Glass Molding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431769 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Glass Molding Market Size

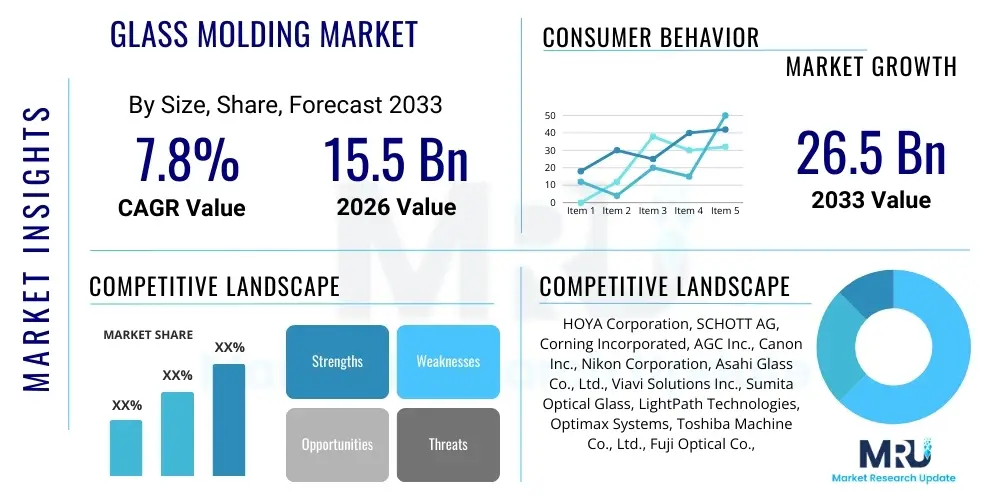

The Glass Molding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 26.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing demand for precision optical components across high-tech industries, particularly consumer electronics, automotive sensing systems, and advanced medical diagnostics. The relentless pursuit of miniaturization and enhanced performance in devices necessitates the use of complex, high-quality molded glass components that offer superior optical properties and durability compared to traditional plastics or ceramics.

The valuation reflects the robust investment in advanced molding technologies, such as ultra-precision press molding and specialized thermal processing equipment, which enable manufacturers to produce intricate glass shapes with extremely tight tolerances. Although the initial capital expenditure for specialized tooling remains high, the large-scale adoption of molded glass lenses in mass-produced items like smartphone cameras, augmented reality (AR) headsets, and LiDAR systems is driving significant economies of scale. Furthermore, the rising adoption of high-refractive-index glass materials, which are optimally processed using molding techniques, contributes significantly to the overall market valuation and anticipated expansion throughout the forecast period.

Glass Molding Market introduction

The Glass Molding Market encompasses the manufacturing processes used to form high-precision glass parts, primarily lenses, prisms, and other optical elements, by pressing softened glass material into a precisely machined mold cavity. This method, often referred to as precision glass molding (PGM), allows for the creation of complex geometries, including aspheric and freeform surfaces, that are difficult or cost-prohibitive to achieve through traditional grinding and polishing techniques. The core products derived from this market include optical lenses used in consumer electronics (smartphones, cameras), lighting (LEDs), medical devices (endoscopes, diagnostics), and critical components for advanced automotive safety systems (ADAS). The technology significantly reduces manufacturing time and cost per unit, making it indispensable for high-volume production of optical components.

Major applications driving the demand for molded glass include the integration of multiple lenses into compact camera modules required for sophisticated mobile imaging and the specialized optics necessary for virtual and augmented reality devices where distortion control and weight reduction are paramount. Furthermore, the automotive sector is rapidly increasing its reliance on high-durability molded glass components for light detection and ranging (LiDAR) systems, heads-up displays (HUDs), and in-cabin sensing solutions that require reliability under extreme environmental conditions. The intrinsic benefits of molded glass, such as high thermal stability, superior scratch resistance, and excellent optical transmission across various wavelengths, position it as the preferred material solution over polymer alternatives in demanding applications.

Key driving factors fueling the market expansion are the global push toward 5G technology requiring advanced optical networking components, the explosion of demand for higher-resolution cameras in smartphones, and the regulatory mandates promoting vehicle safety systems utilizing precise sensors and lenses. The capability of glass molding to produce accurate aspheric lenses directly, eliminating post-processing steps, is a primary technological advantage, reducing manufacturing complexity and increasing yield rates. These technological and application drivers cement glass molding’s critical role in the future landscape of precision manufacturing.

Glass Molding Market Executive Summary

The Glass Molding Market is characterized by intense technological evolution centered on achieving finer tolerances and handling new, specialized glass compositions required by emerging applications in sensing and advanced display technologies. Business trends indicate a consolidation among specialized mold tooling manufacturers, paired with significant capacity expansion by major optical component providers in Asia Pacific, particularly in regions catering to high-volume consumer electronics assembly. The overarching strategic movement involves integrating automation and digital twin technologies into the molding process to enhance process control and reduce cycle times. There is a notable business pivot towards supplying specialized optics for deep-UV (DUV) applications and infrared (IR) sensing, driven by industrial metrology and military requirements, offering higher profit margins than conventional consumer optics.

Regionally, the Asia Pacific (APAC) market maintains dominant leadership due to its vast manufacturing infrastructure for mobile devices, high-definition televisions, and automotive components, which are the primary consumers of molded glass lenses. North America and Europe, while smaller in production volume, lead in R&D and specialized high-precision applications, particularly in aerospace, defense, and advanced medical imaging, necessitating bespoke, low-volume, high-value molded components. Segment trends highlight the rapid growth of the optical segment, specifically precision optics for communication and imaging, eclipsing the traditional dominance of general glass products. Furthermore, the material segment shows a clear shift toward low-dispersion and high-refractive-index glasses suitable for next-generation telecommunication optics and miniaturized camera systems.

Overall, the market remains capital-intensive, favoring established players with expertise in materials science and ultra-precision machining for mold creation. The future growth hinges on the industry's ability to lower tooling degradation rates and further optimize thermal cycle times to sustain high-volume, cost-competitive production necessary for ubiquitous applications like advanced driver-assistance systems (ADAS) and affordable AR/VR hardware. Supply chain resilience, particularly concerning the sourcing of specialized glass preforms and mold materials (e.g., tungsten carbide alloys), is becoming a critical competitive differentiator among major market participants.

AI Impact Analysis on Glass Molding Market

Users frequently inquire how Artificial Intelligence (AI) and machine learning (ML) are being integrated to overcome the persistent challenges associated with precision glass molding, specifically regarding mold lifespan, defect rates, and process optimization. Key themes center around AI's ability to predict and compensate for thermal shrinkage during cooling, a critical factor determining final component accuracy. Users are also highly interested in AI-driven solutions for real-time quality control (QC), moving beyond traditional visual inspection to predictive analytics for identifying potential process flaws before component failure occurs. Expectations are high that AI will significantly shorten the R&D cycle for new glass compositions and mold designs by simulating millions of production scenarios, thereby reducing the dependency on expensive, time-consuming physical prototyping and optimizing the overall yield of complex optical elements.

- AI-driven optimization of thermal profiles and pressing force to minimize internal stress and achieve ultra-high precision component geometry.

- Machine learning algorithms predict mold erosion and degradation rates based on usage parameters, enabling predictive maintenance and extending mold tool lifespan.

- Real-time visual inspection systems utilize deep learning for automated, non-contact defect detection (e.g., surface scratches, bubbles, inclusion) at high throughput, surpassing human capability.

- Generative design AI assists in optimizing the geometry of glass preforms and mold cavities to ensure uniform material flow and stress distribution during the pressing process.

- AI supports supply chain resilience by forecasting demand fluctuations for specific glass types and raw materials, optimizing inventory management and procurement strategies.

- Simulation models enhanced by AI provide digital twins of the molding process, allowing manufacturers to test parameter changes virtually before implementing them on costly production lines.

DRO & Impact Forces Of Glass Molding Market

The Glass Molding Market is heavily influenced by a combination of powerful drivers accelerating demand, critical restraints limiting expansion, and lucrative opportunities for technological differentiation, all collectively constituting the market's impact forces. Key drivers include the exponential growth in demand for high-resolution cameras in smartphones, requiring multiple high-precision molded glass lenses per device, and the mandatory incorporation of ADAS features in modern vehicles, demanding robust molded optics for LiDAR and camera systems. These drivers are intrinsically linked to the increasing sophistication of consumer electronics and the regulatory push for enhanced automotive safety, ensuring a steady, high-volume requirement for precision molded components. Additionally, the shift from traditional spherical lenses to compact aspheric and freeform designs, which are best manufactured via molding, strongly propels market growth.

Conversely, significant restraints hinder growth and operational efficiency. The primary limiting factor is the extremely high cost and long lead times associated with the development and production of ultra-precision mold tooling, which requires specialized materials (e.g., tungsten carbide) and advanced machining techniques (e.g., diamond turning). Furthermore, the limited lifespan of these molds, which suffer from material erosion and surface degradation under high-temperature and high-pressure cycles, necessitates frequent replacement, raising operational expenditure. Technical limitations related to the available range of glass compositions compatible with the molding process, particularly limitations in molding glass with very high softening points, also restrict the application scope in certain extreme environments.

Opportunities for market expansion are centered on exploiting emerging high-value applications, such as supplying custom optics for advanced medical diagnostic devices (e.g., portable spectroscopy) and the burgeoning market for specialized optics in Virtual Reality (VR) and Augmented Reality (AR) headsets, which require extremely lightweight and distortion-free lenses. Furthermore, developing advanced mold materials and surface coatings that significantly increase mold durability and reduce cycle times represents a substantial area for competitive advantage and market opportunity. Successful integration of process automation and data analytics will be critical in capitalizing on these high-growth potential segments and mitigating the inherent production costs associated with ultra-precision manufacturing.

Segmentation Analysis

The Glass Molding Market is typically segmented based on crucial dimensions including the process type, the material composition of the glass used, the ultimate application of the molded components, and the geographic region. This multi-faceted segmentation allows for a detailed analysis of market dynamics, revealing that growth is unevenly distributed, heavily concentrated in segments related to high-performance optics and specialized materials. The technological capabilities and economic viability of the various process types—from high-volume hot pressing to highly controlled precision molding—determine their suitability for different end-user requirements, ranging from inexpensive consumer lenses to mission-critical aerospace optics. The fundamental understanding of how these segments interact is crucial for stakeholders developing targeted investment strategies and product diversification plans.

The most lucrative segments are currently precision glass molding (PGM) techniques used for manufacturing aspheric and freeform optics, as these components command premium pricing due to their complexity and performance benefits. Geographically, while the manufacturing base remains dominated by Asia Pacific due to consumer electronics production, the fastest growth in terms of R&D and high-value product sales is often observed in North America and Europe, driven by innovation in medical devices and defense technology. Furthermore, the material segmentation underscores a growing preference for specialty glasses, such as chalcogenide glasses for infrared applications and high-index optical glasses, reflecting the market’s pivot towards advanced functionality beyond simple imaging.

- By Process Type:

- Precision Glass Molding (PGM)

- Hot Press Molding (HPM)

- Slump Molding

- By Application:

- Optical Components (Lenses, Prisms, Filters)

- Automotive Components (LiDAR, ADAS Cameras, Lighting)

- Consumer Electronics (Smartphone Cameras, AR/VR Optics, Displays)

- Medical and Life Sciences (Endoscopes, Diagnostic Devices)

- Industrial and Others (Metrology, Lighting)

- By Glass Type:

- High Refractive Index Glass

- Low Dispersion Glass

- Chalcogenide Glass (Infrared Optics)

- Aluminosilicate Glass

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Glass Molding Market

The value chain of the Glass Molding Market begins with upstream activities focused on the specialized preparation of raw materials, primarily involving glass manufacturers producing customized glass blanks or preforms, often through highly controlled melting and cutting processes. This upstream segment is crucial as the quality and homogeneity of the glass preform directly dictate the success and yield rate of the subsequent molding process. Key upstream players specialize in specific material chemistries (e.g., fluorides, phosphates, borosilicates) tailored for specific optical properties, which are then shaped into near-net-shape components ready for precision molding.

Midstream activities constitute the core of the market, focusing on the precision molding process itself, including mold design, ultra-precision machining of the mold cavity (often using diamond turning), the heating and pressing cycles, and post-processing treatments like anti-reflective coatings. This stage is highly proprietary and technologically intensive, requiring significant investment in advanced machinery, thermal controls, and metrology equipment for quality assurance. The success in the midstream is highly dependent on the precision and longevity of the specialized mold tooling, which often represents the largest non-recurring engineering (NRE) cost.

Downstream analysis involves the distribution channel, which is highly segmented based on end-user requirements. Direct distribution is prevalent for large OEMs in the automotive and high-end consumer electronics sectors, where custom specifications and tight integration are required, necessitating close collaboration between the molder and the end-product manufacturer. Indirect channels, often involving specialized optical distributors or system integrators, handle smaller volume orders or standardized components, serving niche markets such as medical diagnostics or specialized industrial sensors. The final stage involves the integration of the molded glass components into complex systems, adding value through assembly and testing, particularly in sectors like augmented reality where multiple molded lenses must be aligned with micrometer precision.

Glass Molding Market Potential Customers

Potential customers and primary end-users of the Glass Molding Market are concentrated in sectors requiring high-precision, repeatable, and durable optical components for mass-market or mission-critical applications. The largest segment remains the Consumer Electronics industry, particularly smartphone manufacturers and makers of emerging AR/VR head-mounted displays, who require millions of identical aspheric lenses annually to meet increasing consumer demand for superior imaging quality and compact device profiles. These buyers prioritize scalability, cost-effectiveness, and the molder's capability to integrate anti-reflection coatings directly onto the molded surface.

The Automotive sector represents the fastest-growing customer base, driven by ADAS (Advanced Driver-Assistance Systems) deployment. These customers, including Tier 1 suppliers and vehicle OEMs, require molded glass components for cameras, LiDAR systems, and specialized lighting systems that must withstand extreme temperature fluctuations, vibration, and road debris, prioritizing reliability and automotive-grade certification (e.g., AEC-Q100). The shift toward autonomous driving ensures sustained, high-value demand in this segment, moving away from simple protective covers to complex sensor optics.

Another significant customer segment is Medical and Life Sciences, encompassing manufacturers of advanced surgical equipment, endoscopes, diagnostic devices, and laboratory instrumentation. These buyers demand exceptionally high-quality, often custom-designed molded optics that meet stringent regulatory requirements (e.g., FDA clearance) where precision and sterilization capabilities are non-negotiable. Furthermore, industrial metrology and telecommunication infrastructure providers, needing specialized lenses for fiber optics, sensors, and high-power lasers, form a critical, high-margin customer group prioritizing custom optical performance over volume economics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 26.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | HOYA Corporation, SCHOTT AG, Corning Incorporated, AGC Inc., Canon Inc., Nikon Corporation, Asahi Glass Co., Ltd., Viavi Solutions Inc., Sumita Optical Glass, LightPath Technologies, Optimax Systems, Toshiba Machine Co., Ltd., Fuji Optical Co., Ltd., Shin-Etsu Quartz Products Co., Ltd., CDGM Glass Co., Ltd., China South Industries Group Corporation (CSGC), Avantier Inc., O-film Tech Co., Ltd., Edmund Optics, Shanghai Bicom Optics Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glass Molding Market Key Technology Landscape

The technological landscape of the Glass Molding Market is primarily defined by the evolution of Precision Glass Molding (PGM), which allows for the direct formation of complex optical surfaces, eliminating the need for extensive grinding and polishing. Core advancements involve highly controlled, automated molding machines capable of maintaining exceptional thermal stability and pressure control throughout the heating, pressing, and annealing cycles. Key technologies include induction heating systems that ensure rapid and uniform temperature ramping, and active cooling systems that precisely manage the cooling rate to minimize internal stresses within the glass component, thereby maintaining optical integrity and dimensional accuracy. The pursuit of sub-micrometer precision for freeform optics is driving continuous investment in sophisticated machine tool design and advanced process simulation software.

Crucially, advancements in mold material science and surface treatment technologies are transforming the market. Specialized mold materials, typically high-temperature resistant alloys like cemented tungsten carbide (WC-Co) or ceramics, are often coated with diamond-like carbon (DLC) or other refractory materials to reduce friction and chemical reaction with the softened glass. These coatings are vital for extending mold life and maintaining the ultra-smooth surface finish of the mold cavity, directly translating into the optical quality of the molded component. The development of predictive monitoring systems, sometimes incorporating AI, is also gaining traction to forecast mold wear and schedule necessary refurbishments, thereby ensuring consistent product quality and higher operational uptime.

Further technological differentiation occurs in the handling of new glass chemistries. Techniques are being refined to mold specialty glasses, such as low softening-point chalcogenide glasses for mid-infrared applications and complex high-refractive index glasses crucial for miniaturized optics. These materials require distinct processing parameters, including lower pressing temperatures and specialized atmospheric controls (e.g., inert gas environments) to prevent oxidation or contamination. The capability to successfully mold these advanced materials opens up lucrative opportunities in defense, medical thermal imaging, and advanced spectroscopy, positioning technology leaders capable of handling these challenging materials at the forefront of innovation.

Regional Highlights

- Asia Pacific (APAC): APAC is the global manufacturing powerhouse and consequently the largest consumer of molded glass components, primarily driven by the colossal consumer electronics manufacturing base in China, South Korea, Japan, and Taiwan. The region accounts for the majority of the world’s production capacity for smartphone camera lenses, display glass, and AR/VR optics. Low labor costs, coupled with government incentives supporting high-tech manufacturing, ensure the continued dominance of APAC in volume production, although the focus is increasingly shifting towards advanced precision capabilities to support local automotive and 5G infrastructure development.

- North America: North America is characterized by high R&D intensity, strong demand from the defense and aerospace sectors, and a robust cluster of high-tech firms specializing in ADAS, medical devices, and advanced computing optics. While production volume is lower than in APAC, the region commands premium pricing for highly specialized, low-volume, high-precision components. Key drivers include government contracts for military optics and significant private investment in autonomous vehicle technology and commercial space exploration, requiring radiation-hardened or specific-wavelength molded lenses.

- Europe: Europe maintains a strong position in the high-end industrial and specialized automotive markets, particularly in Germany and France, which are centers for precision engineering and luxury vehicle manufacturing. The region is focused on supplying high-quality molded lenses for specialized machine vision, industrial automation, and advanced lighting systems (e.g., adaptive LED matrix headlamps). European manufacturers often lead in sustainability and efficiency innovations related to the molding process, aiming to reduce energy consumption and material waste while maintaining stringent quality standards.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized primarily by import and assembly operations. Growth in glass molding component consumption is tied to increasing domestic demand for basic consumer electronics and the expansion of infrastructure projects, including solar energy installations and basic automotive assembly. While local manufacturing capacity for precision molding remains limited, there is growing potential for local distribution centers and localized assembly operations driven by increasing foreign direct investment in technology manufacturing hubs in countries like Mexico and Brazil.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glass Molding Market.- HOYA Corporation

- SCHOTT AG

- Corning Incorporated

- AGC Inc.

- Canon Inc.

- Nikon Corporation

- Asahi Glass Co., Ltd.

- Viavi Solutions Inc.

- Sumita Optical Glass

- LightPath Technologies

- Optimax Systems

- Toshiba Machine Co., Ltd.

- Fuji Optical Co., Ltd.

- Shin-Etsu Quartz Products Co., Ltd.

- CDGM Glass Co., Ltd.

- China South Industries Group Corporation (CSGC)

- Avantier Inc.

- O-film Tech Co., Ltd.

- Edmund Optics

- Shanghai Bicom Optics Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Glass Molding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is precision glass molding (PGM) and how does it differ from traditional grinding?

Precision Glass Molding (PGM) is a manufacturing technique where a glass preform is heated to its softening point and pressed into a highly precise mold cavity to directly form complex optical shapes, such as aspheric lenses. Unlike traditional grinding and polishing, PGM is a highly efficient, net-shape process that eliminates the need for labor-intensive post-processing, making it ideal for high-volume, cost-effective production of complex optics used in modern electronics.

Which applications are currently driving the highest growth in the Glass Molding Market?

The highest growth is primarily driven by the Automotive sector, specifically the integration of Advanced Driver-Assistance Systems (ADAS) requiring high-precision molded lenses for LiDAR and camera modules, and the Consumer Electronics industry, fueled by the demand for sophisticated, multi-lens camera systems in smartphones and the burgeoning market for Augmented Reality (AR) and Virtual Reality (VR) devices.

What are the primary technical challenges facing manufacturers in the Glass Molding industry?

The main technical challenges involve managing the extremely high cost and limited lifespan of ultra-precision mold tooling (often made of cemented carbide or high-temperature alloys), controlling thermal shrinkage and stress during the cooling phase to maintain sub-micrometer accuracy, and successfully molding new, specialized glass materials that have high softening temperatures or unique chemical properties.

How is AI transforming the efficiency and quality control within glass molding?

AI is significantly enhancing efficiency by optimizing thermal processing parameters in real time and predicting mold wear to enable proactive maintenance, thereby reducing downtime. For quality control, AI-driven machine vision systems use deep learning to rapidly and accurately detect minute defects and anomalies in the molded components, ensuring higher yield rates than manual inspection methods.

Why is the Asia Pacific region dominant in the global Glass Molding Market?

Asia Pacific dominates the market due to its overwhelming concentration of consumer electronics, IT, and automotive manufacturing infrastructure, particularly in countries like China, Japan, and South Korea. This concentration allows for economies of scale, extensive supply chain integration, and readily available skilled labor, positioning the region as the central hub for high-volume optical component production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Precision Glass Molding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Precision Glass Molding Market Statistics 2025 Analysis By Application (Electronic, Medical), By Type (Low-Tg Glass, Chalcogenide Glass, Fused Silica), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Precision Glass Molding Market Statistics 2025 Analysis By Application (Digital Cameras, Automotive), By Type (Small Size, Medium Size, Large Size), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager