GMS) technology in advanced battery systems, specifically for industrial batteries and grid-scale energy storage, contributes significantly to this market trajectory. Investment in sustainable manufacturing processes and the development of specialized fiber chemistries tailored for extreme environments are further stabilizing and accelerating market capitalization.

Glass Microfiber Market introduction

The Glass Microfiber Market encompasses the production and distribution of extremely fine fibers manufactured from various glass compositions, primarily borosilicate and silica, characterized by diameters often less than 1 micrometer. These fibers are distinct from standard glass wool due to their significantly smaller diameter and high specific surface area, making them crucial components in applications demanding high filtration efficiency, superior thermal management, or effective chemical containment. Key product forms include matts, papers, rolls, and specialized composites used in demanding industrial contexts.

Major applications of glass microfibers span across air and liquid filtration (HEPA/ULPA filters), battery separators (especially in Absorbed Glass Mat (AGM) batteries), specialized insulation materials for aerospace and petrochemical industries, and high-performance laboratory consumables. Their primary benefit lies in their capacity to achieve exceptional retention efficiencies for submicron particles without significant pressure drop, coupled with superior resistance to high temperatures and corrosive chemicals that often degrade organic alternatives. This dual functionality ensures their continued preference in critical infrastructure and health-related applications.

The market is predominantly driven by increasing global awareness regarding air quality, leading to the mandatory adoption of advanced air filtration systems in commercial and residential settings. Additionally, technological advancements in battery technology, particularly the shift toward more efficient and robust AGM batteries, necessitate substantial volumes of high-quality glass microfibers for optimal performance and extended lifespan. Regulatory compliance related to environmental protection and workplace safety acts as a perpetual catalyst, fueling consistent demand across various end-use sectors globally.

Glass Microfiber Market Executive Summary

The Glass Microfiber Market is experiencing dynamic growth, characterized by significant shifts in manufacturing technology and sustained demand from high-growth end-use sectors like automotive and life sciences. Current business trends indicate a strong focus on optimizing fiber diameter control and developing surface modifications to enhance product efficacy, particularly for applications requiring extremely low pressure drop and high particulate loading capacity. Investment in expanding manufacturing capacity, predominantly in Asia Pacific, is a key strategic priority for leading market participants aiming to capitalize on rising industrialization and subsequent increases in pollution control requirements. Furthermore, sustainability initiatives are driving R&D toward incorporating recycled glass feedstock without compromising fiber integrity.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market segment, underpinned by rapid urbanization, massive infrastructure development, and increasingly stringent environmental legislation implemented by governments in China, India, and Southeast Asia. North America and Europe maintain leading positions in terms of technological adoption and demand for premium, ultra-high-efficiency products, driven largely by the automotive filtration industry and stringent regulatory frameworks concerning indoor air quality (IAQ) and vehicle emissions. These developed markets prioritize quality certifications (e.g., ISO, EN) and specialized applications in pharmaceuticals and microelectronics.

Segment trends reveal that the Filtration application segment dominates the market, specifically within the HVAC and industrial dust collection sectors, due to necessary regulatory compliance. The Borosilicate type segment holds the largest market share owing to its excellent balance of mechanical strength, thermal stability, and low-cost processability. However, the Silica microfiber segment is projected to register the highest growth rate, fueled by its specialized use in extreme-temperature insulation applications and highly acidic or basic filtration environments, offering superior chemical resilience compared to standard borosilicate compositions.

AI Impact Analysis on Glass Microfiber Market

User inquiries frequently center around how artificial intelligence (AI) can optimize the complex, energy-intensive process of glass microfiber manufacturing, particularly focusing on achieving nanoscale precision and consistent quality control in high-volume production. Common concerns include the deployment of predictive maintenance algorithms to minimize equipment downtime in high-temperature environments, the use of computer vision for real-time defect detection in fiber matting, and leveraging machine learning models to correlate input material composition with final filtration performance. Users are keen to understand how AI-driven simulation can accelerate the development of novel glass compositions tailored for specific filtration challenges, reducing costly and time-consuming physical prototyping, and enabling manufacturers to meet increasingly tight product specifications required by advanced industries like semiconductor fabrication and high-purity chemical processing.

AI's influence is transforming the efficiency and innovation cycles within the glass microfiber sector. Integrating AI tools allows manufacturers to move beyond traditional manual inspection and reactive maintenance strategies toward predictive, data-driven operations. This transition enhances yield rates, significantly reduces waste material, and optimizes energy consumption during the melting and fiberization stages, providing a critical competitive edge. Furthermore, sophisticated AI algorithms are enabling a deeper understanding of filtration dynamics, assisting customers in selecting the precise fiber media configuration required for specific air or liquid stream purification tasks, leading to better product recommendations and custom solutions.

- AI optimizes furnace temperature control and melt flow dynamics, reducing energy costs by up to 15%.

- Machine learning models predict fiber diameter and distribution consistency in real time, enhancing product quality control.

- Computer vision systems enable high-speed, non-destructive inspection of fiber webs for homogeneity and defect identification.

- Predictive analytics optimize supply chain logistics by forecasting raw material demand (silica, boron) based on end-user sector growth.

- AI-driven simulation accelerates R&D for novel, chemically resistant fiber chemistries for specialized applications like flue gas desulfurization.

- Automated scheduling systems reduce production cycle times and increase overall equipment effectiveness (OEE).

DRO & Impact Forces Of Glass Microfiber Market

The Glass Microfiber Market is fundamentally driven by stringent global environmental regulations mandating cleaner air and water, particularly the standards set for HEPA and ULPA filtration across industrial and commercial sectors. This regulatory push is coupled with strong demand from the rapidly expanding electric vehicle (EV) and energy storage markets, where AGM technology, reliant on glass microfibers, remains a cost-effective and reliable solution for specific battery types. However, the market faces constraints related to the high initial capital investment required for specialized fiberization equipment and volatility in the cost and supply of high-purity raw materials. Opportunities are abundant in developing specialized battery separators for advanced lithium-ion and sodium-ion systems, and in bio-pharmaceutical filtration where ultra-purity is non-negotiable.

Impact forces within the market are predominantly shaped by intense competition from alternative filtration media, such as synthetic polymer fibers (e.g., PTFE, polypropylene) and specialized ceramic media, which offer performance trade-offs that appeal to cost-sensitive applications. Buyer power is moderate to high, as large OEM customers (e.g., HVAC manufacturers, battery assemblers) command significant leverage in pricing and specification demands. Supplier power is generally moderate, although fluctuations in the cost of high-purity silica and borax can influence manufacturer margins. The threat of new entrants is moderate, deterred by the high technical barriers to entry and the need for rigorous product qualification processes.

Technological substitution risk is perhaps the most critical external force; while glass microfibers hold a dominant position in high-temperature and high-efficiency domains, advancements in nanofiber production and membrane technology pose a credible threat in certain sub-segments. Success in mitigating these forces hinges on continuous product innovation, vertical integration to secure raw material supply, and strategic partnerships with major end-users to co-develop custom filtration solutions that maximize the inherent benefits of glass fiber chemistry and structure.

Segmentation Analysis

The Glass Microfiber Market is comprehensively segmented based on its Type, Application, and End-Use Industry, allowing for granular analysis of market dynamics and targeted strategic development. The Type segmentation primarily distinguishes between Borosilicate, which is widely used due to its excellent cost-performance ratio and established production techniques, and Silica, preferred for extremely high-temperature or highly corrosive environments. Application segmentation highlights the dominance of Filtration (air, liquid, and gas) over Insulation and Battery Separation, reflecting global environmental and industrial safety priorities. Understanding these distinct segments is crucial as growth rates and technological requirements vary significantly across these categories, demanding specialized R&D efforts and unique marketing strategies for optimized market penetration and share capture.

- By Type:

- Borosilicate Glass Microfiber

- Silica Glass Microfiber

- Other Fiber Types (e.g., Alkali-resistant)

- By Application:

- Filtration Media (Air Filtration, Liquid Filtration, Gas Filtration)

- Battery Separators (Absorbed Glass Mat (AGM) Batteries)

- Thermal and Acoustic Insulation

- Composite Reinforcement

- High-Performance Laboratory Paper

- By End-Use Industry:

- Automotive and Transportation (Vehicle Filters, AGM Batteries)

- HVAC and Air Purification

- Industrial Manufacturing (Chemical, Oil & Gas, Power Generation)

- Pharmaceutical and Life Sciences

- Aerospace and Defense

- Energy and Utilities

Value Chain Analysis For Glass Microfiber Market

The Glass Microfiber value chain begins with upstream activities focused on sourcing and processing high-purity raw materials, principally silica sand, boron oxide (for borosilicate), and other specialized chemical additives that define the final fiber properties. This stage is critical as the purity of the raw materials directly impacts the melting process efficiency and the physical characteristics (e.g., tensile strength, chemical stability) of the drawn fibers. Key activities include material crushing, precise batch mixing, and melting in high-temperature furnaces, which are highly energy-intensive and require specialized infrastructure and sophisticated process control to ensure consistent melt quality necessary for successful fiberization.

Midstream activities involve the specialized manufacturing processes, such as melt-blowing, rotary fiberizing, or flame attenuation, which transform the molten glass into micro-diameter fibers. These fibers are then processed into usable forms, such as continuous webs, matts, or specialized paper, through processes like wet-laid or dry-laid papermaking. Distribution channels for these semi-finished products are categorized into direct and indirect routes. Direct distribution often involves tailored supply agreements with large OEMs in the automotive or battery sector requiring specific fiber specifications and bulk deliveries. Indirect distribution utilizes specialized industrial distributors and filtration system integrators who convert the glass microfiber media into finished products like HEPA filters or industrial air scrubbers before reaching the final end-user.

Downstream activities focus on the final conversion, integration, and aftermarket services. System integrators and finished goods manufacturers utilize the glass microfiber media to produce end products (filters, battery separators). The final end-users, such as industrial plants, commercial buildings, or automotive manufacturers, rely on the performance and regulatory compliance of these final products. The value chain is characterized by a strong emphasis on technical expertise at every stage, given the critical performance requirements of the final applications. Maintaining quality certification and technical support post-sale are essential components of sustained market competitiveness and customer loyalty.

Glass Microfiber Market Potential Customers

The potential customer base for the Glass Microfiber Market is highly diverse, spanning numerous industrial sectors that require high-performance materials for environmental control, energy storage, or thermal management. Primary customers include manufacturers of advanced filtration systems, encompassing both industrial air pollution control equipment (e.g., baghouses, scrubbers) and commercial/residential HVAC systems that utilize HEPA and ULPA rated filters to meet stringent air quality standards. These customers purchase glass microfiber media in rolls or sheets for assembly into standardized and custom filter cartridges, prioritizing high efficiency, low pressure drop, and long service life to minimize maintenance requirements for the end-user.

A second major segment consists of battery manufacturers, particularly those focusing on Absorbed Glass Mat (AGM) batteries used extensively in start-stop automotive systems, uninterruptible power supplies (UPS), and deep-cycle applications. These buyers require consistent, highly porous glass microfiber separators that effectively immobilize the electrolyte while providing low electrical resistance and excellent compression resilience over the battery's lifespan. The increasing global production of vehicles, coupled with the rising adoption of renewable energy storage systems, places this segment among the highest growth opportunities for microfiber suppliers demanding tailored specifications for pore size distribution and chemical inertness.

Furthermore, specialized industries such as aerospace and defense, pharmaceuticals, and high-purity chemical processing represent key niche markets. Aerospace customers demand silica glass microfibers for extreme-temperature thermal and acoustic insulation where weight reduction and fire resistance are paramount. The pharmaceutical industry requires ultra-high purity filtration media for sterile venting, cell culture, and liquid pharmaceutical clarification, where any leaching or fiber shedding is unacceptable. These customers are characterized by demanding technical specifications, rigorous qualification processes, and a willingness to pay a premium for certified, superior quality products, making them valuable targets for specialized glass microfiber manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lydall Inc., Ahlstrom-Munksjö Oyj, Hollingsworth & Vose Company, Owens Corning, JRS Rettenmaier & Söhne GmbH, SWM International, Nippon Sheet Glass Co., Ltd. (NSG), Johns Manville, Taishan Fiberglass Inc., Hubei Guangwang Environmental Protection Technology Co., Ltd., Zibo Huabang Fiberglass Co., Ltd., Clear Edge Filtration, GE Aviation, Saint-Gobain, Purafil Inc., Pall Corporation, Mann+Hummel, Fibertex Nonwovens, Sinoma Science & Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Microfiber Market Key Technology Landscape

The key technology landscape of the Glass Microfiber Market is centered around optimizing fiberization techniques to achieve ultra-fine diameters (typically 0.1 to 3.0 micrometers) with high uniformity and cost-effectiveness. The dominant technology remains the rotary fiberizing process (spinning process), utilized for high-volume production of staple fibers, where molten glass is spun and attenuated using high-speed rotational forces. However, advancements are increasingly focused on the melt-blowing process, which utilizes high-velocity gas streams to draw the fibers, enabling the production of fibers closer to the sub-micron scale required for ULPA grade filtration media and advanced battery separators with highly controlled porosity and density.

A crucial technological area involves developing specialized glass compositions (chemistries) that enhance performance characteristics such as chemical resistance to harsh solvents or acids (critical for liquid filtration) and improved thermal stability for high-temperature insulation applications. Furthermore, surface treatment technologies, including specialized coatings and chemical modification processes, are gaining importance. These post-production treatments are designed to enhance water repellency (hydrophobicity), improve adhesion in composite matrices, or introduce static charges to boost filtration efficiency without compromising air flow, thereby maximizing the lifetime and functionality of the finished product, especially in moisture-prone environments or specialized chemical filtering.

The integration of Industry 4.0 principles, particularly advanced sensor technology and process automation, represents a significant technological shift. Modern manufacturing plants are adopting precise laser-based monitoring systems and complex algorithms to continuously measure fiber diameter distribution and web consistency in real time, ensuring extremely tight adherence to quality specifications. This level of process control is non-negotiable for supplying industries like microelectronics, where even minor variations in filter media performance can lead to significant manufacturing defects. Future research is focused on developing hybrid materials that combine glass microfibers with organic components to achieve synergistic properties, such as enhanced flexibility or tailored biodegradability, pushing the boundaries of traditional glass microfiber utility.

Regional Highlights

The regional dynamics of the Glass Microfiber Market exhibit significant disparities based on industrial maturity, environmental policy stringency, and local manufacturing capabilities. North America, specifically the United States, commands a substantial market share driven by robust industrial regulatory compliance and a highly developed HVAC infrastructure requiring premium, certified filtration products. Demand is particularly strong in the automotive aftermarket and in specialized sectors like aerospace and defense, where quality assurance and adherence to strict performance standards (e.g., efficiency, fire resistance) are paramount. The region benefits from early technological adoption and significant investment in R&D for next-generation filtration media and EV battery components.

Europe represents a mature but technologically demanding market, characterized by strict EU directives regarding emissions control and circular economy initiatives. Western European countries are leaders in implementing stringent building codes requiring highly efficient indoor air filtration, boosting the Borosilicate segment. Furthermore, the rapid penetration of electric vehicles and large-scale grid energy storage projects across the region sustains strong demand for AGM battery separators. Germany and Scandinavia, in particular, are centers for high-quality filter manufacturing and thermal insulation production, focusing heavily on sustainability and energy efficiency metrics in product design.

Asia Pacific (APAC) is currently the fastest-growing region and is expected to dominate the market volume by the end of the forecast period. This accelerated growth is primarily attributed to unprecedented levels of industrialization and infrastructure development, particularly in China and India. Escalating pollution levels in major cities have compelled governments to enforce stricter emission and air quality standards, driving mass adoption of high-efficiency industrial and residential air filters. The region is also the global epicenter for battery manufacturing, necessitating massive volumes of glass microfiber separators for AGM and other battery chemistries, positioning APAC as the strategic manufacturing hub for future market growth.

- North America: Dominates premium segment demand due to stringent EPA regulations, strong investment in R&D, and high penetration of high-efficiency (HEPA) filtration in commercial spaces.

- Europe: Characterized by mandatory EU environmental and energy efficiency standards; high adoption rates in the automotive start-stop battery market and advanced thermal insulation for green building initiatives.

- Asia Pacific (APAC): Highest volume growth driven by rapid industrial expansion, increasing awareness of urban air pollution, and massive manufacturing capacity expansion for batteries and consumer electronics; China and India are key growth catalysts.

- Latin America (LATAM): Emerging market with increasing adoption of industrial filtration solutions in mining and petrochemical sectors; growth trajectory dependent on stabilizing regulatory frameworks and infrastructure investment.

- Middle East and Africa (MEA): Growth focused on industrial filtration in the oil & gas and petrochemical sectors; increasing infrastructural projects are slowly driving demand for commercial HVAC filtration and insulation media.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Microfiber Market.- Lydall Inc. (now part of Filtration Group)

- Ahlstrom-Munksjö Oyj

- Hollingsworth & Vose Company

- Owens Corning

- JRS Rettenmaier & Söhne GmbH & Co. KG

- SWM International (Schweitzer-Mauduit International, Inc.)

- Nippon Sheet Glass Co., Ltd. (NSG)

- Johns Manville (Berkshire Hathaway Company)

- Taishan Fiberglass Inc.

- Zibo Huabang Fiberglass Co., Ltd.

- Clear Edge Filtration

- Saint-Gobain

- Unifrax I LLC (A Standard Industries Company)

- Sinoma Science & Technology Co., Ltd.

- Glatfelter Corporation

- Lianhe New Materials Co., Ltd.

- Tianyuan Filter Cloth Co., Ltd.

- Guangdong Nanfang Environmental Protection Technology Co., Ltd.

- Pall Corporation (Danaher Corporation)

- Mann+Hummel Group

Frequently Asked Questions

Analyze common user questions about the Glass Microfiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Borosilicate Glass Microfibers?

Borosilicate glass microfibers are primarily in demand for high-efficiency air filtration, specifically HEPA (High-Efficiency Particulate Air) and ULPA (Ultra-Low Penetration Air) filters, and as separators in Absorbed Glass Mat (AGM) batteries due to their optimal balance of chemical resistance, thermal stability, and low cost for mass production.

How does the growth of electric vehicles (EVs) impact the Glass Microfiber Market?

The EV market indirectly drives growth through increased demand for advanced batteries. While lithium-ion dominates pure EVs, glass microfibers are critical in high-performance AGM batteries used in start-stop systems of internal combustion engine (ICE) and hybrid vehicles, as well as industrial energy storage solutions that support EV charging infrastructure.

What is the key technological challenge in producing ultra-fine glass microfibers?

The main technological challenge is achieving uniform fiber diameter consistency and distribution at the sub-micron scale (below 0.5 µm) while maintaining cost-effective, high-volume production. This requires extremely precise control over melt viscosity, temperature, and attenuation forces during the fiberization process to ensure product quality for specialized filtration applications.

Which regional segment is expected to exhibit the highest CAGR for glass microfibers?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is fueled by rapid industrialization, increasing governmental focus on mitigating severe air pollution, and the massive scale of domestic battery manufacturing capacity being built across countries like China and India.

Are glass microfibers biodegradable, and are there sustainable alternatives being developed?

Standard glass microfibers are not biodegradable but are chemically inert and recyclable. Sustainability efforts are focusing on incorporating higher content of recycled glass feedstock into the manufacturing process and exploring hybrid materials that combine glass with bio-based polymers to reduce the overall environmental footprint of the final filter media product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Glass Microfiber Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Laboratory Filtration Market Size Report By Type (Filtration Media, Membrane Filters, Filter Paper, Quartz Filter, Cellulose Filter Papers, Glass Microfiber Filter Papers, Syringe Filters, Syringeless Filters, Capsule Filters, Filtration Microplates, Other Filtration Media, Filtration Assemblies, Ultrafiltration Assemblies, Microfiltration Assemblies, Vacuum Filtration Assemblies, Reverse Osmosis Assemblies, Other), By Application (Pharmaceutical & biotechnology companies, Hospitals & diagnostic laboratories, Foods & beverages Industry, Academic & research Institutions), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Laboratory Filtration Market Size Report By Type (Filtration Media, Membrane Filters, Filter Paper, Quartz Filter, Cellulose Filter Papers, Glass Microfiber Filter Papers, Syringe Filters, Syringeless Filters, Capsule Filters, Filtration Microplates, Other Filtration Media, Filtration Assemblies, Ultrafiltration Assemblies, Microfiltration Assemblies, Vacuum Filtration Assemblies, Reverse Osmosis Assemblies, Other Filtration Assemblies, Filtration Accessories, Filter Holders, Filter Dispensers, Filter Flasks, Cartridge Filters, Filter Funnels, Filter Housings, Seals, Vacuum Pumps, Other Laboratory Filtration Accessories, Microfiltration, Nanofiltration, Vacuum Filtration, Ultrafiltration, Reverse Osmosis), By Application (Pharmaceutical & biotechnology companies, Hospitals & diagnostic laboratories, Foods & beverages Industry, Academic & research Institutions), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Glass Microfiber Market Size Report By Type (A-Glass, B-Glass, C-Glass, E-Glass), By Application (Filter Paper, Battery, Heat Preservation Materials, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Glass Microfiber Filter Paper Market Statistics 2025 Analysis By Application (ASHRAE, HEPA, ULPA), By Type (40 g/m2, 70 g/m2, 90 g/m2, 110 g/m2), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager