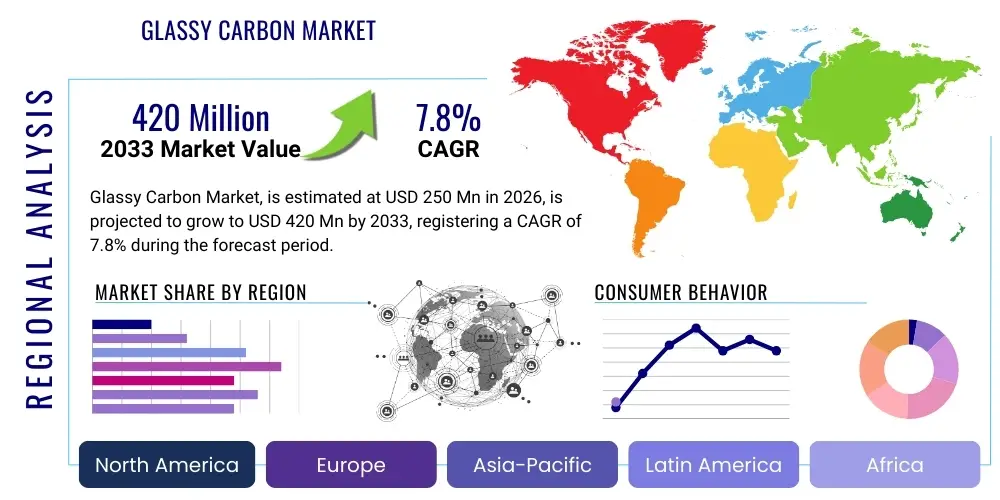

Glassy Carbon Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438463 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Glassy Carbon Market Size

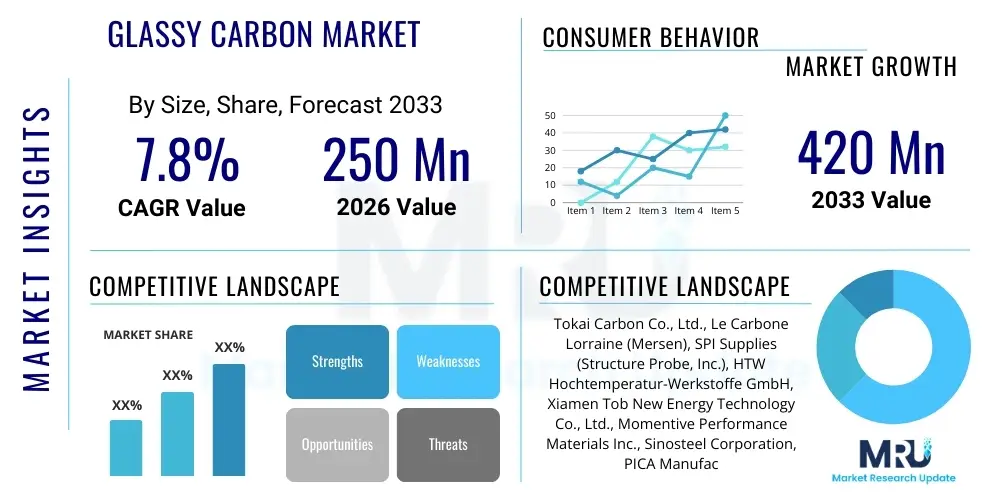

The Glassy Carbon Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $250 Million in 2026 and is projected to reach $420 Million by the end of the forecast period in 2033.

Glassy Carbon Market introduction

Glassy carbon, often referred to as vitreous carbon, is an advanced non-graphitizing carbon material renowned for its unique combination of properties, including extreme thermal resistance, high hardness, impermeability to gases and liquids, chemical inertness, and metallic electrical conductivity. This material is primarily manufactured by the controlled pyrolysis of carbonaceous precursors under high temperatures, resulting in a structure that possesses both graphite and amorphous carbon characteristics. The unique microstructure, lacking grain boundaries typical of crystalline solids, makes it highly suitable for demanding applications where purity and stability are paramount. Its deployment spans critical sectors, including electrochemistry, where it is utilized extensively as an electrode material due to its wide potential window and low background current, and in high-temperature crucibles for crystal growth, demanding highly pure, contamination-resistant containers. Furthermore, its mechanical strength and biocompatibility have opened pathways in specialized biomedical device manufacturing and analytical instrumentation, driving consistent demand growth across various technological fronts. The sustained innovation in material synthesis and the development of thinner films and microstructures continue to expand its commercial viability.

Glassy Carbon Market Executive Summary

The global Glassy Carbon Market is poised for robust expansion, driven primarily by accelerating demand from the electrochemical sector, particularly in advanced battery research and development, and the burgeoning analytical instrumentation industry. Geographically, the Asia Pacific region maintains market dominance due to high manufacturing capacity and substantial investment in electronics and energy storage technologies, while North America and Europe demonstrate strong growth, focused on high-value, specialized scientific equipment and medical implants. Key business trends involve vertical integration among major manufacturers aimed at quality control and cost optimization, alongside significant R&D expenditures focused on developing nanoscale glassy carbon variations for enhanced performance in supercapacitors and sensing devices. Segment-wise, the high-purity electrode segment is anticipated to register the highest CAGR, reflecting the material’s irreplaceable role in sensitive electrochemical assays and next-generation energy systems. The market landscape is moderately consolidated, with competitive advantages being established through proprietary manufacturing techniques and strategic collaborations with research institutions to explore novel applications in quantum technology and advanced material science.

AI Impact Analysis on Glassy Carbon Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Glassy Carbon Market frequently center on optimizing synthesis processes, predicting material performance under extreme conditions, and accelerating the discovery of novel applications, particularly in sensing and energy storage. Concerns often revolve around the initial high capital investment required for implementing AI-driven manufacturing and quality control systems, and the need for specialized data infrastructure to handle complex pyrolysis parameters. Users expect AI to significantly reduce defect rates, tailor material properties for specific electrochemical requirements (e.g., electrode kinetics optimization), and shorten the product development lifecycle. The central theme is leveraging predictive modeling and machine learning to move away from traditional, lengthy trial-and-error methods in carbon material fabrication, thereby enhancing efficiency and precision crucial for high-purity applications like biosensors and fuel cells. Furthermore, AI is increasingly viewed as a tool for supply chain optimization and predicting fluctuating raw material costs, ensuring better market stability and pricing strategies for glassy carbon products globally.

- AI-driven optimization of pyrolysis parameters leads to enhanced material purity and customized electrical properties.

- Machine learning algorithms accelerate the discovery of novel precursor materials and synthesis routes, reducing R&D timelines.

- Predictive maintenance schedules for high-temperature furnaces minimize downtime and operational costs in manufacturing.

- AI aids in automated quality control and defect detection during the high-heat treatment phase, ensuring stringent product specifications.

- Computational material science (CMS) powered by AI enables simulation of glassy carbon performance in complex electrochemical environments.

DRO & Impact Forces Of Glassy Carbon Market

The market trajectory for glassy carbon is fundamentally shaped by robust demand drivers stemming from the need for high-performance, chemically stable electrode materials, particularly within the rapid evolution of lithium-ion and flow batteries, and specialized electrochemical sensors. However, the high capital expenditure associated with the complex, prolonged high-temperature manufacturing process and stringent purity requirements acts as a significant restraint, limiting market entry for smaller players. Opportunities are substantial in leveraging the material’s unique properties in emerging fields such as microelectromechanical systems (MEMS), high-temperature structural components, and advanced analytical chemistry where miniaturization and inertness are critical. These dynamics collectively exert considerable influence on market pricing, supply chain resilience, and technological innovation, dictating the pace of adoption across diverse high-tech industries. The impact forces are generally positive, favoring market growth driven by technological necessity, but constrained by production complexity and the availability of precursor materials.

Drivers: The increasing global investment in renewable energy and subsequent demand for advanced energy storage solutions is a primary catalyst. Glassy carbon electrodes offer unparalleled stability and chemical resistance, making them ideal for aggressive electrolytes and high-throughput electrochemical operations common in modern batteries and supercapacitors. Furthermore, the material's increasing acceptance in the biomedical field, specifically for neural interfaces and implantable devices, due to its biocompatibility and non-toxic nature, provides a strong, high-margin revenue stream. The expansion of research activities in universities and commercial laboratories requiring inert, high-precision materials for spectroscopic analysis and synthesis further solidifies the demand foundation, ensuring sustained market vitality. Regulatory pushes towards cleaner energy sources and technological miniaturization also indirectly bolster the need for high-performance carbon variants.

Restraints: The most significant hurdle facing the glassy carbon market remains the technical challenge and cost associated with its production. The process is lengthy, energy-intensive, and highly sensitive to temperature gradients and precursor material quality, requiring specialized high-temperature vacuum furnaces and highly trained personnel. This manufacturing complexity results in a high selling price, which restricts its use primarily to niche, high-value applications where no substitute is viable. Additionally, the availability and cost fluctuations of specific precursor polymers, such as certain types of resins, can introduce supply chain volatility. Competition from alternative carbon materials, such as highly ordered pyrolytic graphite (HOPG) or advanced carbon nanotubes, though often lacking the unique isotropy of glassy carbon, poses a challenge in cost-sensitive segments. Overcoming these restraints requires continuous process optimization and economies of scale.

Opportunities: Significant future growth is anticipated from the expanding integration of glassy carbon into microfabricated devices, leveraging its ability to be precision machined and patterned. Opportunities abound in the development of highly sensitive, miniaturized sensors for environmental monitoring and point-of-care medical diagnostics, capitalizing on its excellent electrochemical properties at the microscale. The push towards sustainable manufacturing practices also presents an avenue, exploring more environmentally friendly synthesis routes or recycling methodologies for carbon materials. Furthermore, the burgeoning field of quantum computing and advanced semiconductor manufacturing may adopt glassy carbon for specialized componentry where purity, thermal stability, and low coefficient of thermal expansion are mandatory. Strategic partnerships focusing on application-specific customization will unlock previously inaccessible market segments, particularly those requiring bespoke thermal or electrical conductivity profiles.

Segmentation Analysis

The Glassy Carbon Market is segmented primarily based on Product Type, Application, and geographic Region, reflecting the diverse industrial requirements and manufacturing capabilities worldwide. Product segmentation distinguishes between High-Purity Grade and Standard Grade materials, determined largely by the precision and homogeneity required for the end application. High-purity grades are typically reserved for highly sensitive electrochemical electrodes, semiconductor processing crucibles, and biomedical implants, while standard grades find use in general laboratory apparatus and metallurgical processing. Application segmentation is crucial, categorizing end-use sectors such as Electrochemistry, Metallurgy, Semiconductor Manufacturing, Chemical Processing, and Analytical Instrumentation, each exhibiting unique consumption patterns and growth rates based on technological advancements and capital investment within that industry. Understanding these segments is vital for manufacturers to tailor production capabilities and strategically target high-growth niches, especially those demanding customized material thicknesses and structural integrity.

- Product Type

- High Purity Grade

- Standard Grade

- Application

- Electrodes and Sensors

- Crucibles and Boats

- Analytical Instruments

- High-Temperature Structural Components

- Others (Biomedical, Nuclear)

- Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Glassy Carbon Market

The value chain for the Glassy Carbon Market is characterized by highly specialized production steps, beginning with the upstream procurement of high-quality precursor materials, primarily thermosetting resins such as phenol-formaldehyde or polyimides, which must meet strict purity standards. Upstream activities also involve the initial molding and shaping of these organic polymers, which dictate the final form factor of the glassy carbon product. The midstream stage is the most critical and capital-intensive, involving the multi-step, controlled pyrolysis process under inert atmospheres and high vacuum, transforming the polymer into the final vitreous carbon structure. This pyrolysis step, which can last for weeks, determines the material's ultimate density, porosity, and electrical properties. Downstream distribution involves specialized channels tailored to high-tech customers, predominantly direct sales to research institutions, specialized manufacturers (e.g., semiconductor fabricators), and original equipment manufacturers (OEMs) in the analytical instrument sector. Due to the high value and sensitive nature of the product, indirect distribution through general chemical distributors is less common, favoring direct relationship models for technical support and customized orders.

The upstream segment is significantly influenced by the petrochemical industry, as precursor resins derived from fossil fuels are essential inputs. Ensuring a consistent supply of these high-purity precursors requires strong vetting and quality assurance processes, as contaminants introduced at this stage are difficult, if not impossible, to remove during subsequent thermal treatment. Key suppliers in this phase focus on material science excellence and consistent batch quality. Furthermore, the preparatory processes, including molding and curing of the green body, require precision engineering to minimize internal stresses and ensure dimensional accuracy before the high-temperature processing begins. Failures in upstream quality control directly translate to high scrap rates in the midstream production phase, significantly impacting overall profitability and production throughput across the market.

The midstream processing phase, dominated by the proprietary manufacturing techniques of a few key players, represents the highest value addition. This stage involves sophisticated thermal engineering, utilizing specialized furnaces capable of reaching temperatures up to 3000°C with highly controlled ramp rates and dwell times. Investment in this area includes not only the physical infrastructure but also the intellectual property concerning pyrolysis protocols tailored to achieve specific material characteristics, such as extremely low permeability or specific electrical resistivity. Successful navigation of this stage ensures the final product meets the required specifications for demanding applications like plasma etching crucibles or electrochemical sensing platforms. Vertical integration is a strategic choice for many midstream players, allowing them complete control over quality from precursor to final product, mitigating risks associated with outsourcing critical processing steps.

Downstream market engagement focuses heavily on application engineering and technical support. Direct distribution channels are essential because end-users often require customized sizes, shapes, or specific surface treatments (e.g., polishing, surface modification) for seamless integration into their systems. Sales often involve long-term contracts with major research institutions, battery manufacturers, and specialized electronics firms. Marketing efforts in the downstream market emphasize the material’s unique selling propositions: chemical inertness, purity, and thermal resilience. The role of indirect channels, usually specialty technical distributors, is typically limited to serving smaller academic laboratories or providing localized inventory management, but even these distributors often maintain highly technical sales teams capable of addressing complex material science inquiries, ensuring that the specialized nature of glassy carbon is accurately conveyed to potential users globally.

Glassy Carbon Market Potential Customers

The primary end-users of glassy carbon are highly specialized industrial sectors and advanced research institutions requiring materials that exhibit exceptional chemical stability, high thermal shock resistance, and electrochemical inertness. Key buying entities include manufacturers of analytical instruments, such as potentiostats, spectrophotometers, and chromatographs, where glassy carbon is a critical component for high-precision electrodes and sample holders. Furthermore, metallurgical and materials processing companies that utilize high-temperature vacuum furnaces for the production of high-purity metals, semiconductors, and single crystals are significant customers, demanding crucibles and boats resistant to aggressive melts and extreme heat. The energy storage sector, encompassing R&D laboratories and manufacturers focused on advanced battery chemistries (e.g., redox flow batteries and solid-state systems), also constitutes a rapidly growing customer base, relying on glassy carbon for reliable and durable electrode interfaces to enhance performance and longevity. These customers prioritize material consistency, guaranteed purity levels, and precise dimensional tolerances over generalized cost considerations.

Analytical laboratories, encompassing academic, government, and commercial testing facilities, represent a large and consistent customer segment. In these environments, glassy carbon electrodes are indispensable for cyclic voltammetry, stripping analysis, and sensor fabrication due to their low adsorption characteristics and broad potential window, facilitating accurate detection of trace elements and complex chemical species. Buyers in this segment are highly sensitive to product performance repeatability and certified material data sheets, often necessitating compliance with international standards for research quality. The demand here is driven by the increasing complexity of chemical analysis, environmental monitoring regulations, and pharmaceutical quality control, pushing the need for materials capable of higher precision and lower detection limits. Maintaining rigorous quality control and providing extensive technical documentation are key success factors for suppliers targeting the analytical instrument market.

The high-temperature processing segment, which includes semiconductor and photovoltaic manufacturers, requires glassy carbon for crucial components exposed to extreme thermal cycles and corrosive environments, such as heating elements, susceptors, and deposition fixtures. For these customers, the material's non-contaminating nature is paramount, as even trace impurities can render high-value electronic components defective. Purchases in this segment are often large-scale, project-based, and subject to stringent supplier qualification processes that emphasize dimensional stability, thermal endurance, and longevity in aggressive plasma environments. The strategic shift towards advanced silicon carbide (SiC) and gallium nitride (GaN) technologies in power electronics further solidifies this customer base, as these processes often demand the unique properties of glassy carbon crucibles capable of withstanding ultra-high purity requirements and operational temperatures exceeding 2000°C, ensuring minimal volatile contamination.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250 Million |

| Market Forecast in 2033 | $420 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tokai Carbon Co., Ltd., Le Carbone Lorraine (Mersen), SPI Supplies (Structure Probe, Inc.), HTW Hochtemperatur-Werkstoffe GmbH, Xiamen Tob New Energy Technology Co., Ltd., Momentive Performance Materials Inc., Sinosteel Corporation, PICA Manufacturing Solutions, Carbon Composites, Inc., Graphenea, Inc., Alfa Aesar (Thermo Fisher Scientific), Sigri Carbon Group (SGL Carbon), Chempur GmbH, Nanjing Ziyuan Carbon Co., Ltd., Furuuchi Chemical Corporation, Carbice Corporation, Advanced Carbon Products, Inc., Cemcotech Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Glassy Carbon Market Key Technology Landscape

The technology landscape for the glassy carbon market is defined by specialized thermal processing and precision material modification techniques essential for achieving the material’s unique physical and chemical characteristics. The core manufacturing technology centers on controlled pyrolysis, where precursor materials—primarily organic polymers—are heated slowly under tightly controlled, inert atmospheres at extremely high temperatures (up to 3000°C). Crucial advancements include optimizing the temperature ramp rates and pressure control to minimize material shrinkage and internal stresses, ensuring structural integrity and homogeneity, which is vital for high-precision electrodes. Furthermore, surface modification technologies, such as chemical vapor deposition (CVD) or plasma treatment, are increasingly employed to functionalize the glassy carbon surface, tailoring it for specific electrochemical reactions or enhancing its bonding capabilities in composite structures, thus expanding its utility beyond traditional applications. This highly specialized technological domain mandates significant investment in R&D to maintain a competitive edge, focusing on maximizing yield while upholding ultra-high purity specifications demanded by the semiconductor and biomedical industries.

Recent technological developments emphasize the creation of nano-structured glassy carbon and thin films, enabling integration into miniaturized devices like microfluidic chips and high-density sensor arrays. Techniques like micro-patterning and lithography are used to create intricate glassy carbon microelectrodes, providing enhanced surface area-to-volume ratios crucial for improving sensor sensitivity and electrochemical reaction kinetics. Another significant trend involves the development of novel, low-cost precursor materials that still yield high-quality glassy carbon upon pyrolysis, aiming to reduce manufacturing dependency on expensive, specialized thermoset resins. This research is critical for commercializing glassy carbon in broader, more cost-sensitive applications. Furthermore, advancements in analytical characterization technologies, such as advanced Raman spectroscopy and scanning electron microscopy (SEM) coupled with energy-dispersive X-ray spectroscopy (EDS), enable manufacturers to precisely measure the structural order and purity of the carbon, ensuring batch-to-batch consistency—a non-negotiable requirement for critical applications like certified reference materials and medical implants. Continuous improvement in furnace design, particularly achieving better temperature uniformity and energy efficiency, remains a technological priority for optimizing production throughput and sustainability.

The future technology trajectory points toward additive manufacturing techniques capable of fabricating complex, three-dimensional glassy carbon structures. While current 3D printing methods for glassy carbon are nascent, researchers are exploring routes utilizing photopolymerization followed by high-temperature carbonization to produce highly customized components without relying solely on traditional subtractive machining methods, which can be difficult and costly due to the material’s hardness. Successful development of such additive manufacturing processes would revolutionize the market, allowing for the rapid prototyping and production of customized electrochemical cells, complex biomedical scaffolds, and intricate microreactors. Concurrently, efforts are focused on integrating glassy carbon with other materials to form high-performance composites, such as carbon fiber-reinforced glassy carbon, designed for extreme structural applications requiring both high strength and high-temperature tolerance. The material’s adoption in next-generation lithium-ion battery anodes, leveraging its excellent cycle stability, also represents a substantial area of technological focus, requiring innovations in particle size control and surface treatment to manage interface impedance effectively.

Regional Highlights

Geographically, the Asia Pacific (APAC) region currently dominates the Glassy Carbon Market in terms of volume consumption and production capacity, primarily driven by substantial investments in electronics, semiconductor manufacturing, and renewable energy infrastructure, particularly in China, South Korea, and Japan. The presence of major analytical instrumentation manufacturers and extensive government support for advanced materials research further propels market expansion across this region. APAC’s leadership is reinforced by its strong supply chain for precursor materials and its ability to achieve economies of scale in the complex, high-temperature processing required for glassy carbon production. The rapid growth of the electric vehicle (EV) battery sector and associated R&D necessitates high volumes of pure carbon materials for testing and eventual commercialization, cementing APAC’s position as the primary market driver. This sustained industrial development and high adoption rate of advanced materials technologies ensure a positive outlook for the region throughout the forecast period.

North America and Europe represent mature markets characterized by high-value, niche applications and stringent quality requirements, maintaining a strong focus on innovation in the analytical chemistry, aerospace, and biomedical sectors. North America, driven by the presence of leading research universities and large pharmaceutical companies, shows robust demand for high-purity glassy carbon electrodes for advanced sensor development and medical device fabrication, where material performance and biocompatibility are paramount. Similarly, Europe’s market is buoyed by its established automotive sector and significant funding directed towards hydrogen fuel cell and advanced energy storage technologies, where the chemical inertness of glassy carbon is highly valued. While production volumes might be lower compared to APAC, the average selling price and profit margins in these regions are generally higher, reflecting the demand for specialized, custom-manufactured components and stringent quality certifications such as ISO and FDA compliance necessary for medical applications.

Latin America (LATAM) and the Middle East and Africa (MEA) currently hold smaller market shares but present emerging opportunities, especially as these regions increase investment in domestic analytical capabilities and industrial diversification, particularly in the energy and mining sectors. LATAM’s growth is expected to stem from increasing deployment of environmental monitoring sensors and academic research expansion. MEA’s market growth is tied to large-scale infrastructure projects, including new refineries and petrochemical plants, necessitating high-performance laboratory equipment and specialized corrosion-resistant components. Although these regions face challenges related to technological maturity and specialized manufacturing infrastructure, the increasing focus on localized manufacturing and reduced reliance on imports will incrementally boost the demand for glassy carbon components, particularly those used in industrial process control and material testing laboratories, driving moderate growth throughout the latter half of the forecast period.

- Asia Pacific (APAC): Dominates the market due to significant electronics manufacturing, large-scale battery production (EVs), and robust government support for material science R&D in countries like China, Japan, and South Korea.

- North America: Focuses on high-value applications, including biomedical implants, aerospace components, and advanced scientific instrumentation, driven by major R&D centers and strict regulatory standards.

- Europe: Exhibits steady growth, fueled by strong investment in renewable energy technologies (fuel cells, flow batteries) and stringent regulatory requirements for chemical processing and analytical devices.

- Latin America (LATAM): Emerging market driven by increased academic investment and growing demand for environmental and chemical analytical instrumentation across the continent.

- Middle East and Africa (MEA): Growth potential linked to industrial diversification, petrochemical sector expansion, and development of regional research infrastructure requiring high-purity laboratory ware and electrodes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Glassy Carbon Market.- Tokai Carbon Co., Ltd.

- Le Carbone Lorraine (Mersen)

- SPI Supplies (Structure Probe, Inc.)

- HTW Hochtemperatur-Werkstoffe GmbH

- Xiamen Tob New Energy Technology Co., Ltd.

- Momentive Performance Materials Inc.

- Sinosteel Corporation

- PICA Manufacturing Solutions

- Carbon Composites, Inc.

- Graphenea, Inc.

- Alfa Aesar (Thermo Fisher Scientific)

- Sigri Carbon Group (SGL Carbon)

- Chempur GmbH

- Nanjing Ziyuan Carbon Co., Ltd.

- Furuuchi Chemical Corporation

- Carbice Corporation

- Advanced Carbon Products, Inc.

- Cemcotech Co., Ltd.

- Cotronics Corporation

- Zhongke Carbon Materials Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Glassy Carbon market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using glassy carbon electrodes over traditional metallic or graphite electrodes?

Glassy carbon electrodes offer superior chemical inertness, a wide potential window, extremely low porosity, and high resistance to corrosion. These properties result in minimal background current and low adsorption of species, making them ideal for high-precision electrochemical analysis, stripping voltammetry, and sensitive biosensing applications where purity and stability are critical for reliable measurements.

How is the High Purity Grade of glassy carbon defined, and for which applications is it strictly required?

High Purity Grade glassy carbon is defined by having ultra-low levels of metallic and non-metallic impurities (often less than 50 parts per million total). This grade is strictly required for highly sensitive applications such as semiconductor manufacturing crucibles, atomic spectroscopy sample holders, and implantable medical devices to prevent contamination that could compromise device function or material integrity.

What is the main manufacturing challenge limiting mass production and lowering the cost of glassy carbon?

The primary challenge is the highly complex, energy-intensive, and time-consuming thermal pyrolysis process. This process requires specialized vacuum furnaces operating at extremely high temperatures (up to 3000°C) over extended periods to carbonize the precursor materials, resulting in high production costs and limited economies of scale, restricting its use mainly to specialized, high-value markets.

Which geographical region exhibits the fastest growth rate for the adoption of glassy carbon materials?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by the massive expansion of its manufacturing base in the electronics and semiconductor industries, coupled with significant governmental and private sector investment into advanced energy storage technologies, such as lithium-ion and flow batteries, where high-performance carbon is essential.

Does the emergence of carbon nanotubes or graphene pose a significant competitive threat to the glassy carbon market?

While carbon nanotubes and graphene are powerful alternative carbon materials, they generally do not pose an existential threat to glassy carbon. Glassy carbon is uniquely valued for its isotropic properties, impermeability, and ease of machining into specific bulk shapes (like crucibles or complex electrodes), characteristics that alternatives often struggle to replicate, ensuring glassy carbon retains its dominance in high-temperature and bulk electrochemical applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Glassy Carbon Coating Graphite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Glassy Carbon Market Size Report By Type (Service Temperature 1100°C, Service Temperature 2000°C), By Application (Glassy Carbon Crucibles, Glassy Carbon Plate, Glassy Carbon Rods, Glassy Carbon Disks, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Glassy Carbon Tube (Service Temperature Grater Than 2000 Degree Celsious) Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (0-300 mm, 301-600 mm, 601-800 mm, Above 800 mm), By Application (Microscopy and Microanalysis, Metallurgical, Laboratory Research, Vacuum Evaporation, Semiconductor and Electronics, Nuclear, Aerospace, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager